Electric Vehicle Thermal Management Solutions Market Synopsis

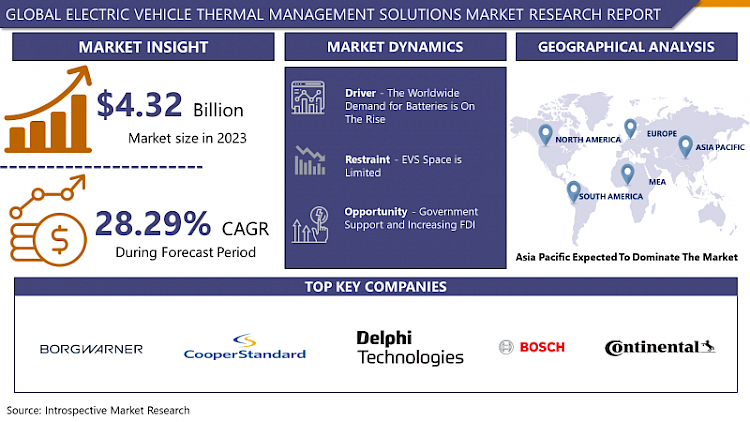

Electric Vehicle Thermal Management Solutions Market size is expected to grow from USD 4.32 billion in 2023 to USD 40.66 billion by 2032, at a CAGR of 28.29% during the forecast period (2024-2032)

Electric Vehicle Thermal Management Solutions (EVTMS) contain an collection of technology and structures that are mainly designed to manipulate and decorate the temperature of numerous components placed within EVs. By effectively coping with heat dissipation and preserving most efficient temperature degrees, those solutions are important for making sure the optimized operation of electricity electronics, batteries, motors, and other vital components.

- These novel solutions fulfill various features inside electric vehicles. The temperature of lithium-ion batteries is actively monitored and controlled, which serves to boom their durability, optimize charging efficiency, and guarantee safety.

- In addition, thermal control systems are of critical importance in ensuring that electric powered motors and strength electronics operate at perfect temperatures, accordingly improving their basic overall performance and dependability. Further, through successfully controlling heating and cooling mechanisms, these structures make a contribution to the upkeep of comfortable indoors temperatures for passengers.

- The implementation of those solutions gives numerous advantages. They enhance the general efficacy of the vehicle, boom electricity efficiency, and prolong the existence of EV components. Moreover, thru skillful thermal management, they make a sizeable contribution to the dependability and security of electric automobiles.

- The worldwide market for electric powered automobile thermal management answers changed into witnessing considerable growth as of 2023, broadly speaking pushed by the increasing occurrence of electric motors on a global scale. As apprehensions regarding the overall performance and efficiency of batteries improved, it become anticipated that the marketplace for those solutions could continue to grow at an annual fee, propelled by means of technological tendencies that sought to improve the range, performance, and dependability of electric motors.

Electric Vehicle Thermal Management Solutions Market Trend Analysis

Demand For Robust Thermal Management Solutions For EV

- The growing want for efficient thermal control answers serves as a vast motive force behind the expansion of the worldwide marketplace for electric powered vehicle thermal management solutions. The significance of efficaciously regulating and controlling temperatures within electric vehicles (EVs) grows in tandem with their rising popularity. Robust thermal control solutions are critical for assuring the most excellent functioning of a extensive range of electrical car (EV) additives, with a particular emphasis on battery packs, strength electronics, and electric powered cars.

- The increasing demand can be attributed, in massive part, to the crucial factors of battery performance and durability. By making sure that lithium-ion batteries remain inside the top-rated temperature range, thermal control systems prevent the unfavourable consequences of severe cold and overheating, which could have a large poor effect on the batteries' lifecycle. Moreover, these structures facilitate the optimization of charging tactics, decorate the overall efficacy of electrical vehicle (EV) operation, and guarantee protection.

- The growing want for efficient thermal control answers serves as a vast motive force behind the expansion of the worldwide marketplace for electric powered vehicle thermal management solutions. The significance of efficaciously regulating and controlling temperatures within electric vehicles (EVs) grows in tandem with their rising popularity. Robust thermal control solutions are critical for assuring the most excellent functioning of a extensive range of electrical car (EV) additives, with a particular emphasis on battery packs, strength electronics, and electric powered cars.

