Condiments Market Synopsis:

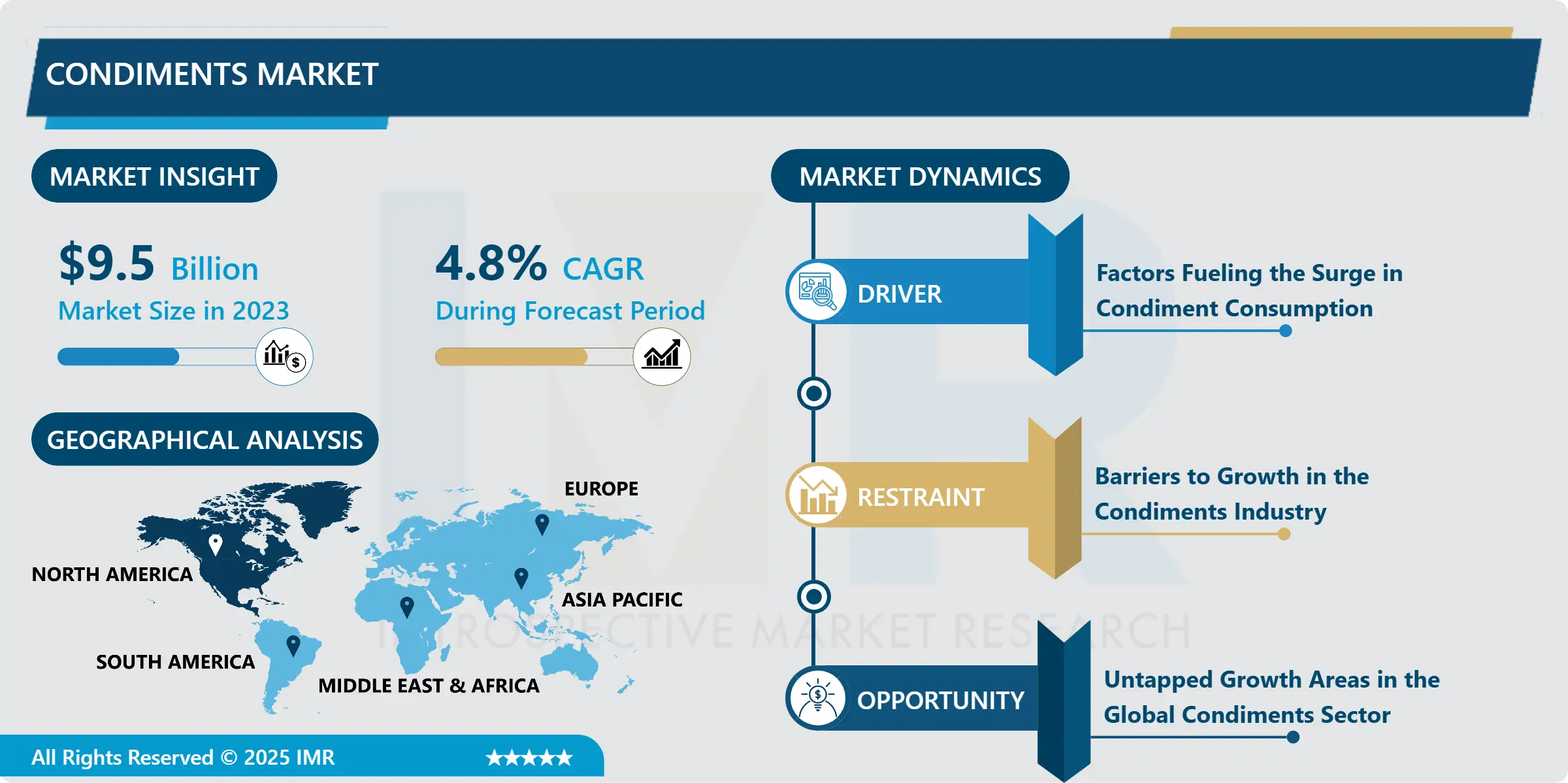

Condiments Market Size Was Valued at USD 9.50 Billion in 2023, and is Projected to Reach USD 14.48 Billion by 2032, Growing at a CAGR of 4.80% From 2024-2032.

