Calcineurin Inhibitor Market Synopsis:

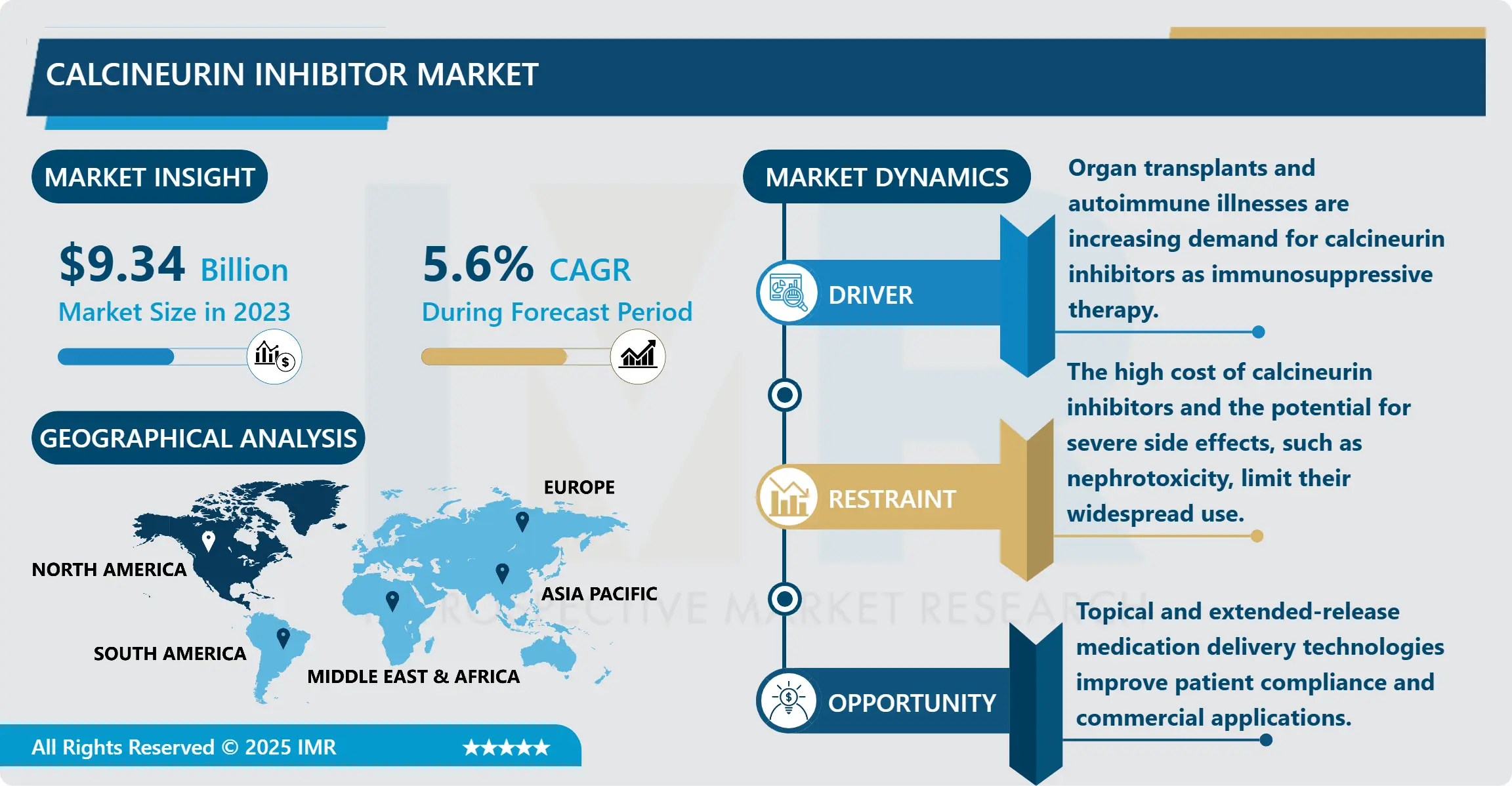

Calcineurin Inhibitor Market Size Was Valued at USD 9.34 Billion in 2023, and is Projected to Reach USD 12.5 Billion by 2032, Growing at a CAGR of 3.3% From 2024-2032.

The Calcineurin Inhibitor Market is as a result influenced by its importance in immunosuppressive therapy especially in autoimmune diseases and organ transplantation. Protease inhibitors example are saquinavir, ritonavir and indinavir; calcineurin inhibitors are cyclosporine and tacrolimus and work by suppressing the immune system to prevent organ rejection or to treat auto immune diseases.

