Electric Forklift Market synopsis :

The Global Market for Electric Forklift Estimated at USD 58.10 Billion In the Year 2022, Is Projected to Reach A Revised Size of USD 176.5 Billion by 2030, Growing at A CAGR of 14.9% Over the Forecast Period 2022-2030.

Electric forklifts are a subtype of forklifts that are powered exclusively by electricity, rather than traditional sources such as gas or diesel. These models offer an effective, quiet, and powerful way to utilize forklift technology in even tight, enclosed spaces. They are equipped with an electric motor to provide the necessary power for lifting and moving heavy loads. Electric forklifts use rechargeable batteries as their energy source.

These batteries need to be periodically charged to ensure continuous operation. Electric forklifts operate more quietly compared to diesel or gasoline-powered forklifts, making them well-suited for noise-sensitive environments. While the initial investment in electric forklifts can be higher, they often have lower operating costs over time due to reduced fuel and maintenance expenses.

Electric forklifts typically require less maintenance since they have fewer moving parts compared to internal combustion engine forklifts. The growth of e-commerce and the rise in automation in the supply chain industry are among the significant factors driving the demand for electric forklifts. Additionally, technological advancements have led to the development of more sophisticated electric forklifts equipped with features such as enhanced battery life, improved performance, and better operator comfort.

The Electric Forklift Market Trend Analysis

Growing focus on reducing emissions from the e-commerce sector

- The growing focus on reducing emissions from the e-commerce sector has emerged as a significant driving factor for the electric forklift market. With the rapid expansion of e-commerce, driven by changing consumer behavior and technological advancements, there has been an increasing concern about the environmental impact of the industry's operations. As a result, businesses are actively seeking more sustainable solutions throughout their supply chain, and electric forklifts offer a compelling alternative to traditional internal combustion engine (ICE) forklifts.

- The rise of e-commerce has revolutionized the retail landscape, with consumers now demanding faster delivery times and a seamless online shopping experience. This has led to an exponential increase in warehousing and logistics activities, as well as a higher demand for material-handling equipment like forklifts. However, the traditional ICE forklifts widely used in the industry are known for their emissions, contributing to air pollution and greenhouse gas emissions, which in turn exacerbate climate change.

- As environmental concerns and fluctuating oil prices continue to push consumers toward alternatives to traditional internal combustion (IC) engines, forklift operations have increasingly looked toward electric vehicle solutions over the last decade.

- As per the Toyota Material Handling report Customers are now buying far more electric forklifts than those powered by IC engines. Electric forklifts now make up 70 percent of total sales, and with increasing demand for electric power comes a need to provide a solution that provides all of the benefits of IC without a loss in productivity.

Increasing Demand for Sustainable Solutions

- With a growing focus on environmental sustainability and reducing carbon footprints, businesses are increasingly seeking eco-friendly alternatives in their operations. Electric forklifts, being emission-free at the point of use, present a viable solution for companies looking to meet their sustainability goals.

- In recent years, the warehousing and logistics industry has experienced a significant shift toward sustainability goals and practices. The increasing global focus on reducing greenhouse gas emissions and improving energy efficiency has accelerated the adoption of lithium battery-powered forklifts as an effective means of meeting sustainability goals.

- Technological advancements, such as the introduction of lithium-ion batteries, have enabled electric forklifts to deliver enhanced performance and longer runtimes than their lead-acid battery predecessors. Additionally, improved charging systems have made electric forklifts more practical for various applications, including high-volume and round-the-clock operations. These factors have contributed to the growing demand for electric forklifts in the warehousing and logistics industry.

- One of the primary drivers behind the adoption of electric forklifts is their potential to reduce greenhouse gas emissions. Traditional internal combustion engines (ICE) and propane-powered forklifts, which run on diesel or propane, emit significant amounts of carbon dioxide and other harmful pollutants. In contrast, electric forklifts produce zero tailpipe emissions, contributing to a cleaner environment and helping companies achieve their carbon reduction targets.

