CCTV Video Camera Market Synopsis

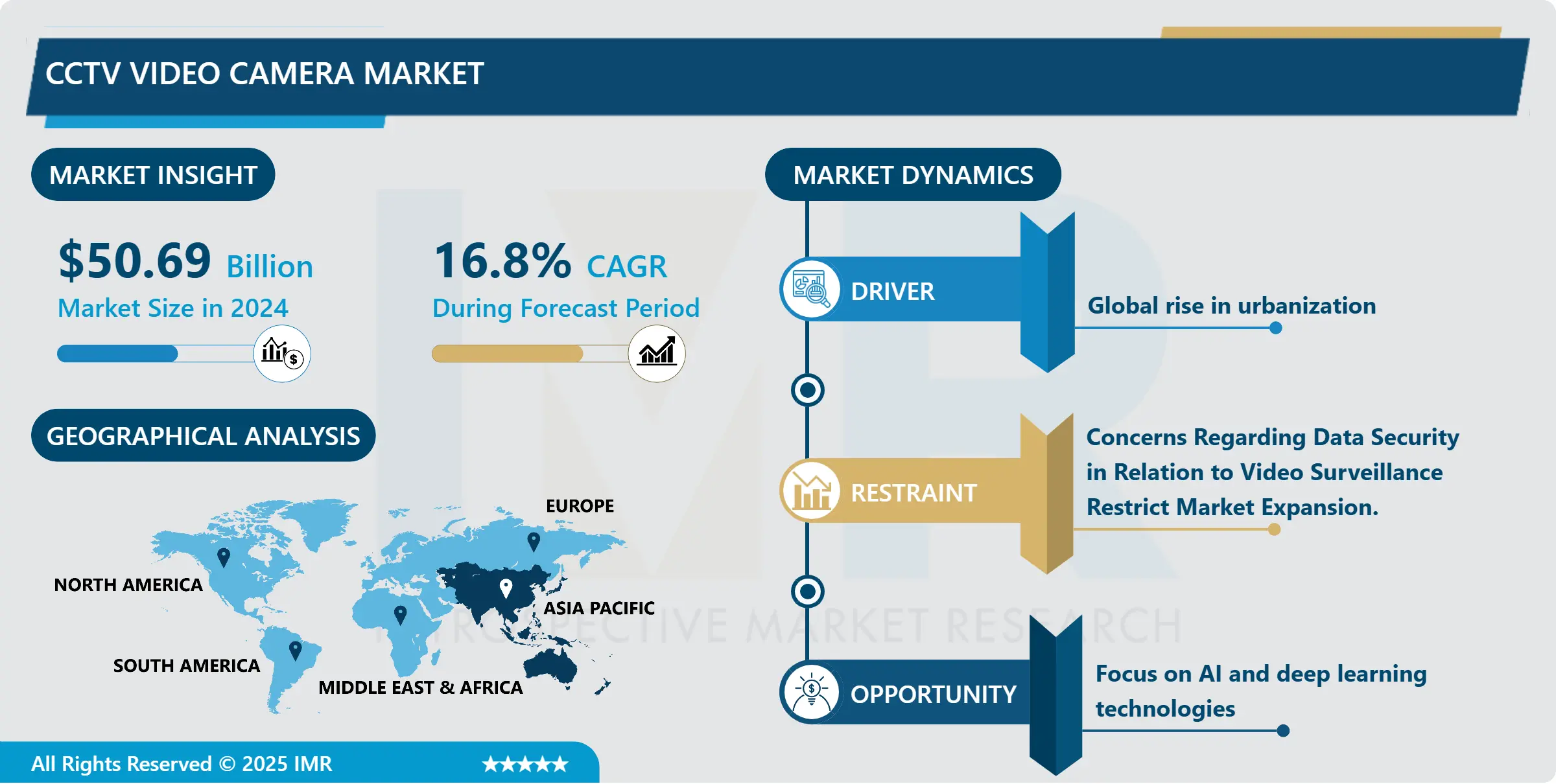

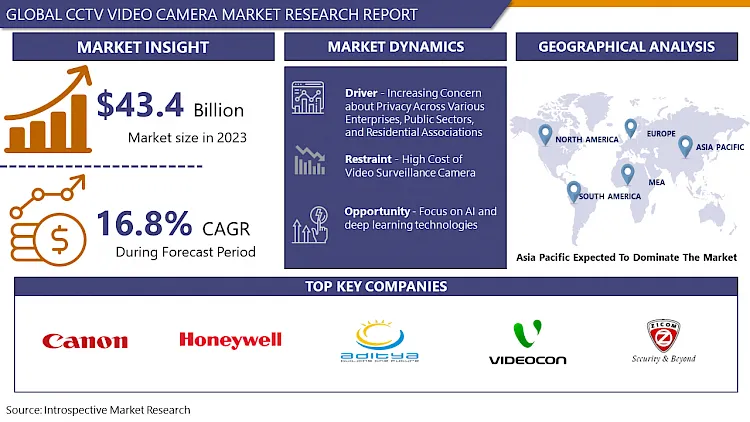

CCTV Video Camera Market Size Was Valued at USD 50.69 Billion in 2024, and is Projected to Reach USD 175.58 Billion by 2032, Growing at a CAGR of 16.8% From 2025-2032.