Prominent factors such as advanced technology in drug delivery systems and new product formations have raised the market’s prospects to a greater level. For instance, the formulation of the topical and extended release forms of calcineurin inhibitors has led to increased medication compliance and less side effects that affects the entire body. Besides, increasing knowledge about autoimmune diseases and an improved healthcare infrastructure in the emerging markets also drive the market.

These include the approval of new formulations and the growing trend of biosimilars in the market produces a boost to the market, But there are emerging issues that acts as threats to the market; these include; high costs of therapy, side effects of long term administration, and the expiration of key patents. Reimbursement pressures and competition from other systems of therapy such as biosimilars and JAK inhibitors also constrain growth. However, recent research on calcineurin inhibitors to achieve better efficacy as well as safety profile will persist to unlock ideas and guarantee their significance in immunosuppressive medications.

Calcineurin Inhibitor Market Trend Analysis:

Rise of Biosimilars and Generic Alternatives

-

The rise of biosimilars and generic alternatives is significantly driving growth in the Calcineurin Inhibitor Market. As patents on original calcineurin inhibitor drugs expire, pharmaceutical companies are introducing biosimilar and generic versions that offer comparable efficacy at lower costs. This increased availability improves patient access to essential treatments for conditions like organ transplant rejection and autoimmune diseases, fueling market expansion.

- Additionally, healthcare providers and insurance companies are increasingly encouraging the use of cost-effective alternatives to manage rising treatment expenses. Regulatory support for faster approval pathways for biosimilars further accelerates their adoption. As a result, the growing presence of biosimilars and generics is not only intensifying competition but also expanding the overall patient base for calcineurin inhibitors worldwide.

Advancements in Drug Delivery Systems

-

Advancements in drug delivery systems present a significant opportunity for growth in the Calcineurin Inhibitor Market. Innovative delivery methods such as nanoparticle carriers, liposomal formulations, and transdermal patches are enhancing the bioavailability, targeting precision, and patient compliance for calcineurin inhibitors. These technologies help minimize side effects and optimize therapeutic outcomes, making treatments safer and more effective.

- Moreover, improved delivery systems can extend the lifecycle of existing drugs by offering new formulations that meet unmet medical needs. Pharmaceutical companies investing in advanced delivery platforms can differentiate their products in a competitive market and open new revenue streams. As patient-centric therapies gain priority, the integration of cutting-edge delivery technologies into calcineurin inhibitor therapies is poised to drive long-term market expansion.

Calcineurin Inhibitor Market Segment Analysis:

Calcineurin Inhibitor Market Segmented on the basis of Drug Type, Route of Administration, Therapeutic Application, End User, and Region

By Drug Type, Cyclosporine segment is expected to dominate the market during the forecast period

-

The Calcineurin Inhibitor Market based on the drug type we get tacrolimus, cyclosporine, pimecrolimus, and abatacept each with specific medical application. They have taken larger shares of the market because their applications are firmly founded on clinical research in the treatment of organ transplants and autoimmune disorders. Pimecrolimus primarily used for dermatological disease such as atopic dermatitis has the advantage of localized delivery, which minimizes systemic adverse effects. Though abatacept cannot be categorized under traditional calcineurin inhibitors.

- it is expected to exhibit immunomodulatory effects, being used for rheumatoid arthritis as well as other autoimmune diseases, which are a shift in the market trend. Both of these drugs treat various essential human requirements with increasing innovation in immunological disease treatment and rising frequency of immunological diseases boosting the market.

By End User, Hospitals segment expected to held the largest share

-

The segmentation of calcineurin inhibitor market based on its end users are majorly composed of hospitals, home care and pharmacies. Thus, the largest share is now occupied by hospitals as they are primary involved in organ transplantation and treatment of severe autoimmune diseases in which calcineurin inhibitors are vital for immunosuppressive therapy. They are well endowed with specially trained medical personnel and facilities for the handling of such cases.

- Growing trends are homecare, as more patients aim to receive treatments which include oral formulations and topical systems, benefiting from a treatment of their illness at home away from the hospital. Retailers involved in the distribution of these medications include the pharmacies who sell both the over the counter as well as prescription based calcineurin inhibitors stand to benefit from increased patient base often requiring long-term therapy in chronic illnesses. The overal trend shows an increase in homecare work due to cost ad convenience that comes with work done at home.

