Cargo Bike Market Synopsis:

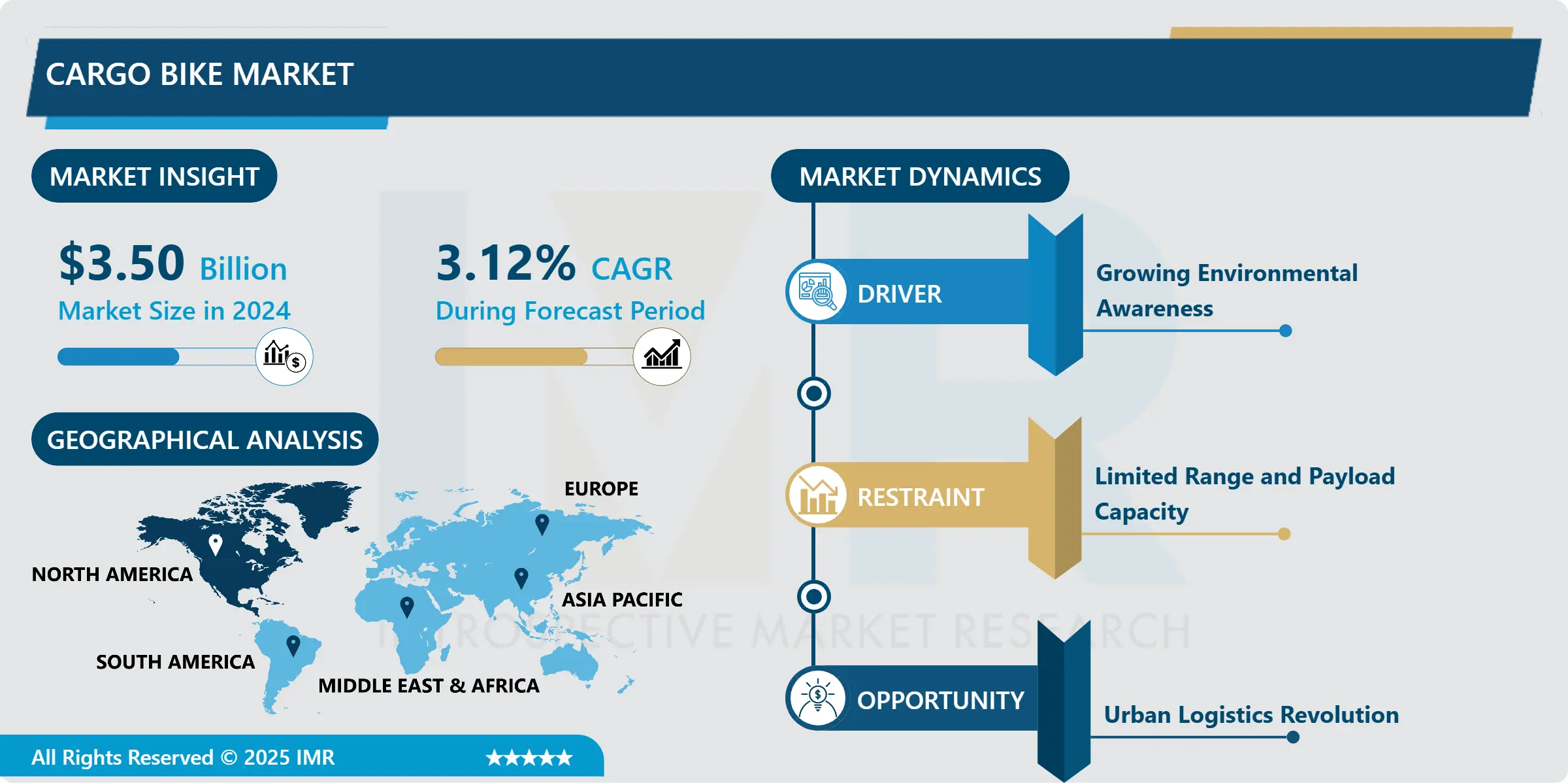

Cargo Bike Market Size Was Valued at USD 3.50 Billion in 2024, and is Projected to Reach USD 4.35 Billion by 2032, Growing at a CAGR of 3.12% From 2025-2032.

The cargo bike market is the market in which players are involved in the design, production, and distribution of bicycles built with the purpose of freight, transporting products, items, gear, or people. They are designed with large storage space or large storage platforms, which can be tw0-wheeled, three-wheeled or four-wheeled. They provide a reliable, energy-efficient and feasible means of transport in the transport system and for personal uses especially in the rapidly growing urban environments.

