Antibacterial Drugs Market Synopsis:

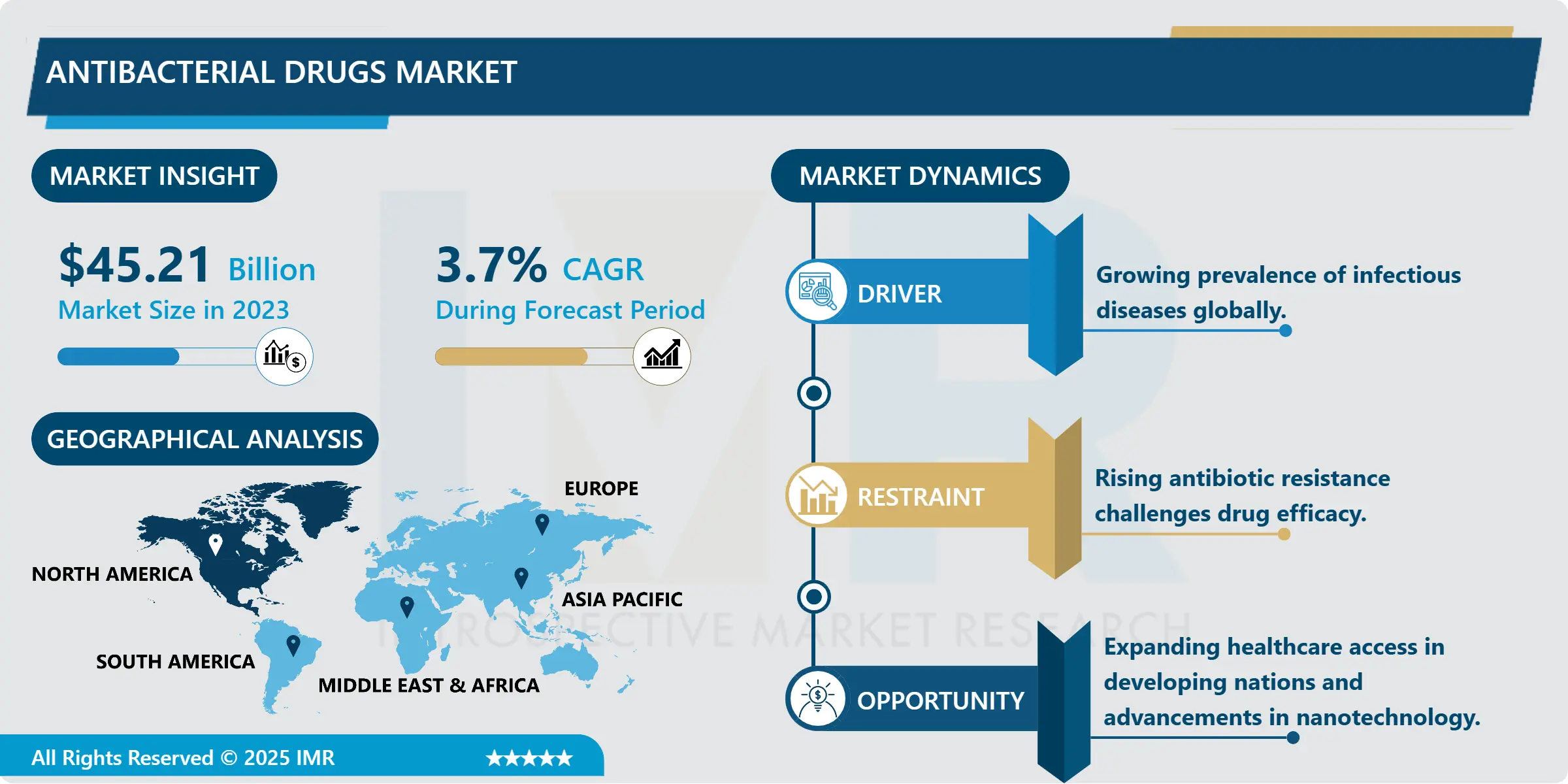

Antibacterial Drugs Market Size Was Valued at USD 45.21 Billion in 2023, and is Projected to Reach USD 62.70 Billion by 2032, Growing at a CAGR of 3.7% From 2024-2032.

