Global Horticulture Bioplastic Market Overview

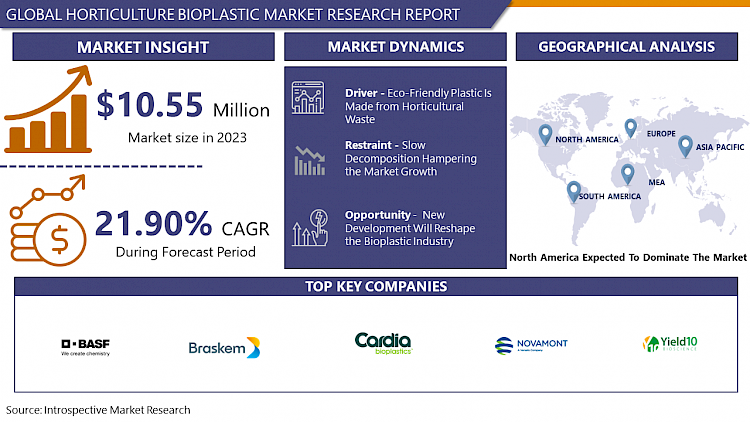

The Horticulture Bioplastic Market was estimated at USD 10.55 billion in 2023 and is anticipated to reach USD 62.70 billion by 2032, growing at a CAGR of 21.90% globally.

Bioplastics are plastics made from renewable biomass sources such as vegetable fats and oils, corn starch, straw, woodchips, sawdust, and recovered food waste, among others. Some bioplastics are made directly from natural biopolymers such as polysaccharides (e.g. starch, cellulose, chitosan, and alginate) and proteins (e.g. soy protein, gluten, and gelatin), while others are chemically synthesized from sugar derivatives (e.g. lactic acid) and lipids (oils and fats) from plants and animals, or biologically produced through sugar or lipid fermentation. Common plastics, such as fossil-fuel plastics (also known as petro-based polymers), on the other hand, are made from petroleum or natural gas.

To make Horticulture Bioplastics acceptable for field use and competitive with plastic products, manufacturers must also collaborate with consumers and suppliers. Manufacturers must offer superior performance attributes, as well as economic viability and ease of availability, for horticulture bioplastic to become a widely utilized material. To retain green solutions for the horticulture sector, manufacturers should also focus on specific conditions required for disposal at end-of-life with current recycling systems. Bioplastics are being employed in a growing number of applications, including packaging and consumer goods also. According to the European Bioplastics Conference, the global production of horticulture bioplastics was 243000 tons in 2021.

Market Dynamics And Key Factors of Horticulture Bioplastic Market

Drivers:

Eco-Friendly Plastic Is Made from Horticultural Waste

The environment is becoming increasingly contaminated. The water is becoming a dumping ground for plastic bottles, plastic bags, and other harmful materials, posing a threat to marine life and the environment. Though plastic is used in agriculture for mulching and other uses, no one has ever considered that horticulture trash could be transformed into environmentally beneficial plastic. Researchers at Ecoembes' Circular Lab, a circular economy innovation Centre, have invented a new plastic that is biobased, compostable, recyclable, and biodegradable at sea. It's manufactured from fruit and vegetable waste, and it's expected to be approved for usage in the next five years. Jorge Garca, an Ecoembes innovation specialist, explains the distinctions between biobased bioplastic (made from biomass) and biodegradable bioplastic (which come from oil). The project's major purpose, according to Garca, was to create biobased and compostable packaging. Now that the product has been developed in the laboratory, it's time for the industry to approve it and issue compliance certificates. In around five years, the plastic items that come from this breakthrough could be on the market.

Growing Awareness Among the Individuals by Supporting the Government Policies

In the next years, demand for horticulture bioplastics will be driven by a shift in customer preferences toward environmentally friendly products. As a result, major plastic makers and packaging vendors have shifted their focus to bioplastic technology. Furthermore, landfills constitute a significant environmental threat, prompting the use of bioplastic in horticulture techniques. With innovative biodegradable materials, greenhouses and gardeners may simply reduce the environmental impact of plastic pots. Government initiatives are encouraging horticulturists to utilize sustainable and environmentally friendly goods, which is one of the primary drivers driving the bioplastics market in the horticulture industry. Organizations that produce and promote environmentally friendly materials can also benefit from government subsidies, incentives, exemptions, and certifications.

