Buy Now Pay Later Market Synopsis

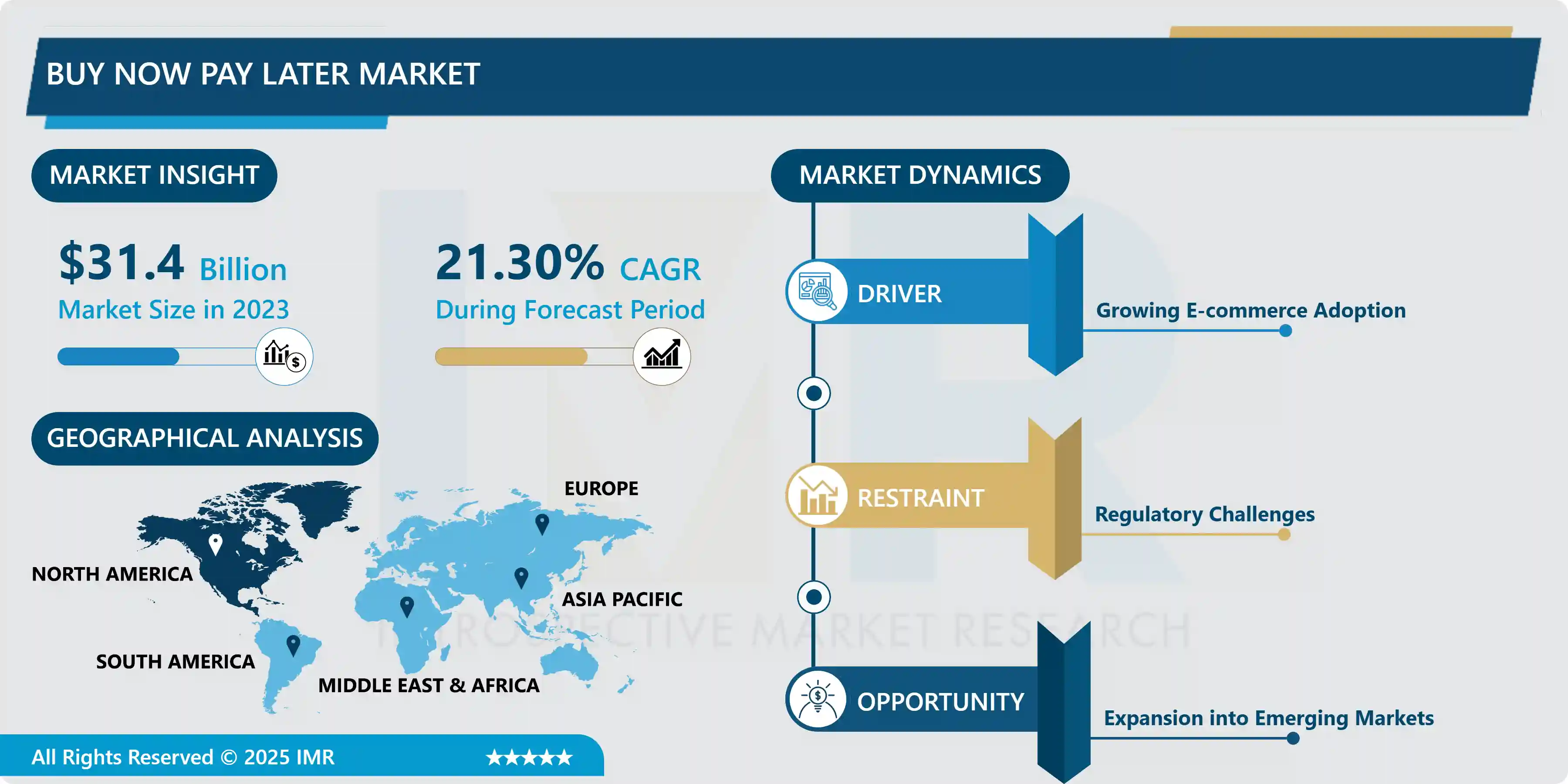

Buy Now Pay Later Market Size Was Valued at USD 31.40 Billion in 2023, and is Projected to Reach USD 178.52 Billion by 2032, Growing at a CAGR of 21.30% From 2024-2032.