The antibacterial drugs market refers to products with capabilities of eradicating bacteria in patients, including humans and animals. These drugs usually eliminate the bacterial organisms or slow their growth to cover many types of infections such as respiratory, skin, urinary tract and gastrointestinal infections.

The increasing frequency of bacterial infections and hospital acquired infections, and the growing use of antibiotics such as cephalosporins and macrolides drives the market. But it is afraid significant problem that is antibiotic resistance. These challenges are most likely to be overcome by innovation in drug delivery methods such as nanotechnology and development of new classes of drug.

North America led the antibacterial drugs market. The leadership of this region has been accredited to strong health care system, high research and development percentage and introduction of new antibiotics therapy. However, other regions such as Europe and Asia Pacific are expected to grow at a much larger percentage due to rising healthcare expenditure as well as fight against infectious diseases.

Antibacterial Drugs Market Trend Analysis:

Tackling Antibiotic Resistance

- One of the most exciting and rapidly advancing features of the antibacterial drugs market is the ability to use nanotechnology in the creation of new antibiotics. Nanotechnology lies in the earlier phase of research to augment the efficiency of the antibiotics including MDR bacterial strains. These nanoparticles can enhance drug delivery, augment stability of antibiotics and enhance selective targeting to bacteria. This is the case because the fast-growing cases of antibiotic resistance make many existing drugs organisms counters to many bacterial infections that are common in the health facilities.

- In addition to nanotechnology, there is enormous emphasis in the development of new drugs specifically targeting antibiotic resistance. For example, minocycline derivatives are also being studied for their comparative efficacy and capacity to function in disregard of the resistances as alternative treatments of bacterial infections that do not respond to other antibiotics. This and many others show that the pharmaceutical industry has been very active in trying to come up with new ways of combating bacterial infections. These factors are trends of continued growth as resistance to conventional antibiotics increases, and the hope for better treatments in the future of these innovations.

Rising Demand in Emerging Markets

- Market in Asia-Pacific and Africa is expected to be the growth drivers for the antibiotics market particularly for antibacterial drugs. With the fast-growing urban population and advances in healthcare, these areas are using increasing quantities of antibiotics to fight proliferating bacterial infections. Non-communicable diseases and communicable diseases continue to be diseases and there is therefore a great need for treatment. Policymakers in these regions are also putting their best efforts and a lot of money through health budgets to address these health issues that include improving availability of key medicines. Population health campaign for the prevention of the spread of infections, including the spreading awareness of AMR, is also empowering the growth of antibacterial drugs market.

- Advancement in technology like Tele-medicine and e-pharmacy is creating an additional measure to make the healthcare system of the country more effective to the patients in the remote area. These innovations enhance the ability of a patient from remote or other difficult to locate area in the country access prescriptions and get access to antibiotics even though the health facilities in those regions may not be well developed. It was especially useful in the regions that have limited access to physical physician services due to COVID and otherwise, which has broadened the accessibility to necessary antibacterial remedies. This trend is expected to escalate as several digital health platforms are established and develop the need for antibacterial drugs in developing countries.

Antibacterial Drugs Market Segment Analysis:

Antibacterial Drugs Market is Segmented on the basis of Drug Class, Route of Administration, End User, and Region.

By drug class, Beta-lactams segment is expected to dominate the market during the forecast period

- The market of antibacterial drugs is mainly classified by the class of the drugs, but it contains several major categories. Penicillin’s, cephalosporins and carbapenems are the most popular antibiotic groups because of their activity against a range of bacterial infections. quinolones is another broad group closely related to fluoroquinolones known primarily as respiratory and urinary tract infections and macrolides which act by inhibiting bacterial proteins involved in their synthesis improve such diseases as pneumonia and sexually transmitted infections. Tetracyclines are another broad group of antibiotics which may be used for acne or respiratory infections, rich with nonselective antibacterial activity.