Restraints:

Slow Decomposition Hampering the Market Growth

Crop-based bioplastics are dependent on weather conditions and require fertile land, water, and fertilizers. This means that natural disasters, such as drought, could threaten the supply of raw ingredients for bioplastics. Due to inferior mechanical qualities, such as more water vapor permeability than normal plastic, being easy to shred like tissue paper, or being exceedingly brittle, some bioplastics have a shorter lifetime than oil-based polymers. When placed in water, some algae-based bioplastics will degrade in a matter of hours, making them both biodegradable and fragile. Recycling horticultural bioplastic products is a time-consuming and expensive procedure, which has limited its use in the industry. The slow breakdown of horticulture bioplastics may also limit their usage in agriculture.

Opportunities:

New Development Will Reshape the Bioplastic Industry

The environmental impact of vast amounts of non-biodegradable waste materials is spurring research into novel biodegradable materials made from natural resources such as biomass, plants, and microorganisms. Bioplastics' new improvements in the future may result in increased manufacturing efficiency, as well as new applications and prospects for bioplastics. Furthermore, due to its long-term viability, the future market for bioplastics is expected to grow. Furthermore, microorganism biotechnology opens the door to bioplastic production because it may be used and commercialized in a variety of industries, including agriculture, medicine, pharmaceuticals, and veterinary medicine. As a result, a new bioplastics guideline and standard should be developed for bioplastics production, use, and waste disposal around the world. As a result, product labeling legislation must be improved to consider raw material usage, energy consumption, and manufacturing and use emissions.

Challenges:

Bioplastics are frequently advocated as a long-term and environmentally friendly alternative to traditional plastics. However, the creation of bioplastics has become the most difficult task since it must avoid disturbing potential food sources. This situation can be alleviated by utilizing non-food resources for the task. Second-generation bioplastics are what they're termed. These, on the other hand, must be manufactured using methods like extrusion, compression, and injection molding. Bioplastics' potential environmental hazards and repercussions have yet to be fully explored and understood. As a result, more research is needed to overcome the restricted resources available, improve resource efficiency, and mitigate environmental issues.

Market Segmentation

Segmentation Analysis of Horticulture Bioplastic Market:

By Type, the bio-based segment is anticipated to dominate the horticulture bioplastic market over the forecast period. Bio-based plastics are fully or partially made from biological resources, rather than fossil raw materials. The Bio range of protective solutions is made from plant-based bioplastic. Sourced from sugar canes, the Bio range is a natural progression in our commitment to make a positive impact on the world around us. Bioplastics have the same physical and chemical properties as regular plastic and maintain full recycling capabilities. In various applications from transportation and industrial to energy and packaging, bio-based materials have demonstrated performance benefits over petroleum-derived incumbents.

By Raw Material, Bio- the Polyethene Terephthalate segment is expected to dominate the Horticulture Bioplastic market over the forecast period. Polyesters are a broad class of polymers with the potential to be synthesized from bio-based feedstocks. According to the European Bioplastic Report, the most important for a shift toward bio-based chemicals are PET, PBT, PBS, PBA, and the copolymers PBAT, poly (butylene succinate-co-lactate) (PBSL), poly (butylene succinate adipate) (PBSA), and poly (butylene succinate terephthalate) (PBST), but also polyvinylacetate (PVAc), polyacrylates, poly (trim Those polymers are made from a bio-based diol, whereas diacid or diester can be bio-based (such as succinic or adipic acid) or petrochemical-based (such as PTA and/or dimethyl terephthalate, DMT). PET is the most commonly used polyester, with physical and mechanical qualities that make it excellent for fiber (65%) and packaging (35%). This last application is for bottles (76%), containers (11%), and films (13%). It is essential in the plastic industry, but due to its poor sustainability due to a much slower degradability, it causes serious environmental difficulties, particularly for waste treatment, when utilized for short-term applications, such as food packaging.

Regional Analysis of Horticulture Bioplastic Market:

North America presently dominates the horticulture bioplastic industry, and this dominance is expected to remain in the next years. Government support and growing consumer health awareness are the key elements pushing the development of bioplastics. The presence of prominent manufacturers such as Metabolix, Inc. (US), Green Dot Bioplastics (US), Good Natured Products Inc. (Canada), Natureworks LLC (US), and others is accelerating the market's expansion over the projection period. To grow their business, the market's leading players have used methods such as R&D investment, innovations, and developments in the industry, new product releases, acquisitions, and mergers.

