Electric Scooter Market Synopsis:

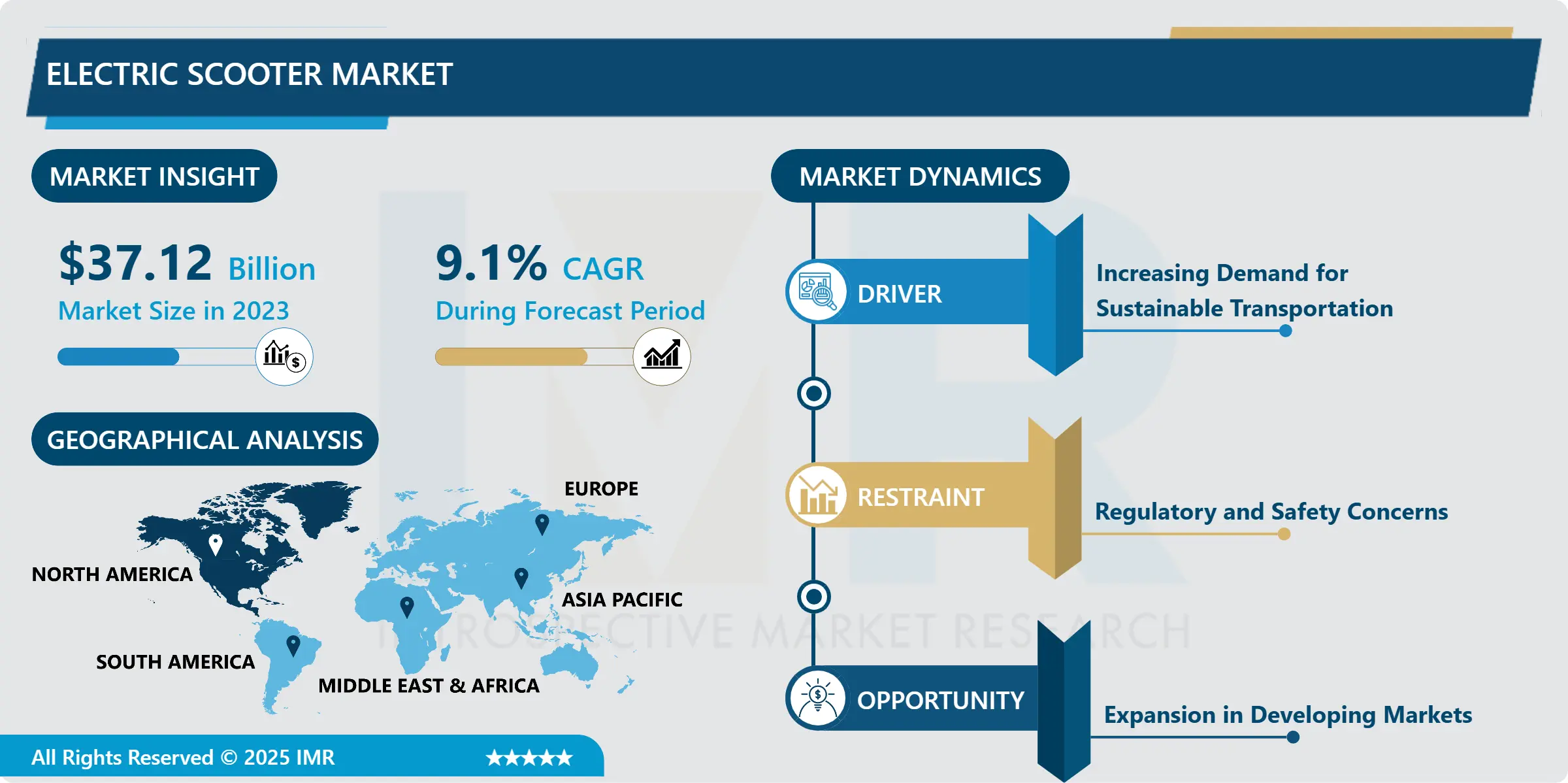

Electric Scooter Market Size Was Valued at USD 37.12 Billion in 2023, and is Projected to Reach USD 81.29 Billion by 2032, Growing at a CAGR of 9.10% From 2024-2032.

The electric scooter industry on the other hand relates to the segment where there are scooter that runs on electricity; it is two-wheeled powered by electric motors and rechargeable batteries for use in cities for transport. These scooters are mainly used for short journeys within both town centre and sub urban centres, making them an effective replacement for ordinary cars, particularly for daily usage.

