Candles Market Synopsis

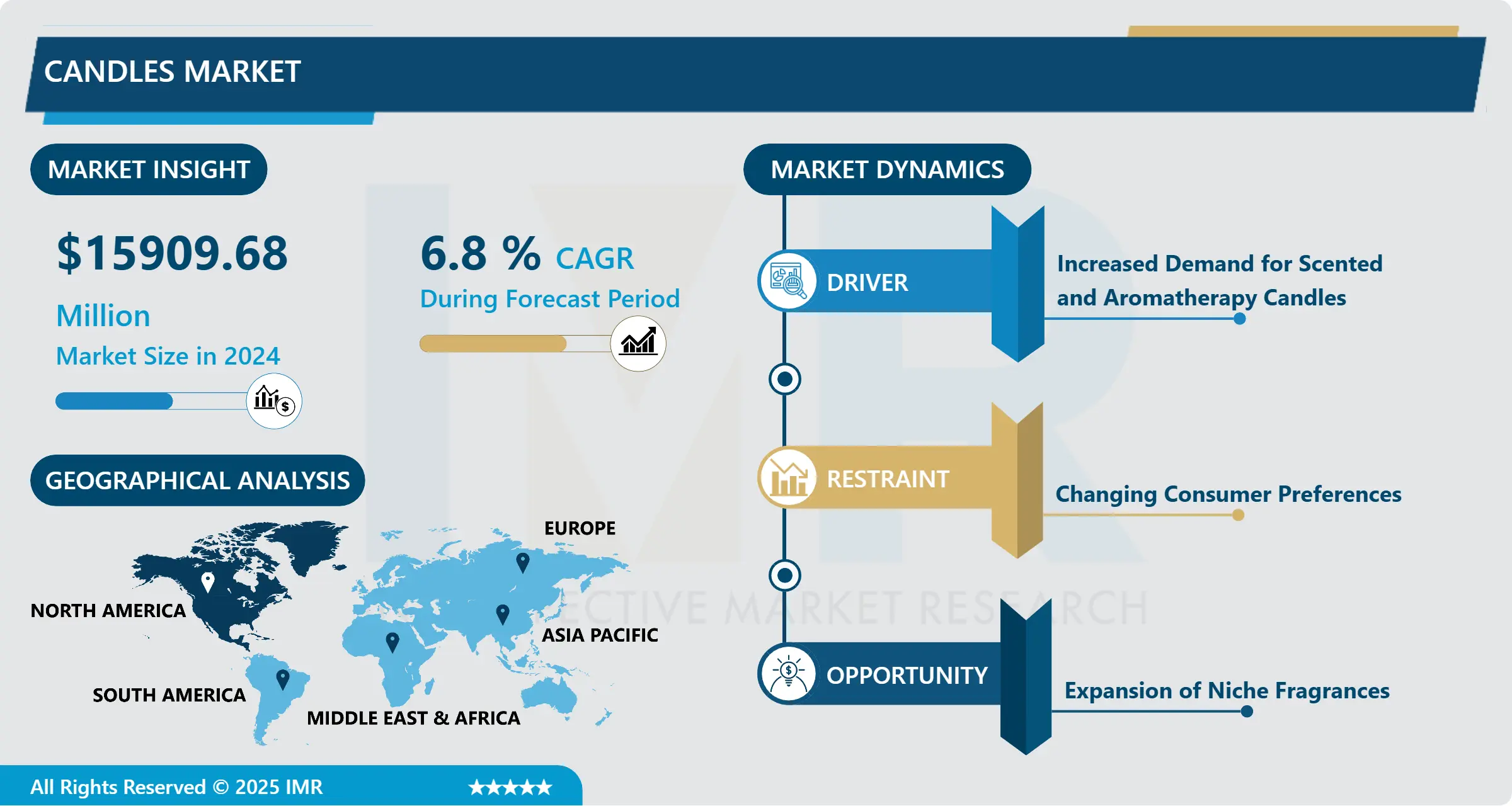

Candles Market Size Was Valued at USD 15909.68 Million in 2024, and is Projected to Reach USD 26929.69 Million by 2032, Growing at a CAGR of 6.8% From 2025-2032.