- Besides these well-known classes the category of Others comprises of; glycopeptides, polymyxins and aminoglycosides which have their specific role in the management of severe infections, sepsis and resistant pathogen infections. The division concerned with the segmentation by the drug class presents itself in a way aimed at providing correct treatment for the bacterial infections depending on the category and level of infection.

By Route of Administration , oral segment expected to held the largest share

- The antibacterial drugs market can also analysed based on the route of administration where the key classifications are oral, intravenous (IV) and other. One of the most frequent ways of administration is enteral, especially for moderate and relatively mild pathogen reactions. Tablets or capsules are easy to administer and can be given to the patients with ease apart from the fact that they are cheaper to the health care facilities. They are mostly applied to ambulatory cares and to infections such as urinary system, respiratory system, skin infections among others. Oral antibiotics are also preferred if the complaint is chronic and will require long-term control, for example acne or bacterial prostatitis.

- Subcutaneous administration is more commonly used in mild or moderate bacterial infections while intravenous administration is used commonly in more severe or serious bacterial infections. IV antibiotics are those that are normally given in a hospital or clinically and are used when oral antibiotics cannot or are not effective in use. The category of Others consists of the IM injection, topical use or aerosolized forms of antibiotics that are used depending to the location of the infection, or the condition of the patient. This segmentation assist in the selection of the appropriate technique or approach for drug delivery, gain maximum chances of treatment and adherence to the same by the patient.

Antibacterial Drugs Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America has the largest share in antibacterial drugs market. The region’s dominance can be attributed to the fact of well-developed health care facilities, higher incidence of bacterial infections, favourable government measures to contain infectious diseases. The American manufacturers take the leading position, and for this successful position it invests a lot in the research and development of new drugs and modern means of their delivery. Moreover, ongoing national and global regulatory policies, increased dedicated funding for antibiotic research and development guarantee that new treatments always reach the market.

- Europe and Asia-Pacific regions are also coming up as other regions that are making a good performance although North America leads the way. In Europe, expenditures made on healthcare and governmental plans for the containment of antibiotic resistance are factors which have led to expansion of the market. On the other hand, Asia-Pacific’s health industry is experiencing growth and bacterial infections rates have been on the rise causing the need for efficient antibacterial treatments. This however, is still not set to slow down, as North America, which had well established itself in the antibacterial drugs market, has the added advantages of increased market share as well as technology.

Active Key Players in the Antibacterial Drugs Market:

- Astellas Pharma (Japan)

- Bayer AG (Germany)

- Cipla Limited (India)

- Dr. Reddy’s Laboratories (India)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Gilead Sciences (USA)

- GlaxoSmithKline plc (UK)

- Johnson & Johnson (USA)

- Lupin Limited (India)

- Merck & Co., Inc. (USA)

- Novartis AG (Switzerland)

- Pfizer Inc. (USA)

- Sanofi (France)

- Sun Pharmaceutical Industries Ltd. (India)

- Teva Pharmaceutical Industries (Israel)

- Other Active Players

|

Antibacterial Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 45.21 Billion |

|

Forecast Period 2024-32 CAGR: |

3.70% |

Market Size in 2032: |

USD 62.70 Billion |

|

Segments Covered: |

By Drug Class |

|

|

|

By Route of Administration |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Antibacterial Drugs Market by drug class

4.1 Antibacterial Drugs Market Snapshot and Growth Engine

4.2 Antibacterial Drugs Market Overview

4.3 Beta-lactams

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Beta-lactams: Geographic Segmentation Analysis

4.4 Quinolones

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Quinolones: Geographic Segmentation Analysis

4.5 Macrolides

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Macrolides: Geographic Segmentation Analysis

4.6 Tetracyclines

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Tetracyclines: Geographic Segmentation Analysis

4.7 Others)

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Others): Geographic Segmentation Analysis

