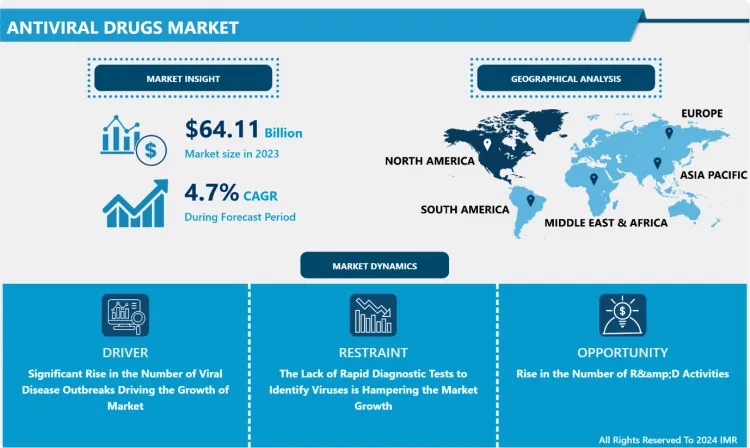

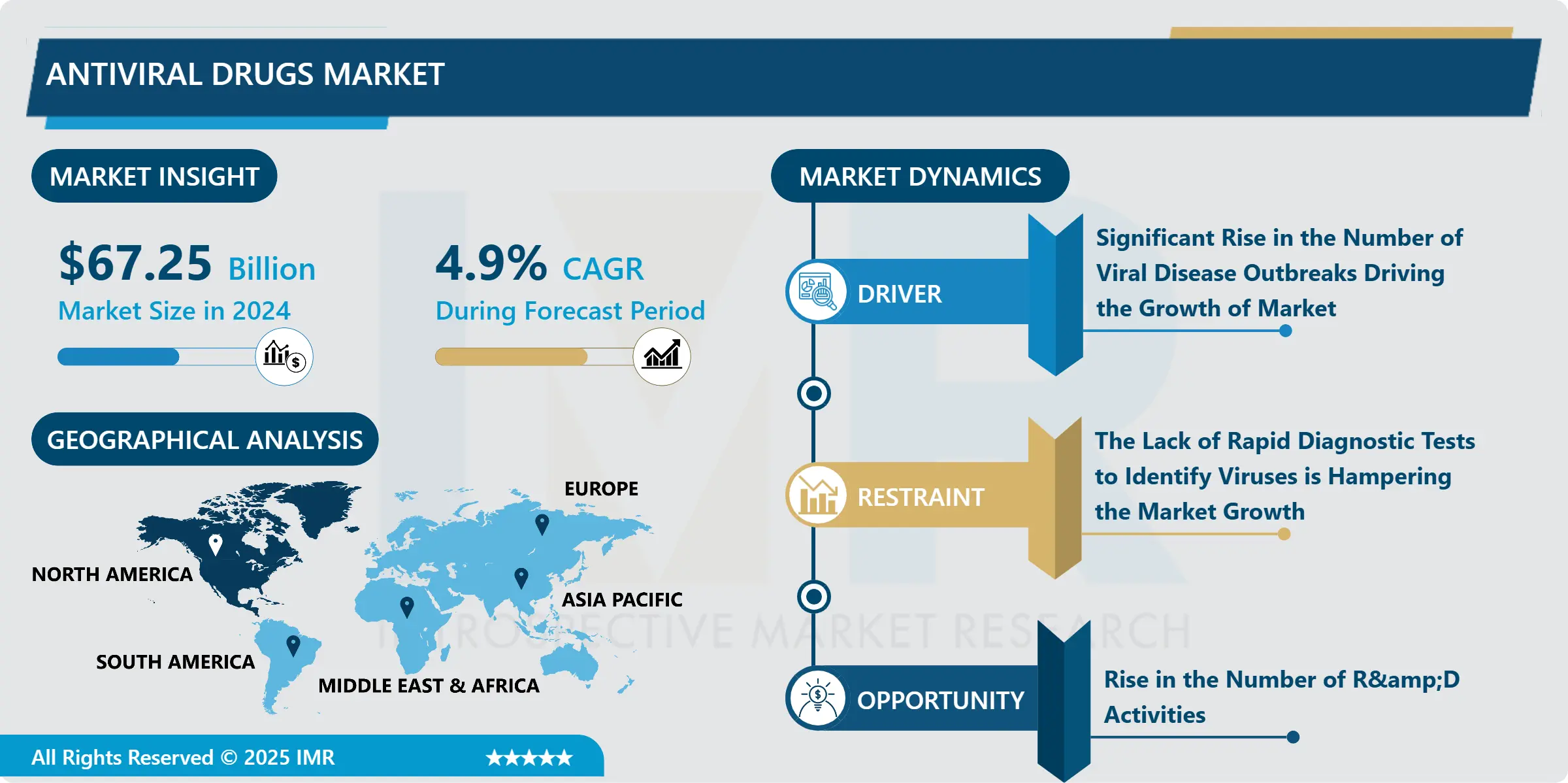

Global Antiviral Drugs Market Overview

Global Antiviral Drugs Market was valued at USD 67.25 Billion in 2024 and is expected to reach USD 113.82 Billion by the year 2035, at a CAGR of 4.9%.

Antiviral drugs are a class of medication that is used to kill or suppress the ability of a virus to replicate hence it prohibits the virus potential to proliferate and reproduce. Viruses are made of genetic material such as DNA or RNA which is alive when it is outside in the environment but gains its ability to reproduce and proliferate when it enters a susceptible host. In addition, antiviral drugs can prevent and protect individuals from getting viral infections or spreading the virus to others. Moreover, the development of antivirals is the outcome of newly acquired knowledge of the molecular and genetic activity of organisms letting us better apprehend the structure and function of viruses, chief advances in the techniques for finding novel drugs, and the stress placed on the medical sector to deal with the human immunodeficiency virus (HIV), the cause of acquired immunodeficiency syndrome is propelling the market growth in the period of forecast.

Additionally, there are many viruses which to date don't have antiviral drugs to treat the cause such as Rabies and HIV. According to WHO, 37.7 million people were living with HIV in 2020. Furthermore, to provide relief from viral diseases antiviral drugs are used, they significantly reduce the symptoms hence helps the infected individual to feel better, these factors are promoting the growth of the antiviral drugs market throughout the forecast.

