Digital Camera Market Synopsis

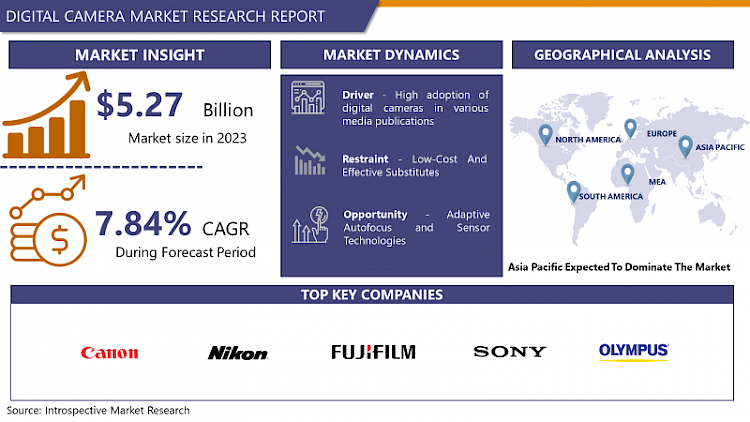

The global market for Digital cameras estimated at USD 5.27 Billion in the year 2023, is anticipated to reach USD 10.4 billion by 2032, growing at a CAGR of 7.84% over the period 2024-2032.

A digital camera is a camera that captures photographs in digital memory. Most cameras produced today are digital, largely replacing those that capture images on photographic film. Digital cameras are now widely incorporated into mobile devices like smartphones with the same or more capabilities and features of dedicated cameras (which are still available).

High-end, high-definition dedicated cameras are still commonly used by professionals and those who desire to take higher-quality photographs. Youngsters widely use digital cameras to capture classic and high-resolution photographs for their personal & professional usage. Mirrorless digital cameras are widely popular among film producers as they can efficiently capture high-resolution videos and images for their film shoots. Consumers largely seek to understand the various parameters such as device compactness, weight, cost, and resolution features of a particular digital camera during its buying process.

The Digital Camera Market Trend Analysis

High adoption of digital cameras in various media publications

- The increasing use of digital cameras in sports media is the primary driver of the market. The stadium's high-speed and digital camera structure lets viewers see slow-motion repeats in critical game conditions and improves accuracy while watching. Similarly, high-resolution digital cameras aid in the capture of sharp and crisp images and videos in wildlife, landscape, architecture, and studio photography.

- The emphasis on action photography has increased demand for small digital cameras such as GoPro. Furthermore, social media platforms such as Instagram have significantly expanded the scope of photography, which is expected to drive the digital camera market's growth.

- The global digital camera market is experiencing robust growth driven by various factors, including the growing trend of photography, the use of cameras in entertainment, media, and sports industries, and the increasing number of social media small businesses worldwide. Digital cameras have become essential tools in these industries for both personal and professional photography

- The rising usage of digital cameras in sports media is the key driver of the market. The stadium's high-speed and digital camera system allows viewers to witness slow-motion repeats in critical game conditions and improves accuracy while viewing. Similarly, high-resolution digital cameras aid in the capture of clean and crisp photographs and movies in animal, landscape, architecture, and studio photography. The emphasis on action photography has raised the demand for small digital cameras such as GoPro. Furthermore, social media platforms such as Instagram have significantly enlarged the scope for photography, which is likely to drive the growth of the Digital Camera Market

Adaptive Autofocus and Sensor Technologies

- The photography industry is advancing rapidly, and the introduction of adaptive autofocus and sensor technologies will revolutionize the way to take pictures. Artificial intelligence and machine learning are used to enable autofocus systems to detect and track subjects in motion, making it easier to capture fast-moving objects.

- Additionally, the introduction of revolutionary sensors will allow for larger pixel sizes resulting in higher-resolution images and improved low-light performance. Combined with innovative camera technology, the future will undoubtedly bring ground-breaking advancements in photography.