A CCTV video camera is a surveillance device that is used to watch and record the activities in a specific area. The live video feed is sent to a recording device or monitoring station. These cameras are the key to increasing security measures in all these environments such as housing areas, business premises, public buildings and transport hubs among others. Modern CCTV cameras are often equipped with remote access features, motion detection, night vision and high-definition video quality which make them the best surveillance tools for many applications.

The market potential of CCTV video camera is supposed to be heavily influenced by a lot of factors, such as the increasing technological spread, the rising urbanization and digitization, and the growing demand for security solutions in infrastructure. g. , smart grids and power plants), and the fast development of CCTV video camera technologies.

The installation of CCTV video camera is an unavoidable result of the growth in office spaces and start-ups all over the world. Besides, for security reasons, some people put up CCTV video camera outside their houses. The government also enforces the deployment of CCTV video cameras in certain places.

The digitization and the advancement of technology in everyday life of people have brought about a major change in the demand for surveillance cameras, which has increased over years. The frequency of the burglaries and other security-related issues has been raised in the recent years, hence, making security an important issue.

In addition, the CCTV video camera procurement in many countries has been accelerated by government policies to promote security. To enhance the security of passengers during rail travel, Indian Railways started installing IP cameras. It was expected that the installation of surveillance cameras would be completed by March 2022 at major stations across Hong Kong.

CCTV Video Camera Market Trend Analysis

Increased Residential and Commercial Adoption of Security Systems Facilitates Increased Market Size

- CCTV cameras are widely used all around the world to protect both business and home areas. The building was designed with the help of modern technologies such as infrared, artificial intelligence, and deep learning to make it secure for residential and public places. Besides, the increase of residential and commercial robberies as well as the awareness of consumers about surveillance cameras is also a reason for the expansion.

- The growth of the market is caused by more residential and commercial camera installations which are for crime prevention and asset protection. In the whole world, the growth of surveillance cameras is speeding up so that governments can keep control over their population. In all the urban areas of every continent, vigilance systems are currently being installed and their number is in millions. The PreciseSecurity Report speculates that there are over one billion cameras worldwide, China alone has deployed about two hundred million surveillance systems.

- Besides, the United States and Germany have set up around 50 million and 5. Both US and China have installed 2 million surveillance systems each.

- The growing number of these surveillance systems in public spaces is the driving force behind the growth of the global CCTV video camera market..

Exponential growth of IP cameras drive the market

- The IP cameras exponential growth has changed the application of video surveillance technologies significantly, which resulted in innovations like high-definition, more clear digital images and progress in video analytics and neural networks. IP cameras supply better video details because they are the real digital signal transmitters, so they can be used for such applications as license plate recognition and facial recognition.

- For instance, in July 2022, Xiaomi, a Chinese technology company conglomerate presented their new home security camera in India. Thus they brought the state of art 360° solutions to Indian people. Both online and offline the Xiaomi 360 Home Security Camera 1080 is available at a cheap price with many features to set up a home security system that works for 24 hours.

- Besides, the boost in production has caused a decrease in costs and an increasing frequency of implementation. The development of software solutions in the video surveillance systems has made it possible to identify the unforeseen and unattended packages or objects, line crosses, path tracing and so on..

CCTV Video Camera Market Segment Analysis:

CCTV Video Camera Market is segmented based on Camera Type, Technology, and End User.

By Camera Type, dome CCTV segment is expected to dominate the market during the forecast period

- The market is divided into sections in accordance with the type of camera, including box CCTV, bullet CCTV, dome CCTV and others (such as infrared cameras). The main segment which had the highest share in 2021 was dome CCTV. Hence, the government has been mainly responsible for this. Bhubaneswar Smart City Limited in India, an entity of the government initiative, deployed over 350 high-end dome cameras for smart city surveillance on September 2022. The process of world population growth and the rise in urbanization have been the main driving forces behind market expansion.

- The PTZ cameras segment is expected to be the fastest growing and will have the highest CAGR during the forecast period. The market is widening up as more and more advanced features are developed and zoom PTZ systems powered by AI start to be used.

