Electric Traction Motor Market Synopsis:

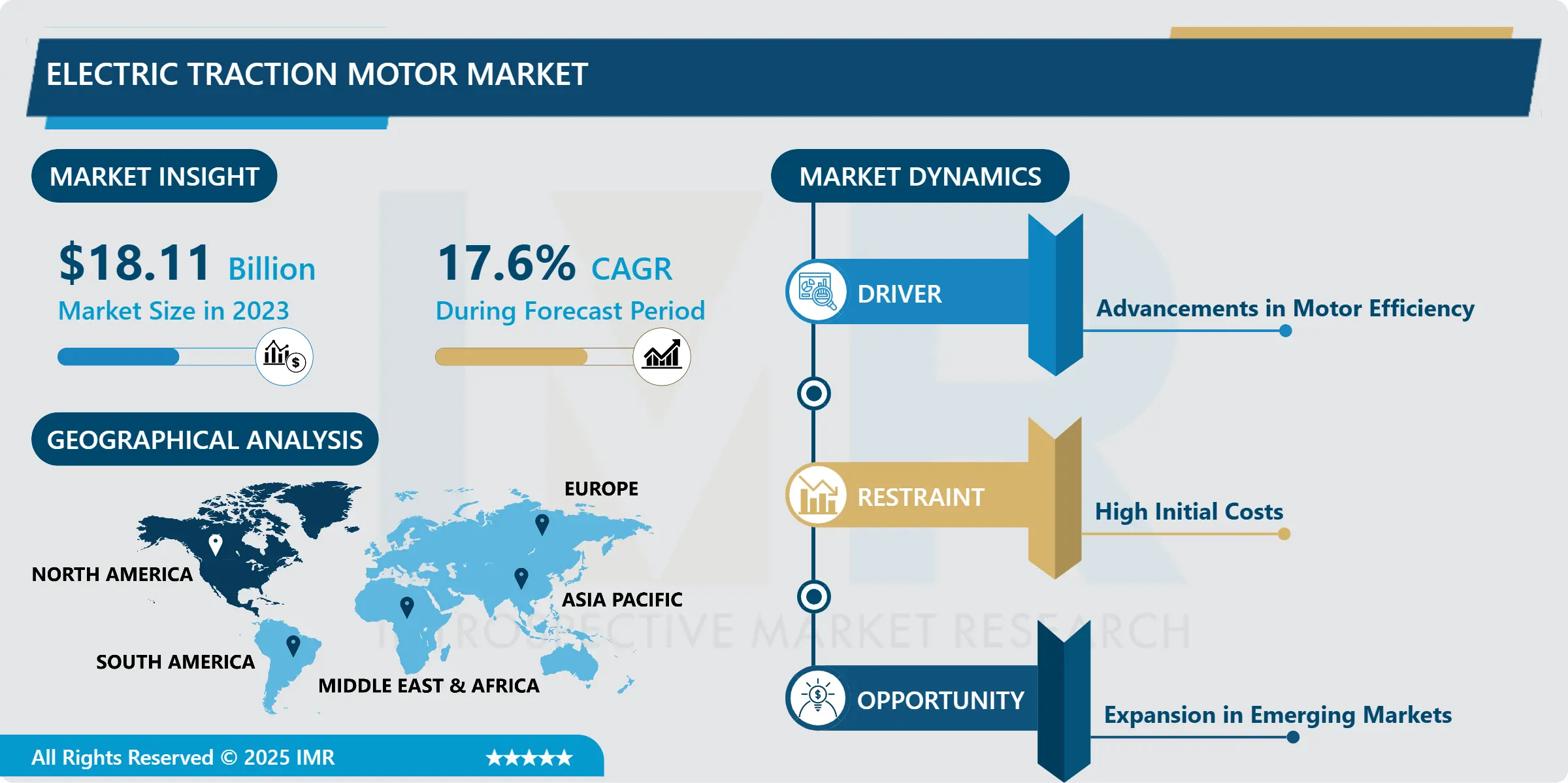

Electric Traction Motor Market Size Was Valued at USD 18.11 Billion in 2023, and is Projected to Reach USD 77.91 Billion by 2032, Growing at a CAGR of 17.6% From 2024-2032.

The electric traction motor market refers to motors used to develop tractive force for electric as well as hybrid automobiles and railcars and industrial uses. These motors convert electrical energy to mechanical energy and therefore producing efficiency when it comes to movement. The market is driven by factors such as rise in use of electric vehicles, evolution of transports system, and need for energy efficient solutions.

Electric traction motors are essential to fourth-generation transport systems and are clean and efficient compared to ordinary otto-cycle inner combustion engines. They are used across various industries for railways, and electric vehicle (EVs) integration, industrial machines, and more. The market has grown drastically majorly due to electrification happening in various industries across the globe encouraged by climate change initiatives which are already in place.

The growth of the market is directly linked to EVs as governments around the globe implement incentives and charging infrastructure for them. At the same time, the elements of electric traction motor are gradually being embodied in railways to improve the working performance and ecological capabilities. The industrial manufacturing equipment also uses these motors to ensure that precision and reliability is achieved in operations.