Market Dynamics And Factors of Antiviral Drugs Market

Drivers:

The advantages of antiviral drugs are that they can cure some viral illnesses like hepatitis C or decrease the course of other viral illnesses like influenza. Antiviral drugs can be used to prevent the outbreak of certain viral illnesses like herpes. Moreover, characteristics of anti-viral drugs such as they can enter the cell infected with the virus and interfere with viral nucleic acid synthesis and thus restrict the virus ability to reproduce and proliferate in number thus, strengthening the growth of the anti-viral drugs market in the period o forecast. Furthermore, there has been a significant rise in the number of viral disease outbreaks in recent times hence to reduce future outbreaks there is a need for antiviral drugs hence strengthening the expansion of the antiviral drug market throughout the forecast.

Viral disease like smallpox is no longer a threat to the human population due to global vaccination programs. Furthermore, Polio caused by poliovirus is on the verge of extinction due to the wide-scale of antiviral drugs incorporated to prevent poliovirus from infecting healthy individuals. All these notable factors are promoting the use of antiviral drugs to prevent and eradicate viral diseases. Moreover, the increasing number of HIV, herpes, influenza, and other viral infections are driving the antiviral drug market. Furthermore, an increase in research and development activities for generating novel and advance formulations, such as vaccines, broad-spectrum antiviral drugs, and combination therapies to treat viral infection is propelling the antiviral drugs market.