Condiments are those products that are used in food preparation enhancing on the texture and taste of the food. These are; marinades, salad dressing, dips, rubs, condiments, sauces, seasonings, mustard, ketchup, and chutneys. Seasonings, sauces, and dressings are a part of the everyday products range for both the store and restaurant industries, playing a role in cultural profiles and the trends toward more palatable and prepared food and condiments. The market is defined by consumers’ desire to change the flavors; increased focus on the effective and healthy formulation of foods available on the market and increased innovation in regard to the packaging and distribution system.

Convenience and speeding up the, the increase in demand for convenience and fast foods are the main factors influencing the condiments market. Since the population of the world is urbanizing, rising demand for faster way of living along with the inclination towards junk food boosts the demand for the condiments. Such products are employed in the assumption that it is easy to prepare meals with them in the growing context of fast-food meals and takeaway.

There are also many factors that contributes for the growth of condiments market, such as there is a raising trend of globalization and the attraction towards the ethnically differentiated food products and their flavors. People are willing and able to buy different types of food products which means higher demand on sauces, spices and seasonings. The people’s affection for global tastes is even higher in areas like North America and Europe and thus contributes to the market growth.

Condiments Market Trend Analysis:

Becoming more health-conscious

-

Increasing use of more natural and healthier substances in condiments and related products is firmly on the rise. Consumers are now more conscious with their diet hence there is an increased spending on organic refrigerated, low sugar, low sodium, no gluten condiment. There is ever-increasing consumer demand for clean-label products that contain low levels of preservatives, artificial additives, and chemicals, respectively. This trend is manifested in such increased product differentiation in the market as the number of organic and health-focused condiment types.

- Sustainability is another value, which is in high demand in the condiments industry. Concerns on the effects of packaging on the environment have grown amongst consumers and this has made manufactures to seek the use of improved packages such as returnable glass jars and biodegradable pouches. Brands are also began to consume green inputs like organic or localized spices that are preferred by more and more clients.

Expanding e-commerce segment

-

The direction of e-commerce sales also remains a great opportunity for sales of condiments. Internet shopping platforms are quickly expanding leading to clients being able to find many different types of condiments that may not be sold locally. This is especially made possible by new direct B2C business models where brands can easily satisfy the end consumers desire for unique or specific products.

- The second chance is in private-label and regional condiments that have shown that they can expand steadily over time. In supermarkets and hypermarkets, there is a trend where retailers creating own brand condiments to suit the regional market. This makes consumers have an opportunity to get products that suit their local culinary tastes and on the other hand, it makes the retailers be in a position to differentiate themselves in the harsh market.

Condiments Market Segment Analysis:

Condiments Market is Segmented on the basis of Product type, Packaging Type, End User, and Region.

By Product Type, Sauces segment is expected to dominate the market during the forecast period

-

The condiments market is classified based on different products such as sauces, dressings, dips, spices & seasonings, mustard, kettle and relishes & chutneys. Current Sauces barbecue sauces, tomato sauce along with other types of sauces have the highest share of the pie because they are very much used in most kinds of foods. Salad and sandwich dressings such as, ranch, vinaigrette & mayonnaise is widely used ingredients in the market. Most dips such as hummus, salsa, and even guacamole is well known as appetizers or snacks. Condiments and flavors enhance the taste of foods: chili powders and herb mixes, used as seasonings in preparation. At the same time, mustard and ketchup still occupy their place on the ketchup shelves, especially for fast food products, while a variety of marinades and chutneys provide regional taste solutions for consumers.