The growth of the global market for cargo bikes continues to rise as cities around the world become more adaptation to environments and concerns with sustainability defined by Green. These bicycles have benefits over conventional delivery vehicles, notably in heavy urban traffic where pollution is severe and traffic congestion is rife. Here, cargo bikes are divided according to the types of cargo and use of bikes such as delivery and courier services, family or business use.

Governments around the globe are also introducing cargo bikes through subsidization, infrastructure improvement and policy measures to combat carbon footprint and improve urban logistics situation. Various developments in the electric-assist technology have continued to expand the cargo bike market since they are now suitable for almost everyone in terms of steep gradients or weight-carrying ability. The market is also growing in areas such as Europe where cycling industry as well as going green concept is more developed.

Cargo Bike Market Trend Analysis:

Integration of Electric Assist (E-Cargo Bikes)

-

Electric-assist cargo bikes, also known as e-cargo bikes, have perhaps been the biggest revolution in the cargo bike market. These bicycles are a modification of the conventional cargo bicycles, but loaded with electric motors to boost their performance, speed and ease of operation.

-

The e-cargo bikes as such will be more useful for the commerial purposes like the last mile deliveries since they are capable of taking longer trips and can accommodate greater load without too much human exertion being exerted. Furthermore, they also reach longer distances with quicker charging, which also fits well into the requirements of urban delivery companies. The usage of e-cargo bikes is expected to increase even more as firms seek more sustainable solutions and lower expenses for delivery.

Urban Logistics Revolution

-

The market of cargo bikes itself has great potential for the supply chain in urban areas. As cities of the world implement changes to emissions and restricted entry into city centers, cargo bikes are an ideal solution to last mile deliveries.

-

Logistics firms have shifted to the use of Cargobikes since they are environmentally friendly and maneuver well in any small city streets or pedestrian areas. This opportunity is further boosted by the increased use of e-commerce which increases the need for efficient, cheap and environmentally friendly delivering methods. Amsterdam, London, and Paris are already large markets that are seeing high levels of take-up and this client base is expected to increase as urban populations rise in other world cities.

Cargo Bike Market Segment Analysis:

Cargo Bike Market is Segmented on the basis of Product Type, Application, Battery Type, End User, and Region.

By Product Type, Two-Wheeled Cargo Bikes segment is expected to dominate the market during the forecast period

-

Two-Wheeled Cargo Bikes: These are the lightest and most popular cargo bikes appropriate for use in the urban setting and for midsize loads. Small cars and delivery vehicles are the most frequent users of such systems.

-

Three-Wheeled and Four-Wheeled Cargo Bikes: These types of bikes provide superior stability and also capable to carry higher payload due to which ideal for large volume transport. Their design is uniquely advantageous for those businesses that need significant storage or stop frequently, including grocery delivery or mobile vending.

By Application, Personal Transportation segment expected to held the largest share

-

Personal Transportation are now gaining acceptance among families and individuals for clean and efficient urban mobility. They are widely utilized for toting kids, purchase groceries, or fun gadgets.

-

Companies and logistics startups have shifted to using cargo bikes for better first-and-last-mile operations and service purposes. Succesful in traversing the complexities of urban environments and hence they are ideal for compnaies who want efficiency and sustainability.

Cargo Bike Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

-

Europe holds the largest share of the cargo bike market due to the high intensiveness of cycling culture, liberal policies as well as the availability of cycling infrastructure in the region. Norway, Sweden, Denmark, Germany and the Netherlands are among the most active users of this form of social media with both humans as well as companies.

-

The passion of the European Union when it comes to lowering the levels of emission of greenhouses and improving urban mobility has boosted the uptake of cargo bikes even further. Many cities in Europe are acquiring cargo bicycles and this shows that the region is the most advanced in the market.

Active Key Players in the Cargo Bike Market:

- Urban Arrow (Netherlands)

- Tern Bicycles (Taiwan)

- Xtracycle Inc. (USA)

- Riese & Müller (Germany)

- Babboe (Netherlands)

- Larry vs Harry (Denmark)

- Butchers & Bicycles (Denmark)

- Yuba Cargo Bikes (USA)

- Douze Cycles (France)

- Rad Power Bikes (USA)

- Nihola (Denmark)

- CERO Bikes (USA)

- Other Active Players

Key Industry Developments in the Cargo Bike Market:

-

In October 2024, Busy Bee EV Ltd launched new electric cargo bikes designed to transform last-mile deliveries. These eco-friendly bikes are equipped with interchangeable cargo pods and real-time tracking, suitable for all weather conditions. Additional features include safety upgrades like proximity detectors and a more comfortable ergonomic seat.

