Button Cell Market Synopsis

Button Cell Market Size Was Valued at USD 4,457.12 Million in 2022, and is Projected to Reach USD 7304.79 Million by 2030, Growing at a CAGR of 6.37% From 2023-2030.

A button cell, also known as a coin cell or watch battery, is a small, round battery typically used to power devices such as wristwatches, calculators, hearing aids, and small electronic devices. These batteries are called "button cells" because of their shape and size, resembling a button. They are compact and come in various sizes, with common types including CR2032, CR2025, and LR44.

- Button cells are characterized by their relatively low capacity and voltage, making them suitable for low-power devices that require a small, reliable power source. Due to their size and shape, they are often used in situations where a larger battery would be impractical. The positive and negative terminals are usually on opposite sides of the battery, and they are typically installed in a way that allows for easy replacement when necessary.

- The button cell market has been witnessing steady growth driven by the increasing demand for compact and portable electronic devices. These coin-shaped batteries, also known as button cells, find widespread use in various applications such as watches, hearing aids, medical devices, and small electronic gadgets. The market is fueled by the continuous innovation in electronics, leading to the development of smaller and more power-efficient devices that rely on these compact power sources.

- Additionally, the rising adoption of Internet of Things (IoT) devices and wearable technologies has further propelled the demand for button cells. As consumers embrace smart and connected devices, there is a growing need for reliable and long-lasting power solutions, which button cells offer due to their small form factor and efficient energy output. Manufacturers in the button cell market continue to focus on advancements in battery technology to enhance performance, lifespan, and environmental sustainability.

Button Cell Market Trend Analysis

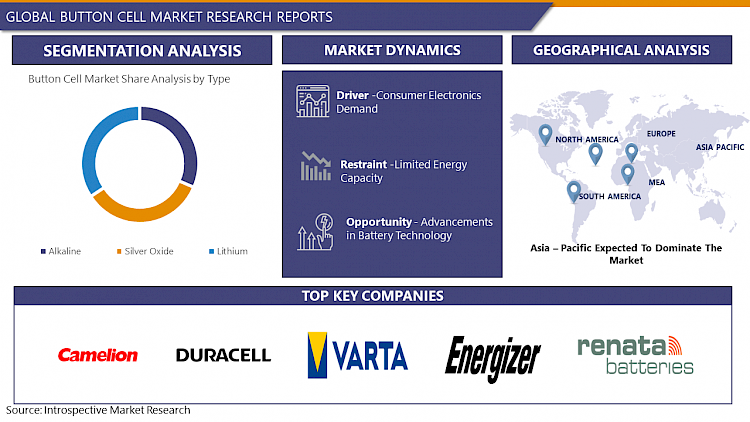

Consumer Electronics Demand

- The button cell market is experiencing a significant upswing primarily due to the robust demand in consumer electronics. As the global appetite for gadgets and portable devices continues to surge, so does the need for compact and reliable power sources, with button cells emerging as a key solution. These small, coin-shaped batteries find widespread applications in various consumer electronic devices, such as watches, calculators, key fobs, and hearing aids.

- Consumers' increasing reliance on smartwatches, fitness trackers, and other wearable devices has particularly fueled the demand for button cells. These batteries offer a compact and lightweight power solution that is essential for the design and functionality of these portable gadgets. Additionally, the expanding Internet of Things (IoT) ecosystem, characterized by a plethora of connected devices, relies on button cells for their energy efficiency and space-saving attributes.

- As technological advancements continue to drive the innovation and miniaturization of electronic devices, the button cell market is expected to remain a vital component in meeting the escalating power demands of the ever-growing consumer electronics landscape. Consequently, manufacturers in the button cell industry are poised to capitalize on this trend by enhancing production capabilities and exploring innovative battery technologies to keep pace with the dynamic consumer electronics market.

Advancements in Battery Technology Create an Opportunity for Button Cell Market

- The development of high-performance materials, such as lithium-air and solid-state electrolytes, has enhanced energy density and battery life. This directly benefits button cell applications, particularly in compact electronic devices like medical implants, watches, and hearing aids.

