Recreational Boat Market Overview

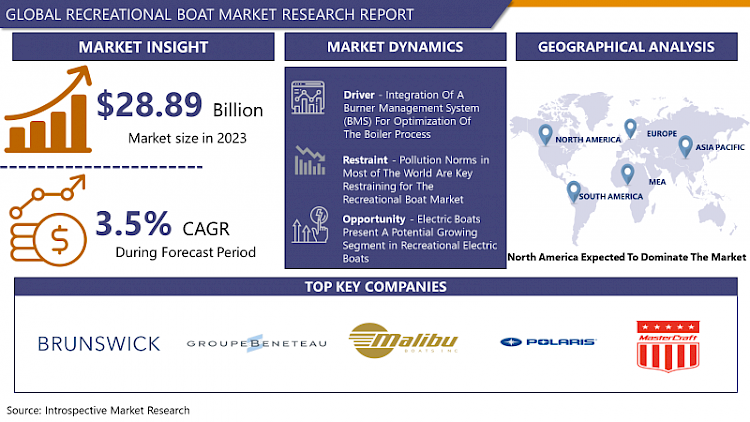

Global Recreational Boat Market Size Was Valued at USD 28.89 Billion In 2023 And Is Projected to Reach USD 36.05 Billion By 2032, Growing at A CAGR of 2.49% From 2024- 2032

Recreational boats are generally, vessels that are manufactured or to be used specifically for non-commercial use or leased or rented for any given commercial use later on. Such boats are utilized for sailing, fishing, travel through waterways, and leisure purposes which are specifically for private use. As rising popularity of outdoor activities and water sports with increasing participation of young crowd to engage in such activities, especially in adventure water sports and recreational boating activities are likely to push the recreational boat market revenue. A growing trend in recreational fishing and sea outing has seen major growth in North America, European cost lines, and Caribbean island cluster. On the luxury end, speed boats, yachts, and house boats have seen tremendous demand from the wealthy population. With the exception to the definition of the recreational boat, large investment in rental boat segment has seen growth as major population opts rental recreational boats for such activities have lured in the big market players to pump investment into recreational boat rental market which subsequently adding growth in the sale of Recreational boat market.

Market Dynamics And Factors For The Recreational Boat Market

Drivers:

The recreational boat market will increase exponentially with the growing trend of the tourism industry. Since the last decade, the recreational boat market has proven its capability to develop alongside the tourism industry, particularly for the sales of pontoon boats, cruises, and water sports activities at famous vacation hotspots. Personal watercraft and pre-owned boat sales have additionally expanded over these years for offering great vacation activities for its consumers and leasing organizations on a seasonal basis. European ministry of overseas affairs has published data in February 2021, Growth in the tourism industry in popular locations of Europe have increased the demand for small sea and medium-sized cruise are favored by medium-sized operators, and large cruise ships are operated by the well-established companies on the seasonal basis which creating a buzz in the overall boat industry. Such rising growth in the tourism industry is the main key driver of the growth in the recreational boat market.

Tourism company operators and local authorities invest in these boats according to demand and offered for leasing by tourists and develop an additional tourism attraction of the region. Spain is a highly active market of recreational boats over the past decade due to crystal clear seawater, enriched marine ecosystem, and the demand for water sports in such famous spots. In India, the Kerala government have invested heavily into the boating ecosystem for tourist as well as locals. With the tourism demand in leisure boats, houseboats, and traditional fishing tourism, locals use boats extensively to travel through backwater routes that are connected to nearby villages and fish marketplaces. Due to such use of boats, there is a constant boat market in South India. Europe consists of around 37,000 km of inland waterways and more than 70,000 km of coastline which is the perfect environment for the European population as well as tourists who regularly participate in recreational marine. As the recreational boat market presents large scope, many leading manufacturers have introduced new models in recreational boats with additional features and comfort with a variety of options and create competitiveness. Such a positive environment and growing demand have boosted the recreational boat market.