The Asia-Pacific region is the major shareholder in the global bioplastic industry in terms of market size and volume. This increase was considerable due to low production and labor costs, rapid urbanization, and industrialization in developing countries such as Japan, China, and India, and increased awareness of the benefits of bio-based chemicals. According to a European Bioplastics report, around 56 percent is produced in the region. The sector in this region is predicted to grow fast as China concentrates on adopting its foreign investment law, which has been delayed owing to the worldwide pandemic. The region's thriving packaging industry will help to drive regional growth even further.

One of the key factors impacting the market in the Rest of the World is the growing demand for bioplastics for agriculture and horticulture. Furthermore, the expansion of the food products manufacturing industry will be a defining component in the region's progress. As the global society seeks restrictions on the use of traditional plastics, these manufacturers have sought sustainable packaging options for their products.

Players Covered In Horticulture Bioplastic Market are:

- BASF S.A. (Germany)

- Braskem (Brazil)

- Cardia Bioplastics (Australia)

- Novomant SPA (Italy)

- Metabolix Inc. (US)

- Innovia Films (UK)

- Biome Technologies Plc (UK)

- FKuR Kunststoff GmbH (Germany)

- Green Dot Bioplastics (US)

- Good Natured Products Inc. (Canada)

- Natureworks LLC (US)

- Corbion Purac (Netherlands)

- Purac (Netherlands) and other major players.

COVID-19 Impact Analysis on Horticulture Bioplastic Market

According to World Bank data, global GDP will have decreased by around 3.5 percent in 2020 as a result of the COVID-19 epidemic. By 2021, several countries' economies have begun to recover and have partially adjusted to pandemic constraints. Since the advent of the COVID-19 pandemic, all production, manufacturing, research, import-export, and other operations have come to a halt. The COVID-19 epidemic has resulted in severe economic, industrial, GDP, and, most significantly, human life losses, as well as the emergence of a hunger crisis among lower-income and daily wage laborers, who are unable to feed their families. The industry's processing and output were halted due to a decline in plastic manufacture. Many end-user industries, including transportation, industrial equipment, consumer items, automotive, electronics, and construction, were severely damaged. The COVID-19 epidemic prompted the installation of a lockdown, which reduced horticulture bioplastic production and disrupted the worldwide supply chain, lowering demand for the horticulture bioplastic market.

Key Industry Developments In Horticulture Bioplastic Market

- In January 2023, US Agriculture Secretary Tom Vilsack stated that the USDA is following through on its promise to expand markets by spending US$1 Bn in partnerships to benefit America's climate-smart farmers, ranchers, and forest landowners. The new Partnerships for Climate-Smart Commodities opportunity will fund pilot projects to develop market opportunities for US agriculture and forestry goods that adopt climate-smart practices and incorporate novel, cost-effective methods of measuring and verifying greenhouse gas benefits.

|

Global Horticulture Bioplastic Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

21.90% |

Market Size in 2032: |

USD 62.70 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Raw Material |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Raw Material

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Horticulture Bioplastic Market by Type

5.1 Horticulture Bioplastic Market Overview Snapshot and Growth Engine

5.2 Horticulture Bioplastic Market Overview

5.3 Bio based

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Bio based: Grographic Segmentation

5.4 Petrochemical based

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Petrochemical based: Grographic Segmentation

Chapter 6: Horticulture Bioplastic Market by Raw Material

6.1 Horticulture Bioplastic Market Overview Snapshot and Growth Engine

6.2 Horticulture Bioplastic Market Overview

6.3 Polyesters

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Polyesters: Grographic Segmentation

6.4 Bio-Polyethylene

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Bio-Polyethylene: Grographic Segmentation

6.5 Polylactic Acid

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Polylactic Acid: Grographic Segmentation

6.6 Bio-Polyamide

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Bio-Polyamide: Grographic Segmentation

6.7 Bio-Polyethene Terephthalate

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Bio-Polyethene Terephthalate: Grographic Segmentation

6.8 Polyhydroxyalkanoates

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Polyhydroxyalkanoates: Grographic Segmentation

6.9 Starch Blends

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size (2017-2032F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 Starch Blends: Grographic Segmentation

6.10 Others

6.10.1 Introduction and Market Overview

6.10.2 Historic and Forecasted Market Size (2017-2032F)

6.10.3 Key Market Trends, Growth Factors and Opportunities

6.10.4 Others: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Horticulture Bioplastic Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Horticulture Bioplastic Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Horticulture Bioplastic Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 BASF S.A.

