Global Hydrogen Fuel Cell Vehicle Market Overview

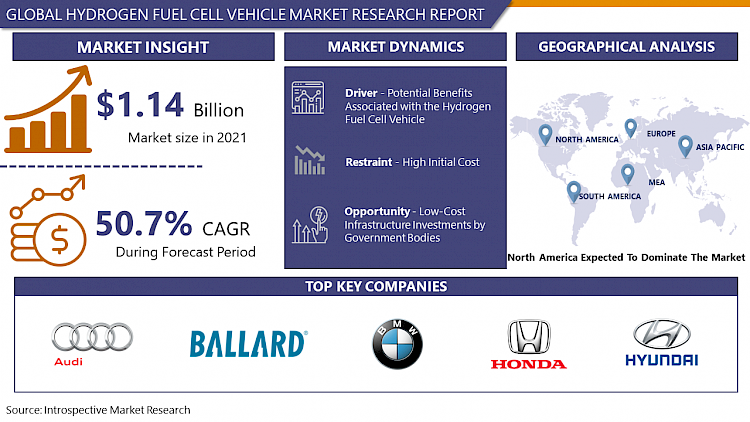

The Global Hydrogen Fuel Cell Vehicle Market size is expected to grow from USD 2.59 billion in 2023 to USD 103.83 billion by 2032, at a CAGR of 50.7 % during the forecast period (2024-2032).

A hydrogen vehicle is a hybrid vehicle that operates on hydrogen as its major fuel source. Hydrogen vehicles include space rockets that run on hydrogen, as well as automobiles and other modes of transportation. Hydrogen's chemical energy is transferred to mechanical energy by either reacting hydrogen with oxygen in a fuel cell to power electric motors or burning hydrogen in an internal combustion engine, which is less common. Hydrogen is not found in reservoirs or natural deposits like fossil fuels; thus, it is produced from natural gas or biomass, or electrolyzed from water. Hydrogen can be produced via a proton exchange membrane (PEM) or fuel cell. A proton exchange membrane (PEM) utilizes hydrogen (H2) and oxygen (O2) gas to convert potential chemical energy into electrical energy. The fuel cell, on the other hand, requires only hydrogen to power the vehicle because oxygen is readily available in the environment. Moreover, the combustion of hydrogen minimizes greenhouse gas emissions, especially when hydrogen is produced by converting water to hydrogen using renewable electricity thus, supporting the growth of the hydrogen fuel vehicle market.

Market Dynamics and Key Factors in Hydrogen Fuel Cell Vehicle:

Drivers:

Hydrogen is the most abundant element in the universe and a unique renewable source of energy, making it ideal for zero-carbon combined heat and power needs. Unlike biofuel or hydropower, hydrogen production does not require a large area of land. NASA has been experimenting with hydrogen as a resource, with the water created as a byproduct being utilized as drinking water for astronauts. This illustrates that hydrogen fuel cells are a non-toxic fuel source, making them superior to coal, natural gas, and nuclear power, which are either potentially dangerous or difficult to obtain. hydrogen production, storage, and consumption will all play a key role in driving the growth of the hydrogen fuel cell vehicle market.

The charge time for hydrogen fuel cell power units is extremely fast, similar to that of conventional internal combustion engines (ICEs), and significantly faster than that of battery-powered electric vehicles. Hydrogen fuel cells can be recharged within five minutes, while electric vehicles require 30 minutes to several hours. Due to quick charging time, hydrogen-powered vehicles have the same flexibility as conventional cars. Other renewable energy sources, such as wind power, cause noise pollution, whereas hydrogen fuel cells do not. Similar to electric automobiles, hydrogen-fueled vehicles are significantly quieter than those powered by traditional internal combustion engines. Furthermore, hydrogen fuel cells are more efficient in terms of utilization times. A hydrogen vehicle has the same range as a fossil-fuel vehicle (around 300 miles). Hydrogen-powered vehicles are better than current electric vehicles (EVs), which are increasingly being built with fuel cell power units as "range-extenders." Unlike electric vehicles, hydrogen fuel cells are unaffected by the outer temperature and do not deteriorate in cold weather thus, supporting the development of the hydrogen fuel cell vehicle market over the projected period.