Restraints:

Modern science technology has reached record height due to the research and development going on in this sector since the mid-20th century. Despite the rigorous research to find antivirals the arsenal of antivirals drugs remains dangerously small. Additionally, only about 100 antiviral drugs are available in the US market. Moreover, the lack of rapid diagnostic tests to identify viruses is hampering the antiviral drugs market in the period of forecast. Furthermore, the safety of antiviral drugs is a matter of concern. Moreover, a tremendous amount of money is utilized for manufacturing drugs which results in high pricing of antiviral drugs hence restraining the growth of the antiviral drugs market during the period of forecast. Antiviral drug resistance is a growing concern in immunocompromised individual populations, where ongoing viral replication and prolonged drug exposure results in the development of resistant strains. Moreover, WHO has reported cases of resistance to most antivirals including antiretroviral (ARV) drugs which are used to treat HIV thus hindering the antiviral drug market development in the span of the forecast. Furthermore, the growing trend of alternative medicines such as naturopathy and homeopathy are restraining the growth of the antiviral drug market throughout the forecast period.

Challenges:

To test the safety and efficiency of antiviral drugs, they are given to healthy individuals, however, sometimes it can cause adverse life-threatening situations thus trials on healthy individuals are the major challenge for the antiviral drug manufacturer. Moreover, urbanization has resulted in zoonosis (transfer of diseases from animals to humans) which has affected several economies worldwide. Furthermore, analyzing the disease-causing viral organism and producing antiviral drugs against it within a short period is one of the vital challenges for market players. In addition, on average to develop a novel antiviral drug takes around 10 to 15 years thus to reduce the time involved in research and developing effective antiviral drugs in a limited period is the biggest challenge for market players involved in antiviral drug manufacturing.

Opportunities:

The increasing number of viral infections and the growing demand for antiviral drugs is the major opportunity for market players. Moreover, several governments are investing huge funds in research and development to provide antiviral drugs to their population hence providing ample opportunities for market players. Developing broad-spectrum antiviral drugs with promising effects is a vital opportunity for market players.

Antiviral Drugs Market Segmentation

Segmentation Analysis of Antiviral Drugs Market:

Based on Drug Action Mechanisms, Reverse Transcriptase Inhibitors are anticipated to have the highest share in the antiviral drugs market. The increasing number of HIV patients globally and the efficiency of these medicines to treat HIV infection are the key factors promoting the use of Reverse Transcriptase Inhibitors. Protease inhibitors are expected to have the second-highest share in the antiviral drug market owing to their ability to block the spread of HIV to uninfected cells.

Based on Application, the HIV segment is expected to dominate the antiviral drug market owing to the increasing cases of HIV patients. HIV followed by Hepatitis is estimated to have the second-largest share in the antiviral drug market owing to vaccination against Hepatitis A and Hepatitis B.

Based on Type, the antiviral drug market is segmented into branded and generic. The branded segment is estimated to dominate the antiviral drug market throughout the forecast owing to priorities given to branded drugs considering their effectiveness and almost negligible side effects. The generic segment is also expected to have significant growth in developing and underdeveloped countries owing to low prices and having almost the same efficacy as branded medicines.

Based on Age Group, the Geriatric segment is anticipated to lead the market owing to the increasing geriatric population and the high risk associated to contract the virus.

Regional analysis of Antiviral Drugs Market:

Depending on geography, the antiviral drug market is segmented into 5 regions North America, Middle East, and Africa, Asia-Pacific, Europe, and South America.

North America is anticipated to dominate the antiviral drug market in the period of forecast owing to the enhanced and well-developed healthcare sector. Furthermore, the U.S. government is undertaking several measures including investment in infectious diseases programs and encouraging the R&D activities of innovative therapies to manage viral infections.

Asia-Pacific region is expected to grow at the fastest growth rate owing to the increasing prevalence and treatment rate of viral infections, developing healthcare sector, increasing number of research institutes, and increasing health awareness among people about infectious diseases.

Europe region is estimated to have a positive growth rate in the period of forecast. The well-developed healthcare sector, presence of major research institutes is propelling the antiviral drug market in this region.

