Americas Aluminum Composite Panels Market Overview

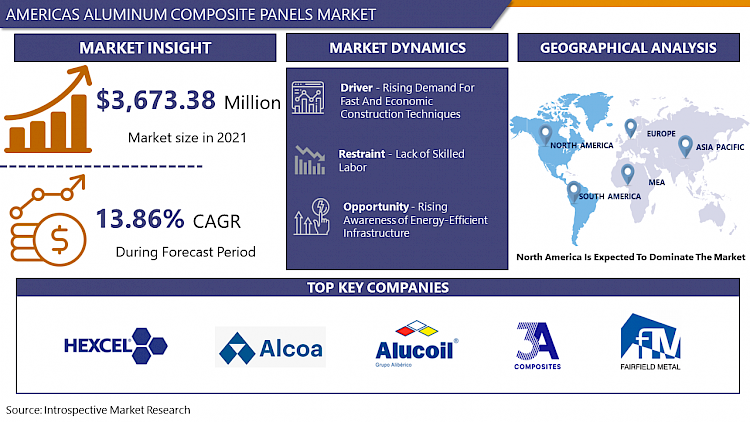

The Americas Aluminum Composite Panels Market size was valued at USD 3,673.38 Million in 2021 and is projected to reach USD 9,113.06 Million by 2028, growing at a CAGR of 13.86% from 2022 to 2028.

Aluminum composite panels are light-weight composite material consisting of two pre-finished aluminum cover sheets heat-bonded to a core made of polyethylene plastic material. These panels are used widely as exterior coverings of commercial buildings and corporate houses. The demand for aluminum composite panels is limited in certain countries of the Americas where the cost of the raw materials is still a more prominent factor. However, the scenario is changing with changing lifestyles and growing urbanization. Such a change is expected to shift the impact of the rising demand for fast and economic construction techniques on the Americas aluminum composite panels market from moderate to high over the forecast period.

According to the global construction 2030 report by Global Construction Perspectives and Oxford Economics, the global construction industry is expected to reach approximately USD 8 trillion by 2030 which will help to grow American market as well. In the American countries, construction of factories, manufacturing plants, stadiums, and offices has increased. This would directly influence the need for sustainable decorative building construction solutions in these structures which leads to an increase in the demand for aluminum composite panels in the American countries. However, the sub-prime crisis in the US caused a recession in the construction industry. But the industry has now recovered and is growing at a moderate pace.

Market Dynamics And Factors For Americas Aluminum Composite Panels Market

Drivers:

Rising Demand For Fast And Economic Construction Techniques

The construction industry is witnessing high growth due to the high demand for infrastructure and buildings in the American countries. The increasing housing activities and growing residential, non-residential, and infrastructure projects due to urbanization and rising population primarily drive the growth of the construction industry. According to the Global Construction Perspective (GCP) and Oxford Economics, the US, India, and China are estimated to account for around 57% of total growth in the construction and engineering market by 2030. Aluminum composite panel form an important aspect of the quick construction techniques that deliver superior properties and outstanding features to construction enclosures. They are used to support light-weighted structures cost-effectively. Aluminum composite panel facilitate quick construction and make it feasible to avoid welding and utilize lighter lifting equipment at building sites. Moreover, they are suitable for large projects as the assembly of panels requires less time and drives their adoption in the construction sector. The need for innovative and durable construction solutions that are durable, save construction time, and are low maintenance is expected to lead to a rise in the demand for aluminum composite panel. Furthermore, the rise in home improvement and renovation projects adds to the demand for aluminum composite panel. The changing consumer preferences and increase in per capita disposable income of consumers are further expected to lead to the increasing adoption of innovative building solutions. Thus, the rising demand for fast and economic construction techniques is expected to drive the growth of the Americas aluminum composite panel market during the forecast period. However, the scenario is changing with changing lifestyles and growing urbanization. Such a change is expected to shift the impact of the rising demand for fast and economic construction techniques on the Americas aluminum composite panels market from moderate to high over the forecast period.

