Botanical Extracts Market Synopsis

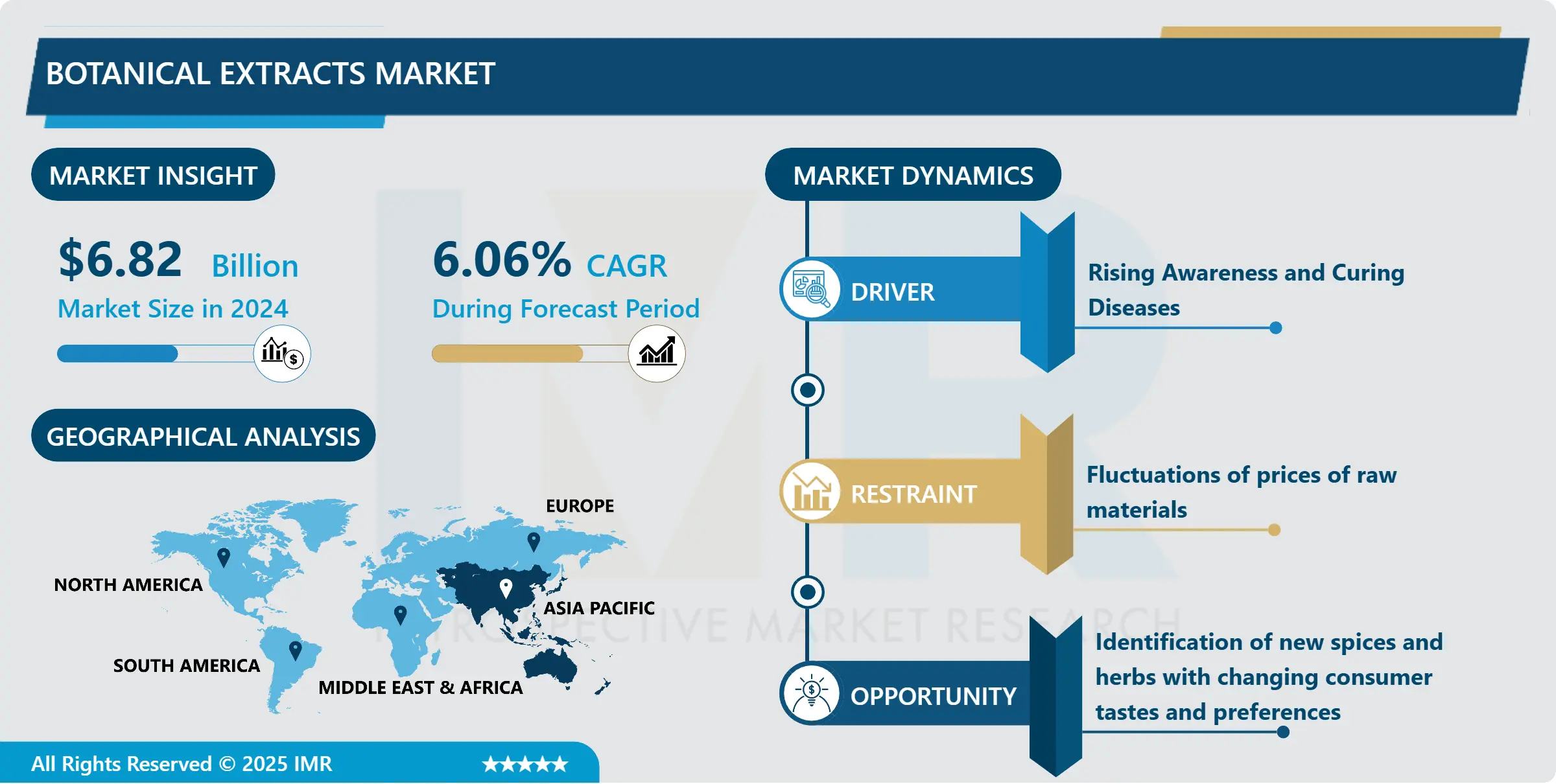

The Global Botanical Extracts Market size is expected to grow from USD 6.82 billion in 2024 to USD 10.91 billion by 2032, at a CAGR of 6.06% during the forecast period (2025-2032)

Botanical extracts are used as an ingredient in the food & beverages industry to amend flavor, aroma, or nutritive quality. This market is greatly altered by the changes in preferences and consumption patterns of consumers who are looking for natural flavors in their food.

