Global Tire Recycling Downstream Products Market Overview

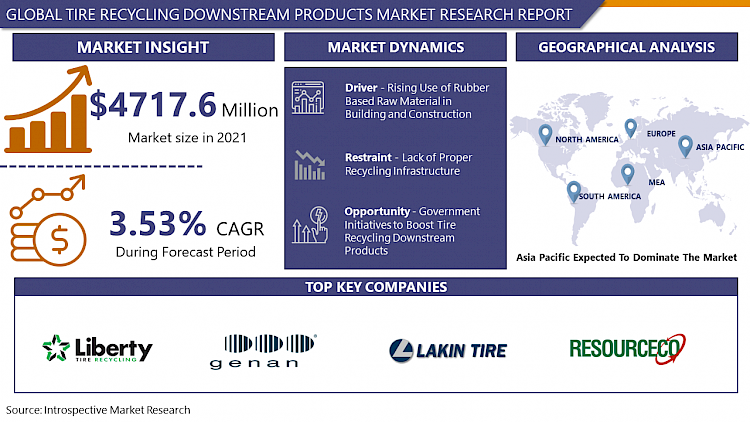

Tire Recycling Downstream Products Market was valued at USD 4717.6 million in 2021 and is expected to reach USD 6014.3 million by the year 2028, at a CAGR of 3.53%.

The tire recycling market has grown largely in the past two decades as about 110 million tires get discarded each year creating a large stockpile of rubber that can be recycled and utilized in various applications. The majority of recycled rubber is procured from the reuse of rubber tires, which is a significant way to reduce discarded tires and benefit the environment. The tire recycling process involves the removal of fibers and metal wires generally hard steel which provides stiffness to the tire and later on clean rubber is shredded into crumb rubber. Such fine and granular rubber can be used in a variety of applications such as turf fields, synthetic track, hospital floors, roads, and raw material for other products such as shoes, sports equipment, and rubber-based appliances. Recycled rubber from tires provides innovative ways to decrease waste while solving significant challenges such as facilitating softer surfaces to reducing probabilities of injuries for athletes and constructing lower-impact hospital floors. Tire Recycling Downstream Products are a great way to reduce rubber-based pollution by utilizing discarded tires and turning them into a useful application. The tire recycling industry has been growing with the large volume of dumped tires and rubber and government encouragement making existing and new players in the market discover new methods and products based on recycled rubber creating growth opportunities for the Tire Recycling Downstream Products Market.

Market Dynamics and Factors:

Drivers

The construction and Infrastructure industry have adopted rubber-based raw material into building construction. Recently construction industry opted for crumb rubber concrete which has seen tremendous demand in the global market. Such crumb rubber is ground to the consistency of the sand and utilized in either raw concrete or concrete blocks making a great alternative for natural extracted sand which has several adverse effects on the environment. Crumb rubber concrete provides sustainability through recycled tire rubber into useful and robust application in construction. Currently, the Construction market is expanding rapidly with the small and large projects in the United States, India, and China creating a potent market for tire recycled downstream products.

The growing use of recycled rubber in utility product manufacturing has increased significantly as government initiatives and various subsidies are provided for the use of recycled rubber in manufacturing goods and utility products. USEPA's Small Business Innovative Research Program provides funding for tire rubber scarp management and clean-up with innovative utilization of rubber waste. The Program is envisioned to attract commercial ventures that improve the environment and quality of life by creating jobs, increasing productivity and supporting economic growth, and improving the international competitiveness of the United States technology industry. Various blue ocean companies are developing innovative ways to use waste rubber in products such as hard bricks from crumb rubber, sports gears, floor carpet, security gears such as protective shields, hostile vehicle mitigation (HVM) barriers, and helmets. The growing trend of sustainable product integration into mass manufacturing companies has boosted the Tire Recycling Downstream Products Market.