The electric scooter market has been growing rapidly in recent years due to the development of the market’s need for electrical scooters as more environmentally friendly solutions for transportation. Due to emerging issues of traffic jam specifically in developed cities and pollution, electric scooters have proved to be efficient for a short distance travel. These scooters provide an effective, cheap, and eco-friendly ways of transport; in addition, they are suitable for use in cities where traffic jams are rampant. Increasing awareness of the need to control the amount of carbon emissions and enhance ambient air quality has made governments and municipalities to embrace adoption by facilitating the creation of structures like scooter-sharing systems and lanes meant for scooters.

The current improvements of scooter’s batteries have increased its range and also efficiency thus making it more suitable to be used in the daily activities. Electric scooters are also getting more intelligent with the inclusion of the GPS tracking feature, applicability to smartphones, and various safety features, and this can suit any type of consumer – private and business. The advent of electric scooter-sharing business has also added to this growth more than the services being offered across most cities worldwide. The market is also expected to rise alongside every other EV as consumer demands shift and find ways to reduce their carbon emissions.

Electric Scooter Market Trend Analysis:

Growing Adoption of Electric Scooter-Sharing Platforms

-

Use of electric scooter sharing applications as one of the trends in the electric scooter market. These applications enable people to hire electric scooters for short distances, and this business model is fashionable among all the cities worldwide since it solves the problem of parking and constantly jammed roads. Lime, Bird and Spin are some companies which have popularized this market; scooters that can be rented through smartphone applications are very convenient for clients who do not permanently possess a scooter but may need it for several minutes.

- Trend corresponds to the general tendency of the increase of population density and transition to multi-passenger transport services. The connectivity of most of these scooters into other public means of transport has also played a significant role in increasing its utility in first and last mile mobility. Electric scooter sharing services fill gaps in mobility needs that are less met by car or public transport ownership and use, for a diverse population. The opportunity to easily rent a scooter for short distances is nice, especially when you literally are pressed for time and space, usually, within big city areas.

Expansion in Developing Markets

-

The electric scooter market’s chance is the globalization of the electric scooter market or the penetration into the developing countries markets. A large number of emerging markets especially in Asia as well as America Latina, are also experiencing high level of urbanization, and increasing need for affordable mobility solutions. Many of these countries are now experiencing traffic jams, air pollution, etc., thus the world needs environmentally sustainable transport systems. Electric scooters can be economically efficient for consumers and have the biggest appeal in less-developed countries where people cannot even afford regular cars.

- There are other different opportunities, in addition to individual consumers which include; commercial usage such as the last one kilometer delivery services. Due to the steady growth of e-commerce, organizations in emerging economy generates needs for cheaper and effective delivery. Especially for this case, electric scooters are perfect since they are compact and can easily get through traffic. This venture into the developing markets might foster growth of the electric scooter market because governments and businesses of such countries embrace sustainable means of transport.

Electric Scooter Market Segment Analysis:

Electric Scooter Market is Segmented on the basis of Type, Battery Type, Voltage, Propulsion Type, Range, Distribution Type, End User, and Region.

By Type, Stand-up Electric Scooters segment is expected to dominate the market during the forecast period

-

Among all types of the electric scooters, stand-up models remain the most popular type of scooters available for purchase, especially in large cities. These are scooter which are tailored for solo riders who ride while standing on the vehicle. They are simple to operate and come in small sizes hence can be used for short distances daily mobility. It is conventional and used by workers, students and tourist who need an efficient means of transport for short distances that cannot be tapped by major transport systems like trains or buses.

- These scooters are also popular with scooter-sharing companies due to their design so that they can be parked and picked in central cities with ease. Technological advancements which include battery capacity, charging networks, and advancements in power have defended this niche of stand-up electric scooters boosting the general utilization of this kind of scooter. As more and more consumers demand convenience and environmentally friendly products, stand-up electric scooters are set to maintain market control.

By End User, Individual segment expected to held the largest share

-

The largest product niche electric scooters are targeted at individual consumers. Such users use electric scooters for personal commute, for instance, going to work, doing shopping, or just joyriding. Rental electric scooters are particularly appealing to people who reside in urban centers because the devices enable them to bypass traffic, at least for short distances. Adjustability kept at the next level together with the freedom to operate means that electric scooter is slowly gaining popularity among city users.