- Autofocus technologies are one of the most important breakthroughs in the arena of digital photography and as well as digital image processing. Providing versatility and ease of use, autofocus technologies have put photography on digital cameras to a new dimension. However, in the state of the art, there are different focusing systems for digital autofocus in digital cameras.

- With the development of new technologies, photographers will be able to take more creative and stunning photographs and capture moments that have never been seen before. All in all, the future of photography is looking bright, and that can expect to be amazed by the amazing images that innovative camera technology can bring to the table in the future.

Segmentation Analysis of the Digital Camera Market

Digital Camera market segments cover the Product Type, Digital Sensor Type, Component, Distribution Channel, End-User, and Region. By Product Type, the Digital Single-Lens Reflex (DSLR) Cameras segment is anticipated to dominate the Market over the Forecast period.

- DSLR cameras typically deliver high-quality images due to their large image sensors, which capture more light and detail. This results in better low-light performance, lower noise, and a greater dynamic range compared to smaller-sensor cameras.

- DSLR cameras allow to use of a wide variety of lenses, enabling greater flexibility and creativity in photography. Consumers can choose from prime lenses, zoom lenses, and specialty lenses like macro or fisheye to achieve different effects and perspectives.

- Additionally, Digital Single-Lens Reflex (DSLR) offers extensive manual controls, allowing experienced photographers to fine-tune their settings to achieve the desired result. This includes control over the aperture, shutter speed, ISO, white balance, and more.

- DSLR cameras use an optical viewfinder, which shows the image as seen through the lens, providing a clear, real-time view of your subject. This can be advantageous in certain situations, such as bright sunlight, where it may be difficult to see the image on an electronic screen, these factors boost the Digital Single-Lens Reflex (DSLR) Cameras segment, and ultimately these factors boost the digital camera market.

Regional Analysis of the Digital Camera Market

Asia Pacific is expected to Dominate the Market over the Forecast period.

- Most of the world's leading electronics manufacturers, including camera makers, are based in countries within the Asia-Pacific region. Countries like Japan (home to companies like Canon, Nikon, and Sony), South Korea (Samsung), and China (various manufacturers) are known for their strong presence in the electronics industry.

- The Asia-Pacific region has been at the forefront of technological innovation in electronics, including digital cameras. Japanese companies, in particular, have a long history of innovation in the camera industry, consistently introducing new technologies and features that set trends globally.

- The region boasts a skilled workforce in the fields of electronics, engineering, and manufacturing. This pool of skilled labor contributes to the efficient production of high-quality digital cameras.

- The Camera & Imaging Products Association in Japan (CIPA) anticipates the production of 5.29 million mirrorless and DSLR devices in calendar 2022, whereas Nikon forecasts 5.1 million between April 2022 and March 2023.

- Furthermore, the rising number of destination and big wedding events in the Asia-Pacific region has resulted in a boom in demand for wedding photography, significantly impacting the digital camera market.

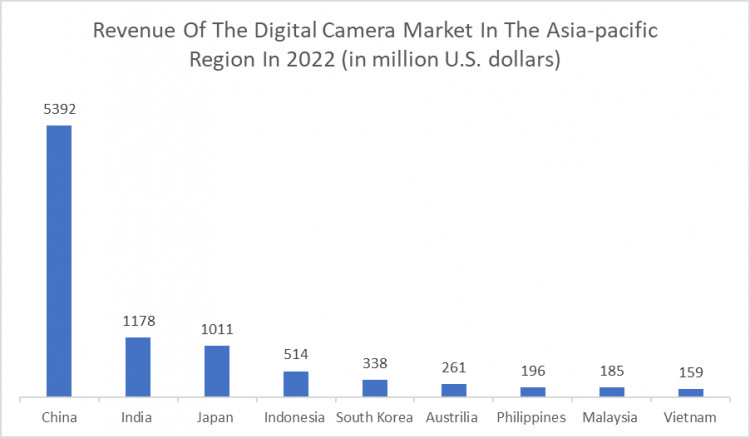

The above graph shows the revenue of the digital camera market in the Asia-Pacific region in 2022. China is the largest country in the digital camera market and they generate revenue of nearly 5,392 USD. India is the second largest country in the Asia Pacific region generating revenue of about 1,178 USD. Also, all other countries belonging to Asia Pacific generate strong revenue from digital cameras, countries like; Japan, Indonesia, South Korea, Australia, Philippines, Malaysia, and Vietnam.