A candle is an ignitable wick embedded in wax, or another flammable solid substance such as tallow, that provides light, and in some cases, a fragrance. A candle can also provide heat, or be used as a method of keeping time. The candle can be used during the event of a power outage to provide light.

Candles are typically composed of paraffin wax, a colourless wax obtained from petroleum oil and coal shales. Candles are typically utilized for ornamentation in various settings, occasions, and celebrations like Diwali, Christmas, weddings, and the widely enjoyed candlelit dinners. Different types of candles are now on the market to cater to customer preferences, including coloured and shaped candles, scented candles, and candles with designer holders.

Consumers are now purchasing candles to uphold a healthy lifestyle. Having burning candles provides important health advantages by promoting a calm mind, refreshing moods, and facilitating a restful sleep. Increase in widespread use of candles in everyday life is a major factor driving the growth of the candle market. The candle industry offers a wide variety of products that serve both practical and aesthetic purposes, meeting consumer demand for creating a cozy atmosphere, enjoying pleasant scents, and enhancing home décor.

Candles come in different sizes, shapes, scents, and styles, providing a flexible option for customizing the ambiance in residences, workplaces, and public areas. The use of candles in therapy has become increasingly popular for its ability to alleviate back pain, osteoarthritis, headache, and anxiety. In the same way, upscale restaurants and dining establishments have been utilizing high-end candles more and more to establish a lovely and fragrant atmosphere for their patrons. Furthermore, candles hold significant importance in various events such as celebrations, religious rituals, gatherings, and festivals.

Candles Market Trend Analysis

Candles Market Growth Drivers- Increased Demand for Scented and Aromatherapy Candles

- Consumers look for aromatherapy candles to gain health advantages such as alleviating stress, boosting mood, and enhancing sleep using fragrances such as lavender, eucalyptus, and chamomile. The wellness trend emphasizes mindfulness and relaxation, leading to a higher demand for candles that help create a peaceful atmosphere at home. This has been especially noticeable amidst the pandemic. Brands are incorporating a wider range of scents, such as exotic and intricate fragrances, to attract a variety of consumer tastes beyond floral and fruity options.

- Growing interest in candles that have specific scents associated with health benefits aimed at boosting energy, improving focus, and inducing relaxation for customers. Consumers are looking for scented candles containing natural, high-quality ingredients such as essential oils, soy or beeswax, and non-toxic wicks, and are willing to spend extra money for them. Luxurious candles from well-known brands such as Jo Malone and Diptyque enhance the visual appeal of a space while also serving as practical items and decorative accents.

- Seasonal scents like pumpkin spice in autumn and peppermint in winter, which are only available for a short time, boost sales by eliciting a sense of exclusivity and necessity. Themed candles extend beyond just holidays, incorporating collections influenced by feelings, locations, or events, packaged and marketed in a unique way. Consumers are more frequently choosing aromatherapy candles made from natural, renewable materials such as soy, beeswax, and coconut wax because of a greater understanding of sustainability and health advantages compared to paraffin.

Candles Market Opportunity- Expansion of Niche Fragrances

- Specialized scents enable candle manufacturers to distinguish their products in a crowded market full of identical options. Businesses can differentiate themselves and appeal to customers looking for personalized options by providing special artisanal blends. Consumers are currently seeking experiences and products that showcase their uniqueness. Specialized perfumes cater to this longing, offering a feeling of uniqueness and opulence. These clients are frequently prepared to spend extra for exclusive and high-quality fragrances.

- Specialized scents effectively cater to specific target markets. Candles with unique aromas are attractive to those who enjoy exploring new experiences or have a preference for specialized interests. Customers develop brand loyalty to niche fragrances by discovering unique scents that they enjoy, leading them to come back for that particular experience. Niche perfumes cater to profitable gifting sector, providing one-of-a-kind and customized presents.

- Investigating unique fragrances leads to creativity, establishing fresh product ranges and classification, sparking enthusiasm in the industry and generating excitement. Incorporating cultural aspects or narratives into specialized fragrances cultivates emotional connections with customers, transforming products into more than just commodities. Candle manufacturers focus on sourcing ethically and sustainably to match consumer values and brand identity.

Candles Market Segment Analysis:

Candles Market is segmented on the basis of Type, Raw Material, Fragrance, Distribution Channel, End-User, and Region.

