Electric Vehicle Plastic Components Market Synopsis

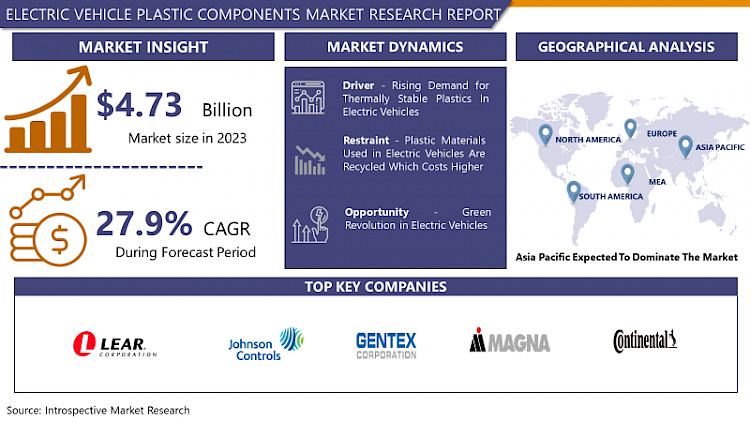

Electric Vehicle Plastic Components Market Size Was Valued at USD 4.73 Billion in 2023, and is Projected to Reach USD 43.0 Billion by 2032, Growing at a CAGR of 27.9% From 2024-2032.

- Global electric vehicle (EV) plastic components market is growing at a rapid pace due to the rising popularity of environment-friendly mobility solutions across the world. Plastic parts are a critical requirement in EVs due to their light weight, durability, and cost-effectiveness when compared with traditional materials. These components include interior trims, exterior body panels, battery boxes, and other structural parts. Factors that contribute to the growth of the market include the rising rates of EV adoption, government incentives that encourage the use of environment-friendly vehicles, and advances in plastic technology to enhance performance and reduce the negative impact of vehicles on the environment. In addition, environmental considerations and the necessity to cut GHG emissions also contribute to the rising demand for electric vehicles. Therefore, to meet the increased demand for EV components, producers are focusing on the creation of new types of plastic-based solutions. This, in turn, is driving the global electric vehicle plastic components market.

- Plastic components are of significant use in EVs as exterior body, battery, and inner body parts. Battery covers made up of tough polymers help in shielding against environmental factors hence enhancing battery safety and controlling thermal management. Similarly, interior plastics, visible in dashboards, seats, and trim, offer attractive, versatile, lightweight, and customizable solutions for the overall interior of the vehicle.

- EVs often use polymers for outer body shells, thus reducing vehicle weight and improving aerodynamics for overall efficiency. These varied uses show that plastics are versatile in enhancing the usability of electric vehicles without compromising on safety and efficiency standards.

- Plastic components are preferred by the manufacturers and original equipment manufacturers (OEMs) due to their low cost and ability to be easily molded when compared to conventional materials like metals. This cost effectiveness and design adaptability promote innovation by simplifying manufacturing. Moreover, EVs are more suited to meeting regulatory emissions limits due to the use of polymers, which improves energy efficiency and reduces emissions.

Electric Vehicle Plastic Components Market Trend Analysis

The demand for thermally stable plastics in electric vehicles is growing.

- The tendency of original equipment manufacturers (OEMs) towards heat-resistant applications for thermally stable plastics is a significant factor that is driving the global electric vehicle plastic component market. Today’s OEMs are selecting thermally stable plastics such as PPS, PEEK, and PAI. This is because these materials are very good at handling heat without loosing shape or function.

- The use of electric vehicles generates higher temperatures in components including battery housings, connectors, and electrical rubbers. Hence, there is a critical requirement for plastics that can maintain stability under such conditions. These thermally stable plastics are suitable for EVs due to their high melting point, high dimensional stability, and low thermal degradation.

- Industry experts also believe that the shift towards electric vehicles has accelerated the need for durable and reliable materials. The rising interest of OEMs in improving the thermal performance of EVs is expected to drive demand for thermally stable plastics, which will accelerate the growth of the EV plastic components market. This is in line with the sector’s initiative to offer heat-resistant, light-weight, and cost-effective materials to ensure the safe and efficient operation of EVs.

Evolution of Green Electric Vehicles.

- The rise of sustainability as a core value has seen bio-based and recyclable plastics take center stage in the global electric vehicle plastic components market – not only as sustainable alternatives but also as a force for transformative change. These proposed remedies will enable the automotive sector to overcome ecological concerns and also tap the potential environmentally conscious consumers’ market.

