Global Automotive Filters Market Overview

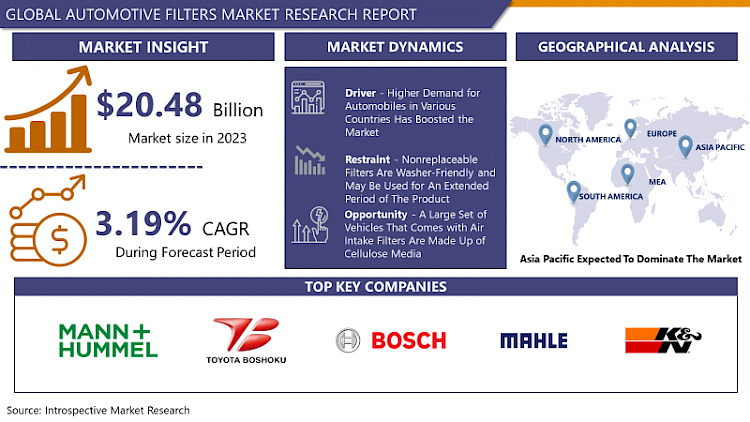

Automotive Filters Market Size Was Valued at USD 20.48 Billion in 2023 and is Projected to Reach USD 27.17 Billion by 2032, Growing at a CAGR of 3.19% From 2024-2032.

In automobiles, the filters feature as a method to remove dangerous particulates of dirt and metallic, which can cause the engine to malfunction and be harmful to the engine in terms of the life of the engine. Automotive filters serve a large variety of filters designed for energy and engine efficiency. Automotive filters come in a variety of types that serves in the automobile which include gas filtration, lube filtration, and coolant filtration. The automotive filter allows the flow of clean air to minimize engine damage as it requires a constant supply of fresh air for its smooth operations and improved life span. High petrol prices are anticipated to shift manufacturers' focus on reduced fuel consumption. All contemporary vehicles including light & heavy commercial vehicles, two-wheelers, and passenger cars come with different filters for up-gradation of power and vehicle efficiency and performance. Consumer preference towards diesel cars to increase fuel efficiency has boosted the automotive filer market due to the rising demand for high-performance filters in diesel vehicles.

Market Dynamics and Factors:

Drivers

Higher demand for automobiles in various countries has boosted the market for automobile spare parts all around the world. Affordable vehicles, higher buying power, and large option to select the desired vehicle boosted the production of the vehicle in the last 10 years. Such a sudden jump in the demand for automobile vehicles has boosted the automobile filters market. Due to environmental issues and stringent emission norms, the passenger automobile phase in Europe is predicted to witness a growing call for gas engines and gas filters. Increasing awareness with recognition to air cabin best is similarly predicted to power the market boom for automobile filters.

Due to technological improvements in filter media types, the replacement cycle of filters in line with the automobile is optimized. However, developing automobile manufacturing will result in the improved intake of automobile filters. According to the ACEA (European Automobile Manufacturers’ Association), passenger automobile manufacturing hit 78.6 million in 2018, with the Asia Pacific and North America anticipated to be the main regions. A regular restoration in automobile manufacturing submits the COVID-19 effect is predicted to power the market boom for automobile filters. Strict emission norms in Europe, North America, and other parts of the world have pushed automobile filer manufacturers to produce high-performance filers which will reduce the pollution from the ICEs.

Restraints

Nonreplaceable filters are washer-friendly and may be used for an extended period of the product. However, to clean the filters, a unique cleaning kit is required. The alternative air filters supplied through K&N Engineering last as long as 50,000 miles. By the usage of the K&N Air Filter Cleaning Kit, air filters may be without difficulty wiped clean and re-oiled to brand-new condition and, thus, getting ready for any other 50,000 miles of use. This pocket-friendly choice for automobile proprietors ultimately reflects on the constant demand for the filter.

In the coming years, the filter aftermarket is likely to be impacted by the nonreplaceable filters. Various filters, such as air and cabin filters have a long life of the product which can be hampering the filter market. The market for nonreplaceable filters is at a very promising stage. However, in the coming years, these filters are likely to have a decent market owing to the various advantages they offer, such as zero replacement and cost savings over conventional filters.

Opportunities

A filter media is a primary component of a filter that comes in direct contact with engine oil or the air of the engine. It is used to capture any unwanted and foreign particles. It is largely made up of cellulose, synthetic, glass fiber, and activated carbon, considering the applications. Progressions in filter media types or technology will offer an enormous opportunity for automotive filter manufacturers in the coming years. Presently, cabin filters are fixed to resist dust particles entering the vehicle. In the coming years, there would be a major market for dust and odor filters. The blend of dust and odor filters has a covering of stimulated charcoal or baking soda to absorb odor and air pollutants.

