Cider Market Synopsis:

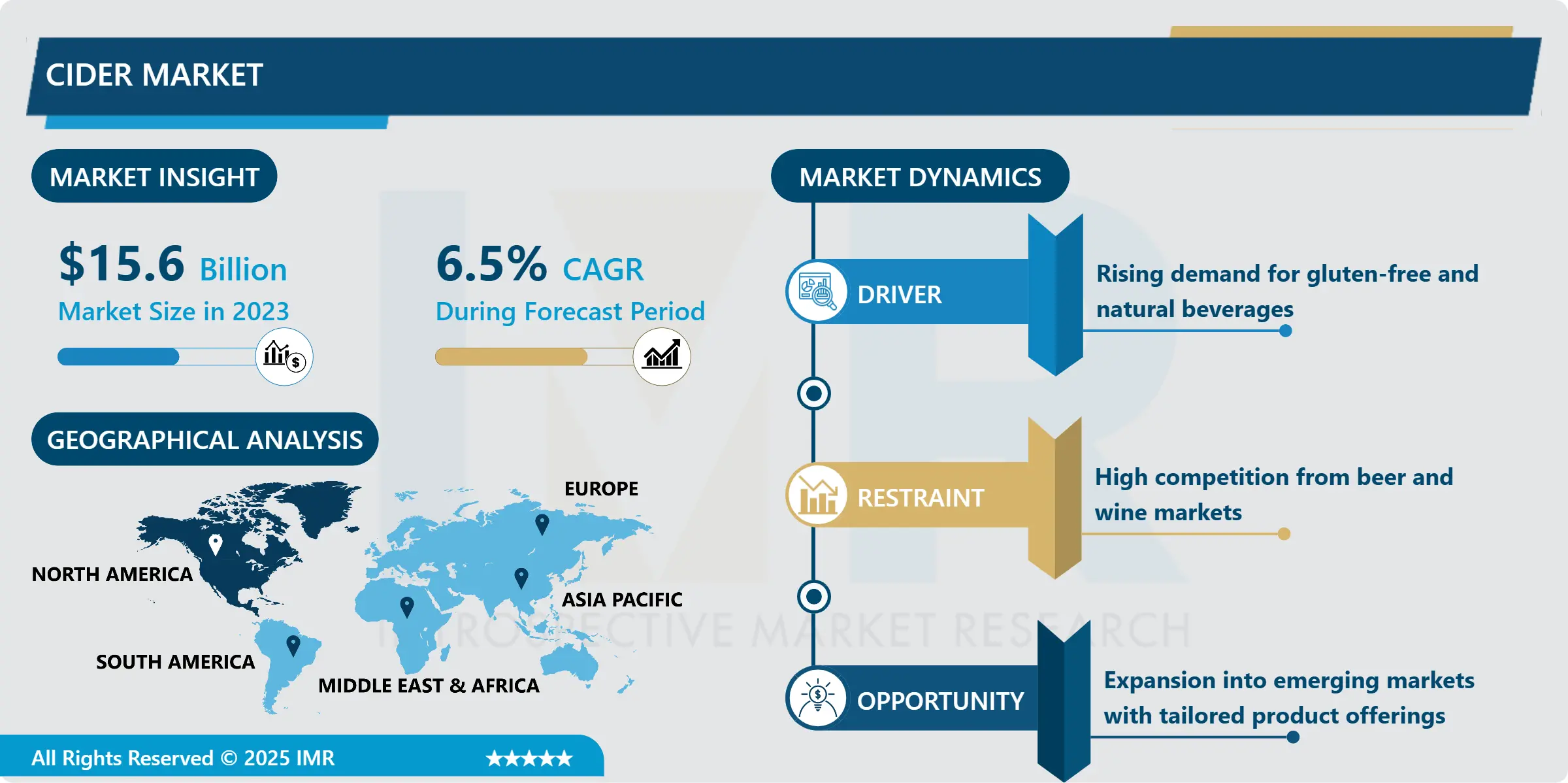

Cider Market Size Was Valued at USD 15.6 Billion in 2023 and is Projected to Reach USD 27.50 Billion by 2032, Growing at a CAGR of 6.5 % From 2024-2032.

The Cider Market is the area of interest as regards cider, an alcoholic beverage which is made from the fermented juice of apples. It has a vast capability in terms of taste, its alcoholic content, and its kind – ciders that are still, sparkling, non-dry, and non-sweet. Because of the perceived health benefits Blip is associated with it redirects diverse consumer choices by selling the proposition of being natural and a refreshing drink.