Restraints:

New stricter emission laws and regulations to commercial and recreational vessels are being introduced globally to reduce carbon emission and sea pollutants from fossil fuel engines. According to USEPA, the new regulatory circular has been issued to address the effects of marine compression ignition diesel engines which is the most common engine fitted in vessels. New emission standard and certification is required for diesel engines, exhaust emission test procedure, general compliance procedures and Sulfur limits in a marine diesel engine with another set of compliance are necessary to own a recreational or commercial boat. Such stringent rules and regulations which need to be followed periodically make it a restraining factor for the recreational boating enthusiast. Europe has set the NOX limit to 1.8 g/kW-hr for which boat engine manufacturers need to upgrade their engine technology according to strict pollution norms. Pollution norms in most of the world are key restraining for the recreational boat market.

Opportunities:

The newly developing online marketplace for boats has furnished a brand-new channel for promoting those boats. Earlier, the majority of boat dealers used to promote their boats through sellers’ markets and boat shows. The increase of online mode of boat income elevated the market for the boat producers. Many producers had been capable of promoting their boats in more modern markets without putting in place massive scale dealership networks and avoiding store maintenance costs. Online sale of boats additionally saves dealership fees and increases affordability. All those elements have increased in demand for recreational boat sales through online mediums. Such massive opportunities seized by E-Commerce groups like Amazon, Walmart, and Alibaba promote boats for numerous apex manufacturers like Intex, Bris, Classic, Solstice, Sea Eagle, and FRP. Currently, a large portion of the recreational boat of sales is noted through the online medium which created the future opportunity for a local manufacturer to go online with their traditional building quality and craftsmanship to catch a larger customer base.

Electric boats present a potential growing segment in recreational electric boats as governments imposed rigorous rules and emission regulations on ICE-powered boats. Electric boats provide an emission-free clean boating experience that is environmentally friendly and far less harmful for a marine line. Candela, DOMANI Yachts, Eldorado Marine, Elco Motor Yachts, Electracraft are some of the leading brands which manufacture highly efficient and top-class electric boats.

Market Segmentation

Segmentation Analysis of Recreational Boat Market:

By Boat Type, Yacht is the dominating in the boat type segment of the recreational boat market. A yacht is considered to be an apt recreational boat that consists of comfort, leisure, high-performance engine, and surreal boating experience. The yacht segment is expected to grow swiftly during the forecasted period. High demand from North America and Europe for leisure boating among wealthy customers contributes the majority share of the revenue for the recreational boat market. Superyachts are the new trend in the owner of recreational boats and yachts. In 2020, 341 superyachts were sold with the costliest yacht from Hasna Superyacht costing USD 92.5 million. Such high demand in the luxury yacht segment has boosted the revenue and demand in the recreational boat market.

By Engine Type, ICE is the dominating engine type segment in the recreational boat market. Internal Combustion Engine is the most common and widely used engine type in boats and vessels around the world. Diesel, Bio-Diesel, and gasoline is the most common fuel type in recreational boats and vessels. To power high-performance engines and to generate propulsion in harsh water conditions, high-performance diesel engines are used in recreational boats. As new emission norms are being introduced by the government to curb marine pollution, manufacturers of diesel engines need to shift towards highly efficient and high-performing diesel engines to meet the emission standard. Such emission norms hinder the growth of diesel engine-powered boats. These regulations are favorable for electric-based reactional boats as existing manufacturers are shifting to integrate electric boats into their portfolio.

By Engine Placement, Outboard placement dominates the engine placement segment in the recreational boat market. Due to the outside placement of the engine, it is easier to repair and replace spare parts of the engine making it convenient for the owner as well as operators to maintain the boat. Outboard placement boats have a lower chance of fire-mishap due to the engine being located outside the boat. This makes outboard boats being the most popular boat option for boating enthusiasts which has resulted in high demand for outboard engine placement boats in the recreational boat market globally.