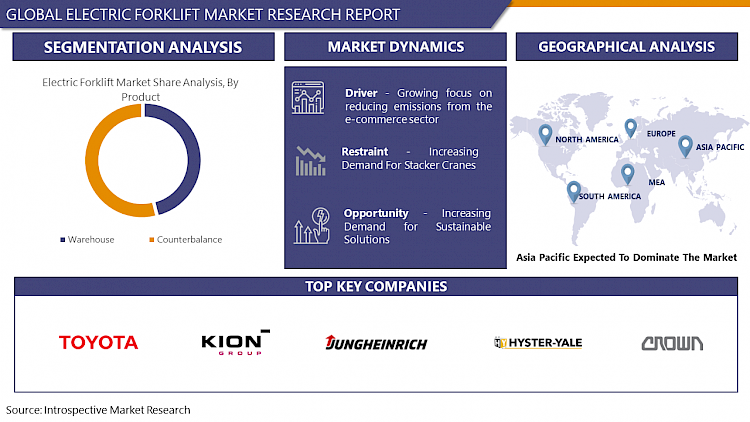

Segmentation Analysis of the Electric Forklift Market

Electric Forklift market segments cover the Product, Class, Battery Type, Application, and Region. By Battery Type, the Li-Ion Battery segment is anticipated to dominate the Market over the Forecast period.

- There are several energy solutions available when choosing an electric forklift. lithium-ion batteries have become an increasingly popular power source in the electric forklift market. Lithium-ion batteries deliver maximum power all the time, regardless of how much charge is left, unlike lead-acid batteries where less charge affects speed and lifting capacity. For instance, Toyota has assembled thousands of lithium-ion batteries that power trucks throughout Europe, providing businesses with a high-quality and safe way to power their material handling equipment.

- Greater energy efficiency means lower costs and lower emissions. Lithium-ion batteries provide a wide variety of efficiency advantages, from consistent power delivery to faster charging capabilities. Exploring lithium-ion forklift battery options help to achieve sustainability and commercial goals.

- Additionally, Li-ion batteries have a higher energy density compared to lead-acid batteries, which means they can store more energy in a smaller and lighter package. This higher energy density allows electric forklifts equipped with Li-ion batteries to operate for longer periods on a single charge, increasing productivity and reducing downtime.

- Li-ion batteries generally have a longer lifespan compared to traditional lead-acid batteries. They can endure a higher number of charge-discharge cycles before experiencing significant capacity loss, leading to reduced maintenance costs and longer-lasting batteries.

Regional Analysis of the Electric Forklift Market

Asia Pacific is expected to Dominate the Market over the Forecast period.

- Asia Pacific accounting for the largest share of the world’s business-to-consumer e-commerce market. Asia Pacific is home to some of the world's largest industrial and manufacturing economies, including China, Japan, South Korea, and India. These countries have robust industrial sectors that rely heavily on material-handling equipment, such as forklifts, for their operations.

- The region has experienced rapid economic growth and urbanization over the years, leading to an increase in construction and infrastructure development. This growth has driven the demand for material handling equipment, including electric forklifts, in various industries.

- Many countries in the Asia Pacific have implemented supportive policies and incentives to encourage the adoption of electric vehicles, including forklifts, as part of their efforts to reduce greenhouse gas emissions and combat air pollution. These incentives may include tax breaks, subsidies, and favorable regulations for electric forklifts.

- The rise of e-commerce has led to a surge in demand for warehousing and logistics facilities in the region. As businesses strive for more sustainable practices, there is a growing interest in adopting electric forklifts to reduce emissions in indoor environments. These are some factor that drives the electric forklift market in the Asia Pacific region.

COVID-19 Impact Analysis on the Electric Forklift Market

The COVID-19 pandemic had a notable impact on various industries, including the electric forklift market. The pandemic caused disruptions in global supply chains, affecting the production and distribution of electric forklifts and their components. Manufacturing plants and suppliers faced temporary closures, delayed shipments, and shortages of raw materials, leading to challenges in meeting demand. Various industries experienced a decline in demand during lockdowns and restrictions, impacting the need for material-handling equipment like electric forklifts.