- The increasing demand can be attributed, in massive part, to the crucial factors of battery performance and durability. By making sure that lithium-ion batteries remain inside the top-rated temperature range, thermal control systems prevent the unfavourable consequences of severe cold and overheating, which could have a large poor effect on the batteries' lifecycle. Moreover, these structures facilitate the optimization of charging tactics, decorate the overall efficacy of electrical vehicle (EV) operation, and guarantee protection.

The expansion of the electric vehicle (EV) fleet continues to rise.

- As the global electric vehicle (EV) fleet continues its expansion, a significant and emerging opportunity is unfolding within the aftermarket segment concerning thermal management solutions. The maintenance, repair, and enhancement of pre-current electric powered cars (EVs) represent this aftermarket area, which gives a large opportunity for growth inside the Electric Vehicle Thermal Management Solutions industry.

- Electric car sales saw another record year in 2022, despite supply chain disruptions, macro-economic and geopolitical uncertainty, and high commodity and energy prices. The boom in electric powered automobile sales befell inside the context of contracting international automobile markets: overall automobile income decreased through three% in 2022 in comparison to 2021. Last year, there had been extra than 10 million income of electric motors (PHEVs) and battery electric automobiles (BEVs), an increase of 55% in comparison to 2021.

- Global EV income of 10 million surpass the cumulative matter of automobiles bought in the European Union (about nine.5 million automobiles) and account for almost 50% of the whole motors sold in China throughout the 12 months 2022. From 2017 to 2022, electric powered automobile (EV) income increased from approximately a million to over ten million. In the preceding five years, Between 2017 and 2022, electric powered automobile (EV) income elevated from about 1 million to more than 1 million. Over the past 5 years, among 2017 and 2022, electric powered car (EV) sales elevated from about $1 million to extra than $1 million. Over the beyond 5 years, from 2012 to 2017, the variety of advantages for electric cars (EVs) accelerated to extra than 100,000 gadgets, indicating that EV revenues are growing exponentially. Electric automobiles' market percentage prolonged from nine% in 2021 to fourteen% in 2022, a increase charge exceeding ten instances that of 2017.

- Governments worldwide allocated USD 14 billion toward direct purchase incentives and tax deductions for electric powered vehicles in 2020, representing a every year growth of 25%. Despite this, the share of general expenditure on electric powered cars because of government incentives has decreased from about 20% in 2015 to ten% in 2020.

- Moreover, it is probable that there will be an ongoing demand for aftermarket solutions to facilitate the conversion of older EVs to more recent thermal management technologies, as EV technology advances. This generates a lucrative market for aftermarket service providers, allowing them to accommodate the evolving needs of electric vehicle (EV) proprietors who desire enhanced performance and an extended lifespan.

Electric Vehicle Thermal Management Solutions Market Segment Analysis:

Electric Vehicle Thermal Management Solutions Market is Segmented based on type, application, and Vehicle Type.

By Type, Active segment is expected to dominate the market during the forecast period

- The active segment stands out as the dominant force in the global Electric Vehicle Thermal Management Solutions market, securing a substantial market share of approximately 64.14%. The robust presence of this segment in the market indicates its widespread importance and acceptance in the sector.

- The active segment comprises a variety of sophisticated thermal management solutions, including refrigerant-based solutions and liquid cooling systems, that are distinguished by actively controlled mechanisms. These structures offer accurate temperature control and powerful warmth dissipation, which are important for preserving perfect operating conditions in quite a few electric powered automobile (EV) components, such as cars, batteries, and power electronics.

- The active segment's preponderance can be ascribed to its capacity to efficiently tackle the thermal management obstacles encountered by electric vehicles. By effectively managing thermal dissipation, these solutions ensure consistent performance, prolong the lifespan of components and optimize the overall energy efficiency of electric vehicles.