Regional Analysis of Recreational Boat Market:

North America is the dominating in the recreational boat market during the forecasted period. The US is anticipated to be a fast-growing market in the North American region with the government assisting grow the recreational boat market. More than 3,10,000 units of powerboat have sold in 2020 which is 12% more than the previous year. Personal Watercraft sales jumped by 8% compared to 2019 with 82000 units. Freshwater fishing boats and pontoons sales topped at 1,43,000 units in the United States. Canada also has a high demand due to recreational boating being a traditional pastime in the region. Mexico is a fast emerging market with recreational boating is being adopted in the tourism sector.

The European region is the second leading and one of the fastest-growing regions in the recreational boat market. Europe has 70000 km of coastline with among the most popular tourist destination creating a highly potential market for recreational boats. Spain, Portugal, Greece, Malta, Turkey, France, Croatia are famous for coastline destinations and water sports which makes them a lucrative market for recreational boats.

In the Asia Pacific, South East Asia is one of the emerging markets for recreational boats as tourist destinations like Thailand, Bangkok, Pattaya, Phuket Islands, and Bali have attracted tourists from all parts of the world. Local boat manufacturers are leading providers of recreational and commercial boats in the region and have a high potential for a global boat manufacturer to capture the growing market in the Asia Pacific.

Players Covered in Recreational Boat Market are:

- Brunswick Corporation

- Groupe Beneteau

- Malibu Boats

- Polaris Inc.

- MasterCraft Boat Company

- Candela

- DOMANI Yachts

- Edorado Marine

- Elco Motor Yachts

- Electracraft and other major players.

Key Industry Developments of Recreational Boat Market

- In February 2024, Brunswick Corporation the global leader in recreational marine technology has announced a new partnership with Apex.AI, a leader in embedded software technology and middleware solutions. The collaboration will integrate the company’s Apex.Grace and Apex. Ida safety-certified products with Brunswick’s continued advancements in its autonomous solutions ecosystem as part of its ACES (Autonomy, Connectivity, Electrification, Shared Access) strategy. The software from Apex.AI will support the seamless integration of these systems in vessels equipped with autonomous technology and improving the boating experience across a range of applications.

- In April 2023, Ferretti Group launched Custom Line 106' hull 14. The Custom Line 106 Ft, a Ferretti Group Engineering Department design, is the entry-level model for the brand's planning line. The yacht has interior spaces with a 2-meter-high ceiling, large windows, and over 200 square meters of interconnected outdoor spaces.

|

Global Recreational Boat Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2016 to 2022 |

Market Size in 2023: |

USD 28.89 Bn. |

|

Forecast Period 2024-32 CAGR: |

2.49% |

Market Size in 2032: |

USD 36.05 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Engine Type |

|

||

|

By Engine Placement |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Engine Type

3.3 By Engine Placement

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Recreational Boat Market by Type

4.1 Recreational Boat Market Overview Snapshot and Growth Engine

4.2 Recreational Boat Market Overview

4.3 Yachts

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Yachts: Grographic Segmentation

4.4 Sailboats

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Sailboats: Grographic Segmentation

4.5 Personal Watercraft

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size (2016-2028F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Personal Watercraft: Grographic Segmentation

4.6 Inflatables

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size (2016-2028F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Inflatables: Grographic Segmentation

4.7 Others

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size (2016-2028F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Others: Grographic Segmentation

Chapter 5: Recreational Boat Market by Engine Type

5.1 Recreational Boat Market Overview Snapshot and Growth Engine

5.2 Recreational Boat Market Overview

5.3 Ice

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Ice: Grographic Segmentation

5.4 Electric

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Electric: Grographic Segmentation

Chapter 6: Recreational Boat Market by Engine Placement

6.1 Recreational Boat Market Overview Snapshot and Growth Engine

6.2 Recreational Boat Market Overview

6.3 Outboards

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Outboards: Grographic Segmentation

6.4 Inboards

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Inboards: Grographic Segmentation

6.5 Others

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Others: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Recreational Boat Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Recreational Boat Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Recreational Boat Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 BRUNSWICK CORPORATION

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 GROUPE BENETEAU

7.4 MALIBU BOATS

7.5 POLARIS INC. AND MASTERCRAFT BOAT COMPANY

7.6 CANDELA

7.7 DOMANI YACHTS

7.8 EDORADO MARINE

7.9 ELCO MOTOR YACHTS

7.10 ELECTRACRAFT

Chapter 8: Global Recreational Boat Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Yachts

