Cancer Vaccine Market Synopsis:

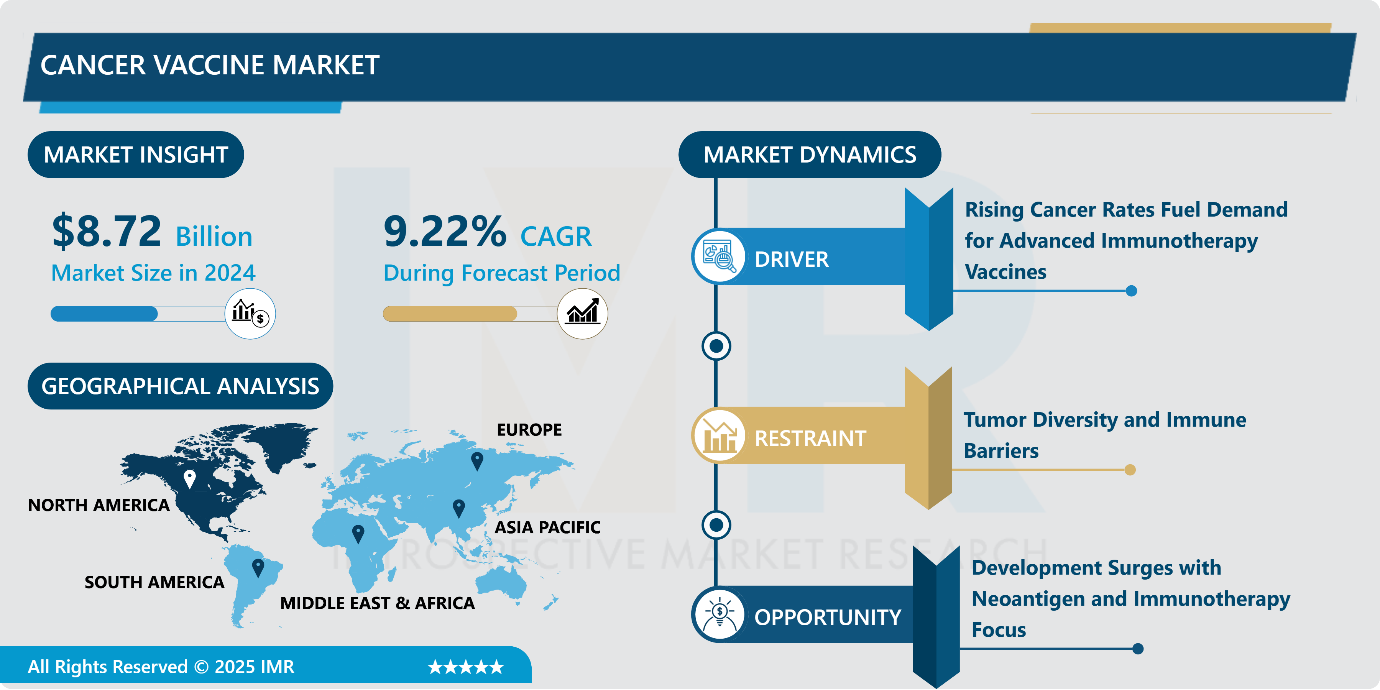

The Cancer Vaccine Market Size Was Valued at USD 8.72 Billion in 2024 and is Projected to Reach USD 17.66 Billion by 2032, Growing at a CAGR of 9.22% From 2025 to 2032.

The therapeutic cancer vaccine functions as a treatment method that provides immune system training by exposing patients to antigens that signify cancer to allow immune destruction. These vaccines function to combat cancer directly after its occurrence due to their primary purpose is to fight tumor growth destroy residual malignant cells and prevent disease rebound. These treatments activate immune system responses against cancer cells yet leverage checkpoint inhibitors with them to reach superior effectiveness results.

The worldwide growth of the cancer vaccine market advances primarily due to breakthrough advancements in immunotherapy and biotech advancements. New cancer medications discovered among immune checkpoint inhibitors and adoptive cell therapies together with other immunotherapeutic strategies have transformed cancer therapy by creating innovative vaccines that activate immune cells to attack oncolytic cells. The increased efficiency and precision of cancer vaccines which are now used worldwide result from recent technological developments.

Cancer Vaccine Market Growth and Trend Analysis:

Rising Cancer Rates Fuel Demand for Advanced Immunotherapy Vaccines

- The projected rise in global cancer cases to over 35 million by 2050 is fueling the expansion of the global cancer vaccine market. The rising cancer incidence of 77% over 2022 intensifies the need for forward-thinking preventive measures and treatment solutions due to population demographics continuing to increase and environmental factors along with lifestyle choices.

