Autonomous Car Market Synopsis:

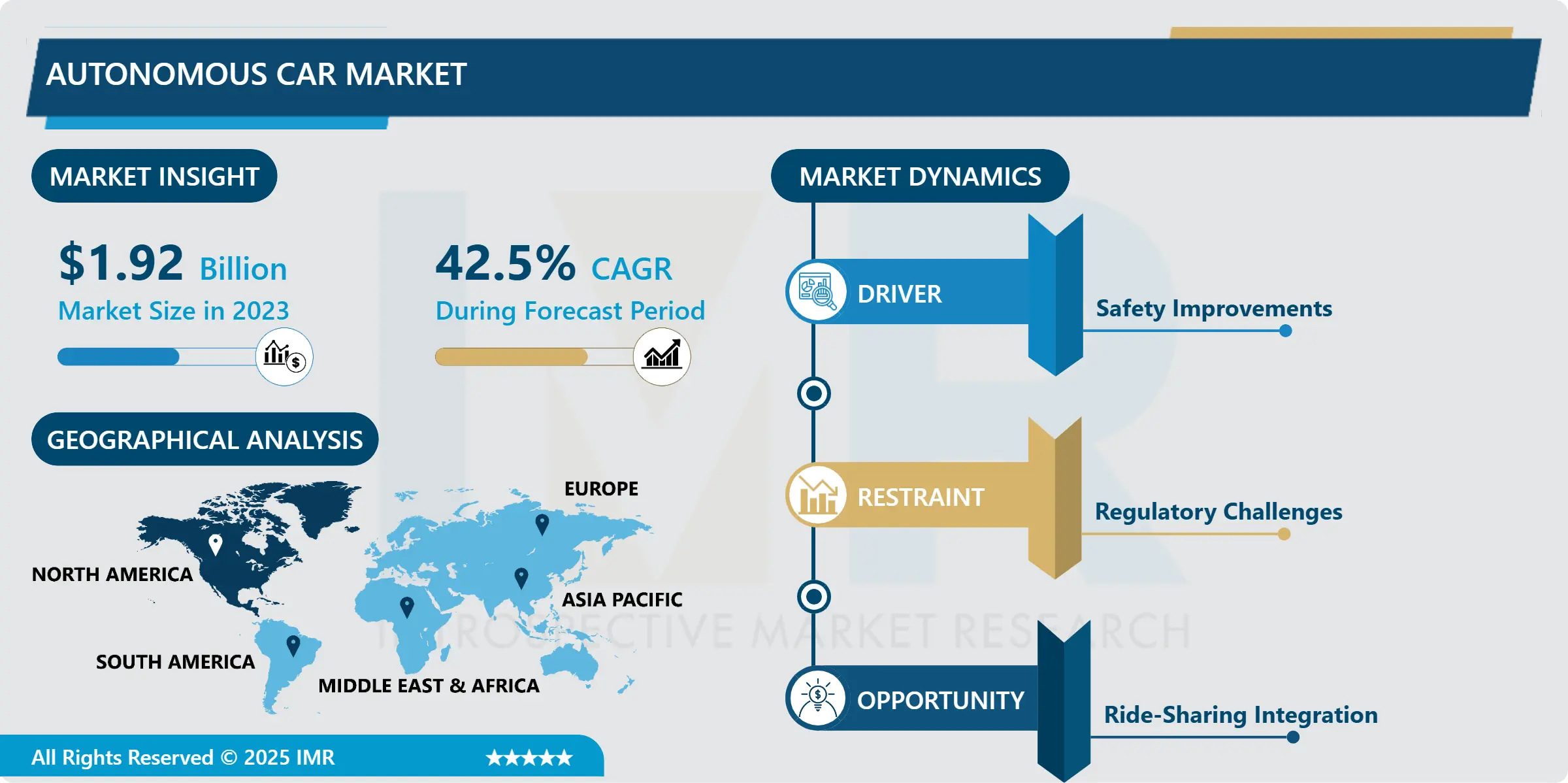

Autonomous Car Market Size Was Valued at USD 1.92 Billion in 2023, and is Projected to Reach USD 46.52 Billion by 2032, Growing at a CAGR of 42.5% From 2024-2032.