Calcineurin Inhibitor Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America is expected to dominate the Calcineurin Inhibitor Market over the forecast period due to its well-established healthcare infrastructure, high healthcare spending, and strong presence of leading pharmaceutical companies. The region benefits from early adoption of advanced therapies, a high prevalence of autoimmune diseases, and an increasing number of organ transplants, all of which drive demand for calcineurin inhibitors.

- Additionally, supportive regulatory frameworks, growing awareness about treatment options, and continuous investments in research and development further strengthen North America’s market position. The United States, in particular, holds the largest share, fueled by a robust pipeline of innovative drug formulations and the availability of biosimilars. These factors collectively contribute to North America's leadership in the global Calcineurin Inhibitor Market

Active Key Players in the Calcineurin Inhibitor Market

- AstraZeneca (United Kingdom)

- Merck and Co (USA)

- Sanofi (France)

- AbbVie (USA)

- Eli Lilly and Company (USA)

- Johnson and Johnson (USA)

- Celgene (USA)

- Bristol-Myers Squibb (USA)

- Teva Pharmaceutical Industries (Israel)

- Gilead Sciences (USA)

- Biogen (USA)

- Hoffmann-La Roche (Switzerland)

- Pfizer (USA)

- Novartis (Switzerland)

- Amgen (USA)

- Other Active Players

|

Calcineurin Inhibitor Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.34 Billion |

|

Forecast Period 2024-32 CAGR: |

5.60% |

Market Size in 2032: |

USD 12.5 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Sample Type |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Calcineurin Inhibitor Market by Drug Type

4.1 Calcineurin Inhibitor Market Snapshot and Growth Engine

4.2 Calcineurin Inhibitor Market Overview

4.3 Tacrolimus

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Tacrolimus: Geographic Segmentation Analysis

4.4 Cyclosporine

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Cyclosporine: Geographic Segmentation Analysis

4.5 Pimecrolimus

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Pimecrolimus: Geographic Segmentation Analysis

4.6 Abatacept

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Abatacept: Geographic Segmentation Analysis

Chapter 5: Calcineurin Inhibitor Market by Route of Administration

5.1 Calcineurin Inhibitor Market Snapshot and Growth Engine

5.2 Calcineurin Inhibitor Market Overview

5.3 Oral

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Oral: Geographic Segmentation Analysis

5.4 Intravenous

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Intravenous: Geographic Segmentation Analysis

5.5 Topical

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Topical: Geographic Segmentation Analysis

Chapter 6: Calcineurin Inhibitor Market by Therapeutic Application

6.1 Calcineurin Inhibitor Market Snapshot and Growth Engine

6.2 Calcineurin Inhibitor Market Overview

6.3 Organ Transplantation

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Organ Transplantation: Geographic Segmentation Analysis

6.4 Autoimmune Diseases

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Autoimmune Diseases: Geographic Segmentation Analysis

6.5 Dermatology

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Dermatology: Geographic Segmentation Analysis

6.6 Cardiology

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Cardiology: Geographic Segmentation Analysis

Chapter 7: Calcineurin Inhibitor Market by End User

7.1 Calcineurin Inhibitor Market Snapshot and Growth Engine

7.2 Calcineurin Inhibitor Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hospitals: Geographic Segmentation Analysis

7.4 Homecare Settings

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Homecare Settings: Geographic Segmentation Analysis

7.5 Pharmacies

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Pharmacies: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Calcineurin Inhibitor Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ASTRAZENECA (UNITED KINGDOM)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MERCK AND CO (USA)

