DC Contractor Market Synopsis:

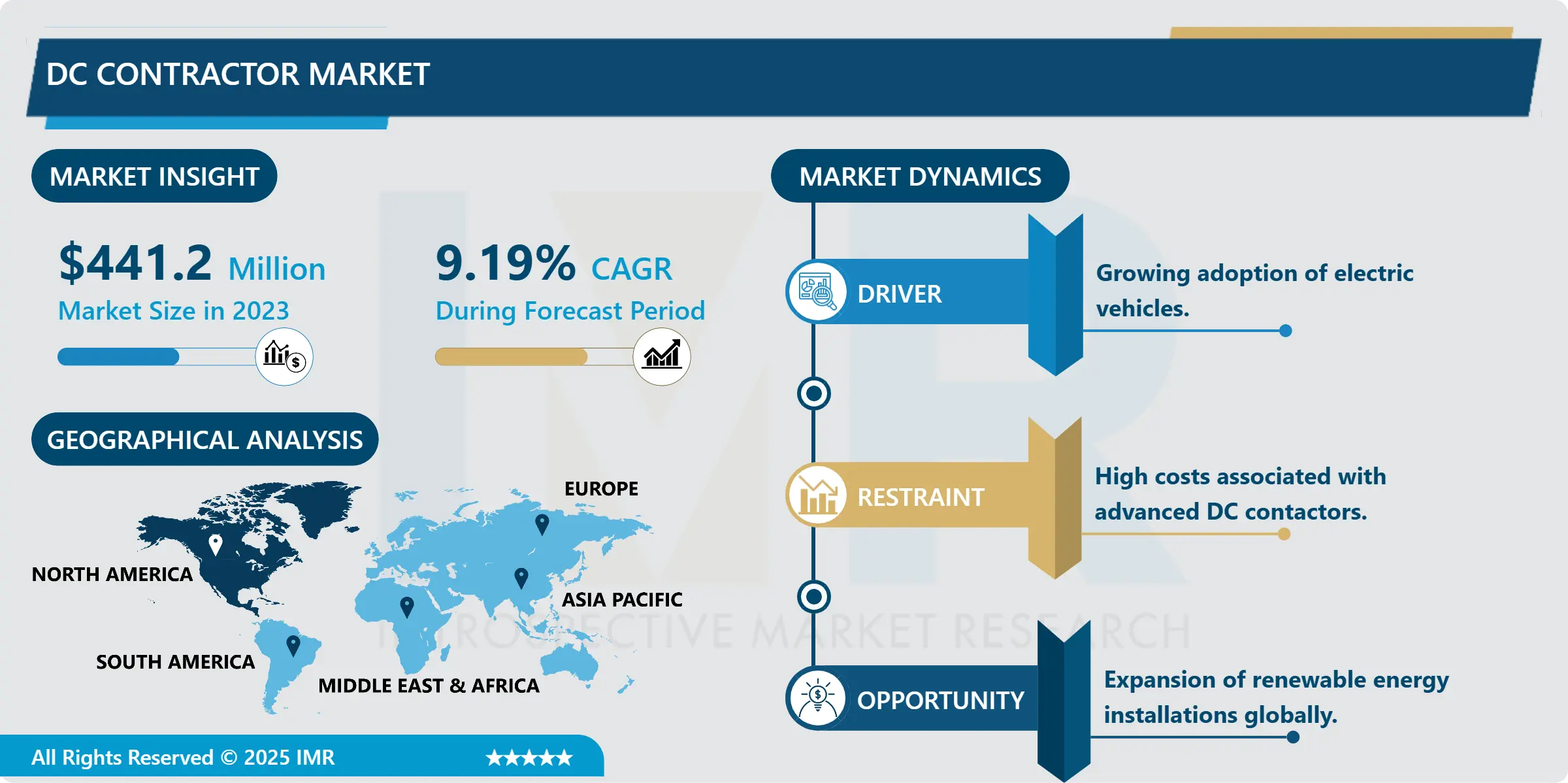

DC Contractor Market Size Was Valued at USD 441.2 Million in 2023, and is Projected to Reach USD 973.38 Million by 2032, Growing at a CAGR of 9.19 % From 2024-2032.

The DC contactor is an important subfield industry of the overall electrical component market, which is an important component that controls the closure or opening of an electrical circuit used for a direct current (DC). DC contactors are particularly employed in electric cars, renewable energy systems, industry, and rail transport equipment that require frequent high current switching. DC-Link components provide high reliability, durability, safety, and efficiency in switching operations for the operation of many DC-powered systems. With rising uses in energy storage systems, smart grids, and transport solutions, the global DC contactor market is set for solid growth.

