Business Tourism Market Synopsis:

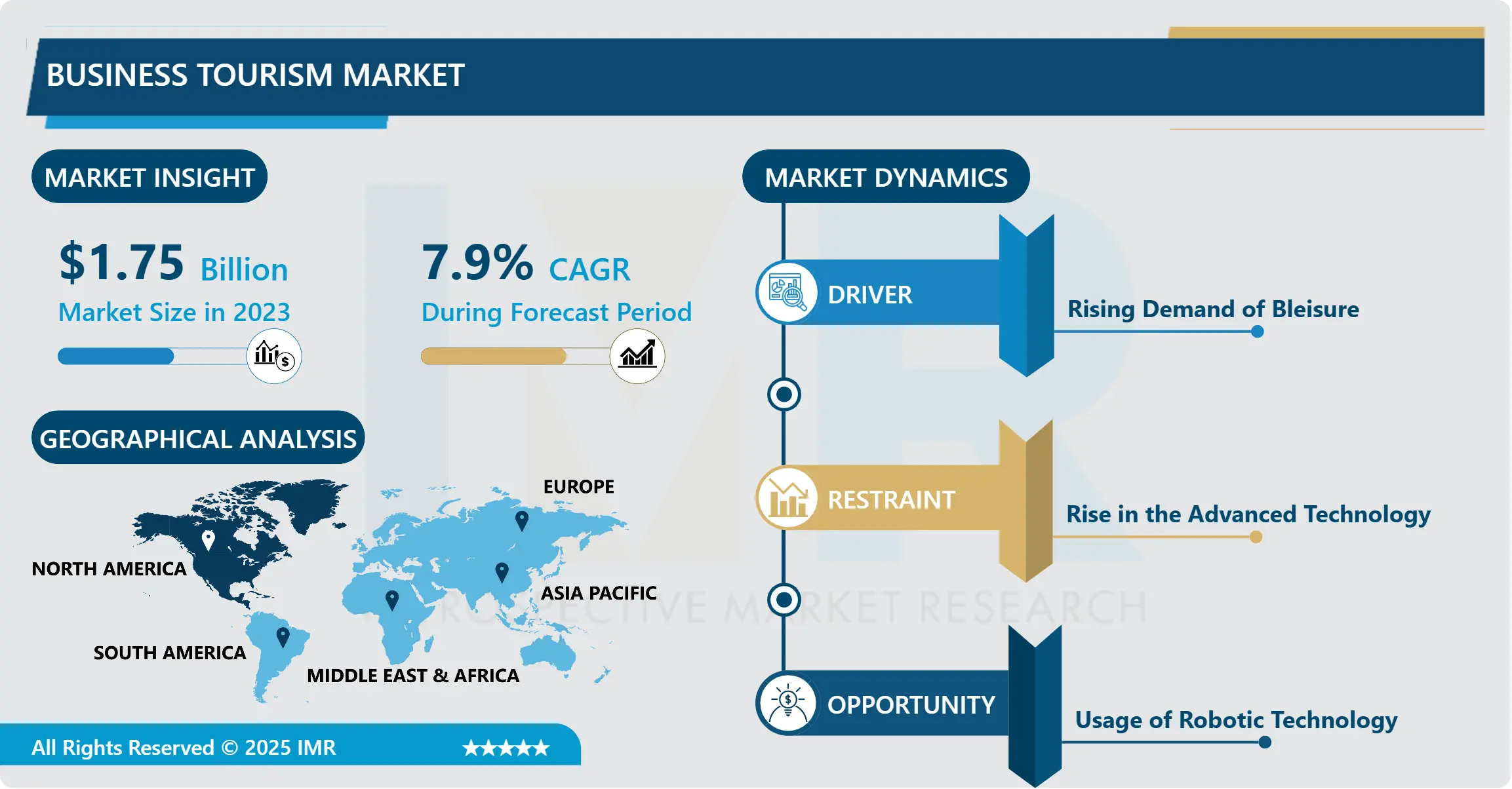

Business Tourism Market Size Was Valued at USD 1.75 Billion in 2023, and is Projected to Reach USD 2.85 Billion by 2032, Growing at a CAGR of 7.9% From 2024-2032.