- Furthermore, the ability of the active segment to dynamically adjust to changing environmental conditions and deliver temperature control in real-time is highly compatible with the ever-changing operational requirements of electric vehicles.

By Application, Liquid cooling and heating segment held the largest share in 2023

- The technology sector, which encompasses liquid cooling and heating, maintains a significant market share of around 73.8%. The considerable importance and extensive implementation of liquid-based thermal management systems in the electric vehicle sector is highlighted by this dominance.

- Liquid cooling and heating technologies regulate the temperatures of electric vehicle (EV) components, particularly batteries, motors, and power electronics, via the circulation of coolants or refrigerants through a closed-loop systemThese systems demonstrate exceptional efficiency in heat dissipation and the maintenance of ideal operating temperatures, resulting in improved functionality, durability, and safety of vital electric vehicle components.

- The efficacy with which liquid-based thermal management solutions tackle the thermal obstacles encountered by electric vehicles is the primary factor contributing to their present and anticipated prevalence. Liquid cooling and heating technologies are favored for assuring the dependability and durability of electric vehicle (EV) components due to their precise temperature regulation, efficient heat transfer, and ability to flexibly respond to various environmental conditions.

Electric Vehicle Thermal Management Solutions Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Many major EV manufacturers and suppliers are based in the Asia-Pacific region. An example of a country with a considerable awareness of electric vehicle producers and a resilient deliver chain for EV additives, together with thermal management solutions, is China.This preponderance of manufacturing capabilities significantly contributes to the region's market dominance in this industry.

- The Asia-Pacific region, with South Korea, Japan, and China in particular, having been at the vanguard of the worldwide electric vehicle revolution The adoption of electrical vehicles in the ones nations has elevated extensively due to authorities pointers, incentives, and a concerted attempt to reduce emissions.

- Proactive development of sophisticated thermal management solutions for electric vehicles has occurred in the region. Prominent international places inclusive of Japan and South Korea are identified for his or her talent in pioneering thermal manipulate answers and cutting-edge era for electric cars.

- Growing apprehension and consciousness regarding environmental matters, including climate change and air pollution, have compelled governments and consumers in the Asia-Pacific region to choose cleaner modes of transportation, such as electric vehicles. As a result, the call for for associated technology, such as thermal control answers, has extended.

- Significant investments have been made in charging infrastructure and associated technology within the Asia-Pacific region. The improvement of this infrastructure is of the maximum importance in facilitating the substantial integration of electric cars, thereby increasing the want for effective thermal control solutions.

Active Key Players in the Electric Vehicle Thermal Management Solutions Market

- Aisin Seiki (Japan)

- BorgWarner (U.S.)

- Calsonic Kansei (Japan)

- Continental AG (Germany)

- Cooper Standard (U.S.)

- Dana Incorporated (U.S.)

- Delphi Technologies (U.S.)

- Denso (Japan)

- Eaton Corporation (U.S.)

- Hanon Systems (South Korea)

- Honeywell International (U.S.)

- Johnson Controls International (Ireland)

- MAHLE (Germany)

- Mitsubishi Electric (Japan)

- Modine Manufacturing (U.S.)

- Robert Bosch GmbH (Germany)

- Schaeffler Group (Germany)

- Tenneco(U.S.)

- Valeo (France)

- Other Key Players

Key Industry Developments in the Electric Vehicle Thermal Management Solutions Market:

- In June 2023, Carrar and Gentherm, two industry leaders in electric vehicle thermal management technologies, collaborated to develop a new thermal management solution for EV battery modules based on two-phase immersion. By combining Carrar's proficiency in two-phase immersion technology with Gentherm's expertise in thermal management valves, this collaboration will produce an innovative thermal management system for electric vehicles. The collaboration between Carrar and Gentherm represents a noteworthy advancement in the domain of electric vehicle thermal management.

- In February 2023, Volkswagen Group Technology is currently developing electric propulsion pulse inverters and thermal management systems. These components are being developed using the same modular approach that has been applied to other components. On the MEB+ platform, this modular system will initially be implemented.