Restraint:

Lack of Skilled Labor

The high number of construction projects across the Americas creates a high demand for skilled workers. The projected requirement for workforce in construction is more than the availability. The lack of skilled labor leads to an increase in the risks of contractors as it increases the likelihood of a delay. Moreover, the countries have witnessed a severe shortage of skilled labor because of the migration of skilled workers, an aging workforce, and the lack of training. According to a skill gap report commissioned by the National Skill Development Corporation, in the US, the building, construction, and real estate sector is estimated to require around 24 million of additional skilled workforce by 2024. However, the gap between the required workforce and their employability is expected to hamper the aluminum composite panels industry, which would affect the growth of the market for aluminum composite panels. Aluminum composite panel products require highly skilled labor to ensure proper cutting, fixing, and finishing. Thus, the lack of skilled labor is expected to restrain the growth of the Americas aluminum composite panels market during the forecast period. Programs such as Skills for Trade and Economic Diversification (STED) and Rural Economic Empowerment (TREE) programs are launched by the ILO for the development of the workforce worldwide. Moreover, the ILOs Skills and Employability Program for the United States (ILO-USA) was also launched with the objective of providing solutions to the skill development issues in North America. Thus, the lack of skilled labor is expected to restrain the growth of the Americas aluminum composite panels market during the forecast period.

Opportunity:

Rising Awareness of Energy-Efficient Infrastructure

Globally, buildings consume more electricity than any other sector and account for ~33% of the total carbon emissions in the world. The energy-efficiency of these buildings can contribute to energy conservation and control the emission of greenhouse gases. The regulatory organizations have realized the importance of energy-efficiency in the construction sector. The major energy consumption operations in the residential and commercial buildings are heating, ventilation, and air conditioning, which account for around 35% of total building energy consumption. Aluminum composite panels in a house can help keep a house warm, reduce the energy bills, and make the home quieter. The regulatory associations promote the use of aluminum composite panels for new building codes and energy-efficiency owing to their lower energy consumptions. Similarly, the National Building Regulations and Building Standards Act No. 103 of 1977 also provides guidelines for using aluminum composite panels in buildings for efficient energy operations. These regulations are likely to boost the demand for aluminum composite panels in the American market. The focus on using energy-efficient technologies is expected to prompt customers and construction companies to adopt aluminum composite panels. Thus, the rising awareness of energy-efficient infrastructure is anticipated to create opportunities for the growth of the Americas aluminum composite panels market during the forecast period.

Segmentation Analysis of Americas Aluminum Composite Panels Market

By Type, anti-bacterial aluminum composite panel is expected to have the largest share of America Aluminum Composite Panels Market. The anti-bacterial aluminum composite panel is painting internationally advanced coating with the ability to resist bacteria and kill bacteria to the aluminum composite panel to control breed of microorganism and sterilizing. The anti-bacterial ACP is coated with a special coating with anti-bacterial and bactericidal effects so that the surface of the ACP sheet has strong anti-bacterial and bactericidal effects, inhibits the activity and reproduction of microorganisms, and gradually kills them, creating a clean environment. Fire-resistant panels are predicted to have the second-highest share of the America Aluminum composite panels market.

By Coating Base, PVDF aluminum composite panel is anticipated to dominate the America Aluminum Composite Panels Market during the forecast period. The surface of a PVDF aluminum composite panel features Polyvinylidene Fluoride with good weather resistance, impact resistance, UV resistance, sound & heat resistance, colorful, smooth, and beautiful. Its life is about 20 years. It is mainly used for exterior decoration. It is available in various colors and in different thicknesses to cater to the varying demand from the customers. Polyethylene (PE) ACP’s are predicted to have the second-highest share of the America Aluminum Composite Panels Market. PE aluminum composite panel can also be used for interior wall decoration, low building cladding, shop face decoration, partitions interior decorations, and more.

By End-Use, Building and Construction is anticipated to dominate the America Aluminum Composite Panels Market during the forecast period. Aluminum composite panels, also commonly known as ACP cladding, are the most preferred building material in today’s construction world. The advanced structures, be it business, private, institutional, or medical clinics, will have ACP deal with them. The ACP cladding is such durable panels that it will not be required to change even after several years and, therefore, has become the best choice for builders. Transportation is predicted to have the second-highest share of the America Aluminum Composite Panels Market. ACP is increasingly used in commercial vehicles as it is one of the safest, eco-friendly, and cost-efficient ways to enhance performance, reduce emissions, and boost fuel economy.