The market of business tourism has remained highly active thanks to the higher frequency and demand for business events, conferences, exhibitions, and incentive travel all around the globe. Business travel refers to the movement of people for business-related activities such as business meetings, incentive trips and reward trips among others, conferences and exhibitions or otherwise known as the MICE sector plays a central role in developing international business relations.

The growth of the business tourism market can partially be attributed to the increase in international conferences and events to which people from many industries and countries come. They enable organizations to reveale new products, in addition to analysing the prevailing market trends, and also foster partnership between global companies. Also, there still remains the need to meet the need for more premium travel and related quality products that are required by business entrepreneurs and superior class employees in their organizations.

North America and Europe have the most developed business tourism market because of well-developed corporate structures and numerous conference facilities in these regions and a thriving business environment. On the other hand Asia-Pacific region is anticipated to showcase the highest growth in the coming forecast period triggered by the emerging giants like China and India which have now turned as global theatre for business events and international meetings. It is predicted that the further development of the approaches related to digital transformation and virtual events will form the future character of business tourism through the initial account of the hybrid approach, which will include both face-to-face participation and remote attendance at events

Business Tourism Market Trend Analysis

Growth of Hybrid and Virtual Events

- The business tourism market has experienced significant growth driven by the rise of hybrid and virtual events. These events offer organizations the flexibility to host both in-person and online engagements, attracting a broader audience. Hybrid models, combining physical and digital elements, cater to varying preferences and allow global participation without the need for extensive travel. This adaptability is a game-changer, enabling companies to enhance their reach and impact, especially for international conferences, trade shows, and corporate meetings. The seamless integration of digital platforms with traditional formats ensures continuity, reduces costs, and expands networking opportunities.

- Virtual events have gained traction due to their ability to eliminate geographical limitations and reduce logistical complexities. This shift in format has proven especially advantageous in post-pandemic times, with businesses prioritizing safety and cost-efficiency. As virtual tools evolve and audience expectations grow, hybrid and virtual events will remain central to the expansion of business tourism, driving innovation and opening new avenues for collaboration and engagement.

Rising Popularity of Experiential and Bleisure Travel

- The business tourism market is witnessing a surge in popularity, driven by the growing trend of "bleisure" travel—combining business trips with leisure activities. This shift in consumer behavior presents significant opportunities for companies within the sector. As professionals seek to balance work with personal exploration, destinations offering integrated work and leisure experiences are becoming increasingly attractive. Businesses are capitalizing on this trend by offering tailored packages that blend conferences, seminars, and leisure activities, positioning themselves to cater to this evolving demand.

- With the rise of experiential travel, which emphasizes immersive and engaging experiences, the market is also adapting to meet the needs of travelers seeking more than traditional meetings and conferences. Destinations that offer unique cultural experiences, local activities, and opportunities for relaxation are becoming key factors in decision-making. For companies in the business tourism space, this shift represents an opportunity to innovate and diversify offerings, appealing to a broader segment of the market that values both productivity and personal enrichment.

Business Tourism Market Segment Analysis:

Business Tourism Market is Segmented on the basis of Type, Purpose, Expenditure, Age Group, Traveller, Service, Industry, and Region

By Type, Managed Business Travel segment is expected to dominate the market during the forecast period

- The business tourism market is categorized in to two; managed business travel and unmanaged business travel. On the other hand, managed business travel is a kind of business travel that is closely monitored through the corporate travel management department or through a third party agent and it mostly entails the business of decrease of costs, bookings and even the policies that are followed by the company’s travel department. Such type of travel is usually related to the large organizations with the aim of cutting costs, reducing risks, and time wastage.

- There is also unmanaged business where employees are on their own when it comes to making bookings, and this entails more freedom regarding destination, accommodation and time of travel. Unmanaged travel provides even bigger liberties to the employees, but involves higher prices of travelling and generally inconsistent travelling experience. While both are on the rise, the manged business travel is still commonly found within the corporate environment due to cost-savvy and efficiencies.

By Industry, Government segment expected to held the largest share

- The business tourism market is primarily driven by two key industries: government as well as the corporate world. This segment is led primarily by the government, through the hosting of international conference and business and diplomatic summits, policy meetings, which involve participants from all over the world. These events enhance the international relations and diplomacy, and also shape the international business relationships. On the other hand, the business section to the market is enormous since many businessmen arrange and attend industry tradeshows, corporate events, product launches, and corporate incentives.