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 BRASKEM

7.4 CARDIA BIOPLASTICS

7.5 NOVOMANT SPA

7.6 METABOLIX INC.

7.7 INNOVIA FILMS

7.8 BIOME TECHNOLOGIES PLC

7.9 FKUR KUNSTSTOFF GMBH

7.10 GREEN DOT BIOPLASTICS

7.11 GOOD NATURED PRODUCTS INC.

7.12 NATUREWORKS LLC

7.13 CORBION PURAC

7.14 PURAC

7.15 OTHER MAJOR PLAYERS

Chapter 8: Global Horticulture Bioplastic Market Analysis, Insights and Forecast, 2017-2032

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Bio based

8.2.2 Petrochemical based

8.3 Historic and Forecasted Market Size By Raw Material

8.3.1 Polyesters

8.3.2 Bio-Polyethylene

8.3.3 Polylactic Acid

8.3.4 Bio-Polyamide

8.3.5 Bio-Polyethene Terephthalate

8.3.6 Polyhydroxyalkanoates

8.3.7 Starch Blends

8.3.8 Others

Chapter 9: North America Horticulture Bioplastic Market Analysis, Insights and Forecast, 2017-2032

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Bio based

9.4.2 Petrochemical based

9.5 Historic and Forecasted Market Size By Raw Material

9.5.1 Polyesters

9.5.2 Bio-Polyethylene

9.5.3 Polylactic Acid

9.5.4 Bio-Polyamide

9.5.5 Bio-Polyethene Terephthalate

9.5.6 Polyhydroxyalkanoates

9.5.7 Starch Blends

9.5.8 Others

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Horticulture Bioplastic Market Analysis, Insights and Forecast, 2017-2032

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Bio based

10.4.2 Petrochemical based

10.5 Historic and Forecasted Market Size By Raw Material

10.5.1 Polyesters

10.5.2 Bio-Polyethylene

10.5.3 Polylactic Acid

10.5.4 Bio-Polyamide

10.5.5 Bio-Polyethene Terephthalate

10.5.6 Polyhydroxyalkanoates

10.5.7 Starch Blends

10.5.8 Others

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Horticulture Bioplastic Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Bio based

11.4.2 Petrochemical based

11.5 Historic and Forecasted Market Size By Raw Material

11.5.1 Polyesters

11.5.2 Bio-Polyethylene

11.5.3 Polylactic Acid

11.5.4 Bio-Polyamide

11.5.5 Bio-Polyethene Terephthalate

11.5.6 Polyhydroxyalkanoates

11.5.7 Starch Blends

11.5.8 Others

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Horticulture Bioplastic Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Bio based

12.4.2 Petrochemical based

12.5 Historic and Forecasted Market Size By Raw Material

12.5.1 Polyesters

12.5.2 Bio-Polyethylene

12.5.3 Polylactic Acid

12.5.4 Bio-Polyamide

12.5.5 Bio-Polyethene Terephthalate

12.5.6 Polyhydroxyalkanoates

12.5.7 Starch Blends

12.5.8 Others

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Horticulture Bioplastic Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Bio based

13.4.2 Petrochemical based

13.5 Historic and Forecasted Market Size By Raw Material

13.5.1 Polyesters

13.5.2 Bio-Polyethylene

13.5.3 Polylactic Acid

13.5.4 Bio-Polyamide

13.5.5 Bio-Polyethene Terephthalate

13.5.6 Polyhydroxyalkanoates

13.5.7 Starch Blends

13.5.8 Others

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Horticulture Bioplastic Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

21.90% |

Market Size in 2032: |

USD 62.70 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Raw Material |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HORTICULTURE BIOPLASTIC MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HORTICULTURE BIOPLASTIC MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HORTICULTURE BIOPLASTIC MARKET COMPETITIVE RIVALRY

TABLE 005. HORTICULTURE BIOPLASTIC MARKET THREAT OF NEW ENTRANTS

TABLE 006. HORTICULTURE BIOPLASTIC MARKET THREAT OF SUBSTITUTES

TABLE 007. HORTICULTURE BIOPLASTIC MARKET BY TYPE

TABLE 008. BIO BASED MARKET OVERVIEW (2016-2028)