By Technology, IP Camera segment held the largest share

- Ann analog camera has the digital IP (network) camera with wireless cameras among them. In 2021, the digital part constituted the highest world market share. The main reason behind this is the expanding demand for the technologies and growth in smart city projects initiated by the government, which further drives the adoption among the people.

- The segment of IP cameras (network) has been predicted to display the highest CAGR over this period. Ascending infrastructural investments and the rapidly developing protectionist measures accelerated the market growth.

- ACT HomeCam launched a Surveillance Home Security System in April, 2021 as an initiative. It is simple, effortless, and can be easily integrated with the existing networks of Wi-Fi. The camera allows users access to their house footage through TP-Link application Tapo, which works with the Google Play store..

CCTV Video Camera Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The burgeoning crime statistics of India over the last couple of years have led to the upsurge of CCTV system demand in order to maintain the safety of the masses. The implementation of more public security systems in the form of government campaigns have fueled the demand of security cameras such as IP cameras, dome cameras, and bullet cameras.

- Finally, the increased of highly influential CCTV manufacturers like Hanwah Techwin and Hikvision in China will play a major role in the demand for CCTV video cameras in the country. Owing to the favorable environment, incurred from China's low manufacturing costs, the manufacturers of CCTV video camera are likely to reap the benefits of that feature.

- The government strategies that focus on the development of technology business are anticipated to boost the potential chances for the CCTV video camera industry in China. It is believed that the Chinese market will exhibit a CAGR of 5. 8%.

- The apprehension on the part of the USA about Chinese manufacturing technology can be expected to serve as a hurdle that would most likely be impeding the sales of CCTV video camera manufacturers from the People's Republic of China.

- For example, in June 2021, the regulators in the United States were considering imposing a moratorium on the products that include the surveillance cameras manufactured in the Hangzhou Hikvision Digital Technology and Dahua Technology among others. After it being ratified in October 2021, the bill was sent to the president of United States for signing..

Active Key Players in the CCTV Video Camera Market

- Canon Inc.

- Honeywell International Inc

- Hangzhou Hikvision Digital Technology Co Ltd

- Bosch Security Systems Inc.

- Panasonic Corporation

- Dahua Technology Co. Ltd

- Pelco

- Sony Corporation

- Samsung

- Cisco Systems, and Other Active Players

Key Industry Developments in the CCTV Video Camera Market:

- Airtel launched the 'Xsafe' end-to-end home surveillance systems solution in September 2022. Such a system has been established by the corporation over forty cities of India including Bengaluru, Chennai, Mumbai, Delhi, Kolkata and Bengaluru. The telecommunication company of India, called Airtel, offers three types of surveillance platforms.

- In September 2023, Sony Electronics Co., Ltd made FX30 as a member of its Cinema Line. The 4K Super 35 compact FX30 comes with ample professional camera features like cinematography equipment.

- ONVIF Integration into Video Recording by the Honeywell Security Group IP Surveillance System has been introduced in September 2022 by the emerging technology. This tool was intended to respond to the demand for security of customers and to ensure smooth operations within MAXPRO NVRs..

|

Global CCTV Video Camera Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 50.69 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.8 % |

Market Size in 2032: |

USD 175.58 Bn. |

|

Segments Covered: |

By Camera Type |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

• North America (U.S., Canada, Mexico) • Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) • Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe) • Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC) • Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) • South America (Brazil, Argentina, Rest of SA) |

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: CCTV Video Camera Market by Camera Type (2018-2032)

4.1 CCTV Video Camera Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Box CCTV

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Bullet CCTV

4.5 Dome CCTV

4.6 C-Mounted

4.7 PTZ Camera

Chapter 5: CCTV Video Camera Market by Technology (2018-2032)

5.1 CCTV Video Camera Market Snapshot and Growth Engine

5.2 Market Overview

5.3 IP Camera

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Analog

Chapter 6: CCTV Video Camera Market by End User (2018-2032)

6.1 CCTV Video Camera Market Snapshot and Growth Engine

6.2 Market Overview

6.3 BFSI

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Homeland Security

6.5 Retail

6.6 Residential

6.7 Logistics & Transportation

6.8 Hospitality

6.9 Commercial Spaces

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 CCTV Video Camera Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 NAUTICA INTERNATIONAL (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 NOVURANIA (UNITED STATES)

