Alfalfa Market Synopsis

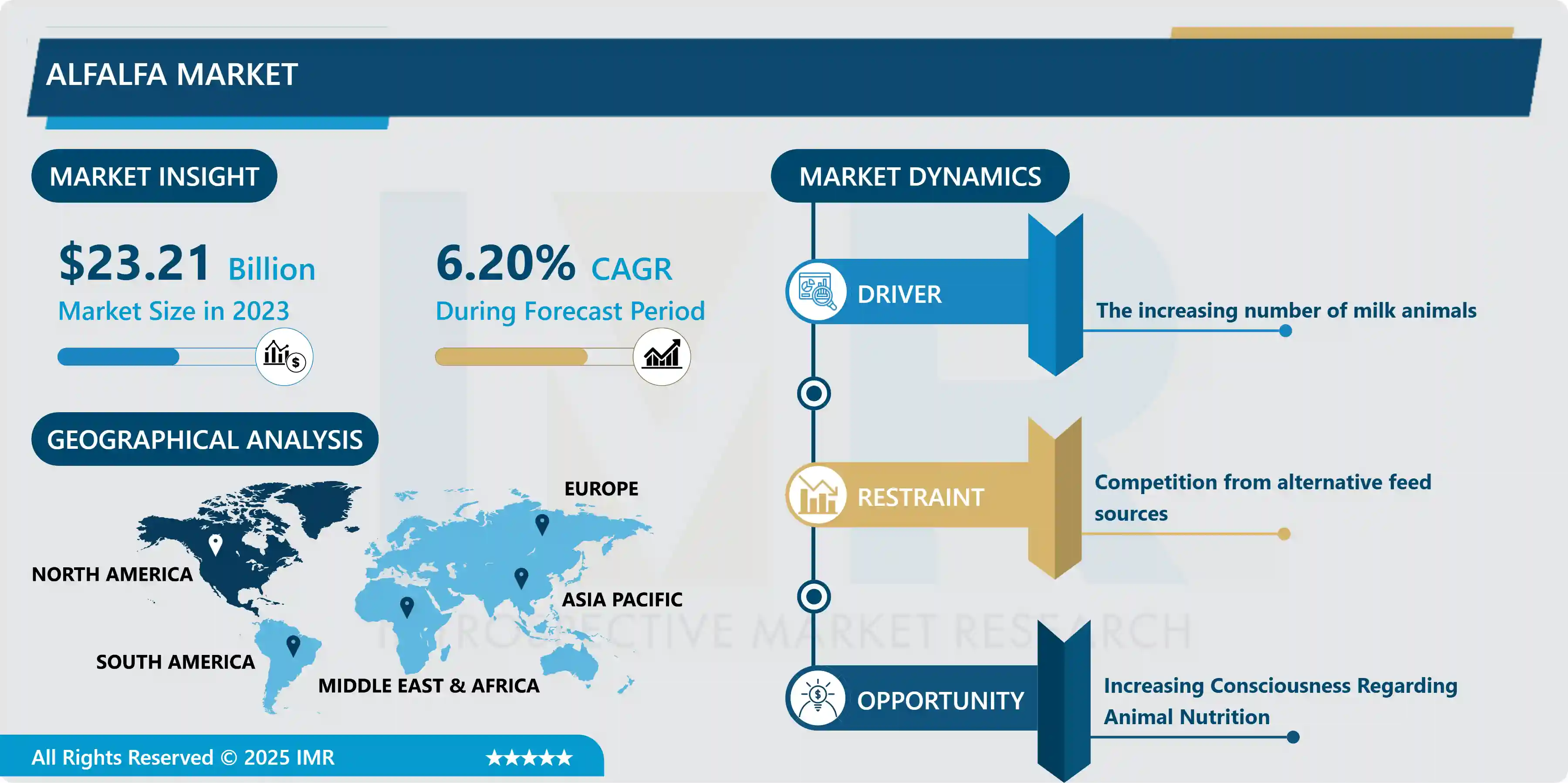

Alfalfa Market Size Was Valued at USD 23.21 Billion in 2023, and is Projected to Reach 39.88 USD Billion by 2032, Growing at a CAGR of 6.2% From 2024-2032.

