Commodity Trading Transaction and Risk Management (CTRM) Software Market Synopsis

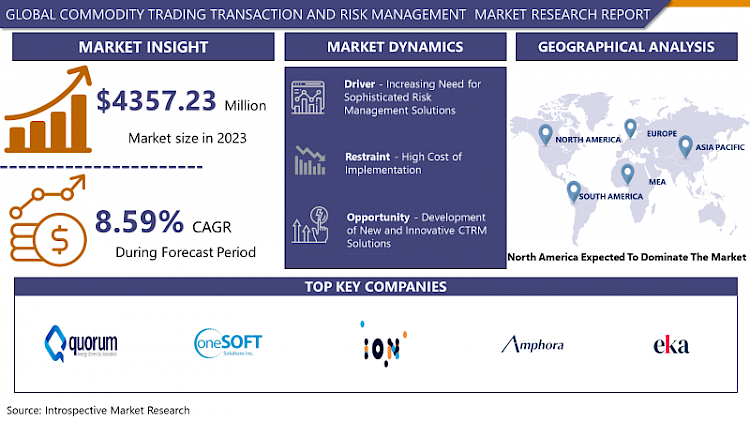

Commodity Trading Transaction and Risk Management Market Size Was Valued at USD 4357.23 Million in 2023 and is Projected to Reach USD 4731.52 Million by 2032, Growing at a CAGR of 8.59% From 2024-2032.

CTRM software simplifies and automates commodity trading processes, covering various commodities like oil, gas, metals, and agricultural products. It enables live tracking, evaluation, and control of trading operations, concurrently managing risks linked with price shifts, supply chain interruptions, and regulatory adherence.

Commodity Trading Transaction and Risk Management (CTRM) software is utilized across various sectors involved in commodity trading, encompassing energy, agriculture, metals, and soft commodities. It aids in streamlining trading processes by providing tools for procurement, logistics, pricing, and risk assessment. Traders, producers, processors, and consumers utilize CTRM software to improve decision-making, streamline operations, and address risks related to price fluctuations, supply chain disruptions, and regulatory compliance.

- It furnishes real-time market insights, empowering traders to make informed decisions and devise effective trading strategies. Additionally, CTRM software automates manual tasks, enhancing operational efficiency and reducing the potential for errors. Moreover, through the integration of risk management functionalities, CTRM software enables proactive identification and mitigation of risks, safeguarding financial interests and boosting overall profitability.

- With commodity markets becoming more intricate and volatile, there is an increasing requirement for adaptable software solutions. Furthermore, as trade globalization and technological advancements continue, organizations seek advanced CTRM software equipped with predictive analytics and artificial intelligence capabilities to optimize trading operations and gain a competitive edge. This trajectory is anticipated to fuel ongoing innovation and progression in the CTRM market, meeting the evolving demands of commodity trading entities globally.

Commodity Trading Transaction and Risk Management (CTRM) Software Market Trend Analysis

Increasing Need for Sophisticated Risk Management Solutions

- The increasing need for advanced risk management solutions acts as a crucial catalyst for the expansion of the Commodity Trading Transaction and Risk Management (CTRM) software market. As commodity markets grow more intricate and volatile, there's a rising demand for robust tools to manage risks linked with price fluctuations, supply chain interruptions, and regulatory adherence. Organizations involved in commodity trading acknowledge the necessity for comprehensive risk management solutions to protect their investments and boost profitability amid evolving market dynamics.

- CTRM software meets this demand by offering tailored risk management functionalities suited to the specific requirements of commodity trading. These solutions enable real-time monitoring and analysis of market trends, empowering traders to proactively identify and address risks. With comprehensive risk assessment tools and scenario analysis capabilities, CTRM software assists organizations in making well-informed decisions and implementing effective risk mitigation strategies.

- Furthermore, with the globalization of trade and the increasing integration of technology in commodity trading, there's an anticipated surge in demand for advanced risk management solutions. Organizations seek CTRM software equipped with predictive analytics, artificial intelligence, and machine learning capabilities to anticipate market trends and optimize risk management processes. The CTRM software market is poised for significant growth as commodity trading entities prioritize the adoption of cutting-edge solutions to navigate the complexities of modern commodity markets and achieve sustainable growth and profitability.