TABLE 009. PETROCHEMICAL BASED MARKET OVERVIEW (2016-2028)

TABLE 010. HORTICULTURE BIOPLASTIC MARKET BY RAW MATERIAL

TABLE 011. POLYESTERS MARKET OVERVIEW (2016-2028)

TABLE 012. BIO-POLYETHYLENE MARKET OVERVIEW (2016-2028)

TABLE 013. POLYLACTIC ACID MARKET OVERVIEW (2016-2028)

TABLE 014. BIO-POLYAMIDE MARKET OVERVIEW (2016-2028)

TABLE 015. BIO-POLYETHENE TEREPHTHALATE MARKET OVERVIEW (2016-2028)

TABLE 016. POLYHYDROXYALKANOATES MARKET OVERVIEW (2016-2028)

TABLE 017. STARCH BLENDS MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA HORTICULTURE BIOPLASTIC MARKET, BY TYPE (2016-2028)

TABLE 020. NORTH AMERICA HORTICULTURE BIOPLASTIC MARKET, BY RAW MATERIAL (2016-2028)

TABLE 021. N HORTICULTURE BIOPLASTIC MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE HORTICULTURE BIOPLASTIC MARKET, BY TYPE (2016-2028)

TABLE 023. EUROPE HORTICULTURE BIOPLASTIC MARKET, BY RAW MATERIAL (2016-2028)

TABLE 024. HORTICULTURE BIOPLASTIC MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC HORTICULTURE BIOPLASTIC MARKET, BY TYPE (2016-2028)

TABLE 026. ASIA PACIFIC HORTICULTURE BIOPLASTIC MARKET, BY RAW MATERIAL (2016-2028)

TABLE 027. HORTICULTURE BIOPLASTIC MARKET, BY COUNTRY (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA HORTICULTURE BIOPLASTIC MARKET, BY TYPE (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA HORTICULTURE BIOPLASTIC MARKET, BY RAW MATERIAL (2016-2028)

TABLE 030. HORTICULTURE BIOPLASTIC MARKET, BY COUNTRY (2016-2028)

TABLE 031. SOUTH AMERICA HORTICULTURE BIOPLASTIC MARKET, BY TYPE (2016-2028)

TABLE 032. SOUTH AMERICA HORTICULTURE BIOPLASTIC MARKET, BY RAW MATERIAL (2016-2028)

TABLE 033. HORTICULTURE BIOPLASTIC MARKET, BY COUNTRY (2016-2028)

TABLE 034. BASF S.A.: SNAPSHOT

TABLE 035. BASF S.A.: BUSINESS PERFORMANCE

TABLE 036. BASF S.A.: PRODUCT PORTFOLIO

TABLE 037. BASF S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. BRASKEM: SNAPSHOT