- The ongoing increase in cancer-related exposure to tobacco and alcohol and obesity and air pollution risks stimulates intensive cancer vaccine research through the development sector. The drug and biotechnology sector now focuses its investment on immunotherapy-based vaccines to improve both vaccines as prevention tools and immunotherapy treatments.

- The global cancer vaccine market will experience substantial growth due to advances in mRNA technology personalized cancer vaccine development and enhanced support from both public and private entities. Worldwide cancer burden increases will establish vaccines as essential tools to lower incidence statistics and enhance survival outcomes, especially in regions unable to access standard cancer therapies.

Tumor Diversity and Immune Barriers

- The global vaccine market faces several challenges that hinder the rapid development and deployment of vaccines. One major obstacle is vaccine hesitancy, fueled by misinformation and skepticism, particularly concerning mRNA vaccines, which impacts immunization efforts globally. The development of cancer vaccines remains complex due to tumor heterogeneity, difficulties in identifying suitable tumor-specific antigens, and the immunosuppressive tumor microenvironment, which limits vaccine efficacy.

Development Surges with Neoantigen and Immunotherapy Focus

- The global vaccine market is experiencing significant transformations driven by technological advancements and evolving healthcare demands. The vaccine approval process received regulatory support through updated frameworks that introduced speedier approval methods to establish new commercialization practices. The field of cancer vaccines shows growing interest in tumor-associated antigens and neoantigen-targeting technology due to increased investment in oncology immunotherapy.

High Development Costs and Complex Clinical Trials Slow Market Progress

- The global cancer vaccine market faces significant challenges due to the high costs and lengthy timelines involved in vaccine research, development, and clinical trials. Designing vaccines that effectively target diverse and rapidly mutating cancer cells adds scientific complexity, often leading to trial failures or extended approval periods.

Cancer Vaccine Market Segment Analysis:

Cancer Vaccine Market is segmented based on type, technology, indication, distribution channel, and region

By Type, Preventive segment is expected to dominate the market during the forecast period

- Preventive cancer vaccines are increasingly recognized as a vital part of global cancer prevention efforts, aligning with the broader goal of reducing the cancer burden. Preventive measures which include vaccines provide a potent and affordable solution to address the 30-50% of cancer cases that are avoidable.

- The WHO emphasizes targeted interventions with vaccines as a fundamental strategy to decrease premature mortality according to their Global Action Plan for the Prevention and Control of Noncommunicable Diseases (NCDs). The preventive measures brought by vaccination ensure protection through hepatitis B (HBV) and human papillomavirus (HPV) immunizations. The vaccines lower the incidence of cancer from HBV-caused liver cancer and HPV-caused cervical cancer.

- The prevention of infectious agents leading to cancer serves as an important strategy against cancer development that benefits people living in low- and middle-income countries with the highest cancer burdens. Cancer prevention vaccines have established themselves as significant global healthcare components due to their increasing popularity. Market dominance by cancer prevention vaccines demonstrates the combination of demonstrated effectiveness with their crucial contribution to public health programs focused on cancer prevention.

By Indication, the Cervical Cancer segment held the largest share in the projected period

- Cervical cancer represents a significant and growing challenge within the global cancer vaccine market, driven by the high incidence of the disease, particularly in low- and middle-income countries. WHO in 2022 revealed that worldwide cervical cancer diagnoses reached 660,000 but resulted in 350,000 mortalities especially common among low-and-middle-income nations.

- The global vaccine market intensified its actions after the growing understanding emerged that HPV-based prevention strategies make cervical cancer avoidable. The World Health Organization established a goal that reach 90% of HPV vaccine coverage among girls by their 15th birthday for its global strategy toward eliminating cervical cancer as a public health threat by 2030.

- A significant market expansion within the cervical cancer segment will occur due to people needing vaccines that protect against the leading HPV infection that causes cervical cancer. The accelerating global cervical cancer elimination initiative will strengthen the cancer vaccine market's role through HPV vaccines as the main instrument to lower cervical cancer prevalence rates in regions where this disease poses the highest health risks.

Cancer Vaccine Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America’s dominance in the global cancer vaccine market is driven by its high cancer incidence, strong healthcare infrastructure, and advanced research capabilities. National Cancer Institute estimates that the United States will face around 2 million new cancer diagnoses and more than 600,000 cancer-related fatalities during 2024 thus creating substantial demand for new treatment options which include immunization.

- Such therapies acquire greater importance because the region focuses on early cancer detection together with HPV vaccine initiatives for cervical cancer prevention. The healthcare systems of North America achieve excellent cancer survival results with 88.6% breast cancer survival and 97.2% prostate cancer survival establishing its leadership position in medical care. Cancer vaccine market leadership in North America keeps growing due to its fast regulatory approval procedures combined with advanced medical systems which drives both the market expansion and worldwide acceptance of new treatment methods.

Cancer Vaccine Market Active Players:

- Advaxis Inc. (U.S.)