Restraints

Every year one billion used tires are generated from which 30-40% of tires are recycled properly. Due to such large incoming discarded tires landfills are generated with large and bulky tires which are difficult to transport as well as a process for the removal of metal wires and another cleaning process that is time-consuming and costly for recycling companies to manage. Many of the time fire incidences and burning of tire stockpile is disastrous for living being as well as create a huge negative impact on the environment due to highly toxic smoke and small burning tire particles which are hazardous for health.

Opportunities

The automotive industry shows lucrative opportunities for tire recycled products. The global auto industry has developed rapidly, especially in the Asia-Pacific region. The number of vehicles for government, corporate and private applications has increased significantly. Microeconomic development, effective and efficient vehicle manufacturing processes, and an increasing number of medium-sized consumers are factors that drive vehicle sales. In addition, the increasing popularity of electric vehicles in North America, Asia Pacific, and Europe to overcome pollution is driving the demand for newer electric vehicles, which is estimated to increase the use of scrap tires in the coming years. Several governments around the world are using the Reduce, Reuse, and Recover (3R) concept for waste tire management. It is expected that the demand for low-cost alternatives such as tire-based fuel will increase due to rising fossil fuel prices. Fuels. This is expected to open up growth opportunities for tire-based fuel products and indirectly boost the tire recycling product market. Many Original Equipment manufacturers are also started using recycled rubber material as raw material from tier 1 suppliers which are boosting the demand in the automotive market and hence provide a growing opportunity for Tire Recycling Downstream Products Market.

Challenges

Lack of awareness and recycling initiatives in many developing and underdeveloped countries can lead the landfills with tire dumping and burning ground which is hazardous to the environment as well as a living being. Tire landfills are undesirable as they become breeding grounds for mosquitoes and other pathogenic pests. These landfills can also catch fire and release strong toxic smoke. The global tire industry is expected to expand rapidly, with the Asia Pacific accounting for 66% of demand. Due to a lack of awareness and negligible government regulations more than 50% of tires end up in landfills in Saudi Arabia, Russia, Ukraine, and Argentina each year, which is expected to hinder the market for tire recycling products. In Asia, used tires are routinely disposed of in landfills or by other environmentally harmful methods such as burning. Such constant challenges in developing countries can slow down the growth of the Tire Recycling Downstream Products Market.

Market Segmentation

By Product, Rubber mulch is the dominating segment in the Tire Recycling Downstream Products Market. Rubber mulch is generated from the shredding of tires into small pieces from which metal wires are extracted and a remaining mulch of rubber is used in a variety of applications. Rubber mulch is useful in making floor carpets, manufacturing utility products, and rubber asphalt. Also, Rubber mulch is fine ground for use in construction applications in making bricks and cement which is a more sustainable way to procure the raw material. Many industries prefer rubber mulch as a raw material from m which they can create or mix with appropriate use according to the manufacturing process. Currently, rubber mulch is largely used in road construction as rubber asphalt which makes the normal concrete road more durable and provides better traction in rainy reasons. The growing use of rubber mulch in a variety of industries makes high growth prospects for Global Tire Recycling Downstream Products Market.

By Recycling Method, Shredding is the dominating segment in the Tire Recycling Downstream Products Market. Shredding of tires is one of the common and widely used recycling methods of use tires. The tire recycling process involves the shredding of tires into tiny pieces from which metal wires are segregated for other use. Raw rubber crumb is whether fine ground or tuned into textile fibers. According to the end-user industry, rubber is shredded in different sizes and shapes. The shredding method is useful to segregate metal wires of tires which are removed with the magnetic remover on the conveyer belt. The shredding method is widely used due to its cost-effectiveness and ease of operation compared to other methods like Pyrolysis and cryogenic method. Genan is a leading company that works in the tire-shredding and recycling business creating innovative methods and machines to minimize the efforts as well as easy and clean recycling process. Such wide application in various parts of the world pushes the growth of the Tire Recycling Downstream Products Market.