By Type, Votive candles Segment Is Expected to Dominate the Market During the Forecast Period

- Votive candles are multifunctional because of their compact size, making them ideal for religious rituals, setting a mood, aromatherapy, and enhancing home aesthetics. They have the ability to be used in a variety of candle holders, which makes them versatile. Votive candles are well-liked for their steady, prolonged burn time, outlasting standard candles, offering economical, effective illumination. Hours of burning duration.

- Votive candles, featuring distinct patterns and frosted glass containers, bring a decorative element to rooms, increasing their appeal with their pleasing aesthetics. Votive candles play a significant role in both culture and spirituality, especially within the Catholic faith, resulting in a steady increase in demand and market expansion. Votive candles cater to various markets, including religious, home decor, and events. Their widespread influence allows them to control the candle market.

- Affordable pricing of votive candles appeals to a wide range of customers, leading to higher sales from both repeat purchases and bulk orders. Votive candles are readily available in a variety of retail stores and online outlets because they are favoured by consumers. Candle brands are adding votives to their product lines, which allows for a wide range of fragrances to be explored with little need for production adjustments, leading to a diverse selection of votive candles.

By Fragrance, Scented Candles Segment Held the Largest Share in 2024

- Scented candles are used not only for their pleasant scents but also for their capacity to elevate moods and promote well-being. Candles with scents can be utilized in both households and businesses. The demand for scented candles in the residential sector has been fuelled by increased home remodelling and design projects. Businesses such as spas regularly utilize scented candles because of their therapeutic qualities.

- Scented candles are utilized in retail establishments to give clients a unique and enjoyable shopping experience. They enhance the air quality, and improve the shop's ambiance. Scented candles can also be used as a marketing tool to advertise goods and services. For example, a retailer might promote its summer sales using a citrus-scented candle. People from all around the world are turning toward the use of eco-friendly candles due to growing environmental concerns.

- Additionally, there has been a significant increase in the use of candles for house decoration. These elements produce significant sales opportunities for businesses engaged in the global scented candle market. Scents and packaging are regularly refreshed to maintain the attractiveness of products. Innovative packaging improves the attractiveness of a gift. Growing consumer interest in environmentally conscious candles created with natural components such as soy wax and essential oils is driving up demand.

- In 2023, vanilla led the scented candle market worldwide with 11% share, followed closely by citrus/lemon at 10%, rose and lavender tied at 8% each, and pumpkin at 7%. Other popular scents included coconut and cranberry, each holding 4% of the market. The remaining 48% was distributed among various other scents. Overall, the scented candle market experienced steady growth and expansion, with consumers showing increasing interest in a diverse range of fragrances.

Candles Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- Candles are highly sought-after during holidays like Christmas, Halloween, and Thanksgiving for decorating homes and giving as gifts. The popularity of using candles to create a cozy atmosphere in North America has grown, as consumers are purchasing them for their visual appeal. Famous candle brands such as Yankee Candle, Bath & Body Works, and Colonial Candle have established strong brand loyalty and distribution networks in North America. Continual advancements in scents, packaging, and items uphold consumer engagement and boost recurring purchases.

- The rise in interest in self-care has resulted in a surge in the demand for scented candles, particularly aromatherapy candles, promoted for their ability to promote relaxation and alleviate stress. In North America, candles are a popular option for gifts, leading to consistent sales throughout the year. North American candle companies use partnerships with influencers and celebrities, seasonal deals, and exclusive collections to boost brand recognition and attract consumer attention.

- Consumers in North America with more money to spend have convenient access to scented and decorative candles at big retail stores, specialty shops, and online websites. Prominent candle companies in North America make use of wide-ranging retail channels like department stores, specialty stores, and online platforms, in addition to selling directly to consumers through their websites for tailored shopping experiences. Candle brands in North America provide a variety of options including scented, unscented, votive, pillar, jar, and specialty candles to meet consumer preferences. Certain businesses also provide personalization for specific target markets and special events.