7.4 RIBCRAFT USA (UNITED STATES)

7.5 QUICKSILVER BOATS (UNITED STATES)

7.6 WALKER BAY BOATS (CANADA)

7.7 ZODIAC MARINE & POOL (FRANCE)

7.8 AB INFLATABLES (COLOMBIA)

7.9 BRIG INFLATABLE BOATS (UKRAINE)

7.10 AVON MARINE (UNITED KINGDOM)

7.11 CARIBE INFLATABLES (VENEZUELA)

7.12 ZODIAC NAUTIC (FRANCE)

7.13 WILLIAMS JET TENDERS (UNITED KINGDOM)

7.14 HIGHFIELD BOATS (AUSTRALIA)

7.15 SIROCCO MARINE (AUSTRALIA)

7.16 APEX INFLATABLES (SOUTH AFRICA)

7.17

Chapter 8: Global CCTV Video Camera Market By Region

8.1 Overview

8.2. North America CCTV Video Camera Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Camera Type

8.2.4.1 Box CCTV

8.2.4.2 Bullet CCTV

8.2.4.3 Dome CCTV

8.2.4.4 C-Mounted

8.2.4.5 PTZ Camera

8.2.5 Historic and Forecasted Market Size by Technology

8.2.5.1 IP Camera

8.2.5.2 Analog

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 BFSI

8.2.6.2 Homeland Security

8.2.6.3 Retail

8.2.6.4 Residential

8.2.6.5 Logistics & Transportation

8.2.6.6 Hospitality

8.2.6.7 Commercial Spaces

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe CCTV Video Camera Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Camera Type

8.3.4.1 Box CCTV

8.3.4.2 Bullet CCTV

8.3.4.3 Dome CCTV

8.3.4.4 C-Mounted

8.3.4.5 PTZ Camera

8.3.5 Historic and Forecasted Market Size by Technology

8.3.5.1 IP Camera

8.3.5.2 Analog

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 BFSI

8.3.6.2 Homeland Security

8.3.6.3 Retail

8.3.6.4 Residential

8.3.6.5 Logistics & Transportation

8.3.6.6 Hospitality

8.3.6.7 Commercial Spaces

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe CCTV Video Camera Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Camera Type

8.4.4.1 Box CCTV

8.4.4.2 Bullet CCTV

8.4.4.3 Dome CCTV

8.4.4.4 C-Mounted

8.4.4.5 PTZ Camera

8.4.5 Historic and Forecasted Market Size by Technology

8.4.5.1 IP Camera

8.4.5.2 Analog

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 BFSI

8.4.6.2 Homeland Security

8.4.6.3 Retail

8.4.6.4 Residential

8.4.6.5 Logistics & Transportation

8.4.6.6 Hospitality

8.4.6.7 Commercial Spaces

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific CCTV Video Camera Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Camera Type

8.5.4.1 Box CCTV

8.5.4.2 Bullet CCTV

8.5.4.3 Dome CCTV

8.5.4.4 C-Mounted

8.5.4.5 PTZ Camera

8.5.5 Historic and Forecasted Market Size by Technology

8.5.5.1 IP Camera

8.5.5.2 Analog

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 BFSI

8.5.6.2 Homeland Security

8.5.6.3 Retail

8.5.6.4 Residential

8.5.6.5 Logistics & Transportation

8.5.6.6 Hospitality

8.5.6.7 Commercial Spaces

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa CCTV Video Camera Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Camera Type

8.6.4.1 Box CCTV

8.6.4.2 Bullet CCTV

8.6.4.3 Dome CCTV

8.6.4.4 C-Mounted

8.6.4.5 PTZ Camera

8.6.5 Historic and Forecasted Market Size by Technology

8.6.5.1 IP Camera

8.6.5.2 Analog

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 BFSI

8.6.6.2 Homeland Security

8.6.6.3 Retail

8.6.6.4 Residential

8.6.6.5 Logistics & Transportation

8.6.6.6 Hospitality

8.6.6.7 Commercial Spaces

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America CCTV Video Camera Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Camera Type

8.7.4.1 Box CCTV

8.7.4.2 Bullet CCTV

8.7.4.3 Dome CCTV

8.7.4.4 C-Mounted

8.7.4.5 PTZ Camera

8.7.5 Historic and Forecasted Market Size by Technology

8.7.5.1 IP Camera

8.7.5.2 Analog

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 BFSI

8.7.6.2 Homeland Security

8.7.6.3 Retail

8.7.6.4 Residential

8.7.6.5 Logistics & Transportation

8.7.6.6 Hospitality

8.7.6.7 Commercial Spaces

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global CCTV Video Camera Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 50.69 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.8 % |

Market Size in 2032: |

USD 175.58 Bn. |

|

Segments Covered: |

By Camera Type |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

• North America (U.S., Canada, Mexico) • Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) • Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe) • Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC) • Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) • South America (Brazil, Argentina, Rest of SA) |

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||