By Packaging Type, Glass Bottles segment expected to held the largest share

-

Closable glass bottles are also used for packing extra quality product such as olive oil and exquisite sauces to provide quality look and enhanced preservation. Ketchup, mustard and the other sauces are packed in plastic bottles because of their cheap and easily applicable nature. They are increasingly being used for controlled single doses particularly in convenience stores and quick service restaurants. Bottles are more popular for products such as dressings, relishes and chutneys since they afford a strongly built reusable container type. Used for a particular product such as tamarind or high-volume sauces to be put in.

Condiments Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America remains the market leader in its segment due to the key influence of the United States. The country has a good market potential for virtually all types of condiments, including ketchup and mustard, barbeque sauce, and hot spices. The trend towards fast foods and convenient products as well as the generally developing palette preferences have also positively impacted the regional demand for condiments. Hence, the trend of Ethnic cuisine consumption and E-Commerce sales also substantiate North America’s leading place.

- The demand for condiments in the United States, especially meat sauce, is inspired by a strong and growing foodservice industry. Significant demand is found in major and numerous fast-food chains and quick service restaurants which often incorporate major volumes of condiments including ketchup, sauces, and dressings. The changes in trend towards healthy and environmentally friendly condiments also drives the growth in North America.

Active Key Players in the Condiments Market

- Conagra Brands (USA)

- Del Monte Foods, Inc. (USA)

- General Mills, Inc. (USA)

- H.J. Heinz Company (USA)

- Kraft Heinz Company (USA)

- McCormick & Company (USA)

- Nestlé S.A. (Switzerland)

- SC Johnson Professional (USA)

- The Kikkoman Corporation (Japan)

- Unilever PLC (UK)

- Other Active Players.

|

Global Condiments Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.50 Billion |

|

Forecast Period 2024-32 CAGR: |

4.80% |

Market Size in 2032: |

USD 14.48 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Packaging Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Condiments Market by Product Type

4.1 Condiments Market Snapshot and Growth Engine

4.2 Condiments Market Overview

4.3 Sauces

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Sauces: Geographic Segmentation Analysis

4.4 Dressings

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Dressings: Geographic Segmentation Analysis

4.5 Dips

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Dips: Geographic Segmentation Analysis

4.6 Spices & Seasonings

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Spices & Seasonings: Geographic Segmentation Analysis

4.7 Mustard & Ketchup

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Mustard & Ketchup: Geographic Segmentation Analysis

4.8 Relish & Chutneys

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Relish & Chutneys: Geographic Segmentation Analysis

Chapter 5: Condiments Market by Packaging Type

5.1 Condiments Market Snapshot and Growth Engine

5.2 Condiments Market Overview

5.3 Glass Bottles

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Glass Bottles: Geographic Segmentation Analysis

5.4 Plastic Bottles

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Plastic Bottles: Geographic Segmentation Analysis

5.5 Pouches

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Pouches: Geographic Segmentation Analysis

5.6 Jars

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Jars: Geographic Segmentation Analysis

5.7 Cans

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Cans: Geographic Segmentation Analysis

Chapter 6: Condiments Market by End User

6.1 Condiments Market Snapshot and Growth Engine

6.2 Condiments Market Overview

6.3 Residential

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Residential: Geographic Segmentation Analysis

6.4 Commercial (Restaurants

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Commercial (Restaurants: Geographic Segmentation Analysis

6.5 Hotels

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Hotels: Geographic Segmentation Analysis

6.6 Foodservice

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Foodservice: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Condiments Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MCCORMICK & COMPANY (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 NESTLÉ S.A. (SWITZERLAND)