Currently, a large set of vehicles that comes with air intake filters are made up of cellulose media which is considered to be cost-effective. Nevertheless, synthetic media filters are being widely adopted and would have bright prospects in the future, mainly due to their tremendous advantages over cellulose media. Synthetic media filter offers increased flow area, high performance, less sensitivity to water provides long life of the filter which is essential for the budget cars by reducing the frequent part replacements. These filters can be used to allow better airflow for combustion, resulting in higher fuel efficacy and lower emission.

Market Segmentation

By Type, Oil Filter is the dominating segment in the automotive filters market. Currently, ICE vehicles dominate the automobile industry in which engine oil is an essential part. Oil in any engine ensures the lubrication of internal components and smooth functioning of the engine. The oil filter removes the impurities in oil, dust particles, and carbon deposits which protects the oil pump from wear and tear from such unwanted debris from the oil and dust in the engine. Oil filter extends the average life of a vehicle and keeps the engine clean and high functioning. Due to the maximum usage of internal combustion engine vehicles around the world, oil and oil-related spare parts are have high demand in the automotive market. Thus, the oil filter is the most utilized spare part in vehicles. Countries like China, India, the USA have the highest vehicle on the ground creating a constant demand for oil filters globally.

By Filter Media, Activated Carbon dominates the filter media segment in the automotive filter market. Activated carbon media contains tiny carbon pieces in the filter which is super-efficient to remove dust, lint, mold spores, hazardous smoke and particles, and very small debris. Most o automotive vehicle comes with carbon activated filter due to the high efficiency of the filter. Aftermarket sale is one of the major contributing factors of the growth in automotive filters, especially for carbon-activated filters. Companies like K and N industries, Bosch and Sogefi S.p.A provides high-performance carbon-activated filters globally.

By Material Type, Synthetic is the dominating material type segment in the automotive filters market. The synthetic filter is the most commonly used in automobiles due to its high quality and performance and effectiveness in removing 50% of the particles in size between 20 to 40 microns and 25% particles in the range of 8 to 10-micron range. The life of synthetic media filers is around 9000-11000 kilometers which are far higher than cellulose filers hence the higher demand for synthetic filers drives the automotive market globally.

Players Covered in Automotive Filters market are :

- MANN+HUMMEL

- Toyota Boshoku Corporation

- Robert Bosch GmbH

- MAHLE GmbH

- Denso Corporation

- K&N Engineering

- Sogefi S.p.A Hengst SE

- ACDelco Inc

- Valeo S.A. and other major players.

Regional Analysis of Automotive Filters Market

The Asia Pacific is dominating in Automotive Filters market during the forecasted period Due to the growing disposable incomes, speedy industrialization, and growth in passenger automobile sales in Asian countries boosted the automotive filter market. Massive car production from India and China is creating opportunities in the automotive sector and depending on industries like spare parts and the filter market. Favorable FDI rules on aftermarket components production and authorities’ policies focused on lowering the carbon emissions will create exquisite market conditions for high-performance automotive filers in the Asia Pacific. Key producers specialize in the growing area of interest merchandise and capability expansions due to robust demand for affordable aftermarket merchandise in the Asia Pacific region., Donaldson filtration company has introduced its Wuxi production plant in China to capture opportunities in the central Asian market. Through this expansion, the corporation may be capable of growth its air filters production capability and setup of first Chinese primarily based liquid filtration manufacturing capability which will boost the Automotive Filters market in the Asia Pacific

Key Industry Developments in Automotive Filters Market

- In January 2024, Robert Bosch GmbH introduced the FILTER+pro, a cabin filter that prevents viruses and mold development. Its antimicrobial filter layer is expertly tailored to resist bacteria, pollen, and allergies. The carbon layer removes smells and hazardous gasses like ozone or smog, while the ultrafine microfiber layer filters out more than 98% of particulate matter sized 2.5 micrometers or larger.

