Electric Vehicle Charging Socket Market Synopsis

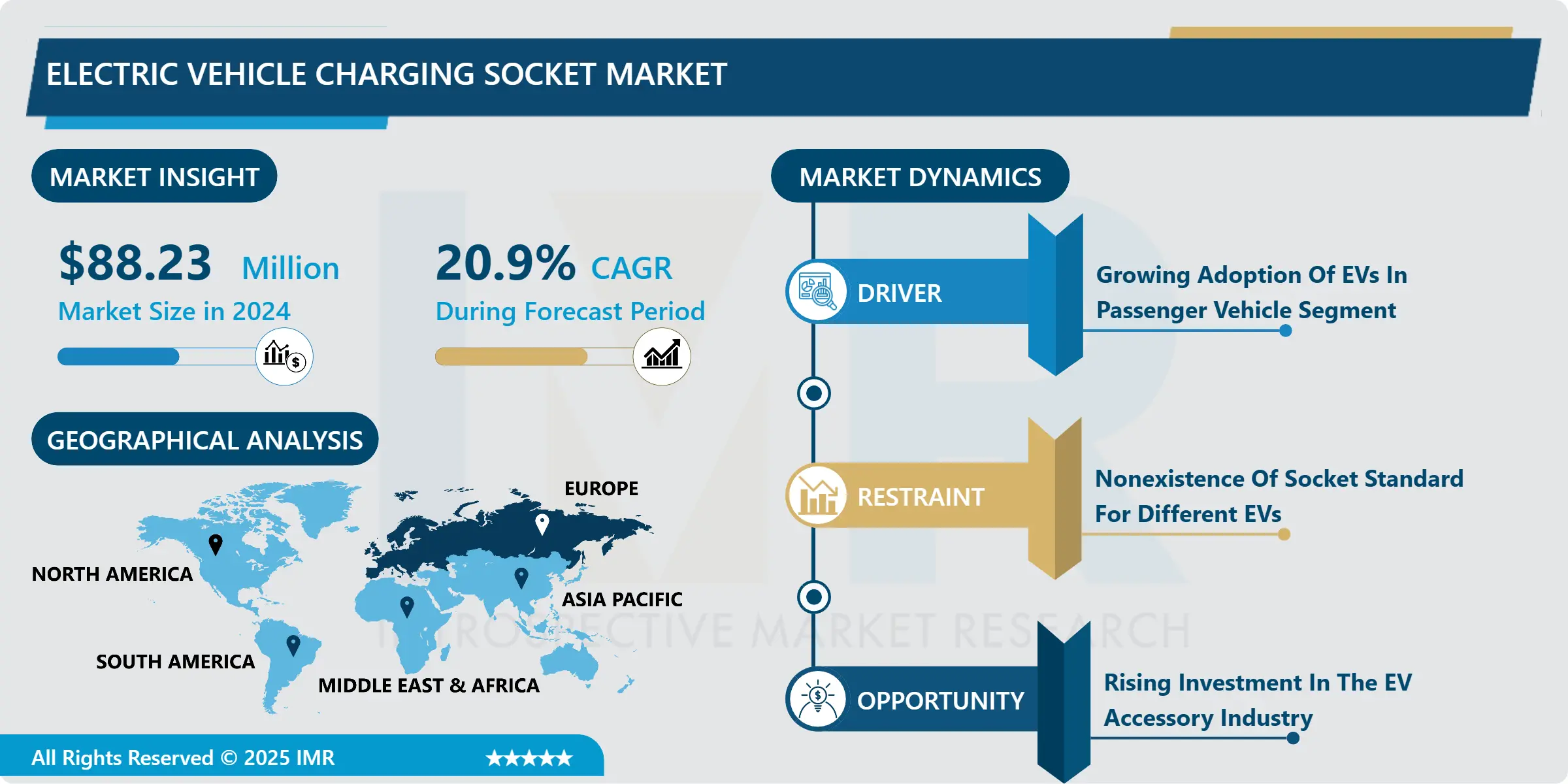

Electric Vehicle Charging Socket Market Size Was Valued at USD 88.23 Million in 2024 and is Projected to Reach USD 402.74 Million by 2032, Growing at a CAGR of 20.9% From 2025-2032.

