OLED TV Market Synopsis

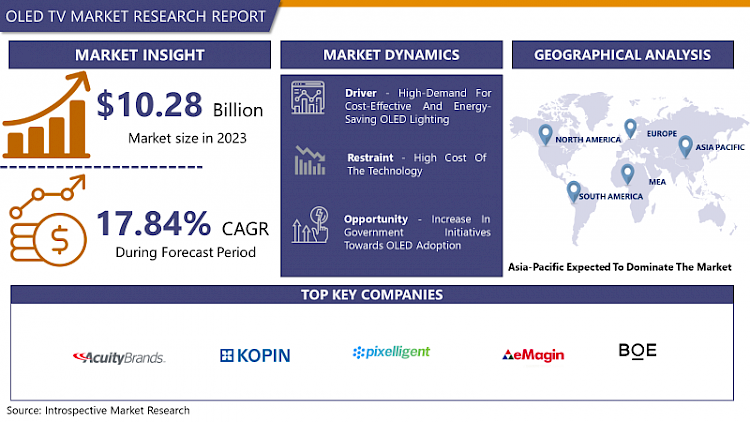

Global OLED TV Market Size Was Valued at USD 10.28 Billion In 2023 And Is Projected to Reach USD 45.04 Billion By 2032, Growing at A CAGR of 17.84% From 2024-2032.

OLED TV stands for Organic Light-Emitting Diode Television. It is a type of television display technology that has gained significant popularity in recent years due to its impressive picture quality and unique features.

- Unlike traditional LED/LCD TVs that use a backlight to illuminate pixels, OLED TVs use individual organic compounds that emit light when an electric current is applied. This means that each pixel in an OLED TV can independently emit its own light and can be turned on or off individually, resulting in true black levels, infinite contrast ratios, and vibrant, accurate colors.

- One of the standout features of OLED TVs is their ability to achieve perfect blacks. When a pixel is turned off, it emits no light, creating absolute darkness in that part of the screen. This leads to unparalleled contrast and makes OLED TVs particularly well-suited for watching movies and playing video games where deep blacks are crucial for an immersive experience.

- OLED TVs offer wide viewing angles, which means that the picture quality remains consistent even when viewed from off-center positions, making them great for group viewing. OLED technology is also incredibly thin and allows for flexible and curved display designs, which has enabled TV manufacturers to produce TVs with sleek, ultra-thin profiles.

- OLED TVs are generally more expensive than their LED/LCD counterparts, and there have been concerns about the long-term durability of organic materials used in OLED displays. Nevertheless, OLED TVs have carved out a niche in the premium TV market and continue to evolve, offering consumers an excellent choice for an impressive and immersive home entertainment experience.

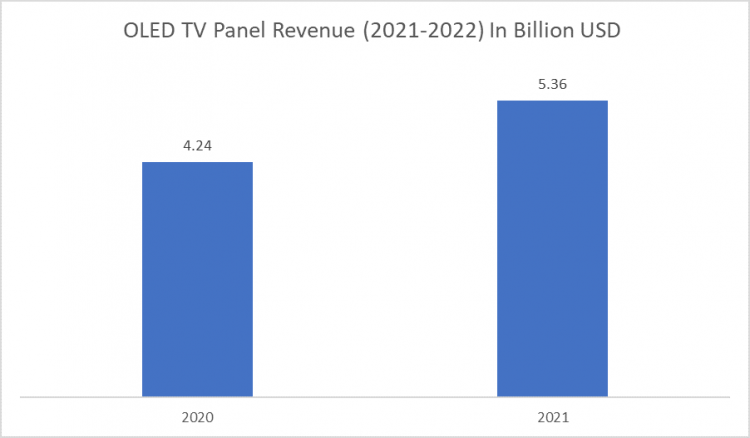

- OLED TVs utilize OLED panels as their display technology. These panels consist of organic compounds that emit light when an electric current is applied. Each pixel in an OLED panel emits its light independently. This technology is fundamentally different from traditional LCD (Liquid Crystal Display) TVs, which use backlighting. Thus, the below graph mention that the OELD TV Panel revenue is increases so the OSLD market growth also increases.

