Hybrid Composites Market Synopsis

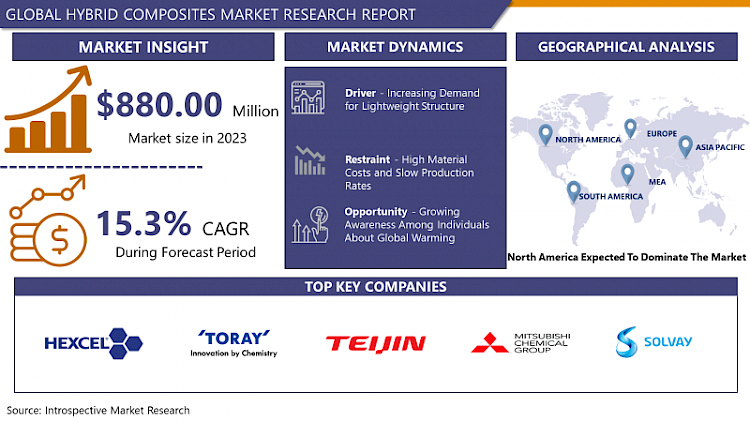

The Global Hybrid Composites Market size is expected to grow from USD 880.00 Million in 2023 to USD 3169.18 Million by 2032, at a CAGR of 15.3% during the forecast period (2024-2032).

Hybrid composites are materials made by combining two or more fibre types into a single matrix. Hybrid composites are more advanced than fiber-supported composites and can be utilized in a wide range of applications.

- Hybrid composites are materials that combine two or more different types of reinforcing fibers or materials to leverage the unique properties of each component. This blending of materials enhances overall performance and allows for tailored solutions in various industries.

- Key drivers of the hybrid composites market include the growing demand for lightweight and high-performance materials across sectors such as aerospace, automotive, and construction. These composites offer a balance between strength, stiffness, and weight reduction, addressing the need for fuel efficiency and sustainability.

- Innovation in manufacturing processes and a focus on improving the mechanical and thermal properties of hybrid composites have fueled market expansion. The aerospace industry, in particular, has seen increased adoption due to the need for advanced materials that meet stringent performance requirements

Hybrid Composites Market Trend Analysis

Increasing Demand for Lightweight Structure

- The Hybrid Composites Market has experienced a surge in demand primarily due to the increasing preference for lightweight structures across various industries. This growing trend is driven by the need for enhanced fuel efficiency in transportation, especially in the automotive and aerospace sectors. Hybrid composites, which combine the benefits of different materials such as carbon fibers, glass fibers, and various resins, offer a compelling solution to achieve a balance between strength and weight.

- Industries such as automotive, aerospace, and construction are actively adopting hybrid composites to replace traditional materials, resulting in improved performance and reduced overall weight. The automotive sector, in particular, is witnessing a significant shift towards hybrid composites as manufacturers strive to meet stringent emission regulations and enhance the fuel efficiency of vehicles.

- Moreover, the construction industry is embracing hybrid composites for their durability, corrosion resistance, and versatility in design. This increasing demand for lightweight structures, coupled with the unique properties offered by hybrid composites, positions the market for substantial growth and innovation in the coming years.

Growing Awareness Among Individuals About Global Warming creates an Opportunity

- The growing awareness among individuals about global warming has significantly influenced the Hybrid Composites Market. As concerns over environmental sustainability rise, there is a heightened demand for innovative solutions that can reduce carbon footprints and enhance energy efficiency. Hybrid composites, a combination of different materials such as natural fibres, glass fibers, and carbon fibers, have gained prominence in various industries as they offer a balance between strength, lightweight properties, and eco-friendliness.

- Consumers and industries alike are increasingly recognizing the importance of adopting sustainable practices to mitigate the adverse effects of global warming. This shift in mindset has created a significant opportunity for the hybrid composites market. These materials find applications in automotive, aerospace, construction, and other sectors where the emphasis on environmental responsibility is growing.

- Governments and regulatory bodies are also playing a role by incentivizing the use of eco-friendly materials through policies and regulations. This, coupled with the increasing consumer preference for sustainable products, is driving the growth of the hybrid composites market.

