Anti-Fungal Drugs Market Synopsis:

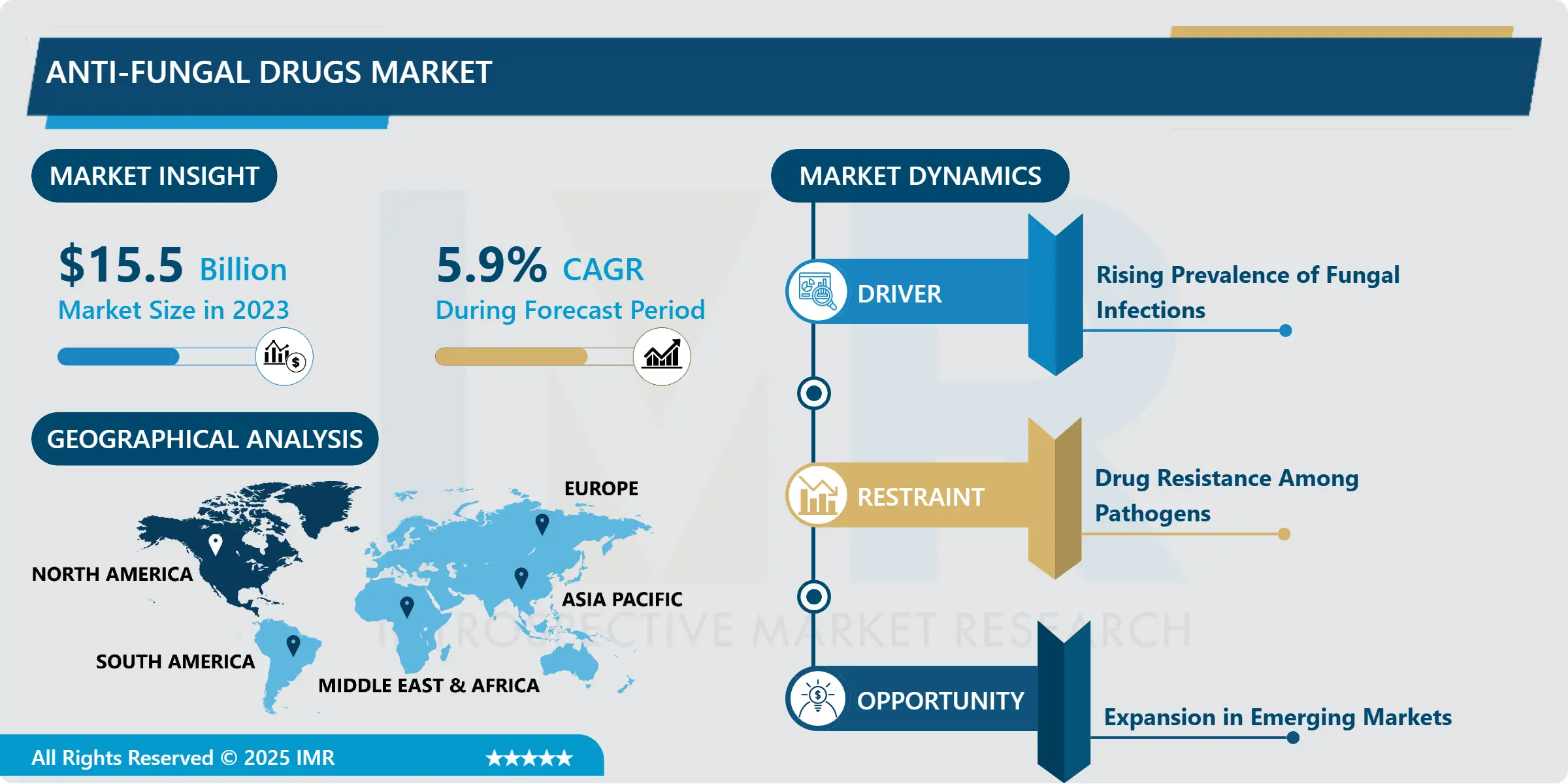

Anti-Fungal Drugs Market Size Was Valued at USD 15.5 Billion in 2023, and is Projected to Reach USD 21.2 Billion by 2032, Growing at a CAGR of 5.9% From 2024-2032.

The antifungal drugs market refers to medicines that are developed to treat fungal disorders in humans and animals only. These drugs treat such cutaneous disorders as athletes’ foot, and severe invasive systemic disorders like aspergillosis. Its subcategories are drugs both for purchase from the counter and by prescription and formulations oral, topical and injectable for many fungal pathogens and patients.

The global antifungal drugs market is growing rapidly due to the more occurrences of fungal infections across the world, especially in immunocompromised cases like HIV/AIDS, cancer, organ transplants. Higher emergence of fungal diseases and various developments in medical technology contribute to the better diagnostic tools, which leads to the market growth. Furthermore, the rising number of infections arising from increased life spans since elder people have weak immune systems and are vulnerable to opportunistic infections by fungi.

Problems such as drug resistance and the unavailability of many new antifungal compounds are acting as hurdles. Industry giants have not remained indifferent to these problems, which is why new drugs appear on the market with time that have higher performance and safety indicators. Some other related drivers which contribute to the market growth include combination therapies, use of antifungal agents in agriculture and many others.

