Electric Vehicle Busbar Market Synopsis

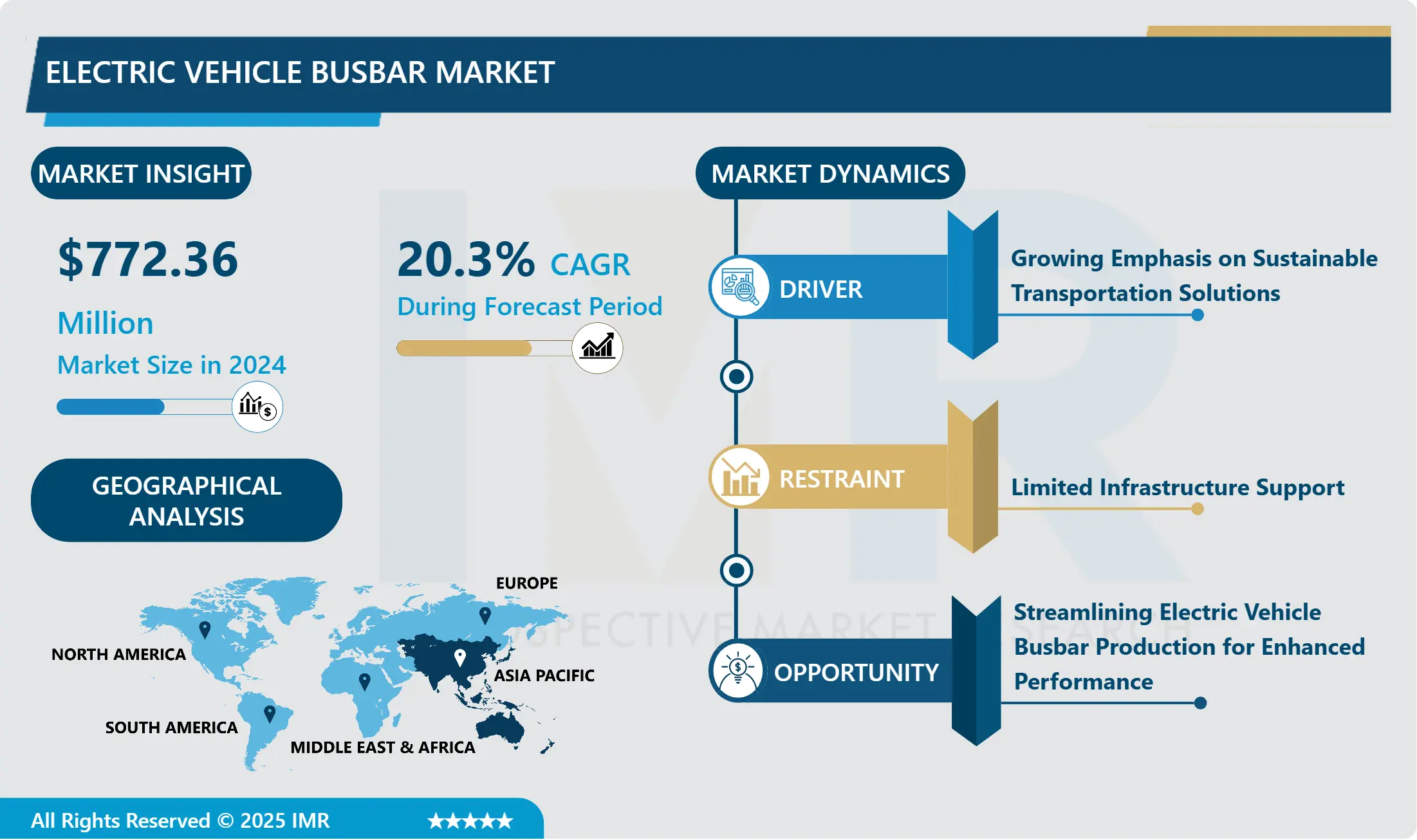

Electric Vehicle Busbar Market Size Was Valued at USD 772.36 Million in 2024 and is Projected to Reach USD 3388.01 Million by 2032, Growing at a CAGR of 20.3% From 2025-2032.

An electric vehicle busbar is a vital structure in an electric vehicle (EV) which is responsible for distribution of electrical power efficiently. In essence, it is a metallic strip or rod that works like a conductor, being a connection between various electrical components such as batteries, motors, and the other systems inside the car. Busbars are key for handling a large current and minimizing power losses during electricity transmission. Thus, they allow for the normal working of EV.