Restraints

Hydrogen, while being the most abundant element in the universe, does not exist on its own and must be extracted from water or separated from carbon fossil fuels. Both of these processes demand a significant amount of energy to accomplish. This energy may be greater than that obtained from hydrogen alone, as well as being more costly. Moreover, fuel cells and some types of water electrolyzers require precious metals such as platinum and iridium as catalysts, which means that the initial cost of fuel cells (and electrolyzers) can be high. This initial high cost has refrained several business organizations and governments from investing in hydrogen fuel cell technology. To make hydrogen fuel cells a viable fuel source, these prices must be decreased. In addition to the high price, storage and transportation of hydrogen are more complex hence further increasing the cots thereby, hampering the development of the hydrogen fuel cell vehicle market in the forecasted timeframe.

Opportunities:

Oil prices are likely to rise, prompting energy companies to increase their investments in green technologies. As the oil prices are fluctuated by many factors such as the demand-supply gap, war-like situations, and the growing environmental concern. Several governments are ramping up infrastructure development for hydrogen production and storage. Oil plays an important role in GDP and can harm the economic development of a country if it relies extensively on oil imports. To promote infrastructure development governments are also offering low-cost infrastructure investments to decarbonize industrial sectors thereby creating a golden opportunity for market players. Furthermore, support for autonomous vehicles—closely linked to EV and FCEV development—is soaring in developing as well as in developed regions as countries are recognizing the hour needs for clean and green energy thus, creating a profitable opportunity for market players.

Market Segmentation

By vehicle type, the passenger vehicle segment is anticipated to lead the growth of the hydrogen fuel cell vehicle market over the forecast period. The Toyota Mirai, which debuted in 2014, was the first commercially assembled hydrogen fuel cell passenger vehicle. When compared to conventional automobiles, fuel cell passenger vehicles provide a zero-emission option with similar usability. A conventional fuel-cell passenger vehicle takes about 3-5 minutes to refuel and can go 250-350 miles on a single tank, which is equivalent to ICE vehicles. Early adopters are mainly leasing companies, fleet operators 115, government agencies, and corporate customers, with few individual customers. More than 5,000 hydrogen-powered passenger vehicles are sold in Japan and US alone. The demand for passenger vehicles is expected to rise shortly attributed to the increasing hydrogen infrastructure.

By fuel cell type, the proton membrane exchange (PEM) segment is expected to have the leading position in the hydrogen fuel cell vehicle market. The advantages of a proton membrane exchange fuel cell (PEMFC) are a quick startup, input fuel flexibility, compact design, lightweight, low cost, and electrolyte solidity. Pure hydrogen, methanol, and formic acid can all be utilized as inputs. It is appropriate for both mobile and stationary applications. As the reaction rate increases, the efficiency of PEMFC increases, due to the temperature rise. PEMFC is the best candidate for electric vehicle and portable power supply applications as it quickly warms up and starts generating electricity thus, driving the growth of the segment.

Players Covered in Hydrogen Fuel Cell Vehicle market are :

- Audi AG

- Ballard Power Systems Inc

- BMW Group

- Daimler AG

- General Motors Company

- Honda Motor Co. Ltd.

- Hyundai Motor Group

- MAN SE

- Toyota Motor Corporation

- Volvo Group and other major players.

Regional Analysis of Hydrogen Fuel Cell Vehicle Market:

The North American region is anticipated to have the highest share of the hydrogen fuel cell vehicle market over the forecast period attributed to the supportive government policies. The US was the first country to incorporate hydrogen and fuel cell technologies into its national energy policy. Since the 1970s, the US government has financed hydrogen research sponsorship, which began as a result of the oil crisis. The Department of Energy (DOE), which has established a framework on an R&D system led by the DOE's national lab and supplemented by universities, research institutes, and businesses through allocating funds on key technical challenges, has largely led the R&D of hydrogen and fuel cells in the United States. In terms of commercial uses, the United States has the most fuel cell passenger cars in the world, with 7,271 sold and leased as of August 2019. Additionally, as of April 2019, there were over 30,000 fuel cell forklifts in use in the United States, which are widely utilized by companies such as Walmart and Amazon. Bolstering the growth of the hydrogen fuel cells in this region, California Fuel Cell Partnership has aimed for 1,000 hydrogen refueling stations and 1,000,000 fuel cell electric vehicles (FCEVs) by 2030.