- The usage of individual mobility has also been hampered by the electric scooter sharing firm. Today people prefer to rent a scooter for short distances, so for such needs, they do not buy. Such freedom attracts people who require a scooter sometimes but have no interest in possessing and maintaining one. When people embraced the fact that e-scooters are environmentally friendly then more persons will start using them as a mode of transport.

Electric Scooter Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

The global electric scooter market is most influentially commanded by North America. It is equipped with an identified charging facilities infrastructure and the legal framework accommodating the EV market. Current popular US cities like San Francisco, Los Angeles, and New York have adopted regular electric scooters for both individual and shared uses.

- Same as with the Asia Pacific region, North America leads the investment in the electric vehicle technologies also through players such as Bird and Lime. Besides, there are other perks, these include federal grants, like tax credits on electric cars, good for electric scooters as well. Due to the rising sophistication of consumers’ attitude towards environment issues in the North America region in addition to the increasing demand for convenient and cheap transport, the region remains one of the most competitive for electric scooters.

Active Key Players in the Electric Scooter Market:

- Bird (USA)

- Lime (USA)

- Spin (USA)

- Scoot (USA)

- Xiaomi (China)

- Segway-Ninebot (China)

- Razor (USA)

- Gotrax (USA)

- Helbiz (USA)

- Voi Technology (Sweden)

- TIER Mobility (Germany)

- Bolt (Estonia), and Other Active Players

Key Industry Developments in the Electric Scooter Market:

- In January 2024, Riley Scooter, a Cambridge-based company proposed plans to introduce RS3 Electric Scooter, a fully foldable electric scooter in the U.S. at the Consumers Electronics Show held in Las Vegas.

- In December 2023, Gogoro, a Taiwanese player unveiled Gogoro CrossOver GX250 domestically produced electric scooter in India. The company offers a tailor smart scooter to Indian riders. The introduction of these models marked a strategic move for Komatsu to tap into the Indian electric scooter market.

- In September 2023, Bird, a key player in the electric micro mobility market acquired Spin, an electric scooter and e-bike rental company for USD 19 million. This acquisition has reduced bird competition and aided in maintaining the company’s dominance in the market.

- In March 2023, Yadea Technology Group Co, Ltd, launched the range of products YADEA Fierider, YADEA VoltGuard Scooter, and YADEA Keeness Electric Motorcycle in Vietnam. The products offered by the company have premium-level quality and exceptional rider experience which provide a competitive edge to the company.

|

Global Electric Scooter Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 37.12 Billion |

|

Forecast Period 2024-32 CAGR: |

9.10% |

Market Size in 2032: |

USD 81.29 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Battery Type |

|

||

|

By Voltage |

|

||

|

By End User |

|

||

|

By Propulsion Type |

|

||

|

By Range |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electric Scooter Market by Type

4.1 Electric Scooter Market Snapshot and Growth Engine

4.2 Electric Scooter Market Overview

4.3 Stand-up Electric Scooters

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Stand-up Electric Scooters: Geographic Segmentation Analysis

4.4 Sit-down Electric Scooters

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Sit-down Electric Scooters: Geographic Segmentation Analysis

Chapter 5: Electric Scooter Market by Battery Type

5.1 Electric Scooter Market Snapshot and Growth Engine

5.2 Electric Scooter Market Overview

5.3 Lithium-ion Battery

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Lithium-ion Battery: Geographic Segmentation Analysis

5.4 Lead-acid Battery

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Lead-acid Battery: Geographic Segmentation Analysis

5.5 Nickel-based Battery

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Nickel-based Battery: Geographic Segmentation Analysis

Chapter 6: Electric Scooter Market by Voltage

6.1 Electric Scooter Market Snapshot and Growth Engine

6.2 Electric Scooter Market Overview

6.3 Below 24V

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Below 24V: Geographic Segmentation Analysis

6.4 24V to 36V

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 24V to 36V: Geographic Segmentation Analysis

6.5 36V to 48V

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 36V to 48V: Geographic Segmentation Analysis

6.6 Above 48V

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Above 48V: Geographic Segmentation Analysis

Chapter 7: Electric Scooter Market by End-User

7.1 Electric Scooter Market Snapshot and Growth Engine

7.2 Electric Scooter Market Overview

7.3 Individual

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Individual: Geographic Segmentation Analysis

7.4 Commercial

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Commercial: Geographic Segmentation Analysis