The electric vehicle busbar market is growing at an impressively fast rate and it is largely due to the rising global demand for EVs. Busbars, the essential elements of EVs, are responsible for the smooth and uninterrupted supply of electrical power in the auto system. With the transportation sector moving more towards electrification to address environmental issues and meet stringent emission rules, the need for electric buses and other EVs keeps growing. This usually rapid increase in demand leads to greater busbar requirements as they are crucial components for enabling quick and efficient electrical connectivity in EVs.

Busbar technology is moving forward in lightweight and high-conductivity materials which bring the market growth. Also, governmental actions and subsidies that are focused on promoting the use of electric vehicles are forming a solid ground for market expansion by encouraging both manufacturers and end-users. In the electric vehicle industry, the demand for busbars is expected to keep growing which is good news for both the existing players and new entrants in the market.

Electrification of transport system includes not only personal vehicles but also lorries and public buses. The use of electric buses, in particular, is gaining in popularity as municipalities worldwide seek solutions that are cleaner and more sustainable for transportation, to decrease air pollution, and to reduce CO2 emissions. Electric buses provide many advantages, including lower operating costs, noise reduction, and better air quality, which is a desirable option for public transit authorities and fleet owners. There is a rising usage of the electric buses that results in outstanding demand for busbar systems, which are customized to the individual needs of such vehicles, therefore boosting market expansion.

The growing demand for energy efficiency and longer driving range in electric vehicles is trigging developments in the area of busbar design and manufacturing. Thermal management features such as heat sinks are becoming more and more critical for busbars thanks to the fact that they help to significantly reduce heat accumulation, leading to better-performing and more reliable vehicles. Furthermore, the incorporation of smart busbar facilities, such as sensors and diagnostic systems, is allowing for real time diagnostics and predictive maintenance improving the safety and the lifetime of electric vehicle systems.

As the electric vehicle industry experiences more improvements brought about by technological advancements, regulatory mandates, and shifting consumers’ preferences, the demand for innovative busbar solutions is likely to grow too. This provides a significant chance for the market members to act upon the growing electric vehicle eco-system and to be part of the green transition of the automotive industry.

Electric Vehicle Busbar Market Trend Analysis

Increased Adoption of Lightweight Materials for Busbar Construction

- One major trend in the EV industry is the growth in demand for lightweight materials for the manufacture of busbars. Copper has been the preferred material in the past due to its superior conductive characteristics. Nevertheless, with the growing pressure to improve energy efficiency in vehicles and extend range, automakers are considering the use of other materials including aluminum and advanced composites.

- There are several benefits of these lightweight materials, such as less vehicle weight, better energy efficiency, and heat management. Furthermore, they provide cost effectiveness and streamline production. Consequently, EV busbar manufacturers are engaging in research and development initiatives to evolve lightweight materials for busbar applications to enhance their performance and reliability.

- It is in sync with the recent industry inclination to reduce the carbon emissions and the goals of sustainability. With the involvement of lightweight busbars in electric vehicles, manufacturers have chances to increase the efficiency of those vehicles and thus contribute to the environmental sustainability of electric transportation systems.

Streamlining Electric Vehicle Busbar Production for Enhanced Performance

- Streamlining EV busbar production is paramount for improving efficiency in the expansion of EV busbar range. Busbars are indispensible in efficiently conducting the electricity inside EVs, leading to the optimized performance and safety. Manufacturers need to implement modern manufacturing methods to enhance their manufacturing process and decrease production time. They can rely on automated assembly lines and precision machines to increase efficiency.

- Using innovative materials such as lightweight yet durable alloys for conductivity with low weight, car performance and range can be improved. Moreover, quality control management should ensure consistent and trustable performance across the entire production process to cater for the high standards of the the EV industry. By adopting these strategies, manufacturers do not only meet the increasing need for EV busbars but also take part in the development of electric vehicle technology..

Electric Vehicle Busbar Market Segment Analysis:

Electric Vehicle Busbar Market is segmented based on System Type, Power Rating, Conductor, and Region.

By System Type, Single segment is expected to dominate the market during the forecast period

- Single: This setup has only one busbar control system managing the electrical circulation within the car. This could include a common busbar through which power would be supplied throughout the vehicle to components like the battery pack, motor controller, and other electrical systems.