The European region is anticipated to have the second-highest share of the hydrogen fuel cell vehicle market in the projected period. The European Research Area ("ERA") initiative, which includes the creation of a European hydrogen and fuel cell technology research and development platform focused on important technologies in the hydrogen and fuel cell industries, was initiated in 2003 by the 25 EU members. To boost the adoption of hydrogen fuel cells vehicles, the EU established a public-private partnership called the Fuel Cells and Hydrogen Joint Undertaking (FCHJU). This organization has made plans to put a fleet of 3.7 million fuel cell passenger vehicles, 500,000 fuel cell LCVs, 45,000 fuel cell trucks, and buses on road by 2030. In addition, the government also plans to replace roughly 570 diesel trains by 2030. In terms of infrastructure by 2030, around 3,700 large refueling stations are projected to be installed for fuel cell vehicles. The growing awareness about climate change among end-users is propelling the growth of the market in this region.

The hydrogen fuel cell vehicle market in the APAC region is forecasted to develop at the highest CAGR attributed to the developing infrastructure for the production and storage of hydrogen. For instance, with a current industrial hydrogen production capacity of 25 million tonnes per year, China possesses the world's largest hydrogen production volume. In terms of consumption, China sold over 3,000 FCEVs between 2017 and 2019, making it one of the world's top markets for FCEV deployment. Moreover in 2016, China's energy strategy and technology innovation plan identified hydrogen as one of 15 priority focus areas. In addition, Japan, South Korea, and India also have plans to deploy hydrogen fuel cells vehicles in the forecasted period. For instance, India's MNRE with the research institutions in this region has established two hydrogen refueling stations and has also developed and demonstrated the efficiency of two-wheelers, three-wheelers, and mini buses that run on hydrogen fuels. Similar initiatives by other nations will propel the growth of the market in this region.

Recent Industry Developments in the Hydrogen Fuel Cell Vehicle market:

- In July 2021, Tata Motors has placed a purchase order for 15 of Ballard Power Systems' 70-kilowatt (kW) FCmoveTM-HD fuel cell modules, which will power 15 of Tata's zero-emission Fuel Cell Electric Buses (FCEBs). By 2022, Ballard expects to have delivered all of the modules.

- In April 2021, The Volvo Group and Daimler Truck AG have announced the formation of cellcentric, a joint venture dedicated to hydrogen-based fuel cells. This joint venture is dedicated to advancing the usage of hydrogen-based fuel cells in long-haul trucks and beyond.

COVID-19 Impact on Hydrogen Fuel Cell Vehicle market:

Governments of major economies throughout the world are ramping up their efforts to cut global greenhouse gas emissions. One major uncertainty that affects oil demand in the scenarios is whether COVID hastened or delayed government climate action. Environmental policies have typically advanced during periods of strong economic growth in the past. COVID shutdowns in 2020 will have a significant economic impact. Governments are also implementing unprecedented stimulus to help businesses get back on the road. The timing of the stimulus provides an opportunity for climate-related actions to be accelerated as well. In reaction to the COVID-related economic crisis, major Western economies, including the United States, are choosing for a "green" stimulus. If it hadn't been for the need for economic stimulation, it's unlikely that as much money would have been spent on sustainable energy. People may be more willing to accept regulatory mandates related to clean air because COVID raised concerns about public health and environmental sustainability. Governments have increased green investment in reaction to COVID, according to evidence. Recently several governments throughout the world, including the United States, Europe, South Korea, China, and Canada, have announced significant "green" stimulus investment. According to a recent report by the UN Environment Program and Oxford University, only $341 billion—or approximately 18 percent—of the $2 trillion long-term COVID-19 economic recovery money will go to green spending and an inclusive recovery through February 2021. The COVID-19 pandemic has boosted the sales of green vehicles thereby, propelling the growth of the hydrogen fuel cell vehicles market.