Candles Market Active Players

- Yankee Candle Company (USA)

- Bath & Body Works Direct, Inc. (USA)

- Colonial Candle (USA)

- NEST Fragrances, LLC (USA)

- Jo Malone London (UK)

- Diptyque S.A.S. (France)

- Circle E Candles (USA)

- Bridgewater Candle Company (USA)

- Better Homes & Gardens (USA)

- SC Johnson & Son Inc. (USA)

- Candle-lite (USA)

- Empire Candle (USA)

- Dianne's Custom Candles (USA)

- Dandong Evenlight Candle Industry Co. Ltd. (China)

- ZHONG Nam Industrial (International) Co. Ltd. (China)

- BeCandle (China)

- Armadilla Wax Works (USA)

- Village Candle (USA)

- Slatkin & Co. (USA)

- Thymes (USA)

- White Barn Candle Co. (USA)

- Trudon (France)

- Le Labo (USA)

- Conscious Candle Company (USA)

- Contract Candles & Diffusers Ltd. (UK)

- Ellis Brooklyn (USA) and Other Active Players.

Key Industry Developments in the Candles Market:

- In March 2024, Bath & Body Works and Netflix join forces to bring fragrance and beloved stories to life for consumers and fans. Get comfy, light a candle and prepare to press play on one of the most sensorial and highly-anticipated partnerships of the year, brought to you by the makers of your favourite scents and entertainment. Bath & Body Works announced a yearlong partnership with leading streaming service, Netflix, to bring award-winning storytelling to life through the power of fragrance in the first collaboration of its kind for the brand.

|

Global Candles Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 15909.68 Million |

|

Forecast Period 2024-32 CAGR: |

6.8 % |

Market Size in 2032: |

USD 26929.69 Million |

|

Segments Covered: |

By Type |

|

|

|

By Raw Material |

|

||

|

By Fragrance |

|

||

|

By Distribution Channel |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Candles Market by Type (2018-2032)

4.1 Candles Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Pillar Candles

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Votive Candles

4.5 Container Candles

4.6 Taper Candles

4.7 Floating Candles

4.8 Others {Tea Light Candle

4.9 Speciality Candle

4.10 Cartridge Candle

4.11 Birthday Candle}

Chapter 5: Candles Market by Raw Material (2018-2032)

5.1 Candles Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Paraffin Wax

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Soy Wax

5.5 Paraffin Wax

5.6 Palm Wax

5.7 Gel Wax

5.8 Others {such as stearic acid-based or gel-based candles}

Chapter 6: Candles Market by Fragrance (2018-2032)

6.1 Candles Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Scented Candles

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Unscented Candles

Chapter 7: Candles Market by Distribution Channel (2018-2032)

7.1 Candles Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Supermarket and Hypermarket

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Gift Shops

7.5 Department or home decor stores

7.6 Mass Merchandise Retailers

7.7 Convenience Stores

7.8 Online Retails

Chapter 8: Candles Market by End-User (2018-2032)

8.1 Candles Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Household

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Commercial

8.5 Hospitality Industry

8.6 Special Events

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Candles Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 YANKEE CANDLE COMPANY (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 BATH & BODY WORKS DIRECT INC. (USA)

