Ceramics Market Synopsis

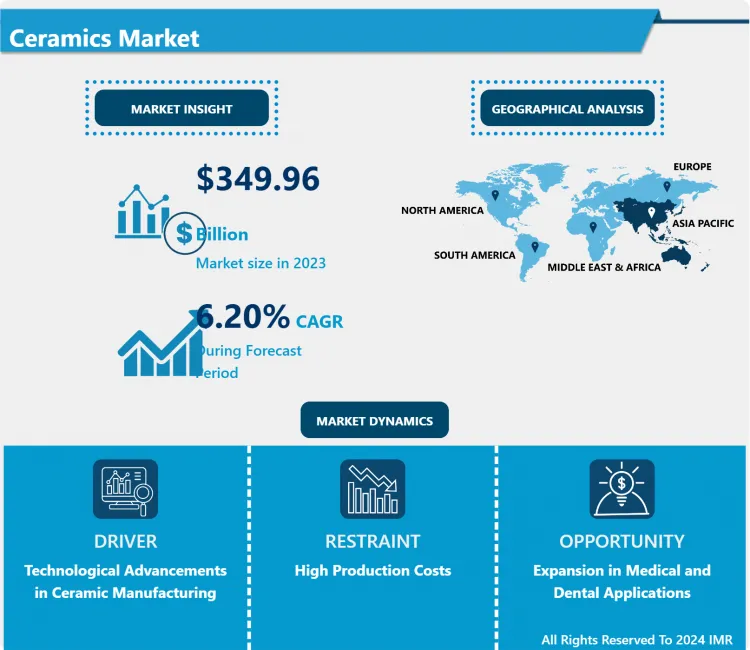

Ceramics Market Size Was Valued at USD 349.96 Billion in 2023, and is Projected to Reach USD 601.37 Billion by 2032, Growing at a CAGR of 6.20% From 2024-2032.

Ceramics are inorganic non-metallic materials formed by shaping and firing for the first time a non-metallic mineral, for example, clay. They are very hard, brittle, resistant to heat and possess good insulation characteristics for electrical purpose. Ceramics comprises of basic items such as pottery, bricks and tiles and sophisticated products that are needed in high tech applications for items such as planes, gadgets, and in medical purposes. The properties to be derived from their crystal structure and the nature of being ionic or covalent inorganic salts.

Ceramics market emerged a sub-sector over the last few years due to new technologies, new materials and as a result of high demands from several sectors. Ceramics, which in the past have been employed as pottery materials in decorations, tiles and bricks, is today widely applied in electronics, automotive, flight industries as well as in health sector. Due to its features such as flexibility, resilience and the ability to withstand high temperatures, ceramics can be used widely in various products which range from the commonly used products in homes to contemporary technological products.

Another factor that remains a positive influence towards ceramics is the construction sector where there is strong ceramics demand for tiles, sanitary goods and others. Infrastructural development and urbanization in the emerging markets are considered to be driving the global demand for these kind of products. Also, the cumulative consideration of sustainable development in the construction industry has made many people to embrace the use of energy conserving and eco-efficient ceramics. Further changes in the design and production of ceramics also introduced beauty and efficiency to their final products in line with the current architectural looks.

Therefore, advanced ceramics have become essentials in the field of electronics because of their outstanding electrical insulation, thermal stability, and mechanical strength. It is used in the making of semiconductors, capacitors, insulators, and other small parts into which most modern electronics are divided. Recent years, the increase in the consumer electronics industry as well as the emergence of 5G, IoT, electric vehicle industries has fueled the demand for high-performance ceramics. As a result of the technological development especially in the electronics and microelectronics, there is a call for materials that can meet the demands of the smaller and compacter electronic gadgets and devices, a factor well fulfilled by advanced ceramics.