Chapter 5: Antibacterial Drugs Market by route of administration

5.1 Antibacterial Drugs Market Snapshot and Growth Engine

5.2 Antibacterial Drugs Market Overview

5.3 Oral

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Oral: Geographic Segmentation Analysis

5.4 Intravenous

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Intravenous: Geographic Segmentation Analysis

5.5 Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Others: Geographic Segmentation Analysis

Chapter 6: Antibacterial Drugs Market by End User

6.1 Antibacterial Drugs Market Snapshot and Growth Engine

6.2 Antibacterial Drugs Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Clinics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Clinics: Geographic Segmentation Analysis

6.5 Home care settings

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Home care settings: Geographic Segmentation Analysis

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Antibacterial Drugs Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BAYER AG

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CIPLA LIMITED

7.4 GILEAD SCIENCES

7.5 JOHNSON & JOHNSON

7.6 AND PFIZER INC

7.7 OTHER ACTIVE PLAYERS

Chapter 8: Global Antibacterial Drugs Market By Region

8.1 Overview

8.2. North America Antibacterial Drugs Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By drug class

8.2.4.1 Beta-lactams

8.2.4.2 Quinolones

8.2.4.3 Macrolides

8.2.4.4 Tetracyclines

8.2.4.5 Others)

8.2.5 Historic and Forecasted Market Size By route of administration

8.2.5.1 Oral

8.2.5.2 Intravenous

8.2.5.3 Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals

8.2.6.2 Clinics

8.2.6.3 Home care settings

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Antibacterial Drugs Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By drug class

8.3.4.1 Beta-lactams

8.3.4.2 Quinolones

8.3.4.3 Macrolides

8.3.4.4 Tetracyclines

8.3.4.5 Others)

8.3.5 Historic and Forecasted Market Size By route of administration

8.3.5.1 Oral

8.3.5.2 Intravenous

8.3.5.3 Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals

8.3.6.2 Clinics

8.3.6.3 Home care settings

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Antibacterial Drugs Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By drug class

8.4.4.1 Beta-lactams

8.4.4.2 Quinolones

8.4.4.3 Macrolides

8.4.4.4 Tetracyclines

8.4.4.5 Others)

8.4.5 Historic and Forecasted Market Size By route of administration

8.4.5.1 Oral

8.4.5.2 Intravenous

8.4.5.3 Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals

8.4.6.2 Clinics

8.4.6.3 Home care settings

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Antibacterial Drugs Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By drug class

8.5.4.1 Beta-lactams

8.5.4.2 Quinolones

8.5.4.3 Macrolides

8.5.4.4 Tetracyclines

8.5.4.5 Others)

8.5.5 Historic and Forecasted Market Size By route of administration

8.5.5.1 Oral

8.5.5.2 Intravenous

8.5.5.3 Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals

8.5.6.2 Clinics

8.5.6.3 Home care settings

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Antibacterial Drugs Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By drug class

8.6.4.1 Beta-lactams

8.6.4.2 Quinolones

8.6.4.3 Macrolides

8.6.4.4 Tetracyclines

8.6.4.5 Others)

8.6.5 Historic and Forecasted Market Size By route of administration

8.6.5.1 Oral

8.6.5.2 Intravenous

8.6.5.3 Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals

8.6.6.2 Clinics

8.6.6.3 Home care settings

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Antibacterial Drugs Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By drug class

8.7.4.1 Beta-lactams

8.7.4.2 Quinolones

8.7.4.3 Macrolides

8.7.4.4 Tetracyclines

8.7.4.5 Others)

8.7.5 Historic and Forecasted Market Size By route of administration

8.7.5.1 Oral

8.7.5.2 Intravenous

8.7.5.3 Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals

8.7.6.2 Clinics

8.7.6.3 Home care settings

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Antibacterial Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 45.21 Billion |

|

Forecast Period 2024-32 CAGR: |

3.70% |

Market Size in 2032: |

USD 62.70 Billion |

|

Segments Covered: |

By Drug Class |

|

|

|

By Route of Administration |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||