- Amgen, Inc. (U.S.)

- AstraZeneca (U.K.)

- Bristol-Myers Squibb Company (U.S.)

- Center of Molecular Immunology (Cuba)

- Dendreon Pharmaceuticals LLC. (U.S.)

- Dynavax Technologies (U.S.)

- F Hoffmann-La Roche AG (Switzerland)

- Ferring B.V. (Switzerland)

- Generex Biotechnology Corporation (U.S.)

- GSK plc (U.K.)

- Immunocellular Therapeutics, Ltd. (U.S.)

- Merck & Co., Inc. (U.S.)

- Moderna, Inc. (U.S.)

- OSE Immunotherapeutics (France)

- Sanofi (France)

- Serum Institute of India Pvt. Ltd. (India)

- Synthaverse S.A. (Poland)

- Vaccinogen, Inc. (U.S.)

- Walvax Biotechnology Co., Ltd. (China)

- Wantai BioPharm (China)

- Other Active Players

Key Industry Developments in the Cancer Vaccine Market:

- In January 2025, Global biopharmaceutical company GSK announced a strategic collaboration with the University of Oxford, committing up to USD 63 million to establish the GSK-Oxford Cancer Immuno-Prevention Programme. This initiative aims to enhance the understanding of cancer development and explore innovative vaccine-based approaches for cancer prevention. Bringing together GSK’s expertise in vaccine development and Oxford’s pioneering research in cancer biology and immunology, the program seeks to uncover new insights into the mechanisms of cancer formation. These findings could pave the way for future vaccine development, potentially transforming cancer prevention strategies worldwide.

- In December 2024, Russia announced the development of an mRNA cancer vaccine, slated for a 2025 launch. Pre-clinical trials demonstrate tumor suppression and metastasis reduction. AI integration promises to personalize vaccine creation within an hour, significantly accelerating the current lengthy process. The vaccine aims to bolster the immune system's ability to target and eliminate cancer cells.

|

Cancer Vaccine Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 8.72 Bn. |

|

Forecast Period 2025-32 CAGR: |

9.22 % |

Market Size in 2032: |

USD 17.66 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Indication |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cancer Vaccine Market by Type

4.1 Cancer Vaccine Market Snapshot and Growth Engine

4.2 Cancer Vaccine Market Overview

4.3 Preventive and Therapeutic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Preventive and Therapeutic: Geographic Segmentation Analysis

Chapter 5: Cancer Vaccine Market by Technology

5.1 Cancer Vaccine Market Snapshot and Growth Engine

5.2 Cancer Vaccine Market Overview

5.3 Molecular-based

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Molecular-based: Geographic Segmentation Analysis

5.4 Vector-based

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Vector-based: Geographic Segmentation Analysis

5.5 and Cell-based

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 and Cell-based: Geographic Segmentation Analysis

Chapter 6: Cancer Vaccine Market by Indication

6.1 Cancer Vaccine Market Snapshot and Growth Engine

6.2 Cancer Vaccine Market Overview

6.3 Cervical Cancer

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Cervical Cancer: Geographic Segmentation Analysis

6.4 Bladder Cancer

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Bladder Cancer: Geographic Segmentation Analysis

6.5 Prostate Cancer

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Prostate Cancer: Geographic Segmentation Analysis

6.6 Lung Cancer

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Lung Cancer: Geographic Segmentation Analysis

6.7 and Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 and Others: Geographic Segmentation Analysis

Chapter 7: Cancer Vaccine Market by Distribution Channel

7.1 Cancer Vaccine Market Snapshot and Growth Engine

7.2 Cancer Vaccine Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hospitals: Geographic Segmentation Analysis

7.4 Government & Organization Supply

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Government & Organization Supply: Geographic Segmentation Analysis

7.5 and Others

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 and Others: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Cancer Vaccine Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ADVAXIS INC. (U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 AMGEN