The OLED TV Market Trend Analysis

High-demand for cost-effective and energy-saving OLED Lighting

- Lighting accounts for approximately 15% of the world's total energy consumption, with lighting-related activities contributing to roughly 5% of global carbon emissions. To combat these environmental challenges, the United Nations Environment Programme (UNEP) has issued guidance on adopting energy-efficient lighting solutions.

- The rapid urbanization and economic growth observed in Europe and the Middle East are expected to drive a substantial surge in demand for OLED-based lighting over the next two decades.

- Consequently, there is a growing need for increased adoption of LED-based lighting solutions to achieve cost-effective energy savings, which is poised to fuel the global expansion of the OLED lighting market in the coming years.

- The development and production of OLED lighting have led to advancements in OLED technology, making it more cost-effective and efficient. As OLED manufacturers scale up their production to meet the demand for lighting solutions, the economies of scale benefit not only the lighting sector but also OLED TVs. This results in more affordable OLED panels, which, in turn, makes OLED TVs more accessible to a broader consumer base.

Increase In Government Initiatives Towards OLED Adoption

- The adoption of OLED technology in lighting systems has presented a significant opportunity for the OLED TV market, offering cost savings and environmental benefits. Governments across the globe have shown a keen interest in embracing OLED lighting solutions to reduce costs and environmental pollution.

- For instance, Germany's government actively supports municipalities in upgrading their public assets, such as outdated street lighting, with modern OLED lighting through grants and incentives.

- The presence of organizations like the Middle East Lighting Association (MELA) in the Middle Eastern nations further amplifies this opportunity. MELA, a non-profit organization established in collaboration with leading lighting product manufacturers such as Gulf Advanced Lighting, Osram, Philips Lighting, and Tridonic, plays a pivotal role in shaping lighting policies, standards, and regulations across the region.

- Their efforts not only assist lawmakers in developing and enforcing lighting-related guidelines but also promote energy-efficient lighting practices for environmental conservation, human comfort, and consumer safety.

- This growing momentum toward government support and initiatives favoring OLED lighting systems signifies a positive trajectory for the OLED TV market. As more nations embrace OLED technology for lighting, it creates a favorable ecosystem where OLED displays, including TVs, can also benefit from the increased affordability and awareness of OLED technology, potentially expanding their market reach and consumer appeal.

Segmentation Analysis Of The OLED TV Market

OLED TV market segments covers the Technology, Product Type, Display Panel Type, Application. By Type, Active-matrix OLED (AMOLED) segment is Anticipated to Dominate the Market Over the Forecast period.

- Active-Matrix Organic Light-Emitting Diode (AMOLED) is a display technology that has gained widespread popularity in various electronic devices, particularly smartphones and high-end television sets.

- AMOLED displays are known for their vibrant colors, deep blacks, and fast response times. Unlike passive-matrix OLEDs (PMOLEDs), which are primarily used in smaller screens, AMOLEDs are designed for larger and more complex displays, making them suitable for a wide range of applications.

- The key feature that sets AMOLED displays apart is the use of an active matrix of thin-film transistors (TFTs) to control each individual OLED pixel. Each pixel in an AMOLED screen has its own dedicated transistor, which allows for precise control over the brightness and color of that pixel. This active-matrix arrangement results in high-resolution, sharp images, and also enables better power efficiency as compared to PMOLED displays.

- AMOLED displays are known for their flexibility and ability to produce curved and edge displays, which has enabled the creation of innovative smartphone designs and curved TVs. Additionally, AMOLED technology offers excellent viewing angles, meaning that the picture quality remains consistent even when viewed from off-center positions, making it ideal for larger screens like TVs.

Regional Analysis of The OLED TV Market

Asia Pacific is Expected to Dominate the Market Over the Forecast period.