- Double: It implies two different bus-bar systems within the vehicle. In addition to double systems, redundancy and high reliability can be provided. It also allows to separate high-voltage and low-voltage components for safety and efficiency purposes.

- Ring: In ring topology, busbars form a circle, often used to ensure redundancy and fault tolerance. Such a part of the busbar could be damaged or malfunction and the current could still flow through the ring, leading to uninterrupted conduction.

Conductor Copper, the segment accounted to dominate the market in 2024

- Copper Busbars: Copper has traditionally been a preferred material for busbars because of its high electrical conductivity, high thermal conductivity and the ability to withstand corrosion. It is applied in many areas of electrical engineering, such as electric vehicles, where high efficiency and reliability are critical. Copper busbars have low resistances, hence, energy loss is reduced as well as heat generation and the vehicles run more efficiently overall. Nevertheless, copper's high cost is usually the greatest obstacle to its wide scale implementation, particularly in projects where cost reduction is the determining factor.

- Aluminum Busbars: Copper is replaced by Aluminum which is cheaper than copper. It is lighter and cheaper, hence it is suitable for particular applications. Even though aluminum has a lower conductivity than copper, its performance is now enhanced and it becomes a viable alternative as electric vehicle busbars due to the advancement in technology. Aluminum busbars are a common choice in the electric vehicles where weight is very important, because they are the contributors to the vehicle efficiency and its range. On the flip side though, to achieve comparable performance with copper, aluminum will require larger cross-sectional areas which can cause design problems.

Electric Vehicle Busbar Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- Asia-Pacific countries are projected to occupy a commendable position, with a dominant presence in the electric vehicle busbar market over the forecast period. The reason for this projected supremacy lies in the combination of multiple significant factors. Firstly, the Asia-Pacific is the home of some of the world's remarkable and famous economies which are growing at a rapid pace; these include China, India, Japan, and South Korea that are investing in the electric car (EV) infrastructure and technology. Moreover, stringent environmental regulations and the effort to reduce carbon emissions have gained popularity among governments and are getting adopted across the region as various incentives are given to encourage EV purchase. The other aspect is that the more and more crowded city dwellers in Asia turn to electric buses to combat fouled city air and traffic jams, for which busbar solutions would be in demand as a consequence.

- Together, the well-established and the emerging market players along with advanced manufacturing capabilities and technology innovations in the electric bus busbar industry in Asia-Pacific makes the region a frontrunner in the introduction and use of new busbar technology for electric buses.

Active Key Players in the Electric Vehicle Busbar Market

- Siemens AG (Germany)

- Mersen Corporate Services SAS (France)

- Hitachi Metals Ltd. (Japan)

- Sertec Group Ltd (UK)

- TB&C Holding GmbH(Germany)

- EG Electronics AB (Sweden)

- Legrand Holding SA (France)

- ABB Group (Switzerland)

- AMETEK Inc (US)

- Interplex Holdings Pte. Ltd (Singapore)

- Mitsubishi Electric Corporation (Japan)

- Schneider Electric SE (France)

- Copperberg AB (Sweden)

- Ryoden Kasei Corporation (Japan)

- Storm Power Components (US)

- Other Active Players

Key Industry Developments in the Commercial Electric Vehicle market

- In March 2024,Indian government issued EV policy setting the minimum investment of around 500 million US dollars. The investors will be given a three-year window to carry out the manufacture of EVs locally with 25% value addition within the third year and 50% value addition within the fifth year, and so the business outlook shall become a necessity.

- In January 2024, the U. S. Department of Transportation and Energy unveiled a fund to the tune of USD 325 million that will go towards three initiatives which are designed to boost the reliability and resilience of the publicly accessible chargers, give the necessary push for the development of EV technologies and facilitate training on its charging deployment and maintenance, ultimately fuelling the market growth.