|

Global Hydrogen Fuel Cell Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.59 Bn. |

|

Forecast Period 2024-32 CAGR: |

50.7% |

Market Size in 2032: |

USD 103.83 Bn. |

|

Segments Covered: |

By Vehicle Type |

|

|

|

By Fuel Cell Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Vehicle Type

3.2 By Fuel Cell Type

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Hydrogen Fuel Cell Vehicle Market by Vehicle Type

5.1 Hydrogen Fuel Cell Vehicle Market Overview Snapshot and Growth Engine

5.2 Hydrogen Fuel Cell Vehicle Market Overview

5.3 Passenger Vehicles

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Passenger Vehicles: Grographic Segmentation

5.4 Commercial Vehicles

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Commercial Vehicles: Grographic Segmentation

5.5 Heavy Commercial Vehicles

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Heavy Commercial Vehicles: Grographic Segmentation

5.6 Buses & Coaches Vehicles

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Buses & Coaches Vehicles: Grographic Segmentation

Chapter 6: Hydrogen Fuel Cell Vehicle Market by Fuel Cell Type

6.1 Hydrogen Fuel Cell Vehicle Market Overview Snapshot and Growth Engine

6.2 Hydrogen Fuel Cell Vehicle Market Overview

6.3 Proton Membrane Exchange

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Proton Membrane Exchange: Grographic Segmentation

6.4 Phosphoric Acid Fuel Cell

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Phosphoric Acid Fuel Cell: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Hydrogen Fuel Cell Vehicle Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Hydrogen Fuel Cell Vehicle Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Hydrogen Fuel Cell Vehicle Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 AUDI AG

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 BALLARD POWER SYSTEMS INC.

7.4 BMW GROUP

7.5 DAIMLER AG

7.6 GENERAL MOTORS COMPANY

7.7 HONDA MOTOR CO. LTD.

7.8 HYUNDAI MOTOR GROUP

7.9 MAN SE

7.10 TOYOTA MOTOR CORPORATION

7.11 OTHER MAJOR PLAYERS

Chapter 8: Global Hydrogen Fuel Cell Vehicle Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Vehicle Type

8.2.1 Passenger Vehicles

8.2.2 Commercial Vehicles

8.2.3 Heavy Commercial Vehicles

8.2.4 Buses & Coaches Vehicles

8.3 Historic and Forecasted Market Size By Fuel Cell Type

8.3.1 Proton Membrane Exchange

8.3.2 Phosphoric Acid Fuel Cell

Chapter 9: North America Hydrogen Fuel Cell Vehicle Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Vehicle Type

9.4.1 Passenger Vehicles

9.4.2 Commercial Vehicles

9.4.3 Heavy Commercial Vehicles

9.4.4 Buses & Coaches Vehicles

9.5 Historic and Forecasted Market Size By Fuel Cell Type

9.5.1 Proton Membrane Exchange

9.5.2 Phosphoric Acid Fuel Cell

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Hydrogen Fuel Cell Vehicle Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Vehicle Type

10.4.1 Passenger Vehicles

10.4.2 Commercial Vehicles

10.4.3 Heavy Commercial Vehicles

10.4.4 Buses & Coaches Vehicles

10.5 Historic and Forecasted Market Size By Fuel Cell Type

10.5.1 Proton Membrane Exchange

10.5.2 Phosphoric Acid Fuel Cell

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Hydrogen Fuel Cell Vehicle Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Vehicle Type

11.4.1 Passenger Vehicles

11.4.2 Commercial Vehicles

11.4.3 Heavy Commercial Vehicles

11.4.4 Buses & Coaches Vehicles

11.5 Historic and Forecasted Market Size By Fuel Cell Type

11.5.1 Proton Membrane Exchange

11.5.2 Phosphoric Acid Fuel Cell

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Hydrogen Fuel Cell Vehicle Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Vehicle Type

12.4.1 Passenger Vehicles

12.4.2 Commercial Vehicles

12.4.3 Heavy Commercial Vehicles

12.4.4 Buses & Coaches Vehicles

12.5 Historic and Forecasted Market Size By Fuel Cell Type

12.5.1 Proton Membrane Exchange

12.5.2 Phosphoric Acid Fuel Cell

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Hydrogen Fuel Cell Vehicle Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Vehicle Type

