Antihyperlipidemic Drugs Market Synopsis:

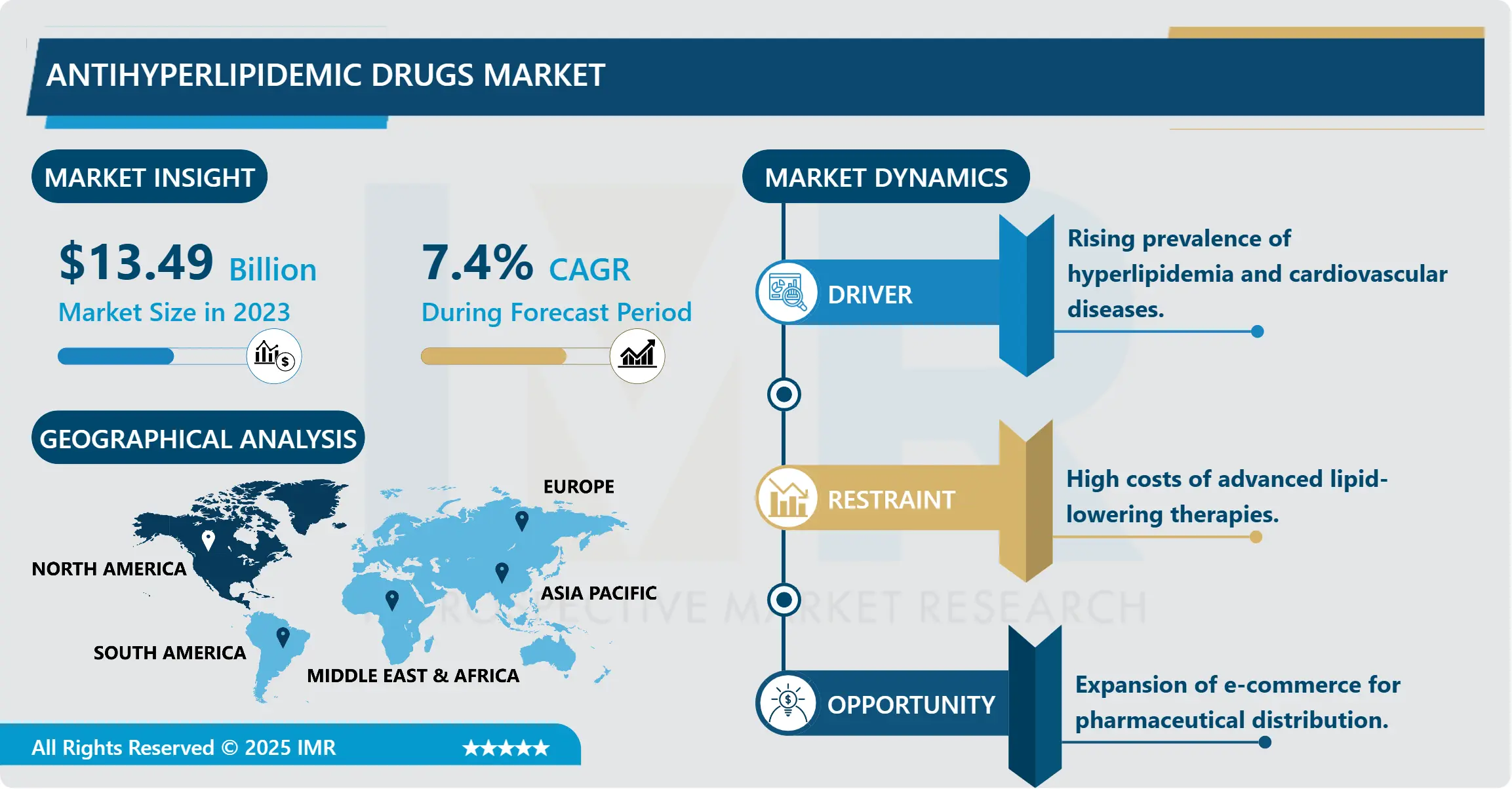

Antihyperlipidemic Drugs Market Size Was Valued at USD 13.49 Billion in 2023, and is Projected to Reach USD 25.65 Billion by 2032, Growing at a CAGR of 7.4% From 2024-2032.

The antihyperlipidemic drugs market comprises drug therapies designed to lower high levels of lipids in the blood that are associated with CVD. These drugs act on other lipid irregularities including high LDL cholesterol and triglycerides using classes including statins, bile acid binders, cholesterol uptake inhibitors and proton receptor over tone suppression kind inhibitors.

