Antiepileptic Drugs Market Synopsis:

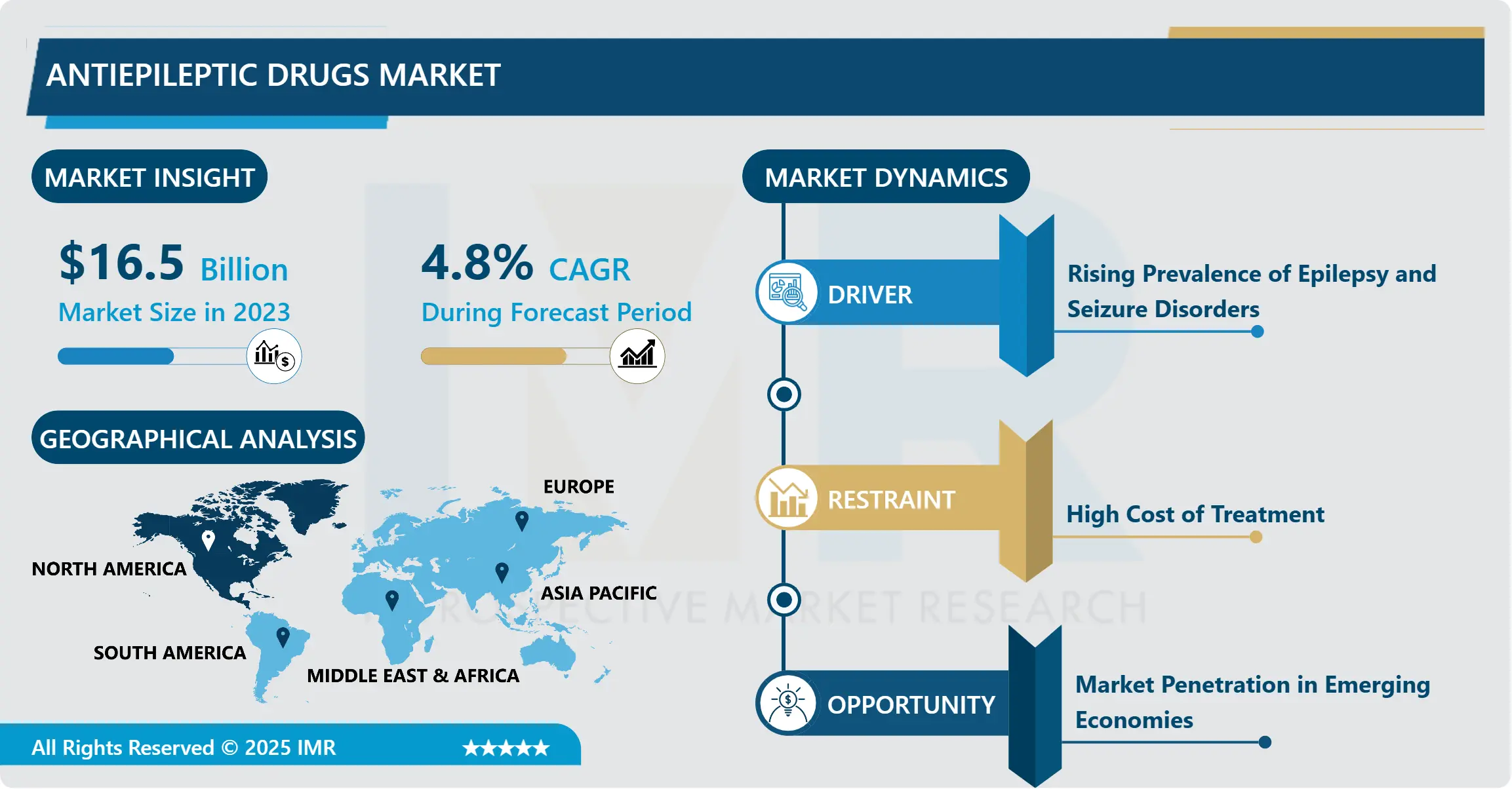

Antiepileptic Drugs Market Size Was Valued at USD 16.5 Billion in 2023, and is Projected to Reach USD 24.85 Billion by 2032, Growing at a CAGR of 4.8% From 2024-2032.

This report defines the antiepileptic drugs (AEDs) as the industry that deals with the invention, production and distribution of drugs that are used to control seizures in epilepsy and other related disorders. AEDs help in regulating the activity of the brain to stop development of seizures that have been described as minor to grave. They are used to treat epilepsy, a neuronal disorder which affects a large population of the global community. Market encompasses a myriad of pharmaceutical forms comprising of tablets and capsules, injectable preparations and the extent of its growth depends on factors such as medical developments, policies and patient access to medication.