The DC contactor market is expanding with an increased growth rate due to the increasing demand for electrical solutions across the globe especially in automotive, energy, and manufacturing sectors. One such application that has been a key growth driver is electric vehicles or what is abbreviated as EVs and the signal-switching applications of DC contactors in managing power systems in EVs. Further, the growth of renewable power generation especially solar, and wind technology has increased the demand for DC contactors for efficient storage and distribution of energy. Hypothesised from developing interest in deploying and incorporating clean technologies in energy production, together with the global concern for lowering carbon emissions.

In addition, modern industrial automation and implementation of smart systems in production processes have continued to drive the market.’ Sectors are now using DC contactors mainly for amplifying efficiency, safety, and reduction in energy losses in applications such as heavy-load machinery equipment. Policies and subsidies have been adopted in many countries to support sustainable energy solutions, which are equally put pressure on the DC contactors market indirectly. The market is expected to show consistent growth during the period to come due to enhanced uses of high voltage and compact DC contactors.

DC Contractor Market Trend Analysis:

Integration of Smart DC Contactors

-

Smart DC contactors’ adoption is establishing itself as a progressive development in the market. These advanced contactors are designed with monitoring and diagnosis capabilities for real-time monitoring and programmed maintenance. The application of smart contactors in industries has become common for optimization of the system performance and minimizing failure times. Additionally, these contractors are being adopted in renewable energy systems where timing and accuracy are important in flow of energy. Currently, the population of IoT devices has increased significantly, and the applications of Industry 4.0 concepts initiated the need for smart DC contactors as an excellent opportunity for the market.

Expansion of Renewable Energy Projects

-

Unrestricted expansion of renewable energy project development can be deemed as a major factor for the growth of the DC contactor market. Due to the increasing concern in the use of renewable resources for energy needs around the world solar and wind power plants are being erected. The machines have to include rigid DC contactors to handle the power produced, archived, and decentralized within the system. The increasing interest in microgrids and hybrid energy systems and especially in remote off-grid locations is another factor. Further, governments are offering incentives and subsidies for the renewable energy segment thus developing a conducive environment for the manufacturers to satisfy the demands of this sector.

DC Contractor Market Segment Analysis:

DC Contractor Market is Segmented on the basis of product type, voltage, end user and region.

By Product Type, General Purpose segment is expected to dominate the market during the forecast period

-

The major application area that is likely to majorize the DC contactor market during the forecast period is the general-purpose segment. These contractors are flexible and popular in the automotive manufacturing industry, industrial control systems, and renewable energy systems. These cables can easily operate in both low and high voltage levels which makes end users prefer them. Consequently, as industries keep embracing automation of production and extending their production fronts, general-purpose DC contactors with high reliability and durability will likely enjoy the market’s increasing attention. To complement the increased use of these contactors, manufacturers are now working directly on improving the performance and efficiency of such contactors.

By Voltage, the 1000V segment is expected to held the largest share

-

The 1000V segment was identified to have the largest share of the DC contactor market. This voltage range is used in electric vehicles, energy storage systems, and industrial applications where high power is required. They are primarily used in renewable energy systems and the transportation industry where usage of high voltage electrical systems is seen or EVs has enhanced demand for 1000V DC contactors. These contractors offer blazing output and durability to manage high-voltage power control while maintaining its flow and safety. The further development of innovation in high-voltage contactors should also promote the segment’s development subsequently.

DC Contractor Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

It is forecasted that the North American market will maintain its dominance in the context of the development of DC contactors in the future due to continuous progress in electric vehicle manufacturing, the renewable energy industry, and industrialization. The United States plays a big role in this growth due to its strong automotive industry and rising investments in clean technology. The focus on sustainable development and decarbonization across the region has transformed the industry and brought unique electrical solutions like the DC contactor in several fields. In addition, the large number of market players and easy availability of infrastructure backup favors North America, which is the largest market globally.

- Canada is also a key participant in the market, especially in the fid of renewable power generation. As the governments of various countries put emphasis on green energy and electrification of transport systems, the demand for DC contactors in Canada will increase gradually. North American market size is prospective to generate around 40% of the overall market earnings across the forecast timeframe. It is also predicted that more emphasis is being made towards the implementation of smart grid systems and the bring-in of IoT in energies will enable the global market to grow at a faster pace in the region.

Active Key Players in the DC Contractor Market:

-

ABB Ltd (Switzerland)

- Albright International Ltd (UK)

- Curtis Instruments Inc. (USA)

- Eaton Corporation (USA)

- Gigavac (USA)

- Hubbell Industrial Controls (USA)

- Joslyn Clark Controls (USA)

- Kilovac (USA)

- Mitsubishi Electric Corporation (Japan)

- Panasonic Corporation (Japan)

- Schneider Electric SE (France)

- Sensata Technologies (USA)

- Siemens AG (Germany)

- TE Connectivity (Switzerland)

- Trombetta (USA)

- Other Active Players

|

Global DC Contractor Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 441.2 Million |

|

Forecast Period 2024-32 CAGR: |

9.19 % |

Market Size in 2032: |

USD 973.38 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Voltage |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: DC Contractor Market by Product Type

