Autonomous Tractor Market Synopsis:

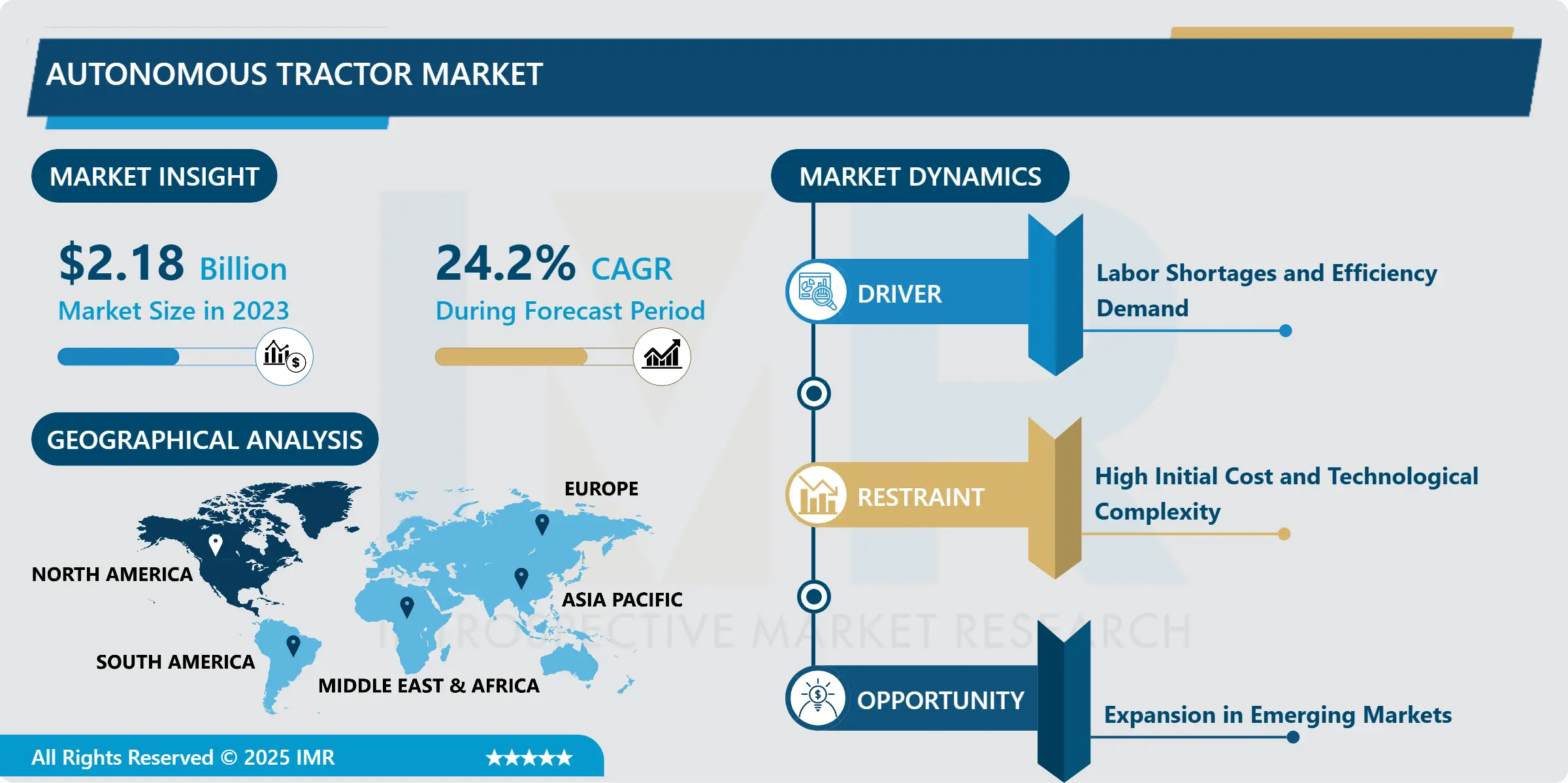

Autonomous Tractor Market Size Was Valued at USD 2.18 Billion in 2023, and is Projected to Reach USD 15.33 Billion by 2032, Growing at a CAGR of 24.2% From 2024-2032.