By End Use, Construction and Infrastructure is the dominating segment in the Tire Recycling Downstream Products Market. Currently, large-scale infrastructure projects are being carried on in various mega economies like the United States, China, and India. The infrastructure industry is adopting sustainable methods in the construction material and use of tire recycled fuels as well as fine ground granules as crumb rubber cement in the active use of construction. Growing infrastructure projects and integration of sustainable methods in construction materials have created a large demand for tire recycled downstream products globally.

Players Covered in Tire Recycling Downstream Products market are :

- Liberty Tire Recycling

- Genan Holding A/S

- Lakin Tires West Inc

- Regn-Sells Group

- L & S Tire Company

- Scandinavian Enviro Systems AB

- ETR Group

- ResourceCo Pty Ltd

- Probio Energy International

- Renelux Cyprus Ltd

- Emanuel Tire LLC

- Reliable Tire Disposal

- Globarket Tire Recycling LLC

- Tire Disposal & Recycling Inc

- West Coast Rubber Recycling Inc

- Lehigh Technologies Inc. and other major players.

Regional Analysis of Tire Recycling Downstream Products Market

The Asia Pacific is likely to dominate the Tire Recycling Downstream Products Market. The tire recycling downstream products market within the region is anticipated to expand at a fast pace throughout the forecast period, because of the expansion of the automotive sector, a lot of scrap tires are generated each year. Most corporations and vendors of tire recycling downstream products are targeting high potential markets appreciate Japan and China in the Asia Pacific.

Europe is another profitable region of the global tire recycling downstream products market, due to the presence of organized channels of scrap tire assortment and processing. in step with the EU Tire and Rubber Manufacturers' Association (ETRMA), European nations collect and treat 94% of the used tires that they generate. in step with the ETRMA, European countries are chop-chop adopting extended producer responsibility (EPR) programs for tires. Currently, 23 European nations had started tire EPR programs, with Slovakia, Ireland, and therefore the Czech Republic the newest to adopt them. FRG and the U.K are the key countries for tire utilization downstream merchandise in Europe. The market share of Europe is predicted to extend as an increase in awareness concerning carbon emissions at the global level pushed by various governments.

North America is one of the key regions in terms of recycling initiatives and innovative companies are investing in creating a solution of rubber-based green recycling methods to minimize the carbon emission from recycling activities. The United States provides funding to such start-ups and empowers the clean energy sector. With a growing number of vehicles in the United States, there is a bright opportunity for Tire Recycling Downstream Products Market in the coming years.

Key Developments of Tire Recycling Downstream Products Market

- March 2021, the tire gathering and assortment event was offered by Vernon County with the partnership with Region M Waste Management District. The event will allow only residents to bring 10 tires whose cost depends on the tire type for recycling creating proper disposal of tires in the region.

- October 2020, the Rubber bitumen plant for tire waste recycling was completed by MOL Group October 2020. The plant is capable of producing rubber bitumen of approximately 20-kilo tons per year and situated at the Zala site which recycles around 8-10% of domestic tire waste.

- In April 2020, Michelin Group declared its partnership with Enviro which is a Sweden-based company. The partnership expressed to build a plant and scale up the pyrolysis technology. The agreement aims to fulfill Michelin's "All Sustainable Vision".

Covid19 Impact on Tire Recycling Downstream Products Market

COVID-19 pandemic has created uncertainty in healthcare facilities, transportation, and a shortage of essential goods. The lockdown has impacted various sectors in terms of disruption in the supply chain and logistics. Other factors like unavailability of labor, lack of transportation facilities are creating challenges for any industry. The leading tire manufacturers have stated that the pandemic's impact on tire manufacturing and recycling is uncertain. During the initial stage of lockdown, demand for tire-based recycled rubber has declined, but later as the situation normalized, key companies in the manufacturing sector started the operation at a moderate pace. Moreover, the Bureau of International Recycling (BIR) tire recycling committee showed statistics and informed that the internal logistics in China was affected by the virus caused a setback for the Tire Recycling Downstream Products Market. A gradual recovery is expected for Tire Recycling Downstream Products Market during the forecasted period.

