Alcohol Wipes Market Synopsis

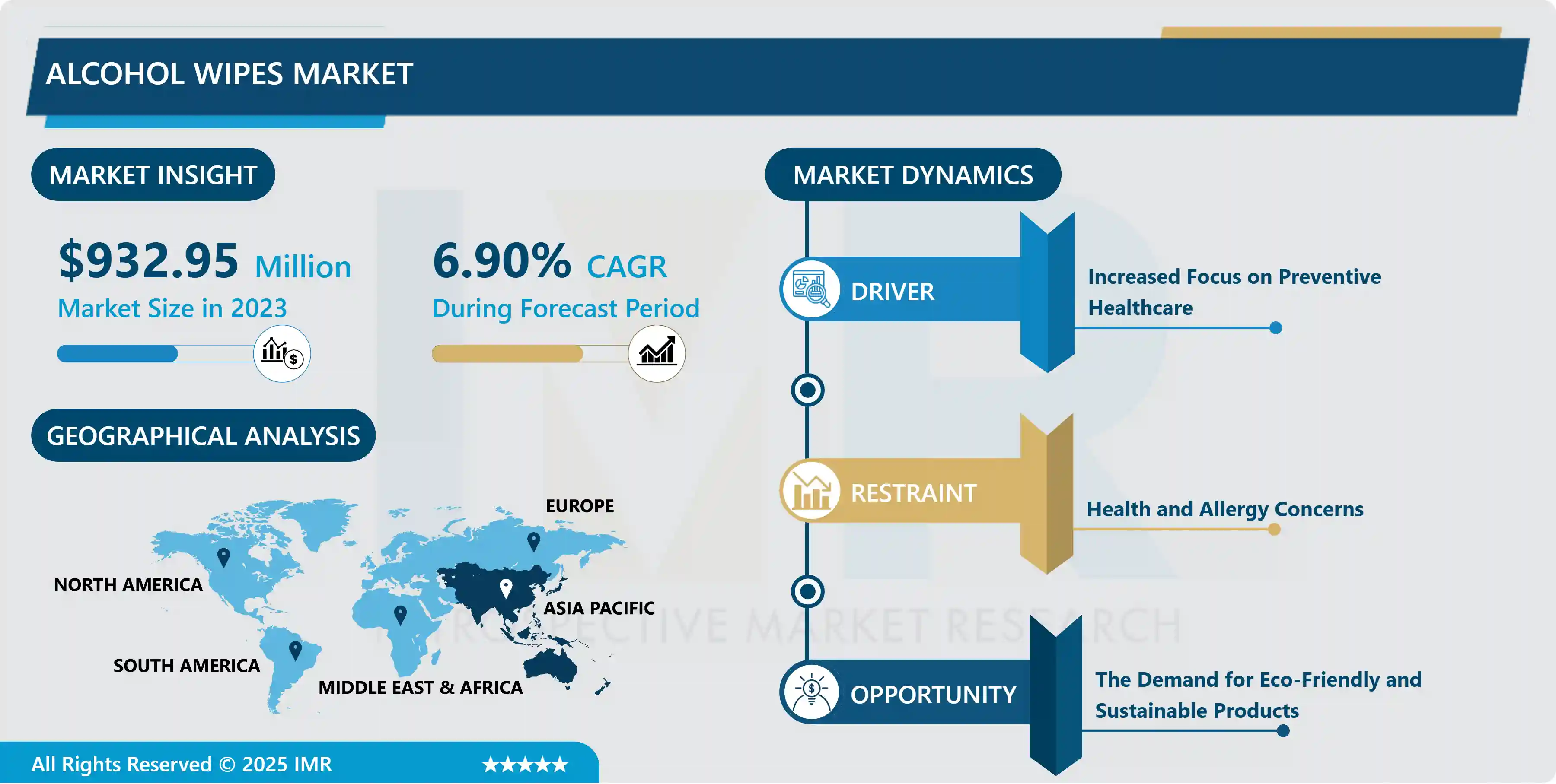

Alcohol Wipes Market Size Was Valued at USD 932.95 Million in 2023, and is Projected to Reach USD 1,700.82 Million by 2032, Growing at a CAGR of 6.9% From 2024-2032.

