Automotive Glazing Market Synopsis

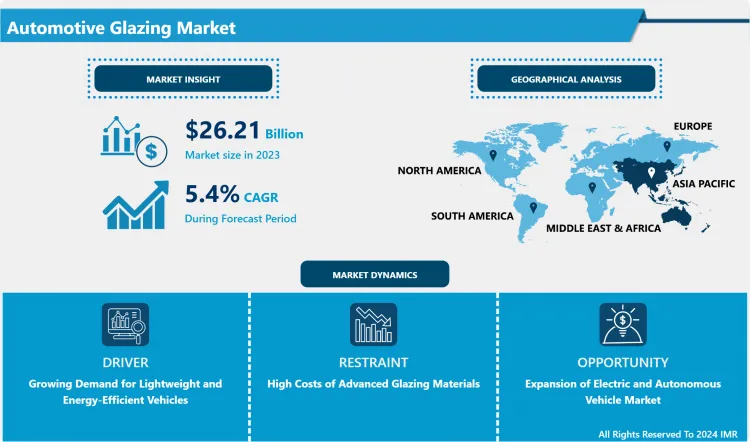

Automotive Glazing Market Size is Valued at USD 26.21 Billion in 2023, and is Projected to Reach USD 39.93 Billion by 2032, Growing at a CAGR of 5.40% From 2024-2032.

Automotive glazing can therefore be understood as the utilization of glasses or other transparent plastics such as polycarbonate for windows as well as windscreens. It is very useful in maintaining safety and enhancing the character and forms of transport, as well as the quality of energy efficiency. Ble acknowledging the facts on this site, it is clear that glazing materials are applied in the windshield, side windows, back windows and the sunroof. Technological advancements like lightweight polycarbonate glazing and the integration of smart glass practices are steady revolutionizing the industry, and definitively improving vehicular efficiency as well as improving the riding experience of passengers.

- The first factor that has significantly impacted the imagery of sales of Automotive Glazing Market is the increasing demand in efficient fuel economy and lightweight cars. The use of polycarbonate glazing has increased steadily mainly because automotive manufacturers are concerned with weight reduction as they seek to meet emission requirements. Further, switching of automotive sector to electric vehicles (EVs) is also being driven by weight reduction synergistically for longer driving range per battery. Advanced glazing materials therefore present a solution by being lightweight while at the same time providing adequate safety.

- Another important demand factor is the increased interest of consumers in such options as a panoramic sunroof and intelligent glass. Customer today are demanding vehicles with features that can make the driving experience even better, and automotive glazing comes in handy here. The effective use of Smart glass technologies in the design of rolling stock not only enhances the architectural looks, but also regulates internal temperature and lightening that makes passengers comfortable. The quest to optimize the aesthetics of automobiles in addition to operational comfort and convenience in car interiors is steering automobile manufacturers to making tremendous investments with glazing technology advances.

Automotive Glazing Market Trend Analysis

Adoption of polycarbonate glazing for windows and windshields

- The most significant trend, which has been observed in the automotive glazing market is the use of polycarbonate glazing used in windows and windshields. Compared with glass material, polycarbonate material has more advantages, which are light weight, high impact strength, and good thermal insulation performance. It is being increasingly applied in the manufacture of electric and hybrid vehicles particularly because weight is a derivate attribute. Due to increased awareness of energy conservation the market is shifting to more efficient means of power usage, the automotive industry is also embracing this change to fit in the emerging trend of green energy.

- Another interesting tendency is that the application of smart glazing technologies is getting more and more popular. Such technologies enable the car’s windows to open and close in response to the state of the outside environment. Specifically, switchable glazing is gradually becoming widely used in luxury cars because it makes the interior condition more comfortable and convenient. Furthermore, solar control glazing that can cut out the UV and IR rays are receiving much attention as a way to promote more effective energy use through reduction of air conditioning in the hot climate areas.

The shift toward electric and hybrid vehicles presents a significant opportunity.

- The increasing demand for electric and the hybrid automotive has created a major opportunity for the Automotive Glazing Market. With the transition of the world to greener solutions in transportation, the demand for lightweight solutions such as polycarbonate glazing will remain strong. Electric car makers are looking to increases the driving distance as well as efficiency hence are in dire need of lightweight glazing. This trend provides further opportunity for glazing manufacturers who are targeting the improvement of lighter weight, yet safer material.

- In addition, this need for self-driving cars is opening up new avenues for automotive glazing producers. Because the prospects of autonomous vehicles are high, the market will require new solutions and glazing products for safety and comfort requirements, as well as functional for the passengers. Other solutions like composite windshield systems with HUDs and panoramic sunroof with enhanced features like sensor based smart glass solutions will attract better call for which again is a good business prospect for leading players.

Automotive Glazing Market Segment Analysis:

Automotive Glazing Market Segmented on the basis of Product Type, Vehicle Type, By Technology and Application.