Sectors such as automotive, aerospace, and non-essential retail were particularly affected, leading to decreased orders for forklifts. Many businesses postponed or scaled back their capital expenditure plans during the pandemic's uncertainty. Investments in new equipment, including electric forklifts, were put on hold as companies focused on conserving cash and navigating through the crisis.

On the other hand, industries deemed essential during the pandemic, such as food and grocery distribution, healthcare, and e-commerce, experienced a surge in demand. These sectors relied heavily on material handling equipment, including electric forklifts, to manage increased workload and distribution needs.

Top Key Players Covered in the Electric Forklift Market

The major key player in the Electric Forklift market include:

- Toyota - (Japan)

- Kion - (Germany)

- Jungheinrich - (Germany)

- Mitsubishi Logisnext - (Japan)

- Hyster-Yale - (USA)

- Crown Equipment - (USA)

- Anhui Heli - (China)

- Hangcha - (China)

- Doosan Corporation Industrial Vehicle - (South Korea)

- Clark Material Handling - (USA)

- Komatsu - (Japan)

- Hyundai Heavy Industries - (South Korea)

- Combilift - (Ireland)

- Lonking - (China)

- EP Equipment - (China)

- Hubtex Maschinenbau - (Germany)

- Paletrans Equipment - (Brazil)

- Godrej & Boyce - (India) and Other Major Players.

Key Industry Developments in the Electric Forklift Market

- In July 2023, Godrej & Boyce, a key player in material handling solutions, has launched its latest innovation, the GST series of electric forklifts. This groundbreaking series showcases a diverse range of capacities and configurations, designed to meet varied industrial needs while prioritizing efficiency and sustainability.

- In August 2023, Hubtex, a leading provider of specialized material handling equipment, has introduced its latest innovation, the 3VT electric forklift. This groundbreaking addition to their portfolio is meticulously engineered for unparalleled flexibility across a myriad of applications.

|

Global Electric Forklift Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 58.10 Bn. |

|

Forecast Period 2023-30 CAGR: |

14.9% |

Market Size in 2030: |

USD 176.5 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Class |

|

||

|

By Battery Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ELECTRIC FORKLIFT MARKET BY PRODUCT (2016-2030)

- ELECTRIC FORKLIFT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- WAREHOUSE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COUNTERBALANCE

- ELECTRIC FORKLIFT MARKET BY CLASS (2016-2030)

- ELECTRIC FORKLIFT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SEGMENT2A

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CLASS 1

- CLASS 2

- CLASS 3

- CLASS 4/5

- ELECTRIC FORKLIFT MARKET BY BATTERY TYPE (2016-2030)

- ELECTRIC FORKLIFT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LI-ION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LEAD ACID

- ELECTRIC FORKLIFT MARKET BY APPLICATION (2016-2030)

- ELECTRIC FORKLIFT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CHEMICAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FOOD & BEVERAGE

- INDUSTRIAL

- LOGISTICS

- RETAIL & E-COMMERCE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Electric Forklift Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- TOYOTA - (JAPAN)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- KION - (GERMANY)

- JUNGHEINRICH - (GERMANY)

- MITSUBISHI LOGISNEXT - (JAPAN)

- HYSTER-YALE - (USA)

- CROWN EQUIPMENT - (USA)

- ANHUI HELI - (CHINA)

- HANGCHA - (CHINA)

- DOOSAN CORPORATION INDUSTRIAL VEHICLE - (SOUTH KOREA)

- CLARK MATERIAL HANDLING - (USA)

- KOMATSU - (JAPAN)

- HYUNDAI HEAVY INDUSTRIES - (SOUTH KOREA)

- COMBILIFT - (IRELAND)

- LONKING - (CHINA)

- EP EQUIPMENT - (CHINA)

- HUBTEX MASCHINENBAU - (GERMANY)

- PALETRANS EQUIPMENT - (BRAZIL)

- GODREJ & BOYCE - (INDIA) AND OTHER MAJOR PLAYERS.