Development of New and Innovative CTRM Solutions

- The development of fresh and inventive CTRM solutions presents a significant opportunity for expanding the Commodity Trading Transaction and Risk Management (CTRM) software market. As commodity markets evolve and grow more intricate, there's an increasing demand for advanced tools capable of effectively addressing the diverse needs and challenges of commodity trading. The emergence of novel CTRM solutions holds the potential to transform how organizations oversee their trading operations, empowering them to keep abreast of market trends and handle risks more efficiently.

- These pioneering CTRM solutions utilize state-of-the-art technologies like artificial intelligence, machine learning, and predictive analytics to offer enhanced functionalities for risk management, trading analytics, and decision support. By harnessing data analytics and automation, these solutions enable traders to delve deeper into market dynamics, spot emerging opportunities, and refine trading strategies in real-time. Furthermore, the development of adaptable and scalable CTRM platforms permits organizations to tailor their software solutions to meet specific business requirements and adapt to changing market conditions.

- Moreover, the increasing integration of CTRM software with other enterprise systems and trading platforms fosters seamless interoperability and improved efficiency across trading operations. This integration facilitates smooth data flow, streamlines workflow processes, and enhances collaboration among different departments within an organization. The introduction of new and innovative CTRM solutions not only propels market expansion but also heightens the overall competitiveness and flexibility of commodity trading firms within a dynamic and competitive market landscape.

Commodity Trading Transaction and Risk Management (CTRM) Software Market Segment Analysis:

Commodity Trading Transaction and Risk Management (CTRM) Software Market Segmented on the basis of Deployment Model, Enterprise Size, and End-User.

By Enterprise Size, Large Enterprises segment is expected to dominate the market during the forecast period

- Large enterprises are positioned to lead the growth of the Commodity Trading Transaction and Risk Management (CTRM) software market. Their ample resources, extensive trading volumes, and intricate risk management demands drive them to increasingly adopt CTRM software to streamline trading operations and mitigate risks efficiently. These enterprises operate across various sectors such as energy, agriculture, metals, and soft commodities, engaging in extensive trading activities that necessitate advanced risk management solutions.

- Furthermore, large enterprises possess the financial capability and organizational structure to invest in comprehensive CTRM software solutions tailored to their specific needs. These solutions offer advanced features for real-time monitoring, analysis, and decision support, empowering large enterprises to gain competitive advantages in the dynamic commodity trading landscape. Large enterprises are expected to sustain the demand for CTRM software, significantly contributing to the market's growth and expansion in the foreseeable future.

By Deployment Model, Cloud-based segment held the largest share of 55.21% in 2022

- The cloud-based sector has emerged as the primary driver propelling the expansion of the Commodity Trading Transaction and Risk Management (CTRM) software market. Commanding the largest portion, cloud-based solutions offer various benefits compared to traditional on-premises software, such as scalability, flexibility, and accessibility. This sector caters to the evolving demands of commodity trading firms by furnishing them with a cost-effective and effective means of managing trading operations and mitigating risks in real-time.

- Cloud-based CTRM software enables organizations to access their trading platforms from any location with an internet connection, facilitating seamless collaboration and decision-making among dispersed teams. Furthermore, the scalability of cloud-based solutions permits firms to effortlessly scale up their operations and adjust to shifting market conditions without necessitating substantial infrastructure investments. With the rising adoption of cloud technology across sectors, the cloud-based segment is anticipated to sustain its dominance in the CTRM software market, propelling ongoing growth and advancements in commodity trading methodologies.

Commodity Trading Transaction and Risk Management (CTRM) Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is expected to take the lead in the regional expansion of the Commodity Trading Transaction and Risk Management (CTRM) software market. With its well-developed economies, robust technological infrastructure, and widespread presence of commodity trading firms, North America offers an ideal environment for the adoption and advancement of CTRM solutions. The region's diverse commodity markets, encompassing energy, agriculture, metals, and soft commodities, fuel the demand for sophisticated software tools to manage trading operations and mitigate risks effectively.