8.2.2 Sailboats

8.2.3 Personal Watercraft

8.2.4 Inflatables

8.2.5 Others

8.3 Historic and Forecasted Market Size By Engine Type

8.3.1 Ice

8.3.2 Electric

8.4 Historic and Forecasted Market Size By Engine Placement

8.4.1 Outboards

8.4.2 Inboards

8.4.3 Others

Chapter 9: North America Recreational Boat Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Yachts

9.4.2 Sailboats

9.4.3 Personal Watercraft

9.4.4 Inflatables

9.4.5 Others

9.5 Historic and Forecasted Market Size By Engine Type

9.5.1 Ice

9.5.2 Electric

9.6 Historic and Forecasted Market Size By Engine Placement

9.6.1 Outboards

9.6.2 Inboards

9.6.3 Others

9.7 Historic and Forecast Market Size by Country

9.7.1 U.S.

9.7.2 Canada

9.7.3 Mexico

Chapter 10: Europe Recreational Boat Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Yachts

10.4.2 Sailboats

10.4.3 Personal Watercraft

10.4.4 Inflatables

10.4.5 Others

10.5 Historic and Forecasted Market Size By Engine Type

10.5.1 Ice

10.5.2 Electric

10.6 Historic and Forecasted Market Size By Engine Placement

10.6.1 Outboards

10.6.2 Inboards

10.6.3 Others

10.7 Historic and Forecast Market Size by Country

10.7.1 Germany

10.7.2 U.K.

10.7.3 France

10.7.4 Italy

10.7.5 Russia

10.7.6 Spain

Chapter 11: Asia-Pacific Recreational Boat Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Yachts

11.4.2 Sailboats

11.4.3 Personal Watercraft

11.4.4 Inflatables

11.4.5 Others

11.5 Historic and Forecasted Market Size By Engine Type

11.5.1 Ice

11.5.2 Electric

11.6 Historic and Forecasted Market Size By Engine Placement

11.6.1 Outboards

11.6.2 Inboards

11.6.3 Others

11.7 Historic and Forecast Market Size by Country

11.7.1 China

11.7.2 India

11.7.3 Japan

11.7.4 Southeast Asia

Chapter 12: South America Recreational Boat Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Yachts

12.4.2 Sailboats

12.4.3 Personal Watercraft

12.4.4 Inflatables

12.4.5 Others

12.5 Historic and Forecasted Market Size By Engine Type

12.5.1 Ice

12.5.2 Electric

12.6 Historic and Forecasted Market Size By Engine Placement

12.6.1 Outboards

12.6.2 Inboards

12.6.3 Others

12.7 Historic and Forecast Market Size by Country

12.7.1 Brazil

12.7.2 Argentina

Chapter 13: Middle East & Africa Recreational Boat Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Yachts

13.4.2 Sailboats

13.4.3 Personal Watercraft

13.4.4 Inflatables

13.4.5 Others

13.5 Historic and Forecasted Market Size By Engine Type

13.5.1 Ice

13.5.2 Electric

13.6 Historic and Forecasted Market Size By Engine Placement

13.6.1 Outboards

13.6.2 Inboards

13.6.3 Others

13.7 Historic and Forecast Market Size by Country

13.7.1 Saudi Arabia

13.7.2 South Africa

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Recreational Boat Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2016 to 2022 |

Market Size in 2023: |

USD 28.89 Bn. |

|

Forecast Period 2024-32 CAGR: |

2.49% |

Market Size in 2032: |

USD 36.05 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Engine Type |

|

||

|

By Engine Placement |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. RECREATIONAL BOAT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. RECREATIONAL BOAT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. RECREATIONAL BOAT MARKET COMPETITIVE RIVALRY

