Coffee Whitener Market Synopsis

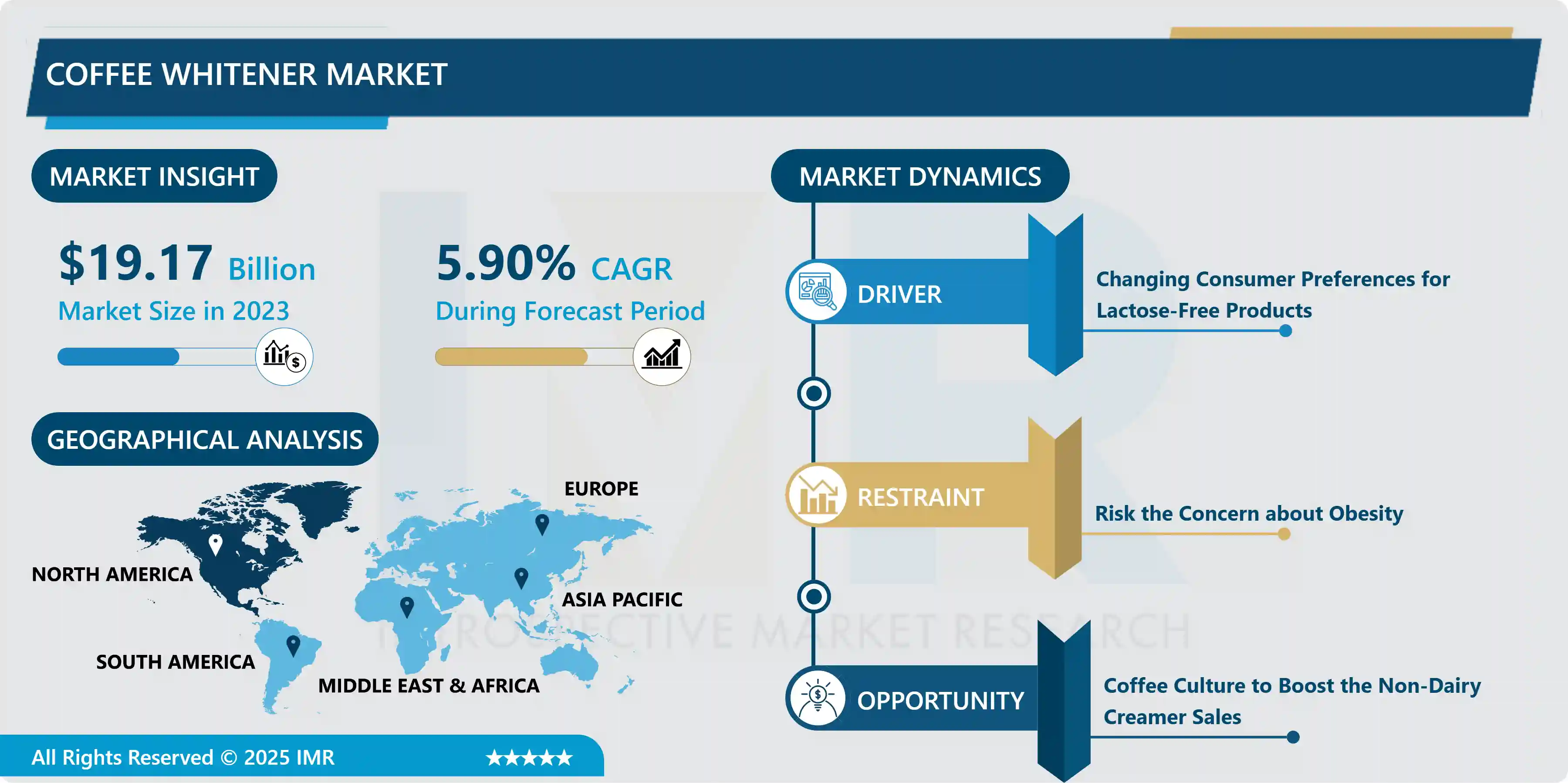

Coffee Whitener Market size is expected to grow from USD 19.17 Billion in 2023 to USD 32.11 Billion by 2032, at a CAGR of 5.9% during the forecast period (2024-2032).

The global coffee whitener market is experiencing steady growth, driven by the rising popularity of coffee worldwide and the increasing preference for convenient, easy-to-use products. North America stands out as the dominant region, thanks to its high coffee consumption and a strong demand for both dairy and non-dairy creamers. The market here is marked by continuous innovation, with companies frequently introducing new flavors and formulations to meet consumer tastes.