The autonomous car market pertains to the sphere involved in designing, manufacturing, and implementing vehicle that can operate on roads without the need of human input through the use of sophisticated tools including sensors, artificial intelligence, machine learning and connectivity. These vehicles rely on data obtained from cameras, radar, and lidar to make decisions to move and drive in real life with hopes of minimizing on accidents, enhancing traffic flow and being convenient to users.

The actual market of self-driving cars is rapidly developing due to the improvements of artificial intelligence, machine learning, and sensor equipment. Self-driving cars are divided into five levels according to the level of autonomy: Level 1, which involves assistance from the driver; Level 2, which allows partial automation of control by the driver; Level 3, where the car manages most of the driving but requires the driver to monitor it; Level 4; entirely self-driven; and finally Level 5 where there is no type of authority left for a driver. Today the high automation level with the help of the widely applied algorithms like AGENTS-4-5 is used by many companies, but the fully autonomous level is expected to be reached in future. Self-driving automobiles are expected to drastically transform the mobility market with higher levels of safety and service efficiency and with a lower impact on the environment. One of the markets’ major goals is to focus on upgrading car components, such as better sensors, sound data analysis, as well as the development of quick decision-making possibilities – which are essential to implement self-driving cars as an effective means.

It also depends on the rather different regulatory policies present all over the world. There are efforts being made by different governments to set the right standards that guarantee safety for the implementation of self-driving cars to blend with current facilities. There is a lot of interest and investment in solving problems like safety, reliability of systems, the general population’s attitude, and preparedness of the infrastructure from apparatchiks of manufacture, tech novity, and governments. Furthermore, it states that ride-sharing services shall be among the largest markets pushing for the adoption of fully autonomous transports, since companies hope to cut their overhead costs by using fleets of self-driving cars.

Autonomous Car Market Trend Analysis:

Integration of AI and Machine Learning

-

An important trend in the market of autonomous cars is the use of artificial intelligence and machine learning. These technologies are being applied to improve the decision making gap of the car so that it can make the right decision over its environment. ;Thus, AI and ML technologies enable autonomous vehicles to analyze large amounts of data obtained from various types of sensors and make probable forecasts of traffic situation, movements of pedestrians and other possible dangers, which in turn may contribute to creation of safer and more effective driving patterns.

- In addition, with experience gained by the AI systems, the performance of vehicles can be enhanced and in relation with safety as well. By employing optimum route selection, maintenance scheduling and better energy utilization, machine learning makes driverless vehicles a more viable investment. The continuous evolution of such technologies is expected to greatly contribute to the improvement of the autonomy of such vehicles so that they can satisfactorily navigate through the increasingly challenging environment.

Ride-Sharing Integration

-

The opportunity of the emergence of the self-employing car has great potential in connection with the growth of the services for sharing of automobile rides. Self-driving cars estimate to change the nature of the ride-hailing business by lowering the cost for companies such as Uber and Lyft. Since there are no drivers required to run the automobile in ride-sharing services, the cost of service is lower and requires less capital to run. Also, autonomous vehicles are not restricted by the issues like fatigue, or legal regulation of working hours; thus, can be in operating twenty-four-seven which will enhance the utilization of, for instance, ride-sharing fleets.

- This integration also creates additional opportunities for new mobility concepts including shared autonomous vehicles to alleviate traffic jam and decrease CO2 emission. Self-driving car may also be effective in moving people from the use of self-owning car through shared transport to reduce the incidences of transport ownership among individuals. With cities’ push for sustainable transport, the combination of self-driving vehicles and ride sharing show a bright future of the two markets and higher convenience and efficiency.

