Small Electric Vehicle Rental Market Synopsis

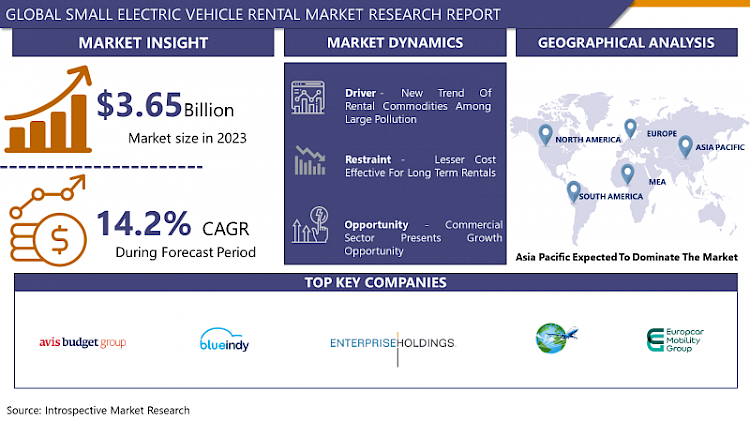

Small Electric Vehicle Rental Market Size Was Valued at USD 3.65 Billion in 2023, and is Projected to Reach USD 12.1 Billion by 2032, Growing at a CAGR of 14.2% From 2024-2032.

- Fleet management systems ensure optimal use of vehicles under the professional management of Small Electric Vehicle Rental. This means that rental companies can now provide complete solutions for their clients by providing electronic payment, EVs, and IoT devices eliminating the need for insurance, repairs, and maintenance. The electric motor is less noisy and less harmful to the environment than the hybrid or internal combustion engine.

- First and foremost, the use of an electric vehicle leads to significantly fewer exhaust emissions, and therefore, we can ensure the environmental safety of the population without losing the comfort of car travel. As a result, rentable electric vehicles are perfect for environmentally conscious people who do not want to contribute to air pollution during their travels.

- Many municipalities have green zones that prohibit the use of vehicles that emit exhaust fumes. Since such vehicles are exempted from such regulations, electric cars are allowed to operate in environmentally sensitive areas. Such localities are Zones for Clean Transport. Even though their number is relatively smaller in Poland compared to other countries and the fact that motorists of ICE cars offer stiff resistance to law enforcement, several cities have announced their plans to implement such zones in the future.

Small Electric Vehicle Rental Market Trend Analysis

New Trend of Rental Commodities Among Large Pollution

- There is a new trend in the rental market that is rising especially in the segment of small electric vehicles. This trend can be explained by the fact that people are more concerned about environmental issues and prefer using sustainable means of transportation. Metropolitan areas, with pollution-related problems, are driving this change as they try to address the adverse effects of automobiles on the environment. The adoption of rental commodities like EVs will help urban residents explore the possibility of mitigating carbon emissions and promoting a better life.

- Additionally, the number of rental services for small electric vehicles means a fundamental change in driving habits and the willingness to pay for this service. This trend is in line with the sharing economy philosophy since people value access rather than possession. Electric vehicle rent is not only convenient but also contributes to the wide use of environmentally friendly transport. However, with rising population and environmental concerns, the rental trend for commodities such as small EVs is expected to continue, enabling more sustainable urban mobility.

Commercial Segment Offers Expansion Potential

- The commercial sector provides a potential opportunity for the growth of small EV rental businesses. As climate change awareness continues to rise, companies are demanding environmentally responsible methods for moving their goods and services.

- Small electric vehicles have a low consumption rate and are eco-friendly for urban transport, which makes them appealing to businesses. Furthermore, the flexibility and affordability of rental services are attractive to companies that may not be interested in purchasing an EV fleet, which will also increase the demand for EV rentals in the B2B segment.

- Focusing on the commercial segment allows small EV-rental businesses to serve millions of companies, from delivery and transport services to restaurants and travel and entertainment. Such businesses are usually operational each day and may need transport for their operations – a steady source of income for the rental services.

- In addition, there is a global trend toward the adoption of sustainable practices, and in the commercial segment, the need for electric vehicle solutions is bound to increase in the future, offering further scope for rental companies to develop their operations and emerge as leading market participants.

Small Electric Vehicle Rental Market Segment Analysis:

Small Electric Vehicle Rental Market IS Segmented on the basis of vehicle type, category, and Rental Length.

