Animal Vaccines Market Synopsis:

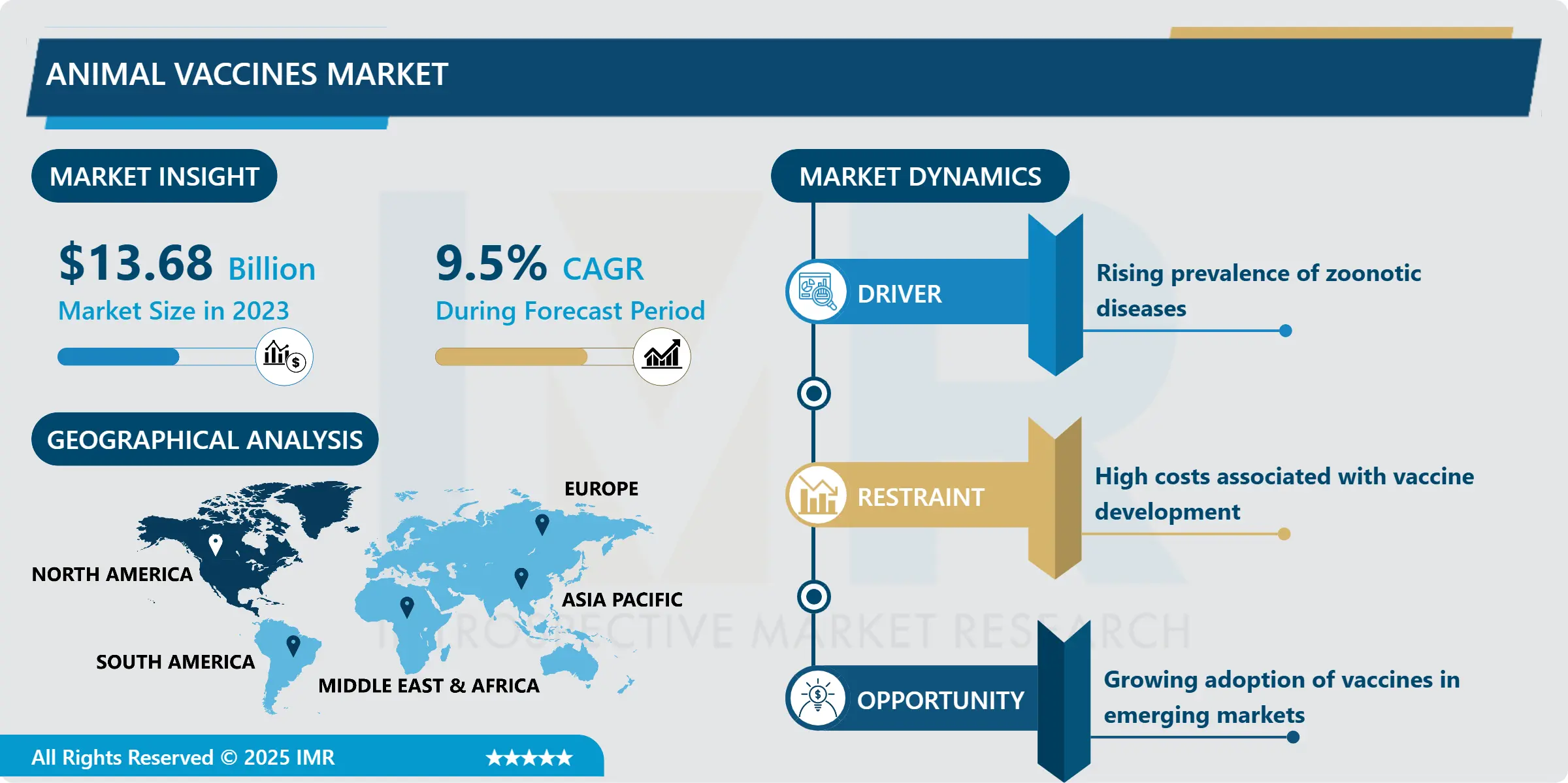

Animal Vaccines Market Size Was Valued at USD 13.68 Billion in 2023, and is Projected to Reach USD 30.96 Billion by 2032, Growing at a CAGR of 9.5 % From 2024-2032.

