Premium Hair Care Market Synopsis

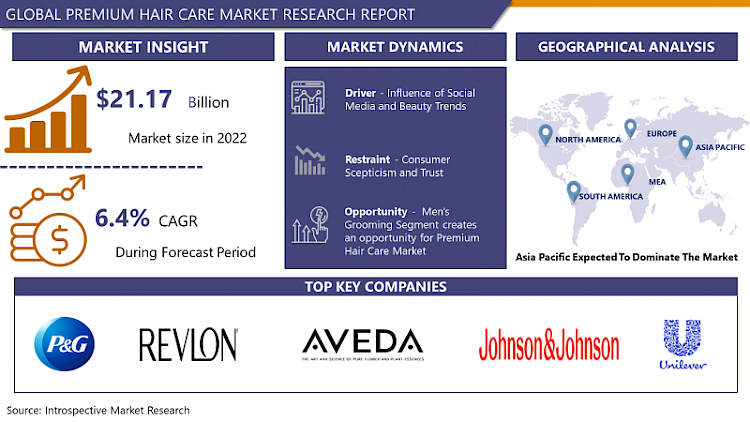

Premium Hair Care Market Size Was Valued at USD 21.17 Billion in 2022 and is Projected to Reach USD 34.77 Billion by 2030, Growing at a CAGR of 6.4% From 2023-2030.

Premium hair care encompasses top-tier hair products crafted with high-quality ingredients and cutting-edge technology to target specific hair issues and deliver outstanding outcomes. These items are meticulously formulated, incorporating elements like botanical extracts, vitamins, proteins, and specialized blends to nourish, shield, and elevate hair health and appearance. They're designed as opulent, high-performing solutions suitable for an array of hair types and concerns, spanning from dryness, damage, and frizz to safeguarding color and catering to styling requirements.

- The benefits of premium hair care products are rooted in their capacity to offer advanced and precise remedies. Compared to standard alternatives, they often provide amplified advantages by containing higher levels of active components that deeply revitalize and mend hair, fostering resilience, luster, and ease of styling. Moreover, these formulations tend to minimize harsh chemicals, sulfates, and parabens, ensuring a gentler approach toward both hair and scalp. Additionally, they offer specialized treatments tailored to address particular issues, such as anti-aging properties, intense hydration for dry and brittle hair, or preserving color vibrancy for treated hair.

- Premium hair care products are widely utilized in salons, spas, upscale retail venues, and online platforms. They cater to individuals seeking top-notch products to uphold the health and vibrancy of their hair. Professional hairstylists often favour premium hair care lines for their exceptional performance in achieving desired results for their clients, solidifying their position as a staple in the beauty industry. Furthermore, these products resonate with consumers who prioritize effectiveness, quality, and luxurious experiences within their hair care regimens.

Global Premium Hair Care Market Trend Analysis

Influence of Social Media and Beauty Trends

- Social media platforms like Instagram, YouTube, TikTok, and beauty blogs have significantly changed how people discover and buy hair care products. Influencers, beauty experts, and celebrities use these platforms to showcase their hair care routines, endorse brands, and share their experiences with various products.

- The visual aspect of social media allows users to see the actual results of using high-end hair care items, creating a strong desire to achieve similar looks. Influencers often partner with brands, promoting premium products to a wide audience, influencing trends, and shaping what consumers prefer. People are attracted to the idea of having healthy, shiny hair like their favorite influencers or celebrities, motivating them to invest in top-notch hair care solutions.

- Furthermore, social media acts as a hub for information, where consumers can research product reviews, ingredients, and other users' experiences before buying. This quick access to information empowers consumers to seek out premium products known for their effectiveness, quality ingredients, and positive reviews. As a result, there's a growing demand for these high-end hair care offerings, largely influenced by social media and beauty trends, impacting consumer decisions significantly.

Men's Grooming creates an opportunity for Premium Hair Care Market

- The premium hair care market sees a promising avenue in men's grooming due to changing societal norms and increased focus on self-care among men. This previously overlooked segment has transformed significantly, with men now placing greater importance on grooming routines, encompassing hair care, styling, and grooming products in general.

- For premium hair care brands, this trend presents a chance to develop specialized products tailored specifically to address men's unique hair concerns and styling needs. These could include formulas targeting issues like hair loss, scalp health, and styling products catering to different hair textures commonly found among men. Crafting solutions using top-quality ingredients and specialized formulas could attract male consumers seeking effective hair care solutions.

