Data Center Networking Market Synopsis

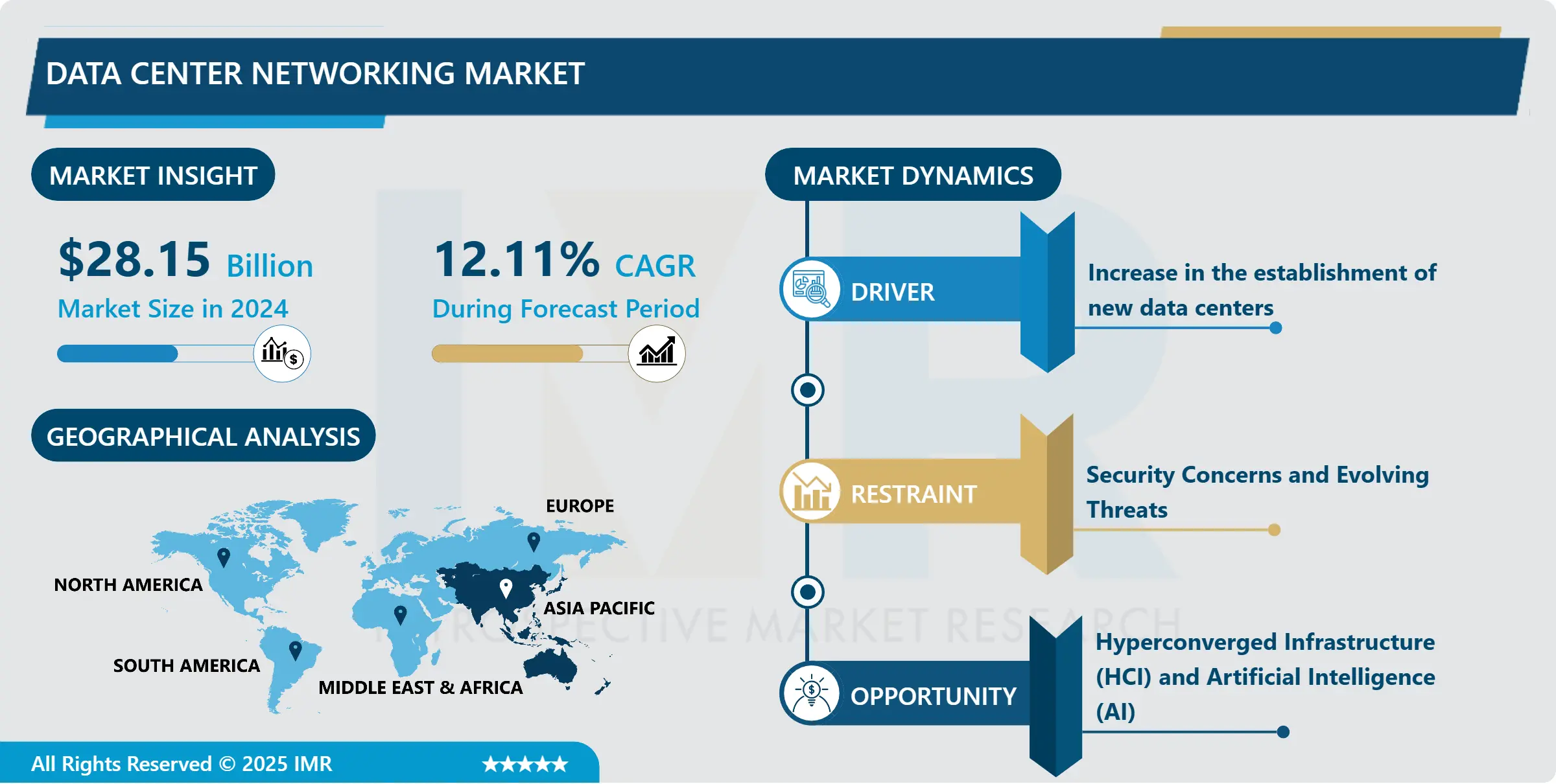

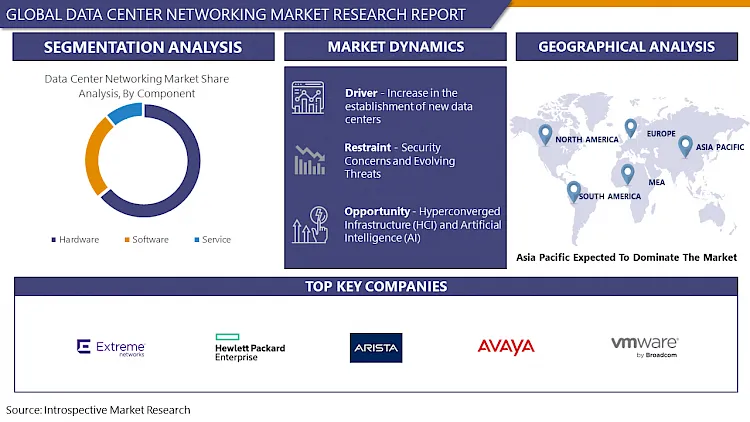

Data Center Networking Market Size Was Valued at USD 28.15 Billion in 2024 and is Projected to Reach USD 70.25 Billion by 2032, Growing at a CAGR of 12.11% From 2025-2032.

Data center networking is the infrastructure and technologies used for communication and data exchange within a data center environment. It includes hardware components like switches, routers, and cables, as well as software solutions like network management systems and security protocols. This infrastructure is crucial for businesses to manage, store, process, and distribute vast amounts of data efficiently.

Data center networking is a vital component of modern digital infrastructure, offering numerous benefits and driving market trends. It facilitates efficient communication and data transfer, optimizing resource utilization, enhancing scalability, and improving performance. With technologies like virtualization and software-defined networking (SDN), it becomes more flexible, allowing for dynamic resource allocation and simplified management. Advanced security measures safeguard data integrity and protect against cyber threats. The demand for data center networking is increasing as organizations embrace cloud computing, big data analytics, IoT, and artificial intelligence. Enterprises require robust, high-speed networking solutions to support data-intensive applications and ensure seamless connectivity across distributed environments.

Data center networking serves various industries, including finance, healthcare, retail, and entertainment, enabling efficient data storage, retrieval, and processing. It supports emerging technologies like edge computing, enabling low-latency data processing and enhancing user experiences in applications like gaming, streaming, and autonomous vehicles. Key market trends include the adoption of SDN and network virtualization, the rise of edge computing, 5G networks, and sustainability, prompting the development of energy-efficient networking technologies and eco-friendly data center designs.

Data Center Networking Market Trend Analysis

Data Center Networking Market Drivers- Increase in the establishment of new data centers

- The surge in establishing new data centers has become a significant catalyst for driving the Data Center Networking Market forward. As digital data creation and consumption skyrocket across various sectors, organizations find themselves compelled to set up new data centers to accommodate the rising need for data storage, processing, and analysis. These fresh data center installations, whether large-scale enterprise facilities or cloud-based platforms, require robust networking solutions to facilitate seamless communication, data transfer, and resource optimization within and between data center environments. In their quest to boost operational efficiency, scalability, and resilience, organizations are making substantial investments in cutting-edge data center networking technologies.

- Technologies encompass high-speed Ethernet switches, routers, software-defined networking (SDN), and network security apparatus, all playing crucial roles in enabling flexible, scalable, and secure data center infrastructures. Moreover, the advent of edge computing, 5G networks, and IoT applications further intensifies the demand for sophisticated data center networking solutions capable of accommodating diverse workloads and distributed architectures. Consequently, the upsurge in establishing new data centers propels innovation and expansion within the Data Center Networking Market, fostering the development of advanced networking technologies and solutions tailored to meet the ever-evolving demands of modern data center environments.