Automotives and aerospace manufacturing industries are also in the list of the major consumers of ceramics due to the high strength, low density, and heat resistant characteristics of ceramics. In automotive, ceramics are applied in the engine and braking as well as exhaust systems in order to enhance fuel efficiency and prove the production of hazardous chemicals to the environment. Aerospace industries use ceramics in such parts as the turbine blades, heat shields, and structural parts, where the material offers the best qualities of heat and corrosion resistance. This means that industries focusing on performance, efficiency, and sustainability will continue to increase, and so will the importance of ceramics. Another field that ceramics is slowly but surely entering is the sphere of healthcare. Bioceramics useful in medical implants, dental and surgical instruments are biocompatible and wear resistant having high strength. Current trends in population coupled with increases in longevity and improvements in technology are causing the market in these materials to grow. With new types of bioceramic materials and technologies like 3-D printing the reserves of possible applications are widening even more due to the opportunity to create innovative individually tailored and intricate designs of implants that improve the performance of the action and interaction with the living tissues.

In total, and taking into account the continuous research and development, the growth of technology, and the broadening of the application area, the ceramics market can be deemed as being promising in the future. Firms that operate within this context are always advancing their technologies to create new materials and techniques for manufacturing that is useful to customers. Thus, ceramics promise to become even more critical for the further development of countless industries as the need for high-performance, sustainable and multifunctional materials continues to rise.

Ceramics Market Trend Analysis

Growing Demand for Advanced Ceramics in Electronics and Automotive Industries

- The increasing use of high-performance ceramics, especially in electronics and automobile applications, is their high thermal stability, wear resistance, electrical insulation, etc. In the electronics industry, the product uses of ceramics include capacitors, substrates and semiconductors due to their high heat and chemical resistant nature necessitated by the operations of electronics. While, on the other, automotive industry made use of advanced ceramics in different ways including using them in engines, sensors, and exhaust systems. These materials help in making vehicles efficient, durable and eco friendly in their present day utilization.

- Further, the emerging electric as well as hybrid vehicle technology has provided an impetus to the growth of advanced ceramics market because they constitute a primary component of batteries and electric powertrains. As new advancements occur and investment continues to pe grow in these industries, the advanced ceramics market is expected to experience rapid growth, especially for other types of high-performance ceramics that are expected to meet the newly developed applications and technologies.

Expansion in Medical and Dental Applications

- The ceramics in the medical and dental segment are rapidly expanding as the result of material science progress and the need for advanced materials, which belong to the bioceramics group that is used in the healthcare industry. The ceramics that can homo geneously combine high strength, wear resistance, and biocompatibility have been widely used in a growing number of medical applications that include orthopedic implants, dental restorations, or surgical tools. Latest advancements in ceramics such as zirconia and alumina are allowing for improvement in improved wear and esthetic applications in implant and prosthodontic systems.

- The highly growing global population, especially people of the older age, escalating health care costs, and higher incidence of chronic diseases are other factors; which are driving the Market. Also, the increasing primary interest in minimal invasive surgery is creating the use of ceramics based components with great mechanical performances and wear resistance than other regular available materials. Modern practices like 3D printing are also being implemented in the production of personalised ceramics for implants and prosthetic devices improving patient care. In addition, some industries’ strict regulatory requirement, and the strictly research and development efforts conducted towards enhancing the ceramic materials performance and durability are expected further to continue driving this market making ceramics an essential material in the modern medical and dental applications.

Ceramics Market Segment Analysis:

Ceramics Market Segmented based on Product Type , Material, Application and End Use .

By Product Type , Traditional segment is expected to dominate the market during the forecast period

- The ceramics market can be categorized into traditional and advanced product types, each serving distinct applications and industries. Traditional ceramics, which include products like bricks, tiles, pottery, and sanitary ware, are primarily used in construction, household items, and art. These products are typically made from natural materials like clay and are known for their durability, thermal stability, and aesthetic appeal. Traditional ceramics have a long history and continue to be widely used due to their cost-effectiveness and established manufacturing processes. On the other hand, advanced ceramics are engineered materials designed for specific, high-performance applications. These include electronic ceramics, bioceramics, and structural ceramics, used in industries such as electronics, healthcare, automotive, and aerospace.

- Advanced ceramics offer superior properties like high strength, wear resistance, and thermal and electrical insulation, making them essential in high-tech and demanding environments. The market for advanced ceramics is driven by the increasing demand for innovative solutions in cutting-edge technologies and the growing need for materials that can withstand extreme conditions. Both segments of the ceramics market are experiencing growth, but advanced ceramics are expanding more rapidly due to ongoing technological advancements and their critical role in modern industry.