- Moreover, the rise of sustainable energy solutions and the growing emphasis on eco-friendly technologies have spurred research into environmentally friendly button cell alternatives. Rechargeable button cells, leveraging innovations like lithium-sulfur chemistry, are gaining traction, reducing environmental impact and long-term costs.

- The increasing demand for miniaturized, energy-efficient devices in various industries, including IoT and wearable technology, further propels the button cell market. Manufacturers are focusing on producing smaller, lighter, and more powerful button cells to meet the evolving needs of these sectors.

Button Cell Market Segment Analysis:

Button Cell Market Segmented on the basis of type and application.

By Type, Alkaline segment is expected to dominate the market during the forecast period

- Button cells are small, cylindrical batteries commonly used in various electronic devices, and they come in different chemistries. The alkaline button cell is a type that utilizes alkaline manganese dioxide chemistry. These cells are known for their reliable and long-lasting power, making them suitable for low-drain devices like watches, calculators, and small electronic gadgets.

- Alkaline button cells typically have a voltage of 1.5 volts and are available in various sizes, denoted by a standardized numbering system. The alkaline chemistry involves the reaction of manganese dioxide as the positive electrode and zinc as the negative electrode, with an alkaline electrolyte facilitating the flow of ions between them. This chemical composition enhances the cell's efficiency and lifespan compared to other types.

By Application, Watches segment held the largest share of xx% in 2022

- Button cell watches, also known as coin cell watches, utilize compact and round batteries that resemble a coin or button in shape. These miniature power sources are commonly found in wristwatches due to their small size and reliable performance. The most prevalent types of button cells for watches include silver oxide and lithium batteries.

- Silver oxide button cells are prevalent in analog quartz watches. They offer stable voltage, ensuring accurate timekeeping, and typically have a longer lifespan than other battery types. These batteries are known for their compact design, making them suitable for slim watch cases.

- Lithium button cells are favored for their lightweight and high energy density. They find applications in digital and multifunctional watches, providing a reliable power source for various features like backlighting and alarms. Lithium batteries are also known for their extended shelf life and resistance to extreme temperatures.

Button Cell Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to dominate the button cell market for several compelling reasons. The region has witnessed rapid industrialization and urbanization, fostering increased demand for electronic devices that utilize button cells, such as watches, calculators, and small electronic gadgets. The burgeoning middle-class population in countries like China and India has significantly contributed to the rising consumer electronics market, further fueling the demand for button cells.

- Additionally, the manufacturing process of countries in the Asia Pacific, coupled with cost-effective production capabilities, positions the region as a global hub for button cell production. As key players in the industry establish and expand their operations in this region, it strengthens the local supply chain and contributes to the overall dominance of the Asia Pacific in the button cell market.

- Furthermore, supportive government policies, investments in research and development, and the presence of a skilled workforce contribute to the region's competitiveness in the industry. The Asia Pacific's strategic geographical location also facilitates efficient distribution and export of button cells to other parts of the world. Collectively, these factors create a favorable environment for sustained growth and dominance in the global button cell market.

COVID-19 Impact Analysis on Button Cell Market:

- The COVID-19 pandemic has significantly impacted the button cell market. With global disruptions in manufacturing, supply chain constraints, and economic downturns, the button cell industry has faced challenges in production and distribution. Lockdown measures led to a decline in demand from key sectors such as consumer electronics, automotive, and medical devices, affecting the market adversely.

- As many industries slowed down or temporarily shut operations, the demand for button cells, commonly used in various electronic devices, witnessed a decline. However, the pandemic also spurred demand for certain medical devices like thermometers and remote monitoring equipment, leading to a partial offset in the market downturn.

- Manufacturers faced difficulties in procuring raw materials and components, causing delays in production schedules. The uncertainty and financial strain across industries further impacted investment in new technologies and product development within the button cell market.