-

In June 2024, Tern launched the Quick Haul Long, the latest evolution of its compact cargo bike series. This new model is designed for practicality and versatility, offering a longer wheelbase and increased cargo capacity. The Quick Haul Long can carry up to 200 kg of cargo and is compatible with various accessories to adapt to different needs, from family transport to deliveries. It combines utility with an eco-friendly, space-saving design.

(Source: https://www.ashapura.com/)

|

Global Cargo Bike Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 3.50 Billion |

|

Forecast Period 2025-32 CAGR: |

3.12% |

Market Size in 2032: |

USD 4.35 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Battery Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cargo Bike Market by Product Type

4.1 Cargo Bike Market Snapshot and Growth Engine

4.2 Cargo Bike Market Overview

4.3 Two-Wheeled Cargo Bikes

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Two-Wheeled Cargo Bikes: Geographic Segmentation Analysis

4.4 Three-Wheeled Cargo Bikes

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Three-Wheeled Cargo Bikes: Geographic Segmentation Analysis

4.5 Four-Wheeled Cargo Bikes

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Four-Wheeled Cargo Bikes: Geographic Segmentation Analysis

Chapter 5: Cargo Bike Market by Application

5.1 Cargo Bike Market Snapshot and Growth Engine

5.2 Cargo Bike Market Overview

5.3 Personal Transportation

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Personal Transportation: Geographic Segmentation Analysis

5.4 Large-Scale Cargo Transportation

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Large-Scale Cargo Transportation: Geographic Segmentation Analysis

5.5 Service Delivery

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Service Delivery: Geographic Segmentation Analysis

Chapter 6: Cargo Bike Market by Battery Type

6.1 Cargo Bike Market Snapshot and Growth Engine

6.2 Cargo Bike Market Overview

6.3 Lithium-Ion Battery

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Lithium-Ion Battery: Geographic Segmentation Analysis

6.4 Nickel-Metal Hydride (NiMH) Battery

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Nickel-Metal Hydride (NiMH) Battery: Geographic Segmentation Analysis

6.5 Lead-Acid Battery

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Lead-Acid Battery: Geographic Segmentation Analysis

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Geographic Segmentation Analysis

Chapter 7: Cargo Bike Market by End User

7.1 Cargo Bike Market Snapshot and Growth Engine

7.2 Cargo Bike Market Overview

7.3 Courier and Parcel Services

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Courier and Parcel Services: Geographic Segmentation Analysis

7.4 Retail Sector

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Retail Sector: Geographic Segmentation Analysis

7.5 Municipal Services

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Municipal Services: Geographic Segmentation Analysis

7.6 Others

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Others: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Cargo Bike Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 URBAN ARROW (NETHERLANDS)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 TERN BICYCLES (TAIWAN)

8.4 XTRACYCLE INC. (USA)

8.5 RIESE & MÜLLER (GERMANY)

8.6 BABBOE (NETHERLANDS)

8.7 LARRY VS HARRY (DENMARK)

8.8 BUTCHERS & BICYCLES (DENMARK)

8.9 YUBA CARGO BIKES (USA)

8.10 DOUZE CYCLES (FRANCE)

8.11 RAD POWER BIKES (USA)

8.12 NIHOLA (DENMARK)

8.13 CERO BIKES (USA)

8.14

8.15 OTHER ACTIVE PLAYERS

Chapter 9: Global Cargo Bike Market By Region

9.1 Overview

9.2. North America Cargo Bike Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Product Type

9.2.4.1 Two-Wheeled Cargo Bikes

9.2.4.2 Three-Wheeled Cargo Bikes

9.2.4.3 Four-Wheeled Cargo Bikes

9.2.5 Historic and Forecasted Market Size By Application

9.2.5.1 Personal Transportation

9.2.5.2 Large-Scale Cargo Transportation

9.2.5.3 Service Delivery

9.2.6 Historic and Forecasted Market Size By Battery Type

9.2.6.1 Lithium-Ion Battery

9.2.6.2 Nickel-Metal Hydride (NiMH) Battery

9.2.6.3 Lead-Acid Battery

9.2.6.4 Others

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Courier and Parcel Services

9.2.7.2 Retail Sector

9.2.7.3 Municipal Services

9.2.7.4 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Cargo Bike Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Product Type