COVID-19 Impact Analysis on the Digital Camera Market

The COVID-19 pandemic had a significant impact on various industries, including the digital camera market. Many digital camera manufacturers are based in countries that were heavily affected by the pandemic, such as Japan and China. Lockdowns, restrictions, and disruptions in these countries' supply chains led to delays in production, shortage of components, and reduced manufacturing capacity. Economic uncertainties and job losses caused by the pandemic led to reduced consumer spending on non-essential items, including digital cameras. Consumers prioritized essentials, which affected the demand for cameras.

During the pandemic, the digital camera industry is facing challenges caused by the COVID-19 pandemic. There are global supply chain issues, which have led to an increase in raw materials and higher production costs. These increases are reflected in the key markets of the digital camera industry. Many retail stores, especially electronics and photography stores, faced closures due to lockdowns and social distancing measures. This impacted the ability of consumers to physically browse and purchase digital cameras.

Top Key Players Covered in the Digital Camera Market

The major Key Players in the Digital Camera Market Include:

- Canon (Japan)

- Nikon (Japan)

- Fujifilm (Japan)

- Sony (Japan)

- Olympus (Japan)

- Panasonic Lumix (Japan)

- Leica: (Germany)

- Pentax: (Japan)

- Ricoh: (Japan)

- Polaroid: (US)

- GoPro: (US)

- Hasselblad: (Sweden)

- Kodak: (US)

- Sigma: (Japan)

- Samsung Electronics (South Korea)

- Red.com LLC: (US)

- Casio: (Japan)

- SJ Cam: (China)

- Tamron Co. Ltd: (Japan)

- Victor Company of Japan Ltd. (JVC): (Japan)

- Kyocera Corporation (Japan), and Other Major Players.

Key Industry Developments in the 3D Printing Materials and Services Market

- In March 2024, Nikon Corporation (Nikon) announced its entry into an agreement to acquire 100% of the outstanding membership interests of RED.com, LLC (RED) whereby RED will become a wholly-owned subsidiary of Nikon, under a Membership Interest Purchase Agreement with Mr. James Jannard, its founder, and Mr. Jarred Land, its current President, subject to the satisfaction of certain closing conditions thereunder.

- In July 2023, FUJIFILM India announced the launch of its mirrorless digital camera “FUJIFILM X-S20”, in India. It was a new addition to the X Series of mirrorless digital cameras known for their compact and lightweight body and superior image quality based on the company’s proprietary color reproduction technology. In its compact and lightweight body, which was the popular property of the previous model, the X-S20 features AI-based subject-detection AF and the capability to record 6.2K/30P video.

- In October 2022, Fujifilm announced a partnership with Adobe to produce a new mirrorless digital camera firmware, "FUJIFILM X-H2S" (X-H2S), in spring 2023, which would deliver the world's first native Camera to Cloud (C2C) connectivity for mirrorless digital cameras, driven by Frame.io. At the same time, the firmware for the "FT-XH" file transmitters will also be launched.