Chapter 8: Electric Scooter Market by Propulsion Type

8.1 Electric Scooter Market Snapshot and Growth Engine

8.2 Electric Scooter Market Overview

8.3 Electric

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Electric: Geographic Segmentation Analysis

8.4 Hybrid

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Hybrid: Geographic Segmentation Analysis

Chapter 9: Electric Scooter Market by Range

9.1 Electric Scooter Market Snapshot and Growth Engine

9.2 Electric Scooter Market Overview

9.3 Below 30 km

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.3.3 Key Market Trends, Growth Factors and Opportunities

9.3.4 Below 30 km: Geographic Segmentation Analysis

9.4 30 km to 60 km

9.4.1 Introduction and Market Overview

9.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.4.3 Key Market Trends, Growth Factors and Opportunities

9.4.4 30 km to 60 km: Geographic Segmentation Analysis

9.5 Above 60 km

9.5.1 Introduction and Market Overview

9.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.5.3 Key Market Trends, Growth Factors and Opportunities

9.5.4 Above 60 km: Geographic Segmentation Analysis

Chapter 10: Electric Scooter Market by Distribution Channel

10.1 Electric Scooter Market Snapshot and Growth Engine

10.2 Electric Scooter Market Overview

10.3 Online

10.3.1 Introduction and Market Overview

10.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

10.3.3 Key Market Trends, Growth Factors and Opportunities

10.3.4 Online: Geographic Segmentation Analysis

10.4 Offline

10.4.1 Introduction and Market Overview

10.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

10.4.3 Key Market Trends, Growth Factors and Opportunities

10.4.4 Offline: Geographic Segmentation Analysis

Chapter 11: Company Profiles and Competitive Analysis

11.1 Competitive Landscape

11.1.1 Competitive Benchmarking

11.1.2 Electric Scooter Market Share by Manufacturer (2023)

11.1.3 Industry BCG Matrix

11.1.4 Heat Map Analysis

11.1.5 Mergers and Acquisitions

11.2 BIRD (USA)

11.2.1 Company Overview

11.2.2 Key Executives

11.2.3 Company Snapshot

11.2.4 Role of the Company in the Market

11.2.5 Sustainability and Social Responsibility

11.2.6 Operating Business Segments

11.2.7 Product Portfolio

11.2.8 Business Performance

11.2.9 Key Strategic Moves and Recent Developments

11.2.10 SWOT Analysis

11.3 LIME (USA)

11.4 SPIN (USA)

11.5 SCOOT (USA)

11.6 XIAOMI (CHINA)

11.7 SEGWAY-NINEBOT (CHINA)

11.8 RAZOR (USA)

11.9 GOTRAX (USA)

11.10 HELBIZ (USA)

11.11 VOI TECHNOLOGY (SWEDEN)

11.12 TIER MOBILITY (GERMANY)

11.13 BOLT (ESTONIA)

11.14 OTHER ACTIVE PLAYERS

Chapter 12: Global Electric Scooter Market By Region

12.1 Overview

12.2. North America Electric Scooter Market

12.2.1 Key Market Trends, Growth Factors and Opportunities

12.2.2 Top Key Companies

12.2.3 Historic and Forecasted Market Size by Segments

12.2.4 Historic and Forecasted Market Size By Type

12.2.4.1 Stand-up Electric Scooters

12.2.4.2 Sit-down Electric Scooters

12.2.5 Historic and Forecasted Market Size By Battery Type

12.2.5.1 Lithium-ion Battery

12.2.5.2 Lead-acid Battery

12.2.5.3 Nickel-based Battery

12.2.6 Historic and Forecasted Market Size By Voltage

12.2.6.1 Below 24V

12.2.6.2 24V to 36V

12.2.6.3 36V to 48V

12.2.6.4 Above 48V

12.2.7 Historic and Forecasted Market Size By End-User

12.2.7.1 Individual

12.2.7.2 Commercial

12.2.8 Historic and Forecasted Market Size By Propulsion Type

12.2.8.1 Electric

12.2.8.2 Hybrid

12.2.9 Historic and Forecasted Market Size By Range

