Automotive Cabin AC Filter Market Synopsis:

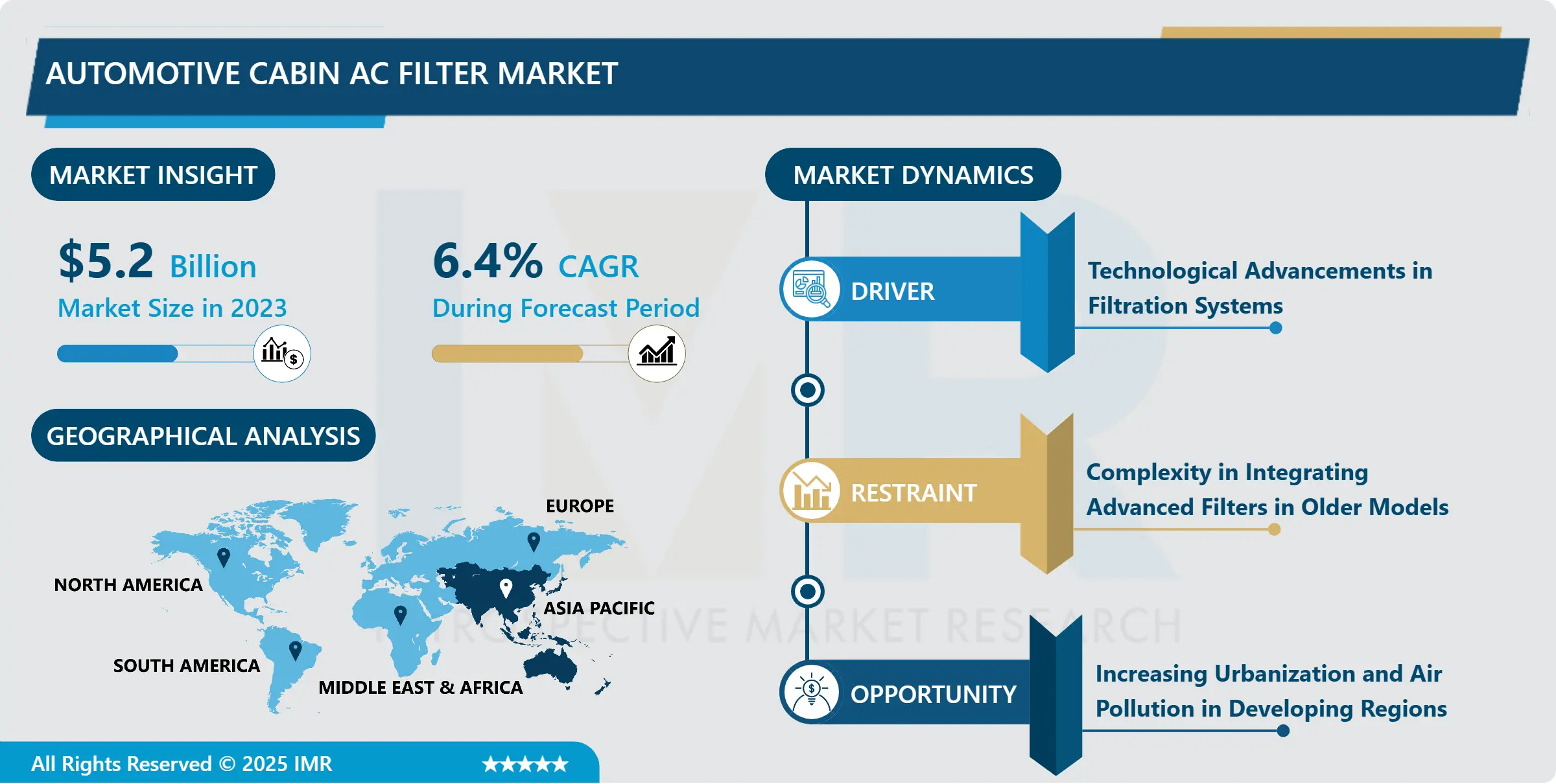

Automotive Cabin AC Filter Market Size Was Valued at USD 5.20 Billion in 2023, and is Projected to Reach USD 9.08 Billion by 2032, Growing at a CAGR of 6.40% From 2024-2032.

