Bridge IC Solutions Market Synopsis

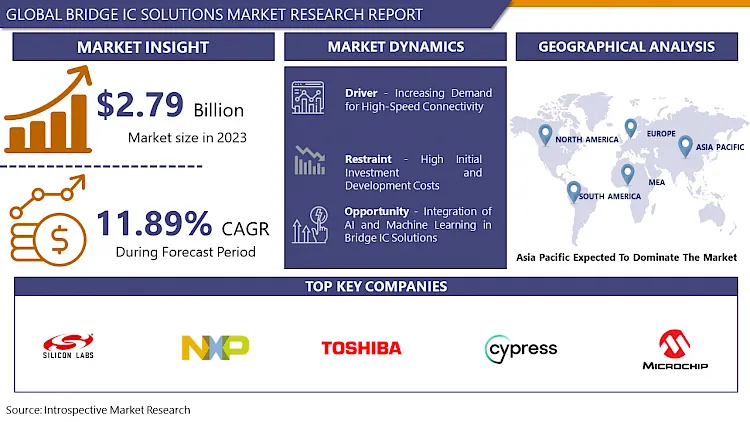

Bridge IC Solutions Market Size Was Valued at USD 2.79 Billion in 2023 and is Projected to Reach USD 7.67 Billion by 2032, Growing at a CAGR of 11.89% From 2024-2032.

Bridge IC Solutions refer to integrated circuits designed to facilitate seamless communication and interoperability between different electronic interfaces and protocols. These specialized chips act as bridges between various systems, converting signals from one format to another. Common applications include USB to UART, HDMI to DisplayPort, and Ethernet to USB bridges.

Bridge IC Solutions plays a crucial role in enabling connectivity and compatibility across diverse devices and interfaces, fostering the integration of technologies in consumer electronics, automotive systems, industrial automation, and other sectors.

Bridge IC Solutions are essential in modern electronics, offering advantages such as bridging diverse communication protocols and interfaces and promoting interoperability and connectivity in electronic devices. As the market integrates technologies in smart devices, automotive systems, and industrial applications, they facilitate continuous data exchange between components, enhancing system efficiency.

The rising demand for high-speed data interfaces, such as HDMI, USB, and DisplayPort, is driven by the popularity of high-resolution displays and data-intensive applications. The proliferation of IoT devices and the Industry 4.0 standard further increases the demand for Bridge ICs. The increasing complexity of electronic systems necessitates effective communication across diverse components with varied interfaces. As industries embrace digital transformation and connectivity becomes a key focus, the Bridge IC Solutions market experiences strong growth, driven by their crucial role in ensuring seamless communication across various applications.

Bridge IC Solutions Market Trend Analysis

Increasing Demand for High-Speed Connectivity

- The Bridge IC Solutions Market is experiencing significant growth due to the growing demand for high-speed connectivity in the digital era. Bridge ICs facilitate the conversion and interoperability of various communication protocols, ensuring efficient data exchange. With the proliferation of technologies like 5G, USB Type-C, HDMI, and DisplayPort, consumers and industries seek faster and more reliable connectivity options.

- Bridge IC Solutions enables devices with different interfaces to communicate at elevated speeds, supporting the transfer of large volumes of data. This trend is particularly prominent in consumer electronics, automotive applications, and data centers, where the demand for high-speed connectivity is dominant.

Integration of AI and Machine Learning in Bridge IC Solutions

- The integration of Artificial Intelligence (AI) and Machine Learning (ML) in Bridge IC Solutions presents a significant opportunity in advanced connectivity solutions. These technologies enable Bridge ICs to dynamically adapt and optimize communication pathways by learning from usage patterns, enhancing efficiency, and minimizing latency. Predictive maintenance is also enabled, identifying potential communication issues before they occur, and enhancing reliability in applications like automotive systems, industrial automation, and data centers.

- AI and ML algorithms in Bridge IC Solutions enable real-time decision-making, optimizing data transfer routes and protocol conversions based on network conditions. This improves device performance and energy efficiency in data transmission. The integration aligns with intelligent connectivity trends, promoting a more responsive and intelligent communication infrastructure, and positioning Bridge IC Solutions at the forefront of innovation.

Bridge IC Solutions Market Segment Analysis:

Bridge IC Solutions Market Segmented based on Type, Function, Technology, and Technology.

By Type, USB Interface ICs segment is expected to dominate the market during the forecast period

- USB (Universal Serial Bus) has become a ubiquitous and standardized interface across a wide range of electronic devices, including computers, smartphones, audio devices, and peripherals. The versatility and widespread adoption of USB makes USB Interface ICs essential components for bridging different communication protocols, ensuring seamless connectivity, and supporting various applications.