|

Global Tire Recycling Downstream Products Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 4717.6 Mn. |

|

Forecast Period 2022-28 CAGR: |

3.53% |

Market Size in 2028: |

USD 6014.3 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Recycling Method |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Product

3.2 By Recycling Method

3.3 By End-Use

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Tire Recycling Downstream Products Market by Product

4.1 Tire Recycling Downstream Products Market Overview Snapshot and Growth Engine

4.2 Tire Recycling Downstream Products Market Overview

4.3 Tire Derived Fuel

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Tire Derived Fuel: Grographic Segmentation

4.4 Tire Derived Aggregates

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Tire Derived Aggregates: Grographic Segmentation

4.5 Rubber Mulch

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size (2016-2028F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Rubber Mulch: Grographic Segmentation

4.6 Steel

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size (2016-2028F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Steel: Grographic Segmentation

4.7 Rubber Powder

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size (2016-2028F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Rubber Powder: Grographic Segmentation

4.8 Other

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size (2016-2028F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Other: Grographic Segmentation

Chapter 5: Tire Recycling Downstream Products Market by Recycling Method

5.1 Tire Recycling Downstream Products Market Overview Snapshot and Growth Engine

5.2 Tire Recycling Downstream Products Market Overview

5.3 Pyrolysis

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Pyrolysis: Grographic Segmentation

5.4 Shredding

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Shredding: Grographic Segmentation

Chapter 6: Tire Recycling Downstream Products Market by End-Use

6.1 Tire Recycling Downstream Products Market Overview Snapshot and Growth Engine

6.2 Tire Recycling Downstream Products Market Overview

6.3 Cement Manufacturing

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Cement Manufacturing: Grographic Segmentation

6.4 Pulp and Paper

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Pulp and Paper: Grographic Segmentation

6.5 Utility Boilers

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Utility Boilers: Grographic Segmentation

6.6 Construction and Infrastructure

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Construction and Infrastructure: Grographic Segmentation

6.7 Playground and Sports Complexes

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Playground and Sports Complexes: Grographic Segmentation

6.8 Tire and Rubber

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size (2016-2028F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Tire and Rubber: Grographic Segmentation

6.9 Others

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size (2016-2028F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 Others: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Tire Recycling Downstream Products Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Tire Recycling Downstream Products Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Tire Recycling Downstream Products Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 LIBERTY TIRE RECYCLING

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 GENAN HOLDING A/S

7.4 LAKIN TIRES WEST INC

7.5 REGN-SELLS GROUP

7.6 L & S TIRE COMPANY

7.7 SCANDINAVIAN ENVIRO SYSTEMS AB

7.8 ETR GROUP

7.9 RESOURCECO PTY LTD

7.10 PROBIO ENERGY INTERNATIONAL

7.11 RENELUX CYPRUS LTD

7.12 EMANUEL TIRE LLC

7.13 RELIABLE TIRE DISPOSAL

7.14 GLOBARKET TIRE RECYCLING LLC

7.15 TIRE DISPOSAL & RECYCLING

7.16 INC

7.17 WEST COAST RUBBER RECYCLING INC

7.18 LEHIGH TECHNOLOGIES INC.

Chapter 8: Global Tire Recycling Downstream Products Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Product

8.2.1 Tire Derived Fuel

8.2.2 Tire Derived Aggregates

8.2.3 Rubber Mulch

8.2.4 Steel

8.2.5 Rubber Powder

8.2.6 Other

8.3 Historic and Forecasted Market Size By Recycling Method

8.3.1 Pyrolysis

8.3.2 Shredding

8.4 Historic and Forecasted Market Size By End-Use

8.4.1 Cement Manufacturing

8.4.2 Pulp and Paper

8.4.3 Utility Boilers

8.4.4 Construction and Infrastructure

8.4.5 Playground and Sports Complexes

8.4.6 Tire and Rubber

8.4.7 Others

Chapter 9: North America Tire Recycling Downstream Products Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Product