The global antihyperlipidemic drugs market is anticipation to reach USD 12.91 billion in the year 2023 primarily due to rising incidences of hyperlipidemia and cardiovascular disorders in the global population. This paper will therefore focus on hyperlipidemia which is an influential modifiable risk factor of heart diseases calling for proper control through drug treatments. The increasing proportion of geriatric population, a major consumer of lipid lowering drugs, also adds to it. Further, new entrants into the drug class, including further-generation PCSK9 inhibitors and non-statin therapies, are also expanding treatment options. They, in conjunction with attempts to enhance the perception of the significance of cardiovascular diseases, are defining recent market progress.

There are still some barriers involved in this case. Lack of sufficient knowledge and high prices resulting from the use of advanced technologies also hinder market penetration in low income regions. However there is still a growth trend in the market backed by government encouraging policies in the healthcare sector and rising financier towards the cardiovascular disease restraint programs.

Antihyperlipidemic Drugs Market Trend Analysis:

Non-Statin Therapies in Focus

- The statin-sparing or non-statin therapies have come to assume considerable importance in the management of hyperlipidemia in the last few years. Such change has been driven by new drugs such as bempedoic acid for patients with statin intolerance or for patients needing more than the statin therapeutic effects. These therapies are most useful in patients with genetic lipid disorders or those in whom standard therapy is in effective, thus these therapies help to fill the current gaps for management of high cholesterol and cardiovascular complications.

- Current research shows that pharmaceutical companies are trying hard to expand the options of non-statin therapies. Investment in clinical research, partnership, and development of new drug classes are confirmations of efforts toward more options. In pursuit of individualized treatment for lipid disorders, the current and future usage of non-statins is expected to gain significant momentum and increase the therapeutic scope in the antihyperlipidemic drugs market.

Rise of E-Commerce in Drug Distribution

- The increase in the popularity of electronics as a way to deliver a range of products is contributing to an innovative chance in the group of antihyperlipidemic drugs. Online pharmacies are improving availability especially in areas where bricks-and-mortar healthcare infrastructure is … Users turn to these channels for products’ affordability and convenience as well as due to the availability of a broad range of goods, from plain statins to novel lipid management therapies. This shift is closing a hopeless gap that had seen patients in remote regions make extensive travels before they can access their medications.

- E-commerce platforms, thus, are emerging as a highly viable sales channel for pharmaceutical firms in the global market especially in the underserved markets. The use of digital tools can enable firms to provide consumers with line recommendations, measure demand, and address the delivery of products. This correct incorporation of e-commerce also increases revenues and optimizes the drug flow in the market significantly to drive the growth of antihyperlipidemic drugs.

Antihyperlipidemic Drugs Market Segment Analysis:

Antihyperlipidemic Drugs Market is Segmented on the basis of Drug Type, Distribution Channel, Administration, and Region.

By Drug Type, the statins segment is expected to dominate the market during the forecast period

- The global antihyperlipidemic drugs market is essentially categorized based on drug class, however, statins being the most optimal therapeutic category. At present, atrovastin and rosuvastin are among the most popular drugs with the desired cholesterol lowering effects and cardiovascular risk decreasing action. Moreover, new entrants named PCSK9 inhibitors, including evolocumab and alirocumab, could be prescribed additionally to statins or used in cases when patients have side reactions on statins. The class of drugs also used to lower the LDL cholesterol include the bile acid sequestrants and cholesterol absorption inhibitors including Ezetimibe. Fibric acid derivatives such as gemfibrozil and fenofibrate are reducing triglycerides and raising HDL cholesterol levels.

- The trend for combination drugs is emerging because it integrates two or more lipid-lowering agents into a single dosage form that enhances convenience among patients and compliance. The other is more recent or experimental drugs, bempedoic acid/AAA and omega-3 fatty acid formulations, that provide for those with hyperlipidemia/ CVD more options for their therapy. The indicated drug classes are important in offering specific techniques of handling the multifaceted aspects of lipid dysfunctions.

By Distribution Channel, Hospitals Pharmacies segment expected to held the largest share

- The global antihyperlipidemic drugs market is essentially categorized based on drug class, however, statins being the most optimal therapeutic category. At present, atrovastin and rosuvastin are among the most popular drugs with the desired cholesterol lowering effects and cardiovascular risk decreasing action. Moreover, new entrants named PCSK9 inhibitors, including evolocumab and alirocumab, could be prescribed additionally to statins or used in cases when patients have side reactions on statins. The class of drugs also used to lower the LDL cholesterol include the bile acid sequestrants and cholesterol absorption inhibitors including Ezetimibe. Fibric acid derivatives such as gemfibrozil and fenofibrate are reducing triglycerides and raising HDL cholesterol levels.

