Autonomous Surgical Robots Market Synopsis:

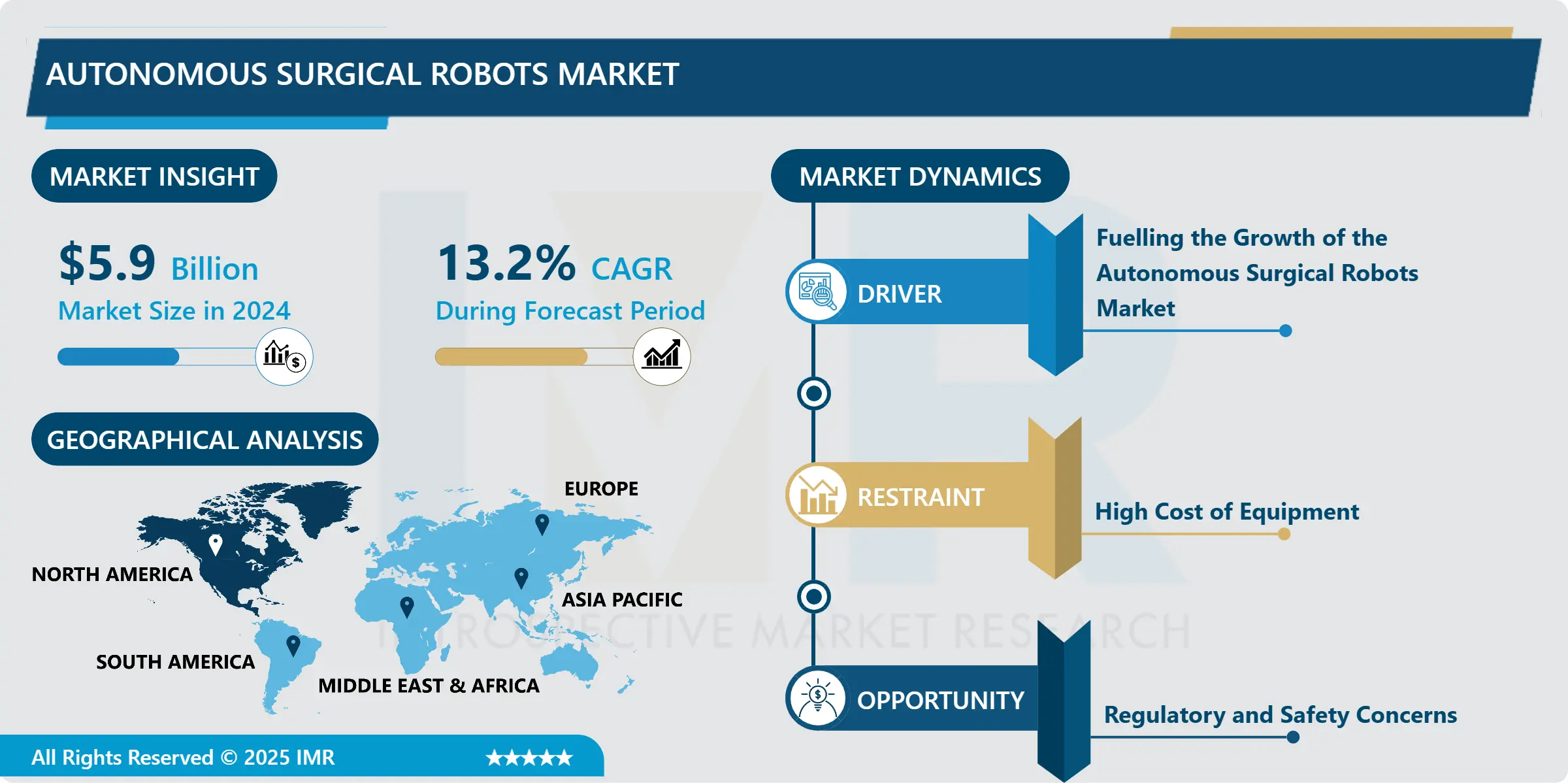

Autonomous Surgical Robots Market Size Was Valued at USD 5.9 Billion in 2024, and is Projected to Reach USD 23.08 Billion by 2035, Growing at a CAGR of 13.2 % from 2025-2035.

Autonomous surgical robots are advanced machines designed to assist or perform surgeries with minimal human involvement. These robots use artificial intelligence (AI), sensors, and advanced imaging to perform tasks with high precision, such as making incisions, suturing, or navigating complex anatomical structures. They are most commonly used in minimally invasive surgeries, which help reduce recovery time and complications for patients.