The competitive landscape of the global coffee whitener market is shaped by the presence of major international players and numerous local brands, all vying for market share through diverse product offerings and strategic marketing. Companies are investing in research and development to create innovative products that cater to health-conscious consumers and those with dietary restrictions, such as lactose intolerance or vegan preferences. The rise of e-commerce has made it easier for consumers to access a wide range of coffee whitener products, further driving market growth.

Coffee whitener is often used by people who are lactose intolerant, vegan, or who simply prefer a non-dairy alternative to milk or cream. It can come in a variety of flavors such as vanilla, hazelnut, and caramel, and is usually sold in a powder form that can be stored easily.

Coffee whiteners usually contain more corn syrup solids, partially hydrogenated vegetable oil, and fake flavoring, like Irish creme or French vanilla, than actual milk or cream. Coffee whiteners are liquid or granular products intended to substitute for milk or cream as an additive to coffee, tea, hot chocolate, or other beverages.

The coffee whiteners can be well substituted in the place of milk and can be easily added to coffee, tea, cereals, yogurt, cocoa, and ready-to-drink beverages. It just not yields good flavor to consumers but also comes in convenient packaging and longer shelf life.

The Coffee Whitener Market Trend Analysis

Changing Consumer Preferences for Lactose-Free Products

- Many people are lactose intolerant, which means they have difficulty digesting lactose, a sugar found in milk and dairy products. This condition can cause digestive problems such as bloating, gas, and diarrhea. As a result, people with lactose intolerance often avoid dairy-based coffee creamers and look for lactose-free alternatives.

- Some people choose lactose-free coffee creamers for health reasons. For example, they may be trying to reduce their intake of saturated fat and calories, which are often found in dairy-based creamers. A growing number of consumers are following vegan or plant-based diets, which exclude all animal products, including dairy. These consumers seek out coffee creamers that are free from animal-based ingredients. This factor is increasing the Coffee Whitener market.

- Some consumers simply prefer the taste of non-dairy coffee creamers over dairy-based options. Non-dairy creamers come in a range of flavors, such as vanilla, hazelnut, and caramel, which can add variety and flavor to coffee. the demand for lactose-free coffee creamers is increasing as more consumers seek out non-dairy, vegan, and healthier alternatives. This trend is driving innovation in the coffee whitener market, with manufacturers introducing new products that cater to these changing consumer preferences.

Coffee Culture to Boost the Non-Dairy Creamer Sales

- As the coffee culture trend grows, more consumers are seeking out non-dairy options for their coffee, including non-dairy creamers. This trend is driven by a growing interest in plant-based and vegan diets, health concerns, and changing consumer preferences. The demand for non-dairy creamers is driving innovation and product development in the coffee whitener market. Companies are introducing new flavors, formats, and packaging options to cater to this growing demand, creating new growth opportunities.

- As non-dairy creamers become more popular, they are being sold in a wider range of retail and food service channels, including coffee shops, grocery stores, and online retailers. This expanded distribution creates new opportunities for the coffee whitener market to reach new consumers and grow sales.

- Non-dairy creamers offer convenience and customization options for consumers, allowing them to create their own unique coffee experience. Manufacturers are responding to this trend by offering a wide range of flavors and formats, such as liquid and powder, to meet consumer needs and preferences. Hence, the coffee culture trend is creating opportunities for the coffee whitener market by driving demand for non-dairy creamers, promoting innovation and product development, expanding distribution channels, and offering convenience and customization options for consumers.

Segmentation Analysis of the Coffee Whitener Market

Coffee Whitener market segments cover the Type, Application, Distribution Channel, and Industry Vertical. By Type, the Powder Coffee Whitener segment is Anticipated to Dominate the Market Over the Forecast period.

- The growing popularity of instant coffee, especially in regions with a fast-paced lifestyle, has led to an increased demand for powder coffee whiteners as a convenient and quick solution for whitening coffee.

- The powder coffee whitener market is growing and driving the overall coffee whitener market due to several factors that have contributed to its increasing popularity and demand. Powder coffee whiteners are non-dairy creamers used as a substitute for milk or cream in coffee and other hot beverages.