9.4.1 Tire Derived Fuel

9.4.2 Tire Derived Aggregates

9.4.3 Rubber Mulch

9.4.4 Steel

9.4.5 Rubber Powder

9.4.6 Other

9.5 Historic and Forecasted Market Size By Recycling Method

9.5.1 Pyrolysis

9.5.2 Shredding

9.6 Historic and Forecasted Market Size By End-Use

9.6.1 Cement Manufacturing

9.6.2 Pulp and Paper

9.6.3 Utility Boilers

9.6.4 Construction and Infrastructure

9.6.5 Playground and Sports Complexes

9.6.6 Tire and Rubber

9.6.7 Others

9.7 Historic and Forecast Market Size by Country

9.7.1 U.S.

9.7.2 Canada

9.7.3 Mexico

Chapter 10: Europe Tire Recycling Downstream Products Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Product

10.4.1 Tire Derived Fuel

10.4.2 Tire Derived Aggregates

10.4.3 Rubber Mulch

10.4.4 Steel

10.4.5 Rubber Powder

10.4.6 Other

10.5 Historic and Forecasted Market Size By Recycling Method

10.5.1 Pyrolysis

10.5.2 Shredding

10.6 Historic and Forecasted Market Size By End-Use

10.6.1 Cement Manufacturing

10.6.2 Pulp and Paper

10.6.3 Utility Boilers

10.6.4 Construction and Infrastructure

10.6.5 Playground and Sports Complexes

10.6.6 Tire and Rubber

10.6.7 Others

10.7 Historic and Forecast Market Size by Country

10.7.1 Germany

10.7.2 U.K.

10.7.3 France

10.7.4 Italy

10.7.5 Russia

10.7.6 Spain

Chapter 11: Asia-Pacific Tire Recycling Downstream Products Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Product

11.4.1 Tire Derived Fuel

11.4.2 Tire Derived Aggregates

11.4.3 Rubber Mulch

11.4.4 Steel

11.4.5 Rubber Powder

11.4.6 Other

11.5 Historic and Forecasted Market Size By Recycling Method

11.5.1 Pyrolysis

11.5.2 Shredding

11.6 Historic and Forecasted Market Size By End-Use

11.6.1 Cement Manufacturing

11.6.2 Pulp and Paper

11.6.3 Utility Boilers

11.6.4 Construction and Infrastructure

11.6.5 Playground and Sports Complexes

11.6.6 Tire and Rubber

11.6.7 Others

11.7 Historic and Forecast Market Size by Country

11.7.1 China

11.7.2 India

11.7.3 Japan

11.7.4 Southeast Asia

Chapter 12: South America Tire Recycling Downstream Products Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Product

12.4.1 Tire Derived Fuel

12.4.2 Tire Derived Aggregates

12.4.3 Rubber Mulch

12.4.4 Steel

12.4.5 Rubber Powder

12.4.6 Other

12.5 Historic and Forecasted Market Size By Recycling Method

12.5.1 Pyrolysis

12.5.2 Shredding

12.6 Historic and Forecasted Market Size By End-Use

12.6.1 Cement Manufacturing

12.6.2 Pulp and Paper

12.6.3 Utility Boilers

12.6.4 Construction and Infrastructure

12.6.5 Playground and Sports Complexes

12.6.6 Tire and Rubber

12.6.7 Others

12.7 Historic and Forecast Market Size by Country

12.7.1 Brazil

12.7.2 Argentina

Chapter 13: Middle East & Africa Tire Recycling Downstream Products Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Product