Players Covered in Antiviral Drugs Market are:

- Gilead Sciences Inc (US)

- GlaxoSmithKline plc (UK)

- Johnson & Johnson Services Inc (US)

- AstraZeneca (UK)

- AbbVie Inc (US)

- Merck & Co Inc (US)

- Teva Pharmaceutical Industries Ltd (Israel) Regeneron Pharmaceuticals Inc (US)

- Bristol-Myers Squibb Company (US)

- Zydus Cadila (India)

- Cipla Inc (India)

- Prinston Pharmaceutical Inc (US)

- Hetero (India)

- Aurobindo Pharma (India)

- Apotex Inc (Canada)

- Mylan N.V. (US)

- Vir Biotechnology Inc (US) and others major key players.

Key Industry Development in Antiviral Drugs Market

- In September 2024, Hyundai Bioscience announced XAFTY®, a broad-spectrum antiviral effective against COVID-19, mpox, dengue, and H1N1, at the "Disease Prevention and Control Summit 2024." Currently in Phase 3 trials, XAFTY® aims to transform the antiviral drug market with its multi-target approach and advanced delivery technology.

- In April 2024, Onconova Therapeutics and Trawsfynydd Therapeutics announced a merger to form Traws Pharma, focusing on developing best-in-class antivirals. The combined company, with $28 million in funding from a private placement led by OrbiMed and Torrey Pines, will advance its antiviral assets, including viroksavir for influenza, travaltrelvir for COVID-19, and narazaciclib for endometrial cancer. With multiple clinical data catalysts expected in 2024, Traws Pharma aims to be a key player in the antiviral drug market.

|

Global Antiviral Drugs Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 67.25 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.9% |

Market Size in 2035: |

USD 113.82 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Age Group |

|

||

|

By Mechanism of Action |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Antiviral Drugs Market by Type (2018-2035)

4.1 Antiviral Drugs Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Branded

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Generics

Chapter 5: Antiviral Drugs Market by Application (2018-2035)

5.1 Antiviral Drugs Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Influenza

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 HIV

5.5 Hepatitis

5.6 Coronavirus Infection

5.7 Human Papillomavirus

5.8 Others

Chapter 6: Antiviral Drugs Market by Age Group (2018-2035)

6.1 Antiviral Drugs Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Adult

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Pediatric

Chapter 7: Antiviral Drugs Market by Mechanism of Action (2018-2035)

7.1 Antiviral Drugs Market Snapshot and Growth Engine

7.2 Market Overview

7.3 DNA Polymerase Inhibitors

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Reverse Transcriptase Inhibitors

7.5 Protease Inhibitors

7.6 Neuraminidase Inhibitors

7.7 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Antiviral Drugs Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 MOËT & CHANDON (FRANCE)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 VEUVE CLICQUOT (FRANCE)

8.4 DOM PÉRIGNON (FRANCE)

8.5 LOUIS ROEDERER (FRANCE)

8.6 PERRIER-JOUËT (FRANCE)

8.7 FREIXENET (SPAIN)

8.8 CAVA (SPAIN)

8.9 TAITTINGER (FRANCE)

8.10 G.H. MUMM (FRANCE)

8.11 PROSECCO (ITALY)

8.12 CHANDON (UNITED STATES)

8.13 BOLLINGER (FRANCE)

8.14 PIPER-HEIDSIECK (FRANCE)

8.15 POL ROGER (FRANCE)

8.16 CAVE DE LUGNY (FRANCE)

8.17 OTHERS

Chapter 9: Global Antiviral Drugs Market By Region

9.1 Overview

9.2. North America Antiviral Drugs Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Branded

9.2.4.2 Generics

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Influenza

9.2.5.2 HIV

9.2.5.3 Hepatitis

9.2.5.4 Coronavirus Infection

9.2.5.5 Human Papillomavirus

9.2.5.6 Others

9.2.6 Historic and Forecasted Market Size by Age Group

9.2.6.1 Adult

9.2.6.2 Pediatric

9.2.7 Historic and Forecasted Market Size by Mechanism of Action

9.2.7.1 DNA Polymerase Inhibitors

9.2.7.2 Reverse Transcriptase Inhibitors

9.2.7.3 Protease Inhibitors

9.2.7.4 Neuraminidase Inhibitors

9.2.7.5 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Antiviral Drugs Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Branded

