Smart Labels Market Overview

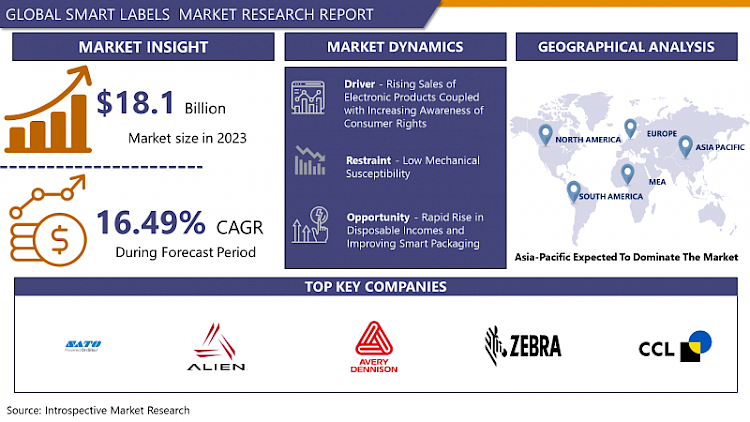

Smart Labels Market Size Was Valued at USD 18.1 Billion in 2023 and is Projected to Reach USD 71.5 Billion by 2032, Growing at a CAGR of 16.49 % From 2024-2032.

Smart labels are innovative tags equipped with technologies like RFID (Radio Frequency Identification) or NFC (Near Field Communication) to provide real-time data about products. They enhance supply chain management, enabling tracking, authentication, and inventory control. Smart labels can store information about a product's origin, expiration date, and usage instructions. They facilitate inventory management, reduce counterfeit products, and enhance consumer experiences through interactive features like product information or promotions accessed via smartphones.

The smart Labels Market is the growing need for product traceability and verification across industries like retail, healthcare, food & beverage, and logistics. RFID and NFC-enabled smart labels allow businesses to monitor their supply chains efficiently, reducing instances of imitating and enhancing inventory management practices. In the retail sector, smart labels facilitate seamless checkout processes and enable retailers to gather valuable insights into consumer behavior. Moreover, the increasing adoption of IoT (Internet of Things) technology is fueling the demand for smart labels as they serve as a crucial interface between physical products and digital platforms. This integration enables innovative applications such as smart packaging, where labels provide real-time information about product freshness and usage instructions.

- The Smart Labels Market is also witnessing significant growth due to regulatory mandates aimed at ensuring product safety and authenticity. Governments worldwide are imposing stringent regulations, especially in industries like pharmaceuticals and food, driving the adoption of smart labeling solutions. Furthermore, advancements in printing technologies, such as digital printing and flexible electronics, are making smart labels more affordable and customizable, further boosting market growth. Overall, the Smart Labels Market is poised for substantial expansion driven by technological innovations, regulatory requirements, and the growing need for enhanced supply chain visibility and consumer engagement.

Market Segmentation

Segmentation Analysis of Smart Labels Market:

- By Technology Type, the RFID segment is accounted for the largest segment with Smart Labels market share of 54.32% and estimated to have a market size of USD 15.39 billion in the year 2026. Due to key benefits associated with the RFID segment like Automatic data capture, information accuracy, and real-time tracking, the segment RFID is growing the Smart Labels market.

- By Applications Type, the Perishable Goods segment is accounted for the largest segment with Smart Labels market share of 45.32% and estimated to have a market size of USD 12.48 billion in the year 2026 with a CAGR of 16.05%. Apart from perishable goods, retail inventory is the fastest and largest growing segment that is witnessing and leading the growth of Smart Labels market.

Regional Insights:

The Smart Labels market is growing rapidly in the Asia-Pacific region. Asia-Pacific region is accounted for the largest Smart Labels market share of 37.2% across the globe with a CAGR of 16.52% and a market size of USD 3.71 billion in the year 2019. But in the forecast period, due to the high demand from the regions like China, Japan, Australia, and India, Asia-Pacific is expected to continue the growth with estimated market size of USD 10.71 billion in the year 2026.

Major Key Players Considered in the Market

- Avery Dennison Corporation

- CCL Industries.

- Checkpoint Systems.

- Smartrac N.V.

- Zebra Technologies Corporation

- Alien Technology.

- Sato Holding Corporation

- Intermec Inc.

- Thin Film Electronics ASA

- Checkpoint Systems, Inc. and other major players.

Salient Features of the Smart Labels Market

Global Smart Labels market was valued at USD 13.36 billion in 2021 and is expected to reach USD 38.66 billion by the year 2028, at a CAGR of 16.39% between 2022 to 2028.