- Bio-based plastics which are produced from natural resources such as plant-based materials and can be recycled at the end of their lifecycle provide a distinct advantage over conventional plastics derived from petroleum. These materials help to decrease pollution, which in turn helps to reduce the demand for fossil fuels, lowers carbon emissions, and promotes a circular economy.

- Changes in consumer behavior seem to be taking place, with a growing tendency to purchase products and support environmentally beneficial actions. This predilection has a significant impact on consumer’s buying behavior and forces automotive manufacturers to use sustainable materials like bio-based and recyclable polymers in the production of electric vehicles.

- In addition, regulatory bodies are increasingly focusing on environmental factors thus offering an impetus for the adoption of sustainable materials in automobile manufacturing. Bio-based and recyclable plastics are not only helping manufacturers to achieve environmental goals but are also providing a competitive advantage in a market that is increasingly demanding sustainable and environmentally friendly products. This gives the electric vehicle plastic components market a great opportunity to expand its product line and address the demands of the consumers and the world’s sustainability agenda.

Electric Vehicle Plastic Components Segment Analysis:

Electric Vehicle Plastic Components Market is Segmented based on Type and Material

By Type, Trim segment dominance characterizes the global electric vehicle plastic components market by type.

- Door panels, roof linings, seat trim, and steering cover – This segment has the highest market share and is expected to reach approximately 26%. 5%.

- Interior ornamentation is significant in enhancing the look and feel of the interior of the vehicle. Plastics add to the premium experience of electric vehicles by allowing designers to enjoy more freedom and creativity when it comes to creating comfortable and visually appealing interiors.

- Plastic interior components also help to cut the vehicle’s weight and improve its range and effectiveness – both of which are vital for electric cars. Plastics are attractive to automobile manufacturers because of their relative affordability compared to other materials for interior components.

By Material, Polypropylene (PP) segment is anticipated to maintain an XX% market share over the forecast period.

- Based on material type, polypropylene (PP) accounts for a significant market share in the global electric vehicle plastic component market. PP thermoplastic polymer is used in various industries, including the automotive industry. In the case of electric cars.

- PP helps in reducing the overall weight of electric vehicles which is one of the most important factors influencing energy efficiency and range due to its relatively lowA wide range of automotive components that are subjected to various environmental conditions find use of this material due to its excellent resistance to wear, tear, impact, and chemical corrosion.

- Compared to other engineering plastics, PP is known for its affordability, which makes it ideal for economies of scale in the automotive industry. The material can be easily moulded or manipulated into various shapes and designs in order to produce components for electric vehicles.

Global Electric Vehicle Plastic Components Market Regional Insights

Asia Pacific Dominates the Market Over the Forecast Period

- Asia-Pacific currently holds a significant market share in the Global Electric Vehicle Plastic Components Market of 54% as of 2022. 7%. The automobile industry is a manufacturing giant in the Asia-Pacific region and especially in China, Japan, South Korea, and India. It has been noted that the region produces plastic components for EVs due to not only advanced manufacturing but also labour and infrastructural expertise.

- The Asia-Pacific region has experienced a significant increase in the manufacturing and use of electric cars. Such support in the form of charging stations, subsidies and other favourable policies has increased consumer interest and boosted demand for EVs and their associated plastic parts.

- A well-established and efficient supply chain network for automotive components including plastic parts exists in the region. This ensures an efficiently managed production and distribution of plastic components for electric vehicles and ensures that it meets the increasing market demand.

- Continuous investments in research, development, and technological advancement of the area ensure further progress in terms of materials and manufacturing technologies. This innovation results in the cost-efficient high-performance plastic components for electric cars and further strengthens the region’s leading market position.

Active Key Players in the Electric Vehicle Plastic Components Market

- Lear Corporation (U.S.)

- Johnson Controls International (U.S.)

- Plasticom International (U.S.)

- Gentex Corporation (U.S.)