An alcohol wipe is a disposable cleaning product saturated with a solution containing various types of alcohol, typically isopropyl or ethyl alcohol. These wipes are designed for disinfecting surfaces, hands, or medical equipment, offering a convenient and portable solution for maintaining hygiene. The alcohol content in these wipes acts as an effective antimicrobial agent, killing bacteria and viruses upon contact.

Alcohol wipes find applications across various industries and settings. In healthcare, they are widely used to sanitize medical instruments, surfaces, and hands. In the consumer sector, alcohol wipes are popular for personal hygiene, such as cleaning hands, smartphones, and household surfaces. They are also utilized in industrial and commercial environments to maintain a sanitized workspace.

Current trends in the alcohol wipe market reflect the increased emphasis on hygiene and sanitation, driven by the global response to the COVID-19 pandemic. There is a heightened demand for portable and easily accessible disinfecting solutions, contributing to the popularity of alcohol wipes. Manufacturers are innovating to create biodegradable and eco-friendly options to address environmental concerns. Additionally, the incorporation of skin-friendly additives and pleasant fragrances enhances user experience, catering to evolving consumer preferences. The market is witnessing a surge in online sales and distribution channels, reflecting the growing awareness and adoption of alcohol wipes for maintaining cleanliness and preventing the spread of infections.

Alcohol Wipes Market Trend Analysis

Increased Focus on Preventive Healthcare

- With a global shift towards proactive health measures, individuals and businesses are placing a heightened emphasis on preventive hygiene practices to mitigate the risk of infections, especially in the wake of the COVID-19 pandemic. Alcohol wipes, with their proven efficacy in eliminating germs and viruses, have become integral components of preventive healthcare routines.

- Individuals are becoming more conscientious about personal hygiene, and the convenience offered by alcohol wipes for quick and effective cleaning has contributed to their widespread adoption. Moreover, in healthcare settings, where infection control is paramount, alcohol wipes play a crucial role in maintaining a sterile environment by disinfecting surfaces, medical equipment, and hands.

- Businesses, schools, and public spaces are integrating alcohol wipes into daily hygiene practices as part of a proactive approach to safeguard the health of employees, students, and visitors. Regulatory standards emphasizing hygiene and sanitation further drive the adoption of alcohol wipes across various industries. As the concept of preventive healthcare continues to gain traction, the demand for alcohol wipes is expected to persist and even grow, making them a cornerstone in the arsenal of tools for maintaining a clean and health-conscious environment.

The Demand for Eco-Friendly and Sustainable Products

- As global environmental consciousness continues to rise, consumers are increasingly seeking products that align with their sustainability values. This shift has spurred a growing interest in eco-friendly alternatives, prompting manufacturers in the alcohol wipe industry to explore greener options.

- Opportunities lie in developing alcohol wipes that are biodegradable, compostable, and manufactured using environmentally friendly materials. The incorporation of sustainable packaging, such as recyclable materials or reduced packaging waste, further contributes to the appeal of these wipes. Brands embracing sustainability not only meet consumer expectations but also actively participate in reducing the environmental impact of single-use products.

- The eco-friendly focus extends beyond consumer preferences; businesses are also recognizing the importance of adopting sustainable practices. As corporate responsibility gains prominence, there is an opportunity for manufacturers to forge partnerships with environmentally conscious companies, creating a demand for sustainable alcohol wipes in various industries.

- Moreover, aligning with eco-friendly trends can enhance brand reputation and market positioning. Companies investing in research and development to improve the sustainability profile of their alcohol wipes are likely to not only meet current market demands but also lead the way in shaping the future of environmentally responsible hygiene solutions.

Alcohol Wipes Market Segment Analysis:

Alcohol Wipes Market Segmented based on fabric material, distribution channel, and end-users.