An electric vehicle charging socket can be defined as a physical point of contact that connects an electric vehicle (EV) to the source of power required for battery charging. Ordinarily, it comprises a plug on the one side which fits into the car's charging port, and a socket on the other side that gets connected to a power supply. Socket is responsible for bringing electricity to the vehicle safely and effectively through particular rules and protocols, which would depend on the charging system standing behind (AC, DC). g. These include AC charging (called Level 1 and Level 2 charging), and DC fast charging. EV charging ports may differ in form, size and layout, based on local norms or the type of fast charging infrastructure deployed.

The electric vehicle (EV) charging socket market gained a momentum of growth in recent years due to the growing numbers of electric vehicles introduced into the world market. More governments and industries of the world are pushing the sustainability and emission-free agendas while the need for EV charging sockets are at the all-time high. Manufacturers are capable of designing different types of sockets to meet the specific requirements imposed on different charging standards and vehicle models.

The integration of fast-charging technology is instrumental in the introduction of powerful charging sockets that are designed to pump quick currents and therefore increase the appeal of electric vehicles. In the line with the electric vehicles (EV) business expansion and the pressure of the renewable energy sources, the EV charging socket market will sustain the growth in the coming years.

On the other hand, the fact that EV charging infrastructure is focused more on renewable energy sources than in the past is playing a role in shaping the EV charging market. Some charging stations have combined renewable energy generation and storage systems, and the utilization of smart charging sockets that can adjust incoming energy amounts timely while properly managing the demands is essential. In general, the growth of electric vehicle fleets in fields like transportation and logistics is creating demand for durable high-power charging system including scokets able to handle high throughputs as well as simultaneous charging.

The advent of the wireless charging technology brings new possibilities to the market as producers invest in the production of electric chargers that lack the necessity of any cable connections.

Electric Vehicle Charging Socket Trend Analysis

Electric Vehicle Charging Socket Market Drivers- Growing Adoption Of EVs In Passenger Vehicle Segment

- The revolutionary innovation of wireless charging for electric vehicles (EVs), therefore, seems to be one of the rapidly developing trends that the EV charging infrastructure is undergoing. The technology has the potential of giving a higher degree of ease and effectiveness for EV users by removing the hinderance of physical wires and plugs. Alternatively, vehicles may charge their batteries only by parking over a wireless charging pad and using electromagnetic induction to deliver power to the vehicle This technology can transform the EV charging paradigm into a more seamless and user-friendly design (e.g., it is very useful in autonomous vehicles and fleet operations where frequent charging is required).

- Wireless charging will help to overcome the problems of charging stations which are not lcoated strategically near busy roads and highways. Though only beginning its infancy at the moment, the increasing interest and investment in wireless charging technology show its promise of becoming a basis for an EV ecosystem of the future, which will make the process of wide usage of EVs more achievable and thus speed up the progress towards sustainable transportation.

Electric Vehicle Charging Socket Market Opportunities- Rising Investment In The EV Accessory Sectors

- The rapid growth of the EV industry has definitely been paralleled by the deluge of the EV accessory market. Due to the growing need in EVs investor and entrepreneurs start receiving rewards made by the service that includes those automobiles. EV accessories have successfully penetrated the market on different aspects of EV charging infrastructure and battery technology to innovative accessories such as smart mats, organizers and customized personalized accessories. Therefore, EV accessory industry is rapidly changing to cater to the emerging needs and taste of consumers.

- Sustainability and the environment consciousness impose the advancement in the raw materials and techniques of manufacturing on this exact industry. Given the shifting focus towards user experiences improvement and power efficiency of EVs, the future of EV accessory industry is full of the prospects of growth, change and creativeness..

Electric Vehicle Thermal Management Solutions Market Segment Analysis:

Electric Vehicle Thermal Management Solutions Market is Segmented on the basis of type, and Charging level.

By Type, CCS (Combined Charging System)segment is expected to dominate the market during the forecast period

- Type 1 Sockets: Leading the roots in North America and Japan, being compromised with Nissan Leaf or Mitsubishi i-MiEV.

- CCS (Combined Charging System): A majority of installations took place in the European and North American regions with a reputation for fast charging and compatibility with different EV models which provided a convenience users can deal with.