- The trend for combination drugs is emerging because it integrates two or more lipid-lowering agents into a single dosage form that enhances convenience among patients and compliance. The other is more recent or experimental drugs, bempedoic acid/AAA and omega-3 fatty acid formulations, that provide for those with hyperlipidemia/ CVD more options for their therapy. The indicated drug classes are important in offering specific techniques of handling the multifaceted aspects of lipid dysfunctions.

Antihyperlipidemic Drugs Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The antihyperlipidemic drugs market was pioneered by North America in 2023, owing to various factors which include; improved medical facilities and high incidences of hyperlipidemia. This dominance is supported by sizeable spends on pharmaceutical research and development, which has introduced state-of-the-art cures, in this case. The involvement of the leading market players including Pfizer, Merck, and Amgen enhances the regional market with growth and development of lipid-lowering therapies.

- It is also said that the region is strong in insurance cover and the public has active campaigns on the need to boost on cholesterol to reduce cardiovascular diseases. These and other factors coupled with the exceptional adoption of new generation therapies like PCSK9 inhibitors and other none statin competitors have placed North America squarely on the crest of approximately 40 % of global market for antihyperlipidemic drugs and therefore redefined the growth and innovation outcome of this sector.

Active Key Players in the Antihyperlipidemic Drugs Market:

- Abbott Laboratories (USA)

- Amgen Inc. (USA)

- AstraZeneca PLC (UK)

- Bristol-Myers Squibb (USA)

- Daiichi Sankyo Company (Japan)

- Dr. Reddy’s Laboratories Ltd. (India)

- Merck & Co., Inc. (USA)

- Mylan N.V. (USA)

- Novartis AG (Switzerland)

- Pfizer Inc. (USA)

- Sanofi S.A. (France)

- Sun Pharma (India)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Zydus Lifesciences (India)

- Esperion Therapeutics, Inc. (USA), and Other Active Player

|

Antihyperlipidemic Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.49 Billion |

|

Forecast Period 2024-32 CAGR: |

7.4% |

Market Size in 2032: |

USD 25.65 Billion |

|

Segments Covered: |

By Drug Class |

|

|

|

By Distribution Channel |

|

||

|

By Administration |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Antihyperlipidemic Drugs Market by drug Type

4.1 Antihyperlipidemic Drugs Market Snapshot and Growth Engine

4.2 Antihyperlipidemic Drugs Market Overview

4.3 Statins

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Statins: Geographic Segmentation Analysis

4.4 PCSK9 Inhibitors

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 PCSK9 Inhibitors: Geographic Segmentation Analysis

4.5 Bile Acid Sequestrants

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Bile Acid Sequestrants: Geographic Segmentation Analysis

4.6 Cholesterol Absorption Inhibitors

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Cholesterol Absorption Inhibitors: Geographic Segmentation Analysis

4.7 Fibric Acid Derivatives

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Fibric Acid Derivatives: Geographic Segmentation Analysis

4.8 Combination Drugs

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Combination Drugs: Geographic Segmentation Analysis

4.9 Others

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Others: Geographic Segmentation Analysis

Chapter 5: Antihyperlipidemic Drugs Market by Distribution Channel

5.1 Antihyperlipidemic Drugs Market Snapshot and Growth Engine

5.2 Antihyperlipidemic Drugs Market Overview

5.3 Hospitals Pharmacies

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hospitals Pharmacies: Geographic Segmentation Analysis

5.4 Retail Pharmacies

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Retail Pharmacies: Geographic Segmentation Analysis

5.5 Drug Stores

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Drug Stores: Geographic Segmentation Analysis

5.6 E-Commerce

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 E-Commerce: Geographic Segmentation Analysis

Chapter 6: Antihyperlipidemic Drugs Market by Administration

6.1 Antihyperlipidemic Drugs Market Snapshot and Growth Engine

6.2 Antihyperlipidemic Drugs Market Overview

6.3 intravenous

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 intravenous: Geographic Segmentation Analysis

6.4 oral

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 oral: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Antihyperlipidemic Drugs Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMGEN INC.