Button Cell Market Top Key Players:

- Camelion Battery (United States)

- Duracell Inc. (United States)

- Energizer (United States)

- Varta (Rayovac) (Germany)

- Renata Batteries (Swatch Group) (Switzerland)

- Swatch Group (Switzerland)

- Swatch Group (Switzerland)

- EVE Energy (China)

- NANFU (China)

- Panasonic (Japan)

- Seiko (Japan)

- Hitachi (Japan)

- Sony (Japan)

- Maxell (Hitachi) (Japan)

- Toshiba (Japan)

- GP Batteries (Hong Kong)

- Vinnic (Asia)

Key Industry Developments in the Button Cell Market:

- In January 2022, Toshiba Launched 20Ah-HP SCiB™ Rechargeable Lithium-ion Battery Cell that Delivers Both High Energy and High Power. The cell is ideal for heavy-load applications where high-power input and output are essential, and for situations where battery cells must suppress heat and operate continuously, such as rapid charging of commercial vehicles, regenerative power systems for rolling stock, and industrial equipment. The cell is the same size as Toshiba’s current 20Ah product, allowing current customers to easily upgrade to the improved input and output power with the same module pack. The cell is now available to order worldwide.

- In March 2021 -- Duracell, the most trusted battery brand, announced that it was teaming up with The American Academy of Pediatrics (AAP) to help educate parents and caregivers about the importance of lithium coin battery safety to help prevent accidental lithium coin battery ingestions. With families spending more time at home combining work and home life into one, lithium coin battery safety is more essential than ever.

|

Global Button Cell Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 4,457.12 Mn. |

|

Forecast Period 2023-30 CAGR: |

6.37 % |

Market Size in 2030: |

USD 7304.79 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BUTTON CELLMARKET BY TYPE (2016-2030)

- BUTTON CELLMARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ALKALINE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SILVER OXIDE

- LITHIUM

- BUTTON CELLMARKET BY APPLICATION (2016-2030)

- BUTTON CELLMARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- WATCHES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HEARING AID

- MEDICAL DEVICES

- ELECTRONIC PRODUCTS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- BUTTON CELLMarket Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CAMELION BATTERY (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- COMPANYB DURACELL INC. (UNITED STATES)

- ENERGIZER (UNITED STATES)

- VARTA (RAYOVAC) (GERMANY)

- RENATA BATTERIES (SWATCH GROUP) (SWITZERLAND)

- SWATCH GROUP (SWITZERLAND)

- SWATCH GROUP (SWITZERLAND)

- EVE ENERGY (CHINA)

- NANFU (CHINA)

- PANASONIC (JAPAN)

- SEIKO (JAPAN)

- HITACHI (JAPAN)

- SONY (JAPAN)

- MAXELL (HITACHI) (JAPAN)

- TOSHIBA (JAPAN)

- GP BATTERIES (HONG KONG)

- VINNIC (ASIA)

- COMPETITIVE LANDSCAPE

- GLOBAL BUTTON CELLMARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors and Opportunities

- Key Manufacturers

- Historic and Forecasted Market Size by Type

- Historic and Forecasted Market Size by Application

- Historic and Forecasted Market Size by Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Button Cell Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 4,457.12 Mn. |

|

Forecast Period 2023-30 CAGR: |

6.37 % |

Market Size in 2030: |

USD 7304.79 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Button Cell Market research report is 2023-2030.

Camelion Battery (United States), Duracell Inc. (United States), Energizer (United States), Varta (Rayovac) (Germany), Renata Batteries (Swatch Group) (Switzerland), Swatch Group (Switzerland), Swatch Group (Switzerland), EVE Energy (China), NANFU (China), Panasonic (Japan), Seiko (Japan), Hitachi (Japan), Sony (Japan), Maxell (Hitachi) (Japan), Toshiba (Japan), GP Batteries (Hong Kong), Vinnic (Asia) and Other Major Players.

The Button Cell Market is segmented into Type, Application, and region. By Type, the market is categorized into Alkaline, Silver Oxide, Lithium. By Application, the market is categorized into Watches, Hearing Aid, Medical Devices, Electronic Products. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A button cell, also known as a coin cell or watch battery, is a small, round battery typically used to power devices such as wristwatches, calculators, hearing aids, and small electronic devices. These batteries are called "button cells" because of their shape and size, resembling a button. They are compact and come in various sizes, with common types including CR2032, CR2025, and LR44.

Button Cell Market Size Was Valued at USD 4,457.12 Million in 2022, and is Projected to Reach USD 7304.79 Million by 2030, Growing at a CAGR of 6.37% From 2023-2030.