- Business meetings, conventional conferences, team-building exercises, and other similar activities are on the rise and companies are using their time and resources to travel for creating opportunities for networking, knowledge exchange and business development. It is important for both sectors to supply business tourism services such as but not limited to transport facilities and accommodations, events organizations, and destination suppliers.

Business Tourism Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is expected to retain its position as the largest consumer of business tourism across the forecast period owing to well-developed corporate structure, boards of international conferences and conventions, and traditionally high rate of business travels.

- The opportunities to do business are greatly benefitted by such facilities of multinational companies, convention centres and business capitals like New York, Chicago, Toronto and Los Angeles of the region. On the same note, ample growth of bleisure travel coupled with the use of tag-on face-to-face meetings in hybrid or event based virtual meetings is expected to catalyze the demand in North America. Owning to improved air access, high expenditure on business travel, and a shifting focus toward premium business events, North America continues to be a leading global market for business tourism

Active Key Players in the Business Tourism Market

- Airbnb, Inc. (U.S.)

- American Express Compny (U.S.)

- BCD Group (Netherland)

- Booking Holdings (U.S.)

- CWT Solutions (U.S.)

- Corporate Travel Management (Australia)

- Expedia, Inc. (U.S.)

- Fareportal (U.S.)

- Flight Centre Travel Group Limited (formerly Flight Centre Limited) (U.S.)

- Wexas Travel (U.K.)

- Hogg Robinson Ltd (U.K.)

- Priceline (U.S.)

- Egencia LLC (U.S.)

- Frosch International Travel (U.K.)

- Ovation Travel Group (U.S.)

- Travel Leaders Group (U.S.)

- Others Active Players

|

Business Tourism Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.75 Billion |

|

Forecast Period 2024-32 CAGR: |

7.9% |

Market Size in 2032: |

USD 2.85 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Purpose |

|

||

|

By Expenditure |

|

||

|

By Age Group |

|

||

|

By Traveller |

|

||

|

By Service |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Business Tourism Market by Type

4.1 Business Tourism Market Snapshot and Growth Engine

4.2 Business Tourism Market Overview

4.3 Managed Business Travel

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Managed Business Travel: Geographic Segmentation Analysis

4.4 Unmanaged Business Travel

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Unmanaged Business Travel: Geographic Segmentation Analysis

Chapter 5: Business Tourism Market by Purpose

5.1 Business Tourism Market Snapshot and Growth Engine

5.2 Business Tourism Market Overview

5.3 Internal Meetings

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Internal Meetings: Geographic Segmentation Analysis

5.4 Trade Shows

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Trade Shows: Geographic Segmentation Analysis

5.5 Product Launch

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Product Launch: Geographic Segmentation Analysis

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Geographic Segmentation Analysis

Chapter 6: Business Tourism Market by Expenditure

6.1 Business Tourism Market Snapshot and Growth Engine

6.2 Business Tourism Market Overview

6.3 Travel Fare

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Travel Fare: Geographic Segmentation Analysis

6.4 Lodging

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Lodging: Geographic Segmentation Analysis

6.5 Dining

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Dining: Geographic Segmentation Analysis

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Geographic Segmentation Analysis

Chapter 7: Business Tourism Market by Age Group

7.1 Business Tourism Market Snapshot and Growth Engine

7.2 Business Tourism Market Overview

7.3 Travelers below 40 Years

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Travelers below 40 Years: Geographic Segmentation Analysis

7.4 Travelers above 40 Years

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Travelers above 40 Years: Geographic Segmentation Analysis

Chapter 8: Business Tourism Market by Traveller

8.1 Business Tourism Market Snapshot and Growth Engine

8.2 Business Tourism Market Overview

8.3 Group Travel

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Group Travel: Geographic Segmentation Analysis

8.4 Solo Travel

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Solo Travel: Geographic Segmentation Analysis

Chapter 9: Business Tourism Market by Service

9.1 Business Tourism Market Snapshot and Growth Engine

9.2 Business Tourism Market Overview

9.3 Transportation

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.3.3 Key Market Trends, Growth Factors and Opportunities

9.3.4 Transportation: Geographic Segmentation Analysis

9.4 Food and Lodging

9.4.1 Introduction and Market Overview

9.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.4.3 Key Market Trends, Growth Factors and Opportunities