8.4 SANOFI (FRANCE)

8.5 ABBVIE (USA)

8.6 ELI LILLY AND COMPANY (USA)

8.7 JOHNSON AND JOHNSON (USA)

8.8 CELGENE (USA)

8.9 BRISTOL-MYERS SQUIBB (USA)

8.10 TEVA PHARMACEUTICAL INDUSTRIES (ISRAEL)

8.11 GILEAD SCIENCES (USA)

8.12 BIOGEN (USA)

8.13 HOFFMANN-LA ROCHE (SWITZERLAND)

8.14 PFIZER (USA)

8.15 NOVARTIS (SWITZERLAND)

8.16 AMGEN (USA)

8.17 OTHER ACTIVE PLAYERS

Chapter 9: Global Calcineurin Inhibitor Market By Region

9.1 Overview

9.2. North America Calcineurin Inhibitor Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Drug Type

9.2.4.1 Tacrolimus

9.2.4.2 Cyclosporine

9.2.4.3 Pimecrolimus

9.2.4.4 Abatacept

9.2.5 Historic and Forecasted Market Size By Route of Administration

9.2.5.1 Oral

9.2.5.2 Intravenous

9.2.5.3 Topical

9.2.6 Historic and Forecasted Market Size By Therapeutic Application

9.2.6.1 Organ Transplantation

9.2.6.2 Autoimmune Diseases

9.2.6.3 Dermatology

9.2.6.4 Cardiology

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Hospitals

9.2.7.2 Homecare Settings

9.2.7.3 Pharmacies

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Calcineurin Inhibitor Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Drug Type

9.3.4.1 Tacrolimus

9.3.4.2 Cyclosporine

9.3.4.3 Pimecrolimus

9.3.4.4 Abatacept

9.3.5 Historic and Forecasted Market Size By Route of Administration

9.3.5.1 Oral

9.3.5.2 Intravenous

9.3.5.3 Topical

9.3.6 Historic and Forecasted Market Size By Therapeutic Application

9.3.6.1 Organ Transplantation

9.3.6.2 Autoimmune Diseases

9.3.6.3 Dermatology

9.3.6.4 Cardiology

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Hospitals

9.3.7.2 Homecare Settings

9.3.7.3 Pharmacies

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Calcineurin Inhibitor Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Drug Type

9.4.4.1 Tacrolimus

9.4.4.2 Cyclosporine

9.4.4.3 Pimecrolimus

9.4.4.4 Abatacept

9.4.5 Historic and Forecasted Market Size By Route of Administration

9.4.5.1 Oral

9.4.5.2 Intravenous

9.4.5.3 Topical

9.4.6 Historic and Forecasted Market Size By Therapeutic Application

9.4.6.1 Organ Transplantation

9.4.6.2 Autoimmune Diseases

9.4.6.3 Dermatology

9.4.6.4 Cardiology

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Hospitals

9.4.7.2 Homecare Settings

9.4.7.3 Pharmacies

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Calcineurin Inhibitor Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Drug Type

9.5.4.1 Tacrolimus

9.5.4.2 Cyclosporine

9.5.4.3 Pimecrolimus

9.5.4.4 Abatacept

9.5.5 Historic and Forecasted Market Size By Route of Administration

9.5.5.1 Oral

9.5.5.2 Intravenous

9.5.5.3 Topical

9.5.6 Historic and Forecasted Market Size By Therapeutic Application

9.5.6.1 Organ Transplantation

9.5.6.2 Autoimmune Diseases

9.5.6.3 Dermatology

9.5.6.4 Cardiology

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Hospitals

9.5.7.2 Homecare Settings

9.5.7.3 Pharmacies

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Calcineurin Inhibitor Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Drug Type

9.6.4.1 Tacrolimus

9.6.4.2 Cyclosporine

9.6.4.3 Pimecrolimus

9.6.4.4 Abatacept

9.6.5 Historic and Forecasted Market Size By Route of Administration

9.6.5.1 Oral

9.6.5.2 Intravenous

9.6.5.3 Topical

9.6.6 Historic and Forecasted Market Size By Therapeutic Application

9.6.6.1 Organ Transplantation

9.6.6.2 Autoimmune Diseases

9.6.6.3 Dermatology

9.6.6.4 Cardiology

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Hospitals

9.6.7.2 Homecare Settings

9.6.7.3 Pharmacies

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Calcineurin Inhibitor Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Drug Type

9.7.4.1 Tacrolimus

9.7.4.2 Cyclosporine

9.7.4.3 Pimecrolimus

9.7.4.4 Abatacept

9.7.5 Historic and Forecasted Market Size By Route of Administration

9.7.5.1 Oral

9.7.5.2 Intravenous

9.7.5.3 Topical

9.7.6 Historic and Forecasted Market Size By Therapeutic Application

9.7.6.1 Organ Transplantation

9.7.6.2 Autoimmune Diseases

9.7.6.3 Dermatology

9.7.6.4 Cardiology

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Hospitals

9.7.7.2 Homecare Settings

9.7.7.3 Pharmacies

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Calcineurin Inhibitor Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.34 Billion |

|

Forecast Period 2024-32 CAGR: |

5.60% |

Market Size in 2032: |

USD 12.5 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Sample Type |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||