4.1 DC Contractor Market Snapshot and Growth Engine

4.2 DC Contractor Market Overview

4.3 General

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 General: Geographic Segmentation Analysis

4.4 Definite Purpose DC Contractor

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Definite Purpose DC Contractor: Geographic Segmentation Analysis

Chapter 5: DC Contractor Market by Voltage

5.1 DC Contractor Market Snapshot and Growth Engine

5.2 DC Contractor Market Overview

5.3 800V

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 800V: Geographic Segmentation Analysis

5.4 1000V

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 1000V: Geographic Segmentation Analysis

5.5 1200V

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 1200V: Geographic Segmentation Analysis

Chapter 6: DC Contractor Market by End User

6.1 DC Contractor Market Snapshot and Growth Engine

6.2 DC Contractor Market Overview

6.3 Electric Vehicles PV Solar

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Electric Vehicles PV Solar: Geographic Segmentation Analysis

6.4 Aerospace and Defence

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Aerospace and Defence: Geographic Segmentation Analysis

6.5 Rail Vehicles

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Rail Vehicles: Geographic Segmentation Analysis

6.6 Industrial Machinery

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Industrial Machinery: Geographic Segmentation Analysis

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 DC Contractor Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABB LTD (SWITZERLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALBRIGHT INTERNATIONAL LTD (UK)

7.4 CURTIS INSTRUMENTS INC. (USA)

7.5 EATON CORPORATION (USA)

7.6 GIGAVAC (USA)

7.7 HUBBELL INDUSTRIAL CONTROLS (USA)

7.8 JOSLYN CLARK CONTROLS (USA)

7.9 KILOVAC (USA)

7.10 MITSUBISHI ELECTRIC CORPORATION (JAPAN)

7.11 PANASONIC CORPORATION (JAPAN)

7.12 SCHNEIDER ELECTRIC SE (FRANCE)

7.13 SENSATA TECHNOLOGIES (USA)

7.14 SIEMENS AG (GERMANY)

7.15 TE CONNECTIVITY (SWITZERLAND)

7.16 TROMBETTA (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global DC Contractor Market By Region

8.1 Overview

8.2. North America DC Contractor Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 General

8.2.4.2 Definite Purpose DC Contractor

8.2.5 Historic and Forecasted Market Size By Voltage

8.2.5.1 800V

8.2.5.2 1000V

8.2.5.3 1200V

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Electric Vehicles PV Solar

8.2.6.2 Aerospace and Defence

8.2.6.3 Rail Vehicles

8.2.6.4 Industrial Machinery

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe DC Contractor Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 General

8.3.4.2 Definite Purpose DC Contractor

8.3.5 Historic and Forecasted Market Size By Voltage

8.3.5.1 800V

8.3.5.2 1000V

8.3.5.3 1200V

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Electric Vehicles PV Solar

8.3.6.2 Aerospace and Defence

8.3.6.3 Rail Vehicles

8.3.6.4 Industrial Machinery

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe DC Contractor Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 General

8.4.4.2 Definite Purpose DC Contractor

8.4.5 Historic and Forecasted Market Size By Voltage

8.4.5.1 800V

8.4.5.2 1000V

8.4.5.3 1200V

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Electric Vehicles PV Solar

8.4.6.2 Aerospace and Defence

8.4.6.3 Rail Vehicles

8.4.6.4 Industrial Machinery

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific DC Contractor Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 General

8.5.4.2 Definite Purpose DC Contractor

8.5.5 Historic and Forecasted Market Size By Voltage

8.5.5.1 800V

8.5.5.2 1000V

8.5.5.3 1200V

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Electric Vehicles PV Solar

8.5.6.2 Aerospace and Defence

8.5.6.3 Rail Vehicles

8.5.6.4 Industrial Machinery

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa DC Contractor Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 General

8.6.4.2 Definite Purpose DC Contractor

8.6.5 Historic and Forecasted Market Size By Voltage

8.6.5.1 800V

8.6.5.2 1000V

8.6.5.3 1200V

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Electric Vehicles PV Solar

8.6.6.2 Aerospace and Defence

8.6.6.3 Rail Vehicles

8.6.6.4 Industrial Machinery

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America DC Contractor Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 General

8.7.4.2 Definite Purpose DC Contractor

8.7.5 Historic and Forecasted Market Size By Voltage

8.7.5.1 800V

8.7.5.2 1000V

8.7.5.3 1200V

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Electric Vehicles PV Solar

8.7.6.2 Aerospace and Defence

8.7.6.3 Rail Vehicles

8.7.6.4 Industrial Machinery

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global DC Contractor Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 441.2 Million |

|

Forecast Period 2024-32 CAGR: |

9.19 % |

Market Size in 2032: |

USD 973.38 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Voltage |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||