Higher efficiency due to brushless DC motor technology and permanent magnet synchronous motor technology has helped drive the increased market growth. These innovations include better efficiency, low maintenance and high performance. Some threats which include high initial costs as well as disrupted supply chain remain as a hindering factor towards the market growth.

Electric Traction Motor Market Trend Analysis:

Rising Adoption of EVs

-

The change over to EV is another key trend that has rapidly impacted the electric traction motor market. Pavement environmental standards and tightening emission standards have been major drivers to EVs across the world. Governments are devising policies and incentives or production subsidies and tax incentives for popularizing EV vehicles and production resulting in higher demand of electric traction motors.

- The global automakers are focusing on the research of improved and effective electric vehicles incorporating new and enhanced traction motors. Light materials and better motors drive EVs, technologically the world is improving the performance of the more encouraging EVs. Hence, electric traction motors are expected to be a major key of the fast growing EV market in its bid to support a sustainable mode of transport.

Expansion in Emerging Markets

-

New entrants offer a clear growth opportunity for the electric traction motor industry. Newly industrialized countries like India, Brazil, or South East Asia need better or more effective transportation and machinery which is again driving this need. These regions are using electrified railways, metro systems, and EV infrastructure making them suitable markets for electric traction motors.

- Ancillary government policies and affiliation with global organizations is adding strength to the market growth in these areas. Such growth markets should be of interest to companies as they provide immense opportunity and a much larger customer base in which the company or the business can establish or expand thereby placing it strategically as a leading player in the international markets.

Electric Traction Motor Market Segment Analysis:

Electric Traction Motor Market is Segmented on the basis of Type, Power Rating, Application, End User, and Region.

By Type, AC Motors segment is expected to dominate the market during the forecast period

-

The use of AC motors therefore feature predominantly in electric traction motor applications due to efficiency and resilience as well as flexibility in application usage. They are prominently used in electric vehicles and railways, due to their regular high power requirement and power quality requirements. Other advancements in motors like the permanent magnet synchronous motors move AC motor technologies ahead in the market.

- In their turn, DC motors are used in industrial facilities, equipment, and certain automobiles, where precise speed regulation is necessary. There are trends that denote that DC motors are gradually being replaced by their AC equivalent in some areas and applications, yet the simple and cheap construction of the former make them retain competitive edge in certain specific niches.

By Application, Railways segment expected to held the largest share

-

Electrical traction motors are vital components of the railway systems, used in electric and hybrid electric and diesel- electric locomotives. Lately, there has been a significant push towards adoption of sustainable means of transport which has led to emphasis on electrified rail systems hence a very major market for these motors.

- The same way the EV segment is fast emerging as a critical segment of growth given the increasing demand for environment-friendly automobiles. Traction motors are also used by industrial machineries for accuracy and smooth operation while the other uses such as in marine vessels and mining equipments are gradually coming into practice.

Electric Traction Motor Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

-

Owing to rapid industrialization and urbanization, and large investments in electrics transportation system, the Asia-Pacific continues to dominate the electric traction motor market. Currently, the “Immature market” including Asia led by China, Japan, and India is more assertive in the production of EVs and railway electrification, which contributed largely to the region.

- China has also become a leading producer of electric traction motors, as can be seen owing to strong supply chain as well as the technological competence. Efforts by the governments in the region to encourage development of renewable energy and cut emissions bolster the region’s standings in the global marketplace.

Active Key Players in the Electric Traction Motor Market:

- Siemens AG (Germany)

- ABB Ltd (Switzerland)

- General Electric Company (United States)

- Toshiba Corporation (Japan)

- Nidec Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Robert Bosch GmbH (Germany)

- Bharat Heavy Electricals Limited (BHEL) (India)

- Alstom SA (France)

- Hitachi, Ltd. (Japan)

- WEG SA (Brazil)

- VEM Group (Germany), and Other Active Players

|

Global Electric Traction Motor Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.11 Billion |

|

Forecast Period 2024-32 CAGR: |

17.6% |

Market Size in 2032: |

USD 77.91 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Power Rating |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electric Traction Motor Market by Type

4.1 Electric Traction Motor Market Snapshot and Growth Engine

4.2 Electric Traction Motor Market Overview

4.3 AC Motors

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 AC Motors: Geographic Segmentation Analysis

4.4 DC Motors

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 DC Motors: Geographic Segmentation Analysis

Chapter 5: Electric Traction Motor Market by Power Rating

5.1 Electric Traction Motor Market Snapshot and Growth Engine

5.2 Electric Traction Motor Market Overview

5.3 Below 200 kW

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Below 200 kW: Geographic Segmentation Analysis

5.4 200-400 kW

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 200-400 kW: Geographic Segmentation Analysis

5.5 Above 400 kW

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Above 400 kW: Geographic Segmentation Analysis

Chapter 6: Electric Traction Motor Market by Application

6.1 Electric Traction Motor Market Snapshot and Growth Engine

6.2 Electric Traction Motor Market Overview

6.3 Railways

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Railways: Geographic Segmentation Analysis