13.4.1 Tire Derived Fuel

13.4.2 Tire Derived Aggregates

13.4.3 Rubber Mulch

13.4.4 Steel

13.4.5 Rubber Powder

13.4.6 Other

13.5 Historic and Forecasted Market Size By Recycling Method

13.5.1 Pyrolysis

13.5.2 Shredding

13.6 Historic and Forecasted Market Size By End-Use

13.6.1 Cement Manufacturing

13.6.2 Pulp and Paper

13.6.3 Utility Boilers

13.6.4 Construction and Infrastructure

13.6.5 Playground and Sports Complexes

13.6.6 Tire and Rubber

13.6.7 Others

13.7 Historic and Forecast Market Size by Country

13.7.1 Saudi Arabia

13.7.2 South Africa

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Tire Recycling Downstream Products Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 4717.6 Mn. |

|

Forecast Period 2022-28 CAGR: |

3.53% |

Market Size in 2028: |

USD 6014.3 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Recycling Method |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET COMPETITIVE RIVALRY

TABLE 005. TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET THREAT OF NEW ENTRANTS

TABLE 006. TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET THREAT OF SUBSTITUTES

TABLE 007. TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET BY PRODUCT

TABLE 008. TIRE DERIVED FUEL MARKET OVERVIEW (2016-2028)

TABLE 009. TIRE DERIVED AGGREGATES MARKET OVERVIEW (2016-2028)

TABLE 010. RUBBER MULCH MARKET OVERVIEW (2016-2028)

TABLE 011. STEEL MARKET OVERVIEW (2016-2028)

TABLE 012. RUBBER POWDER MARKET OVERVIEW (2016-2028)

TABLE 013. OTHER MARKET OVERVIEW (2016-2028)

TABLE 014. TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET BY RECYCLING METHOD

TABLE 015. PYROLYSIS MARKET OVERVIEW (2016-2028)

TABLE 016. SHREDDING MARKET OVERVIEW (2016-2028)

TABLE 017. TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET BY END-USE

TABLE 018. CEMENT MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 019. PULP AND PAPER MARKET OVERVIEW (2016-2028)

TABLE 020. UTILITY BOILERS MARKET OVERVIEW (2016-2028)

TABLE 021. CONSTRUCTION AND INFRASTRUCTURE MARKET OVERVIEW (2016-2028)

TABLE 022. PLAYGROUND AND SPORTS COMPLEXES MARKET OVERVIEW (2016-2028)

TABLE 023. TIRE AND RUBBER MARKET OVERVIEW (2016-2028)

TABLE 024. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 025. NORTH AMERICA TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY PRODUCT (2016-2028)

TABLE 026. NORTH AMERICA TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY RECYCLING METHOD (2016-2028)

TABLE 027. NORTH AMERICA TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY END-USE (2016-2028)

TABLE 028. N TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 029. EUROPE TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY PRODUCT (2016-2028)

TABLE 030. EUROPE TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY RECYCLING METHOD (2016-2028)

TABLE 031. EUROPE TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY END-USE (2016-2028)

TABLE 032. TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 033. ASIA PACIFIC TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY PRODUCT (2016-2028)

TABLE 034. ASIA PACIFIC TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY RECYCLING METHOD (2016-2028)

TABLE 035. ASIA PACIFIC TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY END-USE (2016-2028)

TABLE 036. TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY PRODUCT (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY RECYCLING METHOD (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY END-USE (2016-2028)

TABLE 040. TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 041. SOUTH AMERICA TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY PRODUCT (2016-2028)

TABLE 042. SOUTH AMERICA TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY RECYCLING METHOD (2016-2028)

TABLE 043. SOUTH AMERICA TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY END-USE (2016-2028)

TABLE 044. TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 045. LIBERTY TIRE RECYCLING: SNAPSHOT