The Buy Now Pay Later (BNPL) market goes a long way in defining as a financing solution where users are able to complete a purchase where both the use and the payment are separated by a certain amount of time. This type of financial service is usually positioned via lay-bys at websites or actual point of purchase with the product, providing convenient ways of accessing credit with little respect to credit histories. The global sector of buying now and paying later has been rising in popularity over the past years, which has shifted consumer’s perception towards their purchase and changed payment paradigms. This is where a client buys a product using immediate money, and the total amount is paid in installments for a given period, maybe without charge. The BNPL appeal to younger buyers, who either cannot obtain credit cards or simply prefer to pay in installments with no additional interest. The flexibility of BNPL has,stded its use namely in e-commerce since allows buyers to make purchases and pay for the purchase online in three months without taking credit checks as well as enjoying low rates. These services have proven easy to use – in many instances they are incorporated right into the check out pages of e-commerce facilities – and the swift increase confirms the desirability of such options compared to actual credit offerings.

BNPL solutions have also provided an added appeal to the retailers as a way of improving the customer experience and increase sales. In particular, consumers are willing to go through with the purchase once the retailer has offered a payment plan that allows them to pay in small amounts. It has become an essential trend that has seen many retailers engage BNPL providers who in turn have a mutually beneficial relationship. Additionally, it has features such as instant approval for credit check and other payment methods, flexible payment options which help in creating brand loyalty and increase check out value. However, the market is now experiencing some problems such as regulation and customer protection issues which are moments of maturing that it encounters. There are certain fears that people will go even deeper under credit than they normally would while attempting to maximize the usage of the mobile money payment systems that are now around. Consequently, the BNPL business model has come under fire from regulators across many geographies, forcing providers to ensure they adhere to sound lending standards and disclose the terms properly

The BNPL industry is expected to keep on growing in the future because of technological innovation and shifts in the customer preferences. AI and ML can also improve the BNPL risk assessment services provided to consumers that can help the BNPL providers to assess the credit worthiness of a consumer more effectively and even customize services. Furthermore, blending of the BNPL with the advanced digital wallet and mobile payment solutions as the traditional ways of payment are slowly phased out will increase its usage. The market itself too, is expected to increase in range and scope, and for providers to look at newer verticals different from the basic retail including travel, health and education. The current scale of BNPL services has indicated its need to diversify in order to increase the availability of those services to customers and at the same time introduce healthy competition amongst the providers. Therefore, the Buy Now Pay Later market discusses the dynamics of consumer financing, targeting younger clients, as well as being compatible with retailization and constantly changing due to the influence of regulatory authorities. As customers continue to put a value for flexibility and convenience in their buying decisions, products like the BNPL services will continue to be central to defining the future of payments. Any merchants who can make proper use of these services can have competitive advantages made in a fast moving market environment, on the other side, consumers also can enjoy more freedom on credit constraint and better payment solutions. But the future of BNPL market depends on how far this concept can be growth by compelling compelling creditworthy consumers and retailers with a sustainable credit option.

Buy Now Pay Later Market Trend Analysis

Increasing Consumer Preference for Flexible Payment Options

- One shift observed across BNPL market is that customers have become more flexible when it comes to payment systems available. Customers including the millennial and Gen Z groups are in search of payment solutions that are more convenient. BNPL can in one way allow customers to do budgeting in a better way making them avoid the misfortune of having to deal with credit cards with high interest rates while, in the same time getting the benefits of products that they want with out having to wait. Such a change in a customer’s behavior is also driving more stores to incorporate BNPL solutions into the checkout experience because of favourable conversion and average order values.

- That is why, in parallel with this development, the providers of BNPL services are actively seeking to cover other spheres apart from retail, such as healthcare and tourism spheres. This diversification adds flexibility to BNPL to increase the likelihood of consumers using these payment plans for such basic utilities. Secondly, the COVID-19 pandemic has boosted the advancement of the mobile commerce system where consumers use applications on their mobile devices to make purchases and payments, resulting in choosing BNPL systems that can be quickly accessed through smartphones.