Hybrid Composites Market Segment Analysis:

Hybrid Composites Market Segmented on the basis of Type, Resin Type, End User.

By Fiber Type, the carbon/glass segment is expected to dominate the market during the forecast period

- In the realm of Hybrid Composites, the carbon/glass fibre segment is anticipated to assert its dominance, shaping the market landscape significantly. This ascendancy can be attributed to the exceptional properties offered by this combination of carbon and glass fibers, providing a synergistic blend of strength, stiffness, and durability.

- Carbon fibers are renowned for their high tensile strength and low weight, making them ideal for reinforcing structures that demand robustness without adding excessive mass. On the other hand, glass fibers contribute to enhanced impact resistance and cost-effectiveness. The amalgamation of these two materials in hybrid composites capitalizes on their individual strengths, resulting in a composite material that surpasses traditional materials in terms of performance and versatility.

- Industries such as automotive, aerospace, and construction are increasingly adopting carbon/glass hybrid composites due to their ability to meet diverse engineering requirements. The market's growth is further fuelled by ongoing innovations in manufacturing processes and increased awareness about the sustainability benefits associated with lightweight and durable materials.

By Resin Type, the epoxy segment held the largest share of 39.7% in 2022

- The dominance of epoxy in the Hybrid Composites Market can be attributed to its remarkable ability to enhance the overall performance of composites, particularly when combined with other reinforcing materials such as carbon fibers, glass fibers, or aramid fibers. The resulting hybrid composites offer a unique synergy of properties, including high strength-to-weight ratio, improved toughness, and enhanced thermal stability.

- Industries such as aerospace, automotive, construction, and sports equipment are increasingly adopting epoxy-based hybrid composites for their lightweight yet robust structures, fueling the market's growth. The widespread use of epoxy resins in various manufacturing processes underscores their pivotal role in shaping the future of hybrid composites, solidifying their position as the frontrunner in this dynamic and evolving market landscape. As technological advancements continue to drive innovation, the epoxy segment is poised to maintain its dominance and contribute significantly to the ongoing evolution of hybrid composite materials

Hybrid Composites Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America has been a key player in the aerospace, automotive, and wind energy industries, all of which extensively utilize hybrid composites due to their lightweight and high-strength properties.

- In the aerospace sector, the demand for fuel-efficient and lightweight materials drives the adoption of hybrid composites in aircraft manufacturing. Similarly, in the automotive industry, the push for electric and hybrid vehicles encourages the use of composites to reduce overall vehicle weight and enhance fuel efficiency.

- Moreover, the wind energy sector in North America has been expanding, with the development of wind farms and a growing focus on renewable energy sources. Hybrid composites find applications in wind turbine blades due to their strength and durability.

Hybrid Composites Market Top Key Players:

- Hexcel Corporation(United States)

- Toray Industries, Inc. (Japan)

- Teijin Limited (Japan)

- Mitsubishi Rayon Co., Ltd. (Japan)

- SGL Carbon SE (Germany)

- Solvay SA(Belgium)

- Gurit Holding AG (Switzerland)

- PAX Global Technology, Inc. (United States)

- Huntsman Corporation (United States)

- IDEX Corporation (United States)

- 3M Company (United States)

- Dow Chemical Company (United States)

- BASF SE (Germany)

- DuPont de Nemours, Inc. (United States)

- Lanxess AG (Germany)

- Evonik Industries AG (Germany)

- CYTEC Industries Inc. (United States)

- AOC Resins Inc. (United States)

- RTP Company (United States)

- PlastiComp, Inc. (United States)

Key Industry Developments in the Hybrid Composites Market:

- In January 2023, Hexcel Corporation acquired C&J Composites. This strategic move expands Hexcel's presence in the North American thermoformed composites market, particularly for aerospace and defense applications.