By Product Type, Laminated Glass segment is expected to dominate the market during the forecast period

- The automotive glazing market offers three main products: There are three types of safety glass, they include the laminated glass, the tempered glass and polycarbonate. Laminated glass used in the construction of wind shields comprises of a layer of plastic between two layers of glass with high impact strength and the glass does not splinter. Laminated glass used in the side and rear window complies with heat treatment that increases the glass’ strength and in the process if comes into contact with it after being shattered, falls in to small non sharp pieces hence challenging the security of those inside. Presently, polycarbonate is typically utilized in lightweight and strong automotive applications that include fitted roof and rear windows owing to the material’s potential of lowering the vehicular weight and enhancing fuel economy while exhibiting excellent strength.

By Application, Windshield segment held the largest share in 2024

- In the automotive glazing market, the application segment comprises of windshield, sidelite, backlite, sunroof, and rear quarter glass. The windshield is the largest glass on a car which serves as a viewing, structural and protective glass. Sidelites have a purpose of the side windows that passengers can be able to see as well as have air circulation. Backlite is actually the rear window used for rear vision and also acts as a supporting cylinder on most automobiles. This is the sunroof part which in most vehicles is a special accommodation but now acts as a source of fresh air and light to the passengers. Rear quarter glass is a small sometimes shaped like a triangle which is placed behind the rear doors or close to the rear side of the car and serves as a supplementary window, – a stylish addition to the car’s design.

Automotive Glazing Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- New research into the Automotive Glazing Market shows that the Asia-Pacific region has the largest market share due to the growing automotive market in this area. Car makers in Asia-Pacific include China, Japan, and India that manufacture vehicles that are traditional and electric. High production capacity of the manufacturing industries integrated with high demand of vehicles especially in china make Asia-Pacific the largest market in the world. Also, the increasing popularity of electric vehicles in the region has led to increased use of lightweight glazing materials to reduce the overall weight of the vehicle; thereby becoming a market leader.

- In addition, Asian Pacific regulations towards vehicle emission reduction and efficiency in fuel usage are fueling development of sophisticated glazing techniques. With several automobile manufacturing companies and suppliers based in countries such as Japan and South Korea several are investing much in research to expand their offer of modern and efficient glazing systems which can effectively meet the increasing demand. All these factors and this focus on innovation keep Asia-Pacific a critically important region to the global automotive glazing market due to the current market conditions.

Active Key Players in the Automotive Glazing Market

- Saint-Gobain (France)

- AGC Inc. (Japan)

- NSG Group (Japan)

- Fuyao Glass Industry Group Co., Ltd. (China)

- Guardian Industries (United States)

- Central Glass Co., Ltd. (Japan)

- Xinyi Glass Holdings Limited (China)

- Magna International Inc. (Canada)

- Sisecam Group (Turkey)

- Webasto Group (Germany) and Others Major Players

|

Global Automotive Glazing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 26.21 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.40 % |

Market Size in 2032: |

USD 39.93 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Vehicle Type |

|

||

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Glazing Market by Product (2018-2032)

4.1 Automotive Glazing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Laminated Glass

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Tempered Glass

4.5 Polycarbonate

Chapter 5: Automotive Glazing Market by Vehicle Type (2018-2032)

5.1 Automotive Glazing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Passenger Vehicles

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial Vehicles

5.5 Electric Vehicles

Chapter 6: Automotive Glazing Market by Technology (2018-2032)

6.1 Automotive Glazing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Conventional Glazing

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Smart Glazing

6.5 Switchable Glazing

Chapter 7: Automotive Glazing Market by Application (2018-2032)

7.1 Automotive Glazing Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Windshield

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Sidelite

7.5 Backlite

7.6 Sunroof

7.7 Rear Quarter Glass

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Automotive Glazing Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SAINT-GOBAIN (FRANCE)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 AGC INC. (JAPAN)

8.4 NSG GROUP (JAPAN)

8.5 FUYAO GLASS INDUSTRY GROUP COLTD. (CHINA)

8.6 GUARDIAN INDUSTRIES (UNITED STATES)

8.7 CENTRAL GLASS COLTD. (JAPAN)

8.8 XINYI GLASS HOLDINGS LIMITED (CHINA)

8.9 MAGNA INTERNATIONAL INC. (CANADA)

8.10 SISECAM GROUP (TURKEY)

8.11 WEBASTO GROUP (GERMANY) OTHERS MAJOR PLAYERS

8.12

Chapter 9: Global Automotive Glazing Market By Region

9.1 Overview

9.2. North America Automotive Glazing Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product

9.2.4.1 Laminated Glass

9.2.4.2 Tempered Glass

9.2.4.3 Polycarbonate

9.2.5 Historic and Forecasted Market Size by Vehicle Type

9.2.5.1 Passenger Vehicles

9.2.5.2 Commercial Vehicles

9.2.5.3 Electric Vehicles

9.2.6 Historic and Forecasted Market Size by Technology

9.2.6.1 Conventional Glazing

9.2.6.2 Smart Glazing

9.2.6.3 Switchable Glazing

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Windshield

9.2.7.2 Sidelite

9.2.7.3 Backlite

9.2.7.4 Sunroof

9.2.7.5 Rear Quarter Glass

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Automotive Glazing Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product