The market for antiepileptic drugs has been on the rise following the growing incidence of epilepsy and other seizure disorder globally. The disease epilepsy has prevalence of 50 million and still poses a lot of problems for physicians and patients. These disorders are at the heart of AEDs and the market provide standard competitors and new innovative products. The growth of the market is helped by growing awareness of epilepsy, new formulations of drugs, and the provision of third generations that have a higher efficiency and fewer side effects.

This need is likely to further be driven by the growing global population of elderly people and increased rates of neurological diseases. Also, due to the recent advancement, the concept of personalized medicine, and increasing number of clinical trials to establish new AED therapies are expected to foster future growth. The market has also shifted towards biologics and biologically-based treatment in the last ten years because they are seen as safer and more effective particularly in sensitive and fragile patient groups. However, some of the problem areas such as high priced AED’s, patent expiry and the requirement of affordable drugs in the developing world reassert their impact on the market.

Antiepileptic Drugs Market Trend Analysis:

Shift Towards Targeted and Personalized Therapies

- One of the chief trends in the market of AEDs is stepping up of patient-oriented approaches and individual targeted treatments for epilepsy. That transition could be prompted by a remarkable progress in genetic studies, and a better understanding of the numerous factors which may explain various forms of epilepsy. Personalized medicine refers to the administration of specific treatments fitted according to the genetic code, life circumstances and the type of epilepsy. Not only does this approach make drugs more effective it also minimizes the effects of side effects, and from this perspective, this approach is more gentle and patient-oriented compared to generalized seizures.

- Newer wave AEDs that act on ion channels or neurotransmitters and are more effective in seizure control and better than the older drugs in patient compliance on the doses for life long treatments. These individualized therapies are suggestive of amiable treatment of the varied and complicated symptoms of epilepsy and hence make it relatively easier for one to handle their condition along with the inception of minimal side effects. Due to the increasing orientation towards individual treatment, essential in the overall development of epilepsy and the AED market, this trend will continue to occupy a focal place in the future.

Expansion in Emerging Markets and Untapped Patient Population

- One new opportunity, which has been identified in the case of AEDs is the increase in access to treatment in newly industrialized markets, which are still not fully developed in many regions. For pharmaceutical companies, it has become apparent that as the incidence of epilepsy increases in Asia-Pacific, Latin America, and the Middle East, they are well poised to make accessible, but efficient AEDs available to the increasingly affected regions. These areas often suffer from an access to new treatments because of expensive prices of medicine, a lack of proper health care facilities, and a lack of knowledge about the condition and its management. These inadequacies can be filled by providing cost-efficient AEDs and promoting EP education activities that these companies need to adapt to address the increasing demand for epilepsy treatments.

- The emerging economy governments are increasingly focusing on the improvement of their healthcare sector, which is propitious for the market. With the increase in disposable income and advancement of healthcare facilities, people in these areas develop a need to access quality and affordable medical brands, barring which are AEDs. Besides, remediating healthcare policies and growing government involvement with the pharmaceutical industry create the right environment that enables firms to widen their market share. This creates the big opportunity for AED market growth to address the large unserved population in emerging economies.

Antiepileptic Drugs Market Segment Analysis:

Antiepileptic Drugs Market is Segmented on the basis of Drug Type, Indication, Distribution Channel, and Region.

By Drug Type, Third-Generation AEDs segment is expected to dominate the market during the forecast period

- The AEDs market was classified primarily based on the indications and out of them epilepsy was the largest segment. Out of all the applications, epilepsy a neurological ailment that is marked with recurrent seizures makes up the biggest part of AED consumption. Such drugs are intended to balance neuronal electrical activity and abolish seizures; therefore, they are the primary treatment for epilepsy. Since more than fifty million individuals experience epilepsy globally, the large patient base in this area significantly benefits from AEDs. Furthermore, introduction of newer generation of better efficacy and less side effects drugs has also contributed to the growth of market epilepsy.

- AEDs are also being used in indications other than epilepsy such as neuropathic pain, bipolar disorder and several other neurological or psychiatric illness. Peripheral neuropathy which is characterized by nerve injury is also treated by AEDs because they help regulate nerve impulses. Likewise, bipolar disorder characterized by superimposed depression and mania, requires the use of mood stabilizers in AEDs. The given applications of AEDs also diversify their demand beyond epilepsy, which contributes to the further market development. Other disorders refer to the other indications, which are still increasing due to additional applications of AEDs as long as more studies are being done in finding a wide range of therapeutic uses of AEDs.