The global animal vaccines market relates to a very broad concept that includes a large number of biological preparations aimed at rendering immunity to animals and improving their health status. Such vaccines have great importance in the containment of disease incidences to maintain the improved food security that comes along with a boost diet from healthy livestock information and the overall welfare of pet animals. Based on the peculiarity of their specialization, they perform and apply disease control in several areas that include livestock, poultry, aquaculture, pets etc All sectors focus on food security and safety as well as addressing more on animal welfare.

The Animal Vaccines Market has been one of the most growing markets in the last ten years because of the rising cases of zoonotic and trans boundary diseases affecting both animals and humans. Of course, with advanced knowledge in animal health and with the continuous integration of new technology in veterinary, demand for vaccines which makes the animal reproductive and free from diseases has been boosted. New born international rules have been adopted by world governments to guarantee that the livestock and pet animals get suitable immunization that has also helped to foster the growth of the market. Market liberalisation in the companion animals; Samples; The increasing rate of pet ownership particularly in urban areas has also resulted in the liberation of the market for companion animal vaccines pointing to the importance of this sector.

New technologies, which include recombinant, and DNA, that have played an impact on the entire market of offering efficient and hard to handle diseases. However, types of vaccines from traditional to advance vaccines, and broader vaccination programs extended in poultry and aquaculture sector have supported firm economic growth in animal vaccines market. Therefore, as international trade in animals’ products has encouraged the need to be able to vaccinate for diseases that may cross borders has been more important than ever.

Animal Vaccines Market Trend Analysis:

Rising Demand for Advanced Biotechnological Vaccines

- Increased demand for the new improved vaccine through biotechnological means is another trend that defines the animal vaccines market. When specificity and outcome are sufficient, vaccines developed using recombinant DNA technology and synthetic biology are the best, safest, most targeted and most suitable for newly discovered illnesses.

- Compared with the classic approach these new strategies involve lower chances of side reaction and are more appropriate to address new challenges posed by pathogenic agents. Moreover, through adjuvants and delivery systems such as nanoparticles, the effectiveness of the vaccines in diseases such as avian influenza and foot and mouth diseases has been enhanced. As more focus is driven on the new forms of biotechnology then the animal vaccines market has the potential of being revolutionised to better control diseases and improve productivity of animals of all types.

Expansion of Vaccination Programs in Emerging Markets

- The segment of Attenuated Live Vaccines appears will continue to dominate the market in the course of animal vaccines during the forecast period as it offers long-term immunity on the first dose. These vaccines administer the pathogen in some form that is non-threatening to the human body, but which forces a natural response out of the animal’s immune system. This makes them suitable to be used on diseases like rabies, for dogs’ distemper, and for cattle’s respiratory syncytial virus.

- Another reason behind the large-scale usage of revived vaccines is that booster Shot is hardly needed and the Shot is still cheaper than the numerous shots on offer. In the last few years, there were improvements in the knowledge of how live vaccines are produced, and thus the conditions for cross-sectional usage of the vaccines have improved the safety measures in birds, fish, and pets. Due to their effectiveness and low expense, they are the four cornerstones of disease management programs worldwide.

Animal Vaccines Market Segment Analysis:

Animal Vaccines Market is Segmented on the basis of Product Type, Application, Distribution Channel, and Region.

By Product Type, Attenuated Live Vaccines segment is expected to dominate the market during the forecast period

- The segment of Attenuated Live Vaccines appears will continue to dominate the market in the course of animal vaccines during the forecast period as it offers long-term immunity on the first dose. These vaccines administer the pathogen in some form that is non-threatening to the human body, but which forces a natural response out of the animal’s immune system. This makes them suitable to be used on diseases like rabies, for dogs’ distemper, and for cattle’s respiratory syncytial virus.