The botanical extracts market has witnessed significant growth in recent years, driven by increasing consumer demand for natural and plant-based products in various industries. These extracts are derived from plants, herbs, and flowers, and are valued for their diverse applications in food and beverages, pharmaceuticals, cosmetics, and nutraceuticals.

Consumers are increasingly seeking healthier and sustainable alternatives, leading to a surge in the popularity of botanical extracts. The food and beverage industry utilizes these extracts for flavoring, coloring, and functional benefits. In the pharmaceutical sector, botanical extracts are valued for their medicinal properties and potential health benefits.

The global market is characterized by a wide range of botanical extracts, including those from herbs like ginseng, echinacea, and turmeric, as well as fruits such as berries and citrus. The rising awareness of the health benefits associated with these extracts, coupled with growing research and development activities, is expected to further propel market growth.

Botanical Extracts Market Trend Analysis

Botanical Extracts Market Growth Drivers- Rising Awareness Among Individuals About the Benefits of Botanical Extracts

- In recent years, there has been a notable surge in awareness among individuals regarding the manifold benefits of botanical extracts, propelling the botanical extracts market to new heights. As people become increasingly health-conscious and seek natural alternatives, the demand for botanical extracts has witnessed a significant upswing. These extracts, derived from various plants and herbs, are gaining recognition for their therapeutic properties and potential contributions to overall well-being.

- Consumers are embracing botanical extracts for their diverse applications, including skincare, dietary supplements, and medicinal purposes. The growing awareness of the potential health benefits, such as anti-inflammatory, antioxidant, and immune-boosting properties, has fueled a positive perception of botanical extracts. Additionally, the trend towards sustainable and eco-friendly products has further amplified the appeal of these natural extracts.

- The information age has played a pivotal role in disseminating knowledge about botanical extracts, with individuals seeking information through online platforms and social media. As a result, there is a burgeoning market for botanical extracts, driven by a well-informed and health-conscious consumer base keen on integrating these natural solutions into their lifestyles. This rising awareness is not only shaping consumer choices but also influencing product innovation and market dynamics within the botanical extracts industry.

Botanical Extracts Market Opportunities- Identification of new spices and herbs with changing consumer tastes and preferences Creates an Opportunity

- The evolving landscape of consumer tastes and preferences presents a lucrative opportunity for the Botanical Extracts Market. As culinary trends shift and consumers seek novel flavor profiles, there is an increased demand for new spices and herbs to enhance the sensory experience of food and beverages. This dynamic market scenario prompts the exploration and identification of unique botanical extracts that can cater to changing preferences.

- Consumers are increasingly drawn to exotic and diverse flavors, driven by a growing interest in global cuisines and a desire for unique culinary experiences. As a result, the Botanical Extracts Market can capitalize on this trend by introducing innovative and lesser-known spices and herbs. The discovery and incorporation of these new botanical extracts not only align with consumer preferences but also contribute to the development of distinctive and marketable products.

- Manufacturers in the botanical extracts industry have the opportunity to collaborate with food innovators and chefs to create cutting-edge flavor combinations. This proactive approach to identifying and incorporating new spices and herbs ensures that the Botanical Extracts Market remains dynamic and responsive to the ever-changing landscape of consumer tastes, ultimately fostering growth and success in the industry.

Botanical Extracts Market Segment Analysis:

Botanical Extracts Market Segmented based on form, source, application.