By Indication, epilepsy segment expected to held the largest share

- The antiepileptic drugs (AEDs) market is segmented into three categories based on drug type: On the basis of the pharmacological action on neurons, there are first-generation, second-generation, and third-generation AEDs. First generation AEDs include phenobarbital, phenytoin, carbamazepine and valproate; the first antiepileptic drugs in epilepsy therapy. These drugs are considered effective for managing seizures but may cause a number of side effects and interfere with other medications. However, they are still in use because they are still more accessible with newer forms in the impoverished and moderately developed areas of the population. Their low cost and standardised treatment algorithms have stood them as firm favourites in the treatment of epilepsy.

- Second and third generation AEDs are defined as the new generations of the epilepsy treatment that have better safety profile and efficacy. Second generation anti-epileptic such as Lamotrigine, Levitraqecam, topiramate, Gabapentin etc are often used because of lesser side effects and indication in conditions like neuropathic pain and bipolar disorder. At the same time, the third generation AEDs including brivaracetam, eslicarbazepine acetate, lacosamide and perampanel can be considered as the new products in the market. They are anti-psychotic drugs which offer specific therapies with less side effects, for patients who cannot benefit from first generation drugs. The increasing use of second- and third-generation AEDs is more individualized and developed in epilepsy treatment.

Antiepileptic Drugs Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America remains the largest AED market, led by the United States, in 2023 and is expected to grow steadily in the forecast period. It is widely believe that the regions influence stems from factors such as well-established health care facilities, high expenditure on health, and accessibility to powerful AED therapies. The United States boasts of formidable players in the global market for pharmaceutical products and services and has sound R&D sectors that always advance innovations in antiepileptic drugs market. Also, in North America we have the aging population that is most vulnerable to illnesses such as epilepsy hence a ready market for AEDs. It is also expressed that the high rate of health care accessibility and novelties in the treatment method also shares the future market dominancy of the region.

- It is estimated that North American market accounts for the 45-50% of the AEDs and majority of these products are from United States. This dominance of the Western can be attributed to improved health care technology and treatment techniques is expected to be realize to 2024. Moreover, the continuous registration of new drugs and the rising number of clinical trial of epilepsy therapeutics in North America established its position in determining the global AED market. Continued concern with enhancing the quality of and expanding access to comprehensive antiepileptic and other treatments has kept North America an active participant in this worldwide market.

Active Key Players in the Antiepileptic Drugs Market:

- Astellas Pharma Inc. (Japan)

- AstraZeneca Plc (UK)

- Biogen Inc. (USA)

- Bristol-Myers Squibb Company (USA)

- Eisai Co., Ltd. (Japan)

- Epilepsy Therapy Project (USA)

- GSK (GlaxoSmithKline) Plc (UK)

- Johnson & Johnson (USA)

- Mylan N.V. (USA)

- Novartis International AG (Switzerland)

- Otsuka Pharmaceutical Co., Ltd. (Japan)

- Pfizer Inc. (USA)

- Sanofi S.A. (France)

- Sun Pharmaceutical Industries Ltd. (India)

- UCB Pharma (Belgium), and Other Active Players

|

Antiepileptic Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 16.5 Billion |

|

Forecast Period 2024-32 CAGR: |

4.8 % |

Market Size in 2032: |

USD 24.85 Billion |

|

Segments Covered: |

By Drug Type |

|

|

|

By Indication |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Antiepileptic Drugs Market by drug Type

4.1 Antiepileptic Drugs Market Snapshot and Growth Engine

4.2 Antiepileptic Drugs Market Overview

4.3 First-Generation AEDs

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 First-Generation AEDs: Geographic Segmentation Analysis

4.4 Second-Generation AEDs

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Second-Generation AEDs: Geographic Segmentation Analysis

4.5 Third-Generation AEDs

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Third-Generation AEDs: Geographic Segmentation Analysis

Chapter 5: Antiepileptic Drugs Market by indication

5.1 Antiepileptic Drugs Market Snapshot and Growth Engine

5.2 Antiepileptic Drugs Market Overview

5.3 Epilepsy

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Epilepsy: Geographic Segmentation Analysis

5.4 Neuropathic Pain

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Neuropathic Pain: Geographic Segmentation Analysis

5.5 Bipolar Disorder

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Bipolar Disorder: Geographic Segmentation Analysis

5.6 Other Disorders

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Other Disorders: Geographic Segmentation Analysis

Chapter 6: Antiepileptic Drugs Market by distribution channel

6.1 Antiepileptic Drugs Market Snapshot and Growth Engine

6.2 Antiepileptic Drugs Market Overview

6.3 Hospital Pharmacies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospital Pharmacies: Geographic Segmentation Analysis