6.4 Electric Vehicles (Evs)

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Electric Vehicles (Evs): Geographic Segmentation Analysis

6.5 Industrial Machinery

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Industrial Machinery: Geographic Segmentation Analysis

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Geographic Segmentation Analysis

Chapter 7: Electric Traction Motor Market by End-User

7.1 Electric Traction Motor Market Snapshot and Growth Engine

7.2 Electric Traction Motor Market Overview

7.3 Automotive

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Automotive: Geographic Segmentation Analysis

7.4 Transportation

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Transportation: Geographic Segmentation Analysis

7.5 Industrial

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Industrial: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Electric Traction Motor Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SIEMENS AG (GERMANY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ABB LTD (SWITZERLAND)

8.4 GENERAL ELECTRIC COMPANY (UNITED STATES)

8.5 TOSHIBA CORPORATION (JAPAN)

8.6 NIDEC CORPORATION (JAPAN)

8.7 MITSUBISHI ELECTRIC CORPORATION (JAPAN)

8.8 ROBERT BOSCH GMBH (GERMANY)

8.9 BHARAT HEAVY ELECTRICALS LIMITED (BHEL) (INDIA)

8.10 ALSTOM SA (FRANCE)

8.11 HITACHI

8.12 LTD. (JAPAN)

8.13 WEG SA (BRAZIL)

8.14 VEM GROUP (GERMANY)

8.15 OTHER ACTIVE PLAYERS

Chapter 9: Global Electric Traction Motor Market By Region

9.1 Overview

9.2. North America Electric Traction Motor Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 AC Motors

9.2.4.2 DC Motors

9.2.5 Historic and Forecasted Market Size By Power Rating

9.2.5.1 Below 200 kW

9.2.5.2 200-400 kW

9.2.5.3 Above 400 kW

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Railways

9.2.6.2 Electric Vehicles (Evs)

9.2.6.3 Industrial Machinery

9.2.6.4 Others

9.2.7 Historic and Forecasted Market Size By End-User

9.2.7.1 Automotive

9.2.7.2 Transportation

9.2.7.3 Industrial

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Electric Traction Motor Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 AC Motors

9.3.4.2 DC Motors

9.3.5 Historic and Forecasted Market Size By Power Rating

9.3.5.1 Below 200 kW

9.3.5.2 200-400 kW

9.3.5.3 Above 400 kW

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Railways

9.3.6.2 Electric Vehicles (Evs)

9.3.6.3 Industrial Machinery

9.3.6.4 Others

9.3.7 Historic and Forecasted Market Size By End-User

9.3.7.1 Automotive

9.3.7.2 Transportation

9.3.7.3 Industrial

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Electric Traction Motor Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 AC Motors

9.4.4.2 DC Motors

9.4.5 Historic and Forecasted Market Size By Power Rating

9.4.5.1 Below 200 kW

9.4.5.2 200-400 kW

9.4.5.3 Above 400 kW

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Railways

9.4.6.2 Electric Vehicles (Evs)

9.4.6.3 Industrial Machinery

9.4.6.4 Others

9.4.7 Historic and Forecasted Market Size By End-User

9.4.7.1 Automotive

9.4.7.2 Transportation

9.4.7.3 Industrial

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Electric Traction Motor Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 AC Motors

9.5.4.2 DC Motors

9.5.5 Historic and Forecasted Market Size By Power Rating

9.5.5.1 Below 200 kW

9.5.5.2 200-400 kW

9.5.5.3 Above 400 kW

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Railways

9.5.6.2 Electric Vehicles (Evs)

9.5.6.3 Industrial Machinery

9.5.6.4 Others

9.5.7 Historic and Forecasted Market Size By End-User

9.5.7.1 Automotive

9.5.7.2 Transportation

9.5.7.3 Industrial

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Electric Traction Motor Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 AC Motors

9.6.4.2 DC Motors

9.6.5 Historic and Forecasted Market Size By Power Rating

9.6.5.1 Below 200 kW

9.6.5.2 200-400 kW

9.6.5.3 Above 400 kW

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Railways

9.6.6.2 Electric Vehicles (Evs)

9.6.6.3 Industrial Machinery

9.6.6.4 Others

9.6.7 Historic and Forecasted Market Size By End-User

9.6.7.1 Automotive

9.6.7.2 Transportation

9.6.7.3 Industrial

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Electric Traction Motor Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 AC Motors

9.7.4.2 DC Motors

9.7.5 Historic and Forecasted Market Size By Power Rating

9.7.5.1 Below 200 kW

9.7.5.2 200-400 kW

9.7.5.3 Above 400 kW

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Railways

9.7.6.2 Electric Vehicles (Evs)

9.7.6.3 Industrial Machinery

9.7.6.4 Others

9.7.7 Historic and Forecasted Market Size By End-User

9.7.7.1 Automotive

9.7.7.2 Transportation

9.7.7.3 Industrial

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Electric Traction Motor Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.11 Billion |

|

Forecast Period 2024-32 CAGR: |

17.6% |

Market Size in 2032: |

USD 77.91 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Power Rating |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||