- In January 2023, An industry leader in the design and production of thermal management solutions, Modine introduced an updated version of its EVantageTM Battery Thermal Management System (BTMS), which is specifically engineered for use in both on-road and off-road electric vehicles. The L-CON BTMS, a novel system, integrates intelligent controls and electronics with proprietary heat exchanger technology to endure challenging environmental conditions.

|

Global Electric Vehicle Thermal Management Solutions Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.32 Bn. |

|

Forecast Period 2024-32 CAGR: |

28.29% |

Market Size in 2032: |

USD 40.66 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Vehicle Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET BY TYPE (2017-2032)

- ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ACTIVE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PASSIVE

- HYBRID

- ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET BY VEHICLE TYPE (2017-2032)

- ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PASSENGER VEHICLES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL VEHICLES

- TWO-WHEELER

- THREE WHEELER

- ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET BY APPLICATION (2017-2032)

- ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LIQUID COOLING AND HEATING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AIR COOLING AND HEATING

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Electric Vehicle Thermal Management Solutions Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AISIN SEIKI (JAPAN)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BORGWARNER (U.S.)

- CALSONIC KANSEI (JAPAN)

- CONTINENTAL AG (GERMANY)

- COOPER STANDARD (U.S.)

- DANA INCORPORATED (U.S.)

- DELPHI TECHNOLOGIES (U.S.)

- DENSO (JAPAN)

- EATON CORPORATION (U.S.)

- HANON SYSTEMS (SOUTH KOREA)

- HONEYWELL INTERNATIONAL (U.S.)

- JOHNSON CONTROLS INTERNATIONAL (IRELAND)

- MAHLE (GERMANY)

- MITSUBISHI ELECTRIC (JAPAN)

- MODINE MANUFACTURING (U.S.)

- ROBERT BOSCH GMBH (GERMANY)

- SCHAEFFLER GROUP (GERMANY)

- TENNECO(U.S.)

- VALEO (FRANCE)

- COMPETITIVE LANDSCAPE

- GLOBAL ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Vehicle Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Electric Vehicle Thermal Management Solutions Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.32 Bn. |

|

Forecast Period 2024-32 CAGR: |

28.29% |

Market Size in 2032: |

USD 40.66 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Vehicle Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET BY TYPE

TABLE 008. ACTIVE MARKET OVERVIEW (2016-2028)

TABLE 009. PASSIVE MARKET OVERVIEW (2016-2028)

TABLE 010. HYBRID MARKET OVERVIEW (2016-2028)

TABLE 011. ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET BY TECHNOLOGY

TABLE 012. LIQUID COOLING AND HEATING MARKET OVERVIEW (2016-2028)

TABLE 013. AIR COOLING AND HEATING MARKET OVERVIEW (2016-2028)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET BY VEHICLE TYPE

TABLE 016. PASSENGER VEHICLES MARKET OVERVIEW (2016-2028)

TABLE 017. COMMERCIAL VEHICLES MARKET OVERVIEW (2016-2028)

TABLE 018. TWO WHEELER AND THREE WHEELER MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY TYPE (2016-2028)

TABLE 020. NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 021. NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 022. N ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY TYPE (2016-2028)

TABLE 024. EUROPE ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 025. EUROPE ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 026. ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY TYPE (2016-2028)

TABLE 028. ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 029. ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 030. ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY TYPE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 034. ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY TYPE (2016-2028)

TABLE 036. SOUTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 037. SOUTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 038. ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 039. BORGWARNER INC: SNAPSHOT

TABLE 040. BORGWARNER INC: BUSINESS PERFORMANCE

TABLE 041. BORGWARNER INC: PRODUCT PORTFOLIO

TABLE 042. BORGWARNER INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. ROBERT BOSCH GMBH: SNAPSHOT

TABLE 043. ROBERT BOSCH GMBH: BUSINESS PERFORMANCE

TABLE 044. ROBERT BOSCH GMBH: PRODUCT PORTFOLIO

TABLE 045. ROBERT BOSCH GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. DANA LIMITED: SNAPSHOT

TABLE 046. DANA LIMITED: BUSINESS PERFORMANCE

TABLE 047. DANA LIMITED: PRODUCT PORTFOLIO

TABLE 048. DANA LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. VOSS AUTOMOTIVE GMBH: SNAPSHOT

TABLE 049. VOSS AUTOMOTIVE GMBH: BUSINESS PERFORMANCE

TABLE 050. VOSS AUTOMOTIVE GMBH: PRODUCT PORTFOLIO

TABLE 051. VOSS AUTOMOTIVE GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. MODINE MANUFACTURING COMPANY: SNAPSHOT