12.2.9.1 Below 30 km

12.2.9.2 30 km to 60 km

12.2.9.3 Above 60 km

12.2.10 Historic and Forecasted Market Size By Distribution Channel

12.2.10.1 Online

12.2.10.2 Offline

12.2.11 Historic and Forecast Market Size by Country

12.2.11.1 US

12.2.11.2 Canada

12.2.11.3 Mexico

12.3. Eastern Europe Electric Scooter Market

12.3.1 Key Market Trends, Growth Factors and Opportunities

12.3.2 Top Key Companies

12.3.3 Historic and Forecasted Market Size by Segments

12.3.4 Historic and Forecasted Market Size By Type

12.3.4.1 Stand-up Electric Scooters

12.3.4.2 Sit-down Electric Scooters

12.3.5 Historic and Forecasted Market Size By Battery Type

12.3.5.1 Lithium-ion Battery

12.3.5.2 Lead-acid Battery

12.3.5.3 Nickel-based Battery

12.3.6 Historic and Forecasted Market Size By Voltage

12.3.6.1 Below 24V

12.3.6.2 24V to 36V

12.3.6.3 36V to 48V

12.3.6.4 Above 48V

12.3.7 Historic and Forecasted Market Size By End-User

12.3.7.1 Individual

12.3.7.2 Commercial

12.3.8 Historic and Forecasted Market Size By Propulsion Type

12.3.8.1 Electric

12.3.8.2 Hybrid

12.3.9 Historic and Forecasted Market Size By Range

12.3.9.1 Below 30 km

12.3.9.2 30 km to 60 km

12.3.9.3 Above 60 km

12.3.10 Historic and Forecasted Market Size By Distribution Channel

12.3.10.1 Online

12.3.10.2 Offline

12.3.11 Historic and Forecast Market Size by Country

12.3.11.1 Russia

12.3.11.2 Bulgaria

12.3.11.3 The Czech Republic

12.3.11.4 Hungary

12.3.11.5 Poland

12.3.11.6 Romania

12.3.11.7 Rest of Eastern Europe

12.4. Western Europe Electric Scooter Market

12.4.1 Key Market Trends, Growth Factors and Opportunities

12.4.2 Top Key Companies

12.4.3 Historic and Forecasted Market Size by Segments

12.4.4 Historic and Forecasted Market Size By Type

12.4.4.1 Stand-up Electric Scooters

12.4.4.2 Sit-down Electric Scooters

12.4.5 Historic and Forecasted Market Size By Battery Type

12.4.5.1 Lithium-ion Battery

12.4.5.2 Lead-acid Battery

12.4.5.3 Nickel-based Battery

12.4.6 Historic and Forecasted Market Size By Voltage

12.4.6.1 Below 24V

12.4.6.2 24V to 36V

12.4.6.3 36V to 48V

12.4.6.4 Above 48V

12.4.7 Historic and Forecasted Market Size By End-User

12.4.7.1 Individual

12.4.7.2 Commercial

12.4.8 Historic and Forecasted Market Size By Propulsion Type

12.4.8.1 Electric

12.4.8.2 Hybrid

12.4.9 Historic and Forecasted Market Size By Range

12.4.9.1 Below 30 km

12.4.9.2 30 km to 60 km

12.4.9.3 Above 60 km

12.4.10 Historic and Forecasted Market Size By Distribution Channel

12.4.10.1 Online

12.4.10.2 Offline

12.4.11 Historic and Forecast Market Size by Country

12.4.11.1 Germany

12.4.11.2 UK

12.4.11.3 France

12.4.11.4 The Netherlands

12.4.11.5 Italy

12.4.11.6 Spain

12.4.11.7 Rest of Western Europe

12.5. Asia Pacific Electric Scooter Market

12.5.1 Key Market Trends, Growth Factors and Opportunities

12.5.2 Top Key Companies

12.5.3 Historic and Forecasted Market Size by Segments

12.5.4 Historic and Forecasted Market Size By Type

12.5.4.1 Stand-up Electric Scooters

12.5.4.2 Sit-down Electric Scooters

12.5.5 Historic and Forecasted Market Size By Battery Type

12.5.5.1 Lithium-ion Battery

12.5.5.2 Lead-acid Battery

12.5.5.3 Nickel-based Battery

12.5.6 Historic and Forecasted Market Size By Voltage

12.5.6.1 Below 24V

12.5.6.2 24V to 36V

12.5.6.3 36V to 48V

12.5.6.4 Above 48V

12.5.7 Historic and Forecasted Market Size By End-User

12.5.7.1 Individual

12.5.7.2 Commercial

12.5.8 Historic and Forecasted Market Size By Propulsion Type

12.5.8.1 Electric

