Hydrogen-powered EV Charging Station Market Synopsis

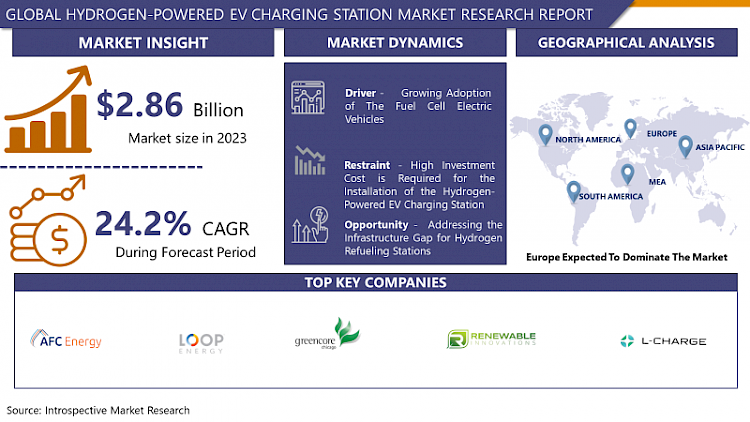

Hydrogen-powered EV Charging Station Market Size Was Valued at USD 2.86 Billion in 2023, and is Projected to Reach USD 20.1 Billion by 2032, Growing at a CAGR of 24.20% From 2024-2032.

Hydrogen- powered electric vehicle station means a facility where a hydrogen battery is refilled. It will be capable of mobile charging and CO2-free electric vehicles having capability of large-scale charging facility. It may be designed to operate as a multifuel centre or standalone operation. Certain technical elements should be included when building a protected zone for hydrogen fuel cars.

- Likewise, the above-mentioned hydrogen filling stations include dispensing machines for filling and storing the gas, suitable hydrogen storage facilities, and pre-cooling systems. The 350 bars stations functions for buses and passenger cars while 700 pressure are always available for hydrogen-powered cars. The station at 350 and 600 bar is going to be used for the hydrogen refilling of the fuel cells during the H2Haul program.

- Hydrogen-powered stations, in general, are potentially comprised of fuel storage, compression, and refueling devices which can be used in tandem with internationally accepted protocols for refueling cars. On the other hand, during the day, hydrogen can be produced and eventually supplied to the station directly or through hydrogen-power. The electric vehicles with hydrogen source (FCEV) are driven by hydrogen.

- The hydrogen-powered fuel cell electric vehicle (FCEV) components are composed of a battery, battery pack, DC-DC converter, electric rack, fuel cell stack, fuel filler, fuel tank, power electronic controller, thermal engineering system, and transmission. Lately, with the development of fuel-cell electric vehicle, the acceptance and popularity of the technology are rising.

- According to Statista, which was current as of March 2021, the number of stakeholders was 5. Considering that 28 thousand FCEVs are in operation among 49 million vehicles in Japan. As a result, low carbon emissions and fuel-cell recharging vehicle sales, the development of the hydrogen power electric car charging station market.

Hydrogen-powered EV Charging Station Market Trend Analysis

The Surge in Investment and Government Support for Hydrogen Infrastructure Development

- Hydrogen, news widely recognized as a crucial part of clean energy transition, has recently become a $2 trillion investment project and a priority of many governments throughout the world to develop hydrogen infrastructure. Governments driven by climate change considerations and concerns about air quality are everywhere fielding hydrogen as a pliable solution to zero carbon of transportation. This principle is clearly noticeable in the regions exhibiting stringent carbon emission targets. In that regard, policymakers, through their plans, are geared towards infrastructure development on hydrogen refuelling networks so as to promote the use of FCEVs.

- The scope of these investments is broad, incorporating a variety of mechanisms such as direct profit sharing, investment tax holidays, and direct investment in infrastructure establishment. Governments are using such collaboration platforms between public and private stakeholders as the major investment platform that could enable the healing of infrastructure gaps and the creation of an environment propitious to the maturity of the hydrogen-powered transportation ecosystem.

- Yet, alongside this, the frontrunners of the automotive sector are doubling efforts in hydrogen-related investments to make it a universal fuel for motor transportation and broaden the network of hydrogen infrastructure. Instrumental in sustainable cars’ long-term goals, major auto manufacturers gradually roll out the hydrogen fuel cell technology in their capital equipment. Such transition is also being backed by financial commitments for carrier-grade technologies involving hydrogen fueled vehicles' research, development, and production.