Expansion into Emerging Markets

- The BNPL market offers new opportunities to expand into new markets where there is a lack of physical ip infrastructure for more conventional solutions. Consumers are often locked out of credit card or loans in many of these regions, making BNPL very appealing. If BNPL providers focus on the flexible payment solutions for customers, then they can attract the large number of customers who seek for the easy financing options. Such opportunity is especially important now in the regions like Southeast Asia, Latin America, and some parts of Africa, where the mobile penetration is already a high level, and more consumers are buying products online.

- Therefore, for BNPL companies to fully exploit this chance, they need to address the market needs of these different niches. That may cover responding to merchants within that region when offering mobile payments assistance and guaranteeing customer services within that local market. Differentiated to the background of the emerging markets for which the BNPL providers offer culturally and economically more suitable services which upon deployment subsequently expand the market front by front.

Buy Now Pay Later Market Segment Analysis:

Buy Now Pay Later Market Segmented based on Channel, Category, and Enterprise Type.

By Channel , Online segment is expected to dominate the market during the forecast period

- It is therefore clear that in the Property & Casualty Insurance market, the provision of paying subsequently (or Buy Now Pay Later (BNPL)) improves customer satisfaction and increases the efficiency of transactions. The Point-of-Sale (POS) channel let insurers provide the client with an instant payment method at the time of acquiring a policy. This can work to the advantage of consumers in that people are likely to take essential coverage that they need since they are in a better position to balance their check-books since they can afford to make installment payments. Insurance companies should offer BNPL options at POS so that people, particularly the young ones, can easily purchase insurance because they find it difficult paying lump sum premiums.

- The online distribution also regards significant importance for the Property & Casualty Insurance market considering the tendencies, where customers turn to the digital tools for insurance services. The use of BNPL in online platforms may help in the reduction of purchase process because customer can choose flexible payment options effortlessly. This capability also serves to enrich the overall usability of the product so that consumers can receive insurance immediately. With the growth of the insurance industry’s digitalisation, the use of BNPL can give insurance companies an advantage as they help maintain customers with steady revenue sources in a highly saturated environment.

By Category , Banking, Financial Services and Insurance (BFSI) segment held the largest share in 2023

- Learn about role of various categories like Banking, Financial Services and Insurance (BFSI), Consumer Electronics, Fashion & Garment etc., operating into Property & Casualty Insurance market for the implantation of Buy Now Pay Later (BNPL) solutions. The bfsi segment is rather sensitive because it concerns the various financial products that can be associated with the bnpl solutions. The insurance companies liaise with BNPL providers where insurance clients can use BNPL schemes to facilitate the payment of premiums. This can increase policy purchases, the circuit breadth of customers, as customers tend to contact relevant products according to their financial levels.

- However, the study also shows that BNPL could also easily integrate with other sectors such as the Consumer Electronics and Fashion & Garment. These two categories are important because consumers often spend a lot of money when they purchase goods under these two categories, therefore, accepting flexible modes of payment is a plus since it will improve the purchasing experience of the clienteles. Allowing customers to acquire products with minimal effort, BNPL solutions are beneficial in producing greater conversions, making retailers appeal to more customers and generate more income. As applied to differing categories, the flexibility of BNPL still enhances the importance of the tool, demonstrating potential for revolutionizing the Property & Casualty Insurance market and associated industries.

Buy Now Pay Later Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America stands out as the dominating region in the Buy Now Pay Later market, driven by advanced technological infrastructure and high consumer awareness. The region's robust e-commerce landscape has fostered a conducive environment for BNPL providers, with numerous companies offering innovative payment solutions that cater to diverse consumer needs. The prevalence of digital wallets and mobile payment options further supports the growth of BNPL services in North America, as consumers increasingly seek flexible financing solutions for their online and in-store purchases.

- Additionally, regulatory frameworks in North America are relatively supportive of BNPL providers, allowing for the proliferation of various payment models. However, increased regulatory scrutiny is expected as consumer protection concerns rise. The North American BNPL market is characterized by intense competition among key players, which drives innovation and enhances service offerings. This competitive landscape, combined with a high level of consumer acceptance, positions North America as the leading region in the global BNPL market.