- Furthermore, North America features a thriving ecosystem of CTRM software vendors and service providers, delivering a broad array of solutions tailored to meet the specific requirements of commodity trading firms. These solutions capitalize on cutting-edge technologies like artificial intelligence, machine learning, and predictive analytics to offer enhanced functionalities for risk management, trading analytics, and decision support. North America is positioned to maintain its dominance in the CTRM software market, propelling ongoing innovation and growth in commodity trading methodologies throughout the region.

Commodity Trading Transaction and Risk Management (CTRM) Software Market Top Key Players:

- ION Group (U.S.)

- FIS (U.S.)

- Amphora Inc. (U.S.)

- Triple Point Technology, Inc. (U.S.)

- Allegro Development Corporation (U.S.)

- Eka Software Solutions (U.S.)

- OATI, Inc. (U.S.)

- OneSoft Solutions Inc (U.S.)

- Quorum Business Solutions, Inc (U.S.)

- Enuit LLC (U.S.)

- SAP SE (Germany)

- Brady PLC (UK)

- Aspect Enterprise Solution (UK)

- Generation10 (UK)

- Chinsay AB (Sweden), and Other Major Players

Key Industry Developments in the Market:

- In January 2023, Amphora Financial Group (Amphora) announced its majority acquisition of Heward Investment Management (Heward), a Montreal-based portfolio management firm. As part of the deal, native Montrealers Charles Gagnon and Louis Galardo from Amphora will join the Heward board. Despite the acquisition, Heward's management and investment strategies remain intact, with the team retaining significant equity participation. The partnership aims to enhance client-focused portfolio management services while maintaining independence and a disciplined investment approach.

- In April 2024, STG, a US-based equity firm, announced its acquisition of Eka Software Solutions, merging it with Quor Group to offer a comprehensive software suite. Eka specializes in commodities trade and risk management (CTRM) and supply chain solutions, focusing on soft agricultural and energy markets. Meanwhile, Quor specializes in CTRM offerings within the metals sector. This merger aims to provide various solutions to address global customer needs amid market volatility and supply chain disruptions.

|

Global Commodity Trading Transaction and Risk Management (CTRM) Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 4357.23 Mn. |

|

Forecast Period 2023-30 CAGR: |

8.59% |

Market Size in 2032 : |

USD 4731.56 Mn. |

|

Segments Covered: |

By Deployment Model |

|

|

|

By Enterprise Size |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET BY DEPLOYMENT MODEL (2017-2030)

- COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ON-PREMISE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CLOUD-BASED

- HYBRID

- COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET BY ENTERPRISE SIZE (2017-2030)

- COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LARGE ENTERPRISES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SMALL AND MEDIUM ENTERPRISES (SMES))

- COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET BY END-USER (2017-2030)

- COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- OIL & GAS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ENERGY & UTILITIES

- RETAIL

- MANUFACTURING

- BANKING & FINANCIAL SERVICES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Commodity Trading Transaction and Risk Management (CTRM) Software Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ION GROUP (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- FIS (U.S.)

- AMPHORA INC. (U.S.)

- TRIPLE POINT TECHNOLOGY, INC. (U.S.)

- ALLEGRO DEVELOPMENT CORPORATION (U.S.)

- EKA SOFTWARE SOLUTIONS (U.S.)

- OATI, INC. (U.S.)

- ONESOFT SOLUTIONS INC (U.S.)

- QUORUM BUSINESS SOLUTIONS, INC (U.S.)

- ENUIT LLC (U.S.)