8.4 INC. (U.S.)

8.5 ASTRAZENECA (U.K.)

8.6 BRISTOL-MYERS SQUIBB COMPANY (U.S.)

8.7 CENTER OF MOLECULAR IMMUNOLOGY (CUBA)

8.8 DENDREON PHARMACEUTICALS LLC. (U.S.)

8.9 DYNAVAX TECHNOLOGIES (U.S.)

8.10 F HOFFMANN-LA ROCHE AG (SWITZERLAND)

8.11 FERRING B.V. (SWITZERLAND)

8.12 GENEREX BIOTECHNOLOGY CORPORATION (U.S.)

8.13 GSK PLC (U.K.)

8.14 IMMUNOCELLULAR THERAPEUTICS

8.15 LTD. (U.S.)

8.16 MERCK & CO. INC. (U.S.)

8.17 MODERNA

8.18 INC. (U.S.)

8.19 OSE IMMUNOTHERAPEUTICS (FRANCE)

8.20 SANOFI (FRANCE)

8.21 SERUM INSTITUTE OF INDIA PVT. LTD. (INDIA)

8.22 SYNTHAVERSE S.A. (POLAND)

8.23 VACCINOGEN

8.24 INC. (U.S.)

8.25 WALVAX BIOTECHNOLOGY CO. LTD. (CHINA)

8.26 WANTAI BIOPHARM (CHINA)

8.27 OTHER ACTIVE PLAYERS.

Chapter 9: Global Cancer Vaccine Market By Region

9.1 Overview

9.2. North America Cancer Vaccine Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 Preventive and Therapeutic

9.2.5 Historic and Forecasted Market Size By Technology

9.2.5.1 Molecular-based

9.2.5.2 Vector-based

9.2.5.3 and Cell-based

9.2.6 Historic and Forecasted Market Size By Indication

9.2.6.1 Cervical Cancer

9.2.6.2 Bladder Cancer

9.2.6.3 Prostate Cancer

9.2.6.4 Lung Cancer

9.2.6.5 and Others

9.2.7 Historic and Forecasted Market Size By Distribution Channel

9.2.7.1 Hospitals

9.2.7.2 Government & Organization Supply

9.2.7.3 and Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Cancer Vaccine Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 Preventive and Therapeutic

9.3.5 Historic and Forecasted Market Size By Technology

9.3.5.1 Molecular-based

9.3.5.2 Vector-based

9.3.5.3 and Cell-based

9.3.6 Historic and Forecasted Market Size By Indication

9.3.6.1 Cervical Cancer

9.3.6.2 Bladder Cancer

9.3.6.3 Prostate Cancer

9.3.6.4 Lung Cancer

9.3.6.5 and Others

9.3.7 Historic and Forecasted Market Size By Distribution Channel

9.3.7.1 Hospitals

9.3.7.2 Government & Organization Supply

9.3.7.3 and Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Cancer Vaccine Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 Preventive and Therapeutic

9.4.5 Historic and Forecasted Market Size By Technology

9.4.5.1 Molecular-based

9.4.5.2 Vector-based

9.4.5.3 and Cell-based

9.4.6 Historic and Forecasted Market Size By Indication

9.4.6.1 Cervical Cancer

9.4.6.2 Bladder Cancer

9.4.6.3 Prostate Cancer

9.4.6.4 Lung Cancer

9.4.6.5 and Others

9.4.7 Historic and Forecasted Market Size By Distribution Channel

9.4.7.1 Hospitals

9.4.7.2 Government & Organization Supply

9.4.7.3 and Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Cancer Vaccine Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 Preventive and Therapeutic

9.5.5 Historic and Forecasted Market Size By Technology

9.5.5.1 Molecular-based

9.5.5.2 Vector-based

9.5.5.3 and Cell-based

9.5.6 Historic and Forecasted Market Size By Indication

9.5.6.1 Cervical Cancer

9.5.6.2 Bladder Cancer

9.5.6.3 Prostate Cancer

9.5.6.4 Lung Cancer

9.5.6.5 and Others

9.5.7 Historic and Forecasted Market Size By Distribution Channel

9.5.7.1 Hospitals

9.5.7.2 Government & Organization Supply

9.5.7.3 and Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Cancer Vaccine Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 Preventive and Therapeutic

9.6.5 Historic and Forecasted Market Size By Technology

9.6.5.1 Molecular-based

9.6.5.2 Vector-based

9.6.5.3 and Cell-based

9.6.6 Historic and Forecasted Market Size By Indication

9.6.6.1 Cervical Cancer

9.6.6.2 Bladder Cancer

9.6.6.3 Prostate Cancer

9.6.6.4 Lung Cancer

9.6.6.5 and Others

9.6.7 Historic and Forecasted Market Size By Distribution Channel

9.6.7.1 Hospitals

9.6.7.2 Government & Organization Supply

9.6.7.3 and Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Cancer Vaccine Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 Preventive and Therapeutic

9.7.5 Historic and Forecasted Market Size By Technology

9.7.5.1 Molecular-based

9.7.5.2 Vector-based

9.7.5.3 and Cell-based

9.7.6 Historic and Forecasted Market Size By Indication

9.7.6.1 Cervical Cancer

9.7.6.2 Bladder Cancer

9.7.6.3 Prostate Cancer

9.7.6.4 Lung Cancer

9.7.6.5 and Others

9.7.7 Historic and Forecasted Market Size By Distribution Channel

9.7.7.1 Hospitals

9.7.7.2 Government & Organization Supply

9.7.7.3 and Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Cancer Vaccine Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 8.72 Bn. |

|

Forecast Period 2025-32 CAGR: |

9.22 % |

Market Size in 2032: |

USD 17.66 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Indication |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||