The market for autonomous surgical robots is growing rapidly due to increasing demand for safer, faster, and more accurate surgical procedures. Hospitals and surgical centres are adopting these systems to improve patient outcomes, reduce human error, and enhance operational efficiency. Recent advancements in AI and robotic technology have made these systems more reliable and capable of handling complex tasks.

However, challenges such as high costs, limited skilled operators, and strict regulatory requirements still exist. Despite these hurdles, the future of autonomous surgical robots looks promising. As technology improves and becomes more affordable, these systems are expected to become a standard part of modern surgery, especially in areas like orthopaedics, neurosurgery, and urology.

Autonomous Surgical Robots Market Growth and Trend Analysis:

Autonomous Surgical Robots Market Growth Driver- Fuelling the Growth of the Autonomous Surgical Robots Market

- The market for autonomous surgical robots is expanding quickly, driven by several important factors. One of the biggest reasons is the rising demand for minimally invasive surgeries. These procedures cause less pain, have fewer complications, and allow patients to recover faster. Surgical robots make these operations more precise and efficient, which encourages hospitals to invest in them.

- Another major driver is the advancement of technology, especially artificial intelligence (AI), machine learning, and real-time imaging. These technologies help robots perform complex surgical tasks more accurately and with less help from human surgeons. As robots become more “intelligent,” they can assist with or even carry out entire parts of surgeries, reducing human error.

- The shortage of skilled surgeons in many parts of the world also plays a role. Autonomous robots can help bridge this gap by performing surgeries in areas where expert surgeons are not available.

- In addition, increased healthcare spending by governments and private sectors, especially in developing countries, supports the adoption of these systems. Lastly, the growing acceptance of robotics in healthcare along with successful results from past surgeries builds trust among both doctors and patients. Together, these factors are helping autonomous surgical robots become a powerful tool in modern medicine, leading to better patient care and improved surgical outcomes.

Autonomous Surgical Robots Market Limiting Factor- High Cost of Equipment

- One of the main factors that limits the growth of the autonomous surgical robots market is the high cost of the technology. These robots are very advanced machines that use artificial intelligence, sensors, cameras, and other smart tools. Because of this, the price of a single robotic system can range from $500,000 to over $2 million. In addition to the initial purchase cost, hospitals must also spend money on maintenance, software updates, staff training, and specialized tools.

- For large hospitals in wealthy countries, this might be affordable. But for small or rural hospitals, especially in developing countries, these costs can be too high. Many healthcare facilities struggle to justify such a large investment when they also need to buy other medical equipment, hire more staff, or expand basic services.

- Even though robotic surgeries can help improve patient outcomes and save money in the long term, the upfront cost is a major obstacle. Until prices come down or financial support options improve, many hospitals will be hesitant to invest. This cost barrier slows down the spread of autonomous surgical robots and limits their use to well-funded medical centres.

Autonomous Surgical Robots Market Expansion Opportunity- Growth in Emerging Markets

- An important opportunity for expanding the autonomous surgical robots market lies in emerging markets like India, Brazil, China, and several African nations. These countries are investing more in healthcare infrastructure to meet the needs of growing populations and rising health problems. As healthcare improves in these regions, hospitals are starting to look for modern and advanced technologies, including robotic surgery systems.

- Many people in emerging markets still don’t have access to high-quality surgical care. Autonomous surgical robots can help fill this gap by assisting surgeons in performing more accurate and less invasive procedures. This means fewer complications, quicker recovery, and shorter hospital stays for patients.

- The cost is still a concern in these regions, but many companies are working on creating more affordable, smaller, and portable robotic systems. Also, governments and private investors are more willing to fund healthcare projects that use new technologies to improve outcomes.

- Training programs, partnerships with local hospitals, and awareness campaigns can also help these regions adopt robotic systems faster. With the right approach, emerging markets could become a major area of growth for companies in the surgical robotics industry in the coming years.

Autonomous Surgical Robots Market Challenge and Risk- Regulatory and Safety Concerns

- One of the biggest challenges facing the autonomous surgical robots market is regulatory and safety concerns. Because these robots are used in life-saving operations, they must be proven to be extremely safe and reliable. Government agencies, like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), require strict testing and approval processes before a surgical robot can be used in hospitals.