- Developing regions are experiencing a rise in coffee consumption and a growing coffee culture. Powder coffee whiteners are more affordable and readily available than liquid creamers, making them a popular choice in these markets. Powder coffee whiteners offer convenience and long shelf life compared to liquid creamers or fresh milk. They are easy to store and use, making them a preferred choice for consumers who need a convenient and stable coffee whitening solution. Powder coffee whiteners allow consumers to adjust the level of creaminess and sweetness in their coffee, tailoring the taste and consistency according to their preferences. This customization factor enhances the appeal of powder coffee whiteners among coffee enthusiasts.

Regional Analysis of the Coffee Whitener Market

North America dominates the global coffee whitener market, driven by the region's high coffee consumption rates and strong preference for convenient, ready-to-use products. The United States, in particular, is a significant contributor to this dominance, with its cultural inclination towards coffee as a daily staple. This widespread coffee consumption creates a robust demand for coffee whiteners, both dairy and non-dairy, ensuring a steady market growth.

North America's market leadership is the continuous product innovation and the availability of diverse options. Companies in the region are consistently developing new flavors, formulations, and packaging solutions to cater to the evolving tastes and preferences of consumers. This innovation not only attracts a broad customer base but also fosters brand loyalty, further solidifying the region's market position.

The presence of established market players is another critical aspect of North America's dominance. Major brands such as Nestlé's Coffee-Mate, Danone, and others have a strong foothold in the region. These companies have extensive distribution networks, strong marketing strategies, and a deep understanding of consumer preferences, enabling them to maintain a competitive edge and significant market share.

COVID-19 Impact Analysis on Coffee Whitener Market

The pandemic has led to changes in consumer behavior, with more people staying at home and making coffee themselves rather than purchasing coffee from coffee shops. As a result, the demand for coffee creamers has increased, particularly for non-dairy and shelf-stable options that are convenient for home use. The pandemic has disrupted global supply chains, leading to shortages of some coffee creamer products. For example, some manufacturers have reported difficulty sourcing packaging materials or ingredients, which has led to production delays and product shortages. The pandemic has caused economic uncertainty, leading some consumers to reduce their spending on non-essential items, including coffee creamers. This has affected sales in some regions, particularly where the pandemic has had a significant impact on the economy.

Top Key Players Covered in the Coffee Whitener Market

- Nestle (Switzerland)

- Coffee-Mate (U.S)

- International Delight (U.S)

- WhiteWave (U.S)

- Caprimo (Sweden)

- Nutpods (U.S)

- Yearrakarn (Bangkok)

- Califia Farms (U.S)

- Bigtree Group (U.S)

- Great Value (U.S)

- Dunkin' Donuts (U.S)

- Starbucks (U.S)

- Custom Food Group (Malaysia)

- Maxwell House (U.S)

- Hills Bros (U.S) and Other Major Players

Key Industry Developments in the Coffee Whitener Market

In March 2022, nestle plans an Arizona factory for plant-based coffee creamers. Nestle USA announced Wednesday it will build a $675 million plant in metro Phoenix to produce beverages including oat milk coffee creamers as consumer demand soars for plant-based products.

In July 2020, Starbucks' non-dairy coffee creamers to launch in the US. Starbucks Non-Dairy Creamers are available in two flavors – caramel and hazelnut – to bring customers exciting new ways to enjoy coffee at home. Crafted with a unique blend of almonds and oats, Starbucks Non-Dairy Creamers create a rich and smooth texture with delicious flavors inspired by customer-favorite handcrafted beverages.

In January 2024, Seattle-based Darigold, Inc. has launched Belle™ dairy-based coffee creamers in four flavors: Vanilla, Sweet Cream, Hazelnut Latte, and Caramel. Made with only five simple ingredients, including real cream, Belle Creamers are now available in grocery stores across the Northwest, aiming to compete in the $6 billion coffee whitener market.

|

Global Coffee Whitener Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 19.17 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.9% |

Market Size in 2032: |

USD 32.11 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Chanel |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Coffee Whitener Market by Type (2018-2032)

4.1 Coffee Whitener Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Liquid Coffee Whitener

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Powder Coffee Whitener

Chapter 5: Coffee Whitener Market by Application (2018-2032)

5.1 Coffee Whitener Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Coffee

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Tea

5.5 Others

Chapter 6: Coffee Whitener Market by Distribution Chanel (2018-2032)

6.1 Coffee Whitener Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Supermarkets/Hypermarkets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Departmental Stores & Groceries

6.5 Online Stores

6.6 Others

Chapter 7: Coffee Whitener Market by Industry Vertical (2018-2032)

7.1 Coffee Whitener Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Food & Beverage

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Healthcare

7.5 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Coffee Whitener Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 HUNAN HEALTH-GUARD BIO-TECH (U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ECO AUROUS (U.S.)