12.5.8.2 Hybrid

12.5.9 Historic and Forecasted Market Size By Range

12.5.9.1 Below 30 km

12.5.9.2 30 km to 60 km

12.5.9.3 Above 60 km

12.5.10 Historic and Forecasted Market Size By Distribution Channel

12.5.10.1 Online

12.5.10.2 Offline

12.5.11 Historic and Forecast Market Size by Country

12.5.11.1 China

12.5.11.2 India

12.5.11.3 Japan

12.5.11.4 South Korea

12.5.11.5 Malaysia

12.5.11.6 Thailand

12.5.11.7 Vietnam

12.5.11.8 The Philippines

12.5.11.9 Australia

12.5.11.10 New Zealand

12.5.11.11 Rest of APAC

12.6. Middle East & Africa Electric Scooter Market

12.6.1 Key Market Trends, Growth Factors and Opportunities

12.6.2 Top Key Companies

12.6.3 Historic and Forecasted Market Size by Segments

12.6.4 Historic and Forecasted Market Size By Type

12.6.4.1 Stand-up Electric Scooters

12.6.4.2 Sit-down Electric Scooters

12.6.5 Historic and Forecasted Market Size By Battery Type

12.6.5.1 Lithium-ion Battery

12.6.5.2 Lead-acid Battery

12.6.5.3 Nickel-based Battery

12.6.6 Historic and Forecasted Market Size By Voltage

12.6.6.1 Below 24V

12.6.6.2 24V to 36V

12.6.6.3 36V to 48V

12.6.6.4 Above 48V

12.6.7 Historic and Forecasted Market Size By End-User

12.6.7.1 Individual

12.6.7.2 Commercial

12.6.8 Historic and Forecasted Market Size By Propulsion Type

12.6.8.1 Electric

12.6.8.2 Hybrid

12.6.9 Historic and Forecasted Market Size By Range

12.6.9.1 Below 30 km

12.6.9.2 30 km to 60 km

12.6.9.3 Above 60 km

12.6.10 Historic and Forecasted Market Size By Distribution Channel

12.6.10.1 Online

12.6.10.2 Offline

12.6.11 Historic and Forecast Market Size by Country

12.6.11.1 Turkiye

12.6.11.2 Bahrain

12.6.11.3 Kuwait

12.6.11.4 Saudi Arabia

12.6.11.5 Qatar

12.6.11.6 UAE

12.6.11.7 Israel

12.6.11.8 South Africa

12.7. South America Electric Scooter Market

12.7.1 Key Market Trends, Growth Factors and Opportunities

12.7.2 Top Key Companies

12.7.3 Historic and Forecasted Market Size by Segments

12.7.4 Historic and Forecasted Market Size By Type

12.7.4.1 Stand-up Electric Scooters

12.7.4.2 Sit-down Electric Scooters

12.7.5 Historic and Forecasted Market Size By Battery Type

12.7.5.1 Lithium-ion Battery

12.7.5.2 Lead-acid Battery

12.7.5.3 Nickel-based Battery

12.7.6 Historic and Forecasted Market Size By Voltage

12.7.6.1 Below 24V

12.7.6.2 24V to 36V

12.7.6.3 36V to 48V

12.7.6.4 Above 48V

12.7.7 Historic and Forecasted Market Size By End-User

12.7.7.1 Individual

12.7.7.2 Commercial

12.7.8 Historic and Forecasted Market Size By Propulsion Type

12.7.8.1 Electric

12.7.8.2 Hybrid

12.7.9 Historic and Forecasted Market Size By Range

12.7.9.1 Below 30 km

12.7.9.2 30 km to 60 km

12.7.9.3 Above 60 km

12.7.10 Historic and Forecasted Market Size By Distribution Channel

12.7.10.1 Online

12.7.10.2 Offline

12.7.11 Historic and Forecast Market Size by Country

12.7.11.1 Brazil

12.7.11.2 Argentina

12.7.11.3 Rest of SA

Chapter 13 Analyst Viewpoint and Conclusion

13.1 Recommendations and Concluding Analysis

13.2 Potential Market Strategies

Chapter 14 Research Methodology

14.1 Research Process

14.2 Primary Research

14.3 Secondary Research

|

Global Electric Scooter Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 37.12 Billion |

|

Forecast Period 2024-32 CAGR: |

9.10% |

Market Size in 2032: |

USD 81.29 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Battery Type |

|

||

|

By Voltage |

|

||

|

By End User |

|

||

|

By Propulsion Type |

|

||

|

By Range |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||