Autonomous tractor market relates to the sector, involving the production and use of tractors that do not require operators’ involvement. These are self-driven tractors with artificial intelligence capabilities, proven GPS, sensors, and machine learning to drive or plow farming lands, plant crops and similar chores for increased efficiency and accuracy not forgetting the aspect of labor.

Automotive autonomous tractors are arguably new and unique markets in the agricultural machinery industry… Alternative farming strategies can present the pressures for more productivity, less human resource utilization, and the incorporation of autonomous tractors. They are designed for ploughing, sowing, manuring, picking and almost all the farming activities that can possibly be done with very little or no interference of human beings. ES using complex formulas, GPS, cameras, and LIDAR sensors enhances the machines’ abilities to traverse through fields, avoid objects and optimise their work in real time thus enhancing operations workflow.

The market is fueled by the strive to employ accurate solutions that shall ensure high yields per acreage while minimizing on the use of resources such as fuel, labor and fertilizers. Also, the scarcity of labor in the global agricultural industry especially in rural areas has heavily inclined the world towards the use of automation in farming. Growing demand of rigid and self-driving tractors is also the result of the rising trend of eco-friendly farming systems because its use leads to minimal pressure to the soil and greater accuracy in applying fertilization and weed eradication.

North America and Europe have been the first to embrace autonomous tractors, where large scale commercialised farms played the pioneer in the overall use of autonomous technology. Nevertheless, emerging regions such as the Asia-Pacific have factors such as high labour costs and a large accent on agriculture. Self-automated equipment innovations and development remain a progressive process where firms are still developing new technologies or expanding applications at better levels of price, performance, and adaptability.

With regards to market segmentation, the AEU market in particular and the autonomy in general, it is important to note that the market for autonomous tractors is expected to grow at an astonishing rate in the years to come. This growth is attributed to the push for innovation in growth in technology and pull innovation by the market place as agriculture becomes more mechanized. Also, contributing to the market growth is the trend of the growing number of partnerships between the manufacturers of agricultural equipment and technological companies. Hence as the use of autonomous tractors increases in the future it is expected to spread to the small holder farmers and new markets.

Autonomous Tractor Market Trend Analysis:

Precision Agriculture with Autonomous Tractors

- One of the growth trends for this market is the prominent use of precision agriculture combined with autonomous tractors. Precision agriculture refers to the practice of applying technology tools to managing variability in fields for production and conservation agriculture. Precision farming itself is made possible by utilization of autonomous tractors as they are capable of gathering data from real time sensors as well as GPS facilities. This enables farmer to decide correctly on which time and area to plant, spray, fertilize, and harvest in order to avoid wastage of resources.

- With the increasing level of adoption of precision farming, these robot tractors are evolving into smart tress not only at physically operating farm tools based on directions but also evaluating the condition of each farm area. Such tractors need an integration of artificial intelligence and machine learning that can make them intelligent by changing their operations based on variables such as soil quality and crop status as well as the climate. Automated adjustment without the presence of people is not only time efficient but also accurate Additional, it reduces costly inputs including pesticides, fertilizer and water significantly.

Expansion in Emerging Markets

- One of the major opportunities to provide growth in the level of autonomous tractor is the development of these applications in other regions. However, while North America and Europe have already demonstrated keen interest in adopting autonomous tractors, many opportunities remain in Asia-Pacific, Africa, and Latin America. India and Brazil for instance, rely majorly on agriculture thus the incorporation of the autonomous tractors play optimizing roles within the sector.

- The benefits which can be expected for the autonomous tractors in the emergent markets are unusually large. Existing large- scale farming companies face the challenges of lack of sufficient labour, high costs of farm equipment and low productivity, self- driven tractors offer efficient, accessible, entrepreneurial, and sustainable solutions to the above challenges. Besides, the process of urbanization in these areas and increasing costs for labor would make the use of robotics more rational from the point of view of local agribusinessmen. As the cost of using autonomous tractors decreases due to improving technologies, then entry from other related global companies is likely to boost demand and therefore expand this market.