13.4.1 Passenger Vehicles

13.4.2 Commercial Vehicles

13.4.3 Heavy Commercial Vehicles

13.4.4 Buses & Coaches Vehicles

13.5 Historic and Forecasted Market Size By Fuel Cell Type

13.5.1 Proton Membrane Exchange

13.5.2 Phosphoric Acid Fuel Cell

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Hydrogen Fuel Cell Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.59 Bn. |

|

Forecast Period 2024-32 CAGR: |

50.7% |

Market Size in 2032: |

USD 103.83 Bn. |

|

Segments Covered: |

By Vehicle Type |

|

|

|

By Fuel Cell Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HYDROGEN FUEL CELL VEHICLE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HYDROGEN FUEL CELL VEHICLE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HYDROGEN FUEL CELL VEHICLE MARKET COMPETITIVE RIVALRY

TABLE 005. HYDROGEN FUEL CELL VEHICLE MARKET THREAT OF NEW ENTRANTS

TABLE 006. HYDROGEN FUEL CELL VEHICLE MARKET THREAT OF SUBSTITUTES

TABLE 007. HYDROGEN FUEL CELL VEHICLE MARKET BY VEHICLE TYPE

TABLE 008. PASSENGER VEHICLES MARKET OVERVIEW (2016-2028)

TABLE 009. COMMERCIAL VEHICLES MARKET OVERVIEW (2016-2028)

TABLE 010. HEAVY COMMERCIAL VEHICLES MARKET OVERVIEW (2016-2028)

TABLE 011. BUSES & COACHES VEHICLES MARKET OVERVIEW (2016-2028)

TABLE 012. HYDROGEN FUEL CELL VEHICLE MARKET BY FUEL CELL TYPE

TABLE 013. PROTON MEMBRANE EXCHANGE MARKET OVERVIEW (2016-2028)

TABLE 014. PHOSPHORIC ACID FUEL CELL MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA HYDROGEN FUEL CELL VEHICLE MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 016. NORTH AMERICA HYDROGEN FUEL CELL VEHICLE MARKET, BY FUEL CELL TYPE (2016-2028)

TABLE 017. N HYDROGEN FUEL CELL VEHICLE MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE HYDROGEN FUEL CELL VEHICLE MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 019. EUROPE HYDROGEN FUEL CELL VEHICLE MARKET, BY FUEL CELL TYPE (2016-2028)

TABLE 020. HYDROGEN FUEL CELL VEHICLE MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC HYDROGEN FUEL CELL VEHICLE MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 022. ASIA PACIFIC HYDROGEN FUEL CELL VEHICLE MARKET, BY FUEL CELL TYPE (2016-2028)

TABLE 023. HYDROGEN FUEL CELL VEHICLE MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA HYDROGEN FUEL CELL VEHICLE MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA HYDROGEN FUEL CELL VEHICLE MARKET, BY FUEL CELL TYPE (2016-2028)

TABLE 026. HYDROGEN FUEL CELL VEHICLE MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA HYDROGEN FUEL CELL VEHICLE MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 028. SOUTH AMERICA HYDROGEN FUEL CELL VEHICLE MARKET, BY FUEL CELL TYPE (2016-2028)

TABLE 029. HYDROGEN FUEL CELL VEHICLE MARKET, BY COUNTRY (2016-2028)

TABLE 030. AUDI AG: SNAPSHOT

TABLE 031. AUDI AG: BUSINESS PERFORMANCE

TABLE 032. AUDI AG: PRODUCT PORTFOLIO

TABLE 033. AUDI AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. BALLARD POWER SYSTEMS INC.: SNAPSHOT

TABLE 034. BALLARD POWER SYSTEMS INC.: BUSINESS PERFORMANCE

TABLE 035. BALLARD POWER SYSTEMS INC.: PRODUCT PORTFOLIO

TABLE 036. BALLARD POWER SYSTEMS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. BMW GROUP: SNAPSHOT

TABLE 037. BMW GROUP: BUSINESS PERFORMANCE

TABLE 038. BMW GROUP: PRODUCT PORTFOLIO

TABLE 039. BMW GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. DAIMLER AG: SNAPSHOT