Data Center Networking Market Opportunity- Hyperconverged Infrastructure (HCI) and Artificial Intelligence (AI)

- Hyperconverged Infrastructure (HCI) and Artificial Intelligence (AI) present substantial opportunities within the Data Center Networking Market.HCI consolidates computing, storage, and networking resources into a unified, software

- -defined platform. This streamlined setup simplifies data center management, enhances scalability, and reduces infrastructure complexity. In terms of data center networking, HCI offers avenues to optimize network performance, increase agility, and seamlessly integrate with virtualized environments. Tailored networking solutions for HCI environments can provide improved visibility, automation, and orchestration capabilities, facilitating efficient data transfer and workload mobility across the infrastructure.

- AI is transforming various facets of data center operations, including network management, security, and performance enhancement. AI-powered networking solutions can analyze extensive network data in real-time, recognizing patterns and proactively identifying anomalies or security risks. Through AI algorithms, data center networks can dynamically adjust to evolving traffic patterns, optimize resource utilization, and mitigate network congestion. Moreover, AI-driven predictive analytics enable proactive maintenance and fault detection, enhancing network reliability and uptime. As AI progresses, data center networking can harness innovative AI-driven technologies to enhance operational efficiency, resilience, and intelligence.

Data Center Networking Market Segment Analysis:

Data Center Networking Market Segmented based on Product, Component, and End-User.

By Product, the Ethernet Switches segment is expected to dominate the market during the forecast period

- The Ethernet Switches segment is poised to lead the Data Center Networking Market due to several factors. Ethernet switches serve as the cornerstone of data center networks, enabling efficient and high-speed data packet transmission among network devices. With the continual expansion of data centers in terms of size and complexity, the demand for Ethernet switches rises to accommodate the growing network infrastructure.

- The surge in cloud computing, big data analytics, IoT, and other data-intensive applications underscores the need for high-performance networking solutions capable of managing substantial traffic volumes. Ethernet switches offer scalability, flexibility, and reliability, making them well-suited for addressing the varied workloads and traffic patterns prevalent in modern data centers.

- Ongoing advancements in Ethernet switch technologies, such as increased port densities, faster data transfer rates, and improved features like Quality of Service (QoS) and virtualization support, further bolster their prominence in the market. These innovations empower data center operators to optimize network performance, enhance resource utilization, and ensure seamless connectivity across their infrastructure.

By Component, Hardware segment is expected to dominate the market during the forecast period

- The Hardware segment is poised to maintain its dominance in the Data Center Networking Market for several key reasons. Hardware serves as the fundamental building block of data center networking, encompassing critical components such as switches, routers, servers, and storage devices. These hardware elements are essential for establishing the physical connections and facilitating data transmission within data centers. given the rise of data-heavy applications, cloud computing, and emerging technologies like edge computing and IoT, there is an increasing demand for robust and scalable hardware infrastructure to handle the growing data volumes and processing requirements.

- As organizations expand their digital presence, the necessity for high-performance hardware components in data center networking continues to grow. Continuous advancements in hardware technology, such as faster processors, higher-density storage solutions, and more efficient networking equipment, enable data centers to achieve improved performance, reliability, and scalability. Companies are heavily investing in upgrading their hardware infrastructure to remain competitive and address the evolving demands of modern data center environments.

Data Center Networking Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to lead the Data Center Networking market due to several pivotal reasons. Initially, the region's rapid economic expansion and industrial growth spurred a heightened demand for digital infrastructure and data center services. As businesses across diverse sectors embrace digitalization, there arises an increasing necessity for robust, scalable data center networking solutions to accommodate their evolving IT needs.

- The Asia Pacific region boasts a sizable and swiftly expanding population alongside rising rates of internet penetration and adoption of smartphones. This trend propels the demand for data-heavy applications and services, thus driving the requirement for high-performance data center networking infrastructure to ensure seamless connectivity and dependable access to digital resources.

- Governments in the Asia Pacific region actively invest in digital initiatives and infrastructure development to foster innovation, enhance competitiveness, and bolster socio-economic progress. Initiatives like smart city projects, digital transformation agendas, and investments in broadband connectivity further stimulate the growth of the data center networking market in the region.

Data Center Networking Market Top Key Players:

- Cisco Systems Inc. (U.S.)

- Juniper Networks Inc. (U.S.)

- Arista Networks Inc. (U.S.)