- Chademo: Developed in Japan, viewed as a good choice for fast charging EVs like some Nissan and Mitsubishi models, and allows for a quick and more efficient charging.

- GB/T Sockets: It is China dominant since its EV sector is strong and the country is making regulations in this area. This is the reason why EV market in this area is growing.

- Tesla Infrastructure: The custom-made plugs and Tesla's Supercharger network designed exclusively for Tesla cars is an ideal representation of Tesla's customer-oriented approach towards a smooth charging experience.

From the market point of view Level 2 segment hold the biggest part in 2024

- Level 1 charging is the standard charging point for standard household outlets with the lowest charging power. Although useful for charging at home overnight and quieter than other charging levels, Level 1 charging may not be fast enough for drivers requiring more time to charge. Similarly, it is still a critical necessity for EV owners whose charging infrastructure does not have any dedicated charging stations.

- Level 2 charging is a significant step that takes convenience to the next level. These recharging outlets are typically available at workplaces, public parking lots, and residential areas equipped with dedicated equipment for EV charging. Level 2 chargers provide faster charging speed than Level 1 thus, they are more suitable for taking up the EV batteries during short stops or daily charging rhythms.

- The third level of charging - commonly referred to as DC fast charging (rapid charging) is the topmost and fastest option available. These powerful fast chargers are able to very quickly side-load an EV's battery, thus making them perfect for long distance journeys and reducing charging times to a level far higher than that of the Level 1 or Level 2 chargers. Level 3 chargers usually be discovered along highways, important traveling lines and in the commercial areas that meet a demand from drivers who prefer quick charging option..

Electric Vehicle Charging Socket Market Regional Insights:

Europe is another dominating region in the electric vehicle charging socket market.

- Europe will be in the future the region most committed to electric vehicle (EV) charging socket technology. The advent of stricter emissions regulations, widespread emission awareness, and extensive government subsidies that increase the affordability of e-mobility, have led to a dramatic increase in the number of EVs sold in Europe. Therefore, there is a clear impetus for the continental infrastructure elements such as charging stations to be developed.

- The initiatives such as European Union's Clean Vehicles Directive as well as charging networks put into practice by companies Ionity and Tesla have additionally reenforced the EV ecosystem of charging. On the top of it, as way of being active, European countries have adopted high-ambitious goals to bring their fleets ICE vehicles to zero by 2030 and in so doing have been generating investment in EV charging infrastructure. With the already present automakers well engaged in e-mobility, as well as Europe's cities that support urban EV usage, Europe is therefore a key market in terms of electric vehicle charging solutions.

Active Key Players in the Electric Vehicle Charging Socket Market

- Tesla, Inc.

- ChargePoint, Inc.

- EVBox Group

- ABB Group

- Schneider Electric SE

- Siemens AG

- Webasto SE

- Delta Electronics, Inc.

- Tritium Pty Ltd.

- Blink Charging Co.

- ClipperCreek, Inc.

- SemaConnect, Inc.

- DBT Group (a subsidiary of Engie SA)

- Pod Point Ltd.

- Alfen N.V.

- Enel X

- Efacec Power Solutions

- EO Charging

- KEBA AG

- Leviton Manufacturing Co., Inc.

- NewMotion (a subsidiary of Royal Dutch Shell)

- EVgo Services LLC

- EVBox (a subsidiary of Engie SA)

- SinoEV Tech Co., Ltd.

- Other Active Players

Key Industry Developments in the Electric Vehicle Charging Socket Market:

- In September,The latest development in EV charging by BOLT company is the introduction of the all-purpose BOLT lite charging station. It will work by using the existing AC power supply at home and is well-suited for all my EV portable chargers.

- In February, Volkswagen Group Technology is manufacturing electric engine pulse inverters and heating cooling systems. These modules are built using the modular strategical approach that has been applied in other components. This component will be implemented for the first time on the MEB+ platform in the beginning.