9.4 COLONIAL CANDLE (USA)

9.5 NEST FRAGRANCES

9.6 LLC (USA)

9.7 JO MALONE LONDON (UK)

9.8 DIPTYQUE S.A.S. (FRANCE)

9.9 CIRCLE E CANDLES (USA)

9.10 BRIDGEWATER CANDLE COMPANY (USA)

9.11 BETTER HOMES & GARDENS (USA)

9.12 SC JOHNSON & SON INC. (USA)

9.13 CANDLE-LITE (USA)

9.14 EMPIRE CANDLE (USA)

9.15 DIANNE'S CUSTOM CANDLES (USA)

9.16 DANDONG EVENLIGHT CANDLE INDUSTRY CO. LTD. (CHINA)

9.17 ZHONG NAM INDUSTRIAL (INTERNATIONAL) CO. LTD. (CHINA)

9.18 BECANDLE (CHINA)

9.19 ARMADILLA WAX WORKS (USA)

9.20 VILLAGE CANDLE (USA)

9.21 SLATKIN & CO. (USA)

9.22 THYMES (USA)

9.23 WHITE BARN CANDLE CO. (USA)

9.24 TRUDON (FRANCE)

9.25 LE LABO (USA)

9.26 CONSCIOUS CANDLE COMPANY (USA)

9.27 CONTRACT CANDLES & DIFFUSERS LTD. (UK)

9.28 ELLIS BROOKLYN (USA)

Chapter 10: Global Candles Market By Region

10.1 Overview

10.2. North America Candles Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Pillar Candles

10.2.4.2 Votive Candles

10.2.4.3 Container Candles

10.2.4.4 Taper Candles

10.2.4.5 Floating Candles

10.2.4.6 Others {Tea Light Candle

10.2.4.7 Speciality Candle

10.2.4.8 Cartridge Candle

10.2.4.9 Birthday Candle}

10.2.5 Historic and Forecasted Market Size by Raw Material

10.2.5.1 Paraffin Wax

10.2.5.2 Soy Wax

10.2.5.3 Paraffin Wax

10.2.5.4 Palm Wax

10.2.5.5 Gel Wax

10.2.5.6 Others {such as stearic acid-based or gel-based candles}

10.2.6 Historic and Forecasted Market Size by Fragrance

10.2.6.1 Scented Candles

10.2.6.2 Unscented Candles

10.2.7 Historic and Forecasted Market Size by Distribution Channel

10.2.7.1 Supermarket and Hypermarket

10.2.7.2 Gift Shops

10.2.7.3 Department or home decor stores

10.2.7.4 Mass Merchandise Retailers

10.2.7.5 Convenience Stores

10.2.7.6 Online Retails

10.2.8 Historic and Forecasted Market Size by End-User

10.2.8.1 Household

10.2.8.2 Commercial

10.2.8.3 Hospitality Industry

10.2.8.4 Special Events

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Candles Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Pillar Candles

10.3.4.2 Votive Candles

10.3.4.3 Container Candles

10.3.4.4 Taper Candles

10.3.4.5 Floating Candles

10.3.4.6 Others {Tea Light Candle

10.3.4.7 Speciality Candle

10.3.4.8 Cartridge Candle

10.3.4.9 Birthday Candle}

10.3.5 Historic and Forecasted Market Size by Raw Material

10.3.5.1 Paraffin Wax

10.3.5.2 Soy Wax

10.3.5.3 Paraffin Wax

10.3.5.4 Palm Wax

10.3.5.5 Gel Wax

10.3.5.6 Others {such as stearic acid-based or gel-based candles}

10.3.6 Historic and Forecasted Market Size by Fragrance

10.3.6.1 Scented Candles

10.3.6.2 Unscented Candles

10.3.7 Historic and Forecasted Market Size by Distribution Channel

10.3.7.1 Supermarket and Hypermarket

10.3.7.2 Gift Shops

10.3.7.3 Department or home decor stores

10.3.7.4 Mass Merchandise Retailers

10.3.7.5 Convenience Stores

10.3.7.6 Online Retails

10.3.8 Historic and Forecasted Market Size by End-User

10.3.8.1 Household

10.3.8.2 Commercial

10.3.8.3 Hospitality Industry

10.3.8.4 Special Events

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Candles Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Pillar Candles

10.4.4.2 Votive Candles

10.4.4.3 Container Candles

10.4.4.4 Taper Candles

10.4.4.5 Floating Candles

10.4.4.6 Others {Tea Light Candle

10.4.4.7 Speciality Candle

10.4.4.8 Cartridge Candle

10.4.4.9 Birthday Candle}

10.4.5 Historic and Forecasted Market Size by Raw Material

10.4.5.1 Paraffin Wax

10.4.5.2 Soy Wax

10.4.5.3 Paraffin Wax

10.4.5.4 Palm Wax

10.4.5.5 Gel Wax

10.4.5.6 Others {such as stearic acid-based or gel-based candles}

10.4.6 Historic and Forecasted Market Size by Fragrance

10.4.6.1 Scented Candles

10.4.6.2 Unscented Candles

10.4.7 Historic and Forecasted Market Size by Distribution Channel

10.4.7.1 Supermarket and Hypermarket

10.4.7.2 Gift Shops

10.4.7.3 Department or home decor stores

10.4.7.4 Mass Merchandise Retailers

10.4.7.5 Convenience Stores

10.4.7.6 Online Retails

10.4.8 Historic and Forecasted Market Size by End-User

10.4.8.1 Household

10.4.8.2 Commercial

10.4.8.3 Hospitality Industry

10.4.8.4 Special Events

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Candles Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Pillar Candles