- Besides, automotive sectors initiate proactive communication with governments and investors which encourages government and private organization to adopt frameworks and strategies that speed up the development of hydrogen refuelling infrastructure in the country. This is where the auto manufacturers become the game-changer. By having similar goals with the over-arching theme of a greener and cleaner environment and a reduction of emissions, they are in the perfect position of persuading as well as catalysing investor’s diversification into hydrogen-related technology which consequently unlocks a page of a cleaner, greener and sustainable transportation future.

Addressing the Infrastructure Gap for Hydrogen Refuelling Stations

- The global market for fuel cell electric vehicles (FCEVs) is likely to surge because of developing demand for this type of vehicles and the currently inadequate hydrogen refuelling infrastructure. The fact that the nascent stage of the hydrogen refuelling infrastructure presents an unaddressed demand suggests that entrepreneurs, investors and governments to start a journey toward sustainable transportation transformation. And in contrast to the long-standing fuel system of oil stations, the little-known hydrogen refueling network is just in the starting blocks, implying vociferous campaign for business development and investments. This shortage creates a problem, but also present an opportunity to involve the stakeholders in coping with the future of mobility’s challenges, notably through the establishment of the extensive hydrogen refuelling infrastructure.

- As FCEVs is adopting wave, the demand to establish a well-developed and readily available network of hydrogen fueling stations is undoubtedly of a high importance. This kind of window of opportunity right now may just be a calling upon entrepreneurs to take the bull by the horn and capitalize on that through the building of hydrogen infrastructure that will set them a whole new level of the emerging market. Additionally, as the knowledge of environmentally friendly and economic profitability of hydrogen as a clean energy container is growing, investors have a special task to promote innovative projects which provide for the creation of hydrogen refilling networks.

- The collaboration of governments, private sector entities, and concerned stakeholders is among the critical vital link in locating and deploying hydrogen refuelling stations throughout the whole infrastructure. Governments craft policies, regulations and funding programs in order to boost investment in hydrogen infrastructure including hydrogen storage, distribution, refueling stations and reaping strategic benefits. Through the time-limited support of the PPP and the use of eligable sources , the sword of Governments can expedite hydrogen refuelling stations dispersion thus enabling a FCEVs wide spread use.

- Furthermore, the cooperation among industry partners like the automobile manufacturers and the energy resources and infrastructure developers is vital for combination of the areas of expertise, resources and technology which later is used to overcoming the problem of building much hydrogen charging stations. unitedly as a consequence of synergy, focus, and cooperations of all stakeholders, the latter can grab the chance and put a step towards the new era of sustainable transportation which is being powered by hydrogen fuel cells.

Hydrogen-powered EV Charging Station Market Segment Analysis:

Hydrogen-powered EVCharging Station Market is Segmented on the basis of product type, and application.

By Product type, Removal Charging Station segment is expected to dominate the market during the forecast period

- Shared service dishes. The Supercharger, vastly operated by Telsa, is the prime distinguishing factor in the removable charging stations industry. It's this feature that makes Tesla the industry leader. By Supercharger, which is the Tesla proprietaries, are installed on major highways and taken places in urban centres, Tesla owners might be lucky enough to access fast charging facilities around the world.

- While other EV manufacturers, who tend to use the same standard connector design, have the same charging infrastructure and thus the same assurances of reliability and efficiency, Tesla distinguishes itself in the segment by its proprietary connector design and its robust network infrastructure. This so-called network effect has imparted Tesla the position of a preferred player in the removable charging stations market especially among regions like North America and Europe where Supercharger network is most proliferated.

- The two other players in this category, EVBox and ChargePoint, have also shown positive results by securing major sales that demonstrate the versatility of their charging solutions. Both of the companies provide stations with the ability to charge various vehicles regardless of their size.

- The infrastructure is as diverse as the needs of different settings such as commercial and residential ones. EVBox with the Internet of Things provided extensive charging stations globally, specializes on running scalable, future-proofing charging solutions, tailored to the changing demands electric mobility by the gravity.

- Just as ChargePoint does, this interoperability and openness would lead to more ease and broader market coverage and impact in the industry. Not surprisingly, as EVs start becoming more popular in the public domain, EVBox and Charge Point are likely to be considered key players in the vehicle charging infrastructure industry, offering a robust and convenient EV charging ecosystem.