9.3.4.1 Laminated Glass

9.3.4.2 Tempered Glass

9.3.4.3 Polycarbonate

9.3.5 Historic and Forecasted Market Size by Vehicle Type

9.3.5.1 Passenger Vehicles

9.3.5.2 Commercial Vehicles

9.3.5.3 Electric Vehicles

9.3.6 Historic and Forecasted Market Size by Technology

9.3.6.1 Conventional Glazing

9.3.6.2 Smart Glazing

9.3.6.3 Switchable Glazing

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Windshield

9.3.7.2 Sidelite

9.3.7.3 Backlite

9.3.7.4 Sunroof

9.3.7.5 Rear Quarter Glass

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Automotive Glazing Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product

9.4.4.1 Laminated Glass

9.4.4.2 Tempered Glass

9.4.4.3 Polycarbonate

9.4.5 Historic and Forecasted Market Size by Vehicle Type

9.4.5.1 Passenger Vehicles

9.4.5.2 Commercial Vehicles

9.4.5.3 Electric Vehicles

9.4.6 Historic and Forecasted Market Size by Technology

9.4.6.1 Conventional Glazing

9.4.6.2 Smart Glazing

9.4.6.3 Switchable Glazing

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Windshield

9.4.7.2 Sidelite

9.4.7.3 Backlite

9.4.7.4 Sunroof

9.4.7.5 Rear Quarter Glass

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Automotive Glazing Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product

9.5.4.1 Laminated Glass

9.5.4.2 Tempered Glass

9.5.4.3 Polycarbonate

9.5.5 Historic and Forecasted Market Size by Vehicle Type

9.5.5.1 Passenger Vehicles

9.5.5.2 Commercial Vehicles

9.5.5.3 Electric Vehicles

9.5.6 Historic and Forecasted Market Size by Technology

9.5.6.1 Conventional Glazing

9.5.6.2 Smart Glazing

9.5.6.3 Switchable Glazing

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Windshield

9.5.7.2 Sidelite

9.5.7.3 Backlite

9.5.7.4 Sunroof

9.5.7.5 Rear Quarter Glass

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Automotive Glazing Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product

9.6.4.1 Laminated Glass

9.6.4.2 Tempered Glass

9.6.4.3 Polycarbonate

9.6.5 Historic and Forecasted Market Size by Vehicle Type

9.6.5.1 Passenger Vehicles

9.6.5.2 Commercial Vehicles

9.6.5.3 Electric Vehicles

9.6.6 Historic and Forecasted Market Size by Technology

9.6.6.1 Conventional Glazing

9.6.6.2 Smart Glazing

9.6.6.3 Switchable Glazing

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Windshield

9.6.7.2 Sidelite

9.6.7.3 Backlite

9.6.7.4 Sunroof

9.6.7.5 Rear Quarter Glass

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Automotive Glazing Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product

9.7.4.1 Laminated Glass

9.7.4.2 Tempered Glass

9.7.4.3 Polycarbonate

9.7.5 Historic and Forecasted Market Size by Vehicle Type

9.7.5.1 Passenger Vehicles

9.7.5.2 Commercial Vehicles

9.7.5.3 Electric Vehicles

9.7.6 Historic and Forecasted Market Size by Technology

9.7.6.1 Conventional Glazing

9.7.6.2 Smart Glazing

9.7.6.3 Switchable Glazing

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Windshield

9.7.7.2 Sidelite

9.7.7.3 Backlite

9.7.7.4 Sunroof

9.7.7.5 Rear Quarter Glass

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Automotive Glazing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 26.21 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.40 % |

Market Size in 2032: |

USD 39.93 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Vehicle Type |

|

||

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Automotive Glazing Market research report is 2024-2032.

Saint-Gobain (France), AGC Inc. (Japan), NSG Group (Japan), Fuyao Glass Industry Group Co., Ltd. (China), Guardian Industries (United States), Central Glass Co., Ltd. (Japan), Xinyi Glass Holdings Limited (China), Magna International Inc. (Canada), Sisecam Group (Turkey), Webasto Group (Germany)., and Other Major Players.

The Automotive Glazing Market is segmented into by Product (Laminated Glass, Tempered Glass, Polycarbonate), By Vehicle Class (Passenger Vehicles, Commercial Vehicles, Electric Vehicles), By Technology (Conventional Glazing, Smart Glazing, Switchable Glazing), By Application (Windshield, Sidelite, Backlite, Sunroof, Rear Quarter Glass). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Automotive Glazing Market involves the use of glass or other transparent materials like polycarbonate for windows and windshields in vehicles. It plays a critical role in ensuring safety, improving the aerodynamics, aesthetics, and energy efficiency of a vehicle. Glazing materials are applied to various parts of a vehicle, including the windshield, side windows, back windows, and sunroofs. Innovations like lightweight polycarbonate glazing and smart glass technologies are transforming the industry, enhancing both vehicle performance and passenger comfort.

Automotive Glazing Market Size is Valued at USD 26.21 Billion in 2024, and is Projected to Reach USD 39.93 Billion by 2032, Growing at a CAGR of 5.40% From 2024-2032.