Active Key Players in the Buy Now Pay Later Market

- Affirm (USA)

- Afterpay (Australia)

- Klarna (Sweden)

- Clearpay (UK)

- Sezzle (USA)

- Laybuy (New Zealand)

- Splitit (USA)

- PayPal Credit (USA)

- Zip (Australia)

- Prospa (Australia), Other Key Player

Key Industry Developments in the Buy Now Pay Later Market

- February 2023 – CRED launched an application, CRED Flash, to enter into the buy now pay later service. CRED Flash would enable users to make payments on the application and across over 500 partner merchants, including Urban Company, Zpto, and Swiggy. It allows users to clear the bill in 30 days at no charge.

- December 2022 – Galileo Financial Technologies, LLC., a financial technology company, launched a custom-made Buy Now Pay Later solution for fintechs and banks. This solution would help banks and fintechs to easily enter the market and allow their customers for higher spending.

- July 2022 – Samsung introduced its buy now pay later option for the first time for its foldable smartphones including Galaxy Z Flip 3, Galaxy S22 series, and Galaxy Z Fold 3 series in India. This BNPL option would enable Samsung customers to pay 60% of the total bill in 18 interest free installments and the remaining 40% of the bill can be paid from the 19th installment.

- May 2023 – ZestMoney announced that it plans to be profitable in 6 months. The fintech firm is said to be finalizing a new investment round from its existing shareholders, including Quona Capital, Zip, Omidyar Network India, Flourish VC, and Scarlet Digital. To ensure business continuity, ZestMoney plans to operate as a Lending Service Provider (LSP), partnering with banks and NBFCs to write out loans rather than lending directly from its balance sheet.

- February 2023 – India lifted the ban on PayU's LazyPay and some other lending apps. India's IT Ministry lifted the ban on seven high-profile lending apps, including PayU's LazyPay, Kissht, KreditBee, and Indiabulls' Home Loans, according to a person familiar with the matter, providing some relief to the fintech industry that has been reeling with immense scrutiny in recent quarters.

|

Buy Now Pay Later Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 31.40 Bn. |

|

Forecast Period 2024-32 CAGR: |

21.30% |

Market Size in 2032: |

USD 178.52 Bn. |

|

Segments Covered: |

By Channel |

|

|

|

By Category |

|

||

|

By Enterprise Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Buy Now Pay Later Market by Channel (2018-2032)

4.1 Buy Now Pay Later Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Point of Sale (POS)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Online

Chapter 5: Buy Now Pay Later Market by Category (2018-2032)

5.1 Buy Now Pay Later Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Banking

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Financial Services and Insurance (BFSI)

5.5 Consumer Electronics

5.6 Fashion & Garment

5.7 Healthcare

5.8 Retail

5.9 Media and Entertainment

5.10 Others (Travel and Transportation

5.11 Education

5.12 Logistics)

Chapter 6: Buy Now Pay Later Market by Enterprise Type (2018-2032)

6.1 Buy Now Pay Later Market Snapshot and Growth Engine

6.2 Market Overview

6.3 SMEs

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Large Enterprises

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Buy Now Pay Later Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AFFIRM (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AFTERPAY (AUSTRALIA)

7.4 KLARNA (SWEDEN)

7.5 CLEARPAY (UK)

7.6 SEZZLE (USA)

7.7 LAYBUY (NEW ZEALAND)

7.8 SPLITIT (USA)

7.9 PAYPAL CREDIT (USA)

7.10 ZIP (AUSTRALIA)

7.11 PROSPA (AUSTRALIA)

7.12 OTHER KEY PLAYER

Chapter 8: Global Buy Now Pay Later Market By Region

8.1 Overview

8.2. North America Buy Now Pay Later Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Channel

8.2.4.1 Point of Sale (POS)

8.2.4.2 Online

8.2.5 Historic and Forecasted Market Size by Category

8.2.5.1 Banking

8.2.5.2 Financial Services and Insurance (BFSI)

8.2.5.3 Consumer Electronics

8.2.5.4 Fashion & Garment

8.2.5.5 Healthcare

8.2.5.6 Retail

8.2.5.7 Media and Entertainment

8.2.5.8 Others (Travel and Transportation

8.2.5.9 Education

8.2.5.10 Logistics)

8.2.6 Historic and Forecasted Market Size by Enterprise Type

8.2.6.1 SMEs

8.2.6.2 Large Enterprises

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Buy Now Pay Later Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Channel