- This process can take a long time sometimes years and can be expensive for companies developing new robots. If a robot makes a mistake during surgery, it could cause serious harm or even death. This creates legal and ethical issues, such as: Who is responsible the robot manufacturer, the hospital, or the surgeon?

- These concerns also make doctors and patients more cautious about trusting robots, especially in surgeries that require high precision. Even after a robot is approved, companies must continue to monitor its performance, update software, and ensure that operators are properly trained.

- Overall, safety and regulatory issues are not just obstacles to launching new products—they also affect how quickly hospitals adopt the technology. Until there is more clarity and trust in autonomous systems, these challenges will continue to slow down market growth.Bottom of Form

Autonomous Surgical Robots Market Segment Analysis:

Autonomous Surgical Robots Market is segmented based on Type, Application, End-Users, and Region

By Type, Autonomous Surgical Robots Segment is Expected to Dominate the Market During the Forecast Period

- Among the various applications, orthopaedic surgery is currently leading in market trends. This includes surgeries like total knee replacements and hip replacements. The reason for this strong trend is the increased demand for joint replacement surgeries, especially among aging populations. Robotic systems like MAKO (by Stryker) are widely used in orthopaedics due to their ability to offer high precision, better alignment, and faster recovery for patients.

- Orthopaedic robots are also easier to standardize for repetitive procedures like joint replacements, which makes them more cost-effective and scalable across hospitals. Other applications like urological and gynaecological surgery are also important, especially where precision and reduced bleeding are critical, but orthopaedics shows the fastest and most consistent growth.

- Another reason for the rise of orthopaedic robotic surgery is that these procedures are highly repetitive, meaning the same steps are followed each time. This makes it easier to standardize robotic systems for these surgeries, improving efficiency and reducing human error. Hospitals also find them more cost-effective over time, especially as the technology becomes more advanced and widely used.

- While other fields like urology, gynaecology, and cardiovascular surgery also benefit from robotic assistance, orthopaedics remains the leader in terms of market adoption and growth. The demand for safer, more precise, and patient-friendly procedures will likely keep orthopaedic surgery at the top in robotic surgery trends over the next several years.

By Application, Autonomous Surgical Robots Segment Held the Largest Share in 2024

- Robotic-Assisted Minimally Invasive Surgery (RAMIS) is one of the most popular and fast-growing trends in the surgical robots market. This technique combines the benefits of minimally invasive surgery which uses small cuts instead of large openings with the high precision and control offered by robotic systems.

- In traditional surgery, large cuts often lead to more pain, longer hospital stays, and slower recovery. In contrast, RAMIS allows surgeons to operate through tiny incisions, which means less pain, lower risk of infection, and faster healing for patients. Robotic arms, guided by the surgeon, make very accurate movements that are difficult to achieve with human hands alone.

- RAMIS is being used more and more in different types of surgeries, especially in urology (e.g., prostate surgery), gynaecology (e.g., hysterectomies), and general surgery (e.g., hernia repair). These are areas where precision is very important because the organs and tissues involved are delicate and tightly packed.

- Hospitals prefer RAMIS because it not only helps improve patient outcomes, but also reduces overall costs by shortening hospital stays and recovery time. As technology improves and more surgeons are trained to use robotic systems, RAMIS is expected to become the standard method for many types of surgery around the world.

Autonomous Surgical Robots Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America, especially the United States, is the top region in the autonomous surgical robots market. This region leads because it has advanced hospitals, strong healthcare systems, and a high focus on technology in medicine. Many top companies like Intuitive Surgical, Johnson & Johnson, and Medtronic are based in the U.S., which helps drive innovation and faster adoption of robotic systems.

- One of the main reasons for growth is the increasing number of robot-assisted surgeries. These systems help doctors perform surgeries with more precision, fewer errors, and quicker recovery for patients. In the U.S., robotic surgery is being used in many fields like orthopaedics, urology, general surgery, and gynaecology.

- Hospitals in the U.S. are also investing more in robotics due to a shortage of skilled medical staff. Robots can help reduce the workload on surgeons and nurses. This is especially important after the COVID-19 pandemic, which increased pressure on the healthcare system.

- Another reason North America leads is because of FDA approvals. The U.S. Food and Drug Administration (FDA) supports and approves many robotic systems faster than in other countries, making it easier for hospitals to use new technologies.

- In summary, North America is the most developed and mature market for autonomous surgical robots, with high demand, strong infrastructure, and major industry players leading the way.