- Furthermore, men now prioritize sophistication, quality, and performance in grooming products. Premium hair care lines that cater to these preferences have a strong chance of succeeding in the men's grooming market. Brands that focus on elegant packaging, and refined branding, and highlight the effectiveness of their products through endorsements by male influencers or grooming experts can resonate well with this audience.

- Collaborations with barbershops, stylists, or men's salons can also enhance brand visibility and credibility within the male grooming domain. These partnerships provide opportunities for product recommendations and reinforce the brand's expertise in catering to men's hair care needs, building consumer trust and loyalty. Overall, the men's grooming segment offers an attractive opportunity for premium hair care brands to expand their customer base and drive growth.

Premium Hair Care Market Segment Analysis

Premium Hair Care Market is Segmented based on product type, demography, and distribution channel.

By Type, Shampoo is expected to dominate the market during the forecast period

- In the Premium Hair Care market, shampoo is anticipated to assert its dominance throughout the forecast period. Shampoo holds a central position in hair care routines, serving as a fundamental product for cleansing and nourishing the hair and scalp. Premium shampoos often feature advanced formulations, high-quality ingredients, and specialized technologies aimed at addressing specific hair concerns, such as damage repair, hydration, or color protection.

- Consumers in the premium segment prioritize superior product performance and luxurious experiences, making premium shampoos a key focal point. The rising consumer awareness of the benefits associated with premium ingredients and innovative formulations contributes to the sustained popularity of premium shampoo products. As consumers continue to seek elevated hair care solutions, the shampoo segment is expected to maintain its dominance in the Premium Hair Care market, reflecting a demand for high-quality and effective hair cleansing products.

By Demography, Women segment held the largest market share of 64.2% in 2022

- The premium hair care market sees a prominent presence from the women's demographic, largely due to various reasons. Over time, women have remained the primary purchasers of hair care items and have shown a greater interest in investing in high-quality solutions. With diverse hair types, lengths, and styling preferences, women often look for specialized products catering to their specific needs, whether it's taming frizz, boosting shine, or preserving color-treated hair.

- Furthermore, the beauty industry has extensively focused on meeting women's hair care demands by offering a wide range of premium choices tailored to their varied requirements. Brands targeting this demographic have capitalized on this by introducing innovative products, employing marketing strategies featuring female influencers and celebrities, and providing numerous options to address different hair textures and styling needs.

- Moreover, women tend to be more involved in beauty trends, always on the lookout for the latest advancements and formulations. This active engagement further cements their role in driving the demand for premium hair care products. Their significant influence on purchasing decisions and their willingness to explore different products firmly establish the women's segment as a key force in the premium hair care market.

Global Premium Hair Care Market Regional Insights

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The premium hair care market sees a significant stronghold in the Asia Pacific region due to multiple factors. This dominance is attributed to a sizable population, evolving beauty ideals, and a growing middle class with higher disposable incomes. Economic growth in these countries has led to increased spending on personal care and beauty products, particularly in the premium hair care segment.

- Cultural influences also play a pivotal role in driving the demand for top-tier hair care products in this region. Many countries in Asia Pacific place a high value on grooming and appearance, considering well-maintained and stylish hair as a crucial aspect of beauty standards. This cultural emphasis on meticulous grooming practices contributes to the demand for premium hair care solutions.

- Additionally, the Asia Pacific market benefits from the adoption of Western beauty trends and rising awareness of the advantages associated with premium hair care products. This unique blend of factors establishes the Asia Pacific region as a leading force in shaping the growth and demand within the premium hair care market.

Global Premium Hair Care Market Top Key Players:

- Procter & Gamble Company (U.S.)

- Revlon, Inc. (U.S.)

- Aveda Corp. (U.S.)

- Johnson & Johnson (U.S.)

- The Estee Lauder Companies (U.S.)

- Alcora Corp. (U.S.)

- John Masters Organic (U.S.)

- Ouai (U.S.)

- Briogeo (U.S.)

- Living Proof, Inc. (U.S.)

- Beiersdorf Group (Nivea) (Germany)

- Henkel Ag & Co. Kgaa (Germany)

- L’oreal S.A. (France)

- Unilever (Netherlands)

- Dabur India (India)

- Marico Ltd. (India)

- Shiseido Company (Japan)

- Kao Corp. (Japan) and Other Major Players

Key Industry Developments in the Global Premium Hair Care Market:

- In June 2022, L’Oréal partnered with Hotel Shilla, a South Korea-based company operating in the hospitality industry, and Anchor Equity Partners, a Korea-based investment company to introduce a new luxury beauty brand. This collaboration would maintain the beauty products company's brand presence in the Asian region.