By Application , Autogas segment held the largest share in 2023

- The ceramics market strategically classifies itself based on ceramics material such as alumina ceramics, titanate ceramics, zirconia ceramics, silicon carbide (SiC), and others. Alumina ceramics have good mechanical properties, high hardness and heat resistance and are largely applying for electronics, automotive and medical fields. Titanate ceramics has uses in electronics hence the importance of dielectric material and its use in capacitors and thermistors. Zirconia ceramics are highly valued for excellent mechanical strength, thermal and chemical stability and therefore they have the applications in dentistry, structural ceramics and cutting tools.

- Silicon carbide ceramics, as hard wearing, thermally stable and chemically resistant, are used in high performance engineering parts, for example car brake disk and ceramics bearings. The “Others” group includes such superior ceramics as silicon nitride, which are applied in unique applications because of their certain characteristics, for example, excellent fracture resistance and thermal shock durability. The utilisation of these materials is fostered due to increase in demands arising from technological beyondisation, the expansion of the work application fields, and the call for utilisation of work materials that have high resistance to natural conditions.

Ceramics Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is expected to continue to have a hold on the market for ceramics in the near future due to several factors. Amidst the significantly improved economic status of countries such as China, India, Japan and South Korea, the ceramics demand in construction, automotive, Electronics and health care Industries has been on the rise. These countries are rapidly developing and experiencing urbanization and industrialization, which requires and defines new technologies such as those associated with ceramics for their application in the construction industry due to their hardness, heat resistance, and appeal. Also, large production industries and readily available raw material at comparatively lower prices are some of the other benefits of ceramics manufacturers in the region.

- Technological development and innovation in ceramics materials and the government’s support to encourage usage of green products and energy efficient commodities also play the role of favourable in the growth of this market. The growing consumer electronics market along with increased usage of ceramic components in electronics also add to the region’s market share. Also, the emergence of the healthcare sector that incorporates use of ceramics in production of medical equipment, and implants drives the demand even higher. Focusing on the future, the increase in economy and industrial growth and advanced technologies make the Asia Pacific region dominate the ceramic market.

Active Key Players in the Ceramics Market

- Saint-Gobain (France)

- Kyocera Corporation (Japan)

- Corning Incorporated (US)

- Morgan Advanced Materials (US)

- CoorsTek Inc. (US)

- RHI Magnesita (UK)

- Kronos Worldwide, Inc. (US)

- Murata Manufacturing Co., Ltd. (Japan)

- NGK Insulators, Ltd. (Japan) and Others Active Player

|

Ceramics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 349.96 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.20% |

Market Size in 2032: |

USD 601.37 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ceramics Market by Product Type (2018-2032)

4.1 Ceramics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Traditional

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Advanced

Chapter 5: Ceramics Market by Material (2018-2032)

5.1 Ceramics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Alumina Ceramics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Titanate Ceramics

5.5 Zirconia Ceramics

5.6 Silicon Carbide (SiC)

5.7 Others

Chapter 6: Ceramics Market by Application (2018-2032)

6.1 Ceramics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Sanitary Ware

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Abrasives

6.5 Bricks & Pipes

6.6 Tiles

6.7 Pottery

6.8 Others

Chapter 7: Ceramics Market by End Use (2018-2032)

7.1 Ceramics Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Building & Construction

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Industrial

7.5 Medical

7.6 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Ceramics Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SAINT-GOBAIN (FRANCE)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 KYOCERA CORPORATION (JAPAN)

8.4 CORNING INCORPORATED (US)

8.5 MORGAN ADVANCED MATERIALS (US)

8.6 COORSTEK INC. (US)

8.7 RHI MAGNESITA (UK)

8.8 KRONOS WORLDWIDE INC. (US)

8.9 MURATA MANUFACTURING COLTD. (JAPAN)

8.10 NGK INSULATORS LTD. (JAPAN) OTHERS ACTIVE PLAYER

8.11

Chapter 9: Global Ceramics Market By Region

9.1 Overview

9.2. North America Ceramics Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product Type

9.2.4.1 Traditional

9.2.4.2 Advanced

9.2.5 Historic and Forecasted Market Size by Material

9.2.5.1 Alumina Ceramics

9.2.5.2 Titanate Ceramics

9.2.5.3 Zirconia Ceramics

9.2.5.4 Silicon Carbide (SiC)

9.2.5.5 Others

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Sanitary Ware

9.2.6.2 Abrasives

9.2.6.3 Bricks & Pipes

9.2.6.4 Tiles

9.2.6.5 Pottery

9.2.6.6 Others

9.2.7 Historic and Forecasted Market Size by End Use

9.2.7.1 Building & Construction

9.2.7.2 Industrial

9.2.7.3 Medical

9.2.7.4 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Ceramics Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product Type