- In September 2022, Canon U.S.A., Inc., a significant provider of digital imaging solutions, announced the addition of a suite of products to its cinema and broadcast offerings in response to user demand. Canon's latest 8K CINE-SERVO lens for a wide range of productions is the CINE-SERVO 15-120mm T2.95-3.95 EF/PL (CN8x15 IAS S); the EU-V3, a modular expansion unit for the EOS C500 Mark II and EOS C300 Mark III cameras; a Cinema EOS firmware update; and the DP-V2730i, a 27-inch 4K professional reference display that may seamlessly fit into workflows of broadcasters and filmmakers.

|

Global Digital Camera Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.27 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.84% |

Market Size in 2032: |

USD 10.4 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Digital Sensor Type |

|

||

|

By Component |

|

||

|

By Distribution channel |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- DIGITAL CAMERA MARKET BY PRODUCT TYPE (2017-2032)

- DIGITAL CAMERA MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DIGITAL SINGLE-LENS REFLEX (DSLR) CAMERAS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors, And Opportunities

- Geographic Segmentation Analysis

- COMPACT DIGITAL CAMERAS

- BRIDGE COMPACT DIGITAL CAMERAS

- MIRRORLESS INTERCHANGEABLE LENS CAMERAS

- DIGITAL CAMERA MARKET BY DIGITAL SENSOR TYPE (2017-2032)

- DIGITAL CAMERA MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CCD SENSOR

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors, And Opportunities

- Geographic Segmentation Analysis

- CMOS SENSOR

- FOVEON X3 SENSOR

- LIVE MOS SENSOR

- DIGITAL CAMERA MARKET BY COMPONENT (2017-2032)

- DIGITAL CAMERA MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LENSES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors, And Opportunities

- Geographic Segmentation Analysis

- SENSORS

- LCD SCREEN

- MEMORY CARD

- OTHERS

- DIGITAL CAMERA MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- DIGITAL CAMERA MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ONLINE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors, And Opportunities

- Geographic Segmentation Analysis

- OFFLINE

- DIGITAL CAMERA MARKET BY END-USER (2017-2032)

- DIGITAL CAMERA MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PERSONAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors, And Opportunities

- Geographic Segmentation Analysis

- PROFESSIONAL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Digital Camera Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CANON

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- NIKON

- FUJIFILM

- SONY

- OLYMPUS

- PANASONIC LUMIX

- LEICA

- PENTAX

- RICOH

- POLAROID

- GOPRO

- HASSELBLAD

- KODAK

- SIGMA

- SAMSUNG ELECTRONICS

- RED.COM LLC

- CASIO

- SJ CAM

- TAMRON CO. LTD

- VICTOR COMPANY OF JAPAN LTD.

- KYOCERA CORPORATION

- COMPETITIVE LANDSCAPE

- GLOBAL DIGITAL CAMERA MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors, And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segment1

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Digital Sensor Type

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors, And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors, And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors, And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors, And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors, And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Digital Camera Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.27 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.84% |

Market Size in 2032: |

USD 10.4 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Digital Sensor Type |

|

||

|

By Component |

|

||

|

By Distribution channel |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DIGITAL CAMERA MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DIGITAL CAMERA MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DIGITAL CAMERA MARKET COMPETITIVE RIVALRY

TABLE 005. DIGITAL CAMERA MARKET THREAT OF NEW ENTRANTS

TABLE 006. DIGITAL CAMERA MARKET THREAT OF SUBSTITUTES

TABLE 007. DIGITAL CAMERA MARKET BY TYPE

TABLE 008. DIGITAL SINGLE-LENS REFLEX (DSLR) CAMERAS MARKET OVERVIEW (2016-2030)

TABLE 009. COMPACT DIGITAL CAMERAS MARKET OVERVIEW (2016-2030)

TABLE 010. BRIDGE COMPACT DIGITAL CAMERAS MARKET OVERVIEW (2016-2030)

TABLE 011. MIRRORLESS INTERCHANGEABLE LENS CAMERAS MARKET OVERVIEW (2016-2030)

TABLE 012. DIGITAL CAMERA MARKET BY DIGITAL SENSOR TYPE

TABLE 013. CCD SENSOR MARKET OVERVIEW (2016-2030)

TABLE 014. CMOS SENSOR MARKET OVERVIEW (2016-2030)