Autonomous Car Market Segment Analysis:

Autonomous Car Market is Segmented on the basis of Level of Level of Autonomy, Component, Vehicle Type, Application, End User, and Region.

By Level of Autonomy, Level 1: Driver Assistance segment is expected to dominate the market during the forecast period

-

The extent of automation in the vehicles is grouped based on five leveled categories depending on the autonomy of the vehicle and engineer’s control in the vehicle. Level 1 of vehicle automation comes equipped with only driver assistance including adaptive cruise control and lane keeping. Level 2 is actually where the vehicle has partial control over both steering and acceleration, but the driver has to take control of the system partially as well. Level 3 is conditional automation meaning that, the car will be able to operate most of the time but will need human supervision when the system fails. G = Level 4, means that the car is highly autonomous and it can drive on its own but in certain circumstances, some of them being, within some geographical area or in certain weather conditions. Last but not the least; the Level 5 represents the self-driving car in which the operational capabilities are complete such that the vehicle can navigate a given environment without reference or input from a human driver.

- Autonomous cars are continuously improving their mobility technology as they transition towards higher levels of self-governance but their usage is yet to be realized. Currently, most of the physically available cars are at Level 2 or 3, with Waymo and Tesla amid the few that are advancing towards Level 4 in clearly defined settings. Moving to Level 5 would take tremendous advancements in technology and resultant approval, and most foresee that it could take anywhere between two or three decades for fully autonomous vehicles to become standard.

By End User, Automotive OEMs segment expected to held the largest share

-

The key consumer groups targeting in the autonomous car market are automotive original equipment manufacturers, technology suppliers and rolling services. Primarily automotive OEMs are most exposed to this wave as they are ambassadors for self-driving automobile features in cars. These companies are partnering with tech vendors that include, software firms and producers of sensors in a bid to develop the proper environment for the L4 Autonomous cars. Automotive OEMs and technology companies will have to work together in order to take the technologies to the next level of autonomy.

- Other transport segment can also be mentioned as ride-sharing services where Uber and Lyft are already piloting AVs for ride-hailing services. These companies bear interest in minimizing operating cost hence eradicating human driver and in the process bring ride hailing nearer to the people and scalable. The business use, especially for self-driving cars adoption in ride-sharing services is expected to be one of the key drivers of mass-market uptake, given their superior safety, efficiency and economic value proposition for consumers.

Autonomous Car Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America has the largest share in the autonomous car market now due to huge investment in research, a developed automobile industry and friendly policies, especially in the USA. Current entrants into the market include Waymo, Tesla, and General Motors that are currently testing and deploying the technology in major cities. Moreover, the U.S. federal government has been trying to impose the clear rules that allows self-driving and motivate the technology progress while keeping public safety in consideration.

- The alliance that is equally present between automotive firms and technology firms ensures that systems of autonomous driving are also developed and integrated at a faster rate in the region. Technological know-how coupled with the right investments in industrial infrastructure and the call for safer more efficient transport means put North America on the forefront of the global self-driving car market. When it comes to the refinement of the autonomy technologies, this region seems poised to retain a hold on the market.

Active Key Players in the Autonomous Car Market:

-

Aptiv (USA)

- Audi (Germany)

- BMW (Germany)

- Ford Motor Company (USA)

- General Motors (USA)

- Honda Motor Co., Ltd. (Japan)

- Nissan Motor Co., Ltd. (Japan)

- Tesla (USA)

- Toyota Motor Corporation (Japan)

- Uber Technologies (USA)

- Volkswagen (Germany)

- Waymo (USA)

- Other Active Players

Key Industry Developments in the Autonomous Car Market:

-

In December 2023, Mercedes-Benz announced that the company received approval from regulators in California and Nevada to utilize turquoise-colored exterior marker lights on vehicles equipped with its Drive Pilot SAE Level 3 automated driving feature. The lights, integrated into test vehicles, are designed to alert other road users that a vehicle is operating in autonomous mode.