TABLE 038. BRASKEM: BUSINESS PERFORMANCE

TABLE 039. BRASKEM: PRODUCT PORTFOLIO

TABLE 040. BRASKEM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. CARDIA BIOPLASTICS: SNAPSHOT

TABLE 041. CARDIA BIOPLASTICS: BUSINESS PERFORMANCE

TABLE 042. CARDIA BIOPLASTICS: PRODUCT PORTFOLIO

TABLE 043. CARDIA BIOPLASTICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. NOVOMANT SPA: SNAPSHOT

TABLE 044. NOVOMANT SPA: BUSINESS PERFORMANCE

TABLE 045. NOVOMANT SPA: PRODUCT PORTFOLIO

TABLE 046. NOVOMANT SPA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. METABOLIX INC.: SNAPSHOT

TABLE 047. METABOLIX INC.: BUSINESS PERFORMANCE

TABLE 048. METABOLIX INC.: PRODUCT PORTFOLIO

TABLE 049. METABOLIX INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. INNOVIA FILMS: SNAPSHOT

TABLE 050. INNOVIA FILMS: BUSINESS PERFORMANCE

TABLE 051. INNOVIA FILMS: PRODUCT PORTFOLIO

TABLE 052. INNOVIA FILMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. BIOME TECHNOLOGIES PLC: SNAPSHOT

TABLE 053. BIOME TECHNOLOGIES PLC: BUSINESS PERFORMANCE

TABLE 054. BIOME TECHNOLOGIES PLC: PRODUCT PORTFOLIO

TABLE 055. BIOME TECHNOLOGIES PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. FKUR KUNSTSTOFF GMBH: SNAPSHOT

TABLE 056. FKUR KUNSTSTOFF GMBH: BUSINESS PERFORMANCE

TABLE 057. FKUR KUNSTSTOFF GMBH: PRODUCT PORTFOLIO

TABLE 058. FKUR KUNSTSTOFF GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. GREEN DOT BIOPLASTICS: SNAPSHOT

TABLE 059. GREEN DOT BIOPLASTICS: BUSINESS PERFORMANCE

TABLE 060. GREEN DOT BIOPLASTICS: PRODUCT PORTFOLIO

TABLE 061. GREEN DOT BIOPLASTICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. GOOD NATURED PRODUCTS INC.: SNAPSHOT

TABLE 062. GOOD NATURED PRODUCTS INC.: BUSINESS PERFORMANCE

TABLE 063. GOOD NATURED PRODUCTS INC.: PRODUCT PORTFOLIO

TABLE 064. GOOD NATURED PRODUCTS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. NATUREWORKS LLC: SNAPSHOT

TABLE 065. NATUREWORKS LLC: BUSINESS PERFORMANCE

TABLE 066. NATUREWORKS LLC: PRODUCT PORTFOLIO

TABLE 067. NATUREWORKS LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. CORBION PURAC: SNAPSHOT

TABLE 068. CORBION PURAC: BUSINESS PERFORMANCE

TABLE 069. CORBION PURAC: PRODUCT PORTFOLIO

TABLE 070. CORBION PURAC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. PURAC: SNAPSHOT

TABLE 071. PURAC: BUSINESS PERFORMANCE

TABLE 072. PURAC: PRODUCT PORTFOLIO

TABLE 073. PURAC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 074. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 075. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 076. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HORTICULTURE BIOPLASTIC MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HORTICULTURE BIOPLASTIC MARKET OVERVIEW BY TYPE

FIGURE 012. BIO BASED MARKET OVERVIEW (2016-2028)

FIGURE 013. PETROCHEMICAL BASED MARKET OVERVIEW (2016-2028)

FIGURE 014. HORTICULTURE BIOPLASTIC MARKET OVERVIEW BY RAW MATERIAL

FIGURE 015. POLYESTERS MARKET OVERVIEW (2016-2028)

FIGURE 016. BIO-POLYETHYLENE MARKET OVERVIEW (2016-2028)

FIGURE 017. POLYLACTIC ACID MARKET OVERVIEW (2016-2028)

FIGURE 018. BIO-POLYAMIDE MARKET OVERVIEW (2016-2028)

FIGURE 019. BIO-POLYETHENE TEREPHTHALATE MARKET OVERVIEW (2016-2028)

FIGURE 020. POLYHYDROXYALKANOATES MARKET OVERVIEW (2016-2028)

FIGURE 021. STARCH BLENDS MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA HORTICULTURE BIOPLASTIC MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE HORTICULTURE BIOPLASTIC MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC HORTICULTURE BIOPLASTIC MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA HORTICULTURE BIOPLASTIC MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA HORTICULTURE BIOPLASTIC MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the market Horticulture Bioplastic research report is 2024-2032.

BASF S.A. (Germany), Braskem (Brazil), Cardia Bioplastics (Australia), Novomant SPA (Italy), Metabolix Inc. (US), Innovia Films (UK), Biome Technologies Plc (UK), FKuR Kunststoff GmbH (Germany), Green Dot Bioplastics (US), Good Natured Products Inc. (Canada), Natureworks LLC (US), Corbion Purac (Netherlands), Purac (Netherlands), and other major players.

The Horticulture Bioplastic market is segmented into Type, Raw Material and region. By Type, it is categorized into Biobased and Petrochemical based. By Raw Material it is categorized into Polyesters, Bio- Polyethylene, Polylactic Acid, Bio- Polyamide, Bio- Polyethene Terephthalate, Polyhydroxyalkanoates, Starch Blends, Others. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

To make horticulture bioplastics acceptable for field use and competitive with plastic products, manufacturers must also collaborate with consumers and suppliers. Manufacturers must offer superior performance attributes, as well as economic viability and ease of availability, for horticulture bioplastic to become a widely utilized material.

The Horticulture Bioplastic Market was estimated at USD 10.55 billion in 2023 and is anticipated to reach USD 62.70 billion by 2032, growing at a CAGR of 21.90% globally.