TABLE 015. FOVEON X3 SENSOR MARKET OVERVIEW (2016-2030)

TABLE 016. LIVE MOS SENSOR MARKET OVERVIEW (2016-2030)

TABLE 017. DIGITAL CAMERA MARKET BY COMPONENT

TABLE 018. LENSES MARKET OVERVIEW (2016-2030)

TABLE 019. SENSORS MARKET OVERVIEW (2016-2030)

TABLE 020. LCD SCREEN MARKET OVERVIEW (2016-2030)

TABLE 021. MEMORY CARD MARKET OVERVIEW (2016-2030)

TABLE 022. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 023. DIGITAL CAMERA MARKET BY DISTRIBUTION CHANNEL

TABLE 024. ONLINE MARKET OVERVIEW (2016-2030)

TABLE 025. OFFLINE MARKET OVERVIEW (2016-2030)

TABLE 026. DIGITAL CAMERA MARKET BY END USER

TABLE 027. PERSONAL MARKET OVERVIEW (2016-2030)

TABLE 028. PROFESSIONAL MARKET OVERVIEW (2016-2030)

TABLE 029. NORTH AMERICA DIGITAL CAMERA MARKET, BY TYPE (2016-2030)

TABLE 030. NORTH AMERICA DIGITAL CAMERA MARKET, BY DIGITAL SENSOR TYPE (2016-2030)

TABLE 031. NORTH AMERICA DIGITAL CAMERA MARKET, BY COMPONENT (2016-2030)

TABLE 032. NORTH AMERICA DIGITAL CAMERA MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 033. NORTH AMERICA DIGITAL CAMERA MARKET, BY END USER (2016-2030)

TABLE 034. N DIGITAL CAMERA MARKET, BY COUNTRY (2016-2030)

TABLE 035. EASTERN EUROPE DIGITAL CAMERA MARKET, BY TYPE (2016-2030)

TABLE 036. EASTERN EUROPE DIGITAL CAMERA MARKET, BY DIGITAL SENSOR TYPE (2016-2030)

TABLE 037. EASTERN EUROPE DIGITAL CAMERA MARKET, BY COMPONENT (2016-2030)

TABLE 038. EASTERN EUROPE DIGITAL CAMERA MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 039. EASTERN EUROPE DIGITAL CAMERA MARKET, BY END USER (2016-2030)

TABLE 040. DIGITAL CAMERA MARKET, BY COUNTRY (2016-2030)

TABLE 041. WESTERN EUROPE DIGITAL CAMERA MARKET, BY TYPE (2016-2030)

TABLE 042. WESTERN EUROPE DIGITAL CAMERA MARKET, BY DIGITAL SENSOR TYPE (2016-2030)

TABLE 043. WESTERN EUROPE DIGITAL CAMERA MARKET, BY COMPONENT (2016-2030)

TABLE 044. WESTERN EUROPE DIGITAL CAMERA MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 045. WESTERN EUROPE DIGITAL CAMERA MARKET, BY END USER (2016-2030)

TABLE 046. DIGITAL CAMERA MARKET, BY COUNTRY (2016-2030)

TABLE 047. ASIA PACIFIC DIGITAL CAMERA MARKET, BY TYPE (2016-2030)

TABLE 048. ASIA PACIFIC DIGITAL CAMERA MARKET, BY DIGITAL SENSOR TYPE (2016-2030)

TABLE 049. ASIA PACIFIC DIGITAL CAMERA MARKET, BY COMPONENT (2016-2030)

TABLE 050. ASIA PACIFIC DIGITAL CAMERA MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 051. ASIA PACIFIC DIGITAL CAMERA MARKET, BY END USER (2016-2030)

TABLE 052. DIGITAL CAMERA MARKET, BY COUNTRY (2016-2030)

TABLE 053. MIDDLE EAST & AFRICA DIGITAL CAMERA MARKET, BY TYPE (2016-2030)