Due to the consumer’s preference for low alcohol-by-volume products, as well as Gluten-Free products, the Cider Market has been growing in the last couple of years. There is another driving force that helps to consume cider and that is the shift in trend towards natural and craft beer along with such a concept associated with better health than the other traditional alcoholic beverages. This is because there is new product innovation which is the flavor, and sparkling water which can capture the larger population better.

Europeans remain on the front line and take a large proportion of consumption of cider products out of the total consumption in the entire world. The management in the region is down to the fact that the region has been associated with the production and consumption of cider for many years ending in the current situation where a variety of products will need to be managed. However, the growing rate with a short time influence is expected more in the developing countries, especially in the Asia-Pacific and Latin America relying on imitation of the westernized drinking cultures, and an improved disposable income. The North American market is also developing rapidly, particularly because of the craft cider trend; the clients also care about the origin and purity of ciders.

Cider Market Trend Analysis:

Growing Popularity of Craft and Premium Ciders

-

The other trend that emerged in the Cider Market is that craft, premium brands of ciders, are in more demand all across the world. As a result, the consumer has shifted towards the quality and versatility of products, which has led to the focus of the manufacture, towards the art of product building, the small-scale production and the source of the raw materials.

- Specifically, craft cider is expanding to places like North America and Europe; at the same time, microbreweries are coming up with innovative concepts for ciders to consumers. Also, there are other preferences including organic and natural ciders since customers thus consider the impact on the environment and their health. Development has also been observed in the preliminary stages with the introduction of such ciders as limited edition eco-sensitive and visually appealing packages.

Rising Demand in Emerging Markets

-

The reasons for the growth factor in the Emerging Market for Cider Market are primarily due to the changing trend of consumer perception in the countries of Cider favouring westernization of their drinking culture and preference change. The large population, more discrete income, and the young generation who are willing and eager to try out new fruits are aiding the cider market in places such as China, India, and Brazil. These opportunities are well understood by the manufacturers, through putting up an option for cheap products, pet bottles, and attractive cultural flavors.

- Another reason is that some markets can only be entered through local distributors and due to marketing trails too act as an entry into such markets with ease. That way, cider is also becoming available in these markets due to the availability of new retails’ outlets, especially through online shopping.

Cider Market Segment Analysis:

Cider Market is Segmented on the basis of Source Type, Product Type, and Region.

By Source Type, Apple segment is expected to dominate the market during the forecast period

-

It has been experienced that the Apple segment carries the largest share of the Cider Market since the Apple-flavored ciders enjoy incredible demand worldwide in all regions. Apples are the most ancestral and the most usual of the products of cider-making: Its taste is always located on everyone’s tongue, or in other words, it has implicit familiarity. This is because there are countless apple types, and as these are easily obtainable their use allows those manufacturers to create a range of cider types – from sweet to sharp.

- Segment is further facilitated by the continually increasing interest in traditional and authentic experiences with the cider product particularly in the European and North American Markets. There are also premium apple ciders, some of the highly spoken of them are produced using variations of heirloom apples and the market brands them in an artisanal and quite expensive manner.

By Product Type, the Sparkling cider segment is expected to held the largest share

-

The Adults segment is anticipated to be the largest in the Cider Market because the product is only consumed by people of 18 years and above as per legal operations. Millennials and the Gen Z population have a great interest in cider due to its flavorful taste, low alcohol content percentage, and, perceived health benefits than drinking beers and other liquor products.

- This has a higher share among this segment since the steady growth of flavored and sparkling water segment is the key reason why every wide variety of consumers gets what they want to taste. The second area is the health-promoting messages about cider as a natural and gluten-free product that may appeal to other adult people who are more conscious of their health.

Cider Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast Period

-

The Cider Market in Europe is estimated to account for a major revenue share in the global market and is further projected to continue its dominance in the forecast period. This has leadership origin in the region as a hub of cider products, especially in the United Kingdom, Spain, and France. The United Kingdom is a leading consumer or cider and the market is quite mature and consumers look for traditional and new-age ciders.

- The cultural inclination toward cider in Europe and also the presence of both premium and artisanal products assures market dominance. It also knows distribution networks, long-standing direct established ones, and most of the large players who often reinvest in product evolution. In particular, the consumption of sparkling cider as an on-trade product has been steadily increasing because of its connection with glamorous and high-profile products. Moreover, the consumer trends towards organic and low-alcohol ciders have shifted which is a key priority for the company thereby establishing a strong market position across Europe.