9.3.4.1 Two-Wheeled Cargo Bikes

9.3.4.2 Three-Wheeled Cargo Bikes

9.3.4.3 Four-Wheeled Cargo Bikes

9.3.5 Historic and Forecasted Market Size By Application

9.3.5.1 Personal Transportation

9.3.5.2 Large-Scale Cargo Transportation

9.3.5.3 Service Delivery

9.3.6 Historic and Forecasted Market Size By Battery Type

9.3.6.1 Lithium-Ion Battery

9.3.6.2 Nickel-Metal Hydride (NiMH) Battery

9.3.6.3 Lead-Acid Battery

9.3.6.4 Others

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Courier and Parcel Services

9.3.7.2 Retail Sector

9.3.7.3 Municipal Services

9.3.7.4 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Cargo Bike Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Product Type

9.4.4.1 Two-Wheeled Cargo Bikes

9.4.4.2 Three-Wheeled Cargo Bikes

9.4.4.3 Four-Wheeled Cargo Bikes

9.4.5 Historic and Forecasted Market Size By Application

9.4.5.1 Personal Transportation

9.4.5.2 Large-Scale Cargo Transportation

9.4.5.3 Service Delivery

9.4.6 Historic and Forecasted Market Size By Battery Type

9.4.6.1 Lithium-Ion Battery

9.4.6.2 Nickel-Metal Hydride (NiMH) Battery

9.4.6.3 Lead-Acid Battery

9.4.6.4 Others

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Courier and Parcel Services

9.4.7.2 Retail Sector

9.4.7.3 Municipal Services

9.4.7.4 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Cargo Bike Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Product Type

9.5.4.1 Two-Wheeled Cargo Bikes

9.5.4.2 Three-Wheeled Cargo Bikes

9.5.4.3 Four-Wheeled Cargo Bikes

9.5.5 Historic and Forecasted Market Size By Application

9.5.5.1 Personal Transportation

9.5.5.2 Large-Scale Cargo Transportation

9.5.5.3 Service Delivery

9.5.6 Historic and Forecasted Market Size By Battery Type

9.5.6.1 Lithium-Ion Battery

9.5.6.2 Nickel-Metal Hydride (NiMH) Battery

9.5.6.3 Lead-Acid Battery

9.5.6.4 Others

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Courier and Parcel Services

9.5.7.2 Retail Sector

9.5.7.3 Municipal Services

9.5.7.4 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Cargo Bike Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Product Type

9.6.4.1 Two-Wheeled Cargo Bikes

9.6.4.2 Three-Wheeled Cargo Bikes

9.6.4.3 Four-Wheeled Cargo Bikes

9.6.5 Historic and Forecasted Market Size By Application

9.6.5.1 Personal Transportation

9.6.5.2 Large-Scale Cargo Transportation

9.6.5.3 Service Delivery

9.6.6 Historic and Forecasted Market Size By Battery Type

9.6.6.1 Lithium-Ion Battery

9.6.6.2 Nickel-Metal Hydride (NiMH) Battery

9.6.6.3 Lead-Acid Battery

9.6.6.4 Others

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Courier and Parcel Services

9.6.7.2 Retail Sector

9.6.7.3 Municipal Services

9.6.7.4 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Cargo Bike Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Product Type

9.7.4.1 Two-Wheeled Cargo Bikes

9.7.4.2 Three-Wheeled Cargo Bikes

9.7.4.3 Four-Wheeled Cargo Bikes

9.7.5 Historic and Forecasted Market Size By Application

9.7.5.1 Personal Transportation

9.7.5.2 Large-Scale Cargo Transportation

9.7.5.3 Service Delivery

9.7.6 Historic and Forecasted Market Size By Battery Type

9.7.6.1 Lithium-Ion Battery

9.7.6.2 Nickel-Metal Hydride (NiMH) Battery

9.7.6.3 Lead-Acid Battery

9.7.6.4 Others

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Courier and Parcel Services

9.7.7.2 Retail Sector

9.7.7.3 Municipal Services

9.7.7.4 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Cargo Bike Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 3.50 Billion |

|

Forecast Period 2025-32 CAGR: |

3.12% |

Market Size in 2032: |

USD 4.35 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Battery Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||