TABLE 054. MIDDLE EAST & AFRICA DIGITAL CAMERA MARKET, BY DIGITAL SENSOR TYPE (2016-2030)

TABLE 055. MIDDLE EAST & AFRICA DIGITAL CAMERA MARKET, BY COMPONENT (2016-2030)

TABLE 056. MIDDLE EAST & AFRICA DIGITAL CAMERA MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 057. MIDDLE EAST & AFRICA DIGITAL CAMERA MARKET, BY END USER (2016-2030)

TABLE 058. DIGITAL CAMERA MARKET, BY COUNTRY (2016-2030)

TABLE 059. SOUTH AMERICA DIGITAL CAMERA MARKET, BY TYPE (2016-2030)

TABLE 060. SOUTH AMERICA DIGITAL CAMERA MARKET, BY DIGITAL SENSOR TYPE (2016-2030)

TABLE 061. SOUTH AMERICA DIGITAL CAMERA MARKET, BY COMPONENT (2016-2030)

TABLE 062. SOUTH AMERICA DIGITAL CAMERA MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 063. SOUTH AMERICA DIGITAL CAMERA MARKET, BY END USER (2016-2030)

TABLE 064. DIGITAL CAMERA MARKET, BY COUNTRY (2016-2030)

TABLE 065. CANON (JAPAN): SNAPSHOT

TABLE 066. CANON (JAPAN): BUSINESS PERFORMANCE

TABLE 067. CANON (JAPAN): PRODUCT PORTFOLIO

TABLE 068. CANON (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. NIKON (JAPAN): SNAPSHOT

TABLE 069. NIKON (JAPAN): BUSINESS PERFORMANCE

TABLE 070. NIKON (JAPAN): PRODUCT PORTFOLIO

TABLE 071. NIKON (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. FUJIFILM (JAPAN): SNAPSHOT

TABLE 072. FUJIFILM (JAPAN): BUSINESS PERFORMANCE

TABLE 073. FUJIFILM (JAPAN): PRODUCT PORTFOLIO

TABLE 074. FUJIFILM (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. SONY (JAPAN): SNAPSHOT

TABLE 075. SONY (JAPAN): BUSINESS PERFORMANCE

TABLE 076. SONY (JAPAN): PRODUCT PORTFOLIO

TABLE 077. SONY (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. OLYMPUS (JAPAN): SNAPSHOT

TABLE 078. OLYMPUS (JAPAN): BUSINESS PERFORMANCE

TABLE 079. OLYMPUS (JAPAN): PRODUCT PORTFOLIO

TABLE 080. OLYMPUS (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. PANASONIC LUMIX (JAPAN): SNAPSHOT

TABLE 081. PANASONIC LUMIX (JAPAN): BUSINESS PERFORMANCE

TABLE 082. PANASONIC LUMIX (JAPAN): PRODUCT PORTFOLIO

TABLE 083. PANASONIC LUMIX (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. LEICA: (GERMANY): SNAPSHOT

TABLE 084. LEICA: (GERMANY): BUSINESS PERFORMANCE

TABLE 085. LEICA: (GERMANY): PRODUCT PORTFOLIO

TABLE 086. LEICA: (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. PENTAX: (JAPAN): SNAPSHOT

TABLE 087. PENTAX: (JAPAN): BUSINESS PERFORMANCE

TABLE 088. PENTAX: (JAPAN): PRODUCT PORTFOLIO

TABLE 089. PENTAX: (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. RICOH: (JAPAN): SNAPSHOT

TABLE 090. RICOH: (JAPAN): BUSINESS PERFORMANCE

TABLE 091. RICOH: (JAPAN): PRODUCT PORTFOLIO

TABLE 092. RICOH: (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. POLAROID: (US): SNAPSHOT

TABLE 093. POLAROID: (US): BUSINESS PERFORMANCE

TABLE 094. POLAROID: (US): PRODUCT PORTFOLIO

TABLE 095. POLAROID: (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. GOPRO: (US): SNAPSHOT