8.4 VAV LIFE SCIENCES (INDIA)

8.5 NATURAL SOURCING (U.S.)

8.6 BIZEN CHEMICAL (JAPAN)

8.7 KEWPIE CORPORATION (JAPAN)

8.8 GO NATURAL PAKISTAN (PAKISTAN)

8.9 JIANGXI GLOBAL NATURAL SPICE (CHINA)

8.10 ECOVATEC SOLUTIONS (CANADA)

8.11 TM MEDIA (U.S.)

8.12 NATURESPLUS (U.S.)

8.13 EYOVA (INDIA)

8.14 ARIUL ESSENTIAL (KOREA)

8.15

Chapter 9: Global Coffee Whitener Market By Region

9.1 Overview

9.2. North America Coffee Whitener Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Liquid Coffee Whitener

9.2.4.2 Powder Coffee Whitener

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Coffee

9.2.5.2 Tea

9.2.5.3 Others

9.2.6 Historic and Forecasted Market Size by Distribution Chanel

9.2.6.1 Supermarkets/Hypermarkets

9.2.6.2 Departmental Stores & Groceries

9.2.6.3 Online Stores

9.2.6.4 Others

9.2.7 Historic and Forecasted Market Size by Industry Vertical

9.2.7.1 Food & Beverage

9.2.7.2 Healthcare

9.2.7.3 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Coffee Whitener Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Liquid Coffee Whitener

9.3.4.2 Powder Coffee Whitener

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Coffee

9.3.5.2 Tea

9.3.5.3 Others

9.3.6 Historic and Forecasted Market Size by Distribution Chanel

9.3.6.1 Supermarkets/Hypermarkets

9.3.6.2 Departmental Stores & Groceries

9.3.6.3 Online Stores

9.3.6.4 Others

9.3.7 Historic and Forecasted Market Size by Industry Vertical

9.3.7.1 Food & Beverage

9.3.7.2 Healthcare

9.3.7.3 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Coffee Whitener Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Liquid Coffee Whitener

9.4.4.2 Powder Coffee Whitener

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Coffee

9.4.5.2 Tea

9.4.5.3 Others

9.4.6 Historic and Forecasted Market Size by Distribution Chanel

9.4.6.1 Supermarkets/Hypermarkets

9.4.6.2 Departmental Stores & Groceries

9.4.6.3 Online Stores

9.4.6.4 Others

9.4.7 Historic and Forecasted Market Size by Industry Vertical

9.4.7.1 Food & Beverage

9.4.7.2 Healthcare

9.4.7.3 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Coffee Whitener Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Liquid Coffee Whitener

9.5.4.2 Powder Coffee Whitener

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Coffee

9.5.5.2 Tea

9.5.5.3 Others

9.5.6 Historic and Forecasted Market Size by Distribution Chanel

9.5.6.1 Supermarkets/Hypermarkets

9.5.6.2 Departmental Stores & Groceries

9.5.6.3 Online Stores

9.5.6.4 Others

9.5.7 Historic and Forecasted Market Size by Industry Vertical

9.5.7.1 Food & Beverage

9.5.7.2 Healthcare

9.5.7.3 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Coffee Whitener Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Liquid Coffee Whitener

9.6.4.2 Powder Coffee Whitener

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Coffee

9.6.5.2 Tea

9.6.5.3 Others

9.6.6 Historic and Forecasted Market Size by Distribution Chanel

9.6.6.1 Supermarkets/Hypermarkets

9.6.6.2 Departmental Stores & Groceries

9.6.6.3 Online Stores

9.6.6.4 Others

9.6.7 Historic and Forecasted Market Size by Industry Vertical

9.6.7.1 Food & Beverage

9.6.7.2 Healthcare

9.6.7.3 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Coffee Whitener Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Liquid Coffee Whitener

9.7.4.2 Powder Coffee Whitener

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Coffee

9.7.5.2 Tea

9.7.5.3 Others

9.7.6 Historic and Forecasted Market Size by Distribution Chanel

9.7.6.1 Supermarkets/Hypermarkets

9.7.6.2 Departmental Stores & Groceries

9.7.6.3 Online Stores

9.7.6.4 Others

9.7.7 Historic and Forecasted Market Size by Industry Vertical

9.7.7.1 Food & Beverage

9.7.7.2 Healthcare

9.7.7.3 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Coffee Whitener Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 19.17 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.9% |

Market Size in 2032: |

USD 32.11 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Chanel |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||