Regional Analysis of Americas Aluminum Composite Panels Market

North America is one of the largest regional markets for aluminum composite panels due to an increased demand for sustainable building material in the construction industry. The strong economy and the growing real estate industry contribute to the growth of the construction industry in North America. The aluminum composite panels market in North America is driven by various factors, including the shifting customer preference for cost-effective and efficient construction techniques. Various types of construction projects, including commercial interiors and retrofits, are being planned across the US, which is expected to create a demand for cost-effective and quick construction techniques, resulting in high demand for aluminum composite panels during the study period.

South America is anticipated to witness a significant increase in construction-related spending. The larger markets in the region— Brazil, Argentina, and Chile—are anticipated to observe decent construction output in the coming years. Significant growth in construction investment is expected to increase the adoption of aluminum composite panels in the region due to several benefits associated with these panels.

Covid-19 Impact Analysis of Americas Aluminum Composite Panels Market

COVID-19 has had a substantial impact on the construction industry across the globe, but the legal repercussions differ from region to region and contract to contract. On the contractual side, there is more focus on the international consulting firms, which provide guidelines and standards such as FIDIC (International Federation of Consulting Engineers) and NEC. Currently, ongoing construction projects altogether have become difficult to complete. The COVID-19 impact is slowing them down, causing disruption and delay, which is attributed to the severely disrupted supply chains. A few governments have also instructed to shut down certain businesses across regions. The construction industry has been severely hit by the outbreak owing to the halting of construction projects in North America. Countries, including the US and Canada, have temporarily stopped the production and construction projects. The overall construction industry is facing several challenges due to the pandemic, and most of the housing projects are expected to remain under construction due to disruptions in supply chains, cash flow constraints, and production shutdown. Additionally, there was almost zero construction activity at the project sites during the lockdown, which has further put a strain on several manufacturer’s and developer’s financial health. Amid the COVID-19 outbreak, laborers moved back to their respective native lands, causing a shortage of labor; thus, the timely completion of projects is also expected to become a major challenge for construction and interior designing companies. Moreover, due to supply chain disruptions and contractual implications, manufacturers are also facing problems in acquiring cheap input material as the manufacturing units are closed. Thus, the demand for aluminum composite panels is anticipated to decrease significantly, owing to the disruptions in the construction industry.

Top Key Players Covered In Americas Aluminum Composite Panels Market:

- Hexcel Corporation

- Alcoa Corporation

- Alucoil

- 3A Composites

- Fairfield Metal LLC

- Alubond U.S.A.

- Alpolic Materials

- Alcotex Inc.

Key Industry Developments In Americas Aluminum Composite Panels Market

In November 2020, ALUCOIL obtained the recognized and prestigious EPD certificate for its larcore A2 Aluminium Honeycomb panel validated under the International EPD System.

In July 2020, ALUCOIL launched the new version of its ALUCOIL DESIGN tool to make it easier to use. The ALUCOIL DESIGN is available in various colors for several applications and is available to everyone.

|

Americas Aluminum Composite Panels Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data : |

2016 to 2020 |

Market Size in 2021: |

USD 3,673.38 Mn. |

|

Forecast Period 2022-28 CAGR: |

13.86% |

Market Size in 2028: |

USD 9,113.06 Mn |

|

Segments Covered: |

By Type |

|

|

|

By Coating Base |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Coating Base

3.3 By End Use

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Americas Aluminum Composite Panels Market by Type

5.1 Americas Aluminum Composite Panels Market Overview Snapshot and Growth Engine

5.2 Americas Aluminum Composite Panels Market Overview

5.3 Fire Resistant

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Fire Resistant: Geographic Segmentation

5.4 Anti-Bacterial

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Anti-Bacterial: Geographic Segmentation

5.5 Anti-Static

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Anti-Static: Geographic Segmentation

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Geographic Segmentation

Chapter 6: Americas Aluminum Composite Panels Market by Coating Base

6.1 Americas Aluminum Composite Panels Market Overview Snapshot and Growth Engine

6.2 Americas Aluminum Composite Panels Market Overview

6.3 Polyvinylidene Difluoride (PVDF)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Polyvinylidene Difluoride (PVDF): Geographic Segmentation

6.4 Polyethylene (PE)

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Polyethylene (PE): Geographic Segmentation

6.5 Others

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Others: Geographic Segmentation

Chapter 7: Americas Aluminum Composite Panels Market by End Use

7.1 Americas Aluminum Composite Panels Market Overview Snapshot and Growth Engine

7.2 Americas Aluminum Composite Panels Market Overview

7.3 Building & Construction

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Building & Construction: Geographic Segmentation