TABLE 096. GOPRO: (US): BUSINESS PERFORMANCE

TABLE 097. GOPRO: (US): PRODUCT PORTFOLIO

TABLE 098. GOPRO: (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. HASSELBLAD: (SWEDEN): SNAPSHOT

TABLE 099. HASSELBLAD: (SWEDEN): BUSINESS PERFORMANCE

TABLE 100. HASSELBLAD: (SWEDEN): PRODUCT PORTFOLIO

TABLE 101. HASSELBLAD: (SWEDEN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. KODAK: (US): SNAPSHOT

TABLE 102. KODAK: (US): BUSINESS PERFORMANCE

TABLE 103. KODAK: (US): PRODUCT PORTFOLIO

TABLE 104. KODAK: (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 104. SIGMA: (JAPAN): SNAPSHOT

TABLE 105. SIGMA: (JAPAN): BUSINESS PERFORMANCE

TABLE 106. SIGMA: (JAPAN): PRODUCT PORTFOLIO

TABLE 107. SIGMA: (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107. SAMSUNG ELECTRONICS (SOUTH KOREA): SNAPSHOT

TABLE 108. SAMSUNG ELECTRONICS (SOUTH KOREA): BUSINESS PERFORMANCE

TABLE 109. SAMSUNG ELECTRONICS (SOUTH KOREA): PRODUCT PORTFOLIO

TABLE 110. SAMSUNG ELECTRONICS (SOUTH KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 110. RED.COM LLC: (US): SNAPSHOT

TABLE 111. RED.COM LLC: (US): BUSINESS PERFORMANCE

TABLE 112. RED.COM LLC: (US): PRODUCT PORTFOLIO

TABLE 113. RED.COM LLC: (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 113. CASIO: (JAPAN): SNAPSHOT

TABLE 114. CASIO: (JAPAN): BUSINESS PERFORMANCE

TABLE 115. CASIO: (JAPAN): PRODUCT PORTFOLIO

TABLE 116. CASIO: (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 116. SJ CAM: (CHINA): SNAPSHOT

TABLE 117. SJ CAM: (CHINA): BUSINESS PERFORMANCE

TABLE 118. SJ CAM: (CHINA): PRODUCT PORTFOLIO

TABLE 119. SJ CAM: (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 119. TAMRON CO. LTD: (JAPAN): SNAPSHOT

TABLE 120. TAMRON CO. LTD: (JAPAN): BUSINESS PERFORMANCE

TABLE 121. TAMRON CO. LTD: (JAPAN): PRODUCT PORTFOLIO

TABLE 122. TAMRON CO. LTD: (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 122. VICTOR COMPANY OF JAPAN LTD. (JVC): (JAPAN): SNAPSHOT

TABLE 123. VICTOR COMPANY OF JAPAN LTD. (JVC): (JAPAN): BUSINESS PERFORMANCE

TABLE 124. VICTOR COMPANY OF JAPAN LTD. (JVC): (JAPAN): PRODUCT PORTFOLIO

TABLE 125. VICTOR COMPANY OF JAPAN LTD. (JVC): (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 125. KYOCERA CORPORATION (JAPAN): SNAPSHOT

TABLE 126. KYOCERA CORPORATION (JAPAN): BUSINESS PERFORMANCE

TABLE 127. KYOCERA CORPORATION (JAPAN): PRODUCT PORTFOLIO

TABLE 128. KYOCERA CORPORATION (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 128. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 129. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 130. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 131. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DIGITAL CAMERA MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DIGITAL CAMERA MARKET OVERVIEW BY TYPE

FIGURE 012. DIGITAL SINGLE-LENS REFLEX (DSLR) CAMERAS MARKET OVERVIEW (2016-2030)

FIGURE 013. COMPACT DIGITAL CAMERAS MARKET OVERVIEW (2016-2030)

FIGURE 014. BRIDGE COMPACT DIGITAL CAMERAS MARKET OVERVIEW (2016-2030)