- In February2023, Solvay partnership with Mitsubishi Chemical Corporation. The two companies join forces to develop and commercialize advanced hybrid composites for the automotive industry, focusing on weight reduction and sustainability.

|

Global Hybrid Composites Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 880.00 Mn. |

|

Forecast Period 2024-2032 CAGR: |

15.3% |

Market Size in 2032: |

USD 3169.18 Mn. |

|

Segments Covered: |

By Fiber Type |

|

|

|

By Resin Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- HYBRID COMPOSITES MARKET BY FIBER TYPE (2016-2030)

- HYBRID COMPOSITES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CARBON/ARAMID

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CARBON/GLASS

- WOOD/PLASTIC

- METAL/PLASTIC

- HYBRID COMPOSITES MARKET BY RESIN TYPE (2016-2030)

- HYBRID COMPOSITES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- EPOXY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- POLYPROPYLENE

- POLYESTER

- PHENOLICS

- HYBRID COMPOSITES MARKET BY END USER (2016-2030)

- HYBRID COMPOSITES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AUTOMOTIVE & TRANSPORTATION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AEROSPACE

- BUILDING & CONSTRUCTION

- MARINE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- HYBRID COMPOSITES Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- HEXCEL CORPORATION (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- TORAY INDUSTRIES, INC. (JAPAN)

- TEIJIN LIMITED (JAPAN)

- MITSUBISHI RAYON CO., LTD. (JAPAN)

- SGL CARBON SE (GERMANY)

- SOLVAY SA (BELGIUM)

- GURIT HOLDING AG (SWITZERLAND)

- PAX GLOBAL TECHNOLOGY, INC. (UNITED STATES)

- HUNTSMAN CORPORATION (UNITED STATES)

- IDEX CORPORATION (UNITED STATES)

- 3M COMPANY (UNITED STATES)

- DOW CHEMICAL COMPANY (UNITED STATES)

- BASF SE (GERMANY)

- DUPONT DE NEMOURS, INC. (UNITED STATES)

- LANXESS AG (GERMANY)

- EVONIK INDUSTRIES AG (GERMANY)

- CYTEC INDUSTRIES INC. (UNITED STATES)

- AOC RESINS INC. (UNITED STATES)

- RTP COMPANY (UNITED STATES)

- PLASTICOMP, INC. (UNITED STATES)

- COMPETITIVE LANDSCAPE

- GLOBAL HYBRID COMPOSITES MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Fiber Type

- Historic And Forecasted Market Size By Resin Type

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Hybrid Composites Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 880.00 Mn. |

|

Forecast Period 2024-2032 CAGR: |

15.3% |

Market Size in 2032: |

USD 3169.18 Mn. |

|

Segments Covered: |

By Fiber Type |

|

|

|

By Resin Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HYBRID COMPOSITES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HYBRID COMPOSITES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HYBRID COMPOSITES MARKET COMPETITIVE RIVALRY

TABLE 005. HYBRID COMPOSITES MARKET THREAT OF NEW ENTRANTS

TABLE 006. HYBRID COMPOSITES MARKET THREAT OF SUBSTITUTES

TABLE 007. HYBRID COMPOSITES MARKET BY FIBER TYPE

TABLE 008. CARBON/ARAMID MARKET OVERVIEW (2016-2028)

TABLE 009. CARBON/GLASS MARKET OVERVIEW (2016-2028)

TABLE 010. WOOD/PLASTIC MARKET OVERVIEW (2016-2028)

TABLE 011. METAL/PLASTIC MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. HYBRID COMPOSITES MARKET BY RESIN TYPE

TABLE 014. EPOXY MARKET OVERVIEW (2016-2028)

TABLE 015. POLYPROPYLENE MARKET OVERVIEW (2016-2028)

TABLE 016. POLYESTER MARKET OVERVIEW (2016-2028)

TABLE 017. PHENOLICS MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. HYBRID COMPOSITES MARKET BY END USER

TABLE 020. AUTOMOTIVE & TRANSPORTATION MARKET OVERVIEW (2016-2028)

TABLE 021. AEROSPACE MARKET OVERVIEW (2016-2028)

TABLE 022. BUILDING & CONSTRUCTION MARKET OVERVIEW (2016-2028)

TABLE 023. MARINE MARKET OVERVIEW (2016-2028)