TABLE 005. RECREATIONAL BOAT MARKET THREAT OF NEW ENTRANTS

TABLE 006. RECREATIONAL BOAT MARKET THREAT OF SUBSTITUTES

TABLE 007. RECREATIONAL BOAT MARKET BY TYPE

TABLE 008. YACHTS MARKET OVERVIEW (2016-2028)

TABLE 009. SAILBOATS MARKET OVERVIEW (2016-2028)

TABLE 010. PERSONAL WATERCRAFT MARKET OVERVIEW (2016-2028)

TABLE 011. INFLATABLES MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. RECREATIONAL BOAT MARKET BY ENGINE TYPE

TABLE 014. ICE MARKET OVERVIEW (2016-2028)

TABLE 015. ELECTRIC MARKET OVERVIEW (2016-2028)

TABLE 016. RECREATIONAL BOAT MARKET BY ENGINE PLACEMENT

TABLE 017. OUTBOARDS MARKET OVERVIEW (2016-2028)

TABLE 018. INBOARDS MARKET OVERVIEW (2016-2028)

TABLE 019. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 020. NORTH AMERICA RECREATIONAL BOAT MARKET, BY TYPE (2016-2028)

TABLE 021. NORTH AMERICA RECREATIONAL BOAT MARKET, BY ENGINE TYPE (2016-2028)

TABLE 022. NORTH AMERICA RECREATIONAL BOAT MARKET, BY ENGINE PLACEMENT (2016-2028)

TABLE 023. N RECREATIONAL BOAT MARKET, BY COUNTRY (2016-2028)

TABLE 024. EUROPE RECREATIONAL BOAT MARKET, BY TYPE (2016-2028)

TABLE 025. EUROPE RECREATIONAL BOAT MARKET, BY ENGINE TYPE (2016-2028)

TABLE 026. EUROPE RECREATIONAL BOAT MARKET, BY ENGINE PLACEMENT (2016-2028)

TABLE 027. RECREATIONAL BOAT MARKET, BY COUNTRY (2016-2028)

TABLE 028. ASIA PACIFIC RECREATIONAL BOAT MARKET, BY TYPE (2016-2028)

TABLE 029. ASIA PACIFIC RECREATIONAL BOAT MARKET, BY ENGINE TYPE (2016-2028)

TABLE 030. ASIA PACIFIC RECREATIONAL BOAT MARKET, BY ENGINE PLACEMENT (2016-2028)

TABLE 031. RECREATIONAL BOAT MARKET, BY COUNTRY (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA RECREATIONAL BOAT MARKET, BY TYPE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA RECREATIONAL BOAT MARKET, BY ENGINE TYPE (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA RECREATIONAL BOAT MARKET, BY ENGINE PLACEMENT (2016-2028)

TABLE 035. RECREATIONAL BOAT MARKET, BY COUNTRY (2016-2028)

TABLE 036. SOUTH AMERICA RECREATIONAL BOAT MARKET, BY TYPE (2016-2028)

TABLE 037. SOUTH AMERICA RECREATIONAL BOAT MARKET, BY ENGINE TYPE (2016-2028)

TABLE 038. SOUTH AMERICA RECREATIONAL BOAT MARKET, BY ENGINE PLACEMENT (2016-2028)

TABLE 039. RECREATIONAL BOAT MARKET, BY COUNTRY (2016-2028)

TABLE 040. BRUNSWICK CORPORATION: SNAPSHOT

TABLE 041. BRUNSWICK CORPORATION: BUSINESS PERFORMANCE

TABLE 042. BRUNSWICK CORPORATION: PRODUCT PORTFOLIO

TABLE 043. BRUNSWICK CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. GROUPE BENETEAU: SNAPSHOT

TABLE 044. GROUPE BENETEAU: BUSINESS PERFORMANCE

TABLE 045. GROUPE BENETEAU: PRODUCT PORTFOLIO

TABLE 046. GROUPE BENETEAU: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. MALIBU BOATS: SNAPSHOT

TABLE 047. MALIBU BOATS: BUSINESS PERFORMANCE

TABLE 048. MALIBU BOATS: PRODUCT PORTFOLIO

TABLE 049. MALIBU BOATS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. POLARIS INC. AND MASTERCRAFT BOAT COMPANY: SNAPSHOT