FIGURE 015. MIRRORLESS INTERCHANGEABLE LENS CAMERAS MARKET OVERVIEW (2016-2030)

FIGURE 016. DIGITAL CAMERA MARKET OVERVIEW BY DIGITAL SENSOR TYPE

FIGURE 017. CCD SENSOR MARKET OVERVIEW (2016-2030)

FIGURE 018. CMOS SENSOR MARKET OVERVIEW (2016-2030)

FIGURE 019. FOVEON X3 SENSOR MARKET OVERVIEW (2016-2030)

FIGURE 020. LIVE MOS SENSOR MARKET OVERVIEW (2016-2030)

FIGURE 021. DIGITAL CAMERA MARKET OVERVIEW BY COMPONENT

FIGURE 022. LENSES MARKET OVERVIEW (2016-2030)

FIGURE 023. SENSORS MARKET OVERVIEW (2016-2030)

FIGURE 024. LCD SCREEN MARKET OVERVIEW (2016-2030)

FIGURE 025. MEMORY CARD MARKET OVERVIEW (2016-2030)

FIGURE 026. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 027. DIGITAL CAMERA MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 028. ONLINE MARKET OVERVIEW (2016-2030)

FIGURE 029. OFFLINE MARKET OVERVIEW (2016-2030)

FIGURE 030. DIGITAL CAMERA MARKET OVERVIEW BY END USER

FIGURE 031. PERSONAL MARKET OVERVIEW (2016-2030)

FIGURE 032. PROFESSIONAL MARKET OVERVIEW (2016-2030)

FIGURE 033. NORTH AMERICA DIGITAL CAMERA MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 034. EASTERN EUROPE DIGITAL CAMERA MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 035. WESTERN EUROPE DIGITAL CAMERA MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 036. ASIA PACIFIC DIGITAL CAMERA MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 037. MIDDLE EAST & AFRICA DIGITAL CAMERA MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 038. SOUTH AMERICA DIGITAL CAMERA MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Digital Camera Market research report is 2024-2032.

Canon (Japan), Nikon (Japan), Fujifilm (Japan), Sony (Japan), Olympus (Japan), Panasonic Lumix (Japan), Leica: (Germany), Pentax: (Japan), Ricoh: (Japan), Polaroid: (US), GoPro: (US), Hasselblad: (Sweden), Kodak: (US), Sigma: (Japan), Samsung Electronics (South Korea), Red.com LLC: (US), Casio: (Japan), SJ Cam: (China), Tamron Co. Ltd: (Japan), Victor Company of Japan Ltd. (JVC): (Japan), Kyocera Corporation (Japan), and Other Major Players.

The Digital Camera Market is segmented into Product Type, Digital Sensor Type, Component, Distribution Channel, End-User, and region. By Product Type, the market is categorized into (Digital Single-Lens Reflex (DSLR) Cameras, Compact Digital Cameras, Bridge Compact Digital Cameras, and Mirrorless Interchangeable Lens Cameras. By Digital Sensor Type, the market is categorized into CCD Sensor, CMOS Sensor, FOVEON X3 Sensor, and Live MOS Sensor. By Component, the market is categorized into Lenses, Sensors, LCD Screen, Memory Card, Others. By Distribution Channel, the market is categorized into Online, Offline. By End User, the market is categorized into Personal, Professional. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A digital camera is a camera that captures photographs in digital memory. Most cameras produced today are digital, largely replacing those that capture images on photographic film. Digital cameras are now widely incorporated into mobile devices like smartphones with the same or more capabilities and features of dedicated cameras (which are still available). High-end, high-definition dedicated cameras are still commonly used by professionals and those who desire to take higher-quality photographs.

The global market for Digital cameras estimated at USD 5.27 Billion in the year 2023, is anticipated to reach USD 10.4 billion by 2032, growing at a CAGR of 7.84% over the period 2024-2032.