Autonomous Surgical Robots Market Active Players:

- Aeon Robotics (USA)

- Asensus Surgical, Inc. (USA)

- AVRA Medical Robotics, Inc. (USA)

- CMR Surgical Ltd. (UK)

- Corindus Vascular Robotics (Siemens Healthineers) (Germany)

- Cyberdyne Inc. (Japan)

- EndoMaster Pte Ltd. (Singapore)

- Intuitive Surgical, Inc. (USA)

- Johnson & Johnson (Ethicon & Auris Health) (USA)

- Mazor Robotics Ltd. (acquired by Medtronic) (Israel)

- Medicaroid Corporation (Japan)

- Medrobotics Corporation (USA)

- Medtronic plc (Ireland/USA)

- Meerecompany Inc. (South Korea)

- NaoTrac (Brain Navi Biotechnology) (Taiwan)

- Neocis Inc. (USA)

- Preceyes B.V. (Netherlands)

- Renishaw plc (UK)

- ReWalk Robotics Ltd. (Israel)

- Robocath (France)

- Siemens Healthineers AG (Germany)

- Smith & Nephew plc (UK)

- Stryker Corporation (USA)

- THINK Surgical, Inc. (USA)

- Titan Medical Inc. (Canada)

- Verb Surgical Inc. (J&J & Verily) (USA)

- Vicarious Surgical Inc. (USA)

- Virtual Incision Corporation (USA)

- XACT Robotics (Israel/USA)

- Zimmer Biomet Holdings, Inc. (USA)

- Other Active Players

Key Industry Developments in the Autonomous Surgical Robots Market:

- In 2025 NHS UK Robotics Plan : NHS announced a 10-year strategy to increase robot-assisted surgeries from 1 in 60 to 1 in 8 by 2035, aiming to cut wait times and improve outcomes.

- In 2025 CMR Surgical Expansion : CMR Surgical (UK) explored a potential $4 billion sale or IPO as part of its global expansion strategy. Its flagship robot, Versus, successfully completed over 30,000 surgeries across multiple countries and received FDA approval for performing gallbladder surgeries in the U.S. This marks a significant step in challenging market leaders like Intuitive Surgical.

|

Autonomous Surgical Robots Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 5.9 Billion |

|

Forecast Period 2025-32 CAGR: |

13.2 % |

Market Size in 2035: |

USD 23.08 Billion |

|

|

By Application

|

|

|

|

By Surgical Procedure |

|

||

|

By Level of Automation |

|

||

|

By Guidance System |

|

||

|

End-user Outlook |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Autonomous Surgical Robots Market by Application (2018-2035)

4.1 Autonomous Surgical Robots Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Orthopaedic Surgery

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cardiovascular Surgery

4.5 Urological Surgery

4.6 Gynaecological Surgery

4.7 General Surgery

Chapter 5: Autonomous Surgical Robots Market by Surgical Procedure (2018-2035)

5.1 Autonomous Surgical Robots Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Minimally Invasive Surgery (MIS)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Robotic-Assisted Minimally Invasive Surgery (RAMIS)

5.5 Robotic-Assisted Open Surgery (RAOS)

5.6 Robotic-Assisted Total Knee Replacement (TKR)

5.7 Robotic-Assisted Total Hip Replacement (THR)

Chapter 6: Autonomous Surgical Robots Market by Level of Automation (2018-2035)

6.1 Autonomous Surgical Robots Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Semi-Autonomous

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Autonomous

6.5 Telerobotic

Chapter 7: Autonomous Surgical Robots Market by Guidance System (2018-2035)

7.1 Autonomous Surgical Robots Market Snapshot and Growth Engine

7.2 Market Overview

7.3 2D Imaging

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 3D Imaging

7.5 Fluorescence Imaging

Chapter 8: Autonomous Surgical Robots Market by End-user Outlook (2018-2035)

8.1 Autonomous Surgical Robots Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Hospitals

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Ambulatory Surgical Centres

8.5 Academic Medical Centres

8.6 Other Healthcare Facilities

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Autonomous Surgical Robots Market Share by Manufacturer/Service Provider(2024)