TABLE 024. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 025. NORTH AMERICA HYBRID COMPOSITES MARKET, BY FIBER TYPE (2016-2028)

TABLE 026. NORTH AMERICA HYBRID COMPOSITES MARKET, BY RESIN TYPE (2016-2028)

TABLE 027. NORTH AMERICA HYBRID COMPOSITES MARKET, BY END USER (2016-2028)

TABLE 028. N HYBRID COMPOSITES MARKET, BY COUNTRY (2016-2028)

TABLE 029. EUROPE HYBRID COMPOSITES MARKET, BY FIBER TYPE (2016-2028)

TABLE 030. EUROPE HYBRID COMPOSITES MARKET, BY RESIN TYPE (2016-2028)

TABLE 031. EUROPE HYBRID COMPOSITES MARKET, BY END USER (2016-2028)

TABLE 032. HYBRID COMPOSITES MARKET, BY COUNTRY (2016-2028)

TABLE 033. ASIA PACIFIC HYBRID COMPOSITES MARKET, BY FIBER TYPE (2016-2028)

TABLE 034. ASIA PACIFIC HYBRID COMPOSITES MARKET, BY RESIN TYPE (2016-2028)

TABLE 035. ASIA PACIFIC HYBRID COMPOSITES MARKET, BY END USER (2016-2028)

TABLE 036. HYBRID COMPOSITES MARKET, BY COUNTRY (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA HYBRID COMPOSITES MARKET, BY FIBER TYPE (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA HYBRID COMPOSITES MARKET, BY RESIN TYPE (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA HYBRID COMPOSITES MARKET, BY END USER (2016-2028)

TABLE 040. HYBRID COMPOSITES MARKET, BY COUNTRY (2016-2028)

TABLE 041. SOUTH AMERICA HYBRID COMPOSITES MARKET, BY FIBER TYPE (2016-2028)

TABLE 042. SOUTH AMERICA HYBRID COMPOSITES MARKET, BY RESIN TYPE (2016-2028)

TABLE 043. SOUTH AMERICA HYBRID COMPOSITES MARKET, BY END USER (2016-2028)

TABLE 044. HYBRID COMPOSITES MARKET, BY COUNTRY (2016-2028)

TABLE 045. TEIJIN LTD.: SNAPSHOT

TABLE 046. TEIJIN LTD.: BUSINESS PERFORMANCE

TABLE 047. TEIJIN LTD.: PRODUCT PORTFOLIO

TABLE 048. TEIJIN LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. DSM N.V.: SNAPSHOT

TABLE 049. DSM N.V.: BUSINESS PERFORMANCE

TABLE 050. DSM N.V.: PRODUCT PORTFOLIO

TABLE 051. DSM N.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. HEXCEL CORP.: SNAPSHOT

TABLE 052. HEXCEL CORP.: BUSINESS PERFORMANCE

TABLE 053. HEXCEL CORP.: PRODUCT PORTFOLIO

TABLE 054. HEXCEL CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. EXEL COMPOSITES: SNAPSHOT

TABLE 055. EXEL COMPOSITES: BUSINESS PERFORMANCE

TABLE 056. EXEL COMPOSITES: PRODUCT PORTFOLIO

TABLE 057. EXEL COMPOSITES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. SOLVAY S.A.: SNAPSHOT

TABLE 058. SOLVAY S.A.: BUSINESS PERFORMANCE

TABLE 059. SOLVAY S.A.: PRODUCT PORTFOLIO

TABLE 060. SOLVAY S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. SGL CARBON: SNAPSHOT

TABLE 061. SGL CARBON: BUSINESS PERFORMANCE

TABLE 062. SGL CARBON: PRODUCT PORTFOLIO

TABLE 063. SGL CARBON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. LANXESS: SNAPSHOT

TABLE 064. LANXESS: BUSINESS PERFORMANCE

TABLE 065. LANXESS: PRODUCT PORTFOLIO

TABLE 066. LANXESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. PLASTICOMP INC.: SNAPSHOT