Anti-Fungal Drugs Market Trend Analysis:

Rise in Combination Therapies

- Rise in Combination Therapies is because combination therapies are increasingly becoming a more apparent trend in the antifungal drugs market since they are more effective against the resistant fungal strains. Due to their ability to work synergistically, these therapies attack the fungal infections from a number of fronts, using mechanisms that stop the growth of the fungi. This method, not only increase flexibility and effectiveness of treatment but also decreases the possibility of drug resistance in managing of both; superficial and systemic forms of mycoses which has remained a chin for therapeutic control. For instance, coadministration of echinocandins with azoles appears practical in managing invasive fungal infections, enhancing result to monotherapy.

- Such concept very much associated with the notion of precision or customized medicine where therapies will be personalized to a patient. New strategies in drug combinations enable the healthcare practitioners to tackle the intensity and nature of these fungal infections for a better prognosis of the patient. Several polyclonal and monoclonal antibodies are under development or in clinical trial phases working on combinations to widen the therapeutic strategy. This innovation therefore satisfies the global market need for better and resistant-proof antifungal treatments.

Rising Demand in Emerging Markets

- The antifungal drugs market is expanding as a range of new economies including India, Brazil, and countries in South East Asia. The apparent factors contributing to increase in incidence of both superficial and systemic mycoses are tropical climates of the said regions. Several related factors, including growing global population and urbanization, constantly ascending rates of chronic diseases (diabetes and cancer) whereby the patients are vulnerable to fungal diseases, all are directing a momentum for huge demand of the antifungal products. There is also better understanding of the healthcare professionals and patients about the connected hazards of untreated fungal infections, which is also supporting the growth of the market.

- Regions are experiencing trends of improved health facilities and availability of drugs with antifungal drugs within easy reach. It showed that pharmaceutical companies today are extending their distribution channels and actively using governmental programs targeted at addressing neglected tropical diseases. This coupled with growing middle-class population that is demanding better healthcare service is a perfect environment for market development. Another advantage comes from the emphasis on the cheap products and locally produced drugs, which soon made antifungal treatments available in these rapidly developing economies.

Anti-Fungal Drugs Market Segment Analysis:

Anti-Fungal Drugs Market is Segmented on the basis of Drug Type, Application, End User, and Region.

By Drug Type, Azoles segment is expected to dominate the market during the forecast period

- Azoles account for the largest market share for antifungal drugs as they are amongst the most potent, with multiple-spectrum activity for treating both dermatophytid and systematic infections. They cover familiar names of agents such as fluconazole and itraconazole that are preferred due to high grade effectiveness with comparatively less side effects. Azoles are commonly prescribed for outpatient and hospitalized patients with candidiasis and aspergillosis, and are considered a mainstay of antifungal treatment. These formulate comes in many forms in oral, topical and even intravenous and this makes the products versatile and widely used.

- Echinocandins that are called ‘antifungal antibiotics’ are preferred for the treatment of invasive systemic candidiasis. These drugs include caspofungin and micafungin which exert appreciable potency and safety in the therapy of critically ill patients by selectively damaging the fungal cell walls. Subsequently, echinocandins are developing popularity, especially in hospital use, attributable to their low resistance profile and security elements for immunocompromised patients. Given the fact that new rates of drug-resistant fungi infections are constantly on the rise, the market will continue to demand more and more of the echinocandins.

By Application, Systemic Infections segment expected to held the largest share

- Hair and nail infections are the most common and they constitute the largest market for antifungal agents. Some of these include athlete’s foot, ring worm and candidiasis affecting millions of people globally each year. Such infections have continued to manifest more frequently due to factors like; high humidity, poor personal hygiene and overcrowding especially in urban centers, thus creating a market need for topical and oral antifungal drugs. This segment is highly defined by over the counter drugs as patients have readily access to treatment and is inexpensive.

- Non-systemic fungal infections, in contrast, are mild and less dangerous, whereas systemic mycoses are aggressive and potentially lethal being mainly observed in immunocompromised patients with malignancies, recipients of chemotherapy or organ transplantation. Conditions such as invasive candidiasis, aspergillosis, and cryptococcosis are conditions whose treatment involves the use of strong systemic antifungal drugs, which include the echinocandins, and azoles. Increased knowledge in these infections has been complemented by improved diagnostic techniques and treatments to accelerate growth on this segment. There are huge considerations on the part of hospitals and specialty clinics to manage systemic infections and this has taken focus to injectable and combination antifungal.

Anti-Fungal Drugs Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America became the largest market for the total antifungal drugs market. This strong position is backed up by the further development of such essential elements of Oriental medicine as diagnosis and treatment of fungal infections available in highly developed Asian region healthcare systems. Given the facts that cutaneous candidiasis is rather widespread globally along with other forms of fungal diseases and that immunocompromised patients in particular, require effective therapy against fungal diseases, which the current range of antifungal drugs can hardly provide. Solid investment on research and development have also put steady supply of new drugs into the market hence enhancing continuous growth in this region.