- VMware Inc. (U.S.)

- Hewlett Packard Enterprise (U.S.)

- Dell Inc. (U.S.)

- IBM Corporation (U.S.)

- Intel Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Avaya Inc. (U.S.)

- Extreme Networks (U.S.)

- Equinix Inc. (U.S.)

- Curvature (U.S.)

- Pluribus Networks (U.S.)

- Apstra (U.S.)

- Broadcom (U.S.)

- Rahi Systems (U.S.)

- ALE International (France)

- NEC Corporation (Japan)

- H3C Holding Limited (China)

- Huawei Technologies Co. Ltd. (China), and Other Active Players.

Key Industry Developments in the Data Center Networking Market:

- In June 2023, Cisco Systems Inc., a prominent software company, unveiled a comprehensive observability platform. This innovative solution consolidates data from various domains, including networking and applications, streamlining analysis and insights generation.

- In March 2023, Arista Networks introduced the Arista WAN Routing System. This system integrates three new networking offerings: enterprise-grade routing platforms, carrier/cloud-neutral internet transit capabilities, and the CloudVision Pathfinder Service. By leveraging Arista's EOS routing capabilities and CloudVision management, the Arista WAN Routing System aims to simplify and enhance customer-wide area networks. It offers architecture, features, and platforms designed to modernize federated and software-defined wide-area networks.

|

Global Data Center Networking Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 28.15 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.11 % |

Market Size in 2032: |

USD 70.25 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Component |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Data Center Networking Market by Product (2018-2032)

4.1 Data Center Networking Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Ethernet Switches

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Routers

4.5 Storage Area Network (SAN) Components

4.6 Network Security Equipment

4.7 Application Delivery Controllers (ADCs)

4.8 Wide Area Network (WAN)

Chapter 5: Data Center Networking Market by Component (2018-2032)

5.1 Data Center Networking Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hardware

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Software

5.5 Service

Chapter 6: Data Center Networking Market by End-User (2018-2032)

6.1 Data Center Networking Market Snapshot and Growth Engine

6.2 Market Overview

6.3 IT and Telecom Sector

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Banking

6.5 Financial Services and Insurance (BFSI)

6.6 Healthcare

6.7 Retail

6.8 Government

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Data Center Networking Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CUMMINS INC. (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CATERPILLAR INC. (US)

7.4 GENERAC POWER SYSTEMS INC. (US)

7.5 KOHLER CO. (US)

7.6 BRIGGS & STRATTON CORPORATION (US)

7.7 MARATHON ELECTRIC (US)

7.8 SIEMENS AG (GERMANY)

7.9 DEUTZ AG (GERMANY)

7.10 MTU ONSITE ENERGY (GERMANY)

7.11 AGGREKO PLC (UK)

7.12 ROLLS-ROYCE HOLDINGS PLC (UK)

7.13 FG WILSON (UK)

7.14 JCB POWER PRODUCTS LTD. (UK)

7.15 SCHNEIDER ELECTRIC SE (FRANCE)

7.16 HIMOINSA S.L. (SPAIN)

7.17 ATLAS COPCO AB (SWEDEN)

7.18 KIRLOSKAR OIL ENGINES LIMITED (INDIA)

7.19 YANMAR HOLDINGS COLTD. (JAPAN)

7.20 MITSUBISHI CORPORATION (JAPAN)

7.21 DOOSAN CORPORATION (SOUTH KOREA)

7.22

Chapter 8: Global Data Center Networking Market By Region

8.1 Overview

8.2. North America Data Center Networking Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product

8.2.4.1 Ethernet Switches

8.2.4.2 Routers

8.2.4.3 Storage Area Network (SAN) Components

8.2.4.4 Network Security Equipment

8.2.4.5 Application Delivery Controllers (ADCs)

8.2.4.6 Wide Area Network (WAN)

8.2.5 Historic and Forecasted Market Size by Component

8.2.5.1 Hardware

8.2.5.2 Software

8.2.5.3 Service

8.2.6 Historic and Forecasted Market Size by End-User

8.2.6.1 IT and Telecom Sector

8.2.6.2 Banking

8.2.6.3 Financial Services and Insurance (BFSI)

8.2.6.4 Healthcare

8.2.6.5 Retail

8.2.6.6 Government

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Data Center Networking Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product