By Application, commercial vehicle segment held the largest share in 2023

- With the commercial vehicle department, ABB asserts itself as the most important player, containing the most substantial portfolio of special charging solutions that are aimed at commercial fleets and heavy-duty vehicles.

- Power by ABB's super-fast chargers is a specified creation for the fuelling of big-sized vehicles dealing with the intrinsic problems of the vehicle electrification. With these chargers, the companies can maintain the operations of their fleets seamlessly by expediting the refill of battery power which, in turn reduces downtime of their commercial operations.

- ABB is a vital actor in the arena, providing charging stations that are dependable and scalable. The use of electric propulsion for commercial travel is speeded up by the electrification of commercial transport which results in decreased emissions and improved environment sustainability in the logistics and transportation sectors.

- Similarly to ABB, EVBox is also creating important advancements in the promote section that are being applied thereon to participate with the governments and companies everywhere.

- The EVBox business strategy of deploying charging infrastructure suitable for commercial electric vehicles also means that the company cares for the transportation cleanliness solutions as they are responsible in order to protect the environment.

- By utilizing partners with innovative charging technologies and developing fleet solutions that work, EVBox has been able to meet the particular needs of commercial fleets of all sizes, whether it is small or large, and many different operational needs.

- For EVBox, that deal favors the adoption of electric vehicles in the business, which leads to pollution reduction as well as to lesser oil dependence, aims the global goal of the climate change fight and the sustainable production of the transport solution.

Hydrogen-powered EV Charging Station Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- European countries aim to green hydrogen (infrastructure) development for reaching progressively stringent climate targets. As countries e.g. Germany, France, and UK are at the forefront of these renewable transition initiatives with concrete commitments to switch towards sustainable transport modes.

- With the fact that by doing that these countries all share the environmental obligation to lower the greenhouse gas emissions they understandably have developed the idea that the hydrogen fuel cell technologies can be major contributors to their efforts.

- As a result, the investments summing up are reorienting toward the hydrogen network expansion that is meant to house the cars equipped with hydrogen driven engines that are supposed to become common in Europe during the next years.

- The main thing that is true for the implementation of hydrogen networks on European territory is to have the involvement of major players, like automakers, energy companies and ministries. Hence, these organizations take a lead in establishing an operational network of hydrogen refilling stations by working together to overcome the bottlenecks related to this technology.

- They are teaming up in various ways utilizing each party’s expertise and assets to quicken with the rollout of the infrastructure that will allow the hydrogen fuel cell vehicles to be smoothly adopted.

- Nevertheless, these alliances also promote the development of more such refuelling facilities that in turn enhance innovative practices and establish knowledge-sharing across the area, which is an excellent way of the growth and sustainability of hydrogen economy as a region.

Active Key Players in the Hydrogen-powered EV Charging Station Market

- AFC Energy

- Loop Energy

- GreenCore EV Services

- Renewable Innovations Inc.

- L- Charge

- Linde plc

- First Element Fuel

- ABB

- H2 Energy

- Light Commercial Vehicle

- Heavy Commercial Vehicle And

- Others key players.

Key Industry Developments in the Hydrogen-powered EV Charging Station Market:

- In September 2021, GreenCore EV Services, a manufacturer of electric vehicles and Loop Energy, a leading developer of fuel cell systems had announced a partnership and the purpose of this collaboration is to design and development of hydrogen-powered fast-charging stations.

|

Global Hydrogen-powered EV Charging Station Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.86 Bn. |

|

Forecast Period 2024-32 CAGR: |

24.2% |

Market Size in 2032: |

USD 20.1 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- HYDROGEN-POWERED EV CHARGING STATION MARKET BY PRODUCT TYPE (2017-2032)

- HYDROGEN-POWERED EV CHARGING STATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- REMOVABLE CHARGING STATION

-

-

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FIXED CHARGING STATION

-

- HYDROGEN-POWERED EV CHARGING STATION MARKET BY APPLICATION (2017-2032)

- HYDROGEN-POWERED EV CHARGING STATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PASSENGER VEHICLE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL VEHICLE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Luxury Goods Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AFC ENERGY

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CO

- LOOP ENERGY

- GREENCORE EV SERVICES

- RENEWABLE INNOVATIONS INC.