Alfalfa is a tonic plant rich in proteins, minerals, enzymes, and vitamins. A bulk quantity of the whole plant is required in the pharmaceutical industries, especially for homeopathic pharmacies.

The increasing awareness regarding animal nutrition among the people is one of the important key factors driving the growth of the market. This can be attributed to the increasing consumer demand for chemical-free meat and milk-based products. Product manufacturers are using innovative processing and harvesting machinery to produce long-fiber hay cubes and hay products with enhanced fiber content.

In the US, beef industries have the most influence over alfalfa and hay prices. In terms of regional analysis, North America, particularly the US is the largest producer as well as exporter of alfalfa owing to the country's excellent geographical conditions. The country is known for its various best-quality alfalfa products.

China imports more than 50 percent of alfalfa products exported by the US owing to the increasing number of dairy and cattle farming in the country. Thus, the increasing consumption and rising demand are leading to the rapid growth of the Alfalfa market in the forecasted years.

Alfalfa Market Trend Analysis

Alfalfa Market Trend Analysis

The Increasing Number of Milk Animals

- The rising milk-producing animal population is one of the prominent factors boosting the development of the alfalfa market. Alfalfa is known for its rich source of protein, high nutrient content, and energy that helps in improving lactation, reproduction, maintenance, and growth of the livestock.

- Over the long term, there has been a rise in demand from commercial dairy operators for alfalfa which is further anticipated to increase due to the increase in investment in large-scale dairy operations.

- The usage of alfalfa has become crucial to poultry feed, followed by animal feed in recent years owing to its importance for crude protein content. The growing dependence on alfalfa for animal feed is increasing exponentially thereby, stimulating the expansion of the alfalfa market over the forecast period.

Increasing Consciousness Regarding Animal Nutrition Creates an Opportunity Line Here

- The growing awareness of the crucial role of animal nutrition in overall health has presented a significant opportunity for the alfalfa market. As consumers become increasingly conscious of the quality of animal products, such as meat and dairy, there is a heightened demand for nutritious and natural feed sources. Alfalfa, with its rich nutritional profile, is gaining prominence as an essential component in animal diets.

- Alfalfa is a high-quality forage that is rich in protein but also contains essential vitamins and minerals. Its inclusion in animal feed enhances the nutritional value of the end products, meeting the discerning preferences of health-conscious consumers. Moreover, the sustainable and eco-friendly nature of alfalfa cultivation aligns with the growing emphasis on ethical and responsible agricultural practices.

- As the awareness of the direct link between animal nutrition and the quality of animal-derived products continues to rise, the alfalfa market is poised for expansion. Producers and suppliers in the agricultural sector have an opportunity to capitalize on this trend by promoting the benefits of alfalfa-based feeds, thereby contributing to the overall improvement of animal welfare and the production of healthier food options for consumers.

Alfalfa Market Segment Analysis:

Alfalfa Market Segmented based on type, application, and Animal type.

By Animal Type, cattle segment is expected to dominate the market during the forecast period

- The cattle segment is poised to assert its dominance in the alfalfa market, driven by various factors that align with the nutritional needs and feeding preferences of cattle. Alfalfa, a highly nutritious forage crop, serves as a staple in the diet of cattle due to its rich content of proteins, vitamins, and minerals. This makes it an ideal choice for livestock, particularly in the beef and dairy industries.

- Cattle farmers widely recognize the benefits of incorporating alfalfa into the feed regimen for their herds. The forage's high protein content is crucial for promoting muscle development, milk production in dairy cows, and overall animal health. Additionally, the digestibility of alfalfa makes it an efficient and valuable source of nutrients for cattle.