Autonomous Tractor Market Segment Analysis:

Autonomous Tractor Market is Segmented on the basis of Type, Technology, Application, End User, and Region.

By Type, Fully Autonomous Tractors segment is expected to dominate the market during the forecast period

- Fully Autonomous Tractors: Self driving tractors are those tractors that do not require human Interface at all and they use AI, GPS and sensors for operations such as plowing and planting and harvesting etc . These are not tractors that have to be monitored from a central control point, these tractors are fully capable of moving across the field, sensing the environment, and adjusting for contingencies on the fly. In the future, as these technologies develop the market for fully autonomous tractors will grow due to the recognition of full automation as an essential factor in large-scale farming that requires high efficiency and productivity.

- Semi-Autonomous Tractors: Semi-automatic tractors do not completely operate on their own, in most instances the farmer has to monitor or control the operation of the tractor, although it mostly runs on owned program or sequence of instructions but not fully automatic. These tractors normally perform routine functions such as steering or ploughing on their own but might need the human control in making complicated decisions or when the environment is unforeseeable. Semi-autonomous segment may rise to large heights of the market as it is in satisfying the farmer’s desire of having automated tractors without completely emptying their pocket.

By Application, Crop Farming segment expected to held the largest share

- Crop Farming: Self-propelled tractors are widely used in crop farming because activities such as planting, spraying, plowing, and linking, which are crucial in crop production, comprise repetitive operations. Fresh planting and fertigation machines lower the cost of labor and enhance the right placement of plants and nutrients, which can enhance crop production and sustainable agriculture. In this sector, it is projected that with the demand for high-efficiency crop farming, there will be a large increase in the use of autonomous tractors.

- Livestock Farming: Even though most developments with autonomous tractors have targeted crop farming, livestock farming is set to benefit from this new generation equipment. Self propelled tractors are useful in tending the cattle, cleaning the farm and general maintenance and development of the farm structures. In large scale livestock farming these tractors could help to minimize the workload because it can help in running operations. In this application, the increasing industry of livestock farming particularly in the regions of low human resource availability will boost tenders for autonomous tractors.

Autonomous Tractor Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is at present the most popular region in the market of autonomous tractors. Of all the nations, the United States of America has been at the fore front in embracing modern techniques and technologies in farming not mentioning autonomous machinery. It has a large agricultural industry in particular large scale commercial farming for which automation is highly advantageous. Due to the growth of demand for better, cost efficient solutions for farming and the availability of sophisticated technological systems, the overall importance of North American market is not likely to diminish any time soon.

- The commitment of key players mainly in North America and the government support for the application of technology in agriculture more especially in the developing world explain why the region leads. Also, the increasing popularity of other concepts, such as sustainable farming and precision agriculture, has also contributed to developments in autonomous tractors at an equally rapid progress. As these technologies continue to gain discos North America is likely to retain the leadership position and expansion in both crop and livestock farming practices.

Active Key Players in the Autonomous Tractor Market:

- AG Leader Technology (USA)

- AGCO Corporation (USA)

- Autonomous Solutions, Inc. (USA)

- Autonomous Tractor Corporation (USA)

- CNH Industrial (UK/Netherlands)

- John Deere (USA)

- Kubota Corporation (Japan)

- Mahindra & Mahindra Ltd. (India)

- Raven Industries (USA)

- Topcon Corporation (Japan)

- Trimble Inc. (USA)

- Yanmar Co., Ltd. (Japan)

- Other Active Players

Key Industry Developments in the Autonomous Tractor Market:

- In February 2024, Deere & Company introduced its latest range of four-track tractors with high hp, which includes a top model boasting 830 horsepower. The 2025 lineup features new models, including the 9RX 710, the 9RX 770, and the 9RX 830, equipped with upgraded engines, hydraulic systems, and technology packages, along with updated cabs. To support farmers in preparing their equipment and farms for autonomous operations, the MY25 8 Series and 9 Series tractors will offer an autonomous-ready option. This feature enables farmers to transition to fully autonomous operation seamlessly, aligning with their farm's specific readiness.