- In April 2022, ELCA Cosmetics Pvt Ltd, a subsidiary of Estee Lauder Companies teamed up with Nykaa, an India-based operator of consumer technology platform. The partnership involves launching premium salons in India. The salons will be branded as Aveda X Nykaa. The new salons would primarily focus on delivering luxury professional hair care services.

- In May 2021, Beacon Bio Life Sciences Private Limited's highly acclaimed launched brand 'Atulya' launched its new Veg Keratin, and Wheat Protein range of products which includes hair shampoo, hair conditioner, hair oil, and hair mask. Atulya Keratin & Wheat Protein Conditioner is made from pure organic and luxurious ingredients to keep the hair strong and manageable, in addition to providing nutrition to hair. The range based on a vegetable alternative to animal keratin is the first of its kind in India.

|

Global Premium Hair Care Market |

||||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 21.17 Bn. |

|

|

CAGR (2023-2030) : |

6.4% |

Market Size in 2030: |

USD 34.77 Bn. |

|

|

Segments Covered: |

By Product Type |

|

|

|

|

By Demography |

|

|

||

|

By Distribution Channel |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PREMIUM HAIR CARE MARKET BY PRODUCT TYPE (2016-2030)

- PREMIUM HAIR CARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SHAMPOO

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DRY SHAMPOO

- HAIR COLOUR

- CONDITIONER

- HAIR STYLING PRODUCTS

- HAIR OIL

- PREMIUM HAIR CARE MARKET BY DEMOGRAPHY (2016-2030)

- PREMIUM HAIR CARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MEN

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WOMEN

- CHILDREN

- PREMIUM HAIR CARE MARKET BY DISTRIBUTION CHANNEL (2016-2030)

- PREMIUM HAIR CARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SUPERMARKETS & HYPERMARKETS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DEPARTMENTAL STORES

- SPECIALTY STORES

- PHARMACY AND DRUG STORE

- ONLINE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- PREMIUM HAIR CARE Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- PROCTER & GAMBLE COMPANY (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- REVLON, INC. (U.S.)

- AVEDA CORP. (U.S.)

- JOHNSON & JOHNSON (U.S.)

- THE ESTEE LAUDER COMPANIES (U.S.)

- ALCORA CORP. (U.S.)

- JOHN MASTERS ORGANIC (U.S.)

- OUAI (U.S.)

- BRIOGEO (U.S.)

- LIVING PROOF, INC. (U.S.)

- BEIERSDORF GROUP (NIVEA) (GERMANY)

- HENKEL AG & CO. KGAA (GERMANY)

- L’OREAL S.A. (FRANCE)

- UNILEVER (NETHERLANDS)

- DABUR INDIA (INDIA)

- MARICO LTD. (INDIA)

- SHISEIDO COMPANY (JAPAN)

- KAO CORP. (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL PREMIUM HAIR CARE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Demography

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Premium Hair Care Market |

||||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 21.17 Bn. |

|

|

CAGR (2023-2030) : |

6.4% |

Market Size in 2030: |

USD 34.77 Bn. |

|

|

Segments Covered: |

By Product Type |

|

|

|

|

By Demography |

|

|

||

|

By Distribution Channel |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PREMIUM HAIR CARE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PREMIUM HAIR CARE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PREMIUM HAIR CARE MARKET COMPETITIVE RIVALRY

TABLE 005. PREMIUM HAIR CARE MARKET THREAT OF NEW ENTRANTS

TABLE 006. PREMIUM HAIR CARE MARKET THREAT OF SUBSTITUTES

TABLE 007. PREMIUM HAIR CARE MARKET BY PRODUCT

TABLE 008. HAIR OIL MARKET OVERVIEW (2016-2028)

TABLE 009. HAIR STYLING PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 010. HAIR COLOR MARKET OVERVIEW (2016-2028)

TABLE 011. SHAMPOO MARKET OVERVIEW (2016-2028)

TABLE 012. DRY SHAMPOO MARKET OVERVIEW (2016-2028)

TABLE 013. CONDITIONER MARKET OVERVIEW (2016-2028)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. PREMIUM HAIR CARE MARKET BY DISTRIBUTION CHANNEL

TABLE 016. SUPERMARKETS & HYPERMARKETS MARKET OVERVIEW (2016-2028)

TABLE 017. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

TABLE 018. DEPARTMENTAL STORES MARKET OVERVIEW (2016-2028)