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ASTRAZENECA

7.4 MERCK & CO.

7.5 NOVARTIS

7.6 PFIZER

7.7 OTHER ACTIVE PLAYERS

Chapter 8: Global Antihyperlipidemic Drugs Market By Region

8.1 Overview

8.2. North America Antihyperlipidemic Drugs Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By drug Type

8.2.4.1 Statins

8.2.4.2 PCSK9 Inhibitors

8.2.4.3 Bile Acid Sequestrants

8.2.4.4 Cholesterol Absorption Inhibitors

8.2.4.5 Fibric Acid Derivatives

8.2.4.6 Combination Drugs

8.2.4.7 Others

8.2.5 Historic and Forecasted Market Size By Distribution Channel

8.2.5.1 Hospitals Pharmacies

8.2.5.2 Retail Pharmacies

8.2.5.3 Drug Stores

8.2.5.4 E-Commerce

8.2.6 Historic and Forecasted Market Size By Administration

8.2.6.1 intravenous

8.2.6.2 oral

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Antihyperlipidemic Drugs Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By drug Type

8.3.4.1 Statins

8.3.4.2 PCSK9 Inhibitors

8.3.4.3 Bile Acid Sequestrants

8.3.4.4 Cholesterol Absorption Inhibitors

8.3.4.5 Fibric Acid Derivatives

8.3.4.6 Combination Drugs

8.3.4.7 Others

8.3.5 Historic and Forecasted Market Size By Distribution Channel

8.3.5.1 Hospitals Pharmacies

8.3.5.2 Retail Pharmacies

8.3.5.3 Drug Stores

8.3.5.4 E-Commerce

8.3.6 Historic and Forecasted Market Size By Administration

8.3.6.1 intravenous

8.3.6.2 oral

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Antihyperlipidemic Drugs Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By drug Type

8.4.4.1 Statins

8.4.4.2 PCSK9 Inhibitors

8.4.4.3 Bile Acid Sequestrants

8.4.4.4 Cholesterol Absorption Inhibitors

8.4.4.5 Fibric Acid Derivatives

8.4.4.6 Combination Drugs

8.4.4.7 Others

8.4.5 Historic and Forecasted Market Size By Distribution Channel

8.4.5.1 Hospitals Pharmacies

8.4.5.2 Retail Pharmacies

8.4.5.3 Drug Stores

8.4.5.4 E-Commerce

8.4.6 Historic and Forecasted Market Size By Administration

8.4.6.1 intravenous

8.4.6.2 oral

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Antihyperlipidemic Drugs Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By drug Type

8.5.4.1 Statins

8.5.4.2 PCSK9 Inhibitors

8.5.4.3 Bile Acid Sequestrants

8.5.4.4 Cholesterol Absorption Inhibitors

8.5.4.5 Fibric Acid Derivatives

8.5.4.6 Combination Drugs

8.5.4.7 Others

8.5.5 Historic and Forecasted Market Size By Distribution Channel

8.5.5.1 Hospitals Pharmacies

8.5.5.2 Retail Pharmacies

8.5.5.3 Drug Stores

8.5.5.4 E-Commerce

8.5.6 Historic and Forecasted Market Size By Administration

8.5.6.1 intravenous

8.5.6.2 oral

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Antihyperlipidemic Drugs Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By drug Type

8.6.4.1 Statins

8.6.4.2 PCSK9 Inhibitors

8.6.4.3 Bile Acid Sequestrants

8.6.4.4 Cholesterol Absorption Inhibitors

8.6.4.5 Fibric Acid Derivatives

8.6.4.6 Combination Drugs

8.6.4.7 Others

8.6.5 Historic and Forecasted Market Size By Distribution Channel

8.6.5.1 Hospitals Pharmacies

8.6.5.2 Retail Pharmacies

8.6.5.3 Drug Stores

8.6.5.4 E-Commerce

8.6.6 Historic and Forecasted Market Size By Administration

8.6.6.1 intravenous

8.6.6.2 oral

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Antihyperlipidemic Drugs Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By drug Type

8.7.4.1 Statins

8.7.4.2 PCSK9 Inhibitors

8.7.4.3 Bile Acid Sequestrants

8.7.4.4 Cholesterol Absorption Inhibitors

8.7.4.5 Fibric Acid Derivatives

8.7.4.6 Combination Drugs

8.7.4.7 Others

8.7.5 Historic and Forecasted Market Size By Distribution Channel

8.7.5.1 Hospitals Pharmacies

8.7.5.2 Retail Pharmacies

8.7.5.3 Drug Stores

8.7.5.4 E-Commerce

8.7.6 Historic and Forecasted Market Size By Administration

8.7.6.1 intravenous

8.7.6.2 oral

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Antihyperlipidemic Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.49 Billion |

|

Forecast Period 2024-32 CAGR: |

7.4% |

Market Size in 2032: |

USD 25.65 Billion |

|

Segments Covered: |

By Drug Class |

|

|

|

By Distribution Channel |

|

||

|

By Administration |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||