TABLE 040. DAIMLER AG: BUSINESS PERFORMANCE

TABLE 041. DAIMLER AG: PRODUCT PORTFOLIO

TABLE 042. DAIMLER AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. GENERAL MOTORS COMPANY: SNAPSHOT

TABLE 043. GENERAL MOTORS COMPANY: BUSINESS PERFORMANCE

TABLE 044. GENERAL MOTORS COMPANY: PRODUCT PORTFOLIO

TABLE 045. GENERAL MOTORS COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. HONDA MOTOR CO. LTD.: SNAPSHOT

TABLE 046. HONDA MOTOR CO. LTD.: BUSINESS PERFORMANCE

TABLE 047. HONDA MOTOR CO. LTD.: PRODUCT PORTFOLIO

TABLE 048. HONDA MOTOR CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. HYUNDAI MOTOR GROUP: SNAPSHOT

TABLE 049. HYUNDAI MOTOR GROUP: BUSINESS PERFORMANCE

TABLE 050. HYUNDAI MOTOR GROUP: PRODUCT PORTFOLIO

TABLE 051. HYUNDAI MOTOR GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. MAN SE: SNAPSHOT

TABLE 052. MAN SE: BUSINESS PERFORMANCE

TABLE 053. MAN SE: PRODUCT PORTFOLIO

TABLE 054. MAN SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. TOYOTA MOTOR CORPORATION: SNAPSHOT

TABLE 055. TOYOTA MOTOR CORPORATION: BUSINESS PERFORMANCE

TABLE 056. TOYOTA MOTOR CORPORATION: PRODUCT PORTFOLIO

TABLE 057. TOYOTA MOTOR CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 058. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 059. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 060. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HYDROGEN FUEL CELL VEHICLE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HYDROGEN FUEL CELL VEHICLE MARKET OVERVIEW BY VEHICLE TYPE

FIGURE 012. PASSENGER VEHICLES MARKET OVERVIEW (2016-2028)

FIGURE 013. COMMERCIAL VEHICLES MARKET OVERVIEW (2016-2028)

FIGURE 014. HEAVY COMMERCIAL VEHICLES MARKET OVERVIEW (2016-2028)

FIGURE 015. BUSES & COACHES VEHICLES MARKET OVERVIEW (2016-2028)

FIGURE 016. HYDROGEN FUEL CELL VEHICLE MARKET OVERVIEW BY FUEL CELL TYPE

FIGURE 017. PROTON MEMBRANE EXCHANGE MARKET OVERVIEW (2016-2028)

FIGURE 018. PHOSPHORIC ACID FUEL CELL MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA HYDROGEN FUEL CELL VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE HYDROGEN FUEL CELL VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC HYDROGEN FUEL CELL VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA HYDROGEN FUEL CELL VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA HYDROGEN FUEL CELL VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Hydrogen Fuel Cell Vehicle Market research report is 2024-2032.

Audi AG, Ballard Power Systems Inc, BMW Group, Daimler AG, General Motors Company, Honda Motor Co. Ltd., Hyundai Motor Group, MAN SE, Toyota Motor Corporation, Volvo Group, and other major players.

The Hydrogen Fuel Cell Vehicle Market is segmented into Vehicle Type, Fuel Cell Type, and region. By Vehicle Type, the market is categorized into Passenger Vehicles, Commercial Vehicles, Heavy Commercial Vehicles, Buses & Coaches Vehicles. By Fuel Cell Type, the market is categorized into Proton Membrane Exchange, Phosphoric Acid Fuel Cell. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A hydrogen vehicle is a hybrid vehicle that operates on hydrogen as its major fuel source. Hydrogen vehicles include space rockets that run on hydrogen, as well as automobiles and other modes of transportation.

The Global Hydrogen Fuel Cell Vehicle Market size is expected to grow from USD 2.59 billion in 2023 to USD 103.83 billion by 2032, at a CAGR of 50.7 % during the forecast period (2024-2032).