- SAP SE (GERMANY)

- BRADY PLC (UK)

- ASPECT ENTERPRISE SOLUTION (UK)

- GENERATION10 (UK)

- CHINSAY AB (SWEDEN)

- COMPETITIVE LANDSCAPE

- GLOBAL COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Deployment Model

- Historic And Forecasted Market Size By Enterprise Size

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Commodity Trading Transaction and Risk Management (CTRM) Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 4357.23 Mn. |

|

Forecast Period 2023-30 CAGR: |

8.59% |

Market Size in 2032 : |

USD 4731.56 Mn. |

|

Segments Covered: |

By Deployment Model |

|

|

|

By Enterprise Size |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET COMPETITIVE RIVALRY

TABLE 005. COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET THREAT OF NEW ENTRANTS

TABLE 006. COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET THREAT OF SUBSTITUTES

TABLE 007. COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET BY TYPE

TABLE 008. CLOUD BASED MARKET OVERVIEW (2016-2028)

TABLE 009. WEB BASED MARKET OVERVIEW (2016-2028)

TABLE 010. COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET BY APPLICATION

TABLE 011. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

TABLE 012. SMES MARKET OVERVIEW (2016-2028)

TABLE 013. NORTH AMERICA COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 014. NORTH AMERICA COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 015. N COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 016. EUROPE COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 017. EUROPE COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 018. COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 019. ASIA PACIFIC COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 020. ASIA PACIFIC COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 021. COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 022. MIDDLE EAST & AFRICA COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 024. COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 025. SOUTH AMERICA COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 026. SOUTH AMERICA COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 027. COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 028. AGEXCEED: SNAPSHOT

TABLE 029. AGEXCEED: BUSINESS PERFORMANCE

TABLE 030. AGEXCEED: PRODUCT PORTFOLIO

TABLE 031. AGEXCEED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 031. AGIBLOCKS CTRM: SNAPSHOT

TABLE 032. AGIBLOCKS CTRM: BUSINESS PERFORMANCE

TABLE 033. AGIBLOCKS CTRM: PRODUCT PORTFOLIO

TABLE 034. AGIBLOCKS CTRM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. AGROSOFT: SNAPSHOT

TABLE 035. AGROSOFT: BUSINESS PERFORMANCE

TABLE 036. AGROSOFT: PRODUCT PORTFOLIO

TABLE 037. AGROSOFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. ASPECTCTRM: SNAPSHOT

TABLE 038. ASPECTCTRM: BUSINESS PERFORMANCE

TABLE 039. ASPECTCTRM: PRODUCT PORTFOLIO

TABLE 040. ASPECTCTRM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. BALSAMO: SNAPSHOT

TABLE 041. BALSAMO: BUSINESS PERFORMANCE

TABLE 042. BALSAMO: PRODUCT PORTFOLIO

TABLE 043. BALSAMO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. BEACON.IO: SNAPSHOT

TABLE 044. BEACON.IO: BUSINESS PERFORMANCE

TABLE 045. BEACON.IO: PRODUCT PORTFOLIO

TABLE 046. BEACON.IO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. BLACKLIGHT: SNAPSHOT

TABLE 047. BLACKLIGHT: BUSINESS PERFORMANCE

TABLE 048. BLACKLIGHT: PRODUCT PORTFOLIO

TABLE 049. BLACKLIGHT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. BRADY CTRM: SNAPSHOT

TABLE 050. BRADY CTRM: BUSINESS PERFORMANCE

TABLE 051. BRADY CTRM: PRODUCT PORTFOLIO

TABLE 052. BRADY CTRM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. CC1: SNAPSHOT

TABLE 053. CC1: BUSINESS PERFORMANCE

TABLE 054. CC1: PRODUCT PORTFOLIO

TABLE 055. CC1: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. CINCH: SNAPSHOT

TABLE 056. CINCH: BUSINESS PERFORMANCE

TABLE 057. CINCH: PRODUCT PORTFOLIO

TABLE 058. CINCH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. CITRUSPRO: SNAPSHOT

TABLE 059. CITRUSPRO: BUSINESS PERFORMANCE

TABLE 060. CITRUSPRO: PRODUCT PORTFOLIO

TABLE 061. CITRUSPRO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. COMCORE: SNAPSHOT