- As the demand for high-speed data transfer continues to grow, USB Interface ICs play a crucial role in facilitating rapid and efficient communication between devices. The introduction of advanced USB standards, such as USB4 and USB Type-C, further amplifies the significance of this segment. USB Type-C, in particular, offers a reversible and versatile connector, driving its adoption in modern devices and contributing to the dominance of USB Interface ICs.

By Application, CMOS-Based segment held the largest share of 76.8% in 2022

- CMOS offers a convincing combination of low power consumption, high integration density, and cost-effectiveness, making it a preferred choice for manufacturing Bridge ICs. The energy efficiency of CMOS technology aligns with the growing demand for power-efficient electronic devices and systems across various applications, including consumer electronics, automotive, and industrial sectors.

- CMOS technology facilitates the integration of complex functionalities on a single chip, enabling the development of highly integrated Bridge IC Solutions that can efficiently manage diverse communication protocols. The scalability and compatibility of CMOS technology make it well-suited for addressing the evolving requirements of advanced connectivity solutions. As the demand for smart devices, IoT applications, and high-speed data transfer continues to rise, the CMOS-Based segment is positioned to dominate the Bridge IC Solutions market by offering a technologically robust and economically viable solution for diverse connectivity needs.

Bridge IC Solutions Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is expected to dominate the Bridge IC Solutions market due to its position as a key player in semiconductor manufacturing and technology adoption. The region is home to leading semiconductor manufacturers, with established ecosystems in countries like Taiwan, South Korea, and China, contributing to the production of high-quality and cost-effective Bridge IC Solutions.

- The region is also experiencing significant growth in consumer electronics, automotive, and industrial sectors, which are key applications for Bridge ICs. The increasing demand for smart devices, IoT solutions, and high-speed connectivity in China and India further drives the adoption of Bridge IC Solutions. Government initiatives, smart cities, and Industry 4.0 initiatives further solidify Asia Pacific's dominance.

Bridge IC Solutions Market Top Key Players:

- Silicon Labs (US)

- Microchip (US)

- TI (US)

- Cypress (US)

- MaxLinear (US)

- Broadcom (US)

- FTDI (UK)

- NXP (Netherlands)

- Fujitsu (Japan)

- Toshiba (Japan)

- JMicron Technology (Taiwan)

- Silicon Motion (Taiwan)

- ASMedia Technology (Taiwan)

- Initio Corporation (Taiwan)

- ASIX (Taiwan)

- Holtek (Taiwan), and other Major Players

Key Industry Developments in the Bridge IC Solutions Market:

- In September 2023, GlobalFoundries® and Microchip jointly launched Microchip's 28-nm SuperFlash® Embedded Flash Memory Solution, marking the immediate release to production of the SST ESF3 third-generation embedded SuperFlash technology NVM solution. This widely deployed Non-Volatile Memory (NVM) solution is specifically optimized for microcontrollers (MCUs), smart cards, and IoT chips.

- In August 2023, TSMC, Bosch, Infineon, and NXP formed a partnership in order to bring advanced semiconductor manufacturing to Europe. ESMC represents a significant step towards the construction of a 300mm fab to support the future capacity needs of the fast-growing automotive and industrial sectors, with the final investment decision pending confirmation of the level of public funding for this project.

|

Bridge IC Solutions Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.79 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.89% |

Market Size in 2032: |

USD 7.67 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Function |

|

||

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Bridge IC Solutions Market by Type (2018-2032)

4.1 Bridge IC Solutions Market Snapshot and Growth Engine

4.2 Market Overview

4.3 USB Interface ICs

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 PCI/PCIe Interface ICs

4.5 SATA Interface ICs

Chapter 5: Bridge IC Solutions Market by Function (2018-2032)

5.1 Bridge IC Solutions Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Interface Bridges

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Sensor Fusion Bridges

5.5 Power Management Bridges

5.6 Connectivity Bridges

Chapter 6: Bridge IC Solutions Market by Technology (2018-2032)

6.1 Bridge IC Solutions Market Snapshot and Growth Engine

6.2 Market Overview

6.3 CMOS-Based

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 BiCMOS-Based

Chapter 7: Bridge IC Solutions Market by Application (2018-2032)

7.1 Bridge IC Solutions Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Communication

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Industrial

7.5 Healthcare

7.6 Automobile

7.7 Consumer Electronic

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Bridge IC Solutions Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 YUBA (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 RAD POWER BIKES (US)