9.3.4.2 Generics

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Influenza

9.3.5.2 HIV

9.3.5.3 Hepatitis

9.3.5.4 Coronavirus Infection

9.3.5.5 Human Papillomavirus

9.3.5.6 Others

9.3.6 Historic and Forecasted Market Size by Age Group

9.3.6.1 Adult

9.3.6.2 Pediatric

9.3.7 Historic and Forecasted Market Size by Mechanism of Action

9.3.7.1 DNA Polymerase Inhibitors

9.3.7.2 Reverse Transcriptase Inhibitors

9.3.7.3 Protease Inhibitors

9.3.7.4 Neuraminidase Inhibitors

9.3.7.5 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Antiviral Drugs Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Branded

9.4.4.2 Generics

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Influenza

9.4.5.2 HIV

9.4.5.3 Hepatitis

9.4.5.4 Coronavirus Infection

9.4.5.5 Human Papillomavirus

9.4.5.6 Others

9.4.6 Historic and Forecasted Market Size by Age Group

9.4.6.1 Adult

9.4.6.2 Pediatric

9.4.7 Historic and Forecasted Market Size by Mechanism of Action

9.4.7.1 DNA Polymerase Inhibitors

9.4.7.2 Reverse Transcriptase Inhibitors

9.4.7.3 Protease Inhibitors

9.4.7.4 Neuraminidase Inhibitors

9.4.7.5 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Antiviral Drugs Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Branded

9.5.4.2 Generics

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Influenza

9.5.5.2 HIV

9.5.5.3 Hepatitis

9.5.5.4 Coronavirus Infection

9.5.5.5 Human Papillomavirus

9.5.5.6 Others

9.5.6 Historic and Forecasted Market Size by Age Group

9.5.6.1 Adult

9.5.6.2 Pediatric

9.5.7 Historic and Forecasted Market Size by Mechanism of Action

9.5.7.1 DNA Polymerase Inhibitors

9.5.7.2 Reverse Transcriptase Inhibitors

9.5.7.3 Protease Inhibitors

9.5.7.4 Neuraminidase Inhibitors

9.5.7.5 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Antiviral Drugs Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Branded

9.6.4.2 Generics

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Influenza

9.6.5.2 HIV

9.6.5.3 Hepatitis

9.6.5.4 Coronavirus Infection

9.6.5.5 Human Papillomavirus

9.6.5.6 Others

9.6.6 Historic and Forecasted Market Size by Age Group

9.6.6.1 Adult

9.6.6.2 Pediatric

9.6.7 Historic and Forecasted Market Size by Mechanism of Action

9.6.7.1 DNA Polymerase Inhibitors

9.6.7.2 Reverse Transcriptase Inhibitors

9.6.7.3 Protease Inhibitors

9.6.7.4 Neuraminidase Inhibitors

9.6.7.5 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Antiviral Drugs Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Branded

9.7.4.2 Generics

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Influenza

9.7.5.2 HIV

9.7.5.3 Hepatitis

9.7.5.4 Coronavirus Infection

9.7.5.5 Human Papillomavirus

9.7.5.6 Others

9.7.6 Historic and Forecasted Market Size by Age Group

9.7.6.1 Adult

9.7.6.2 Pediatric

9.7.7 Historic and Forecasted Market Size by Mechanism of Action

9.7.7.1 DNA Polymerase Inhibitors

9.7.7.2 Reverse Transcriptase Inhibitors

9.7.7.3 Protease Inhibitors

9.7.7.4 Neuraminidase Inhibitors

9.7.7.5 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Antiviral Drugs Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 67.25 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.9% |

Market Size in 2035: |

USD 113.82 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Age Group |

|

||

|

By Mechanism of Action |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||