TABLE 062. COMCORE: BUSINESS PERFORMANCE

TABLE 063. COMCORE: PRODUCT PORTFOLIO

TABLE 064. COMCORE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. COMOTOR: SNAPSHOT

TABLE 065. COMOTOR: BUSINESS PERFORMANCE

TABLE 066. COMOTOR: PRODUCT PORTFOLIO

TABLE 067. COMOTOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. CORETRM: SNAPSHOT

TABLE 068. CORETRM: BUSINESS PERFORMANCE

TABLE 069. CORETRM: PRODUCT PORTFOLIO

TABLE 070. CORETRM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. CTRM4JDE: SNAPSHOT

TABLE 071. CTRM4JDE: BUSINESS PERFORMANCE

TABLE 072. CTRM4JDE: PRODUCT PORTFOLIO

TABLE 073. CTRM4JDE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. DATAGENIC: SNAPSHOT

TABLE 074. DATAGENIC: BUSINESS PERFORMANCE

TABLE 075. DATAGENIC: PRODUCT PORTFOLIO

TABLE 076. DATAGENIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. MUREX: SNAPSHOT

TABLE 077. MUREX: BUSINESS PERFORMANCE

TABLE 078. MUREX: PRODUCT PORTFOLIO

TABLE 079. MUREX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. OPENLINK: SNAPSHOT

TABLE 080. OPENLINK: BUSINESS PERFORMANCE

TABLE 081. OPENLINK: PRODUCT PORTFOLIO

TABLE 082. OPENLINK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. TRIPLE POINT TECHNOLOGY: SNAPSHOT

TABLE 083. TRIPLE POINT TECHNOLOGY: BUSINESS PERFORMANCE

TABLE 084. TRIPLE POINT TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 085. TRIPLE POINT TECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET OVERVIEW BY TYPE

FIGURE 012. CLOUD BASED MARKET OVERVIEW (2016-2028)

FIGURE 013. WEB BASED MARKET OVERVIEW (2016-2028)

FIGURE 014. COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET OVERVIEW BY APPLICATION

FIGURE 015. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

FIGURE 016. SMES MARKET OVERVIEW (2016-2028)

FIGURE 017. NORTH AMERICA COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 018. EUROPE COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. ASIA PACIFIC COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. MIDDLE EAST & AFRICA COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. SOUTH AMERICA COMMODITY TRADING TRANSACTION AND RISK MANAGEMENT (CTRM) SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Commodity Trading Transaction and Risk Management (CTRM) Software Market research report is 2024-2032.

ION Group (U.S.), FIS (U.S.), Amphora Inc. (U.S.), Triple Point Technology, Inc. (U.S.), Allegro Development Corporation (U.S.), Eka Software Solutions (U.S.), OATI, Inc. (U.S.), OneSoft Solutions Inc (U.S.), Quorum Business Solutions, Inc (U.S.), Enuit LLC (U.S.), SAP SE (Germany), Brady PLC (UK), Aspect Enterprise Solution (UK), Generation10 (UK), Chinsay AB (Sweden), and Other Major Players.

The Commodity Trading Transaction and Risk Management (CTRM) Software Market is segmented into Deployment Model, Enterprise Size, End-User, and Region. By Deployment Model, the market is categorized into On-Premise, Cloud-based, and Hybrid. By Enterprise Size, the market is categorized into Large Enterprises and Small and Medium Enterprises (SMEs). By End-User, the market is categorized into Oil & Gas, Energy & Utilities, Retail, Manufacturing, and Banking & Financial Services. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

CTRM software simplifies and automates commodity trading processes, covering various commodities like oil, gas, metals, and agricultural products. It enables live tracking, evaluation, and control of trading operations, concurrently managing risks linked with price shifts, supply chain interruptions, and regulatory adherence.

Commodity Trading Transaction and Risk Management Market Size Was Valued at USD 4357.23 Million in 2023 and is Projected to Reach USD 4731.52 Million by 2032, Growing at a CAGR of 8.59% From 2024-2032.