- In April 2023, DiDi announced that the company is developing its self-driving taxis and plans to roll them out in 2025 on its ride-hailing service. DiDi also introduced two pieces of hardware focused on autonomous driving. The company was first co-developed with Chinese technology firm Benewake and is called DiDi Beiyao Beta LiDAR.

|

Global Autonomous Car Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.92 Billion |

|

Forecast Period 2024-32 CAGR: |

42.5% |

Market Size in 2032: |

USD 46.52 Billion |

|

Segments Covered: |

By Level of Autonomy |

|

|

|

By Component |

|

||

|

By Vehicle Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Autonomous Car Market by Level of Autonomy

4.1 Autonomous Car Market Snapshot and Growth Engine

4.2 Autonomous Car Market Overview

4.3 Level 1: Driver Assistance

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Level 1: Driver Assistance: Geographic Segmentation Analysis

4.4 Level 2: Partial Automation

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Level 2: Partial Automation: Geographic Segmentation Analysis

4.5 Level 3: Conditional Automation

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Level 3: Conditional Automation: Geographic Segmentation Analysis

4.6 Level 4: High Automation

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Level 4: High Automation: Geographic Segmentation Analysis

4.7 Level 5: Full Automation

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Level 5: Full Automation: Geographic Segmentation Analysis

Chapter 5: Autonomous Car Market by Vehicle Type

5.1 Autonomous Car Market Snapshot and Growth Engine

5.2 Autonomous Car Market Overview

5.3 Passenger Vehicles

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Passenger Vehicles: Geographic Segmentation Analysis

5.4 Commercial Vehicles

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Commercial Vehicles: Geographic Segmentation Analysis

Chapter 6: Autonomous Car Market by Application

6.1 Autonomous Car Market Snapshot and Growth Engine

6.2 Autonomous Car Market Overview

6.3 Private

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Private: Geographic Segmentation Analysis

6.4 Shared Mobility (Ridesharing

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Shared Mobility (Ridesharing: Geographic Segmentation Analysis

6.5 Robo-taxis)

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Robo-taxis): Geographic Segmentation Analysis

Chapter 7: Autonomous Car Market by End User

7.1 Autonomous Car Market Snapshot and Growth Engine

7.2 Autonomous Car Market Overview

7.3 Automotive OEMs

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Automotive OEMs: Geographic Segmentation Analysis

7.4 Technology Providers

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Technology Providers: Geographic Segmentation Analysis

7.5 Ride-sharing Services

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Ride-sharing Services: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Autonomous Car Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 WAYMO (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 TESLA (USA)

8.4 GENERAL MOTORS (USA)

8.5 FORD MOTOR COMPANY (USA)

8.6 BMW (GERMANY)

8.7 VOLKSWAGEN (GERMANY)

8.8 AUDI (GERMANY)

8.9 TOYOTA MOTOR CORPORATION (JAPAN)

8.10 HONDA MOTOR CO. LTD. (JAPAN)

8.11 NISSAN MOTOR CO. LTD. (JAPAN)

8.12 UBER TECHNOLOGIES (USA)

8.13 APTIV (USA)

8.14 OTHER ACTIVE PLAYERS

Chapter 9: Global Autonomous Car Market By Region

9.1 Overview

9.2. North America Autonomous Car Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Level of Autonomy

9.2.4.1 Level 1: Driver Assistance

9.2.4.2 Level 2: Partial Automation

9.2.4.3 Level 3: Conditional Automation

9.2.4.4 Level 4: High Automation

9.2.4.5 Level 5: Full Automation

9.2.5 Historic and Forecasted Market Size By Vehicle Type

9.2.5.1 Passenger Vehicles

9.2.5.2 Commercial Vehicles

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Private

9.2.6.2 Shared Mobility (Ridesharing

9.2.6.3 Robo-taxis)

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Automotive OEMs

9.2.7.2 Technology Providers

9.2.7.3 Ride-sharing Services

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Autonomous Car Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Level of Autonomy