8.3.4.1 Point of Sale (POS)

8.3.4.2 Online

8.3.5 Historic and Forecasted Market Size by Category

8.3.5.1 Banking

8.3.5.2 Financial Services and Insurance (BFSI)

8.3.5.3 Consumer Electronics

8.3.5.4 Fashion & Garment

8.3.5.5 Healthcare

8.3.5.6 Retail

8.3.5.7 Media and Entertainment

8.3.5.8 Others (Travel and Transportation

8.3.5.9 Education

8.3.5.10 Logistics)

8.3.6 Historic and Forecasted Market Size by Enterprise Type

8.3.6.1 SMEs

8.3.6.2 Large Enterprises

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Buy Now Pay Later Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Channel

8.4.4.1 Point of Sale (POS)

8.4.4.2 Online

8.4.5 Historic and Forecasted Market Size by Category

8.4.5.1 Banking

8.4.5.2 Financial Services and Insurance (BFSI)

8.4.5.3 Consumer Electronics

8.4.5.4 Fashion & Garment

8.4.5.5 Healthcare

8.4.5.6 Retail

8.4.5.7 Media and Entertainment

8.4.5.8 Others (Travel and Transportation

8.4.5.9 Education

8.4.5.10 Logistics)

8.4.6 Historic and Forecasted Market Size by Enterprise Type

8.4.6.1 SMEs

8.4.6.2 Large Enterprises

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Buy Now Pay Later Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Channel

8.5.4.1 Point of Sale (POS)

8.5.4.2 Online

8.5.5 Historic and Forecasted Market Size by Category

8.5.5.1 Banking

8.5.5.2 Financial Services and Insurance (BFSI)

8.5.5.3 Consumer Electronics

8.5.5.4 Fashion & Garment

8.5.5.5 Healthcare

8.5.5.6 Retail

8.5.5.7 Media and Entertainment

8.5.5.8 Others (Travel and Transportation

8.5.5.9 Education

8.5.5.10 Logistics)

8.5.6 Historic and Forecasted Market Size by Enterprise Type

8.5.6.1 SMEs

8.5.6.2 Large Enterprises

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Buy Now Pay Later Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Channel

8.6.4.1 Point of Sale (POS)

8.6.4.2 Online

8.6.5 Historic and Forecasted Market Size by Category

8.6.5.1 Banking

8.6.5.2 Financial Services and Insurance (BFSI)

8.6.5.3 Consumer Electronics

8.6.5.4 Fashion & Garment

8.6.5.5 Healthcare

8.6.5.6 Retail

8.6.5.7 Media and Entertainment

8.6.5.8 Others (Travel and Transportation

8.6.5.9 Education

8.6.5.10 Logistics)

8.6.6 Historic and Forecasted Market Size by Enterprise Type

8.6.6.1 SMEs

8.6.6.2 Large Enterprises

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Buy Now Pay Later Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Channel

8.7.4.1 Point of Sale (POS)

8.7.4.2 Online

8.7.5 Historic and Forecasted Market Size by Category

8.7.5.1 Banking

8.7.5.2 Financial Services and Insurance (BFSI)

8.7.5.3 Consumer Electronics

8.7.5.4 Fashion & Garment

8.7.5.5 Healthcare

8.7.5.6 Retail

8.7.5.7 Media and Entertainment

8.7.5.8 Others (Travel and Transportation

8.7.5.9 Education

8.7.5.10 Logistics)

8.7.6 Historic and Forecasted Market Size by Enterprise Type

8.7.6.1 SMEs

8.7.6.2 Large Enterprises

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Buy Now Pay Later Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 31.40 Bn. |

|

Forecast Period 2024-32 CAGR: |

21.30% |

Market Size in 2032: |

USD 178.52 Bn. |

|

Segments Covered: |

By Channel |

|

|

|

By Category |

|

||

|

By Enterprise Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||