8.4 XTRACYCLE (US)

8.5 PEDEGO ELECTRIC BIKES (US)

8.6 MADSEN CYCLES (US)

8.7 VELOSOPHY (SWEDEN)

8.8 RIESE AND MÜLLER (GERMANY)

8.9 URBAN ARROW (NETHERLANDS)

8.10 BAKFIETS.NL (NETHERLANDS)

8.11 CHRISTIANIA BIKES (DENMARK)

8.12 WINTHER BIKES (DENMARK)

8.13 LARRY VS HARRY (DENMARK)

8.14 BUTCHERS & BICYCLES (DENMARK)

8.15 DOUZE CYCLES (FRANCE)

8.16 TERN (TAIWAN)

8.17 GOMIER (TAIWAN)

8.18 KOCASS EBIKES (CHINA)

8.19 JXCYCLE (CHINA)

8.20

Chapter 9: Global Bridge IC Solutions Market By Region

9.1 Overview

9.2. North America Bridge IC Solutions Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 USB Interface ICs

9.2.4.2 PCI/PCIe Interface ICs

9.2.4.3 SATA Interface ICs

9.2.5 Historic and Forecasted Market Size by Function

9.2.5.1 Interface Bridges

9.2.5.2 Sensor Fusion Bridges

9.2.5.3 Power Management Bridges

9.2.5.4 Connectivity Bridges

9.2.6 Historic and Forecasted Market Size by Technology

9.2.6.1 CMOS-Based

9.2.6.2 BiCMOS-Based

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Communication

9.2.7.2 Industrial

9.2.7.3 Healthcare

9.2.7.4 Automobile

9.2.7.5 Consumer Electronic

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Bridge IC Solutions Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 USB Interface ICs

9.3.4.2 PCI/PCIe Interface ICs

9.3.4.3 SATA Interface ICs

9.3.5 Historic and Forecasted Market Size by Function

9.3.5.1 Interface Bridges

9.3.5.2 Sensor Fusion Bridges

9.3.5.3 Power Management Bridges

9.3.5.4 Connectivity Bridges

9.3.6 Historic and Forecasted Market Size by Technology

9.3.6.1 CMOS-Based

9.3.6.2 BiCMOS-Based

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Communication

9.3.7.2 Industrial

9.3.7.3 Healthcare

9.3.7.4 Automobile

9.3.7.5 Consumer Electronic

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Bridge IC Solutions Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 USB Interface ICs

9.4.4.2 PCI/PCIe Interface ICs

9.4.4.3 SATA Interface ICs

9.4.5 Historic and Forecasted Market Size by Function

9.4.5.1 Interface Bridges

9.4.5.2 Sensor Fusion Bridges

9.4.5.3 Power Management Bridges

9.4.5.4 Connectivity Bridges

9.4.6 Historic and Forecasted Market Size by Technology

9.4.6.1 CMOS-Based

9.4.6.2 BiCMOS-Based

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Communication

9.4.7.2 Industrial

9.4.7.3 Healthcare

9.4.7.4 Automobile

9.4.7.5 Consumer Electronic

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Bridge IC Solutions Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 USB Interface ICs

9.5.4.2 PCI/PCIe Interface ICs

9.5.4.3 SATA Interface ICs

9.5.5 Historic and Forecasted Market Size by Function

9.5.5.1 Interface Bridges

9.5.5.2 Sensor Fusion Bridges

9.5.5.3 Power Management Bridges

9.5.5.4 Connectivity Bridges

9.5.6 Historic and Forecasted Market Size by Technology

9.5.6.1 CMOS-Based

9.5.6.2 BiCMOS-Based

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Communication

9.5.7.2 Industrial

9.5.7.3 Healthcare

9.5.7.4 Automobile

9.5.7.5 Consumer Electronic

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Bridge IC Solutions Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 USB Interface ICs

9.6.4.2 PCI/PCIe Interface ICs

9.6.4.3 SATA Interface ICs

9.6.5 Historic and Forecasted Market Size by Function

9.6.5.1 Interface Bridges

9.6.5.2 Sensor Fusion Bridges

9.6.5.3 Power Management Bridges

9.6.5.4 Connectivity Bridges

9.6.6 Historic and Forecasted Market Size by Technology

9.6.6.1 CMOS-Based

9.6.6.2 BiCMOS-Based

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Communication

9.6.7.2 Industrial

9.6.7.3 Healthcare

9.6.7.4 Automobile

9.6.7.5 Consumer Electronic

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Bridge IC Solutions Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 USB Interface ICs

9.7.4.2 PCI/PCIe Interface ICs

9.7.4.3 SATA Interface ICs

9.7.5 Historic and Forecasted Market Size by Function

9.7.5.1 Interface Bridges

9.7.5.2 Sensor Fusion Bridges

9.7.5.3 Power Management Bridges

9.7.5.4 Connectivity Bridges

9.7.6 Historic and Forecasted Market Size by Technology

9.7.6.1 CMOS-Based

9.7.6.2 BiCMOS-Based

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Communication

9.7.7.2 Industrial

9.7.7.3 Healthcare

9.7.7.4 Automobile

9.7.7.5 Consumer Electronic

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Bridge IC Solutions Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.79 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.89% |

Market Size in 2032: |

USD 7.67 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Function |

|

||

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||