By Application, Dairy cow feed segment held the largest share of 48.7% in 2022

- The dairy cow feed segment is poised to assert dominance in the alfalfa market, reflecting the pivotal role of alfalfa in supporting optimal nutrition for dairy cattle. This prominence is underpinned by the exceptional nutritional profile of alfalfa, which aligns with the specific dietary requirements of dairy cows. As a rich source of protein, fiber, and essential nutrients, alfalfa proves instrumental in enhancing milk production and quality.

- Dairy farmers recognize the significance of incorporating alfalfa into the feed regimen for their cows, as it positively impacts milk yield and the overall health of the animals. The high protein content in alfalfa contributes to improved lactation performance, ensuring a robust supply of quality milk.

- Additionally, alfalfa's digestibility and palatability make it a preferred choice in formulating well-balanced and nutritious feed for dairy cows. Its versatility in various forms, including hay and pellets, adds to its appeal for feed manufacturers aiming to create customized blends tailored to the specific needs of dairy cattle.

Alfalfa Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is poised to assert its dominance in the alfalfa market, driven by a combination of favorable climatic conditions, advanced agricultural practices, and increasing demand for high-quality forage. The region's extensive agricultural landscape, particularly in the United States and Canada, provides ideal environments for alfalfa cultivation.

- Alfalfa, known for its nutrient-rich composition and versatility as livestock feed, is a staple in North American agriculture. The region's commitment to modern farming techniques, including precision agriculture and genetic advancements, further enhances alfalfa yields and quality. These innovations contribute to a robust and competitive alfalfa market.

- Moreover, the escalating demand for alfalfa from the livestock industry, particularly dairy and beef production, fuels North America's dominance. As consumers prioritize healthier and more sustainable food options, the nutritional benefits of alfalfa make it a preferred choice for livestock feed. This trend is expected to sustain and strengthen North America's leadership in the global alfalfa market.

Alfalfa Market Top Key Players:

- Bayer AG

- Corteva Agriscience

- DLF

- Royal Barenbrug Group

- Syngenta Group

- Ampac Seed Company

- KWS SAAT SE & Co. KGaA

- Land O’Lakes Inc.

- RAGT Group

- S&W Seed Co.

- Al Dahra ACX Global Inc.

- Border Valley

- Standlee Hay Company

- Alfalfa Monegros

- Anderson Hay and Grain Co. Inc.

- Hay USA Inc.

- Pacific Coast Producers

- Timothy Hay Company

- The Gavilon Group LLC

- Interstate Commodities Inc., and Other Active Player.

Key Industry Developments in the Alfalfa Market:

- In August 2024, NIFA Invests $3.7M in Alfalfa Seed and Alfalfa Forage Systems. The Alfalfa Seed and Alfalfa Forage System Program (ASAFS) supports the development of improved alfalfa forage and seed production systems.

|

Alfalfa Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.21 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.2% |

Market Size in 2032: |

USD 39.88 Bn. |

|

Segments Covered: |

By Feed Type |

|

|

|

By Application |

|

||

|

By Animal Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Alfalfa Market by Feed Type (2018-2032)

4.1 Alfalfa Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hays

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Bales

4.5 Pellets

4.6 Cubes

Chapter 5: Alfalfa Market by Application (2018-2032)

5.1 Alfalfa Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Dairy Cow Feed

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cattle and Sheep Feed

5.5 Pig Feed

5.6 Horse Feed

5.7 Poultry Feed

Chapter 6: Alfalfa Market by Animal Type (2018-2032)

6.1 Alfalfa Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Cattle

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Horse

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Alfalfa Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 TUNATECH GMBH (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 VIAQUA THERAPEUTICS LTD. (ISRAEL)