- COMPETITIVE LANDSCAPE

- GLOBAL ELECTRIC FORKLIFT MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Product

- Historic And Forecasted Market Size By Class

- Historic And Forecasted Market Size By Battery Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Electric Forklift Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 58.10 Bn. |

|

Forecast Period 2023-30 CAGR: |

14.9% |

Market Size in 2030: |

USD 176.5 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Class |

|

||

|

By Battery Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTRIC FORKLIFT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTRIC FORKLIFT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTRIC FORKLIFT MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTRIC FORKLIFT MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTRIC FORKLIFT MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTRIC FORKLIFT MARKET BY PRODUCT

TABLE 008. WAREHOUSE MARKET OVERVIEW (2016-2030)

TABLE 009. COUNTERBALANCE MARKET OVERVIEW (2016-2030)

TABLE 010. ELECTRIC FORKLIFT MARKET BY CLASS

TABLE 011. CLASS 1 MARKET OVERVIEW (2016-2030)

TABLE 012. CLASS 2 MARKET OVERVIEW (2016-2030)

TABLE 013. CLASS 3 MARKET OVERVIEW (2016-2030)

TABLE 014. CLASS 4/5 MARKET OVERVIEW (2016-2030)

TABLE 015. ELECTRIC FORKLIFT MARKET BY BATTERY TYPE

TABLE 016. LI-ION MARKET OVERVIEW (2016-2030)

TABLE 017. LEAD ACID MARKET OVERVIEW (2016-2030)

TABLE 018. ELECTRIC FORKLIFT MARKET BY APPLICATION

TABLE 019. CHEMICAL MARKET OVERVIEW (2016-2030)

TABLE 020. FOOD & BEVERAGE MARKET OVERVIEW (2016-2030)

TABLE 021. INDUSTRIAL MARKET OVERVIEW (2016-2030)

TABLE 022. LOGISTICS MARKET OVERVIEW (2016-2030)

TABLE 023. RETAIL & E-COMMERCE MARKET OVERVIEW (2016-2030)

TABLE 024. NORTH AMERICA ELECTRIC FORKLIFT MARKET, BY PRODUCT (2016-2030)

TABLE 025. NORTH AMERICA ELECTRIC FORKLIFT MARKET, BY CLASS (2016-2030)

TABLE 026. NORTH AMERICA ELECTRIC FORKLIFT MARKET, BY BATTERY TYPE (2016-2030)

TABLE 027. NORTH AMERICA ELECTRIC FORKLIFT MARKET, BY APPLICATION (2016-2030)

TABLE 028. N ELECTRIC FORKLIFT MARKET, BY COUNTRY (2016-2030)

TABLE 029. EASTERN EUROPE ELECTRIC FORKLIFT MARKET, BY PRODUCT (2016-2030)

TABLE 030. EASTERN EUROPE ELECTRIC FORKLIFT MARKET, BY CLASS (2016-2030)

TABLE 031. EASTERN EUROPE ELECTRIC FORKLIFT MARKET, BY BATTERY TYPE (2016-2030)

TABLE 032. EASTERN EUROPE ELECTRIC FORKLIFT MARKET, BY APPLICATION (2016-2030)

TABLE 033. ELECTRIC FORKLIFT MARKET, BY COUNTRY (2016-2030)

TABLE 034. WESTERN EUROPE ELECTRIC FORKLIFT MARKET, BY PRODUCT (2016-2030)

TABLE 035. WESTERN EUROPE ELECTRIC FORKLIFT MARKET, BY CLASS (2016-2030)

TABLE 036. WESTERN EUROPE ELECTRIC FORKLIFT MARKET, BY BATTERY TYPE (2016-2030)

TABLE 037. WESTERN EUROPE ELECTRIC FORKLIFT MARKET, BY APPLICATION (2016-2030)

TABLE 038. ELECTRIC FORKLIFT MARKET, BY COUNTRY (2016-2030)