TABLE 052. MODINE MANUFACTURING COMPANY: BUSINESS PERFORMANCE

TABLE 053. MODINE MANUFACTURING COMPANY: PRODUCT PORTFOLIO

TABLE 054. MODINE MANUFACTURING COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. DENSO CORPORATION: SNAPSHOT

TABLE 055. DENSO CORPORATION: BUSINESS PERFORMANCE

TABLE 056. DENSO CORPORATION: PRODUCT PORTFOLIO

TABLE 057. DENSO CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. MAHLE GMBH: SNAPSHOT

TABLE 058. MAHLE GMBH: BUSINESS PERFORMANCE

TABLE 059. MAHLE GMBH: PRODUCT PORTFOLIO

TABLE 060. MAHLE GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. VALEO: SNAPSHOT

TABLE 061. VALEO: BUSINESS PERFORMANCE

TABLE 062. VALEO: PRODUCT PORTFOLIO

TABLE 063. VALEO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. GENTHERM: SNAPSHOT

TABLE 064. GENTHERM: BUSINESS PERFORMANCE

TABLE 065. GENTHERM: PRODUCT PORTFOLIO

TABLE 066. GENTHERM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. AND HANON SYSTEMS: SNAPSHOT

TABLE 067. AND HANON SYSTEMS: BUSINESS PERFORMANCE

TABLE 068. AND HANON SYSTEMS: PRODUCT PORTFOLIO

TABLE 069. AND HANON SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 070. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 071. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 072. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET OVERVIEW BY TYPE

FIGURE 012. ACTIVE MARKET OVERVIEW (2016-2028)

FIGURE 013. PASSIVE MARKET OVERVIEW (2016-2028)

FIGURE 014. HYBRID MARKET OVERVIEW (2016-2028)

FIGURE 015. ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET OVERVIEW BY TECHNOLOGY

FIGURE 016. LIQUID COOLING AND HEATING MARKET OVERVIEW (2016-2028)

FIGURE 017. AIR COOLING AND HEATING MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET OVERVIEW BY VEHICLE TYPE

FIGURE 020. PASSENGER VEHICLES MARKET OVERVIEW (2016-2028)

FIGURE 021. COMMERCIAL VEHICLES MARKET OVERVIEW (2016-2028)

FIGURE 022. TWO WHEELER AND THREE WHEELER MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Electric Vehicle Thermal Management Solutions Market research report is 2024-2032.

BorgWarner Inc., Robert Bosch GmbH, Dana Limited, VOSS Automotive GmbH, Modine Manufacturing Company, Denso Corporation, MAHLE GmbH, Valeo, Gentherm, and Hanon Systems and Other Major Players.

The Electric Vehicle Thermal Management Solutions Market is segmented into Type, Vehicle Type, Application, and region. By Type, the market is categorized into Active, Passive, and Hybrid. By Vehicle Type, the market is categorized into Passenger Vehicles, Commercial Vehicles, two-wheelers and three-wheelers. By Application, the market is categorized into Liquid Cooling And Heating, Air Cooling And Heating, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Electric Vehicle Thermal Management Solutions (EVTMS) contain a collection of technology and structures that are mainly designed to manipulate and decorate the temperature of numerous components placed within EVs. By effectively coping with heat dissipation and preserving the most efficient temperature degrees, those solutions are important for ensuring the optimized operation of electricity electronics, batteries, motors, and other vital components.

Electric Vehicle Thermal Management Solutions Market size is expected to grow from USD 4.32 billion in 2023 to USD 40.66 billion by 2032, at a CAGR of 28.29% during the forecast period (2024-2032)