TABLE 019. PHARMACY & DRUG STORES MARKET OVERVIEW (2016-2028)

TABLE 020. PROFESSIONAL OUTLETS MARKET OVERVIEW (2016-2028)

TABLE 021. DIRECT SALES MARKET OVERVIEW (2016-2028)

TABLE 022. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 023. NORTH AMERICA PREMIUM HAIR CARE MARKET, BY PRODUCT (2016-2028)

TABLE 024. NORTH AMERICA PREMIUM HAIR CARE MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 025. N PREMIUM HAIR CARE MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE PREMIUM HAIR CARE MARKET, BY PRODUCT (2016-2028)

TABLE 027. EUROPE PREMIUM HAIR CARE MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 028. PREMIUM HAIR CARE MARKET, BY COUNTRY (2016-2028)

TABLE 029. ASIA PACIFIC PREMIUM HAIR CARE MARKET, BY PRODUCT (2016-2028)

TABLE 030. ASIA PACIFIC PREMIUM HAIR CARE MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 031. PREMIUM HAIR CARE MARKET, BY COUNTRY (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA PREMIUM HAIR CARE MARKET, BY PRODUCT (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA PREMIUM HAIR CARE MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 034. PREMIUM HAIR CARE MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA PREMIUM HAIR CARE MARKET, BY PRODUCT (2016-2028)

TABLE 036. SOUTH AMERICA PREMIUM HAIR CARE MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 037. PREMIUM HAIR CARE MARKET, BY COUNTRY (2016-2028)

TABLE 038. ST. BOTANICA: SNAPSHOT

TABLE 039. ST. BOTANICA: BUSINESS PERFORMANCE

TABLE 040. ST. BOTANICA: PRODUCT PORTFOLIO

TABLE 041. ST. BOTANICA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. L'OREAL S.A.: SNAPSHOT

TABLE 042. L'OREAL S.A.: BUSINESS PERFORMANCE

TABLE 043. L'OREAL S.A.: PRODUCT PORTFOLIO

TABLE 044. L'OREAL S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. JOHNSON & JOHNSON: SNAPSHOT

TABLE 045. JOHNSON & JOHNSON: BUSINESS PERFORMANCE

TABLE 046. JOHNSON & JOHNSON: PRODUCT PORTFOLIO

TABLE 047. JOHNSON & JOHNSON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. THE ESTEE: SNAPSHOT

TABLE 048. THE ESTEE: BUSINESS PERFORMANCE

TABLE 049. THE ESTEE: PRODUCT PORTFOLIO

TABLE 050. THE ESTEE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. LAUDER COMPANIES: SNAPSHOT

TABLE 051. LAUDER COMPANIES: BUSINESS PERFORMANCE

TABLE 052. LAUDER COMPANIES: PRODUCT PORTFOLIO

TABLE 053. LAUDER COMPANIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. UNILEVER: SNAPSHOT

TABLE 054. UNILEVER: BUSINESS PERFORMANCE

TABLE 055. UNILEVER: PRODUCT PORTFOLIO

TABLE 056. UNILEVER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. PROCTER & GAMBLE COMPANY: SNAPSHOT

TABLE 057. PROCTER & GAMBLE COMPANY: BUSINESS PERFORMANCE

TABLE 058. PROCTER & GAMBLE COMPANY: PRODUCT PORTFOLIO

TABLE 059. PROCTER & GAMBLE COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. AVEDA CORP.: SNAPSHOT

TABLE 060. AVEDA CORP.: BUSINESS PERFORMANCE

TABLE 061. AVEDA CORP.: PRODUCT PORTFOLIO

TABLE 062. AVEDA CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. BRIOGEO: SNAPSHOT

TABLE 063. BRIOGEO: BUSINESS PERFORMANCE

TABLE 064. BRIOGEO: PRODUCT PORTFOLIO

TABLE 065. BRIOGEO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. LIVING PROOF INC.: SNAPSHOT