- Microprocessor from the component segment is expected to show the fastest growth for Smart Labels forecast period due to the heavy demand from the automotive and the electronics industry. Increasing usage from inventory management and asset tracking is driving the Smart Labels market rapidly.

- The retail segment from the end-user industry is expected to be the largest segment in the forecast period with a Smart Labels market share of 35.36% and an estimated market size of USD 10.06 billion in the year 2026.

- Logistics and Fast-moving consumer goods (FMCG) are also one of the fastest-growing while healthcare and pharmaceutical are also expected to have a boost in Smart Labels forecast period with a CAGR of 16.5%.

Key Industry Developments in the Smart Labels Market:

- In July 2023, CCL Industries strengthened its European presence with the acquisition of Germany's Faubel & Co. Nachf. GmbH, a pharmaceutical label business. This strategic move enhances CCL Industries' organizational and operational capabilities, propelling its global expansion efforts. The acquisition underscores CCL Industries' commitment to fortifying its foothold in the European market and signifies a significant step forward in its pursuit of global prominence.

- In January 2023, Avery Dennison unveiled its acquisition agreement with Thermopatch, a leading provider of labeling and embellishments for various industries. The deal positions Thermopatch under Avery Dennison's RBIS Apparel Solutions division. This strategic move aims to capitalize on collective expertise, enhancing external embellishments. Thermopatch, based in Syracuse, New York, reported 2022 revenues of around $40 million, boasting approximately 200 employees across North America and Europe.

|

Global Smart Labels Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data : |

2016 to 2020 |

Market Size in 2023 : |

USD 18.01 Bn. |

|

Forecast Period 2022-28 CAGR: |

16.49 % |

Market Size in 2032 : |

USD 71.05 Bn. |

|

Segments Covered: |

By Technology Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Smart Labels Market by Type

5.1 Smart Labels Market Overview Snapshot and Growth Engine

5.2 Smart Labels Market Overview

5.3 EAS

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 EAS: Grographic Segmentation

5.4 RFID

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 RFID: Grographic Segmentation

5.5 Sensing

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Sensing: Grographic Segmentation

5.6 ESL

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 ESL: Grographic Segmentation

5.7 Near Field Communication (NFC) tags

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Near Field Communication (NFC) tags: Grographic Segmentation

Chapter 6: Smart Labels Market by Application

6.1 Smart Labels Market Overview Snapshot and Growth Engine

6.2 Smart Labels Market Overview

6.3 Retail Inventory

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Retail Inventory: Grographic Segmentation

6.4 Perishable Goods

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Perishable Goods: Grographic Segmentation

6.5 Electronics & IT Assets

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Electronics & IT Assets: Grographic Segmentation

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Smart Labels Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Smart Labels Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Smart Labels Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 AVERY DENNISON CORPORATION

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 CCL INDUSTRIES.

7.4 CHECKPOINT SYSTEMS.

7.5 SMARTRAC N.V.

7.6 ZEBRA TECHNOLOGIES CORPORATION

7.7 ALIEN TECHNOLOGY.

7.8 SATO HOLDING CORPORATION

7.9 INTERMEC INC.

7.10 AVERY DENISON CORPORATION

7.11 THIN FILM ELECTRONICS ASA

7.12 CHECKPOINT SYSTEMS INC

7.13 OTHER MAJOR PLAYERS

Chapter 8: Global Smart Labels Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 EAS

8.2.2 RFID

8.2.3 Sensing

8.2.4 ESL

8.2.5 Near Field Communication (NFC) tags

8.3 Historic and Forecasted Market Size By Application

8.3.1 Retail Inventory

8.3.2 Perishable Goods

8.3.3 Electronics & IT Assets

8.3.4 Others

Chapter 9: North America Smart Labels Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 EAS

9.4.2 RFID

9.4.3 Sensing

9.4.4 ESL

9.4.5 Near Field Communication (NFC) tags

9.5 Historic and Forecasted Market Size By Application

9.5.1 Retail Inventory

9.5.2 Perishable Goods

9.5.3 Electronics & IT Assets

9.5.4 Others

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Smart Labels Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 EAS

10.4.2 RFID

10.4.3 Sensing

10.4.4 ESL

10.4.5 Near Field Communication (NFC) tags

10.5 Historic and Forecasted Market Size By Application

10.5.1 Retail Inventory

10.5.2 Perishable Goods

10.5.3 Electronics & IT Assets

10.5.4 Others

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Smart Labels Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 EAS