- Asia-Pacific is home to some of the world's largest and most prominent electronics manufacturers, including Samsung, LG, Sony, and Panasonic, who have been at the forefront of OLED TV production. These companies have invested heavily in OLED technology research and development, leading to the creation of cutting-edge OLED TVs with innovative features and exceptional picture quality. Their presence and expertise in the region have positioned Asia-Pacific as a hub for OLED TV manufacturing and innovation.

- The rising affluence and growing middle-class population in many Asia-Pacific countries have resulted in an increased demand for high-end consumer electronics, including OLED TVs. As disposable incomes have risen, consumers in countries like China, South Korea, Japan, and India have shown a strong appetite for premium home entertainment systems, contributing significantly to the OLED TV market's growth.

- Asia-Pacific's vast and diverse consumer base has enabled OLED TV manufacturers to experiment with various screen sizes, form factors, and price points to cater to a wide range of preferences and budgets. This adaptability has been pivotal in capturing a substantial market share in both the high-end and mid-range segments.

- Supportive government policies and incentives in certain Asia-Pacific nations have encouraged the adoption of OLED technology. For instance, initiatives in South Korea and China have boosted OLED manufacturing and research, creating favorable conditions for the OLED TV market to thrive.

Top Key Players Covered in The OLED TV Market

- Acuity Brands (US)

- Kopin Corporation (US)

- Pixelligient Technologies (US)

- Lumiotec (US)

- Emagin Corporation (USA)

- BOE Technology (China)

- LG Display (South Korea)

- Osram (Germany)

- AU Optronics (Taiwan)

- Tianma Microelectronics (China)

- Samsung Electronics (South Korea)

- Universal Display Corporation (New Jersey)

- Royole Corporation (China)

- Konica Minolta Pioneer OLED (Japan)

- China Star Optoelectronics Technology (China)

- JOLED (Japan)

- Raystar Optronics (China)

- Panasonic(Japan)

- Truly International (Hong Kong)

- Visionox (China)

- Winstar Display (Taiwan)

- Wisechip Semiconductor (China), And Other Major Players

Key Industry Developments in the OLED TV Market

- In August 2023, LG Electronics (LG) is launching the world’s first wireless OLED TV, the 97-inch LG SIGNATURE OLED M (model 97M3). The 97M3 is currently available in South Korea, with plans for global rollout to key markets including North America and Europe later this year. Drawing on LG’s technical and design prowess from a decade of OLED innovation, the 97M3 is set to reaffirm the company’s leadership in the ultra-large premium TV segment with the industry’s largest 97-inch OLED screen and the Zero Connect Box, the world’s first wireless solution capable of real-time video and audio transmission at 4K 120Hz.

- In June 2023, Samsung launched a Made in India OLED TV with a Neural Quantum Processor 4K. Samsung OLED TV range consists of two series S95C and S90C. Both series come in three sizes 77-inch, 65-inch and 55-inch starting from INR 169,990.

|

OLED TV Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.28 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.84% |

Market Size in 2032: |

USD 45.04 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Product Type |

|

||

|

By Display Panel Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- OLED TV MARKET BY TECHNOLOGY (2017-2032)

- OLED TV MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ACTIVE-MATRIX OLED (AMOLED)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PASSIVE-MATRIX OLED (PAMOLED)

- FOLDABLE OLED

- OTHERS

- OLED TV MARKET BY PRODUCT TYPE (2017-2032)

- OLED TV MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DISPLAY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LIGHTING

- OLED TV MARKET BY DISPLAY PANEL TYPE (2017-2032)

- OLED TV MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RIGID

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FLEXIBLE

- OTHERS

- OLED TV MARKET BY APPLICATION (2017-2032)

- OLED TV MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SMARTPHONE & TABLET

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SMARTWATCHES & WEARABLES

- TELEVISION

- DIGITAL SIGNAGE SYSTEMS

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- OLED TV Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ACUITY BRANDS (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- KOPIN CORPORATION (US)

- PIXELLIGIENT TECHNOLOGIES (US)

- LUMIOTEC (US)

- EMAGIN CORPORATION (USA)

- BOE TECHNOLOGY (CHINA)

- LG DISPLAY (SOUTH KOREA)

- OSRAM (GERMANY)