8.3.4.1 Ethernet Switches

8.3.4.2 Routers

8.3.4.3 Storage Area Network (SAN) Components

8.3.4.4 Network Security Equipment

8.3.4.5 Application Delivery Controllers (ADCs)

8.3.4.6 Wide Area Network (WAN)

8.3.5 Historic and Forecasted Market Size by Component

8.3.5.1 Hardware

8.3.5.2 Software

8.3.5.3 Service

8.3.6 Historic and Forecasted Market Size by End-User

8.3.6.1 IT and Telecom Sector

8.3.6.2 Banking

8.3.6.3 Financial Services and Insurance (BFSI)

8.3.6.4 Healthcare

8.3.6.5 Retail

8.3.6.6 Government

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Data Center Networking Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product

8.4.4.1 Ethernet Switches

8.4.4.2 Routers

8.4.4.3 Storage Area Network (SAN) Components

8.4.4.4 Network Security Equipment

8.4.4.5 Application Delivery Controllers (ADCs)

8.4.4.6 Wide Area Network (WAN)

8.4.5 Historic and Forecasted Market Size by Component

8.4.5.1 Hardware

8.4.5.2 Software

8.4.5.3 Service

8.4.6 Historic and Forecasted Market Size by End-User

8.4.6.1 IT and Telecom Sector

8.4.6.2 Banking

8.4.6.3 Financial Services and Insurance (BFSI)

8.4.6.4 Healthcare

8.4.6.5 Retail

8.4.6.6 Government

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Data Center Networking Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product

8.5.4.1 Ethernet Switches

8.5.4.2 Routers

8.5.4.3 Storage Area Network (SAN) Components

8.5.4.4 Network Security Equipment

8.5.4.5 Application Delivery Controllers (ADCs)

8.5.4.6 Wide Area Network (WAN)

8.5.5 Historic and Forecasted Market Size by Component

8.5.5.1 Hardware

8.5.5.2 Software

8.5.5.3 Service

8.5.6 Historic and Forecasted Market Size by End-User

8.5.6.1 IT and Telecom Sector

8.5.6.2 Banking

8.5.6.3 Financial Services and Insurance (BFSI)

8.5.6.4 Healthcare

8.5.6.5 Retail

8.5.6.6 Government

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Data Center Networking Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product

8.6.4.1 Ethernet Switches

8.6.4.2 Routers

8.6.4.3 Storage Area Network (SAN) Components

8.6.4.4 Network Security Equipment

8.6.4.5 Application Delivery Controllers (ADCs)

8.6.4.6 Wide Area Network (WAN)

8.6.5 Historic and Forecasted Market Size by Component

8.6.5.1 Hardware

8.6.5.2 Software

8.6.5.3 Service

8.6.6 Historic and Forecasted Market Size by End-User

8.6.6.1 IT and Telecom Sector

8.6.6.2 Banking

8.6.6.3 Financial Services and Insurance (BFSI)

8.6.6.4 Healthcare

8.6.6.5 Retail

8.6.6.6 Government

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Data Center Networking Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product

8.7.4.1 Ethernet Switches

8.7.4.2 Routers

8.7.4.3 Storage Area Network (SAN) Components

8.7.4.4 Network Security Equipment

8.7.4.5 Application Delivery Controllers (ADCs)

8.7.4.6 Wide Area Network (WAN)

8.7.5 Historic and Forecasted Market Size by Component

8.7.5.1 Hardware

8.7.5.2 Software

8.7.5.3 Service

8.7.6 Historic and Forecasted Market Size by End-User

8.7.6.1 IT and Telecom Sector

8.7.6.2 Banking

8.7.6.3 Financial Services and Insurance (BFSI)

8.7.6.4 Healthcare

8.7.6.5 Retail

8.7.6.6 Government

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Data Center Networking Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 28.15 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.11 % |

Market Size in 2032: |

USD 70.25 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Component |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||