7.4 Advertising Boards

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Advertising Boards: Geographic Segmentation

7.5 Transportation

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Transportation: Geographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Americas Aluminum Composite Panels Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Americas Aluminum Composite Panels Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Americas Aluminum Composite Panels Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 HEXCEL CORPORATION ALCOA CORPORATION

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 ALUCOIL

8.4 3A COMPOSITES

8.5 FAIRFIELD METAL LLC

8.6 ALUBOND U.S.A.

8.7 ALPOLIC MATERIALS

8.8 ALCOTEX INC.

8.9 OTHER MAJOR PLAYERS

Chapter 9:Americas Aluminum Composite Panels Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Fire Resistant

9.4.2 Anti-Bacterial

9.4.3 Anti-Static

9.4.4 Others

9.5 Historic and Forecasted Market Size By Coating Base

9.5.1 Polyvinylidene Difluoride (PVDF)

9.5.2 Polyethylene (PE)

9.5.3 Others

9.6 Historic and Forecasted Market Size By End Use

9.6.1 Building & Construction

9.6.2 Advertising Boards

9.6.3 Transportation

9.7 Historic and Forecast Market Size by Country

9.7.1 U.S.

9.7.2 Canada

9.7.3 Mexico

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Fire Resistant

10.4.2 Anti-Bacterial

10.4.3 Anti-Static

10.4.4 Others

10.5 Historic and Forecasted Market Size By Coating Base

10.5.1 Polyvinylidene Difluoride (PVDF)

10.5.2 Polyethylene (PE)

10.5.3 Others

10.6 Historic and Forecasted Market Size By End Use

10.6.1 Building & Construction

10.6.2 Advertising Boards

10.6.3 Transportation

10.7 Historic and Forecast Market Size by Country

10.7.1 Brazil

10.7.2 Argentina

10.7.3 Rest of SA

Chapter 11 Investment Analysis

Chapter 12 Analyst Viewpoint and Conclusion

|

Americas Aluminum Composite Panels Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data : |

2016 to 2020 |

Market Size in 2021: |

USD 3,673.38 Mn. |

|

Forecast Period 2022-28 CAGR: |

13.86% |

Market Size in 2028: |

USD 9,113.06 Mn |

|

Segments Covered: |

By Type |

|

|

|

By Coating Base |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. AMERICAS ALUMINUM COMPOSITE PANELS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. AMERICAS ALUMINUM COMPOSITE PANELS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. AMERICAS ALUMINUM COMPOSITE PANELS MARKET COMPETITIVE RIVALRY

TABLE 005. AMERICAS ALUMINUM COMPOSITE PANELS MARKET THREAT OF NEW ENTRANTS

TABLE 006. AMERICAS ALUMINUM COMPOSITE PANELS MARKET THREAT OF SUBSTITUTES

TABLE 007. AMERICAS ALUMINUM COMPOSITE PANELS MARKET BY TYPE

TABLE 008. FIRE RESISTANT MARKET OVERVIEW (2016-2028)

TABLE 009. ANTI-BACTERIAL MARKET OVERVIEW (2016-2028)

TABLE 010. ANTI-STATIC MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. AMERICAS ALUMINUM COMPOSITE PANELS MARKET BY COATING BASE

TABLE 013. POLYVINYLIDENE DIFLUORIDE (PVDF) MARKET OVERVIEW (2016-2028)

TABLE 014. POLYETHYLENE (PE) MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. AMERICAS ALUMINUM COMPOSITE PANELS MARKET BY END USE

TABLE 017. BUILDING & CONSTRUCTION MARKET OVERVIEW (2016-2028)

TABLE 018. ADVERTISING BOARDS MARKET OVERVIEW (2016-2028)

TABLE 019. TRANSPORTATION MARKET OVERVIEW (2016-2028)

TABLE 020. AMERICAS ALUMINUM COMPOSITE PANELS MARKET, BY TYPE (2016-2028)

TABLE 021. AMERICAS ALUMINUM COMPOSITE PANELS MARKET, BY COATING BASE (2016-2028)

TABLE 022. AMERICAS ALUMINUM COMPOSITE PANELS MARKET, BY END USE (2016-2028)

TABLE 023. AMERICAS ALUMINUM COMPOSITE PANELS MARKET, BY COUNTRY (2016-2028)