- In October 2023, The MANN+HUMMEL Group announced the closing of the acquisition of a majority stake in Suzhou U-Air Environmental Technology (“U-Air”). This strategic move reinforces MANN+HUMMEL's commitment to meeting the rising global demand for cleaner air solutions and strengthens its footprint in the growing Chinese and Southeast Asian air filtration market.

|

Global Automotive Filters Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 20.48 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.19% |

Market Size in 2032: |

USD 27.17 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Filter Media |

|

||

|

By Material Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Filter Media

3.3 By Material Type

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Automotive Filters Market by Type

4.1 Automotive Filters Market Overview Snapshot and Growth Engine

4.2 Automotive Filters Market Overview

4.3 Air Filter

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Air Filter: Grographic Segmentation

4.4 Oil Filter

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Oil Filter: Grographic Segmentation

4.5 Fuel Filter

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size (2016-2028F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Fuel Filter: Grographic Segmentation

4.6 Cabin Filter

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size (2016-2028F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Cabin Filter: Grographic Segmentation

Chapter 5: Automotive Filters Market by Filter Media

5.1 Automotive Filters Market Overview Snapshot and Growth Engine

5.2 Automotive Filters Market Overview

5.3 Particle

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Particle: Grographic Segmentation

5.4 Activated Carbon

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Activated Carbon: Grographic Segmentation

5.5 Electrostatic

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Electrostatic: Grographic Segmentation

Chapter 6: Automotive Filters Market by Material Type

6.1 Automotive Filters Market Overview Snapshot and Growth Engine

6.2 Automotive Filters Market Overview

6.3 Cellulose

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Cellulose: Grographic Segmentation

6.4 Synthetic

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Synthetic: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Automotive Filters Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Automotive Filters Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Automotive Filters Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 MANN+HUMMEL

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 TOYOTA BOSHOKU CORPORATION

7.4 ROBERT BOSCH GMBH

7.5 MAHLE GMBH

7.6 DENSO CORPORATION

7.7 K&N ENGINEERING

7.8 SOGEFI S.P.A HENGST SE

7.9 ACDELCO INC

7.10 VALEO S.A.

Chapter 8: Global Automotive Filters Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Air Filter

8.2.2 Oil Filter

8.2.3 Fuel Filter

8.2.4 Cabin Filter

8.3 Historic and Forecasted Market Size By Filter Media

8.3.1 Particle

8.3.2 Activated Carbon

8.3.3 Electrostatic

8.4 Historic and Forecasted Market Size By Material Type

8.4.1 Cellulose

8.4.2 Synthetic

Chapter 9: North America Automotive Filters Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Air Filter

9.4.2 Oil Filter

9.4.3 Fuel Filter

9.4.4 Cabin Filter

9.5 Historic and Forecasted Market Size By Filter Media

9.5.1 Particle

9.5.2 Activated Carbon

9.5.3 Electrostatic

9.6 Historic and Forecasted Market Size By Material Type

9.6.1 Cellulose

9.6.2 Synthetic

9.7 Historic and Forecast Market Size by Country

9.7.1 U.S.

9.7.2 Canada

9.7.3 Mexico

Chapter 10: Europe Automotive Filters Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Air Filter

10.4.2 Oil Filter

10.4.3 Fuel Filter

10.4.4 Cabin Filter

10.5 Historic and Forecasted Market Size By Filter Media

10.5.1 Particle

10.5.2 Activated Carbon

10.5.3 Electrostatic

10.6 Historic and Forecasted Market Size By Material Type

10.6.1 Cellulose

10.6.2 Synthetic

10.7 Historic and Forecast Market Size by Country

10.7.1 Germany

10.7.2 U.K.

10.7.3 France

10.7.4 Italy

10.7.5 Russia

10.7.6 Spain

Chapter 11: Asia-Pacific Automotive Filters Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Air Filter

11.4.2 Oil Filter

11.4.3 Fuel Filter

11.4.4 Cabin Filter

11.5 Historic and Forecasted Market Size By Filter Media

11.5.1 Particle

11.5.2 Activated Carbon

11.5.3 Electrostatic

11.6 Historic and Forecasted Market Size By Material Type

11.6.1 Cellulose

11.6.2 Synthetic

11.7 Historic and Forecast Market Size by Country

11.7.1 China

11.7.2 India

11.7.3 Japan

11.7.4 Southeast Asia

Chapter 12: South America Automotive Filters Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Air Filter

12.4.2 Oil Filter

12.4.3 Fuel Filter

12.4.4 Cabin Filter

12.5 Historic and Forecasted Market Size By Filter Media

12.5.1 Particle

12.5.2 Activated Carbon

12.5.3 Electrostatic

12.6 Historic and Forecasted Market Size By Material Type

12.6.1 Cellulose

12.6.2 Synthetic

12.7 Historic and Forecast Market Size by Country

12.7.1 Brazil

12.7.2 Argentina

Chapter 13: Middle East & Africa Automotive Filters Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Air Filter