By Source, Spices segment is expected to dominate the market during the forecast period

- The Spices segment is anticipated to emerge as the dominant force in the Botanical Extracts Market, fueled by several key factors that underscore its prominence. First and foremost, the increasing consumer demand for natural and organic products has significantly bolstered the appeal of botanical extracts derived from spices. Consumers are increasingly seeking healthier alternatives, and spices not only add flavor but also come with various health benefits.

- Moreover, the rich cultural and culinary heritage associated with spices has contributed to their widespread acceptance and utilization in various cuisines globally. As people become more adventurous in their culinary pursuits, the demand for exotic and diverse flavors, often derived from botanical extracts, is on the rise. This trend has particularly propelled the growth of the Spices segment, positioning it at the forefront of the Botanical Extracts Market.

By Form, powdered form segment held the largest share in 2024

- Powdered botanical extracts are known for their ease of handling, storage, and incorporation into different products, making them a preferred choice for manufacturers across diverse industries such as food and beverages, pharmaceuticals, and cosmetics. The powdered form allows for precise dosing and ensures consistent quality in the final products. Additionally, it offers a longer shelf life compared to liquid or other forms, enhancing the product's stability and usability.

- Furthermore, powdered botanical extracts are often more cost-effective in terms of transportation and storage, making them economically attractive for both producers and consumers. This segment's dominance is also driven by the increasing consumer preference for natural and plant-based ingredients, as powdered botanical extracts retain the essential bioactive compounds of plants in a concentrated form. As the demand for natural and functional ingredients continues to grow, the powdered form segment is expected to maintain its stronghold in the Botanical Extracts Market.

Botanical Extracts Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to emerge as the dominant force in the global botanical extracts market, showcasing robust growth and market leadership. This projection is underpinned by several key factors contributing to the region's ascendancy in this industry.

- The Asia Pacific region boasts an abundant and diverse range of botanical resources, providing a rich repository for the extraction of various plant-based compounds. This abundance not only facilitates cost-effective production but also allows for a wide array of botanical extracts catering to diverse consumer demands.

- The increasing awareness and preference for natural and plant-based products among consumers in the Asia Pacific region drive the demand for botanical extracts. The cultural affinity towards traditional herbal remedies and holistic wellness practices further propels the adoption of botanical extracts in various applications.

- Moreover, the expanding pharmaceutical, food, and cosmetic industries in the Asia Pacific region contribute significantly to the market's growth. These industries increasingly recognize and integrate botanical extracts for their therapeutic, flavoring, and cosmetic properties, further amplifying the demand.

Botanical Extracts Market Top Key Players:

- BI Nutraceuticals (U.S.)

- Synergy Flavors (U.S.)

- Bell Flavors & Fragrances (U.S.)

- International Flavors and Fragrances Inc (US)

- Kalsec Inc (U.S.)

- Martin Bauer Group (Germany)

- Döhler GmbH (Germany)

- Fytosan (France)

- Nexira (France)

- Blue Sky Botanics (U.K.)

- Ransom Naturals Limited (UK)

- Frutarom Ltd. (Israel)

- Haldin Natural (Indonesia)

- Nutra Green Biotechnology Co.Ltd. (China)

- Synthite Industries Limited (India)

- Other Active Players

Key Industry Developments in the Botanical Extracts Market:

- In March 2023, US-basedIngredion, a leading ingredient solutions provider, completed the acquisition of Ingredi SA, a French botanical extracts manufacturer. This move strengthens Ingredion's foothold in the European market and expands its botanical extracts portfolio.