TABLE 067. PLASTICOMP INC.: BUSINESS PERFORMANCE

TABLE 068. PLASTICOMP INC.: PRODUCT PORTFOLIO

TABLE 069. PLASTICOMP INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. POLYONE CORPORATION: SNAPSHOT

TABLE 070. POLYONE CORPORATION: BUSINESS PERFORMANCE

TABLE 071. POLYONE CORPORATION: PRODUCT PORTFOLIO

TABLE 072. POLYONE CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. GURIT: SNAPSHOT

TABLE 073. GURIT: BUSINESS PERFORMANCE

TABLE 074. GURIT: PRODUCT PORTFOLIO

TABLE 075. GURIT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. INNEGRA TECHNOLOGIES LLC: SNAPSHOT

TABLE 076. INNEGRA TECHNOLOGIES LLC: BUSINESS PERFORMANCE

TABLE 077. INNEGRA TECHNOLOGIES LLC: PRODUCT PORTFOLIO

TABLE 078. INNEGRA TECHNOLOGIES LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 079. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 080. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 081. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HYBRID COMPOSITES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HYBRID COMPOSITES MARKET OVERVIEW BY FIBER TYPE

FIGURE 012. CARBON/ARAMID MARKET OVERVIEW (2016-2028)

FIGURE 013. CARBON/GLASS MARKET OVERVIEW (2016-2028)

FIGURE 014. WOOD/PLASTIC MARKET OVERVIEW (2016-2028)

FIGURE 015. METAL/PLASTIC MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. HYBRID COMPOSITES MARKET OVERVIEW BY RESIN TYPE

FIGURE 018. EPOXY MARKET OVERVIEW (2016-2028)

FIGURE 019. POLYPROPYLENE MARKET OVERVIEW (2016-2028)

FIGURE 020. POLYESTER MARKET OVERVIEW (2016-2028)

FIGURE 021. PHENOLICS MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. HYBRID COMPOSITES MARKET OVERVIEW BY END USER

FIGURE 024. AUTOMOTIVE & TRANSPORTATION MARKET OVERVIEW (2016-2028)

FIGURE 025. AEROSPACE MARKET OVERVIEW (2016-2028)

FIGURE 026. BUILDING & CONSTRUCTION MARKET OVERVIEW (2016-2028)

FIGURE 027. MARINE MARKET OVERVIEW (2016-2028)

FIGURE 028. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 029. NORTH AMERICA HYBRID COMPOSITES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. EUROPE HYBRID COMPOSITES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. ASIA PACIFIC HYBRID COMPOSITES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. MIDDLE EAST & AFRICA HYBRID COMPOSITES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. SOUTH AMERICA HYBRID COMPOSITES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Hybrid Composites Market research report is 2024-2032.

Hexcel Corporation (United States), Toray Industries, Inc. (Japan), Teijin Limited (Japan), Mitsubishi Rayon Co., Ltd. (Japan), SGL Carbon SE (Germany), Solvay SA (Belgium), Gurit Holding AG (Switzerland), PAX Global Technology, Inc. (United States), Huntsman Corporation (United States), IDEX Corporation (United States), 3M Company (United States), Dow Chemical Company (United States), BASF SE (Germany), DuPont de Nemours, Inc. (United States), Lanxess AG (Germany), Evonik Industries AG (Germany), CYTEC Industries Inc. (United States), AOC Resins Inc. (United States), RTP Company (United States), PlastiComp, Inc. (United States) and Other Major Players.

Hybrid Composites Market is segmented into Fiber Type, Resin Type, End User and region. By Fiber Type, the market is categorized into Carbon/Aramid, Carbon/Glass, Wood/Plastic, Metal/Plastic, Others. By Resin Type, the market is categorized into Epoxy, Polypropylene, Polyester, Phenolics, Others. By End-User, the market is categorized into Automotive & Transportation, Aerospace, Building & Construction, Marine, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Hybrid composites are materials made by combining two or more fibre types into a single matrix. Hybrid composites are more advanced than fiber-supported composites and can be utilized in a wide range of applications.

The Global Hybrid Composites Market size is expected to grow from USD 880.00 Million in 2023 to USD 3169.18 Million by 2032, at a CAGR of 15.3% during the forecast period (2024-2032).