- AU OPTRONICS (TAIWAN)

- TIANMA MICROELECTRONICS (CHINA)

- SAMSUNG ELECTRONICS (SOUTH KOREA)

- UNIVERSAL DISPLAY CORPORATION (NEW JERSEY)

- ROYOLE CORPORATION (CHINA)

- KONICA MINOLTA PIONEER OLED (JAPAN)

- CHINA STAR OPTOELECTRONICS TECHNOLOGY (CHINA)

- JOLED (JAPAN)

- RAYSTAR OPTRONICS (CHINA)

- PANASONIC (JAPAN)

- TRULY INTERNATIONAL (HONG KONG)

- VISIONOX (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL OLED TV MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Technology

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Display Panel Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

OLED TV Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.28 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.84% |

Market Size in 2032: |

USD 45.04 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Product Type |

|

||

|

By Display Panel Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. OELD TV MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. OELD TV MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. OELD TV MARKET COMPETITIVE RIVALRY

TABLE 005. OELD TV MARKET THREAT OF NEW ENTRANTS

TABLE 006. OELD TV MARKET THREAT OF SUBSTITUTES

TABLE 007. OELD TV MARKET BY TECHNOLOGY

TABLE 008. ACTIVE-MATRIX OLED (AMOLED) MARKET OVERVIEW (2016-2030)

TABLE 009. PASSIVE-MATRIX OLED (PAMOLED) MARKET OVERVIEW (2016-2030)

TABLE 010. FOLDABLE OLED MARKET OVERVIEW (2016-2030)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 012. OELD TV MARKET BY PRODUCT TYPE

TABLE 013. DISPLAY MARKET OVERVIEW (2016-2030)

TABLE 014. LIGHTING MARKET OVERVIEW (2016-2030)

TABLE 015. OELD TV MARKET BY DISPLAY PANEL TYPE

TABLE 016. RIGID MARKET OVERVIEW (2016-2030)

TABLE 017. FLEXIBLE MARKET OVERVIEW (2016-2030)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 019. OELD TV MARKET BY APPLICATION

TABLE 020. SMARTPHONE & TABLET MARKET OVERVIEW (2016-2030)

TABLE 021. SMARTWATCHES & WEARABLES MARKET OVERVIEW (2016-2030)

TABLE 022. TELEVISION MARKET OVERVIEW (2016-2030)

TABLE 023. DIGITAL SIGNAGE SYSTEMS MARKET OVERVIEW (2016-2030)

TABLE 024. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 025. NORTH AMERICA OELD TV MARKET, BY TECHNOLOGY (2016-2030)

TABLE 026. NORTH AMERICA OELD TV MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 027. NORTH AMERICA OELD TV MARKET, BY DISPLAY PANEL TYPE (2016-2030)

TABLE 028. NORTH AMERICA OELD TV MARKET, BY APPLICATION (2016-2030)

TABLE 029. N OELD TV MARKET, BY COUNTRY (2016-2030)

TABLE 030. EASTERN EUROPE OELD TV MARKET, BY TECHNOLOGY (2016-2030)

TABLE 031. EASTERN EUROPE OELD TV MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 032. EASTERN EUROPE OELD TV MARKET, BY DISPLAY PANEL TYPE (2016-2030)

TABLE 033. EASTERN EUROPE OELD TV MARKET, BY APPLICATION (2016-2030)

TABLE 034. OELD TV MARKET, BY COUNTRY (2016-2030)

TABLE 035. WESTERN EUROPE OELD TV MARKET, BY TECHNOLOGY (2016-2030)

TABLE 036. WESTERN EUROPE OELD TV MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 037. WESTERN EUROPE OELD TV MARKET, BY DISPLAY PANEL TYPE (2016-2030)

TABLE 038. WESTERN EUROPE OELD TV MARKET, BY APPLICATION (2016-2030)

TABLE 039. OELD TV MARKET, BY COUNTRY (2016-2030)

TABLE 040. ASIA PACIFIC OELD TV MARKET, BY TECHNOLOGY (2016-2030)