11.4.2 RFID

11.4.3 Sensing

11.4.4 ESL

11.4.5 Near Field Communication (NFC) tags

11.5 Historic and Forecasted Market Size By Application

11.5.1 Retail Inventory

11.5.2 Perishable Goods

11.5.3 Electronics & IT Assets

11.5.4 Others

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Smart Labels Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 EAS

12.4.2 RFID

12.4.3 Sensing

12.4.4 ESL

12.4.5 Near Field Communication (NFC) tags

12.5 Historic and Forecasted Market Size By Application

12.5.1 Retail Inventory

12.5.2 Perishable Goods

12.5.3 Electronics & IT Assets

12.5.4 Others

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Smart Labels Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 EAS

13.4.2 RFID

13.4.3 Sensing

13.4.4 ESL

13.4.5 Near Field Communication (NFC) tags

13.5 Historic and Forecasted Market Size By Application

13.5.1 Retail Inventory

13.5.2 Perishable Goods

13.5.3 Electronics & IT Assets

13.5.4 Others

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Smart Labels Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data : |

2016 to 2020 |

Market Size in 2023 : |

USD 18.01 Bn. |

|

Forecast Period 2022-28 CAGR: |

16.49 % |

Market Size in 2032 : |

USD 71.05 Bn. |

|

Segments Covered: |

By Technology Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SMART LABELS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SMART LABELS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SMART LABELS MARKET COMPETITIVE RIVALRY

TABLE 005. SMART LABELS MARKET THREAT OF NEW ENTRANTS

TABLE 006. SMART LABELS MARKET THREAT OF SUBSTITUTES

TABLE 007. SMART LABELS MARKET BY TYPE

TABLE 008. EAS MARKET OVERVIEW (2016-2028)

TABLE 009. RFID MARKET OVERVIEW (2016-2028)

TABLE 010. SENSING MARKET OVERVIEW (2016-2028)

TABLE 011. ESL MARKET OVERVIEW (2016-2028)

TABLE 012. NEAR FIELD COMMUNICATION (NFC) TAGS MARKET OVERVIEW (2016-2028)

TABLE 013. SMART LABELS MARKET BY APPLICATION

TABLE 014. RETAIL INVENTORY MARKET OVERVIEW (2016-2028)

TABLE 015. PERISHABLE GOODS MARKET OVERVIEW (2016-2028)

TABLE 016. ELECTRONICS & IT ASSETS MARKET OVERVIEW (2016-2028)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. NORTH AMERICA SMART LABELS MARKET, BY TYPE (2016-2028)

TABLE 019. NORTH AMERICA SMART LABELS MARKET, BY APPLICATION (2016-2028)

TABLE 020. N SMART LABELS MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE SMART LABELS MARKET, BY TYPE (2016-2028)

TABLE 022. EUROPE SMART LABELS MARKET, BY APPLICATION (2016-2028)

TABLE 023. SMART LABELS MARKET, BY COUNTRY (2016-2028)

TABLE 024. ASIA PACIFIC SMART LABELS MARKET, BY TYPE (2016-2028)

TABLE 025. ASIA PACIFIC SMART LABELS MARKET, BY APPLICATION (2016-2028)

TABLE 026. SMART LABELS MARKET, BY COUNTRY (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA SMART LABELS MARKET, BY TYPE (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA SMART LABELS MARKET, BY APPLICATION (2016-2028)

TABLE 029. SMART LABELS MARKET, BY COUNTRY (2016-2028)

TABLE 030. SOUTH AMERICA SMART LABELS MARKET, BY TYPE (2016-2028)

TABLE 031. SOUTH AMERICA SMART LABELS MARKET, BY APPLICATION (2016-2028)

TABLE 032. SMART LABELS MARKET, BY COUNTRY (2016-2028)