By Fabric Material, the Synthetic material segment is expected to dominate the market during the forecast period

- In the Alcohol Wipes Market, the synthetic material segment currently dominates the landscape. Synthetic materials, such as polyester or polypropylene, are widely utilized in the manufacturing of alcohol wipes due to their inherent characteristics that enhance durability, absorbency, and overall performance. These materials provide a robust and cost-effective solution, contributing to the segment's dominance.

- Synthetic alcohol wipes are known for their strength, resistance to tearing, and efficient absorption of liquids, making them suitable for various applications, including medical, industrial, and personal hygiene. The synthetic material segment's dominance is reflective of the practical advantages offered by these wipes, meeting the demands of consumers and industries seeking reliable and versatile disinfecting solutions. As the market continues to evolve, manufacturers may further innovate within the synthetic material category to enhance product attributes and maintain market leadership.

By End User, the Commercial segment held the largest market share of 62.7% in 2022

- In the Alcohol Wipes Market, the commercial segment takes the lead, demonstrating dominance among end users. Commercial establishments, including offices, restaurants, hotels, and other businesses, extensively rely on alcohol wipes to maintain hygiene standards. The commercial sector's emphasis on cleanliness, especially in shared spaces, drives the heightened demand for convenient and effective disinfecting solutions, contributing to the dominance of alcohol wipes.

- The commercial segment's preference for alcohol wipes is further fuelled by the need to provide a safe and sanitized environment for employees and customers, particularly in the context of the global COVID-19 pandemic. The versatility of alcohol wipes makes them suitable for various surfaces and equipment commonly found in commercial settings. As businesses prioritize health and safety measures, the commercial segment continues to be a significant driver in the sustained demand for alcohol wipes, ensuring a hygienic atmosphere within shared spaces.

Alcohol Wipes Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific is poised to dominate the Alcohol Wipes Market over the forecast period. The region's anticipated dominance is attributed to several factors, including a large population base, rising awareness of hygiene practices, and increasing urbanization. As economies in Asia Pacific continue to develop, there is a growing emphasis on health and sanitation, driving the demand for alcohol wipes in various sectors.

- The ongoing global health challenges, particularly the COVID-19 pandemic, have further accelerated the adoption of stringent hygiene measures across the region. Government initiatives, coupled with changing consumer behaviors, contribute to the sustained growth of the alcohol wipes market. Additionally, the presence of key manufacturing hubs and a dynamic consumer landscape positions Asia Pacific as a significant player in the production and consumption of alcohol wipes, solidifying its dominance in the market over the forecast period.

Alcohol Wipes Market Top Key Players:

- Reckitt Benckiser Group Plc (U.K.)

- The Clorox Company (U.S.)

- Procter & Gamble Co. (U.S.)

- Kimberly-Clark Corporation (U.S.)

- 3m Company (U.S.)

- Ecolab Inc. (U.S.)

- Sc Johnson & Son, Inc. (U.S.)

- Nice-Pak Products, Inc. (U.S.)

- Pdi, Inc. (Pdi Healthcare) (U.S.)

- Cardinal Health, Inc. (U.S.)

- Pal International (U.K.)

- Diamond Wipes International Inc. (U.S.)

- Edgewell Personal Care (U.S.)

- Gama Healthcare Ltd. (U.K.)

- Hangzhou Linan Jinlong Chemical Fiber Co., Ltd. (China)

- Clarus (U.S.)

- La Fresh Group (U.S.)

- Unilever (U.K.)

- Mölnlycke Health Care (Sweden)

- Dupont De Nemours, Inc. (U.S.) And Other Major Players

Key Industry Developments in the Alcohol Wipes Market:

- In January 2024, Ginni Filaments Limited, in response to the growing Indian wipes market, introduced a sustainable initiative by manufacturing wet wipes using recycled PET bottles. This eco-friendly approach aligns with the company's commitment to environmental responsibility, contributing to the reduction of plastic waste and promoting sustainability in the hygiene products industry.

|

Global Alcohol Wipes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 932.95 Mn. |

|

Forecast Period 2023-30 CAGR: |

6.9% |

Market Size in 2032: |

USD 1,700.82 Mn. |

|

Segments Covered: |

By Fabric Material |

|

|

|

By Distribution Channels |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Alcohol Wipes Market by Fabric Material (2018-2032)