Automotive Cabin AC Filter Market gives information about the manufacturing, providing and marketing of filters used in the car air conditioning systems. These filters aid in making sure that air inside the car cabin is clean from dust, air borne pollutants, allergens and so on making the cabin more comfortable for passengers, while efforts towards making the air quality bette. The market is segmented into categories related to filters including particle filters, carbon filters and combination filters and target both the OEM and Aftermarket segments.

The increase in demand on passenger comfort, and overall health has led to the demand of high-performance cabin air filter. Growing awareness towards the bad quality of air and the problems it causes to the respiratory system has led to passenger awareness of lack of fresh air circulation inside vehicles. Over time, they have grown into a must-have requirement for enhancing the environment within vehicle interiors, and the growth of vehicle usage similarly escalates the need.

Another major factor is the continued increase in the pressure towards higher emission standards worldwide. Indeed, with increasing pressure from regulatory authorities regarding the emission of particles into the atmosphere from vehicles, there is now a focus on using better cabin AC filters as a means of preventing the entry of these pollutants into the cabin. Besides, increased focus on air quality, especially in developed as well as emerging markets, new customer awareness, and willingness to move to healthier products is expected to drive the market.

Trend Analysis:

Trend Analysis:

Trend Towards The Use Of Electric Vehicles

- Emerging tendency to the use of the improved filter materials like HEPA and activated carbon filters giving better characteristics of the dust, pollen and other kinds of allergens filtration. Furthermore, due to the global trend towards the use of electric vehicles, producers are also interested in the creation of filters capable of not only cleaning the air, but also improving the efficiency of energy storage systems in electric vehicles. There is evidence that filters are being built into the expanding frameworks of ‘workspace air quality’ systems, which in turn is driving cabin design.

- Another trend is the incorporation of the smart technologies in automotive cabin filters. Some filters-with-sensors are being installed in vehicles where they detect air quality levels and give signals that the filter needs replacement. This trend is part of global shifted toward a connection and intelligent solutions in automotive industry which provides more convenience and better experience for end users.

Rising Usage Of Electric Automobiles

- Rising usage of electric automobiles represents a high-growth situation for the automotive cabin AC filter market. The HVAC systems of EVs are in some cases different from those of internal combustion engine vehicles. With these systems adapting over time, there appears potential for the creation of industry-specific filters that will work well with electric vehicles, offering markets that can be exploited by firms who are willing to work towards developing and designing new filters that can meet the needs of the growing adaptations.

- Besides this, the growth of awareness regarding quality air and facets of the government control over emissions of vehicle again presents potential for filters for air not only purification but also environmental. Generic filters which offer finer provisions, including removing airborne contaminants from the external environment for instance, vehicle emission, are now airdrop in cities where breathing pollution is in vogue.

Automotive Cabin AC Filter Market Segment Analysis:

Automotive Cabin AC Filter Market is Segmented on the basis of Filler Type, Vehicle Type, Filler Material, and Region.

By Filter Type, Particle Filters segment is expected to dominate the market during the forecast period

- Particle filters help to filter out airborne particles such as dust, pollen and dirt away from the vehicle cabin. They are used frequently because of their cost efficiency as well as from proven results in enhancing the quality of air. The current carbon filters employ the use of activated charcoal, a component that absorbs bad smells, toxic gases and a wide range of gaseous pollutants including volatile organic compounds.

- volatile organic compounds are well used in places that experience high level of air pollution. The combination filters incorporate both particle and carbon filtration systems to provide further clean air by employing both kinds of pollutants. These filters are gradually becoming preferred filters because they produce a higher level of filtration.

By Vehicle Type, Passenger Cars segment expected to held the largest share

- Among the automotive vehicle types, the passenger cars are the largest consumer of the cabin AC filters because this type of vehicles dominate the global traffic. Power filters used on passenger cars are comparatively less in communications but they have to address the rising needs of people for quality air.