9.4.4 Food and Lodging: Geographic Segmentation Analysis

9.5 Recreation Activity

9.5.1 Introduction and Market Overview

9.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.5.3 Key Market Trends, Growth Factors and Opportunities

9.5.4 Recreation Activity: Geographic Segmentation Analysis

Chapter 10: Business Tourism Market by Industry

10.1 Business Tourism Market Snapshot and Growth Engine

10.2 Business Tourism Market Overview

10.3 Government

10.3.1 Introduction and Market Overview

10.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

10.3.3 Key Market Trends, Growth Factors and Opportunities

10.3.4 Government: Geographic Segmentation Analysis

10.4 Corporate

10.4.1 Introduction and Market Overview

10.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

10.4.3 Key Market Trends, Growth Factors and Opportunities

10.4.4 Corporate: Geographic Segmentation Analysis

Chapter 11: Company Profiles and Competitive Analysis

11.1 Competitive Landscape

11.1.1 Competitive Benchmarking

11.1.2 Business Tourism Market Share by Manufacturer (2023)

11.1.3 Industry BCG Matrix

11.1.4 Heat Map Analysis

11.1.5 Mergers and Acquisitions

11.2 AIRBNB INC. (U.S.)

11.2.1 Company Overview

11.2.2 Key Executives

11.2.3 Company Snapshot

11.2.4 Role of the Company in the Market

11.2.5 Sustainability and Social Responsibility

11.2.6 Operating Business Segments

11.2.7 Product Portfolio

11.2.8 Business Performance

11.2.9 Key Strategic Moves and Recent Developments

11.2.10 SWOT Analysis

11.3 AMERICAN EXPRESS COMPNY (U.S.)

11.4 BCD GROUP (NETHERLAND)

11.5 BOOKING HOLDINGS (U.S.)

11.6 CWT SOLUTIONS (U.S.)

11.7 CORPORATE TRAVEL MANAGEMENT (AUSTRALIA)

11.8 EXPEDIA INC. (U.S.)

11.9 FAREPORTAL (U.S.)

11.10 FLIGHT CENTRE TRAVEL GROUP LIMITED (FORMERLY FLIGHT CENTRE LIMITED) (U.S.)

11.11 WEXAS TRAVEL (U.K.)

11.12 HOGG ROBINSON LTD (U.K.)

11.13 PRICELINE (U.S.)

11.14 EGENCIA LLC (U.S.)

11.15 FROSCH INTERNATIONAL TRAVEL (U.K.)

11.16 OVATION TRAVEL GROUP (U.S.)

11.17 TRAVEL LEADERS GROUP (U.S.)

11.18 OTHER ACTIVE PLAYERS

Chapter 12: Global Business Tourism Market By Region

12.1 Overview

12.2. North America Business Tourism Market

12.2.1 Key Market Trends, Growth Factors and Opportunities

12.2.2 Top Key Companies

12.2.3 Historic and Forecasted Market Size by Segments

12.2.4 Historic and Forecasted Market Size By Type

12.2.4.1 Managed Business Travel

12.2.4.2 Unmanaged Business Travel

12.2.5 Historic and Forecasted Market Size By Purpose

12.2.5.1 Internal Meetings

12.2.5.2 Trade Shows

12.2.5.3 Product Launch

12.2.5.4 Others

12.2.6 Historic and Forecasted Market Size By Expenditure

12.2.6.1 Travel Fare

12.2.6.2 Lodging

12.2.6.3 Dining

12.2.6.4 Others

12.2.7 Historic and Forecasted Market Size By Age Group

12.2.7.1 Travelers below 40 Years

12.2.7.2 Travelers above 40 Years

12.2.8 Historic and Forecasted Market Size By Traveller

12.2.8.1 Group Travel

12.2.8.2 Solo Travel

12.2.9 Historic and Forecasted Market Size By Service

12.2.9.1 Transportation

12.2.9.2 Food and Lodging

12.2.9.3 Recreation Activity

12.2.10 Historic and Forecasted Market Size By Industry

12.2.10.1 Government

12.2.10.2 Corporate

12.2.11 Historic and Forecast Market Size by Country

12.2.11.1 US

12.2.11.2 Canada

12.2.11.3 Mexico

12.3. Eastern Europe Business Tourism Market

12.3.1 Key Market Trends, Growth Factors and Opportunities