9.3.4.1 Traditional

9.3.4.2 Advanced

9.3.5 Historic and Forecasted Market Size by Material

9.3.5.1 Alumina Ceramics

9.3.5.2 Titanate Ceramics

9.3.5.3 Zirconia Ceramics

9.3.5.4 Silicon Carbide (SiC)

9.3.5.5 Others

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Sanitary Ware

9.3.6.2 Abrasives

9.3.6.3 Bricks & Pipes

9.3.6.4 Tiles

9.3.6.5 Pottery

9.3.6.6 Others

9.3.7 Historic and Forecasted Market Size by End Use

9.3.7.1 Building & Construction

9.3.7.2 Industrial

9.3.7.3 Medical

9.3.7.4 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Ceramics Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product Type

9.4.4.1 Traditional

9.4.4.2 Advanced

9.4.5 Historic and Forecasted Market Size by Material

9.4.5.1 Alumina Ceramics

9.4.5.2 Titanate Ceramics

9.4.5.3 Zirconia Ceramics

9.4.5.4 Silicon Carbide (SiC)

9.4.5.5 Others

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Sanitary Ware

9.4.6.2 Abrasives

9.4.6.3 Bricks & Pipes

9.4.6.4 Tiles

9.4.6.5 Pottery

9.4.6.6 Others

9.4.7 Historic and Forecasted Market Size by End Use

9.4.7.1 Building & Construction

9.4.7.2 Industrial

9.4.7.3 Medical

9.4.7.4 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Ceramics Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product Type

9.5.4.1 Traditional

9.5.4.2 Advanced

9.5.5 Historic and Forecasted Market Size by Material

9.5.5.1 Alumina Ceramics

9.5.5.2 Titanate Ceramics

9.5.5.3 Zirconia Ceramics

9.5.5.4 Silicon Carbide (SiC)

9.5.5.5 Others

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Sanitary Ware

9.5.6.2 Abrasives

9.5.6.3 Bricks & Pipes

9.5.6.4 Tiles

9.5.6.5 Pottery

9.5.6.6 Others

9.5.7 Historic and Forecasted Market Size by End Use

9.5.7.1 Building & Construction

9.5.7.2 Industrial

9.5.7.3 Medical

9.5.7.4 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Ceramics Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product Type

9.6.4.1 Traditional

9.6.4.2 Advanced

9.6.5 Historic and Forecasted Market Size by Material

9.6.5.1 Alumina Ceramics

9.6.5.2 Titanate Ceramics

9.6.5.3 Zirconia Ceramics

9.6.5.4 Silicon Carbide (SiC)

9.6.5.5 Others

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Sanitary Ware

9.6.6.2 Abrasives

9.6.6.3 Bricks & Pipes

9.6.6.4 Tiles

9.6.6.5 Pottery

9.6.6.6 Others

9.6.7 Historic and Forecasted Market Size by End Use

9.6.7.1 Building & Construction

9.6.7.2 Industrial

9.6.7.3 Medical

9.6.7.4 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Ceramics Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product Type

9.7.4.1 Traditional

9.7.4.2 Advanced

9.7.5 Historic and Forecasted Market Size by Material

9.7.5.1 Alumina Ceramics

9.7.5.2 Titanate Ceramics

9.7.5.3 Zirconia Ceramics

9.7.5.4 Silicon Carbide (SiC)

9.7.5.5 Others

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Sanitary Ware

9.7.6.2 Abrasives

9.7.6.3 Bricks & Pipes

9.7.6.4 Tiles

9.7.6.5 Pottery

9.7.6.6 Others

9.7.7 Historic and Forecasted Market Size by End Use

9.7.7.1 Building & Construction

9.7.7.2 Industrial

9.7.7.3 Medical

9.7.7.4 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Ceramics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 349.96 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.20% |

Market Size in 2032: |

USD 601.37 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||