6.4 Retail Pharmacies

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Retail Pharmacies: Geographic Segmentation Analysis

6.5 Online Pharmacies

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Online Pharmacies: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Antiepileptic Drugs Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ASTELLAS PHARMA INC. (JAPAN)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BIOGEN INC. (USA)

7.4 BRISTOL-MYERS SQUIBB COMPANY (USA)

7.5 GSK (GLAXOSMITHKLINE) PLC (UK)

7.6 OTHER ACTIVE PLAYERS

Chapter 8: Global Antiepileptic Drugs Market By Region

8.1 Overview

8.2. North America Antiepileptic Drugs Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By drug Type

8.2.4.1 First-Generation AEDs

8.2.4.2 Second-Generation AEDs

8.2.4.3 Third-Generation AEDs

8.2.5 Historic and Forecasted Market Size By indication

8.2.5.1 Epilepsy

8.2.5.2 Neuropathic Pain

8.2.5.3 Bipolar Disorder

8.2.5.4 Other Disorders

8.2.6 Historic and Forecasted Market Size By distribution channel

8.2.6.1 Hospital Pharmacies

8.2.6.2 Retail Pharmacies

8.2.6.3 Online Pharmacies

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Antiepileptic Drugs Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By drug Type

8.3.4.1 First-Generation AEDs

8.3.4.2 Second-Generation AEDs

8.3.4.3 Third-Generation AEDs

8.3.5 Historic and Forecasted Market Size By indication

8.3.5.1 Epilepsy

8.3.5.2 Neuropathic Pain

8.3.5.3 Bipolar Disorder

8.3.5.4 Other Disorders

8.3.6 Historic and Forecasted Market Size By distribution channel

8.3.6.1 Hospital Pharmacies

8.3.6.2 Retail Pharmacies

8.3.6.3 Online Pharmacies

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Antiepileptic Drugs Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By drug Type

8.4.4.1 First-Generation AEDs

8.4.4.2 Second-Generation AEDs

8.4.4.3 Third-Generation AEDs

8.4.5 Historic and Forecasted Market Size By indication

8.4.5.1 Epilepsy

8.4.5.2 Neuropathic Pain

8.4.5.3 Bipolar Disorder

8.4.5.4 Other Disorders

8.4.6 Historic and Forecasted Market Size By distribution channel

8.4.6.1 Hospital Pharmacies

8.4.6.2 Retail Pharmacies

8.4.6.3 Online Pharmacies

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Antiepileptic Drugs Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By drug Type

8.5.4.1 First-Generation AEDs

8.5.4.2 Second-Generation AEDs

8.5.4.3 Third-Generation AEDs

8.5.5 Historic and Forecasted Market Size By indication

8.5.5.1 Epilepsy

8.5.5.2 Neuropathic Pain

8.5.5.3 Bipolar Disorder

8.5.5.4 Other Disorders

8.5.6 Historic and Forecasted Market Size By distribution channel

8.5.6.1 Hospital Pharmacies

8.5.6.2 Retail Pharmacies

8.5.6.3 Online Pharmacies

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Antiepileptic Drugs Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By drug Type

8.6.4.1 First-Generation AEDs

8.6.4.2 Second-Generation AEDs

8.6.4.3 Third-Generation AEDs

8.6.5 Historic and Forecasted Market Size By indication

8.6.5.1 Epilepsy

8.6.5.2 Neuropathic Pain

8.6.5.3 Bipolar Disorder

8.6.5.4 Other Disorders

8.6.6 Historic and Forecasted Market Size By distribution channel

8.6.6.1 Hospital Pharmacies

8.6.6.2 Retail Pharmacies

8.6.6.3 Online Pharmacies

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Antiepileptic Drugs Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By drug Type

8.7.4.1 First-Generation AEDs

8.7.4.2 Second-Generation AEDs

8.7.4.3 Third-Generation AEDs

8.7.5 Historic and Forecasted Market Size By indication

8.7.5.1 Epilepsy

8.7.5.2 Neuropathic Pain

8.7.5.3 Bipolar Disorder

8.7.5.4 Other Disorders

8.7.6 Historic and Forecasted Market Size By distribution channel

8.7.6.1 Hospital Pharmacies

8.7.6.2 Retail Pharmacies

8.7.6.3 Online Pharmacies

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Antiepileptic Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 16.5 Billion |

|

Forecast Period 2024-32 CAGR: |

4.8 % |

Market Size in 2032: |

USD 24.85 Billion |

|

Segments Covered: |

By Drug Type |

|

|

|

By Indication |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||