TABLE 046. LIBERTY TIRE RECYCLING: BUSINESS PERFORMANCE

TABLE 047. LIBERTY TIRE RECYCLING: PRODUCT PORTFOLIO

TABLE 048. LIBERTY TIRE RECYCLING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. GENAN HOLDING A/S: SNAPSHOT

TABLE 049. GENAN HOLDING A/S: BUSINESS PERFORMANCE

TABLE 050. GENAN HOLDING A/S: PRODUCT PORTFOLIO

TABLE 051. GENAN HOLDING A/S: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. LAKIN TIRES WEST INC: SNAPSHOT

TABLE 052. LAKIN TIRES WEST INC: BUSINESS PERFORMANCE

TABLE 053. LAKIN TIRES WEST INC: PRODUCT PORTFOLIO

TABLE 054. LAKIN TIRES WEST INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. REGN-SELLS GROUP: SNAPSHOT

TABLE 055. REGN-SELLS GROUP: BUSINESS PERFORMANCE

TABLE 056. REGN-SELLS GROUP: PRODUCT PORTFOLIO

TABLE 057. REGN-SELLS GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. L & S TIRE COMPANY: SNAPSHOT

TABLE 058. L & S TIRE COMPANY: BUSINESS PERFORMANCE

TABLE 059. L & S TIRE COMPANY: PRODUCT PORTFOLIO

TABLE 060. L & S TIRE COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. SCANDINAVIAN ENVIRO SYSTEMS AB: SNAPSHOT

TABLE 061. SCANDINAVIAN ENVIRO SYSTEMS AB: BUSINESS PERFORMANCE

TABLE 062. SCANDINAVIAN ENVIRO SYSTEMS AB: PRODUCT PORTFOLIO

TABLE 063. SCANDINAVIAN ENVIRO SYSTEMS AB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. ETR GROUP: SNAPSHOT

TABLE 064. ETR GROUP: BUSINESS PERFORMANCE

TABLE 065. ETR GROUP: PRODUCT PORTFOLIO

TABLE 066. ETR GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. RESOURCECO PTY LTD: SNAPSHOT

TABLE 067. RESOURCECO PTY LTD: BUSINESS PERFORMANCE

TABLE 068. RESOURCECO PTY LTD: PRODUCT PORTFOLIO

TABLE 069. RESOURCECO PTY LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. PROBIO ENERGY INTERNATIONAL: SNAPSHOT

TABLE 070. PROBIO ENERGY INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 071. PROBIO ENERGY INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 072. PROBIO ENERGY INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. RENELUX CYPRUS LTD: SNAPSHOT

TABLE 073. RENELUX CYPRUS LTD: BUSINESS PERFORMANCE

TABLE 074. RENELUX CYPRUS LTD: PRODUCT PORTFOLIO

TABLE 075. RENELUX CYPRUS LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. EMANUEL TIRE LLC: SNAPSHOT

TABLE 076. EMANUEL TIRE LLC: BUSINESS PERFORMANCE

TABLE 077. EMANUEL TIRE LLC: PRODUCT PORTFOLIO

TABLE 078. EMANUEL TIRE LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. RELIABLE TIRE DISPOSAL: SNAPSHOT

TABLE 079. RELIABLE TIRE DISPOSAL: BUSINESS PERFORMANCE

TABLE 080. RELIABLE TIRE DISPOSAL: PRODUCT PORTFOLIO

TABLE 081. RELIABLE TIRE DISPOSAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. GLOBARKET TIRE RECYCLING LLC: SNAPSHOT

TABLE 082. GLOBARKET TIRE RECYCLING LLC: BUSINESS PERFORMANCE

TABLE 083. GLOBARKET TIRE RECYCLING LLC: PRODUCT PORTFOLIO

TABLE 084. GLOBARKET TIRE RECYCLING LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. TIRE DISPOSAL & RECYCLING: SNAPSHOT