- In January of 2023, a popular OEM in the sector of thermal engineering solutions, Modine, released an upgraded version of its EVaranteTM Battery Thermal Management System (BTMS) that can be used in both on-road and off-road electric cars. The L-CON BTMS, which is the innovation, contains an advanced electronic control unit as well as heat exchanger technology essentials to face up to the adverse environmental circumstances.

|

Global Electric Vehicle Charging Socket Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 88.23 Mn. |

|

Forecast Period 2024-32 CAGR: |

20.9% |

Market Size in 2032: |

USD 402.74 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Charging Level |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electric Vehicle Charging Socket Market by Type (2018-2032)

4.1 Electric Vehicle Charging Socket Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Type1

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 CCS

4.5 Chademo

4.6 GB/T

4.7 Tesla

Chapter 5: Electric Vehicle Charging Socket Market by Charging Level (2018-2032)

5.1 Electric Vehicle Charging Socket Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Level 1

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Level 2

5.5 Level 3

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Electric Vehicle Charging Socket Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 3M (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 DANA INCORPORATED (UNITED STATES)

6.4 GENTHERM INCORPORATED (UNITED STATES)

6.5 GRAYSON (WASHINGTON

6.6 DC)

6.7 HANON SYSTEMS (DAEJEON

6.8 SOUTH KOREA)

6.9 LORD CORPORATION (NORTH CAROLINA

6.10 UNITED STATES)

6.11 MAHLE GMBH (STUTTGART

6.12 GERMANY)

6.13 POLYMER SCIENCE INC. (MONTICELLO

6.14 IN)

6.15 ROBERT BOSCH GMBH (GERLINGEN

6.16 GERMANY)

6.17 VALEO (PARIS

6.18 FRANCE)

6.19 VOSS AUTOMOTIVE GMBH (GERMANY)

6.20 BORGWARNER INC. (UNITED STATES)

6.21 CONTINENTAL AG (GERMANY)

6.22 DENSO CORPORATION (JAPAN)

6.23 JOHNSON ELECTRIC HOLDINGS LIMITED (HONG KONG)

6.24 KONGSBERG AUTOMOTIVE (NORWAY)

6.25 OTHER KEY PLAYERS

Chapter 7: Global Electric Vehicle Charging Socket Market By Region

7.1 Overview

7.2. North America Electric Vehicle Charging Socket Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Type1

7.2.4.2 CCS

7.2.4.3 Chademo

7.2.4.4 GB/T

7.2.4.5 Tesla

7.2.5 Historic and Forecasted Market Size by Charging Level

7.2.5.1 Level 1

7.2.5.2 Level 2

7.2.5.3 Level 3

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Electric Vehicle Charging Socket Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Type1

7.3.4.2 CCS

7.3.4.3 Chademo

7.3.4.4 GB/T

7.3.4.5 Tesla

7.3.5 Historic and Forecasted Market Size by Charging Level

7.3.5.1 Level 1

7.3.5.2 Level 2

7.3.5.3 Level 3

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Electric Vehicle Charging Socket Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Type1

7.4.4.2 CCS

7.4.4.3 Chademo

7.4.4.4 GB/T

7.4.4.5 Tesla

7.4.5 Historic and Forecasted Market Size by Charging Level

7.4.5.1 Level 1

7.4.5.2 Level 2

7.4.5.3 Level 3

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Electric Vehicle Charging Socket Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Type1

7.5.4.2 CCS

7.5.4.3 Chademo

7.5.4.4 GB/T

7.5.4.5 Tesla

7.5.5 Historic and Forecasted Market Size by Charging Level

7.5.5.1 Level 1

7.5.5.2 Level 2

7.5.5.3 Level 3

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Electric Vehicle Charging Socket Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Type1

7.6.4.2 CCS

7.6.4.3 Chademo

7.6.4.4 GB/T

7.6.4.5 Tesla

7.6.5 Historic and Forecasted Market Size by Charging Level

7.6.5.1 Level 1

7.6.5.2 Level 2

7.6.5.3 Level 3

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Electric Vehicle Charging Socket Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Type1

7.7.4.2 CCS

7.7.4.3 Chademo

7.7.4.4 GB/T

7.7.4.5 Tesla

7.7.5 Historic and Forecasted Market Size by Charging Level

7.7.5.1 Level 1

7.7.5.2 Level 2

7.7.5.3 Level 3

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Electric Vehicle Charging Socket Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 88.23 Mn. |

|

Forecast Period 2024-32 CAGR: |

20.9% |

Market Size in 2032: |

USD 402.74 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Charging Level |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||