TABLE 039. ASIA PACIFIC ELECTRIC FORKLIFT MARKET, BY PRODUCT (2016-2030)

TABLE 040. ASIA PACIFIC ELECTRIC FORKLIFT MARKET, BY CLASS (2016-2030)

TABLE 041. ASIA PACIFIC ELECTRIC FORKLIFT MARKET, BY BATTERY TYPE (2016-2030)

TABLE 042. ASIA PACIFIC ELECTRIC FORKLIFT MARKET, BY APPLICATION (2016-2030)

TABLE 043. ELECTRIC FORKLIFT MARKET, BY COUNTRY (2016-2030)

TABLE 044. MIDDLE EAST & AFRICA ELECTRIC FORKLIFT MARKET, BY PRODUCT (2016-2030)

TABLE 045. MIDDLE EAST & AFRICA ELECTRIC FORKLIFT MARKET, BY CLASS (2016-2030)

TABLE 046. MIDDLE EAST & AFRICA ELECTRIC FORKLIFT MARKET, BY BATTERY TYPE (2016-2030)

TABLE 047. MIDDLE EAST & AFRICA ELECTRIC FORKLIFT MARKET, BY APPLICATION (2016-2030)

TABLE 048. ELECTRIC FORKLIFT MARKET, BY COUNTRY (2016-2030)

TABLE 049. SOUTH AMERICA ELECTRIC FORKLIFT MARKET, BY PRODUCT (2016-2030)

TABLE 050. SOUTH AMERICA ELECTRIC FORKLIFT MARKET, BY CLASS (2016-2030)

TABLE 051. SOUTH AMERICA ELECTRIC FORKLIFT MARKET, BY BATTERY TYPE (2016-2030)

TABLE 052. SOUTH AMERICA ELECTRIC FORKLIFT MARKET, BY APPLICATION (2016-2030)

TABLE 053. ELECTRIC FORKLIFT MARKET, BY COUNTRY (2016-2030)

TABLE 054. TOYOTA - (JAPAN): SNAPSHOT

TABLE 055. TOYOTA - (JAPAN): BUSINESS PERFORMANCE

TABLE 056. TOYOTA - (JAPAN): PRODUCT PORTFOLIO

TABLE 057. TOYOTA - (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. KION - (GERMANY): SNAPSHOT

TABLE 058. KION - (GERMANY): BUSINESS PERFORMANCE

TABLE 059. KION - (GERMANY): PRODUCT PORTFOLIO

TABLE 060. KION - (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. JUNGHEINRICH - (GERMANY): SNAPSHOT

TABLE 061. JUNGHEINRICH - (GERMANY): BUSINESS PERFORMANCE

TABLE 062. JUNGHEINRICH - (GERMANY): PRODUCT PORTFOLIO

TABLE 063. JUNGHEINRICH - (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. MITSUBISHI LOGISNEXT - (JAPAN): SNAPSHOT

TABLE 064. MITSUBISHI LOGISNEXT - (JAPAN): BUSINESS PERFORMANCE

TABLE 065. MITSUBISHI LOGISNEXT - (JAPAN): PRODUCT PORTFOLIO

TABLE 066. MITSUBISHI LOGISNEXT - (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. HYSTER-YALE - (USA): SNAPSHOT

TABLE 067. HYSTER-YALE - (USA): BUSINESS PERFORMANCE

TABLE 068. HYSTER-YALE - (USA): PRODUCT PORTFOLIO

TABLE 069. HYSTER-YALE - (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. CROWN EQUIPMENT - (USA): SNAPSHOT

TABLE 070. CROWN EQUIPMENT - (USA): BUSINESS PERFORMANCE

TABLE 071. CROWN EQUIPMENT - (USA): PRODUCT PORTFOLIO

TABLE 072. CROWN EQUIPMENT - (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. ANHUI HELI - (CHINA): SNAPSHOT

TABLE 073. ANHUI HELI - (CHINA): BUSINESS PERFORMANCE

TABLE 074. ANHUI HELI - (CHINA): PRODUCT PORTFOLIO

TABLE 075. ANHUI HELI - (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. HANGCHA - (CHINA): SNAPSHOT