TABLE 024. HEXCEL CORPORATION ALCOA CORPORATION: SNAPSHOT

TABLE 025. HEXCEL CORPORATION ALCOA CORPORATION: BUSINESS PERFORMANCE

TABLE 026. HEXCEL CORPORATION ALCOA CORPORATION: PRODUCT PORTFOLIO

TABLE 027. HEXCEL CORPORATION ALCOA CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 027. ALUCOIL: SNAPSHOT

TABLE 028. ALUCOIL: BUSINESS PERFORMANCE

TABLE 029. ALUCOIL: PRODUCT PORTFOLIO

TABLE 030. ALUCOIL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 030. 3A COMPOSITES: SNAPSHOT

TABLE 031. 3A COMPOSITES: BUSINESS PERFORMANCE

TABLE 032. 3A COMPOSITES: PRODUCT PORTFOLIO

TABLE 033. 3A COMPOSITES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. FAIRFIELD METAL LLC: SNAPSHOT

TABLE 034. FAIRFIELD METAL LLC: BUSINESS PERFORMANCE

TABLE 035. FAIRFIELD METAL LLC: PRODUCT PORTFOLIO

TABLE 036. FAIRFIELD METAL LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. ALUBOND U.S.A.: SNAPSHOT

TABLE 037. ALUBOND U.S.A.: BUSINESS PERFORMANCE

TABLE 038. ALUBOND U.S.A.: PRODUCT PORTFOLIO

TABLE 039. ALUBOND U.S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. ALPOLIC MATERIALS: SNAPSHOT

TABLE 040. ALPOLIC MATERIALS: BUSINESS PERFORMANCE

TABLE 041. ALPOLIC MATERIALS: PRODUCT PORTFOLIO

TABLE 042. ALPOLIC MATERIALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. ALCOTEX INC.: SNAPSHOT

TABLE 043. ALCOTEX INC.: BUSINESS PERFORMANCE

TABLE 044. ALCOTEX INC.: PRODUCT PORTFOLIO

TABLE 045. ALCOTEX INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 046. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 047. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 048. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. AMERICAS ALUMINUM COMPOSITE PANELS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. AMERICAS ALUMINUM COMPOSITE PANELS MARKET OVERVIEW BY TYPE

FIGURE 012. FIRE RESISTANT MARKET OVERVIEW (2016-2028)

FIGURE 013. ANTI-BACTERIAL MARKET OVERVIEW (2016-2028)

FIGURE 014. ANTI-STATIC MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. AMERICAS ALUMINUM COMPOSITE PANELS MARKET OVERVIEW BY COATING BASE

FIGURE 017. POLYVINYLIDENE DIFLUORIDE (PVDF) MARKET OVERVIEW (2016-2028)

FIGURE 018. POLYETHYLENE (PE) MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. AMERICAS ALUMINUM COMPOSITE PANELS MARKET OVERVIEW BY END USE

FIGURE 021. BUILDING & CONSTRUCTION MARKET OVERVIEW (2016-2028)

FIGURE 022. ADVERTISING BOARDS MARKET OVERVIEW (2016-2028)

FIGURE 023. TRANSPORTATION MARKET OVERVIEW (2016-2028)

FIGURE 024. AMERICAS ALUMINUM COMPOSITE PANELS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Americas Aluminum Composite Panels Market research report is 2022-2028.

Hexcel Corporation Alcoa Corporation, Alucoil, 3A Composites, Fairfield Metal LLC, Alubond U.S.A., Alpolic Materials, Alcotex Inc., Other Major Players

The Americas Aluminum Composite Panels Market is segmented into Type, Coating Base, and End Use. By Type, the market is categorized into: Fire Resistant, Anti-Bacterial, Anti-Static, Others. By Coating Base, the market is categorized into: Polyvinylidene Difluoride (PVDF), Polyethylene (PE), Others). By End Use, the market is categorized into: Building & Construction, Advertising Boards, Transportation. By region, it is analyzed across North America (U.S.; Canada; Mexico), South America (Brazil; Argentina, etc.).

Aluminum composite panels are light-weight composite material consisting of two pre-finished aluminum cover sheets heat-bonded to a core made of polyethylene plastic material. These panels are used widely as exterior coverings of commercial buildings and corporate houses.

The Americas Aluminum Composite Panels Market size was valued at USD 3,673.38 Million in 2021 and is projected to reach USD 9,113.06 Million by 2028, growing at a CAGR of 13.86% from 2022 to 2028.