12.3.2 Top Key Companies

12.3.3 Historic and Forecasted Market Size by Segments

12.3.4 Historic and Forecasted Market Size By Type

12.3.4.1 Managed Business Travel

12.3.4.2 Unmanaged Business Travel

12.3.5 Historic and Forecasted Market Size By Purpose

12.3.5.1 Internal Meetings

12.3.5.2 Trade Shows

12.3.5.3 Product Launch

12.3.5.4 Others

12.3.6 Historic and Forecasted Market Size By Expenditure

12.3.6.1 Travel Fare

12.3.6.2 Lodging

12.3.6.3 Dining

12.3.6.4 Others

12.3.7 Historic and Forecasted Market Size By Age Group

12.3.7.1 Travelers below 40 Years

12.3.7.2 Travelers above 40 Years

12.3.8 Historic and Forecasted Market Size By Traveller

12.3.8.1 Group Travel

12.3.8.2 Solo Travel

12.3.9 Historic and Forecasted Market Size By Service

12.3.9.1 Transportation

12.3.9.2 Food and Lodging

12.3.9.3 Recreation Activity

12.3.10 Historic and Forecasted Market Size By Industry

12.3.10.1 Government

12.3.10.2 Corporate

12.3.11 Historic and Forecast Market Size by Country

12.3.11.1 Russia

12.3.11.2 Bulgaria

12.3.11.3 The Czech Republic

12.3.11.4 Hungary

12.3.11.5 Poland

12.3.11.6 Romania

12.3.11.7 Rest of Eastern Europe

12.4. Western Europe Business Tourism Market

12.4.1 Key Market Trends, Growth Factors and Opportunities

12.4.2 Top Key Companies

12.4.3 Historic and Forecasted Market Size by Segments

12.4.4 Historic and Forecasted Market Size By Type

12.4.4.1 Managed Business Travel

12.4.4.2 Unmanaged Business Travel

12.4.5 Historic and Forecasted Market Size By Purpose

12.4.5.1 Internal Meetings

12.4.5.2 Trade Shows

12.4.5.3 Product Launch

12.4.5.4 Others

12.4.6 Historic and Forecasted Market Size By Expenditure

12.4.6.1 Travel Fare

12.4.6.2 Lodging

12.4.6.3 Dining

12.4.6.4 Others

12.4.7 Historic and Forecasted Market Size By Age Group

12.4.7.1 Travelers below 40 Years

12.4.7.2 Travelers above 40 Years

12.4.8 Historic and Forecasted Market Size By Traveller

12.4.8.1 Group Travel

12.4.8.2 Solo Travel

12.4.9 Historic and Forecasted Market Size By Service

12.4.9.1 Transportation

12.4.9.2 Food and Lodging

12.4.9.3 Recreation Activity

12.4.10 Historic and Forecasted Market Size By Industry

12.4.10.1 Government

12.4.10.2 Corporate

12.4.11 Historic and Forecast Market Size by Country

12.4.11.1 Germany

12.4.11.2 UK

12.4.11.3 France

12.4.11.4 The Netherlands

12.4.11.5 Italy

12.4.11.6 Spain

12.4.11.7 Rest of Western Europe

12.5. Asia Pacific Business Tourism Market

12.5.1 Key Market Trends, Growth Factors and Opportunities

12.5.2 Top Key Companies

12.5.3 Historic and Forecasted Market Size by Segments

12.5.4 Historic and Forecasted Market Size By Type

12.5.4.1 Managed Business Travel

12.5.4.2 Unmanaged Business Travel

12.5.5 Historic and Forecasted Market Size By Purpose

12.5.5.1 Internal Meetings

12.5.5.2 Trade Shows

12.5.5.3 Product Launch

12.5.5.4 Others

12.5.6 Historic and Forecasted Market Size By Expenditure

12.5.6.1 Travel Fare

12.5.6.2 Lodging

12.5.6.3 Dining

12.5.6.4 Others

12.5.7 Historic and Forecasted Market Size By Age Group

12.5.7.1 Travelers below 40 Years

12.5.7.2 Travelers above 40 Years

12.5.8 Historic and Forecasted Market Size By Traveller

12.5.8.1 Group Travel

12.5.8.2 Solo Travel

12.5.9 Historic and Forecasted Market Size By Service

12.5.9.1 Transportation

12.5.9.2 Food and Lodging

12.5.9.3 Recreation Activity

12.5.10 Historic and Forecasted Market Size By Industry