10.5.4.2 Votive Candles

10.5.4.3 Container Candles

10.5.4.4 Taper Candles

10.5.4.5 Floating Candles

10.5.4.6 Others {Tea Light Candle

10.5.4.7 Speciality Candle

10.5.4.8 Cartridge Candle

10.5.4.9 Birthday Candle}

10.5.5 Historic and Forecasted Market Size by Raw Material

10.5.5.1 Paraffin Wax

10.5.5.2 Soy Wax

10.5.5.3 Paraffin Wax

10.5.5.4 Palm Wax

10.5.5.5 Gel Wax

10.5.5.6 Others {such as stearic acid-based or gel-based candles}

10.5.6 Historic and Forecasted Market Size by Fragrance

10.5.6.1 Scented Candles

10.5.6.2 Unscented Candles

10.5.7 Historic and Forecasted Market Size by Distribution Channel

10.5.7.1 Supermarket and Hypermarket

10.5.7.2 Gift Shops

10.5.7.3 Department or home decor stores

10.5.7.4 Mass Merchandise Retailers

10.5.7.5 Convenience Stores

10.5.7.6 Online Retails

10.5.8 Historic and Forecasted Market Size by End-User

10.5.8.1 Household

10.5.8.2 Commercial

10.5.8.3 Hospitality Industry

10.5.8.4 Special Events

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Candles Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Pillar Candles

10.6.4.2 Votive Candles

10.6.4.3 Container Candles

10.6.4.4 Taper Candles

10.6.4.5 Floating Candles

10.6.4.6 Others {Tea Light Candle

10.6.4.7 Speciality Candle

10.6.4.8 Cartridge Candle

10.6.4.9 Birthday Candle}

10.6.5 Historic and Forecasted Market Size by Raw Material

10.6.5.1 Paraffin Wax

10.6.5.2 Soy Wax

10.6.5.3 Paraffin Wax

10.6.5.4 Palm Wax

10.6.5.5 Gel Wax

10.6.5.6 Others {such as stearic acid-based or gel-based candles}

10.6.6 Historic and Forecasted Market Size by Fragrance

10.6.6.1 Scented Candles

10.6.6.2 Unscented Candles

10.6.7 Historic and Forecasted Market Size by Distribution Channel

10.6.7.1 Supermarket and Hypermarket

10.6.7.2 Gift Shops

10.6.7.3 Department or home decor stores

10.6.7.4 Mass Merchandise Retailers

10.6.7.5 Convenience Stores

10.6.7.6 Online Retails

10.6.8 Historic and Forecasted Market Size by End-User

10.6.8.1 Household

10.6.8.2 Commercial

10.6.8.3 Hospitality Industry

10.6.8.4 Special Events

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Candles Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Pillar Candles

10.7.4.2 Votive Candles

10.7.4.3 Container Candles

10.7.4.4 Taper Candles

10.7.4.5 Floating Candles

10.7.4.6 Others {Tea Light Candle

10.7.4.7 Speciality Candle

10.7.4.8 Cartridge Candle

10.7.4.9 Birthday Candle}

10.7.5 Historic and Forecasted Market Size by Raw Material

10.7.5.1 Paraffin Wax

10.7.5.2 Soy Wax

10.7.5.3 Paraffin Wax

10.7.5.4 Palm Wax

10.7.5.5 Gel Wax

10.7.5.6 Others {such as stearic acid-based or gel-based candles}

10.7.6 Historic and Forecasted Market Size by Fragrance

10.7.6.1 Scented Candles

10.7.6.2 Unscented Candles

10.7.7 Historic and Forecasted Market Size by Distribution Channel

10.7.7.1 Supermarket and Hypermarket

10.7.7.2 Gift Shops

10.7.7.3 Department or home decor stores

10.7.7.4 Mass Merchandise Retailers

10.7.7.5 Convenience Stores

10.7.7.6 Online Retails

10.7.8 Historic and Forecasted Market Size by End-User

10.7.8.1 Household

10.7.8.2 Commercial

10.7.8.3 Hospitality Industry

10.7.8.4 Special Events

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Candles Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 15909.68 Million |

|

Forecast Period 2024-32 CAGR: |

6.8 % |

Market Size in 2032: |

USD 26929.69 Million |

|

Segments Covered: |

By Type |

|

|

|

By Raw Material |

|

||

|

By Fragrance |

|

||

|

By Distribution Channel |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||