9.1.3 Industry BCG Matrix

9.1.4 PArtnerships, Mergers & Acquisitions

9.2 AEON ROBOTICS (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Recent News & Developments

9.2.10 SWOT Analysis

9.3 ASENSUS SURGICAL

9.4 INC. (USA)

9.5 AVRA MEDICAL ROBOTICS

9.6 INC. (USA)

9.7 CMR SURGICAL LTD. (UK)

9.8 CORINDUS VASCULAR ROBOTICS (SIEMENS HEALTHINEERS) (GERMANY)

9.9 CYBERDYNE INC. (JAPAN)

9.10 ENDOMASTER PTE LTD. (SINGAPORE)

9.11 INTUITIVE SURGICAL

9.12 INC. (USA)

9.13 JOHNSON & JOHNSON (ETHICON & AURIS HEALTH) (USA)

9.14 MAZOR ROBOTICS LTD. (ACQUIRED BY MEDTRONIC) (ISRAEL)

9.15 MEDICAROID CORPORATION (JAPAN)

9.16 MEDROBOTICS CORPORATION (USA)

9.17 MEDTRONIC PLC (IRELAND/USA)

9.18 MEERECOMPANY INC. (SOUTH KOREA)

9.19 NAOTRAC (BRAIN NAVI BIOTECHNOLOGY) (TAIWAN)

9.20 NEOCIS INC. (USA)

9.21 PRECEYES B.V. (NETHERLANDS)

9.22 RENISHAW PLC (UK)

9.23 REWALK ROBOTICS LTD. (ISRAEL)

9.24 ROBOCATH (FRANCE)

9.25 SIEMENS HEALTHINEERS AG (GERMANY)

9.26 SMITH & NEPHEW PLC (UK)

9.27 STRYKER CORPORATION (USA)

9.28 THINK SURGICAL

9.29 INC. (USA)

9.30 TITAN MEDICAL INC. (CANADA)

9.31 VERB SURGICAL INC. (J&J & VERILY) (USA)

9.32 VICARIOUS SURGICAL INC. (USA)

9.33 VIRTUAL INCISION CORPORATION (USA)

9.34 XACT ROBOTICS (ISRAEL/USA)

9.35 ZIMMER BIOMET HOLDINGS

9.36 INC. (USA)

9.37 AND OTHER ACTIVE PLAYERS.

Chapter 10: Global Autonomous Surgical Robots Market By Region

10.1 Overview

10.2. North America Autonomous Surgical Robots Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecast Market Size by Country

10.2.4.1 US

10.2.4.2 Canada

10.2.4.3 Mexico

10.3. Eastern Europe Autonomous Surgical Robots Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecast Market Size by Country

10.3.4.1 Russia

10.3.4.2 Bulgaria

10.3.4.3 The Czech Republic

10.3.4.4 Hungary

10.3.4.5 Poland

10.3.4.6 Romania

10.3.4.7 Rest of Eastern Europe

10.4. Western Europe Autonomous Surgical Robots Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecast Market Size by Country

10.4.4.1 Germany

10.4.4.2 UK

10.4.4.3 France

10.4.4.4 The Netherlands

10.4.4.5 Italy

10.4.4.6 Spain

10.4.4.7 Rest of Western Europe

10.5. Asia Pacific Autonomous Surgical Robots Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecast Market Size by Country

10.5.4.1 China

10.5.4.2 India

10.5.4.3 Japan

10.5.4.4 South Korea

10.5.4.5 Malaysia

10.5.4.6 Thailand

10.5.4.7 Vietnam

10.5.4.8 The Philippines

10.5.4.9 Australia

10.5.4.10 New Zealand

10.5.4.11 Rest of APAC

10.6. Middle East & Africa Autonomous Surgical Robots Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecast Market Size by Country

10.6.4.1 Turkiye

10.6.4.2 Bahrain

10.6.4.3 Kuwait

10.6.4.4 Saudi Arabia

10.6.4.5 Qatar

10.6.4.6 UAE

10.6.4.7 Israel

10.6.4.8 South Africa

10.7. South America Autonomous Surgical Robots Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecast Market Size by Country

10.7.4.1 Brazil

10.7.4.2 Argentina

10.7.4.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Our Thematic Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

14.1 Sources

14.2 List of Tables and figures

14.3 Short Forms and Citations

14.4 Assumption and Conversion

14.5 Disclaimer

|

Autonomous Surgical Robots Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 5.9 Billion |

|

Forecast Period 2025-32 CAGR: |

13.2 % |

Market Size in 2035: |

USD 23.08 Billion |

|

|

By Application

|

|

|

|

By Surgical Procedure |

|

||

|

By Level of Automation |

|

||

|

By Guidance System |

|

||

|

End-user Outlook |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||