- Heavy commercial vehicles such as trucks and buses must have enhanced and unique air filters because it circulates a large quantity of air in a spacious cabin and work in various and polluted conditions. Fluctuating market sales for electrical cars have made car manufacturers seek for higher efficiency cabin filter to suit the new electrical cars’ air-conditioning systems. With the rapid emergence of electric automobiles on the roads, expectations for specific filters should also grow.

Automotive Cabin AC Filter Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is the largest consumer of automotive cabin AC filter market because of the growing production of vehicles particularly in China, Japan, and India. Widespread availability of automotive manufacturers and large customer base in these areas are the key factors driving the elevated demand for cabin filters. More so, the growth of urban population and rising concerns about poor air quality in expanding urban cities also contribute to the market growth.

- It added that the region’s dominance is also as a result of the growth of electric vehicles around the world especially in the Chinese market which the government of China has put a lot of incentives for the production and sale of these electric cars. With the increased number of cars in the market that need the services of high-quality air filtration, the need for cabin AC filters is likely to grow in the future. The Asia Pacific market is expected to continue to dominate the market due to its manufacturing strength, extended government support for green vehicles and rising Eco-consciousness.

Active Key Players in the Automotive Cabin AC Filter Market:

- ACDelco (USA)

- Delphi Technologies (USA)

- DENSO Corporation (Japan)

- Filtration Group (USA)

- Freudenberg Group (Germany)

- Hengst SE (Germany)

- K&N Engineering (USA)

- MAHLE GmbH (Germany)

- MANN+HUMMEL (Germany)

- Sogefi Group (Italy), and Other Active Players

|

Automotive Cabin AC Filter Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.20 Billion |

|

Forecast Period 2024-32 CAGR: |

6.40 % |

Market Size in 2032: |

USD 9.08 Billion |

|

Segments Covered: |

By Filter Type |

|

|

|

By Vehicle Type |

|

||

|

By Filter Material |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Cabin AC Filter Market by Filter Type

4.1 Automotive Cabin AC Filter Market Snapshot and Growth Engine

4.2 Automotive Cabin AC Filter Market Overview

4.3 Particle Filters

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Particle Filters: Geographic Segmentation Analysis

4.4 Carbon Filters

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Carbon Filters: Geographic Segmentation Analysis

4.5 Combination Filters

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Combination Filters: Geographic Segmentation Analysis

Chapter 5: Automotive Cabin AC Filter Market by Vehicle Type

5.1 Automotive Cabin AC Filter Market Snapshot and Growth Engine

5.2 Automotive Cabin AC Filter Market Overview

5.3 Passenger Cars

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Passenger Cars: Geographic Segmentation Analysis

5.4 Commercial Vehicles

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Commercial Vehicles: Geographic Segmentation Analysis

5.5 Electric Vehicles

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Electric Vehicles: Geographic Segmentation Analysis

Chapter 6: Automotive Cabin AC Filter Market by Filler Material

6.1 Automotive Cabin AC Filter Market Snapshot and Growth Engine

6.2 Automotive Cabin AC Filter Market Overview

6.3 Synthetic Fiber

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Synthetic Fiber: Geographic Segmentation Analysis

6.4 Activated Carbon

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Activated Carbon: Geographic Segmentation Analysis

6.5 HEPA Filters

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 HEPA Filters: Geographic Segmentation Analysis

6.6 Other Materials

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Other Materials: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Automotive Cabin AC Filter Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MANN+HUMMEL (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 DELPHI TECHNOLOGIES (USA)

7.4 DENSO CORPORATION (JAPAN)

7.5 HENGST SE (GERMANY)

7.6 MAHLE GMBH (GERMANY)

7.7 ACDELCO (USA)

7.8 FILTRATION GROUP (USA)

7.9 SOGEFI GROUP (ITALY)

7.10 FREUDENBERG GROUP (GERMANY)

7.11 K&N ENGINEERING (USA)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Automotive Cabin AC Filter Market By Region