- L- CHARGE

- LINDE PLC

- FIRST ELEMENT FUEL

- ABB

- H2 ENERGY

- LIGHT COMMERCIAL VEHICLE

- HEAVY COMMERCIAL VEHICLE

- COMPETITIVE LANDSCAPE

- GLOBAL HYDROGEN-POWERED EV CHARGING STATION MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Hydrogen-powered EV Charging Station Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.86 Bn. |

|

Forecast Period 2024-32 CAGR: |

24.2% |

Market Size in 2032: |

USD 20.1 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HYDROGEN-POWERED EVCHARGING STATION MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HYDROGEN-POWERED EVCHARGING STATION MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HYDROGEN-POWERED EVCHARGING STATION MARKET COMPETITIVE RIVALRY

TABLE 005. HYDROGEN-POWERED EVCHARGING STATION MARKET THREAT OF NEW ENTRANTS

TABLE 006. HYDROGEN-POWERED EVCHARGING STATION MARKET THREAT OF SUBSTITUTES

TABLE 007. HYDROGEN-POWERED EVCHARGING STATION MARKET BY PRODUCT TYPE

TABLE 008. REMOVABLE CHARGING STATION MARKET OVERVIEW (2016-2028)

TABLE 009. FIXED CHARGING STATION MARKET OVERVIEW (2016-2028)

TABLE 010. HYDROGEN-POWERED EVCHARGING STATION MARKET BY APPLICATION

TABLE 011. PASSENGER VEHICLE MARKET OVERVIEW (2016-2028)

TABLE 012. COMMERCIAL VEHICLE MARKET OVERVIEW (2016-2028)

TABLE 013. NORTH AMERICA HYDROGEN-POWERED EVCHARGING STATION MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 014. NORTH AMERICA HYDROGEN-POWERED EVCHARGING STATION MARKET, BY APPLICATION (2016-2028)

TABLE 015. N HYDROGEN-POWERED EVCHARGING STATION MARKET, BY COUNTRY (2016-2028)

TABLE 016. EUROPE HYDROGEN-POWERED EVCHARGING STATION MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 017. EUROPE HYDROGEN-POWERED EVCHARGING STATION MARKET, BY APPLICATION (2016-2028)

TABLE 018. HYDROGEN-POWERED EVCHARGING STATION MARKET, BY COUNTRY (2016-2028)

TABLE 019. ASIA PACIFIC HYDROGEN-POWERED EVCHARGING STATION MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 020. ASIA PACIFIC HYDROGEN-POWERED EVCHARGING STATION MARKET, BY APPLICATION (2016-2028)

TABLE 021. HYDROGEN-POWERED EVCHARGING STATION MARKET, BY COUNTRY (2016-2028)

TABLE 022. MIDDLE EAST & AFRICA HYDROGEN-POWERED EVCHARGING STATION MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA HYDROGEN-POWERED EVCHARGING STATION MARKET, BY APPLICATION (2016-2028)

TABLE 024. HYDROGEN-POWERED EVCHARGING STATION MARKET, BY COUNTRY (2016-2028)

TABLE 025. SOUTH AMERICA HYDROGEN-POWERED EVCHARGING STATION MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 026. SOUTH AMERICA HYDROGEN-POWERED EVCHARGING STATION MARKET, BY APPLICATION (2016-2028)

TABLE 027. HYDROGEN-POWERED EVCHARGING STATION MARKET, BY COUNTRY (2016-2028)

TABLE 028. AFC ENERGY: SNAPSHOT

TABLE 029. AFC ENERGY: BUSINESS PERFORMANCE

TABLE 030. AFC ENERGY: PRODUCT PORTFOLIO

TABLE 031. AFC ENERGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 031. LOOP ENERGY: SNAPSHOT

TABLE 032. LOOP ENERGY: BUSINESS PERFORMANCE

TABLE 033. LOOP ENERGY: PRODUCT PORTFOLIO

TABLE 034. LOOP ENERGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. GREENCORE EV SERVICES: SNAPSHOT

TABLE 035. GREENCORE EV SERVICES: BUSINESS PERFORMANCE

TABLE 036. GREENCORE EV SERVICES: PRODUCT PORTFOLIO

TABLE 037. GREENCORE EV SERVICES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. RENEWABLE INNOVATIONS INC.: SNAPSHOT