TABLE 066. LIVING PROOF INC.: BUSINESS PERFORMANCE

TABLE 067. LIVING PROOF INC.: PRODUCT PORTFOLIO

TABLE 068. LIVING PROOF INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. BEIERSDORF GROUP: SNAPSHOT

TABLE 069. BEIERSDORF GROUP: BUSINESS PERFORMANCE

TABLE 070. BEIERSDORF GROUP: PRODUCT PORTFOLIO

TABLE 071. BEIERSDORF GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. JOHN MASTERS ORGANIC: SNAPSHOT

TABLE 072. JOHN MASTERS ORGANIC: BUSINESS PERFORMANCE

TABLE 073. JOHN MASTERS ORGANIC: PRODUCT PORTFOLIO

TABLE 074. JOHN MASTERS ORGANIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. GIMME BEAUTY: SNAPSHOT

TABLE 075. GIMME BEAUTY: BUSINESS PERFORMANCE

TABLE 076. GIMME BEAUTY: PRODUCT PORTFOLIO

TABLE 077. GIMME BEAUTY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. KAO CORP.: SNAPSHOT

TABLE 078. KAO CORP.: BUSINESS PERFORMANCE

TABLE 079. KAO CORP.: PRODUCT PORTFOLIO

TABLE 080. KAO CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. OUAI: SNAPSHOT

TABLE 081. OUAI: BUSINESS PERFORMANCE

TABLE 082. OUAI: PRODUCT PORTFOLIO

TABLE 083. OUAI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. ALCORA CORP.: SNAPSHOT

TABLE 084. ALCORA CORP.: BUSINESS PERFORMANCE

TABLE 085. ALCORA CORP.: PRODUCT PORTFOLIO

TABLE 086. ALCORA CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 087. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 088. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 089. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PREMIUM HAIR CARE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PREMIUM HAIR CARE MARKET OVERVIEW BY PRODUCT

FIGURE 012. HAIR OIL MARKET OVERVIEW (2016-2028)

FIGURE 013. HAIR STYLING PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 014. HAIR COLOR MARKET OVERVIEW (2016-2028)

FIGURE 015. SHAMPOO MARKET OVERVIEW (2016-2028)

FIGURE 016. DRY SHAMPOO MARKET OVERVIEW (2016-2028)

FIGURE 017. CONDITIONER MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. PREMIUM HAIR CARE MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 020. SUPERMARKETS & HYPERMARKETS MARKET OVERVIEW (2016-2028)

FIGURE 021. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

FIGURE 022. DEPARTMENTAL STORES MARKET OVERVIEW (2016-2028)

FIGURE 023. PHARMACY & DRUG STORES MARKET OVERVIEW (2016-2028)

FIGURE 024. PROFESSIONAL OUTLETS MARKET OVERVIEW (2016-2028)

FIGURE 025. DIRECT SALES MARKET OVERVIEW (2016-2028)

FIGURE 026. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 027. NORTH AMERICA PREMIUM HAIR CARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. EUROPE PREMIUM HAIR CARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. ASIA PACIFIC PREMIUM HAIR CARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. MIDDLE EAST & AFRICA PREMIUM HAIR CARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. SOUTH AMERICA PREMIUM HAIR CARE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Premium Hair Care Market research report is 2023-2030.

Procter & Gamble Company (U.S.), Revlon, Inc. (U.S.), Aveda Corp. (U.S.), Johnson & Johnson (U.S.), Unilever (Netherlands), The Estee Lauder Companies (U.S.), Alcora Corp. (U.S.), John Masters Organic (U.S.), Ouai (U.S.), Briogeo (U.S.), Living Proof, Inc. (U.S.), Beiersdorf Group (Nivea) (Germany), Henkel AG & Co. KGaA (Germany), L’Oreal S.A. (France), Dabur India (India), Marico Ltd. (India), Shiseido Company (Japan), Kao Corp. (Japan), and Other Major Players.

Premium Hair Care Market is segmented into Product Type, Demography, Distribution Channel, and region. By Product Type, the market is categorized into Shampoo, Dry Shampoo, Hair Color, Conditioner, Hair Styling Products, and Hair Oil. By Demography, the market is categorized into Men, Women, and Children. By Distribution Channel, the market is categorized into Supermarkets & Hypermarkets, Departmental Stores, Specialty Stores, Pharmacies and Drug Stores, and Online. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Premium hair care encompasses top-tier hair products crafted with high-quality ingredients and cutting-edge technology to target specific hair issues and deliver outstanding outcomes. These items are meticulously formulated, incorporating elements like botanical extracts, vitamins, proteins, and specialized blends to nourish, shield, and elevate hair health and appearance. They're designed as opulent, high-performing solutions suitable for an array of hair types and concerns, spanning from dryness, damage, and frizz to safeguarding color and catering to styling requirements.

Global Premium Hair Care Market size is expected to grow from USD 21.17 Billion in 2022 to USD 34.77 Billion by 2030, at a CAGR of 6.4% during the forecast period (2023-2030).