Global Electric Vehicle Busbar Market Scope:

|

Global Electric Vehicle Busbar Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 772.36 Mn. |

|

Forecast Period 2025-32 CAGR: |

20.3% |

Market Size in 2032: |

USD 3388.01 Mn. |

|

Segments Covered: |

By System Type |

|

|

|

By Power Rating |

|

||

|

By Conductor |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electric Vehicle Busbar Market by System Type (2018-2032)

4.1 Electric Vehicle Busbar Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Single

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Double

4.5 Ring

Chapter 5: Electric Vehicle Busbar Market by Power Rating (2018-2032)

5.1 Electric Vehicle Busbar Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Low

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 High

Chapter 6: Electric Vehicle Busbar Market by Conductor (2018-2032)

6.1 Electric Vehicle Busbar Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Copper

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Aluminum

6.5 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Electric Vehicle Busbar Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABB

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AISIN CORPORATION

7.4 ALLISON TRANSMISSION

7.5 BORGWARNER

7.6 BOSCH

7.7 CONTINENTAL AG

7.8 DANA

7.9 DENSO

7.10 GKN (MELROSE)

7.11 HEXAGON AB

7.12 HITACHI

7.13 HUAYU AUTOMOTIVE ELECTRIC SYSTEM

7.14 HYUNDAI MOBIS

7.15 INFINEON TECHNOLOGIES

7.16 JATCO

7.17 JING-JIN ELECTRIC TECHNOLOGIES

7.18 LG ELECTRONICS

7.19 MAGNA INTERNATIONAL

7.20 MAHLE

7.21 MEIDENSHA CORPORATION

7.22 MERITOR

7.23 NIDEC CORPORATION

7.24 SHANGHAI AUTOMOTIVE SMART ELECTRIC DRIVE

7.25 SIEMENS AG

7.26 SMESH E-AXLE

7.27 ZF GROUP

7.28 OTHER KEY PLAYERS

Chapter 8: Global Electric Vehicle Busbar Market By Region

8.1 Overview

8.2. North America Electric Vehicle Busbar Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by System Type

8.2.4.1 Single

8.2.4.2 Double

8.2.4.3 Ring

8.2.5 Historic and Forecasted Market Size by Power Rating

8.2.5.1 Low

8.2.5.2 High

8.2.6 Historic and Forecasted Market Size by Conductor

8.2.6.1 Copper

8.2.6.2 Aluminum

8.2.6.3 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Electric Vehicle Busbar Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by System Type

8.3.4.1 Single

8.3.4.2 Double

8.3.4.3 Ring

8.3.5 Historic and Forecasted Market Size by Power Rating

8.3.5.1 Low

8.3.5.2 High

8.3.6 Historic and Forecasted Market Size by Conductor

8.3.6.1 Copper

8.3.6.2 Aluminum

8.3.6.3 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Electric Vehicle Busbar Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by System Type

8.4.4.1 Single

8.4.4.2 Double

8.4.4.3 Ring

8.4.5 Historic and Forecasted Market Size by Power Rating

8.4.5.1 Low

8.4.5.2 High

8.4.6 Historic and Forecasted Market Size by Conductor

8.4.6.1 Copper

8.4.6.2 Aluminum

8.4.6.3 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Electric Vehicle Busbar Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by System Type

8.5.4.1 Single

8.5.4.2 Double

8.5.4.3 Ring

8.5.5 Historic and Forecasted Market Size by Power Rating

8.5.5.1 Low

8.5.5.2 High

8.5.6 Historic and Forecasted Market Size by Conductor

8.5.6.1 Copper

8.5.6.2 Aluminum

8.5.6.3 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Electric Vehicle Busbar Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by System Type

8.6.4.1 Single

8.6.4.2 Double

8.6.4.3 Ring

8.6.5 Historic and Forecasted Market Size by Power Rating

8.6.5.1 Low

8.6.5.2 High

8.6.6 Historic and Forecasted Market Size by Conductor

8.6.6.1 Copper

8.6.6.2 Aluminum

8.6.6.3 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Electric Vehicle Busbar Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by System Type

8.7.4.1 Single

8.7.4.2 Double

8.7.4.3 Ring

8.7.5 Historic and Forecasted Market Size by Power Rating

8.7.5.1 Low

8.7.5.2 High

8.7.6 Historic and Forecasted Market Size by Conductor

8.7.6.1 Copper

8.7.6.2 Aluminum

8.7.6.3 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Global Electric Vehicle Busbar Market Scope:

|

Global Electric Vehicle Busbar Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 772.36 Mn. |

|

Forecast Period 2025-32 CAGR: |

20.3% |

Market Size in 2032: |

USD 3388.01 Mn. |

|

Segments Covered: |

By System Type |

|

|

|

By Power Rating |

|

||

|

By Conductor |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||