TABLE 038. RENEWABLE INNOVATIONS INC.: BUSINESS PERFORMANCE

TABLE 039. RENEWABLE INNOVATIONS INC.: PRODUCT PORTFOLIO

TABLE 040. RENEWABLE INNOVATIONS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. BAYOTECH: SNAPSHOT

TABLE 041. BAYOTECH: BUSINESS PERFORMANCE

TABLE 042. BAYOTECH: PRODUCT PORTFOLIO

TABLE 043. BAYOTECH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. L- CHARGE: SNAPSHOT

TABLE 044. L- CHARGE: BUSINESS PERFORMANCE

TABLE 045. L- CHARGE: PRODUCT PORTFOLIO

TABLE 046. L- CHARGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. LINDE PLC: SNAPSHOT

TABLE 047. LINDE PLC: BUSINESS PERFORMANCE

TABLE 048. LINDE PLC: PRODUCT PORTFOLIO

TABLE 049. LINDE PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. FIRSTELEMENT FUEL: SNAPSHOT

TABLE 050. FIRSTELEMENT FUEL: BUSINESS PERFORMANCE

TABLE 051. FIRSTELEMENT FUEL: PRODUCT PORTFOLIO

TABLE 052. FIRSTELEMENT FUEL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. ABB: SNAPSHOT

TABLE 053. ABB: BUSINESS PERFORMANCE

TABLE 054. ABB: PRODUCT PORTFOLIO

TABLE 055. ABB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. H2 ENERGY: SNAPSHOT

TABLE 056. H2 ENERGY: BUSINESS PERFORMANCE

TABLE 057. H2 ENERGY: PRODUCT PORTFOLIO

TABLE 058. H2 ENERGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. LIGHT COMMERCIAL VEHICLE: SNAPSHOT

TABLE 059. LIGHT COMMERCIAL VEHICLE: BUSINESS PERFORMANCE

TABLE 060. LIGHT COMMERCIAL VEHICLE: PRODUCT PORTFOLIO

TABLE 061. LIGHT COMMERCIAL VEHICLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. HEAVY COMMERCIAL VEHICLE: SNAPSHOT

TABLE 062. HEAVY COMMERCIAL VEHICLE: BUSINESS PERFORMANCE

TABLE 063. HEAVY COMMERCIAL VEHICLE: PRODUCT PORTFOLIO

TABLE 064. HEAVY COMMERCIAL VEHICLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 065. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 066. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 067. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HYDROGEN-POWERED EVCHARGING STATION MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HYDROGEN-POWERED EVCHARGING STATION MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. REMOVABLE CHARGING STATION MARKET OVERVIEW (2016-2028)

FIGURE 013. FIXED CHARGING STATION MARKET OVERVIEW (2016-2028)

FIGURE 014. HYDROGEN-POWERED EVCHARGING STATION MARKET OVERVIEW BY APPLICATION

FIGURE 015. PASSENGER VEHICLE MARKET OVERVIEW (2016-2028)

FIGURE 016. COMMERCIAL VEHICLE MARKET OVERVIEW (2016-2028)

FIGURE 017. NORTH AMERICA HYDROGEN-POWERED EVCHARGING STATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 018. EUROPE HYDROGEN-POWERED EVCHARGING STATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. ASIA PACIFIC HYDROGEN-POWERED EVCHARGING STATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. MIDDLE EAST & AFRICA HYDROGEN-POWERED EVCHARGING STATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. SOUTH AMERICA HYDROGEN-POWERED EVCHARGING STATION MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Hydrogen-powered EV Charging Station Market research report is 2024-2032.

AFC Energy, Loop Energy, GreenCore EV Services, Renewable Innovations Inc., BayoTech, L- Charge, Linde plc, First Element Fuel, ABB, H2 Energy, Light Commercial Vehicle, Heavy Commercial Vehicle, and other major players.

The Hydrogen-powered EV Charging Station Market is segmented into product type, application, and region. By Product Type, the market is categorized into Removable Charging Station, Fixed Charging Station. By Application, the market is categorized into Passenger Vehicle, Commercial Vehicle. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

Hydrogen-powered electric vehicle station is an infrastructure designed for filling a vehicle with hydrogen fuel. It has scalable charging capacity for mobile charging and CO2-free electric vehicles. It can be part of a multi fuels station or an independent infrastructure. Specific technical components are necessary for the construction of a hydrogen-powered station.

The global hydrogen-powered EV charging station market size is projected to grow from USD 2.86 billion in 2023 to USD 20.1 billion by 2032, at a CAGR of 24.2%.