9.3.4.1 Level 1: Driver Assistance

9.3.4.2 Level 2: Partial Automation

9.3.4.3 Level 3: Conditional Automation

9.3.4.4 Level 4: High Automation

9.3.4.5 Level 5: Full Automation

9.3.5 Historic and Forecasted Market Size By Vehicle Type

9.3.5.1 Passenger Vehicles

9.3.5.2 Commercial Vehicles

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Private

9.3.6.2 Shared Mobility (Ridesharing

9.3.6.3 Robo-taxis)

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Automotive OEMs

9.3.7.2 Technology Providers

9.3.7.3 Ride-sharing Services

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Autonomous Car Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Level of Autonomy

9.4.4.1 Level 1: Driver Assistance

9.4.4.2 Level 2: Partial Automation

9.4.4.3 Level 3: Conditional Automation

9.4.4.4 Level 4: High Automation

9.4.4.5 Level 5: Full Automation

9.4.5 Historic and Forecasted Market Size By Vehicle Type

9.4.5.1 Passenger Vehicles

9.4.5.2 Commercial Vehicles

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Private

9.4.6.2 Shared Mobility (Ridesharing

9.4.6.3 Robo-taxis)

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Automotive OEMs

9.4.7.2 Technology Providers

9.4.7.3 Ride-sharing Services

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Autonomous Car Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Level of Autonomy

9.5.4.1 Level 1: Driver Assistance

9.5.4.2 Level 2: Partial Automation

9.5.4.3 Level 3: Conditional Automation

9.5.4.4 Level 4: High Automation

9.5.4.5 Level 5: Full Automation

9.5.5 Historic and Forecasted Market Size By Vehicle Type

9.5.5.1 Passenger Vehicles

9.5.5.2 Commercial Vehicles

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Private

9.5.6.2 Shared Mobility (Ridesharing

9.5.6.3 Robo-taxis)

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Automotive OEMs

9.5.7.2 Technology Providers

9.5.7.3 Ride-sharing Services

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Autonomous Car Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Level of Autonomy

9.6.4.1 Level 1: Driver Assistance

9.6.4.2 Level 2: Partial Automation

9.6.4.3 Level 3: Conditional Automation

9.6.4.4 Level 4: High Automation

9.6.4.5 Level 5: Full Automation

9.6.5 Historic and Forecasted Market Size By Vehicle Type

9.6.5.1 Passenger Vehicles

9.6.5.2 Commercial Vehicles

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Private

9.6.6.2 Shared Mobility (Ridesharing

9.6.6.3 Robo-taxis)

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Automotive OEMs

9.6.7.2 Technology Providers

9.6.7.3 Ride-sharing Services

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Autonomous Car Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Level of Autonomy

9.7.4.1 Level 1: Driver Assistance

9.7.4.2 Level 2: Partial Automation

9.7.4.3 Level 3: Conditional Automation

9.7.4.4 Level 4: High Automation

9.7.4.5 Level 5: Full Automation

9.7.5 Historic and Forecasted Market Size By Vehicle Type

9.7.5.1 Passenger Vehicles

9.7.5.2 Commercial Vehicles

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Private

9.7.6.2 Shared Mobility (Ridesharing

9.7.6.3 Robo-taxis)

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Automotive OEMs

9.7.7.2 Technology Providers

9.7.7.3 Ride-sharing Services

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Autonomous Car Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.92 Billion |

|

Forecast Period 2024-32 CAGR: |

42.5% |

Market Size in 2032: |

USD 46.52 Billion |

|

Segments Covered: |

By Level of Autonomy |

|

|

|

By Component |

|

||

|

By Vehicle Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||