TABLE 041. ASIA PACIFIC OELD TV MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 042. ASIA PACIFIC OELD TV MARKET, BY DISPLAY PANEL TYPE (2016-2030)

TABLE 043. ASIA PACIFIC OELD TV MARKET, BY APPLICATION (2016-2030)

TABLE 044. OELD TV MARKET, BY COUNTRY (2016-2030)

TABLE 045. MIDDLE EAST & AFRICA OELD TV MARKET, BY TECHNOLOGY (2016-2030)

TABLE 046. MIDDLE EAST & AFRICA OELD TV MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 047. MIDDLE EAST & AFRICA OELD TV MARKET, BY DISPLAY PANEL TYPE (2016-2030)

TABLE 048. MIDDLE EAST & AFRICA OELD TV MARKET, BY APPLICATION (2016-2030)

TABLE 049. OELD TV MARKET, BY COUNTRY (2016-2030)

TABLE 050. SOUTH AMERICA OELD TV MARKET, BY TECHNOLOGY (2016-2030)

TABLE 051. SOUTH AMERICA OELD TV MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 052. SOUTH AMERICA OELD TV MARKET, BY DISPLAY PANEL TYPE (2016-2030)

TABLE 053. SOUTH AMERICA OELD TV MARKET, BY APPLICATION (2016-2030)

TABLE 054. OELD TV MARKET, BY COUNTRY (2016-2030)

TABLE 055. ACUITY BRANDS (US): SNAPSHOT

TABLE 056. ACUITY BRANDS (US): BUSINESS PERFORMANCE

TABLE 057. ACUITY BRANDS (US): PRODUCT PORTFOLIO

TABLE 058. ACUITY BRANDS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. KOPIN CORPORATION (US): SNAPSHOT

TABLE 059. KOPIN CORPORATION (US): BUSINESS PERFORMANCE

TABLE 060. KOPIN CORPORATION (US): PRODUCT PORTFOLIO

TABLE 061. KOPIN CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. PIXELLIGIENT TECHNOLOGIES (US): SNAPSHOT

TABLE 062. PIXELLIGIENT TECHNOLOGIES (US): BUSINESS PERFORMANCE

TABLE 063. PIXELLIGIENT TECHNOLOGIES (US): PRODUCT PORTFOLIO

TABLE 064. PIXELLIGIENT TECHNOLOGIES (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. LUMIOTEC (US): SNAPSHOT

TABLE 065. LUMIOTEC (US): BUSINESS PERFORMANCE

TABLE 066. LUMIOTEC (US): PRODUCT PORTFOLIO

TABLE 067. LUMIOTEC (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. EMAGIN CORPORATION (USA): SNAPSHOT

TABLE 068. EMAGIN CORPORATION (USA): BUSINESS PERFORMANCE

TABLE 069. EMAGIN CORPORATION (USA): PRODUCT PORTFOLIO

TABLE 070. EMAGIN CORPORATION (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. BOE TECHNOLOGY (CHINA): SNAPSHOT

TABLE 071. BOE TECHNOLOGY (CHINA): BUSINESS PERFORMANCE

TABLE 072. BOE TECHNOLOGY (CHINA): PRODUCT PORTFOLIO

TABLE 073. BOE TECHNOLOGY (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. LG DISPLAY (SOUTH KOREA): SNAPSHOT

TABLE 074. LG DISPLAY (SOUTH KOREA): BUSINESS PERFORMANCE

TABLE 075. LG DISPLAY (SOUTH KOREA): PRODUCT PORTFOLIO

TABLE 076. LG DISPLAY (SOUTH KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. OSRAM (GERMANY): SNAPSHOT

TABLE 077. OSRAM (GERMANY): BUSINESS PERFORMANCE

TABLE 078. OSRAM (GERMANY): PRODUCT PORTFOLIO

TABLE 079. OSRAM (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. AU OPTRONICS (TAIWAN): SNAPSHOT