TABLE 085. TIRE DISPOSAL & RECYCLING: BUSINESS PERFORMANCE

TABLE 086. TIRE DISPOSAL & RECYCLING: PRODUCT PORTFOLIO

TABLE 087. TIRE DISPOSAL & RECYCLING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. INC: SNAPSHOT

TABLE 088. INC: BUSINESS PERFORMANCE

TABLE 089. INC: PRODUCT PORTFOLIO

TABLE 090. INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. WEST COAST RUBBER RECYCLING INC: SNAPSHOT

TABLE 091. WEST COAST RUBBER RECYCLING INC: BUSINESS PERFORMANCE

TABLE 092. WEST COAST RUBBER RECYCLING INC: PRODUCT PORTFOLIO

TABLE 093. WEST COAST RUBBER RECYCLING INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. LEHIGH TECHNOLOGIES INC.: SNAPSHOT

TABLE 094. LEHIGH TECHNOLOGIES INC.: BUSINESS PERFORMANCE

TABLE 095. LEHIGH TECHNOLOGIES INC.: PRODUCT PORTFOLIO

TABLE 096. LEHIGH TECHNOLOGIES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET OVERVIEW BY PRODUCT

FIGURE 012. TIRE DERIVED FUEL MARKET OVERVIEW (2016-2028)

FIGURE 013. TIRE DERIVED AGGREGATES MARKET OVERVIEW (2016-2028)

FIGURE 014. RUBBER MULCH MARKET OVERVIEW (2016-2028)

FIGURE 015. STEEL MARKET OVERVIEW (2016-2028)

FIGURE 016. RUBBER POWDER MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 018. TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET OVERVIEW BY RECYCLING METHOD

FIGURE 019. PYROLYSIS MARKET OVERVIEW (2016-2028)

FIGURE 020. SHREDDING MARKET OVERVIEW (2016-2028)

FIGURE 021. TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET OVERVIEW BY END-USE

FIGURE 022. CEMENT MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 023. PULP AND PAPER MARKET OVERVIEW (2016-2028)

FIGURE 024. UTILITY BOILERS MARKET OVERVIEW (2016-2028)

FIGURE 025. CONSTRUCTION AND INFRASTRUCTURE MARKET OVERVIEW (2016-2028)

FIGURE 026. PLAYGROUND AND SPORTS COMPLEXES MARKET OVERVIEW (2016-2028)

FIGURE 027. TIRE AND RUBBER MARKET OVERVIEW (2016-2028)

FIGURE 028. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 029. NORTH AMERICA TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. EUROPE TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. ASIA PACIFIC TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. MIDDLE EAST & AFRICA TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. SOUTH AMERICA TIRE RECYCLING DOWNSTREAM PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Tire Recycling Downstream Products Market research report is 2022-2028.

Liberty Tire Recycling, Genan Holding A/S, Lakin Tires West Inc, Regn-Sells Group, L & S Tire Company, Scandinavian Enviro Systems AB, ETR Group, ResourceCo Pty Ltd, Probio Energy International, Renelux Cyprus Ltd, Emanuel Tire LLC, Reliable Tire Disposal, Globarket Tire Recycling LLC, Tire Disposal & Recycling Inc, West Coast Rubber Recycling Inc, Lehigh Technologies Inc and Others major players.

The Tire Recycling Downstream Products Market is segmented into Product, Recycling Method, End-Use and Region. By Product, the market is categorized into Tire Derived Fuel, Tire Derived Aggregates, Rubber Mulch, Steel, Rubber Powder, Other. By Recycling Method, the market is categorized into Pyrolysis, Shredding. By End-Use, the market is categorized into Cement Manufacturing, Pulp, And Paper, Utility Boilers, Construction and Infrastructure, Playground and Sports Complexes, Tire, And Rubber, Other. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The tire recycling process involves the removal of fibers and metal wires generally hard steel which provides stiffness to the tire and later on clean rubber is shredded into crumb rubber. Such fine and granular rubber can be used in a variety of applications such as turf fields, synthetic track, hospital floors, roads, and raw material for other products such as shoes, sports equipment, and rubber-based appliances.

Tire Recycling Downstream Products Market was valued at USD 4717.6 million in 2021 and is expected to reach USD 6014.3 million by the year 2028, at a CAGR of 3.53% .