13.4.2 Oil Filter

13.4.3 Fuel Filter

13.4.4 Cabin Filter

13.5 Historic and Forecasted Market Size By Filter Media

13.5.1 Particle

13.5.2 Activated Carbon

13.5.3 Electrostatic

13.6 Historic and Forecasted Market Size By Material Type

13.6.1 Cellulose

13.6.2 Synthetic

13.7 Historic and Forecast Market Size by Country

13.7.1 Saudi Arabia

13.7.2 South Africa

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Automotive Filters Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 20.48 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.19% |

Market Size in 2032: |

USD 27.17 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Filter Media |

|

||

|

By Material Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. AUTOMOTIVE FILTERS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. AUTOMOTIVE FILTERS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. AUTOMOTIVE FILTERS MARKET COMPETITIVE RIVALRY

TABLE 005. AUTOMOTIVE FILTERS MARKET THREAT OF NEW ENTRANTS

TABLE 006. AUTOMOTIVE FILTERS MARKET THREAT OF SUBSTITUTES

TABLE 007. AUTOMOTIVE FILTERS MARKET BY TYPE

TABLE 008. AIR FILTER MARKET OVERVIEW (2016-2028)

TABLE 009. OIL FILTER MARKET OVERVIEW (2016-2028)

TABLE 010. FUEL FILTER MARKET OVERVIEW (2016-2028)

TABLE 011. CABIN FILTER MARKET OVERVIEW (2016-2028)

TABLE 012. AUTOMOTIVE FILTERS MARKET BY FILTER MEDIA

TABLE 013. PARTICLE MARKET OVERVIEW (2016-2028)

TABLE 014. ACTIVATED CARBON MARKET OVERVIEW (2016-2028)

TABLE 015. ELECTROSTATIC MARKET OVERVIEW (2016-2028)

TABLE 016. AUTOMOTIVE FILTERS MARKET BY MATERIAL TYPE

TABLE 017. CELLULOSE MARKET OVERVIEW (2016-2028)

TABLE 018. SYNTHETIC MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA AUTOMOTIVE FILTERS MARKET, BY TYPE (2016-2028)

TABLE 020. NORTH AMERICA AUTOMOTIVE FILTERS MARKET, BY FILTER MEDIA (2016-2028)

TABLE 021. NORTH AMERICA AUTOMOTIVE FILTERS MARKET, BY MATERIAL TYPE (2016-2028)

TABLE 022. N AUTOMOTIVE FILTERS MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE AUTOMOTIVE FILTERS MARKET, BY TYPE (2016-2028)

TABLE 024. EUROPE AUTOMOTIVE FILTERS MARKET, BY FILTER MEDIA (2016-2028)

TABLE 025. EUROPE AUTOMOTIVE FILTERS MARKET, BY MATERIAL TYPE (2016-2028)

TABLE 026. AUTOMOTIVE FILTERS MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC AUTOMOTIVE FILTERS MARKET, BY TYPE (2016-2028)

TABLE 028. ASIA PACIFIC AUTOMOTIVE FILTERS MARKET, BY FILTER MEDIA (2016-2028)

TABLE 029. ASIA PACIFIC AUTOMOTIVE FILTERS MARKET, BY MATERIAL TYPE (2016-2028)

TABLE 030. AUTOMOTIVE FILTERS MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA AUTOMOTIVE FILTERS MARKET, BY TYPE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA AUTOMOTIVE FILTERS MARKET, BY FILTER MEDIA (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA AUTOMOTIVE FILTERS MARKET, BY MATERIAL TYPE (2016-2028)

TABLE 034. AUTOMOTIVE FILTERS MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA AUTOMOTIVE FILTERS MARKET, BY TYPE (2016-2028)

TABLE 036. SOUTH AMERICA AUTOMOTIVE FILTERS MARKET, BY FILTER MEDIA (2016-2028)

TABLE 037. SOUTH AMERICA AUTOMOTIVE FILTERS MARKET, BY MATERIAL TYPE (2016-2028)

TABLE 038. AUTOMOTIVE FILTERS MARKET, BY COUNTRY (2016-2028)