7.4 KRAFT HEINZ COMPANY (USA)

7.5 UNILEVER PLC (UK)

7.6 CONAGRA BRANDS (USA)

7.7 THE KIKKOMAN CORPORATION (JAPAN)

7.8 GENERAL MILLS INC. (USA)

7.9 DEL MONTE FOODS INC. (USA)

7.10 SC JOHNSON PROFESSIONAL (USA)

7.11 H.J. HEINZ COMPANY (USA)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Condiments Market By Region

8.1 Overview

8.2. North America Condiments Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Sauces

8.2.4.2 Dressings

8.2.4.3 Dips

8.2.4.4 Spices & Seasonings

8.2.4.5 Mustard & Ketchup

8.2.4.6 Relish & Chutneys

8.2.5 Historic and Forecasted Market Size By Packaging Type

8.2.5.1 Glass Bottles

8.2.5.2 Plastic Bottles

8.2.5.3 Pouches

8.2.5.4 Jars

8.2.5.5 Cans

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Residential

8.2.6.2 Commercial (Restaurants

8.2.6.3 Hotels

8.2.6.4 Foodservice

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Condiments Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Sauces

8.3.4.2 Dressings

8.3.4.3 Dips

8.3.4.4 Spices & Seasonings

8.3.4.5 Mustard & Ketchup

8.3.4.6 Relish & Chutneys

8.3.5 Historic and Forecasted Market Size By Packaging Type

8.3.5.1 Glass Bottles

8.3.5.2 Plastic Bottles

8.3.5.3 Pouches

8.3.5.4 Jars

8.3.5.5 Cans

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Residential

8.3.6.2 Commercial (Restaurants

8.3.6.3 Hotels

8.3.6.4 Foodservice

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Condiments Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Sauces

8.4.4.2 Dressings

8.4.4.3 Dips

8.4.4.4 Spices & Seasonings

8.4.4.5 Mustard & Ketchup

8.4.4.6 Relish & Chutneys

8.4.5 Historic and Forecasted Market Size By Packaging Type

8.4.5.1 Glass Bottles

8.4.5.2 Plastic Bottles

8.4.5.3 Pouches

8.4.5.4 Jars

8.4.5.5 Cans

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Residential

8.4.6.2 Commercial (Restaurants

8.4.6.3 Hotels

8.4.6.4 Foodservice

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Condiments Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Sauces

8.5.4.2 Dressings

8.5.4.3 Dips

8.5.4.4 Spices & Seasonings

8.5.4.5 Mustard & Ketchup

8.5.4.6 Relish & Chutneys

8.5.5 Historic and Forecasted Market Size By Packaging Type

8.5.5.1 Glass Bottles

8.5.5.2 Plastic Bottles

8.5.5.3 Pouches

8.5.5.4 Jars

8.5.5.5 Cans

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Residential

8.5.6.2 Commercial (Restaurants

8.5.6.3 Hotels

8.5.6.4 Foodservice

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Condiments Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Sauces

8.6.4.2 Dressings

8.6.4.3 Dips

8.6.4.4 Spices & Seasonings

8.6.4.5 Mustard & Ketchup

8.6.4.6 Relish & Chutneys

8.6.5 Historic and Forecasted Market Size By Packaging Type

8.6.5.1 Glass Bottles

8.6.5.2 Plastic Bottles

8.6.5.3 Pouches

8.6.5.4 Jars

8.6.5.5 Cans

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Residential

8.6.6.2 Commercial (Restaurants

8.6.6.3 Hotels

8.6.6.4 Foodservice

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Condiments Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Sauces

8.7.4.2 Dressings

8.7.4.3 Dips

8.7.4.4 Spices & Seasonings

8.7.4.5 Mustard & Ketchup

8.7.4.6 Relish & Chutneys

8.7.5 Historic and Forecasted Market Size By Packaging Type

8.7.5.1 Glass Bottles

8.7.5.2 Plastic Bottles

8.7.5.3 Pouches

8.7.5.4 Jars

8.7.5.5 Cans

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Residential

8.7.6.2 Commercial (Restaurants

8.7.6.3 Hotels

8.7.6.4 Foodservice

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Condiments Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.50 Billion |

|

Forecast Period 2024-32 CAGR: |

4.80% |

Market Size in 2032: |

USD 14.48 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Packaging Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||