- The United States is also one of the dominant North American countries that rely on the industry and have acting favourable legislation. Drug policies for financing and encouraging development of new drugs have shifted industry attention to the area of antifungal treatments. Furthermore, collaborations between industry and universities have enhanced the major markets in the region’s capacity to meet unmet demands in antifungal. This holistic environment guarantees that North America alone retains control over the antifungal drugs market in the global market.

Active Key Players in the Anti-Fungal Drugs Market:

- Astellas Pharma (Japan)

- Bayer AG (Germany)

- Biopharma (USA)

- Cedilla Pharmaceuticals (India)

- Cipla Limited (India)

- Dr. Reddy’s Laboratories (India)

- Glenmark Pharmaceuticals (India)

- GSK plc (United Kingdom)

- Johnson & Johnson (USA)

- Merck & Co. (USA)

- Novartis International AG (Switzerland)

- Pfizer Inc. (USA)

- Sanofi (France)

- Sun Pharmaceutical Industries (India)

- Teva Pharmaceutical Industries (Israel)

- Other Active Players

|

Anti-Fungal Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 15.5 Billion |

|

Forecast Period 2024-32 CAGR: |

5.9% |

Market Size in 2032: |

USD 21.2 Billion |

|

Segments Covered: |

By Drug Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Anti-Fungal Drugs Market by Drug Type

4.1 Anti-Fungal Drugs Market Snapshot and Growth Engine

4.2 Anti-Fungal Drugs Market Overview

4.3 Azoles

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Azoles: Geographic Segmentation Analysis

4.4 Echinocandins

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Echinocandins: Geographic Segmentation Analysis

4.5 Polyenes

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Polyenes: Geographic Segmentation Analysis

4.6 Allylamines

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Allylamines: Geographic Segmentation Analysis

4.7 Others

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Others: Geographic Segmentation Analysis

Chapter 5: Anti-Fungal Drugs Market by Application

5.1 Anti-Fungal Drugs Market Snapshot and Growth Engine

5.2 Anti-Fungal Drugs Market Overview

5.3 uperficial Infections

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 uperficial Infections: Geographic Segmentation Analysis

5.4 Systemic Infections

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Systemic Infections: Geographic Segmentation Analysis

Chapter 6: Anti-Fungal Drugs Market by End User

6.1 Anti-Fungal Drugs Market Snapshot and Growth Engine

6.2 Anti-Fungal Drugs Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Clinics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Clinics: Geographic Segmentation Analysis

6.5 Home Care Settings

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Home Care Settings: Geographic Segmentation Analysis

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Anti-Fungal Drugs Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ASTELLAS PHARMA

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BAYER AG

7.4 CIPLA LIMITED

7.5 JOHNSON & JOHNSON

7.6 PFIZER INC.

7.7 OTHER ACTIVE PLAYERS

Chapter 8: Global Anti-Fungal Drugs Market By Region

8.1 Overview

8.2. North America Anti-Fungal Drugs Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Drug Type

8.2.4.1 Azoles

8.2.4.2 Echinocandins

8.2.4.3 Polyenes

8.2.4.4 Allylamines

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 uperficial Infections

8.2.5.2 Systemic Infections

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals

8.2.6.2 Clinics

8.2.6.3 Home Care Settings

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Anti-Fungal Drugs Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Drug Type

8.3.4.1 Azoles

8.3.4.2 Echinocandins

8.3.4.3 Polyenes

8.3.4.4 Allylamines

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 uperficial Infections

8.3.5.2 Systemic Infections

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals

8.3.6.2 Clinics

8.3.6.3 Home Care Settings

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Anti-Fungal Drugs Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Drug Type

8.4.4.1 Azoles

8.4.4.2 Echinocandins

8.4.4.3 Polyenes

8.4.4.4 Allylamines

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 uperficial Infections

8.4.5.2 Systemic Infections

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals

8.4.6.2 Clinics

8.4.6.3 Home Care Settings

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Anti-Fungal Drugs Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Drug Type

8.5.4.1 Azoles

8.5.4.2 Echinocandins

8.5.4.3 Polyenes

8.5.4.4 Allylamines

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 uperficial Infections

8.5.5.2 Systemic Infections

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals

8.5.6.2 Clinics

8.5.6.3 Home Care Settings

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Anti-Fungal Drugs Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Drug Type

8.6.4.1 Azoles

8.6.4.2 Echinocandins

8.6.4.3 Polyenes

8.6.4.4 Allylamines

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 uperficial Infections

8.6.5.2 Systemic Infections

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals

8.6.6.2 Clinics

8.6.6.3 Home Care Settings

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Anti-Fungal Drugs Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Drug Type

8.7.4.1 Azoles

8.7.4.2 Echinocandins

8.7.4.3 Polyenes

8.7.4.4 Allylamines

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 uperficial Infections

8.7.5.2 Systemic Infections

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals

8.7.6.2 Clinics

8.7.6.3 Home Care Settings

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Anti-Fungal Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 15.5 Billion |

|

Forecast Period 2024-32 CAGR: |

5.9% |

Market Size in 2032: |

USD 21.2 Billion |

|

Segments Covered: |

By Drug Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||