TABLE 076. HANGCHA - (CHINA): BUSINESS PERFORMANCE

TABLE 077. HANGCHA - (CHINA): PRODUCT PORTFOLIO

TABLE 078. HANGCHA - (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. DOOSAN CORPORATION INDUSTRIAL VEHICLE - (SOUTH KOREA): SNAPSHOT

TABLE 079. DOOSAN CORPORATION INDUSTRIAL VEHICLE - (SOUTH KOREA): BUSINESS PERFORMANCE

TABLE 080. DOOSAN CORPORATION INDUSTRIAL VEHICLE - (SOUTH KOREA): PRODUCT PORTFOLIO

TABLE 081. DOOSAN CORPORATION INDUSTRIAL VEHICLE - (SOUTH KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. CLARK MATERIAL HANDLING - (USA): SNAPSHOT

TABLE 082. CLARK MATERIAL HANDLING - (USA): BUSINESS PERFORMANCE

TABLE 083. CLARK MATERIAL HANDLING - (USA): PRODUCT PORTFOLIO

TABLE 084. CLARK MATERIAL HANDLING - (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. KOMATSU - (JAPAN): SNAPSHOT

TABLE 085. KOMATSU - (JAPAN): BUSINESS PERFORMANCE

TABLE 086. KOMATSU - (JAPAN): PRODUCT PORTFOLIO

TABLE 087. KOMATSU - (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. HYUNDAI HEAVY INDUSTRIES - (SOUTH KOREA): SNAPSHOT

TABLE 088. HYUNDAI HEAVY INDUSTRIES - (SOUTH KOREA): BUSINESS PERFORMANCE

TABLE 089. HYUNDAI HEAVY INDUSTRIES - (SOUTH KOREA): PRODUCT PORTFOLIO

TABLE 090. HYUNDAI HEAVY INDUSTRIES - (SOUTH KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. COMBILIFT - (IRELAND): SNAPSHOT

TABLE 091. COMBILIFT - (IRELAND): BUSINESS PERFORMANCE

TABLE 092. COMBILIFT - (IRELAND): PRODUCT PORTFOLIO

TABLE 093. COMBILIFT - (IRELAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. LONKING - (CHINA): SNAPSHOT

TABLE 094. LONKING - (CHINA): BUSINESS PERFORMANCE

TABLE 095. LONKING - (CHINA): PRODUCT PORTFOLIO

TABLE 096. LONKING - (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. EP EQUIPMENT - (CHINA): SNAPSHOT

TABLE 097. EP EQUIPMENT - (CHINA): BUSINESS PERFORMANCE

TABLE 098. EP EQUIPMENT - (CHINA): PRODUCT PORTFOLIO

TABLE 099. EP EQUIPMENT - (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. HUBTEX MASCHINENBAU - (GERMANY): SNAPSHOT

TABLE 100. HUBTEX MASCHINENBAU - (GERMANY): BUSINESS PERFORMANCE

TABLE 101. HUBTEX MASCHINENBAU - (GERMANY): PRODUCT PORTFOLIO

TABLE 102. HUBTEX MASCHINENBAU - (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. PALETRANS EQUIPMENT - (BRAZIL): SNAPSHOT

TABLE 103. PALETRANS EQUIPMENT - (BRAZIL): BUSINESS PERFORMANCE

TABLE 104. PALETRANS EQUIPMENT - (BRAZIL): PRODUCT PORTFOLIO

TABLE 105. PALETRANS EQUIPMENT - (BRAZIL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. GODREJ & BOYCE - (INDIA) OTHER MAJOR PLAYERS.: SNAPSHOT