- In October 2023, Monarch Tractor expanded its operations into Europe, marking a significant milestone in its global growth strategy. This move signifies Monarch Tractor's commitment to global growth and its confidence in meeting farmers' evolving needs for sustainable and efficient agricultural solutions. It positions Monarch Tractor as an emerging player in the European agricultural technology sector and sets the stage for further expansion and innovation in the future.

|

Autonomous Tractor Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.18 Billion |

|

Forecast Period 2024-32 CAGR: |

24.2% |

Market Size in 2032: |

USD 15.33 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Autonomous Tractor Market by Type

4.1 Autonomous Tractor Market Snapshot and Growth Engine

4.2 Autonomous Tractor Market Overview

4.3 Fully Autonomous Tractors

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Fully Autonomous Tractors: Geographic Segmentation Analysis

4.4 Semi-Autonomous Tractors

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Semi-Autonomous Tractors: Geographic Segmentation Analysis

Chapter 5: Autonomous Tractor Market by Application

5.1 Autonomous Tractor Market Snapshot and Growth Engine

5.2 Autonomous Tractor Market Overview

5.3 Crop Farming

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Crop Farming: Geographic Segmentation Analysis

5.4 Livestock Farming

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Livestock Farming: Geographic Segmentation Analysis

5.5 Forestry

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Forestry: Geographic Segmentation Analysis

5.6 Other

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Other: Geographic Segmentation Analysis

Chapter 6: Autonomous Tractor Market by Technology

6.1 Autonomous Tractor Market Snapshot and Growth Engine

6.2 Autonomous Tractor Market Overview

6.3 GPS/GNSS Technology

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 GPS/GNSS Technology: Geographic Segmentation Analysis

6.4 LIDAR Technology

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 LIDAR Technology: Geographic Segmentation Analysis

6.5 Computer Vision

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Computer Vision: Geographic Segmentation Analysis

6.6 Artificial Intelligence

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Artificial Intelligence: Geographic Segmentation Analysis

Chapter 7: Autonomous Tractor Market by End-User

7.1 Autonomous Tractor Market Snapshot and Growth Engine

7.2 Autonomous Tractor Market Overview

7.3 Farmers

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Farmers: Geographic Segmentation Analysis

7.4 Agricultural Service Providers

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Agricultural Service Providers: Geographic Segmentation Analysis

7.5 Large-Scale Farms

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Large-Scale Farms: Geographic Segmentation Analysis

7.6 Small-Scale Farms

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Small-Scale Farms: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Autonomous Tractor Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 JOHN DEERE (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 AGCO CORPORATION (USA)

8.4 CNH INDUSTRIAL (UK/NETHERLANDS)

8.5 KUBOTA CORPORATION (JAPAN)

8.6 TRIMBLE INC. (USA)

8.7 YANMAR CO. LTD. (JAPAN)

8.8 AUTONOMOUS TRACTOR CORPORATION (USA)

8.9 MAHINDRA & MAHINDRA LTD. (INDIA)

8.10 AUTONOMOUS SOLUTIONS INC. (USA)

8.11 RAVEN INDUSTRIES (USA)

8.12 TOPCON CORPORATION (JAPAN)

8.13 AG LEADER TECHNOLOGY (USA)

8.14

8.15 OTHER ACTIVE PLAYERS

Chapter 9: Global Autonomous Tractor Market By Region

9.1 Overview

9.2. North America Autonomous Tractor Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 Fully Autonomous Tractors

9.2.4.2 Semi-Autonomous Tractors

9.2.5 Historic and Forecasted Market Size By Application

9.2.5.1 Crop Farming

9.2.5.2 Livestock Farming

9.2.5.3 Forestry

9.2.5.4 Other

9.2.6 Historic and Forecasted Market Size By Technology

9.2.6.1 GPS/GNSS Technology

9.2.6.2 LIDAR Technology

9.2.6.3 Computer Vision

9.2.6.4 Artificial Intelligence

9.2.7 Historic and Forecasted Market Size By End-User

9.2.7.1 Farmers

9.2.7.2 Agricultural Service Providers

9.2.7.3 Large-Scale Farms

9.2.7.4 Small-Scale Farms

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Autonomous Tractor Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 Fully Autonomous Tractors