TABLE 080. AU OPTRONICS (TAIWAN): BUSINESS PERFORMANCE

TABLE 081. AU OPTRONICS (TAIWAN): PRODUCT PORTFOLIO

TABLE 082. AU OPTRONICS (TAIWAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. TIANMA MICROELECTRONICS (CHINA): SNAPSHOT

TABLE 083. TIANMA MICROELECTRONICS (CHINA): BUSINESS PERFORMANCE

TABLE 084. TIANMA MICROELECTRONICS (CHINA): PRODUCT PORTFOLIO

TABLE 085. TIANMA MICROELECTRONICS (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. SAMSUNG ELECTRONICS (SOUTH KOREA): SNAPSHOT

TABLE 086. SAMSUNG ELECTRONICS (SOUTH KOREA): BUSINESS PERFORMANCE

TABLE 087. SAMSUNG ELECTRONICS (SOUTH KOREA): PRODUCT PORTFOLIO

TABLE 088. SAMSUNG ELECTRONICS (SOUTH KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. UNIVERSAL DISPLAY CORPORATION (NEW JERSEY): SNAPSHOT

TABLE 089. UNIVERSAL DISPLAY CORPORATION (NEW JERSEY): BUSINESS PERFORMANCE

TABLE 090. UNIVERSAL DISPLAY CORPORATION (NEW JERSEY): PRODUCT PORTFOLIO

TABLE 091. UNIVERSAL DISPLAY CORPORATION (NEW JERSEY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. ROYOLE CORPORATION (CHINA): SNAPSHOT

TABLE 092. ROYOLE CORPORATION (CHINA): BUSINESS PERFORMANCE

TABLE 093. ROYOLE CORPORATION (CHINA): PRODUCT PORTFOLIO

TABLE 094. ROYOLE CORPORATION (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. KONICA MINOLTA PIONEER OLED (JAPAN): SNAPSHOT

TABLE 095. KONICA MINOLTA PIONEER OLED (JAPAN): BUSINESS PERFORMANCE

TABLE 096. KONICA MINOLTA PIONEER OLED (JAPAN): PRODUCT PORTFOLIO

TABLE 097. KONICA MINOLTA PIONEER OLED (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. CHINA STAR OPTOELECTRONICS TECHNOLOGY (CHINA): SNAPSHOT

TABLE 098. CHINA STAR OPTOELECTRONICS TECHNOLOGY (CHINA): BUSINESS PERFORMANCE

TABLE 099. CHINA STAR OPTOELECTRONICS TECHNOLOGY (CHINA): PRODUCT PORTFOLIO

TABLE 100. CHINA STAR OPTOELECTRONICS TECHNOLOGY (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. JOLED (JAPAN): SNAPSHOT

TABLE 101. JOLED (JAPAN): BUSINESS PERFORMANCE

TABLE 102. JOLED (JAPAN): PRODUCT PORTFOLIO

TABLE 103. JOLED (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. RAYSTAR OPTRONICS (CHINA): SNAPSHOT

TABLE 104. RAYSTAR OPTRONICS (CHINA): BUSINESS PERFORMANCE

TABLE 105. RAYSTAR OPTRONICS (CHINA): PRODUCT PORTFOLIO

TABLE 106. RAYSTAR OPTRONICS (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. PANASONIC (JAPAN): SNAPSHOT

TABLE 107. PANASONIC (JAPAN): BUSINESS PERFORMANCE

TABLE 108. PANASONIC (JAPAN): PRODUCT PORTFOLIO

TABLE 109. PANASONIC (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 109. TRULY INTERNATIONAL (HONG KONG): SNAPSHOT

TABLE 110. TRULY INTERNATIONAL (HONG KONG): BUSINESS PERFORMANCE

TABLE 111. TRULY INTERNATIONAL (HONG KONG): PRODUCT PORTFOLIO

TABLE 112. TRULY INTERNATIONAL (HONG KONG): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 112. VISIONOX (CHINA): SNAPSHOT