- In August 2023, French botanical extracts specialist Naturex joined forces with Danish flavor and enzyme producer Chr. Hansen in a €8.3 billion deal. This creates a global leader in natural ingredients, aiming to leverage combined expertise and market reach.

|

Global Botanical Extracts Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 6.82 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.06% |

Market Size in 2032: |

USD 10.91 Bn. |

|

Segments Covered: |

By Form |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Botanical Extracts Market by Form (2018-2032)

4.1 Botanical Extracts Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Powder

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Liquid

Chapter 5: Botanical Extracts Market by Source (2018-2032)

5.1 Botanical Extracts Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Herbs and Spices

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Fruits

Chapter 6: Botanical Extracts Market by Application (2018-2032)

6.1 Botanical Extracts Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Beverage

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Personal care

6.5 Pharmaceutical

6.6 Nutraceuticals

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Botanical Extracts Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ALFRED KÄRCHER

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AL-KO

7.4 DEERE & COFUTURE GEN ROBOTICS

7.5 HANGZHOU FAVOR ROBOT TECHNOLOGY

7.6 HITACHI

7.7 HONDA MOTOR COMPANY

7.8 HUSQVARNA

7.9 IROBOT

7.10 LG

7.11 LINEA TIELLE

7.12 MAMIBOT

7.13 MILAGROW HUMANTECH

7.14 MTD PRODUCTS

7.15 NINGBO NGP INDUSTRY

7.16 POSITEC TOOL (WORX)

7.17 ROBERT BOSCH

7.18 STIGA

7.19 STIHL

7.20 THE KOBI COMPANY

7.21 THE SUMEC CORP. (YARD FORCE)

7.22 TURFLYNX

7.23 VOLTA

7.24 WIPER ECOROBT (NIKO)

7.25 YAMABIKO EUROPE (BELROBOTICS)

7.26 ZCS

7.27 ZHEJIANG TIANCHEN INTELLIGENCE & TECHNOLOGY

7.28 ZICOM

7.29 ZIPPER MASCHINEN

Chapter 8: Global Botanical Extracts Market By Region

8.1 Overview

8.2. North America Botanical Extracts Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Form

8.2.4.1 Powder

8.2.4.2 Liquid

8.2.5 Historic and Forecasted Market Size by Source

8.2.5.1 Herbs and Spices

8.2.5.2 Fruits

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Beverage

8.2.6.2 Personal care

8.2.6.3 Pharmaceutical

8.2.6.4 Nutraceuticals

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Botanical Extracts Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Form

8.3.4.1 Powder

8.3.4.2 Liquid

8.3.5 Historic and Forecasted Market Size by Source

8.3.5.1 Herbs and Spices

8.3.5.2 Fruits

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Beverage

8.3.6.2 Personal care

8.3.6.3 Pharmaceutical

8.3.6.4 Nutraceuticals

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Botanical Extracts Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Form

8.4.4.1 Powder

8.4.4.2 Liquid

8.4.5 Historic and Forecasted Market Size by Source

8.4.5.1 Herbs and Spices

8.4.5.2 Fruits

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Beverage

8.4.6.2 Personal care

8.4.6.3 Pharmaceutical

8.4.6.4 Nutraceuticals

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Botanical Extracts Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Form

8.5.4.1 Powder

8.5.4.2 Liquid

8.5.5 Historic and Forecasted Market Size by Source

8.5.5.1 Herbs and Spices

8.5.5.2 Fruits

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Beverage

8.5.6.2 Personal care

8.5.6.3 Pharmaceutical

8.5.6.4 Nutraceuticals

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Botanical Extracts Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Form

8.6.4.1 Powder

8.6.4.2 Liquid

8.6.5 Historic and Forecasted Market Size by Source

8.6.5.1 Herbs and Spices

8.6.5.2 Fruits

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Beverage

8.6.6.2 Personal care

8.6.6.3 Pharmaceutical

8.6.6.4 Nutraceuticals

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Botanical Extracts Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Form

8.7.4.1 Powder

8.7.4.2 Liquid

8.7.5 Historic and Forecasted Market Size by Source

8.7.5.1 Herbs and Spices

8.7.5.2 Fruits

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Beverage

8.7.6.2 Personal care

8.7.6.3 Pharmaceutical

8.7.6.4 Nutraceuticals

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Botanical Extracts Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 6.82 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.06% |

Market Size in 2032: |

USD 10.91 Bn. |

|

Segments Covered: |

By Form |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||