9.3.4.2 Semi-Autonomous Tractors

9.3.5 Historic and Forecasted Market Size By Application

9.3.5.1 Crop Farming

9.3.5.2 Livestock Farming

9.3.5.3 Forestry

9.3.5.4 Other

9.3.6 Historic and Forecasted Market Size By Technology

9.3.6.1 GPS/GNSS Technology

9.3.6.2 LIDAR Technology

9.3.6.3 Computer Vision

9.3.6.4 Artificial Intelligence

9.3.7 Historic and Forecasted Market Size By End-User

9.3.7.1 Farmers

9.3.7.2 Agricultural Service Providers

9.3.7.3 Large-Scale Farms

9.3.7.4 Small-Scale Farms

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Autonomous Tractor Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 Fully Autonomous Tractors

9.4.4.2 Semi-Autonomous Tractors

9.4.5 Historic and Forecasted Market Size By Application

9.4.5.1 Crop Farming

9.4.5.2 Livestock Farming

9.4.5.3 Forestry

9.4.5.4 Other

9.4.6 Historic and Forecasted Market Size By Technology

9.4.6.1 GPS/GNSS Technology

9.4.6.2 LIDAR Technology

9.4.6.3 Computer Vision

9.4.6.4 Artificial Intelligence

9.4.7 Historic and Forecasted Market Size By End-User

9.4.7.1 Farmers

9.4.7.2 Agricultural Service Providers

9.4.7.3 Large-Scale Farms

9.4.7.4 Small-Scale Farms

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Autonomous Tractor Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 Fully Autonomous Tractors

9.5.4.2 Semi-Autonomous Tractors

9.5.5 Historic and Forecasted Market Size By Application

9.5.5.1 Crop Farming

9.5.5.2 Livestock Farming

9.5.5.3 Forestry

9.5.5.4 Other

9.5.6 Historic and Forecasted Market Size By Technology

9.5.6.1 GPS/GNSS Technology

9.5.6.2 LIDAR Technology

9.5.6.3 Computer Vision

9.5.6.4 Artificial Intelligence

9.5.7 Historic and Forecasted Market Size By End-User

9.5.7.1 Farmers

9.5.7.2 Agricultural Service Providers

9.5.7.3 Large-Scale Farms

9.5.7.4 Small-Scale Farms

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Autonomous Tractor Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 Fully Autonomous Tractors

9.6.4.2 Semi-Autonomous Tractors

9.6.5 Historic and Forecasted Market Size By Application

9.6.5.1 Crop Farming

9.6.5.2 Livestock Farming

9.6.5.3 Forestry

9.6.5.4 Other

9.6.6 Historic and Forecasted Market Size By Technology

9.6.6.1 GPS/GNSS Technology

9.6.6.2 LIDAR Technology

9.6.6.3 Computer Vision

9.6.6.4 Artificial Intelligence

9.6.7 Historic and Forecasted Market Size By End-User

9.6.7.1 Farmers

9.6.7.2 Agricultural Service Providers

9.6.7.3 Large-Scale Farms

9.6.7.4 Small-Scale Farms

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Autonomous Tractor Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 Fully Autonomous Tractors

9.7.4.2 Semi-Autonomous Tractors

9.7.5 Historic and Forecasted Market Size By Application

9.7.5.1 Crop Farming

9.7.5.2 Livestock Farming

9.7.5.3 Forestry

9.7.5.4 Other

9.7.6 Historic and Forecasted Market Size By Technology

9.7.6.1 GPS/GNSS Technology

9.7.6.2 LIDAR Technology

9.7.6.3 Computer Vision

9.7.6.4 Artificial Intelligence

9.7.7 Historic and Forecasted Market Size By End-User

9.7.7.1 Farmers

9.7.7.2 Agricultural Service Providers

9.7.7.3 Large-Scale Farms

9.7.7.4 Small-Scale Farms

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Autonomous Tractor Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.18 Billion |

|

Forecast Period 2024-32 CAGR: |

24.2% |

Market Size in 2032: |

USD 15.33 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||