4.1 Alcohol Wipes Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Natural

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Synthetic

Chapter 5: Alcohol Wipes Market by Distribution Channels (2018-2032)

5.1 Alcohol Wipes Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Supermarket/Hypermarket

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Convenience Stores

5.5 Specialty Stores

5.6 E-Commerce

Chapter 6: Alcohol Wipes Market by End User (2018-2032)

6.1 Alcohol Wipes Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Retail

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Commercial

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Alcohol Wipes Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 APPLE INCSONY CORPORATION TOSHIBA CORPORATION SENNHEISER ELECTRONIC GMBH & CO. KG BOSE CORPORATION SAMSUNG KONINKLIJKE PHILIPS N.V. PANASONIC CORPORATION PLANTRONICS INC.

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AUDIO-TECHNICA AUSTRALIA. SKULLCANDY.EU GN STORE NORD A/S HARMAN INTERNATIONAL. HIFIMAN CORPORATION HOOKE AUDIO. LG ELECTRONICS. MOTOROLA MOBILITY LLC. BOWERS & WILKINS ALIPH BRANDS LLC

7.4 PORTRONICS

7.5 AMONG OTHERS

Chapter 8: Global Alcohol Wipes Market By Region

8.1 Overview

8.2. North America Alcohol Wipes Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Fabric Material

8.2.4.1 Natural

8.2.4.2 Synthetic

8.2.5 Historic and Forecasted Market Size by Distribution Channels

8.2.5.1 Supermarket/Hypermarket

8.2.5.2 Convenience Stores

8.2.5.3 Specialty Stores

8.2.5.4 E-Commerce

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Retail

8.2.6.2 Commercial

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Alcohol Wipes Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Fabric Material

8.3.4.1 Natural

8.3.4.2 Synthetic

8.3.5 Historic and Forecasted Market Size by Distribution Channels

8.3.5.1 Supermarket/Hypermarket

8.3.5.2 Convenience Stores

8.3.5.3 Specialty Stores

8.3.5.4 E-Commerce

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Retail

8.3.6.2 Commercial

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Alcohol Wipes Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Fabric Material

8.4.4.1 Natural

8.4.4.2 Synthetic

8.4.5 Historic and Forecasted Market Size by Distribution Channels

8.4.5.1 Supermarket/Hypermarket

8.4.5.2 Convenience Stores

8.4.5.3 Specialty Stores

8.4.5.4 E-Commerce

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Retail

8.4.6.2 Commercial

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Alcohol Wipes Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Fabric Material

8.5.4.1 Natural

8.5.4.2 Synthetic

8.5.5 Historic and Forecasted Market Size by Distribution Channels

8.5.5.1 Supermarket/Hypermarket

8.5.5.2 Convenience Stores

8.5.5.3 Specialty Stores

8.5.5.4 E-Commerce

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Retail

8.5.6.2 Commercial

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Alcohol Wipes Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Fabric Material

8.6.4.1 Natural

8.6.4.2 Synthetic

8.6.5 Historic and Forecasted Market Size by Distribution Channels

8.6.5.1 Supermarket/Hypermarket

8.6.5.2 Convenience Stores

8.6.5.3 Specialty Stores

8.6.5.4 E-Commerce

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Retail

8.6.6.2 Commercial

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Alcohol Wipes Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Fabric Material

8.7.4.1 Natural

8.7.4.2 Synthetic

8.7.5 Historic and Forecasted Market Size by Distribution Channels

8.7.5.1 Supermarket/Hypermarket

8.7.5.2 Convenience Stores

8.7.5.3 Specialty Stores

8.7.5.4 E-Commerce

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Retail

8.7.6.2 Commercial

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Alcohol Wipes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 932.95 Mn. |

|

Forecast Period 2023-30 CAGR: |

6.9% |

Market Size in 2032: |

USD 1,700.82 Mn. |

|

Segments Covered: |

By Fabric Material |

|

|

|

By Distribution Channels |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||