TABLE 106. GODREJ & BOYCE - (INDIA) OTHER MAJOR PLAYERS.: BUSINESS PERFORMANCE

TABLE 107. GODREJ & BOYCE - (INDIA) OTHER MAJOR PLAYERS.: PRODUCT PORTFOLIO

TABLE 108. GODREJ & BOYCE - (INDIA) OTHER MAJOR PLAYERS.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTRIC FORKLIFT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTRIC FORKLIFT MARKET OVERVIEW BY PRODUCT

FIGURE 012. WAREHOUSE MARKET OVERVIEW (2016-2030)

FIGURE 013. COUNTERBALANCE MARKET OVERVIEW (2016-2030)

FIGURE 014. ELECTRIC FORKLIFT MARKET OVERVIEW BY CLASS

FIGURE 015. CLASS 1 MARKET OVERVIEW (2016-2030)

FIGURE 016. CLASS 2 MARKET OVERVIEW (2016-2030)

FIGURE 017. CLASS 3 MARKET OVERVIEW (2016-2030)

FIGURE 018. CLASS 4/5 MARKET OVERVIEW (2016-2030)

FIGURE 019. ELECTRIC FORKLIFT MARKET OVERVIEW BY BATTERY TYPE

FIGURE 020. LI-ION MARKET OVERVIEW (2016-2030)

FIGURE 021. LEAD ACID MARKET OVERVIEW (2016-2030)

FIGURE 022. ELECTRIC FORKLIFT MARKET OVERVIEW BY APPLICATION

FIGURE 023. CHEMICAL MARKET OVERVIEW (2016-2030)

FIGURE 024. FOOD & BEVERAGE MARKET OVERVIEW (2016-2030)

FIGURE 025. INDUSTRIAL MARKET OVERVIEW (2016-2030)

FIGURE 026. LOGISTICS MARKET OVERVIEW (2016-2030)

FIGURE 027. RETAIL & E-COMMERCE MARKET OVERVIEW (2016-2030)

FIGURE 028. NORTH AMERICA ELECTRIC FORKLIFT MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 029. EASTERN EUROPE ELECTRIC FORKLIFT MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 030. WESTERN EUROPE ELECTRIC FORKLIFT MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 031. ASIA PACIFIC ELECTRIC FORKLIFT MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 032. MIDDLE EAST & AFRICA ELECTRIC FORKLIFT MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 033. SOUTH AMERICA ELECTRIC FORKLIFT MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Electric Forklift Market research report is 2023-2030.

Toyota - (Japan), Kion - (Germany), Jungheinrich - (Germany), Mitsubishi Logisnext - (Japan), Hyster-Yale - (USA), Crown Equipment - (USA), Anhui Heli - (China), Hangcha - (China), Doosan Corporation Industrial Vehicle - (South Korea), Clark Material Handling - (USA), Komatsu - (Japan), Hyundai Heavy Industries - (South Korea), Combilift - (Ireland), Lonking - (China), EP Equipment - (China), Hubtex Maschinenbau - (Germany), Paletrans Equipment - (Brazil), Godrej & Boyce - (India) and Other Major Players.

The Electric Forklift Market is segmented into Product, Class, Battery Type, Application and Region. By Product, the market is categorized into Horizontal Warehouse, Counterbalance. By Class, the market is categorized into Class 1, Class 2, Class 3, Class 4/5. By Battery Type, the market is categorized into Li-Ion, Lead Acid. By Application, the market is categorized into Chemical, Food & Beverage, Industrial, Logistics, Retail & E-commerce. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Electric forklifts are a subtype of forklifts that are powered exclusively by electricity, rather than traditional sources such as gas or diesel. These models offer an effective, quiet, and powerful way to utilize forklift technology in even tight, enclosed spaces. They are equipped with an electric motor to provide the necessary power for lifting and moving heavy loads. Electric forklifts use rechargeable batteries as their energy source.

The Global Market for Electric Forklift Estimated at USD 58.10 Billion In the Year 2022, Is Projected to Reach A Revised Size of USD 176.5 Billion by 2030, Growing at A CAGR of 14.9% Over the Forecast Period 2022-2030.