- Magna International (Canada)

- Continental AG (Germany)

- Brose Fahrzeugteile GmbH & Co. KG (Germany)

- TSG Holding GmbH (Germany)

- Covestro AG (Germany)

- Saint-Gobain (France)

- Plastic Omnium (France)

- Pirelli & C. S.p.A. (Italy)

- Adient plc (Ireland)

- Huayu Automotive Group (China)

- Yanfeng Automotive Trim Systems (China)

- Motherson Sumi Systems Limited (India)

- Yazaki Corporation (Japan)

- Sumitomo Electric Industries (Japan)

- Denso Corporation (Japan)

- Sekisui Chemical Co., Ltd. (Japan)

- Marelli Holdings Co., Ltd. (Japan)

- Other Major Players

|

Electric Vehicle Thermal Management Solutions Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 4.73 Bn |

|

Forecast Period 2024-32 CAGR: |

27.9% |

Market Size in 2032: |

USD 43.0 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Region |

|

||

|

Key Market Drivers |

|

||

|

Key Market Restraints |

|

||

|

Key Opportunities |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ELECTRIC VEHICLE PLASTIC COMPONENTS MARKET BY TYPE (2017-2032)

- ELECTRIC VEHICLE PLASTIC COMPONENTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DASHBOARD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SEAT

- TRIM

- BUMPER

- BODY

- OTHER

- ELECTRIC VEHICLE PLASTIC COMPONENTS MARKET BY MATERIAL (2017-2032)

- ELECTRIC VEHICLE PLASTIC COMPONENTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PA

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PP

- PC

- PVB

- PU

- PVC

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Electric Vehicle Plastic Components Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- LEAR CORPORATION (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- JOHNSON CONTROLS INTERNATIONAL (U.S.)

- PLASTICOM INTERNATIONAL (U.S.)

- GENTEX CORPORATION (U.S.)

- MAGNA INTERNATIONAL (CANADA)

- CONTINENTAL AG (GERMANY)

- BROSE FAHRZEUGTEILE GMBH & CO. KG (GERMANY)

- TSG HOLDING GMBH (GERMANY)

- COVESTRO AG (GERMANY)

- SAINT-GOBAIN (FRANCE)

- PLASTIC OMNIUM (FRANCE)

- PIRELLI & C. S.P.A. (ITALY)

- ADIENT PLC (IRELAND)

- HUAYU AUTOMOTIVE GROUP (CHINA)

- YANFENG AUTOMOTIVE TRIM SYSTEMS (CHINA)

- MOTHERSON SUMI SYSTEMS LIMITED (INDIA)

- YAZAKI CORPORATION (JAPAN)

- SUMITOMO ELECTRIC INDUSTRIES (JAPAN)

- DENSO CORPORATION (JAPAN)

- SEKISUI CHEMICAL CO., LTD. (JAPAN)

- MARELLI HOLDINGS CO., LTD. (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL ELECTRIC VEHICLE PLASTIC COMPONENTS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Material

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Electric Vehicle Thermal Management Solutions Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 4.73 Bn |

|

Forecast Period 2024-32 CAGR: |

27.9% |

Market Size in 2032: |

USD 43.0 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Region |

|

||

|

Key Market Drivers |

|

||

|

Key Market Restraints |

|

||

|

Key Opportunities |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Global Electric Vehicle Plastic Components Market research report is 2024-2032.

Lear Corporation (U.S.), Johnson Controls International (U.S.), Plasticom International (U.S.), Gentex Corporation (U.S.), Magna International (Canada), Continental AG (Germany), Brose Fahrzeugteile GmbH & Co. KG (Germany), TSG Holding GmbH (Germany), Covestro AG (Germany), Saint-Gobain (France), Plastic Omnium (France), Pirelli & C. S.p.A. (Italy), Adient plc (Ireland), Huayu Automotive Group (China), Yanfeng Automotive Trim Systems (China), Motherson Sumi Systems Limited (India), Yazaki Corporation (Japan), Sumitomo Electric Industries (Japan), Denso Corporation (Japan), Sekisui Chemical Co., Ltd. (Japan), Marelli Holdings Co., Ltd. (Japan), Hanon Systems (South Korea), and Other Major Players.

The Electric Vehicle Plastic Components Market is segmented into Type, Material, and region. By Type, the market is categorized into Dashboard, Seat, Trim, Bumper, Body, Other. By Material, the market is categorized into Pa, Pp, Pc, Pvb, Pu, Pvc. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Electric vehicles (EVs) contain various plastic components that serve different purposes in the vehicle's structure, interior, and functionality. These plastic components contribute to reducing the vehicle's weight, enhancing efficiency, and providing insulation.

Global Electric Vehicle Plastic Components Market Size Was Valued at USD 4.73 Billion In 2023 And Is Projected to Reach USD 43.0 Billion By 2032, Growing at A CAGR of 27.9% From 2023 To 2032.