TABLE 050. POLARIS INC. AND MASTERCRAFT BOAT COMPANY: BUSINESS PERFORMANCE

TABLE 051. POLARIS INC. AND MASTERCRAFT BOAT COMPANY: PRODUCT PORTFOLIO

TABLE 052. POLARIS INC. AND MASTERCRAFT BOAT COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. CANDELA: SNAPSHOT

TABLE 053. CANDELA: BUSINESS PERFORMANCE

TABLE 054. CANDELA: PRODUCT PORTFOLIO

TABLE 055. CANDELA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. DOMANI YACHTS: SNAPSHOT

TABLE 056. DOMANI YACHTS: BUSINESS PERFORMANCE

TABLE 057. DOMANI YACHTS: PRODUCT PORTFOLIO

TABLE 058. DOMANI YACHTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. EDORADO MARINE: SNAPSHOT

TABLE 059. EDORADO MARINE: BUSINESS PERFORMANCE

TABLE 060. EDORADO MARINE: PRODUCT PORTFOLIO

TABLE 061. EDORADO MARINE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. ELCO MOTOR YACHTS: SNAPSHOT

TABLE 062. ELCO MOTOR YACHTS: BUSINESS PERFORMANCE

TABLE 063. ELCO MOTOR YACHTS: PRODUCT PORTFOLIO

TABLE 064. ELCO MOTOR YACHTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. ELECTRACRAFT: SNAPSHOT

TABLE 065. ELECTRACRAFT: BUSINESS PERFORMANCE

TABLE 066. ELECTRACRAFT: PRODUCT PORTFOLIO

TABLE 067. ELECTRACRAFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. RECREATIONAL BOAT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. RECREATIONAL BOAT MARKET OVERVIEW BY TYPE

FIGURE 012. YACHTS MARKET OVERVIEW (2016-2028)

FIGURE 013. SAILBOATS MARKET OVERVIEW (2016-2028)

FIGURE 014. PERSONAL WATERCRAFT MARKET OVERVIEW (2016-2028)

FIGURE 015. INFLATABLES MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. RECREATIONAL BOAT MARKET OVERVIEW BY ENGINE TYPE

FIGURE 018. ICE MARKET OVERVIEW (2016-2028)

FIGURE 019. ELECTRIC MARKET OVERVIEW (2016-2028)

FIGURE 020. RECREATIONAL BOAT MARKET OVERVIEW BY ENGINE PLACEMENT

FIGURE 021. OUTBOARDS MARKET OVERVIEW (2016-2028)

FIGURE 022. INBOARDS MARKET OVERVIEW (2016-2028)

FIGURE 023. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 024. NORTH AMERICA RECREATIONAL BOAT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. EUROPE RECREATIONAL BOAT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. ASIA PACIFIC RECREATIONAL BOAT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. MIDDLE EAST & AFRICA RECREATIONAL BOAT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. SOUTH AMERICA RECREATIONAL BOAT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Recreational Boat Market research report is 2022-2028.

The key players mentioned are Brunswick Corporation, Groupe Beneteau, Malibu Boats, Polaris Inc., MasterCraft Boat Company, Candela, DOMANI Yachts, Edorado Marine, Elco Motor Yachts, Electracraft and other major players.

The Recreational Boat market is segmented into Type, Engine Type, Engine Placement and region. By Type, it is classified into: Yachts, Sailboats, Personal Watercraft, Inflatables, Others. By Engine Type, it is classified into: Ice, Electric. By Engine Placement, it is classified into: Outboards, Inboards, Others. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

Recreational boats are generally, vessels that are manufactured or to be used specifically for non-commercial use or leased or rented for any given commercial use later on. Such boats are utilized for sailing, fishing, travel through waterways, and leisure purposes which are specifically for private use.

Global Recreational Boat Market Size Was Valued at USD 28.89 Billion In 2023 And Is Projected to Reach USD 36.05 Billion By 2032, Growing at A CAGR of 2.49% From 2024- 2032