By vehicle Type, Battery segment is expected to dominate the market during the forecast period

- Battery small electric vehicle rental means the business activity of renting out battery-operated compact electric vehicles. These vehicles are mainly used for intracity travel and are mainly used for activities like going to work or play. The rental model means that these vehicles can be utilized by an individual or a business entity for a specified period of time without having to purchase them.

- This segment of the rental market is aimed at addressing the growing need for clean mobility solutions because EVs running on batteries emit no pollutants. Companies can specialize in renting such small EVs and focus on potential customers, who are urban residents, companies, and tourists interested in comfortable, environmentally friendly, and relatively inexpensive transport. Moreover, the rental model ensures access to EVs on demand without the cost of vehicle ownership, maintenance, insurance, or depreciation. In conclusion, battery small electric vehicle rental is a rapidly developing segment of the electric vehicle industry due to environmental and mobility-related issues.

By Category, Luxury segment held the largest share in 2023

- Luxury small electric vehicle rental services deal with a small number of clients who are concerned with fashion, comfort, and ecology. These services provide customers with premium EVs with rich interiors and technology, offering a more luxurious and sustainable option for car rentals. Typically, the target audience consists of wealthy tourists, city residents, and especially those interested in something original and memorable.

- Luxury small electric vehicle rental companies compete on the basis of service and experience as well as access to the best models which include exotic electric sports cars or cool electric city cars. They are not only a means of environmentally friendly transport, but also attract those who want to emphasize their wealth and status. Moreover, by adopting EVs, these rental services help cut greenhouse gas emissions and improve sustainable mobility for luxury vehicles. In conclusion, luxurious small electric vehicle rental services target wealthy and discerning customers who desire luxury and sustainability in their travels.

Small Electric Vehicle Rental Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The significant share of Asia Pacific in the small electric vehicle rental market is explained by several crucial factors contributing to its development in the region. The rising demand for urban mobility and the threat of air pollution and traffic congestion have accelerated the electrification of automobiles in several Asian nations. Government support for EVs in the form of subsidies, tax exemptions, and infrastructure development also boosts adoption of EVs, including car rentals.

- In addition, the high population density and short distances between jobs in some Asian cities make small electric vehicles ideal for intra-urban transport. These vehicles are effective and cheap methods of transport especially in densely populated cities where parking is difficult and there is too much traffic. Moreover, the growing popularity of shared mobility and the expansion of the ride-hailing market in Asia Pacific provide a favorable background for the development of small electric vehicle rental services, as these services present easily accessible substitutes for car ownership.

- In addition, the rising awareness of environmental protection and the growing number of middle-income families with purchasing power in countries such as China, India, and other Southeast Asian countries also lead to an increase in the demand for electric vehicles, including rental services. Due to such favorable market conditions and positive government interventions, the Asia Pacific region is expected to retain its leading position in the small electric vehicle rental market during the forecast period.

Active Key Players in the Small Electric Vehicle Rental Market

- Avis Budget Group Inc

- BlueIndy LLC

- Enterprise Holdings Inc.

- ER Travel Services Ltd.

- Europcar Mobility Group SA

- Fleetdrive Management Ltd.

- Green Motion International

- SIXT

- The Hertz Corporation

- Wattacars

- Other key players

|

Global Small Electric Vehicle Rental Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.65 Bn. |

|

Forecast Period 2024-32 CAGR: |

14.2 % |

Market Size in 2032: |

USD 12.1 Bn. |

|

Segments Covered: |

By Vehicle Type |

|

|

|

By Category |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SMALL ELECTRIC VEHICLE RENTAL MARKET BY VEHICLE TYPE (2017-2032)

- SMALL ELECTRIC VEHICLE RENTAL MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BATTERY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HYBRID

- PLUG-IN ELECTRIC VEHICLE

- SMALL ELECTRIC VEHICLE RENTAL MARKET BY CATEGORY (2017-2032)

- SMALL ELECTRIC VEHICLE RENTAL MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LUXURY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ECONOMY CARS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Luxury Goods Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AVIS BUDGET GROUP INC

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BLUEINDY LLC

- ENTERPRISE HOLDINGS INC.

- ER TRAVEL SERVICES LTD.

- EUROPCAR MOBILITY GROUP SA

- FLEETDRIVE MANAGEMENT LTD.