7.4 ALPHARMA INC. (U.S.)

7.5 BLUE RIDGE AQUACULTURE (U.S.)

7.6 CERMAQ ASA (NORWAY)

7.7 COOKE AQUACULTURE (CANADA)

7.8 NIREUS AQUACULTURE S.A. (GREECE)

7.9 TASSAL GROUP LTD. (AUSTRALIA)

7.10 UNIMA GROUP (MEXICO)

7.11 NUTRECO HOLDING N.V. (NETHERLANDS)

7.12 KONA BAY MARINE RESOURCES (U.S.)

7.13 ROYAL GREENLAND A/S (DENMARK)

7.14 SEA WATCH INTERNATIONAL LTD. (U.S.)

7.15 SELONDA AQUACULTURE S.A. (GREECE)

7.16 STARKIST TAYLOR SHELLFISH INC. (U.S.)

7.17 TRIMARINE INTERNATIONAL (U.S.)

7.18 AQUABOUNTY TECHNOLOGIES INC. (U.S.)

7.19 BENCHMARK HOLDINGS PLC (UK)

7.20 ELANCO ANIMAL HEALTH INCORPORATED (U.S.)

7.21 ZOETIS INC. (U.S.)

7.22

Chapter 8: Global Alfalfa Market By Region

8.1 Overview

8.2. North America Alfalfa Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Feed Type

8.2.4.1 Hays

8.2.4.2 Bales

8.2.4.3 Pellets

8.2.4.4 Cubes

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Dairy Cow Feed

8.2.5.2 Cattle and Sheep Feed

8.2.5.3 Pig Feed

8.2.5.4 Horse Feed

8.2.5.5 Poultry Feed

8.2.6 Historic and Forecasted Market Size by Animal Type

8.2.6.1 Cattle

8.2.6.2 Horse

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Alfalfa Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Feed Type

8.3.4.1 Hays

8.3.4.2 Bales

8.3.4.3 Pellets

8.3.4.4 Cubes

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Dairy Cow Feed

8.3.5.2 Cattle and Sheep Feed

8.3.5.3 Pig Feed

8.3.5.4 Horse Feed

8.3.5.5 Poultry Feed

8.3.6 Historic and Forecasted Market Size by Animal Type

8.3.6.1 Cattle

8.3.6.2 Horse

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Alfalfa Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Feed Type

8.4.4.1 Hays

8.4.4.2 Bales

8.4.4.3 Pellets

8.4.4.4 Cubes

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Dairy Cow Feed

8.4.5.2 Cattle and Sheep Feed

8.4.5.3 Pig Feed

8.4.5.4 Horse Feed

8.4.5.5 Poultry Feed

8.4.6 Historic and Forecasted Market Size by Animal Type

8.4.6.1 Cattle

8.4.6.2 Horse

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Alfalfa Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Feed Type

8.5.4.1 Hays

8.5.4.2 Bales

8.5.4.3 Pellets

8.5.4.4 Cubes

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Dairy Cow Feed

8.5.5.2 Cattle and Sheep Feed

8.5.5.3 Pig Feed

8.5.5.4 Horse Feed

8.5.5.5 Poultry Feed

8.5.6 Historic and Forecasted Market Size by Animal Type

8.5.6.1 Cattle

8.5.6.2 Horse

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Alfalfa Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Feed Type

8.6.4.1 Hays

8.6.4.2 Bales

8.6.4.3 Pellets

8.6.4.4 Cubes

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Dairy Cow Feed

8.6.5.2 Cattle and Sheep Feed

8.6.5.3 Pig Feed

8.6.5.4 Horse Feed

8.6.5.5 Poultry Feed

8.6.6 Historic and Forecasted Market Size by Animal Type

8.6.6.1 Cattle

8.6.6.2 Horse

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Alfalfa Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Feed Type

8.7.4.1 Hays

8.7.4.2 Bales

8.7.4.3 Pellets

8.7.4.4 Cubes

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Dairy Cow Feed

8.7.5.2 Cattle and Sheep Feed

8.7.5.3 Pig Feed

8.7.5.4 Horse Feed

8.7.5.5 Poultry Feed

8.7.6 Historic and Forecasted Market Size by Animal Type

8.7.6.1 Cattle

8.7.6.2 Horse

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Alfalfa Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.21 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.2% |

Market Size in 2032: |

USD 39.88 Bn. |

|

Segments Covered: |

By Feed Type |

|

|

|

By Application |

|

||

|

By Animal Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||