TABLE 113. VISIONOX (CHINA): BUSINESS PERFORMANCE

TABLE 114. VISIONOX (CHINA): PRODUCT PORTFOLIO

TABLE 115. VISIONOX (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 115. WINSTAR DISPLAY (TAIWAN): SNAPSHOT

TABLE 116. WINSTAR DISPLAY (TAIWAN): BUSINESS PERFORMANCE

TABLE 117. WINSTAR DISPLAY (TAIWAN): PRODUCT PORTFOLIO

TABLE 118. WINSTAR DISPLAY (TAIWAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 118. WISECHIP SEMICONDUCTOR (CHINA): SNAPSHOT

TABLE 119. WISECHIP SEMICONDUCTOR (CHINA): BUSINESS PERFORMANCE

TABLE 120. WISECHIP SEMICONDUCTOR (CHINA): PRODUCT PORTFOLIO

TABLE 121. WISECHIP SEMICONDUCTOR (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 121. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 122. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 123. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 124. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. OELD TV MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. OELD TV MARKET OVERVIEW BY TECHNOLOGY

FIGURE 012. ACTIVE-MATRIX OLED (AMOLED) MARKET OVERVIEW (2016-2030)

FIGURE 013. PASSIVE-MATRIX OLED (PAMOLED) MARKET OVERVIEW (2016-2030)

FIGURE 014. FOLDABLE OLED MARKET OVERVIEW (2016-2030)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 016. OELD TV MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 017. DISPLAY MARKET OVERVIEW (2016-2030)

FIGURE 018. LIGHTING MARKET OVERVIEW (2016-2030)

FIGURE 019. OELD TV MARKET OVERVIEW BY DISPLAY PANEL TYPE

FIGURE 020. RIGID MARKET OVERVIEW (2016-2030)

FIGURE 021. FLEXIBLE MARKET OVERVIEW (2016-2030)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 023. OELD TV MARKET OVERVIEW BY APPLICATION

FIGURE 024. SMARTPHONE & TABLET MARKET OVERVIEW (2016-2030)

FIGURE 025. SMARTWATCHES & WEARABLES MARKET OVERVIEW (2016-2030)

FIGURE 026. TELEVISION MARKET OVERVIEW (2016-2030)

FIGURE 027. DIGITAL SIGNAGE SYSTEMS MARKET OVERVIEW (2016-2030)

FIGURE 028. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 029. NORTH AMERICA OELD TV MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 030. EASTERN EUROPE OELD TV MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 031. WESTERN EUROPE OELD TV MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 032. ASIA PACIFIC OELD TV MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 033. MIDDLE EAST & AFRICA OELD TV MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 034. SOUTH AMERICA OELD TV MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the OLED TV Market research report is 2024-2032.

Acuity Brands (US), Kopin Corporation (US), Pixelligient Technologies (US), Lumiotec (US), Emagin Corporation (USA), BOE Technology (China), LG Display (South Korea), Osram (Germany), AU Optronics (Taiwan), Tianma Microelectronics (China), Samsung Electronics (South Korea), Universal Display Corporation (New Jersey), Royole Corporation (China), Konica Minolta Pioneer OLED (Japan), China Star Optoelectronics Technology (China), JOLED (Japan), Raystar Optronics (China), Panasonic (Japan), Truly International (Hong Kong), Visionox (China), Winstar Display (Taiwan), Wisechip Semiconductor (China) and Other Major Players.

The OLED TV Market is segmented into Technology, Product Type, Display Panel Type, Application, and region. By Technology, the market is categorized into Active-matrix OLED (AMOLED), Passive-matrix OLED (PAMOLED), Foldable OLED, Others. By Product Type, the market is categorized into Display, Lighting. By Display Panel Type, the market is categorized into Rigid, Flexible, Others. By Application, the market is categorized into Smartphone & Tablet, Smartwatches & Wearables, Television, Digital Signage Systems, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

OLED TV stands for Organic Light-Emitting Diode Television. It is a type of television display technology that has gained significant popularity in recent years due to its impressive picture quality and unique features.

Global OLED TV Market Size Was Valued at USD 10.28 Billion In 2023 And Is Projected to Reach USD 45.04 Billion By 2032, Growing at A CAGR of 17.84% From 2024-2032.