- GREEN MOTION INTERNATIONAL

- SIXT

- THE HERTZ CORPORATION

- WATTACARS

- COMPETITIVE LANDSCAPE

- GLOBAL SMALL ELECTRIC VEHICLE RENTAL MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Category

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Small Electric Vehicle Rental Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.65 Bn. |

|

Forecast Period 2024-32 CAGR: |

14.2 % |

Market Size in 2032: |

USD 12.1 Bn. |

|

Segments Covered: |

By Vehicle Type |

|

|

|

By Category |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SMALL ELECTRIC VEHICLE RENTAL MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SMALL ELECTRIC VEHICLE RENTAL MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SMALL ELECTRIC VEHICLE RENTAL MARKET COMPETITIVE RIVALRY

TABLE 005. SMALL ELECTRIC VEHICLE RENTAL MARKET THREAT OF NEW ENTRANTS

TABLE 006. SMALL ELECTRIC VEHICLE RENTAL MARKET THREAT OF SUBSTITUTES

TABLE 007. SMALL ELECTRIC VEHICLE RENTAL MARKET BY VEHICLE TYPE

TABLE 008. BATTERY MARKET OVERVIEW (2016-2028)

TABLE 009. HYBRID MARKET OVERVIEW (2016-2028)

TABLE 010. PLUG-IN ELECTRIC VEHICLE MARKET OVERVIEW (2016-2028)

TABLE 011. SMALL ELECTRIC VEHICLE RENTAL MARKET BY CATEGORY

TABLE 012. LUXURY MARKET OVERVIEW (2016-2028)

TABLE 013. ECONOMY CARS MARKET OVERVIEW (2016-2028)

TABLE 014. SMALL ELECTRIC VEHICLE RENTAL MARKET BY RENTAL LENGTH

TABLE 015. SHORT TERM MARKET OVERVIEW (2016-2028)

TABLE 016. LONG TERM MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA SMALL ELECTRIC VEHICLE RENTAL MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 018. NORTH AMERICA SMALL ELECTRIC VEHICLE RENTAL MARKET, BY CATEGORY (2016-2028)

TABLE 019. NORTH AMERICA SMALL ELECTRIC VEHICLE RENTAL MARKET, BY RENTAL LENGTH (2016-2028)

TABLE 020. N SMALL ELECTRIC VEHICLE RENTAL MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE SMALL ELECTRIC VEHICLE RENTAL MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 022. EUROPE SMALL ELECTRIC VEHICLE RENTAL MARKET, BY CATEGORY (2016-2028)

TABLE 023. EUROPE SMALL ELECTRIC VEHICLE RENTAL MARKET, BY RENTAL LENGTH (2016-2028)

TABLE 024. SMALL ELECTRIC VEHICLE RENTAL MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC SMALL ELECTRIC VEHICLE RENTAL MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 026. ASIA PACIFIC SMALL ELECTRIC VEHICLE RENTAL MARKET, BY CATEGORY (2016-2028)

TABLE 027. ASIA PACIFIC SMALL ELECTRIC VEHICLE RENTAL MARKET, BY RENTAL LENGTH (2016-2028)

TABLE 028. SMALL ELECTRIC VEHICLE RENTAL MARKET, BY COUNTRY (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA SMALL ELECTRIC VEHICLE RENTAL MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA SMALL ELECTRIC VEHICLE RENTAL MARKET, BY CATEGORY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA SMALL ELECTRIC VEHICLE RENTAL MARKET, BY RENTAL LENGTH (2016-2028)

TABLE 032. SMALL ELECTRIC VEHICLE RENTAL MARKET, BY COUNTRY (2016-2028)

TABLE 033. SOUTH AMERICA SMALL ELECTRIC VEHICLE RENTAL MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 034. SOUTH AMERICA SMALL ELECTRIC VEHICLE RENTAL MARKET, BY CATEGORY (2016-2028)

TABLE 035. SOUTH AMERICA SMALL ELECTRIC VEHICLE RENTAL MARKET, BY RENTAL LENGTH (2016-2028)

TABLE 036. SMALL ELECTRIC VEHICLE RENTAL MARKET, BY COUNTRY (2016-2028)

TABLE 037. SIXT: SNAPSHOT

TABLE 038. SIXT: BUSINESS PERFORMANCE

TABLE 039. SIXT: PRODUCT PORTFOLIO

TABLE 040. SIXT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. ER TRAVEL SERVICES LTD: SNAPSHOT

TABLE 041. ER TRAVEL SERVICES LTD: BUSINESS PERFORMANCE

TABLE 042. ER TRAVEL SERVICES LTD: PRODUCT PORTFOLIO

TABLE 043. ER TRAVEL SERVICES LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. EUROPCAR MOBILITY GROUP SA: SNAPSHOT