- Another reason behind the large-scale usage of revived vaccines is that booster Shot is hardly needed and the Shot is still cheaper than the numerous shots on offer. In the last few years there have been improvements in the knowledge of how live vaccines are produced and thus the conditions for cross-sectional usage of the vaccines have improved the safety measures in birds, fish, and pets. Due to their effectiveness and low expense, they are the four cornerstones of disease management programs worldwide

By Application, the Livestock Animal segment is expected to hold the largest share

- The Livestock Animal segment under the Animal segment can maintain the largest market share for the entire period of the forecast due to the critical importance of Livestock in addressing food insecurity and economic development. These is a very high demand for animal vaccines especially those that impact cattle, sheep, and swine since their control has direct impact on immensely lucrative markets such as F MD, brucellosis, and anthrax.

- Increased global consumption of meat and animal products has demanded healthy animal vaccination that would improve production. Furthermore, the support of many governments of different countries that offer programs and subsidies for livestock vaccination has also boosted the market. The relevance of this segment is also introduced by the need to improve efficiency and prevent further difficulties associated with diseases in the framework of intensive xerophilous production

Animal Vaccines Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Technology advancement in animal vaccines, increasing awareness of animal health, and well-established veterinary healthcare in North America will help it to be the largest consuming region in the estimated period. The advanced livestock economy and a very high number of pets put a bigger emphasis on the production of vaccines. Besides, the enhanced transplanting of government and the growth in concerns for research and development has availed enhanced better vaccines which include recombinant and DNA vaccines. The presence of sizable market consumers and a competitive legal framework also plays for the North American region of the market.

- The rising number of pets and humanization of pets in the United States has coupled with the demand and consumption of companion animal vaccines. The essence of vaccinations as a part of pet healthcare is increasing in response to the need for annual shots to avoid disease which results to increased demand in the market. Similarly, the livestock business has flexible massive vaccination among individuals and sectors, and good cooperation from governments and the private sector as well. As such diseases like swine flu have been seen; this calls for correct vaccination to ensure that North America maintains its dominating position in the world market.

Active Key Players in the Animal Vaccines Market:

- Biogenesis Bago (Argentina)

- Boehringer Ingelheim (Germany)

- Ceva Santé Animale (France)

- Elanco Animal Health (USA)

- Hester Biosciences (India)

- Hipra (Spain)

- Indian Immunologicals Ltd. (India)

- Merck Animal Health (USA)

- Phibro Animal Health (USA)

- SeQuent Scientific Ltd. (India)

- Tianjin Ringpu Bio-Pharmacy (China)

- Vaxxinova (Netherlands)

- Vetoquinol (France)

- Virbac (France)

- Zoetis (USA), and Other Active Players

|

Animal Vaccines Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.68 Billion |

|

Forecast Period 2024-32 CAGR: |

9.5 % |

Market Size in 2032: |

USD 30.96 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Animal Vaccines Market by Product Type

4.1 Animal Vaccines Market Snapshot and Growth Engine

4.2 Animal Vaccines Market Overview

4.3 Attenuated Live Vaccines Conjugate Vaccines Inactivated Vaccines Subunit Vaccines Toxoid Vaccines DNA Vaccines Recombinant Vaccines

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Attenuated Live Vaccines Conjugate Vaccines Inactivated Vaccines Subunit Vaccines Toxoid Vaccines DNA Vaccines Recombinant Vaccines: Geographic Segmentation Analysis

Chapter 5: Animal Vaccines Market by Application

5.1 Animal Vaccines Market Snapshot and Growth Engine

5.2 Animal Vaccines Market Overview

5.3 Companion Animal Livestock Animal Poultry Aquaculture

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Companion Animal Livestock Animal Poultry Aquaculture: Geographic Segmentation Analysis