Active Key Players in the Cider Market:

- Aston Manor Cider (UK)

- C&C Group plc (Ireland)

- Carlsberg Group (Denmark)

- Distell Group Limited (South Africa)

- Heineken N.V. (Netherlands)

- Kopparbergs Bryggeri AB (Sweden)

- Molson Coors Beverage Company (USA)

- SABMiller Limited (USA)

- Samuel Smith Old Brewery (UK)

- SHS Drinks Ltd. (UK)

- Strongbow Cider (UK)

- Thatchers Cider (UK)

- The Boston Beer Company (USA)

- The Hershey Company (USA)

- Weston’s Cider (UK),

- Other Active Players

|

Global Cider Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 15.6 Billion |

|

Forecast Period 2024-32 CAGR: |

6.5 % |

Market Size in 2032: |

USD 27.50 Billion |

|

Segments Covered: |

By Source Type |

|

|

|

By Product Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cider Market by Source Type

4.1 Cider Market Snapshot and Growth Engine

4.2 Cider Market Overview

4.3 Apple

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Apple: Geographic Segmentation Analysis

4.4 Fruit flavored

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Fruit flavored: Geographic Segmentation Analysis

4.5 Perry

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Perry: Geographic Segmentation Analysis

4.6 Others

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Others: Geographic Segmentation Analysis

Chapter 5: Cider Market by Product Type

5.1 Cider Market Snapshot and Growth Engine

5.2 Cider Market Overview

5.3 Sparkling

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Sparkling: Geographic Segmentation Analysis

5.4 Apple wine

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Apple wine: Geographic Segmentation Analysis

5.5 Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Others: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Cider Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ASTON MANOR CIDER (UK)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 C&C GROUP PLC (IRELAND)

6.4 CARLSBERG GROUP (DENMARK)

6.5 DISTELL GROUP LIMITED (SOUTH AFRICA)

6.6 HEINEKEN N.V. (NETHERLANDS)

6.7 KOPPARBERGS BRYGGERI AB (SWEDEN)

6.8 MOLSON COORS BEVERAGE COMPANY (USA)

6.9 SABMILLER LIMITED (USA)

6.10 SAMUEL SMITH OLD BREWERY (UK)

6.11 SHS DRINKS LTD. (UK)

6.12 STRONGBOW CIDER (UK)

6.13 THATCHERS CIDER (UK)

6.14 THE BOSTON BEER COMPANY (USA)

6.15 THE HERSHEY COMPANY (USA)

6.16 WESTON’S CIDER (UK)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Cider Market By Region

7.1 Overview

7.2. North America Cider Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Source Type

7.2.4.1 Apple

7.2.4.2 Fruit flavored

7.2.4.3 Perry

7.2.4.4 Others

7.2.5 Historic and Forecasted Market Size By Product Type

7.2.5.1 Sparkling

7.2.5.2 Apple wine

7.2.5.3 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Cider Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Source Type

7.3.4.1 Apple

7.3.4.2 Fruit flavored

7.3.4.3 Perry

7.3.4.4 Others

7.3.5 Historic and Forecasted Market Size By Product Type

7.3.5.1 Sparkling

7.3.5.2 Apple wine

7.3.5.3 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Cider Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Source Type

7.4.4.1 Apple

7.4.4.2 Fruit flavored

7.4.4.3 Perry

7.4.4.4 Others

7.4.5 Historic and Forecasted Market Size By Product Type

7.4.5.1 Sparkling

7.4.5.2 Apple wine

7.4.5.3 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Cider Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Source Type

7.5.4.1 Apple

7.5.4.2 Fruit flavored

7.5.4.3 Perry

7.5.4.4 Others

7.5.5 Historic and Forecasted Market Size By Product Type

7.5.5.1 Sparkling

7.5.5.2 Apple wine

7.5.5.3 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Cider Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Source Type

7.6.4.1 Apple

7.6.4.2 Fruit flavored

7.6.4.3 Perry

7.6.4.4 Others

7.6.5 Historic and Forecasted Market Size By Product Type

7.6.5.1 Sparkling

7.6.5.2 Apple wine

7.6.5.3 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Cider Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Source Type

7.7.4.1 Apple

7.7.4.2 Fruit flavored

7.7.4.3 Perry

7.7.4.4 Others

7.7.5 Historic and Forecasted Market Size By Product Type

7.7.5.1 Sparkling

7.7.5.2 Apple wine

7.7.5.3 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Cider Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 15.6 Billion |

|

Forecast Period 2024-32 CAGR: |

6.5 % |

Market Size in 2032: |

USD 27.50 Billion |

|

Segments Covered: |

By Source Type |

|

|

|

By Product Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||