8.1 Overview

8.2. North America Automotive Cabin AC Filter Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Filter Type

8.2.4.1 Particle Filters

8.2.4.2 Carbon Filters

8.2.4.3 Combination Filters

8.2.5 Historic and Forecasted Market Size By Vehicle Type

8.2.5.1 Passenger Cars

8.2.5.2 Commercial Vehicles

8.2.5.3 Electric Vehicles

8.2.6 Historic and Forecasted Market Size By Filler Material

8.2.6.1 Synthetic Fiber

8.2.6.2 Activated Carbon

8.2.6.3 HEPA Filters

8.2.6.4 Other Materials

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Automotive Cabin AC Filter Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Filter Type

8.3.4.1 Particle Filters

8.3.4.2 Carbon Filters

8.3.4.3 Combination Filters

8.3.5 Historic and Forecasted Market Size By Vehicle Type

8.3.5.1 Passenger Cars

8.3.5.2 Commercial Vehicles

8.3.5.3 Electric Vehicles

8.3.6 Historic and Forecasted Market Size By Filler Material

8.3.6.1 Synthetic Fiber

8.3.6.2 Activated Carbon

8.3.6.3 HEPA Filters

8.3.6.4 Other Materials

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Automotive Cabin AC Filter Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Filter Type

8.4.4.1 Particle Filters

8.4.4.2 Carbon Filters

8.4.4.3 Combination Filters

8.4.5 Historic and Forecasted Market Size By Vehicle Type

8.4.5.1 Passenger Cars

8.4.5.2 Commercial Vehicles

8.4.5.3 Electric Vehicles

8.4.6 Historic and Forecasted Market Size By Filler Material

8.4.6.1 Synthetic Fiber

8.4.6.2 Activated Carbon

8.4.6.3 HEPA Filters

8.4.6.4 Other Materials

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Automotive Cabin AC Filter Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Filter Type

8.5.4.1 Particle Filters

8.5.4.2 Carbon Filters

8.5.4.3 Combination Filters

8.5.5 Historic and Forecasted Market Size By Vehicle Type

8.5.5.1 Passenger Cars

8.5.5.2 Commercial Vehicles

8.5.5.3 Electric Vehicles

8.5.6 Historic and Forecasted Market Size By Filler Material

8.5.6.1 Synthetic Fiber

8.5.6.2 Activated Carbon

8.5.6.3 HEPA Filters

8.5.6.4 Other Materials

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Automotive Cabin AC Filter Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Filter Type

8.6.4.1 Particle Filters

8.6.4.2 Carbon Filters

8.6.4.3 Combination Filters

8.6.5 Historic and Forecasted Market Size By Vehicle Type

8.6.5.1 Passenger Cars

8.6.5.2 Commercial Vehicles

8.6.5.3 Electric Vehicles

8.6.6 Historic and Forecasted Market Size By Filler Material

8.6.6.1 Synthetic Fiber

8.6.6.2 Activated Carbon

8.6.6.3 HEPA Filters

8.6.6.4 Other Materials

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Automotive Cabin AC Filter Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Filter Type

8.7.4.1 Particle Filters

8.7.4.2 Carbon Filters

8.7.4.3 Combination Filters

8.7.5 Historic and Forecasted Market Size By Vehicle Type

8.7.5.1 Passenger Cars

8.7.5.2 Commercial Vehicles

8.7.5.3 Electric Vehicles

8.7.6 Historic and Forecasted Market Size By Filler Material

8.7.6.1 Synthetic Fiber

8.7.6.2 Activated Carbon

8.7.6.3 HEPA Filters

8.7.6.4 Other Materials

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Automotive Cabin AC Filter Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.20 Billion |

|

Forecast Period 2024-32 CAGR: |

6.40 % |

Market Size in 2032: |

USD 9.08 Billion |

|

Segments Covered: |

By Filter Type |

|

|

|

By Vehicle Type |

|

||

|

By Filter Material |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||