Chapter 6: Animal Vaccines Market by Distribution Channel

6.1 Animal Vaccines Market Snapshot and Growth Engine

6.2 Animal Vaccines Market Overview

6.3 Veterinary Clinics Veterinary Hospitals Veterinary Research Institutes Other

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Veterinary Clinics Veterinary Hospitals Veterinary Research Institutes Other: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Animal Vaccines Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BIOGENESIS BAGO (ARGENTINA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BOEHRINGER INGELHEIM (GERMANY)

7.4 CEVA SANTÉ ANIMALE (FRANCE)

7.5 ELANCO ANIMAL HEALTH (USA)

7.6 HESTER BIOSCIENCES (INDIA)

7.7 HIPRA (SPAIN)

7.8 INDIAN IMMUNOLOGICALS LTD. (INDIA)

7.9 MERCK ANIMAL HEALTH (USA)

7.10 PHIBRO ANIMAL HEALTH (USA)

7.11 SEQUENT SCIENTIFIC LTD. (INDIA)

7.12 TIANJIN RINGPU BIO-PHARMACY (CHINA)

7.13 VAXXINOVA (NETHERLANDS)

7.14 VETOQUINOL (FRANCE)

7.15 VIRBAC (FRANCE)

7.16 ZOETIS (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Animal Vaccines Market By Region

8.1 Overview

8.2. North America Animal Vaccines Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Attenuated Live Vaccines Conjugate Vaccines Inactivated Vaccines Subunit Vaccines Toxoid Vaccines DNA Vaccines Recombinant Vaccines

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Companion Animal Livestock Animal Poultry Aquaculture

8.2.6 Historic and Forecasted Market Size By Distribution Channel

8.2.6.1 Veterinary Clinics Veterinary Hospitals Veterinary Research Institutes Other

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Animal Vaccines Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Attenuated Live Vaccines Conjugate Vaccines Inactivated Vaccines Subunit Vaccines Toxoid Vaccines DNA Vaccines Recombinant Vaccines

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Companion Animal Livestock Animal Poultry Aquaculture

8.3.6 Historic and Forecasted Market Size By Distribution Channel

8.3.6.1 Veterinary Clinics Veterinary Hospitals Veterinary Research Institutes Other

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Animal Vaccines Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Attenuated Live Vaccines Conjugate Vaccines Inactivated Vaccines Subunit Vaccines Toxoid Vaccines DNA Vaccines Recombinant Vaccines

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Companion Animal Livestock Animal Poultry Aquaculture

8.4.6 Historic and Forecasted Market Size By Distribution Channel

8.4.6.1 Veterinary Clinics Veterinary Hospitals Veterinary Research Institutes Other

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Animal Vaccines Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Attenuated Live Vaccines Conjugate Vaccines Inactivated Vaccines Subunit Vaccines Toxoid Vaccines DNA Vaccines Recombinant Vaccines

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Companion Animal Livestock Animal Poultry Aquaculture

8.5.6 Historic and Forecasted Market Size By Distribution Channel

8.5.6.1 Veterinary Clinics Veterinary Hospitals Veterinary Research Institutes Other

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Animal Vaccines Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Attenuated Live Vaccines Conjugate Vaccines Inactivated Vaccines Subunit Vaccines Toxoid Vaccines DNA Vaccines Recombinant Vaccines

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Companion Animal Livestock Animal Poultry Aquaculture

8.6.6 Historic and Forecasted Market Size By Distribution Channel

8.6.6.1 Veterinary Clinics Veterinary Hospitals Veterinary Research Institutes Other

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Animal Vaccines Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Attenuated Live Vaccines Conjugate Vaccines Inactivated Vaccines Subunit Vaccines Toxoid Vaccines DNA Vaccines Recombinant Vaccines

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Companion Animal Livestock Animal Poultry Aquaculture

8.7.6 Historic and Forecasted Market Size By Distribution Channel

8.7.6.1 Veterinary Clinics Veterinary Hospitals Veterinary Research Institutes Other

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Animal Vaccines Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.68 Billion |

|

Forecast Period 2024-32 CAGR: |

9.5 % |

Market Size in 2032: |

USD 30.96 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||