TABLE 039. MANN+HUMMEL: SNAPSHOT

TABLE 040. MANN+HUMMEL: BUSINESS PERFORMANCE

TABLE 041. MANN+HUMMEL: PRODUCT PORTFOLIO

TABLE 042. MANN+HUMMEL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. TOYOTA BOSHOKU CORPORATION: SNAPSHOT

TABLE 043. TOYOTA BOSHOKU CORPORATION: BUSINESS PERFORMANCE

TABLE 044. TOYOTA BOSHOKU CORPORATION: PRODUCT PORTFOLIO

TABLE 045. TOYOTA BOSHOKU CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. ROBERT BOSCH GMBH: SNAPSHOT

TABLE 046. ROBERT BOSCH GMBH: BUSINESS PERFORMANCE

TABLE 047. ROBERT BOSCH GMBH: PRODUCT PORTFOLIO

TABLE 048. ROBERT BOSCH GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. MAHLE GMBH: SNAPSHOT

TABLE 049. MAHLE GMBH: BUSINESS PERFORMANCE

TABLE 050. MAHLE GMBH: PRODUCT PORTFOLIO

TABLE 051. MAHLE GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. DENSO CORPORATION: SNAPSHOT

TABLE 052. DENSO CORPORATION: BUSINESS PERFORMANCE

TABLE 053. DENSO CORPORATION: PRODUCT PORTFOLIO

TABLE 054. DENSO CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. K&N ENGINEERING: SNAPSHOT

TABLE 055. K&N ENGINEERING: BUSINESS PERFORMANCE

TABLE 056. K&N ENGINEERING: PRODUCT PORTFOLIO

TABLE 057. K&N ENGINEERING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. SOGEFI S.P.A HENGST SE: SNAPSHOT

TABLE 058. SOGEFI S.P.A HENGST SE: BUSINESS PERFORMANCE

TABLE 059. SOGEFI S.P.A HENGST SE: PRODUCT PORTFOLIO

TABLE 060. SOGEFI S.P.A HENGST SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. ACDELCO INC: SNAPSHOT

TABLE 061. ACDELCO INC: BUSINESS PERFORMANCE

TABLE 062. ACDELCO INC: PRODUCT PORTFOLIO

TABLE 063. ACDELCO INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. VALEO S.A.: SNAPSHOT

TABLE 064. VALEO S.A.: BUSINESS PERFORMANCE

TABLE 065. VALEO S.A.: PRODUCT PORTFOLIO

TABLE 066. VALEO S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. AUTOMOTIVE FILTERS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. AUTOMOTIVE FILTERS MARKET OVERVIEW BY TYPE

FIGURE 012. AIR FILTER MARKET OVERVIEW (2016-2028)

FIGURE 013. OIL FILTER MARKET OVERVIEW (2016-2028)

FIGURE 014. FUEL FILTER MARKET OVERVIEW (2016-2028)

FIGURE 015. CABIN FILTER MARKET OVERVIEW (2016-2028)

FIGURE 016. AUTOMOTIVE FILTERS MARKET OVERVIEW BY FILTER MEDIA

FIGURE 017. PARTICLE MARKET OVERVIEW (2016-2028)

FIGURE 018. ACTIVATED CARBON MARKET OVERVIEW (2016-2028)

FIGURE 019. ELECTROSTATIC MARKET OVERVIEW (2016-2028)

FIGURE 020. AUTOMOTIVE FILTERS MARKET OVERVIEW BY MATERIAL TYPE

FIGURE 021. CELLULOSE MARKET OVERVIEW (2016-2028)

FIGURE 022. SYNTHETIC MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA AUTOMOTIVE FILTERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE AUTOMOTIVE FILTERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC AUTOMOTIVE FILTERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA AUTOMOTIVE FILTERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA AUTOMOTIVE FILTERS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Automotive Filters Market research report is 2024-2032.

MANN+HUMMEL, Toyota Boshoku Corporation, Robert Bosch GmbH, MAHLE GmbH, Denso Corporation, K&N Engineering, Sogefi S.p.A Hengst SE, ACDelco Inc, Valeo S.A. and other major players.

The Automotive Filters Market is segmented into Type, Filter Media, Material Type, and region. By Type, the market is categorized into Air Filter, Oil Filter, Fuel Filter, Cabin Filter. By Filter Media, the market is categorized into Particle, Activated Carbon, Electrostatic. By Material Type, the market is categorized into Cellulose, Synthetic. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

In automobiles, the filters feature as a method to remove dangerous particulates of dirt and metallic, which can cause the engine to malfunction and be harmful to the engine in terms of the life of the engine.

Automotive Filters Market Size Was Valued at USD 20.48 Billion in 2023 and is Projected to Reach USD 27.17 Billion by 2032, Growing at a CAGR of 3.19% From 2024-2032.