12.5.10.1 Government

12.5.10.2 Corporate

12.5.11 Historic and Forecast Market Size by Country

12.5.11.1 China

12.5.11.2 India

12.5.11.3 Japan

12.5.11.4 South Korea

12.5.11.5 Malaysia

12.5.11.6 Thailand

12.5.11.7 Vietnam

12.5.11.8 The Philippines

12.5.11.9 Australia

12.5.11.10 New Zealand

12.5.11.11 Rest of APAC

12.6. Middle East & Africa Business Tourism Market

12.6.1 Key Market Trends, Growth Factors and Opportunities

12.6.2 Top Key Companies

12.6.3 Historic and Forecasted Market Size by Segments

12.6.4 Historic and Forecasted Market Size By Type

12.6.4.1 Managed Business Travel

12.6.4.2 Unmanaged Business Travel

12.6.5 Historic and Forecasted Market Size By Purpose

12.6.5.1 Internal Meetings

12.6.5.2 Trade Shows

12.6.5.3 Product Launch

12.6.5.4 Others

12.6.6 Historic and Forecasted Market Size By Expenditure

12.6.6.1 Travel Fare

12.6.6.2 Lodging

12.6.6.3 Dining

12.6.6.4 Others

12.6.7 Historic and Forecasted Market Size By Age Group

12.6.7.1 Travelers below 40 Years

12.6.7.2 Travelers above 40 Years

12.6.8 Historic and Forecasted Market Size By Traveller

12.6.8.1 Group Travel

12.6.8.2 Solo Travel

12.6.9 Historic and Forecasted Market Size By Service

12.6.9.1 Transportation

12.6.9.2 Food and Lodging

12.6.9.3 Recreation Activity

12.6.10 Historic and Forecasted Market Size By Industry

12.6.10.1 Government

12.6.10.2 Corporate

12.6.11 Historic and Forecast Market Size by Country

12.6.11.1 Turkiye

12.6.11.2 Bahrain

12.6.11.3 Kuwait

12.6.11.4 Saudi Arabia

12.6.11.5 Qatar

12.6.11.6 UAE

12.6.11.7 Israel

12.6.11.8 South Africa

12.7. South America Business Tourism Market

12.7.1 Key Market Trends, Growth Factors and Opportunities

12.7.2 Top Key Companies

12.7.3 Historic and Forecasted Market Size by Segments

12.7.4 Historic and Forecasted Market Size By Type

12.7.4.1 Managed Business Travel

12.7.4.2 Unmanaged Business Travel

12.7.5 Historic and Forecasted Market Size By Purpose

12.7.5.1 Internal Meetings

12.7.5.2 Trade Shows

12.7.5.3 Product Launch

12.7.5.4 Others

12.7.6 Historic and Forecasted Market Size By Expenditure

12.7.6.1 Travel Fare

12.7.6.2 Lodging

12.7.6.3 Dining

12.7.6.4 Others

12.7.7 Historic and Forecasted Market Size By Age Group

12.7.7.1 Travelers below 40 Years

12.7.7.2 Travelers above 40 Years

12.7.8 Historic and Forecasted Market Size By Traveller

12.7.8.1 Group Travel

12.7.8.2 Solo Travel

12.7.9 Historic and Forecasted Market Size By Service

12.7.9.1 Transportation

12.7.9.2 Food and Lodging

12.7.9.3 Recreation Activity

12.7.10 Historic and Forecasted Market Size By Industry

12.7.10.1 Government

12.7.10.2 Corporate

12.7.11 Historic and Forecast Market Size by Country

12.7.11.1 Brazil

12.7.11.2 Argentina

12.7.11.3 Rest of SA

Chapter 13 Analyst Viewpoint and Conclusion

13.1 Recommendations and Concluding Analysis

13.2 Potential Market Strategies

Chapter 14 Research Methodology

14.1 Research Process

14.2 Primary Research

14.3 Secondary Research

|

Business Tourism Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.75 Billion |

|

Forecast Period 2024-32 CAGR: |

7.9% |

Market Size in 2032: |

USD 2.85 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Purpose |

|

||

|

By Expenditure |

|

||

|

By Age Group |

|

||

|

By Traveller |

|

||

|

By Service |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||