TABLE 033. AVERY DENNISON CORPORATION: SNAPSHOT

TABLE 034. AVERY DENNISON CORPORATION: BUSINESS PERFORMANCE

TABLE 035. AVERY DENNISON CORPORATION: PRODUCT PORTFOLIO

TABLE 036. AVERY DENNISON CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. CCL INDUSTRIES.: SNAPSHOT

TABLE 037. CCL INDUSTRIES.: BUSINESS PERFORMANCE

TABLE 038. CCL INDUSTRIES.: PRODUCT PORTFOLIO

TABLE 039. CCL INDUSTRIES.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. CHECKPOINT SYSTEMS.: SNAPSHOT

TABLE 040. CHECKPOINT SYSTEMS.: BUSINESS PERFORMANCE

TABLE 041. CHECKPOINT SYSTEMS.: PRODUCT PORTFOLIO

TABLE 042. CHECKPOINT SYSTEMS.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. SMARTRAC N.V.: SNAPSHOT

TABLE 043. SMARTRAC N.V.: BUSINESS PERFORMANCE

TABLE 044. SMARTRAC N.V.: PRODUCT PORTFOLIO

TABLE 045. SMARTRAC N.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. ZEBRA TECHNOLOGIES CORPORATION: SNAPSHOT

TABLE 046. ZEBRA TECHNOLOGIES CORPORATION: BUSINESS PERFORMANCE

TABLE 047. ZEBRA TECHNOLOGIES CORPORATION: PRODUCT PORTFOLIO

TABLE 048. ZEBRA TECHNOLOGIES CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. ALIEN TECHNOLOGY.: SNAPSHOT

TABLE 049. ALIEN TECHNOLOGY.: BUSINESS PERFORMANCE

TABLE 050. ALIEN TECHNOLOGY.: PRODUCT PORTFOLIO

TABLE 051. ALIEN TECHNOLOGY.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. SATO HOLDING CORPORATION: SNAPSHOT

TABLE 052. SATO HOLDING CORPORATION: BUSINESS PERFORMANCE

TABLE 053. SATO HOLDING CORPORATION: PRODUCT PORTFOLIO

TABLE 054. SATO HOLDING CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. INTERMEC INC.: SNAPSHOT

TABLE 055. INTERMEC INC.: BUSINESS PERFORMANCE

TABLE 056. INTERMEC INC.: PRODUCT PORTFOLIO

TABLE 057. INTERMEC INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. AVERY DENISON CORPORATION: SNAPSHOT

TABLE 058. AVERY DENISON CORPORATION: BUSINESS PERFORMANCE

TABLE 059. AVERY DENISON CORPORATION: PRODUCT PORTFOLIO

TABLE 060. AVERY DENISON CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. THIN FILM ELECTRONICS ASA: SNAPSHOT

TABLE 061. THIN FILM ELECTRONICS ASA: BUSINESS PERFORMANCE

TABLE 062. THIN FILM ELECTRONICS ASA: PRODUCT PORTFOLIO

TABLE 063. THIN FILM ELECTRONICS ASA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. CHECKPOINT SYSTEMS INC: SNAPSHOT

TABLE 064. CHECKPOINT SYSTEMS INC: BUSINESS PERFORMANCE

TABLE 065. CHECKPOINT SYSTEMS INC: PRODUCT PORTFOLIO

TABLE 066. CHECKPOINT SYSTEMS INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 067. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 068. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 069. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SMART LABELS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SMART LABELS MARKET OVERVIEW BY TYPE

FIGURE 012. EAS MARKET OVERVIEW (2016-2028)

FIGURE 013. RFID MARKET OVERVIEW (2016-2028)

FIGURE 014. SENSING MARKET OVERVIEW (2016-2028)

FIGURE 015. ESL MARKET OVERVIEW (2016-2028)

FIGURE 016. NEAR FIELD COMMUNICATION (NFC) TAGS MARKET OVERVIEW (2016-2028)

FIGURE 017. SMART LABELS MARKET OVERVIEW BY APPLICATION

FIGURE 018. RETAIL INVENTORY MARKET OVERVIEW (2016-2028)

FIGURE 019. PERISHABLE GOODS MARKET OVERVIEW (2016-2028)

FIGURE 020. ELECTRONICS & IT ASSETS MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. NORTH AMERICA SMART LABELS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. EUROPE SMART LABELS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. ASIA PACIFIC SMART LABELS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. MIDDLE EAST & AFRICA SMART LABELS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. SOUTH AMERICA SMART LABELS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Smart Labels Market research report is 2024-2032.

Avery Dennison Corporation (US), CCL Industries (Canada), Checkpoint Systems (US), Smartrac N.V (Netherlands), Zebra Technologies Corporation (US), and other major players.

The Smart Labels Market is segmented into Technology Type, Application, and region. By Technology Type, the market is categorized into EAS, RFID, Sensing, ESL, and Near Field Communication (NFC) tags. By Application, the market is categorized into Retail Inventory, Perishable Goods, Electronics & IT Assets, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Smart Labels acts as electronic responsive device that is embedded in the body of the product as an identification slip. They are made up of chips, antennae, and bonding wires which help in real-time access and tracking of the devices.

Smart Labels Market Size Was Valued at USD 18.1 Billion in 2023 and is Projected to Reach USD 71.5 Billion by 2032, Growing at a CAGR of 16.49 % From 2024-2032.