TABLE 044. EUROPCAR MOBILITY GROUP SA: BUSINESS PERFORMANCE

TABLE 045. EUROPCAR MOBILITY GROUP SA: PRODUCT PORTFOLIO

TABLE 046. EUROPCAR MOBILITY GROUP SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. FLEETDRIVE MANAGEMENT LTD: SNAPSHOT

TABLE 047. FLEETDRIVE MANAGEMENT LTD: BUSINESS PERFORMANCE

TABLE 048. FLEETDRIVE MANAGEMENT LTD: PRODUCT PORTFOLIO

TABLE 049. FLEETDRIVE MANAGEMENT LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. GREEN MOTION INTERNATIONAL: SNAPSHOT

TABLE 050. GREEN MOTION INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 051. GREEN MOTION INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 052. GREEN MOTION INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. AVIS BUDGET GROUP INC: SNAPSHOT

TABLE 053. AVIS BUDGET GROUP INC: BUSINESS PERFORMANCE

TABLE 054. AVIS BUDGET GROUP INC: PRODUCT PORTFOLIO

TABLE 055. AVIS BUDGET GROUP INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. BLUEINDY LLC: SNAPSHOT

TABLE 056. BLUEINDY LLC: BUSINESS PERFORMANCE

TABLE 057. BLUEINDY LLC: PRODUCT PORTFOLIO

TABLE 058. BLUEINDY LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. ENTERPRISE HOLDINGS INC: SNAPSHOT

TABLE 059. ENTERPRISE HOLDINGS INC: BUSINESS PERFORMANCE

TABLE 060. ENTERPRISE HOLDINGS INC: PRODUCT PORTFOLIO

TABLE 061. ENTERPRISE HOLDINGS INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. THE HERTZ CORPORATION: SNAPSHOT

TABLE 062. THE HERTZ CORPORATION: BUSINESS PERFORMANCE

TABLE 063. THE HERTZ CORPORATION: PRODUCT PORTFOLIO

TABLE 064. THE HERTZ CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. WATTACARS: SNAPSHOT

TABLE 065. WATTACARS: BUSINESS PERFORMANCE

TABLE 066. WATTACARS: PRODUCT PORTFOLIO

TABLE 067. WATTACARS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 068. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 069. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 070. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SMALL ELECTRIC VEHICLE RENTAL MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SMALL ELECTRIC VEHICLE RENTAL MARKET OVERVIEW BY VEHICLE TYPE

FIGURE 012. BATTERY MARKET OVERVIEW (2016-2028)

FIGURE 013. HYBRID MARKET OVERVIEW (2016-2028)

FIGURE 014. PLUG-IN ELECTRIC VEHICLE MARKET OVERVIEW (2016-2028)

FIGURE 015. SMALL ELECTRIC VEHICLE RENTAL MARKET OVERVIEW BY CATEGORY

FIGURE 016. LUXURY MARKET OVERVIEW (2016-2028)

FIGURE 017. ECONOMY CARS MARKET OVERVIEW (2016-2028)

FIGURE 018. SMALL ELECTRIC VEHICLE RENTAL MARKET OVERVIEW BY RENTAL LENGTH

FIGURE 019. SHORT TERM MARKET OVERVIEW (2016-2028)

FIGURE 020. LONG TERM MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA SMALL ELECTRIC VEHICLE RENTAL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE SMALL ELECTRIC VEHICLE RENTAL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC SMALL ELECTRIC VEHICLE RENTAL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA SMALL ELECTRIC VEHICLE RENTAL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA SMALL ELECTRIC VEHICLE RENTAL MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Small Electric Vehicle Rental Market research report is 2024-2032.

SIXT, ER Travel Services Ltd., Europcar Mobility Group SA, Fleetdrive Management Ltd., Green Motion International and Other major players.

The Small Electric Vehicle Rental Market is segmented into Vehicle Type, Category, Rental Length, and region. By Vehicle Type, the market is categorized into Battery, Hybrid, Plug-In Electric Vehicle. By Category, the market is categorized into Luxury, Economy Cars. By Rental Length, the market is categorized into Short Term, Long Term. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Small Electric Vehicle Rental facilitates enhanced vehicle utilization under the expert administration of fleet management systems. Rental companies can now offer comprehensive solutions to their clients by incorporating electronic payments, electric vehicles, and IoT (Internet of Things) devices, thereby obviating the necessity for insurance, repairs, and maintenance. Electric motors are quieter and better for the environment than hybrid or internal combustion engines.

Small Electric Vehicle Rental Market Size Was Valued at USD 3.65 Billion in 2023, and is Projected to Reach USD 12.1 Billion by 2032, Growing at a CAGR of 14.2% From 2024-2032.